2. Literature Review

In the fallout from the financial crisis of 2008–2009, which plagued the United States’ economy, a debate arose regarding the culpability of CRAs in creating or contributing to the crisis. Several years later, their performance and reliability are still being called into question. Our research emphasis and focus are intended to strengthen the integrity and improve the transparency of credit ratings. As part of our research, we will explore the possible options for CRAs’ rating performance by evaluating various independent variables. The independent variables mainly represent the type of risk involved in the rating and measure how the ratings help CRAs to develop and grow.

Doumpos and Zopounidis (

2011) concluded that there was the potential for an outranking, multi-criteria, decision-aiding approach for credit rating that would further enhance the quality of credit rating. They thoroughly examined the usage of the accounting ratio as a variable to support this analytical approach. In similar research Khalil, Martel, and Jutras (

Khalil et al. 2007) claimed that credit risk was a default function of the reimbursement capacity of the borrower (risk of default) and the risk type was mainly categorised into the risk of default and the credit risk.

Chan, Faff, Hill, and Scheule (

Chan et al. 2011) used the core empirical predictions of the Boot model to confirm that the prediction of certain credit rating events is likely to be more informative than others, and that CreditWatch procedures are an important driver of such differences and provide an information advantage to investors.

Kisgen (

2009) suggests that once a firm is downgraded, a firm is more likely to reduce leverage, in order to attain a previous rating target. These effects are shown to be significant at the investment grade cutoff, and also important for firms which see downgrades in their commercial paper ratings, both of which are consistent with the significance of regulations. Rating upgrades usually do not affect the subsequent capital structure activity, suggesting that firms target minimum rating levels and lowered leverage after downgrades but respond little to upgrades.

Kisgen’s (

2006) analysis found that credit ratings directly affect the capital structure decisions made by managers, and that firms that are close to a rating change issue approximately 1.0% less net debt relative to net equity annually as a percentage of their total assets than firms that are not near a rating change.

Adams, Rutledge, and Raynes (

Adams et al. 2011) revealed that, when the correlation between the transaction and the insurer is low, the default risk to the insured bonds is lower than either the transaction or the insurer on a standalone basis. In addition, a transaction that factors in the correlation of default between the insurer and the transaction could achieve a similarly low risk of default without the additional capital, or a higher rating, from the insurer.

Mählmann (

2009) examined the impact of optional Fitch ratings on the aggregate firm-level borrowing cost using a procedure that explicitly accounts for self-selection in estimating borrowing cost relations. The study also revealed the role of the expected cost of debt savings in the derived demand for optional ratings. The evidence indicated that soliciting a third Fitch rating has a negative effect on the borrowing cost and is consistent with switchers using optional ratings to minimize their borrowing costs. Further, it indicates that non-switchers do not always weigh the costs and benefits of third ratings optimally.

Salawu (

2007) claimed that there are considerable factors involved in deciding on the appropriate amount of equity and debt, and the factors influencing banks’ capital structure. Credit rating, volatility of earnings and cash flow, bankruptcy or near-bankruptcy, financial distress, transaction costs, fees for issuing debt, and financial flexibility are the important factors in choosing the appropriate amount of debt. An important factor that affects banks’ choices between short- and long-term debts is matching the maturity of the debt with the life of the asset. The ownership structure and management control, growth and opportunity, profitability, issuing cost, and tax economics associated with debt are the major factors influencing the bank’s capital structure.

Kisgen (

2007) examined whether companies devote considerable attention to credit ratings in designing their financial policy. At the time when companies’ fundamentals are near to prompting a rating change, corporations make financing choices between decisions to issue equity rather than debt (or to reduce debt rather than equity) that appear to be designed to avoid downgrades and to achieve upgrades. In cases in which firms are downgraded below their target ratings, they make decisions aimed at restoring those ratings.

Lui, Markov, and Tamayo (

Lui et al. 2007) analysed the determinants and the informativeness of financial analysts’ risk ratings using the cross-sectional variation in risk ratings, taking into account variables that are commonly viewed as measures of risk, such as idiosyncratic risk, size, book-to-market, and leverage. Earnings-based measures of risk, such as earnings quality and accounting losses, also contribute to explaining the cross-sectional variation in risk ratings. Risk ratings can be used to predict future return volatility after controlling for other predictors of future volatility.

