1. Introduction

Consider a line of business or an insurance portfolio to be insured by a property and casualty insurance company. Suppose that random claims arrive in the future according to a counting process, denoted by

, i.e.,

is the random number of claims up to time

t. Assume that

is a sequence of random claim occurrence times and

is a sequence of corresponding random positive claim amounts (also called claim severities), and

is the force of interest at time

t, which is modeled by a stochastic process. Then

defined by

is the aggregate discounted claims (ADCs) up to certain time

t, or the present value of the total amounts paid out by the company up to time

t, which describes the random change over time of the insurer’s future liabilities at present time. Accordingly,

is the ADC process (compound discounted claims) for this business. At a fixed time

t, the randomness of

comes from the number of claims up to time

t, claim occurrence times, and corresponding sizes as well as the values of

. It is an important quantity in the sense that, at the time of issue (

), this quantity would help insurers set a premium for this particular line of business, and predict and manage their future liabilities.

A simple case of model (

1) is one in which the counting process

is a homogeneous Poisson process, independent of claim amounts, and the force of interest is deterministic. In this paper, we assume that the counting process

is a Markovian arrival process (MAP) with representation

, introduced by

Neuts (

1979). That is, claim arrivals are influenced by an underlying continuous-time Markov process

on state space

with an

intensity matrix

and initial distribution

, where

, and is assumed to be irreducible. Precisely,

represents the intensity of transitions from state

i to state

j without claim arrivals, while

represents the intensity of transitions from state

i to state

j with an accompanying claim, having a cumulative distribution function

, density function

k-th moment

and Laplace transform

Here, the process

models the random environment, which affects the frequency and the severity of claims and thus the insurance business; for example, it is well known that the weather or climate conditions have impacts on automobile, property and casualty insurance claims.

Moreover, we assume that the force of interest process

in (

1) is also governed by the same Markov process

and is assumed constant while staying at certain state, that is, when

, for all

. As the force of interest used for evaluation is mainly driven by the local or global economics conditions, we would reasonably model its random fluctuations by a stochastic process that is different from

. Technically, we can assume a two-dimensional Markov process as the environment or background process and other mathematical treatments would be the same as we do below. Hence, we make the above assumption in this paper to simplify notations and presentations. We note that studies of the influence of economic conditions such as interest and inflation on the classical risk theory can be found in papers by

Taylor (

1979),

Delbaen and Haezendonck (

1987),

Willmot (

1989), and

Garrido and Léveill (

2004).

The MAP has received considerable attention in recent decades due to its versatility and feasibility in modeling stochastic insurance claims dynamics. MAPs include Poisson processes, renewal processes with the inter-arrival times following phase-type distributions, and Markov-modulated Poisson processes as special cases, which are intensively studied in actuarial science literature. Detailed characteristics and properties of MAPs can be found in papers by

Neuts (

1979) and

Asmussen (

2003). Below, we present a brief literature review on the related work based on models given by Equation (

1) (including its special cases).

Most of the studies on model (

1) are under the assumption that

is deterministic. For the ADC,

Léveillé and Garrido (

2001a) give explicit expressions for its first two moments in the compound renewal risk process by using renewal theory arguments, while

Léveillé and Garrido (

2001b) further derive a recursive formula for the moments calculation.

Léveillé et al. (

2010) study the moment generating function (mgf) of the ADC by finite and infinite time under a renewal risk model or a delayed renewal risk model. Recently,

Wang et al. (

2018) studied the distribution of discounted compound phase-type renewal sums using the analytical results of their mgf obtained by

Léveillé et al. (

2010).

Jang (

2004) obtains the Laplace transform of the distribution of the ADC using a shot noise process.

Woo and Cheung (

2013) derive recursive formulas for the moments of the ADC using techniques used by

Léveillé and Garrido (

2001b), for a renewal risk process with certain dependence between the claim arrival and the amount caused. The impact of the dependency on the ADC are illustrated numerically.

Kim and Kim (

2007) derive simple expressions for the first two moments of the ADC when the rates of claim arrivals and the claim sizes depend on the states of an underlying Markov process.

Ren (

2008) studies the Laplace transform and the first two moments of the ADC following a MAP process, and

Li (

2008) further derives a recursive formula for the moments of the discounted claims for the same model.

Barges et al. (

2011) study the moments of the ADC in a compound Poisson model with dependence introduced by a Farlie–Gumbel–Morgenstern (FGM) copula;

Mohd Ramli and Jang (

2014) further derive Neumann series expression of the recursive moments by using the method of successive approximation.

There are few papers that study models described by Equation (

1) with a stochastic process

in the literature of actuarial science.

Leveille and Adekambi (

2011,

2012) study the covariance and the joint moments of the discounted compound renewal sum at two different times with a stochastic interest rate where the Ho–Lee–Merton and the Vasicek interest rate models are considered. Their idea of studying the covariance and the joint moments is adopted and extended in this paper. Here, we assume that the components of the ADC process

described by Equation (

1)—the number of claims, the size of the claims, and the force of interest for discounting—are all influenced by the same Markovian environment process, which enhances the flexibility of the model parameter settings. It follows that

depends on the trajectory of this underlying process whose states may represent different external conditions or circumstances that affect insurance claims. The main objective of this paper is to study the moments and the distribution of

given in Equation (

1), occurring in certain states (e.g., certain conditions) by time

t.