Dichev and Piotroski’s (

2001) research claimed that the long-run stock returns following bond rating changes give no reliable abnormal returns following upgrades, whereas there are substantial abnormal negative returns following downgrades. The poor returns of downgraded firms are more pronounced for small and low-credit-quality firms.

Adelson (

2007) conducted a study on the inconsistency within each agency’s rating definitions. Standard & Poor’s (S&P) rating definitions emphasize the probability of default as the key criterion. Moody’s places more emphasis on expected loss in its long-term ratings, but emphasisesthe probability of default in its short-term ratings. Livingston, Wei, and Zhou (

Livingston et al. 2010) extended their research on the relative impact of Moody’s and S&P’s ratings on bond yields. The yields on split rated bonds with superior Moody’s ratings are about 8 basis points lower than the yields on split rated bonds with superior S&P ratings. Moody’s is more likely to give a conservative (or inferior) rating than S&P when these two differ. Bond investors appear to differentiate between these two ratings and assign greater weight to the ratings from the more conservative agency.

Blume, Lim, and Mackinlay (

Blume et al. 1998) conducted research on the credit quality of U.S. corporate debt, which plummeted in the recent past. The decline in the level of actual bond ratings could be due to the use of more stringent rating standards in assigning ratings. In addition, it was found that accounting ratios and market-based risk measures are more informative for larger companies than smaller companies for assigning ratings.

Baestaens’s (

1999) model aimed to present some practical issues in modelling the default risk of a single commercial credit counterparty from the perspective of a large retail bank. The best rating methodology is very much dependent on the segment to which it should be applied, the nature of the data (qualitative versus quantitative), the classification performance (both within sample and out-of-sample), the grade stability, and the absence of ‘black-box syndrome’ or the ease of communication towards the end-user.

Voorhees (

2012) placed more emphasis on credit rating agencies and their contribution to the crisis by giving their highest ratings to poorly understood new financial instruments. The research pointed out that CRAs lacked significant accountability and oversight, and suffered from an intense conflict of interest. In the U.S., the Credit Rating Agency Reform Act and the Dodd–Frank Act now address inappropriate CRA practices, and the SEC can now fine non-compliant CRAs.

Hull and White (

2012) argued that the AAA ratings assigned to ABSs are not totally unreasonable, but that the AAA ratings assigned to tranches of Mezz ABS CDOs cannot be justified. An important point is that the BBB tranche of an ABS cannot be considered similar to a BBB bond for purposes of determining the risks in ABS CDO tranches.

The study by Evans, Simpsonz, Mahate, and Evans (

Evans et al. 2004) showed that Japanese banks have significantly higher tier one capital ratios than European banks, as well as a higher risk rating. The net changes in equity for Japanese banks are small compared with the strongly positive net changes in equity for European banks, reflecting the greater profitability of European banks and the losses experienced by Japanese banks. The change in assets for European banks is substantially stronger, perhaps reflecting a continuation of solid lending by European banks and a slowdown in lending by Japanese banks.

O’Kane and Sen (

2005) explained the credit risk spread and how to determine compensation for assuming credit risk. They examined the main credit spreads for fixed-rate bonds, floating-rate notes, and the credit default swap.

He and Xiong (

2012) claimed that the deterioration in debt market liquidity leads to greater risk in the liquidity premium of corporate bonds and increased credit risk, and emphasized the role of short-term debt in exacerbating rollover risk and the effects of debt market liquidity on a firm’s credit risk through its debt rollover.

Schoppa (

2001) revealed that both functional and non-functional parameters should be considered for credit ratings.

Haan and Amtenbrink’s (

2011) research gave an insight into the overreliance of investors on credit ratings and suggested that investors should not rely on credit ratings in capital requirements. White gave an overview in his article of how to reduce the regulation of the rating agencies to reform the prudential regulation of financial institutions and bond creditworthiness information from a wider range of sources instead from CRAs.

Hoti and McAleer (

2004) examined the country credit rating using qualitative and quantitative information and the impact of economic, financial, and political risk on associated composite risk ratings.