In general, while the expectation of at any given time t can be used as a reference for the insurer’s liability, the higher moments of , describing further characteristics of the random variable such as the variability around the mean and how extreme outcomes could go, may be used to determine the marginals on reserves. Furthermore, the distributional results regarding would be useful for obtaining the risk measures such as the value at risk and the conditional tail expectation, which may help insurers prevent or minimize their losses from extreme cases.

Our work is basically a generalization of some aforementioned studies. We first obtain formulas for calculating mean, variance, and distribution of the ADC occurring in a subset of states at a certain time. The subset may represent a collection of similar conditions that the insurer would consider them as a whole. We then derive explicit matrix-analytic expressions for covariances of the ADC occurring in two subsets of the state space at a certain time and those occurring in a certain subset of states with two different time lengths. The motivation of studying these two types of covariance is that we believe they can reveal the correlation between the random discounted sums either between different underlying conditions or with different time lengths, and the information would be helpful for insurers to set their capital requirements for preventing future losses, and make strategic and contingency plans. Moreover, we obtain a matrix-form partial integro-differential equation satisfied by the distribution function of the ADC occurring in certain subset of states. The equation can be solved numerically to obtain the probability distribution function of the ADC, which again could be useful for measuring insurers’ risks of insolvency.

The rest of the paper is organized as follows. In

Section 2, we study the joint Laplace transforms of the ADC occurring in each state by time

t and pay attention to some special cases. Recursive formulas for calculating the moments of the ADC occurring in certain states are obtained. A formula for computing the covariance of the ADC occurring in two subsets of the state space is derived in

Section 3, while the covariance of the ADC occurring in certain states with two different time lengths is studied in

Section 4. The distribution of the ADC occurring in certain states is investigated in

Section 5. Finally, some numerical illustrations are presented in

Section 6.

2. The Laplace Transforms and Moments

We first decompose

into

m components as

where

is the ADC occurring in state

with

being the indicator function. For a given

),

denote

a sub-state space of

E. We then define

to be the ADC occurring in the subset of state space

In particular,

and

If

and

for all

, then

, where

is the number of claims occurring in the sub-state space

by time

t.

Let

and

denote conditional probability and conditional expectation given

, respectively. Define

to be the joint Laplace transform of

given that the initial state is

In particular, we have

We define, for

the

n-th moment of

,

, and

, respectively, as

given that the initial state is

i.

We write the following column vectors for the Laplace transforms

with

In this section, we first show that satisfies a matrix-form first-order partial differential equation, and derive recursive formulas for calculating the moments of various ADC depending on the initial state of the underlying Markovian process. We also consider some special cases.

Theorem 1. satisfieswhere and Proof. For an infinitesimal

, conditioning on three possible events which can occur in

—no change in the MAP phase (state), a change in the MAP phase accompanied by no claims, and a change in the MAP phase accompanied by a claim—we have

As

is differentiable with respect to

and

t (the differentiability of

with respect to

t is justified in Appendix), we have

where

. Substituting the expression above into Equation (

4), dividing both sides by

h, and letting

we have

Rewriting Equation (

6) in matrix form gives Equation (

3). ☐

Remark 1. Using the same argument, we have the follow results.

- (1)

satisfies the following matrix-form first-order partial differential equation:where is an diagonal matrix with the -th entry being , for and all other entries being 1. - (2)

satisfieswhere - (3)

satisfieswhere

We now study the moments of the ADC considered in Theorem 1. Denote the vectors of the

n-th moment of the corresponding ADC as

From Equation (

7), we obtain in Theorem 2 a matrix-form first-order differential equation satisfied by the moments of

and then, in Theorem 3, obtain recursive formulas for calculating them.

Theorem 2. The moments of satisfywith initial conditions and In particular,where , is an diagonal matrix with the -th entry being for and all other diagonal entries being Proof. By Taylor’s expansion (its existence is easily justified as we assume that

has moment

for any

), we have

In matrix notation,

Substituting Equation (

9) together with

into Equation (

7) and equating the coefficients of

give Equation (

8). ☐

Corollary 1. We have the following results for the moments of and

- (i)

satisfies the matrix-form first-order differential equation:where and In particular, satisfies - (ii)

satisfieswhere is a diagonal matrix with the j-th entry being and 0 otherwise, and In particular, satisfies

Solving differential Equation (

8) with

, we obtain the following recursive formulas for

.

Theorem 3. For and we haveIn particular, Clearly, we have where .

Corollary 2. If we set and in Theorem 3, we have the following recursive formulas for the moments of and :In particular, Remark 2. When , we have the following asymptotic results for the moments of the ADC for :where 6. Numerical Illustrations

In this section, we consider a two-state Markov-modulated with intensity matrix

We also assume that

,

, and

.