Weber, Scholz, and Michalik (

Weber et al. 2010) claimed that there was a correlation between companies’ environment and their financial performance. Their research provided sustainability criteria that can predict the financial performance of a debtor and improve the predictive validity of the credit rating process. The sustainability of the firm demonstrates creditworthiness as part of its financial performance.

Hull and White (

2012) concluded that risk measures (CRA) are not value measures, ratings (S&P and Fitch) create the illusion of a free lunch, and the securitization that was observed is consistent with structures exploiting the criteria used by the rating agencies, whereas

Brookfield and Ormrod (

2000) claimed that official recognition of the rating of bonds/securities has no market-based role. In addition,

Angilella and Mazzu (

2015) reiterated that a multiple-criteria decision aid is appropriate in situations in which there is a lack or absence of analytic quantitative techniques for constructing judgemental credit assessment models. In their book,

Zopounidis and Doumpos (

2017) emphasized the importance of taking a multiple-criteria decision-making approach to streamline the discussions from different experts, formulate creative solutions, and identify the preferred alternatives.

Based on the literature survey, a comparative summary of the performance management of CRAs is tabulated in

Table 1 below:

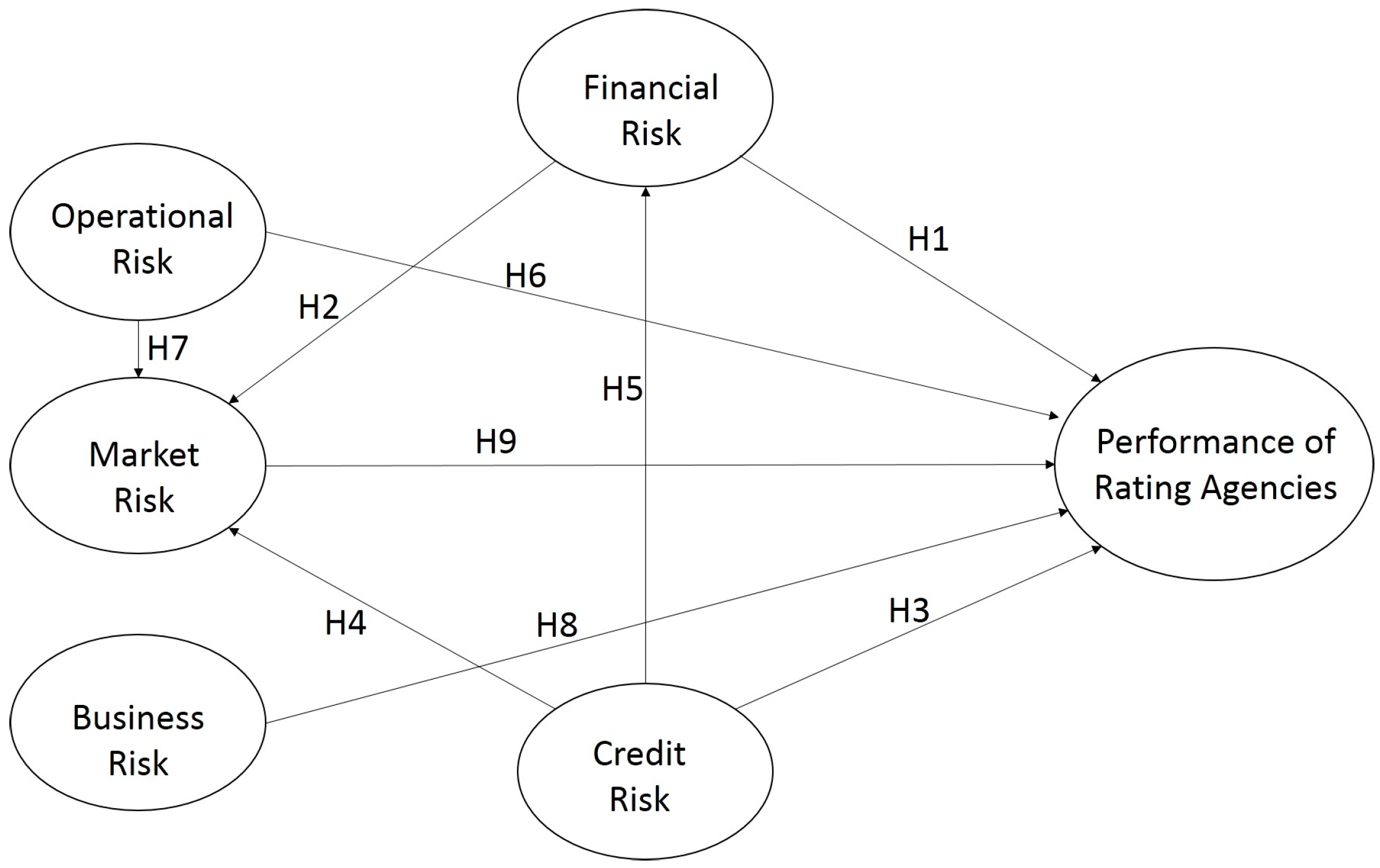

It is clear from the literature review that many studies have been performed to provide an understanding of the CRAs and their rating performance. However, there is a research gap that indicates the need to address the following questions: under which circumstances do credit ratings fail to calculate risk, how did investors overlook the risk pertaining to credit quality and the creditworthiness of ratings and their performance, which measures assisted CRAs to grow, and which factors contributed more to the financial crisis? Against this backdrop the research model, with its attendant nine Hypotheses (H1–H9) below (

Figure 1), will be used to evaluate the impact of various risks on the performance management of rating agencies.

The performance management of CRAs is a conceptual way of analysing their behaviour in a given way in which certain risk factors affect the rating provided by rating agencies. This provides so-called certified bonds and securities with quality and creditworthiness in the market to attract investors. In the current scenario, the rating agencies cannot be separated from corporate bonds and securities, causing investors to look after the ratings of individual corporate bonds and securities, like providing a measure to the investor. However, in today’s scenario, in which investors are more thoughtful, carefully choosing their investment options and considering the failure of rating agencies to calculate the risk related to rated bonds and securities, rating agencies need to be prepared for the next level of rating standards by revisiting their existing way of analysing corporate bonds and securities. As part of this research, we will study the rating agencies’ performance towards the next level of rating measures.

Zelmmer (

2007) suggested that, to achieve this objective, it necessitates a more concerted effort in the study of market and investors’ behavioural intentions, whereas the study performed by

Khalil et al. (

2007) indicated that the various measures of risk would improve the quality of credit ratings.

Voorhees (

2012) explained how credit rating agencies contributed to the crisis by giving their highest ratings to poorly understood new financial instruments, lacking significant accountability and oversight, and suffering from intense conflicts of interest. Similarly, the risk measures proposed in this research can be applied to measure the performance of rating agencies. The latent variables that directly or indirectly affect the performance of rating agencies are operational risk (OR), business risk (BR), market risk (MR), financial risk (FR), and credit risk (CR).

Financial risk was considered as one of the measures of credit rating by rating agencies. Financial risk’s key parameters consist of accounting (liquidity, current ratio, debt equity ratio, average turnover, net profits), governance (financial projects and debt servicing capabilities), risk tolerance (the provision of security for proposed assistance and the quality of collateral security), cash flow adequacy (income growth and net cash accruals), and capital structure and adequacy, which directly or indirectly affect the ratings provided by CRAs that might eventually influence the overall performance of rating agencies.

Partnoy (

2010) stated that liquidity risk is also becoming a more important part of investment decision making and that rating agencies do not cover liquidity risk as a measure to rate bonds and securities. As a result, the market for information about liquidity risk does not suffer from the same regulatory license distortions as the market for credit.

He and Xiong (

2012) explained that the deterioration in debt market liquidity led to greater risk in the liquidity premium in corporate bonds, credit risk, and the role of short-term debt in exacerbating rollover risk.

However, it of interest to note that extant literature, thus far, does not discuss in detail the relationship between the financial risk and the performance management of rating agencies, and how financial risk and rating agencies’ performance would help to build investor confidence in the rating of corporate bonds. Our research focuses on how rating agencies would perceive financial risk and its impact on the performance of rating agencies.

3. Hypothesis Formulation

Hypothesis 1 (H1). There is a significant impact of financial risk on the performance of rating agencies.