Table 1 gives the first moments of

and

and their covariance for

, and

given

and

respectively, in which the covariances, for

are calculated by

It shows that, as expected, the expected values of

and

(and hence

) are increasing in

t given

for

It is not surprised to see that

and

are negatively correlated for any

t, as claims occurring in the two states compete with each other. Moreover, the larger the time

t, the more the negative correlation between

and

.

Figure 1 plots the variances of

and

, given

for

The variances all increase with time

t. The variance of

is bigger than those of

and

for a fixed

t. When time

t goes to

the three variances converge.

Table 2 and

Table 3 display the covariances of the ADC at time

t and

, given

, for some selected

t values and for

and

. It is shown that

and

and

and

and

are all positively correlated. Moreover, when

t increases, the covariances increase; moreover, when

h increases, the covariances decrease. When

the covariances of the pairs

and

,

, and

converge to the variances of

and

, respectively. Similar patterns should be expected for

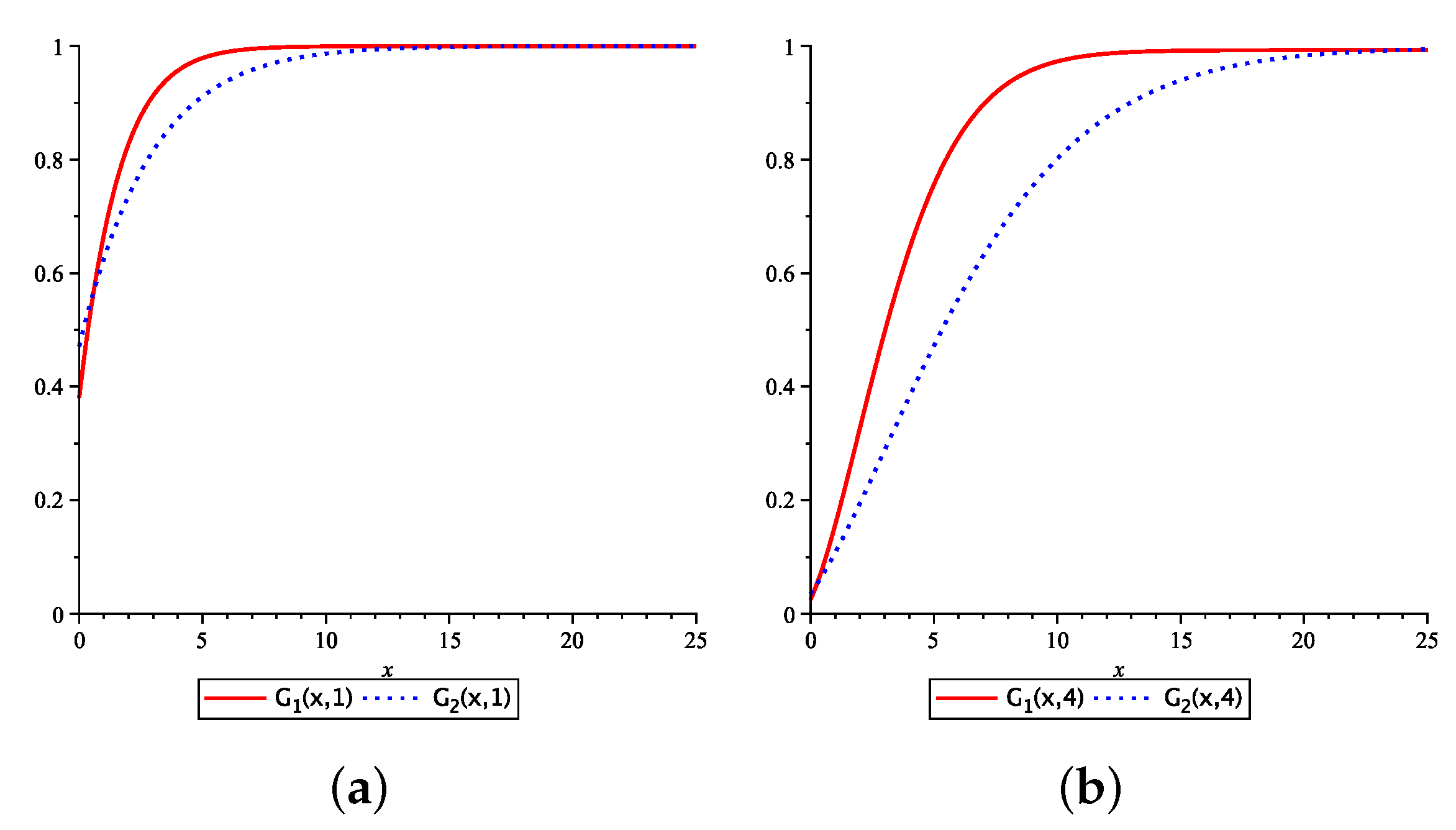

Finally, we display in

Figure 2 the numerical values of the distribution function of

with initial state

i,

, for

and 4,

, and

. Note that

satisfies the partial differential Equation (

25); its solution can be obtained numerically. From the graph, it shows clearly that the probability of

being bigger than a fixed

x is smaller for small values of

t as expected. For most

x values,

is bigger than

due to the fact that the underlying Markov process in our example tends to stay in state 1 more often than staying at state 2.