Hypothesis 2 (H2). There is a significant correlation between financial risk and market risk.

Credit risk is the risk arising from the uncertainty of an obligator’s ability to perform its contractual obligations. The corporate world is exposed to credit risk from diverse financial instruments, such as trade finance products and acceptances, foreign exchange, financial futures, swaps, bonds, options, commitments, and guarantees. Credit risk does not always occur alone, but it might always exert an impact on market risk. An increase in interest rates might damage the creditworthiness of a corporation, affecting its credit risk ability. Further, a fall in the value of a bond would have an impact on the market risk for the corporation, and therefore might affect its financial risk. As such, corporations should consider assessing credit risk and make sure that it is part of their financial risks. Firms should additionally have a risk avoidance model to identify, measure, evaluate, monitor, report, and control or mitigate credit risk on a timely basis (

Monetary Authority of Singapore 2013).

Baestaens (

1999) opined that the rating methodology is dependent on the industry segment, nature of the data, classification performance both within sample and out-of-sample, grade stability, and ease of communication towards the end-user.

O’Kane and Sen (

2005) suggested that corporations should determine the compensation for assuming the credit risk embedded within the security and the return of credit assets relative to some benchmark of higher credit quality and define, describe, and analyse the main credit spreads for fixed-rate bonds, floating-rate notes, and credit default swaps. For our research the three indicators analysed are deterioration in the credit quality of the counterparty, credit litigation and receivables collection, and the creditworthiness of the firm.

Hypothesis 3 (H3). There is a significant impact of credit risk on the performance of rating agencies.

Hypothesis 4 (H4). There is a significant correlation between credit risk and market risk.

Hypothesis 5 (H5). There is a significant interrelation between credit risk and financial risk.

Corporate policy changes and restructuring, changes in the regulation of financial markets, globalization, and deregulation exert a large impact on the magnitude and nature of corporations’ operational risk. The emphasis on operational risk within firms has increased, leading regulators, auditors, and rating agencies to expand their focus. Operational risk, by far, had not received the same amount of attention as credit and market risk until recently. De Fontnouvelle, DeJesus-Rueff, Jordan, and Rosengren (

De Fontnouvelle et al. 2003) suggested that operational risk has been impeded by the lack of internal or external data on operational losses. Operational losses are an important source of risk, and the capital charge for operational risk often exceeds the charge for market risk. Our study focuses on two advanced indicators—outsourcing policy and outsourcing risk.

Hypothesis 6 (H6). There is a significant impact of operational risk on the performance of rating agencies.

Hypothesis 7 (H7). There is a significant correlation between operational risk and market risk.

Business risk is a circumstance that might have a negative impact on the operation or profitability of a corporation. This could be the result of internal factors or external factors. Whenever the demand for the offering decreases, which could be due to a loss of business to competitors or a change in the general economic conditions, the amount of risk involved to investors will increase significantly.

Ferri and Liu (

2002) explained that the corporate growth potential, its capital requirements, the degree of competition in the market and industry, the productive diversification, and the ownership structure are included as business risks. Our research focuses on the integration of two specific indicators, the business continuity plan for the corporation and the downside of a country’s business environment, including the legal environment, levels of corruption, and socioeconomic variables such as income disparity.

Hypothesis 8 (H8). There is a significant impact of business risk on the performance of rating agencies.

Market risk refers to the risk to an institution resulting from movements in market prices, in particular changes in interest rates, foreign exchange rates, credit spreads, and equity and commodity prices. Market risk often arises from other forms of financial risk, such as credit and market liquidity risks. The downgrading of the credit standing of an issuer could lead to a drop in the market value of the securities issued by that issuer. Likewise, a major sale of a relatively illiquid security by another holder of the same security could depress the price of the security.

Yoshino (

2003) explained that market risk is implied by the prices of different options traded in the stock market. Carson, Elyasiani, and Mansur (

Carson et al. 2008) concluded that the market risk for diversified firms is smaller than that for non-diversified firms for both product and geographic diversification. In this research we analyse risk correlations and implied volatilities, the nature of the industry, the complexity of the corporate business activities, future potential internal organizational changes or external changes in market conditions, regulatory requirements, and market best practices and their trends.

Hypothesis 9 (H9). There is significant impact of market risk on the performance of rating agencies.

4. Data Collection

A pilot survey was conducted in personal interviews with 30 respondents to obtain holistic feedback about the survey respondents’ expectations of the performance management of CRAs. The survey included both qualitative and quantitative questions for the latent constructs. Based on the feedback, the final survey questionnaire was formulated. For each latent construct, three questions (indicators) were formulated capturing the indicators that could be used in evaluating the risk and performance of rating agencies. All the reflective indicators were measured on a 5-point Likert scale for data analysis using scales from ‘strongly agree’ to ‘strongly disagree’. The second part of the survey captured the demographic details of the respondents.

The data were collected through an online survey and personal interviews. A total of 304 respondents completed the survey; 16 incomplete or otherwise unusable responses were discarded from the complete data set, leaving 288 complete and usable responses. Finally, 200 good survey responses were chosen, taking into consideration those involved in making the financial decisions in the company. A summary of the demographic characteristics of the respondents is displayed in

Table 2 below.

The responses were compared based on the demographic variables of the respondents, including the number of employees in the organization, registered location of the company, annual turnover, area of employment, role in the industry, and those involved in making financial decisions to evaluate the response bias. Of the 288 respondents, 62.5% were involved in financial decision making and 79.8% were working in either upper management or middle management. In addition, 35.7% of the respondents were from finance and insurance and the remaining 64.3% were from other service sectors, like information and data services, health care, hotels, education, telecommunications, and so on. The respondents were from across the globe—33% were from the USA, 55.20% from the Asia-Pacific region, 7.6% from EMEA (Europe, the Middle East, and Africa), and the remaining 4.2% from countries including Australia, Canada, and Malaysia.

5. Results

We used the partial least squares (PLS) technique to validate the measurements and to test the hypotheses using the SmartPLS 2.0M3 software (

Ringle et al. 2005). The PLS technique employs a component-based approach to model estimation and is best suited to testing complex structural models. The PLS technique was selected because it avoids problems of inadmissible solutions and factor indeterminacy (

Fornell and Bookstein 1982;

Lohmöller 1989;

Wold 1989). The PLS technique also does not impose any normality requirements on the data. In addition, the PLS technique can be used to estimate both reflective and formative constructs (

Chin 1998). We followed a two-step approach first to assess the quality of our measures using the measurement model and then to test the hypotheses using the structural model (

Joreskog and Sorbom 1993).

The SmartPLS 2.0 M3 software was used for path modelling with latent variables. The tool was used to measure the validity and reliability of the constructs. SmartPLS uses the PLS technique to examine theory and measures simultaneously (

Hulland 1999).

We evaluated the reliability of the research measurements using Cronbach’s alpha and composite reliability scores. Constructs are considered to be adequate when the Cronbach’s alpha scores are above the minimum recommended value of 0.6 (

Hair et al. 2010;

Malhotra 2010;

Robinson et al. 1991) and the composite reliability scores are above the recommended cut-off of 0.7 (

Gefen et al. 2000;

Nunnally 1978). Composite reliability is considered to be a more rigorous estimate of reliability (

Chin and Gopal 1995). As shown in

Table 3, the composite reliability scores exceed 0.8 and the Cronbach’s alpha values exceed 0.69. Thus, the model can be considered as reliable.

Furthermore, as shown in

Table 4, the item-to-construct correlation vs. correlations with other constructs shows that the indicators are only part of the highlighted constructs and are not part of the other constructs.

The discriminant validity was investigated to indicate the extent to which the measures in the model are different from other measures in the same model. In the PLS context, the criterion for discriminant validity is that a construct should share more variance with its measures than it shares with other constructs in the given model (

Hulland 1999). The discriminant validity was examined by testing the correlations between the measures of potentially overlapping constructs and must be different from unity (

Anderson and Gerbing 1988). In addition, as shown in

Table 5, the correlation between any two constructs should be greater than 0.7. The highest correlation between any two constructs should have a minimum recommended value of 0.60. Next, as shown in

Table 6, the square root of the AVE of each construct is larger than all the cross-correlations between the construct and other constructs (

Chin 1998;

Fornell and Larcker 1981). These tests suggest that the discriminant validity of the measurement model is satisfactory.

Next the hypotheses were tested by examining the structural model using the SmartPLS software. The structural model includes the estimation of the path coefficients, which indicates the strength of the relationships between the independent and dependent variables. A bootstrapping resampling procedure (

Davison and Hinkley 1997;

Efron and Tibshirani 1993) of 200 samples was followed to determine the significance level of the paths defined within the structural model (

Chatelin et al. 2002;

Chin and Gopal 1995). Bootstrapping results in a larger sample, which is claimed to model the unknown population (

Henderson 2005). The corresponding t-values show the level of significance using the magnitude of the standardized parameter estimates between the constructs. The 5% significance level (

p < 0.05) was used as the statistical decision criterion (

Cowles and Davis 1982;

Fisher 1925).

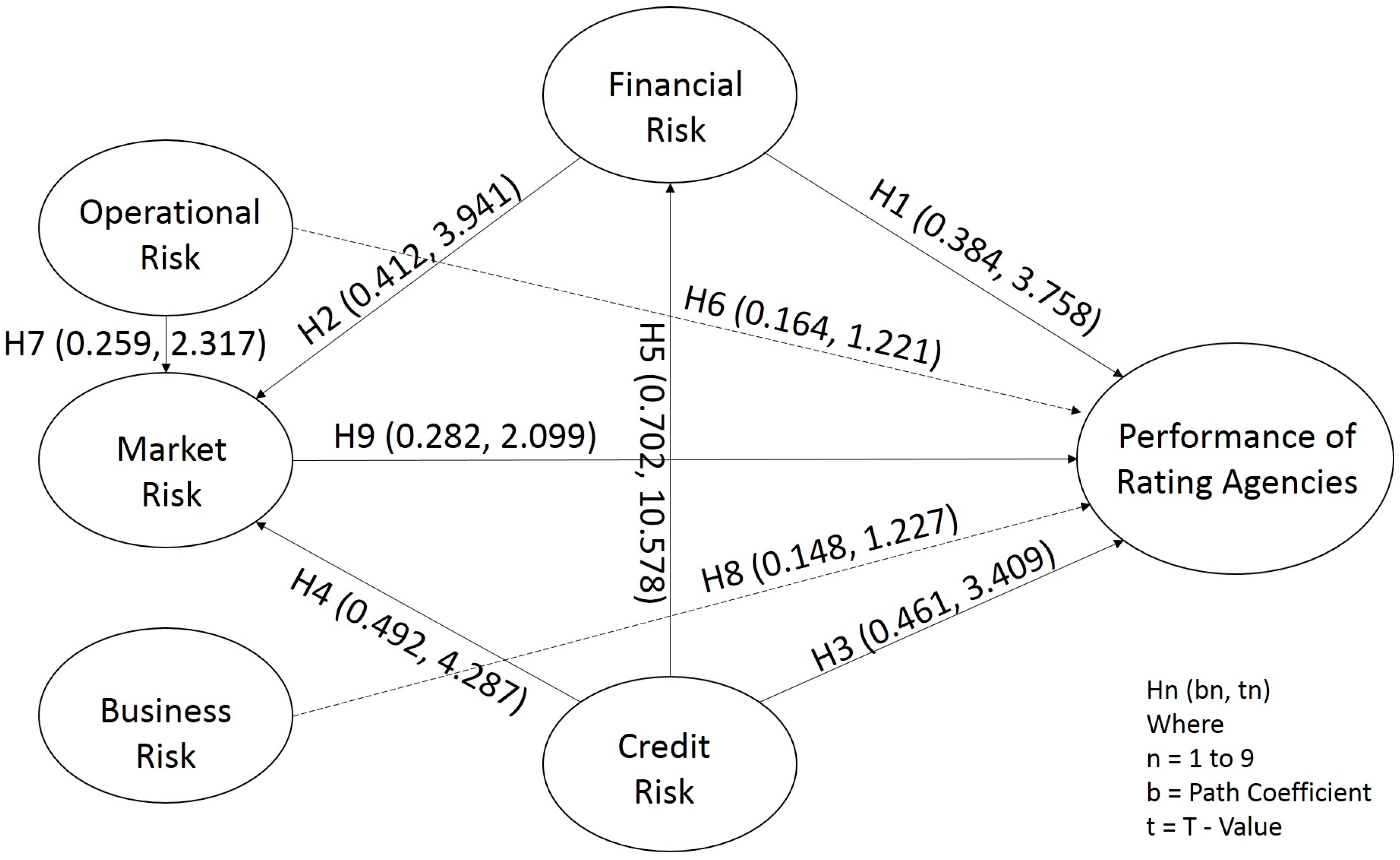

The results of the structural model are summarized in

Table 6.

As observed above, the paths from the impact of financial risk on the performance of rating agencies (b = 0.384, p < 0.01) and the integration of financial risk with market risk (b = 0.412, p < 0.01) are significant, supporting Hypotheses (H1) and (H2), respectively. The impact of operational risk on the performance of rating agencies (b = 0.164, p > 0.1) and the impact of business risk on the performance of rating agencies (b = 0.148, p > 0.1) have insignificant paths over the performance of rating agencies, failing to support Hypotheses (H6) and (H8), respectively.

Hypotheses (H3)–(H5) are supported, because the impact of credit risk on the performance of rating agencies (b = 0.461, p < 0.01), the correlation between credit risk and market risk (b = 0.492, p < 0.01), and the interrelation between credit risk and financial risk (b = 0.702, p < 0.01) have significant positive coefficients. The results show that the correlation between operational risk and market risk (b = 0.259, p < 0.05) is significant and supports Hypothesis (H7). The above results also point out that the impact of market risk on the performance of rating agencies (b = 0.282, p < 0.05) has significant positive coefficients.

The following figures,

Figure 2 and

Figure 3, exhibit our findings using PLS structural modelling.

We conducted a goodness-of-fit (GoF) measure to assess our PLS path modelling (

Amato et al. 2004). GoF is suggested as a global fit measure for PLS path modelling (

Chatelin et al. 2002). GoF (0 < GoF < 1) is defined as the geometric mean of the average communality and average R

2 (for endogenous constructs).

Following the guidelines of (

Wetzels et al. 2009), we had calculated the GoF value to validate our PLS model. The GoF value for our model is 0.622 (the geometric mean of average communality is 0.610 and the average of R

2 is 0.634). The GoF value for the model exceeds the minimum cut-off value of 0.36 for large effect sizes of R

2. The GoF value provides adequate support to validate the PLS model (

Wetzels et al. 2009). The baseline values for validating the PLS model globally are GoF

small = 0.1, GoF

medium = 0.25, and GoF

large = 0.36 (

Akter et al. 2011).

The study centred on the performance of rating agencies and its impact on corporations while measuring various risks related to bond ratings. It focused on the factors that would be critical in designing a model for the performance management of rating agencies. As part of the research, five new factors and the ways in which they would affect the performance of rating agencies were identified. Rating agencies, including financial institutions and other financial intermediaries, can leverage the research while evaluating corporate bond ratings. They should use the research to frame the model for the performance of rating agencies and to attain a competitive edge over their competitors. Industry players should focus on introducing a correlation model for analysing the interrelation between various risks, like credit risk, which might further influence market risk and vice versa. A Nationally Recognized Statistical Rating Organization (NRSRO) and the U.S. Securities and Exchange Commission (SEC) should also consider tightening the rules and regulations for rating agencies apart from providing a license for new players in the rating market to break the ‘natural oligopoly’ of the Big Three. This research can be used to frame a model for other ratings, like a country’s sovereign rating, state ratings, financial institution ratings, and individual ratings.

The study concluded that market risk is internally correlated with credit risk, financial risk, and operational risk and has an impact on the performance management of CRAs. The impact of market risk on the performance of rating agencies is comparatively less than that of credit and financial risk but has greater importance while analysing the performance of ratings. Though market risk carries less significance than financial and credit risk, it has great importance, because it is strongly correlated with financial, credit, and operational risks.

This study further concluded that credit risk and financial risk are interrelated and significantly correlated, forming an important measure in analysing the performance of rating agencies. On the other hand, operational risk and business risk do not have a significant impact on the performance of rating agencies.