Consistent Re-Calibration of the Discrete-Time Multifactor Vasiček Model †

Abstract

:1. Introduction

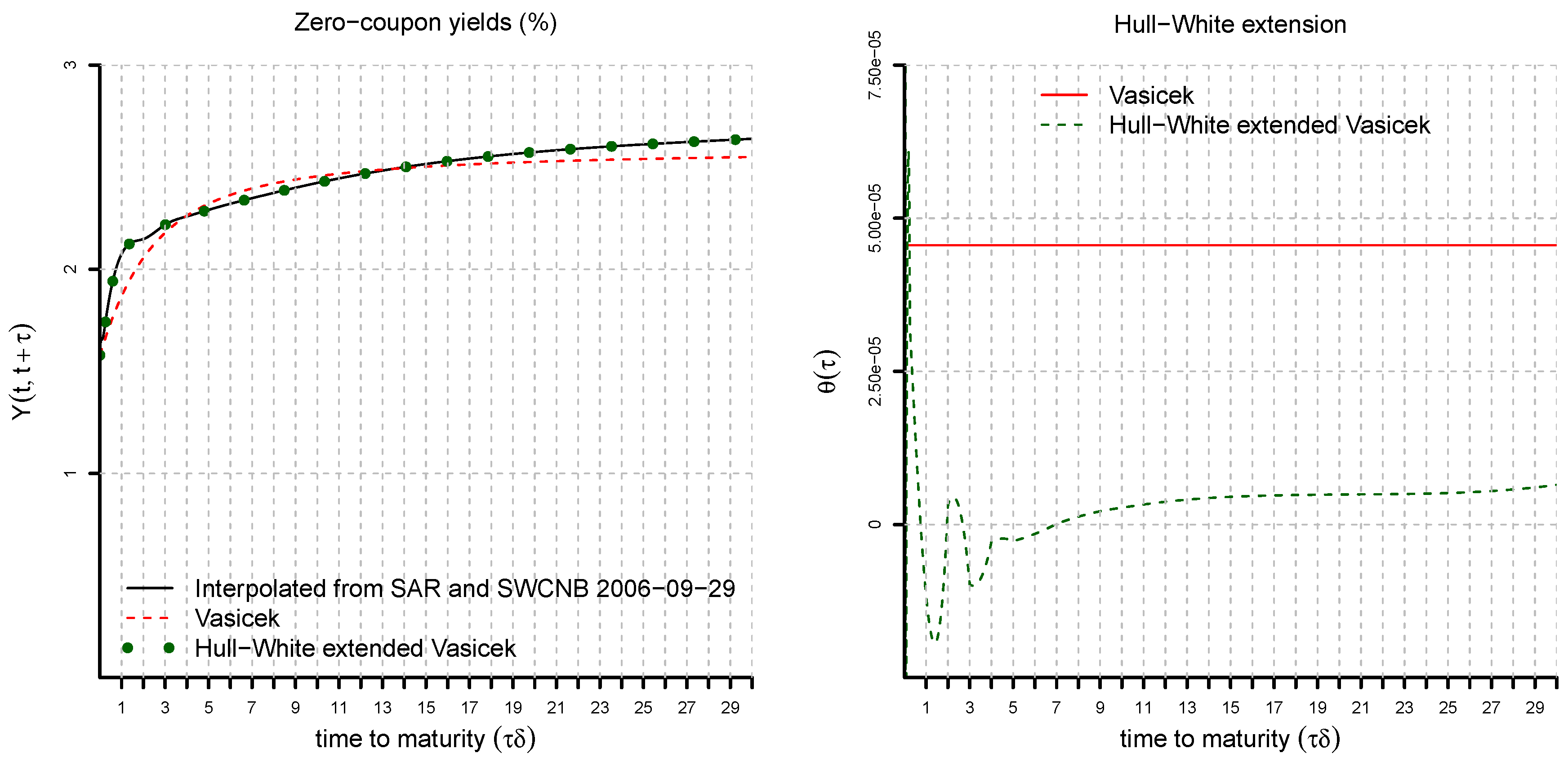

2. Discrete-Time Multifactor Vasiček Model and Hull–White Extension

2.1. Setup and Notation

2.2. Discrete-Time Multifactor Vasiček Model

2.3. Hull–White Extended Discrete-Time Multifactor Vasiček Model

2.4. Calibration of the Hull–White Extended Model

3. Consistent Re-Calibration

3.1. Consistent Re-Calibration Algorithm

3.1.1. Initialization

3.1.2. Increments of the Factor Process from

3.1.3. Parameter Update and Re-Calibration at

3.2. Heath–Jarrow–Morton Representation

- CRC of the multifactor Vasiček spot rate model can be defined directly in the HJM framework assuming a stochastic dynamics for the parameters. However, solely from the HJM representation, one cannot see that the yield curve dynamics is obtained, in our case, by combining well-understood Hull–White extended multifactor Vasiček spot rate models using the CRC algorithm of Section 3; that is, the Hull–White extended multifactor Vasiček model gives an explicit functional form to the HJM representation.

- The CRC algorithm of Section 3 does not rely directly on having independent and Gaussian components. The CRC algorithm is feasible as long as explicit formulas for ZCB prices in the Hull–White extended model are available. Therefore, one may replace the Gaussian innovations by other distributional assumptions, such as normal variance mixtures. This replacement is possible provided that conditional exponential moments can be calculated under the new innovation assumption. Under non-Gaussian innovations, it will no longer be the case that the HJM representation does not depend on the Hull–White extension .

- Interpretation of the parameter processes will be given in Section 5, below.

4. Real World Dynamics and Market Price of Risk

5. Choice of Parameter Process

5.1. Interpretation of Parameters

5.1.1. Level and Speed of Mean Reversion

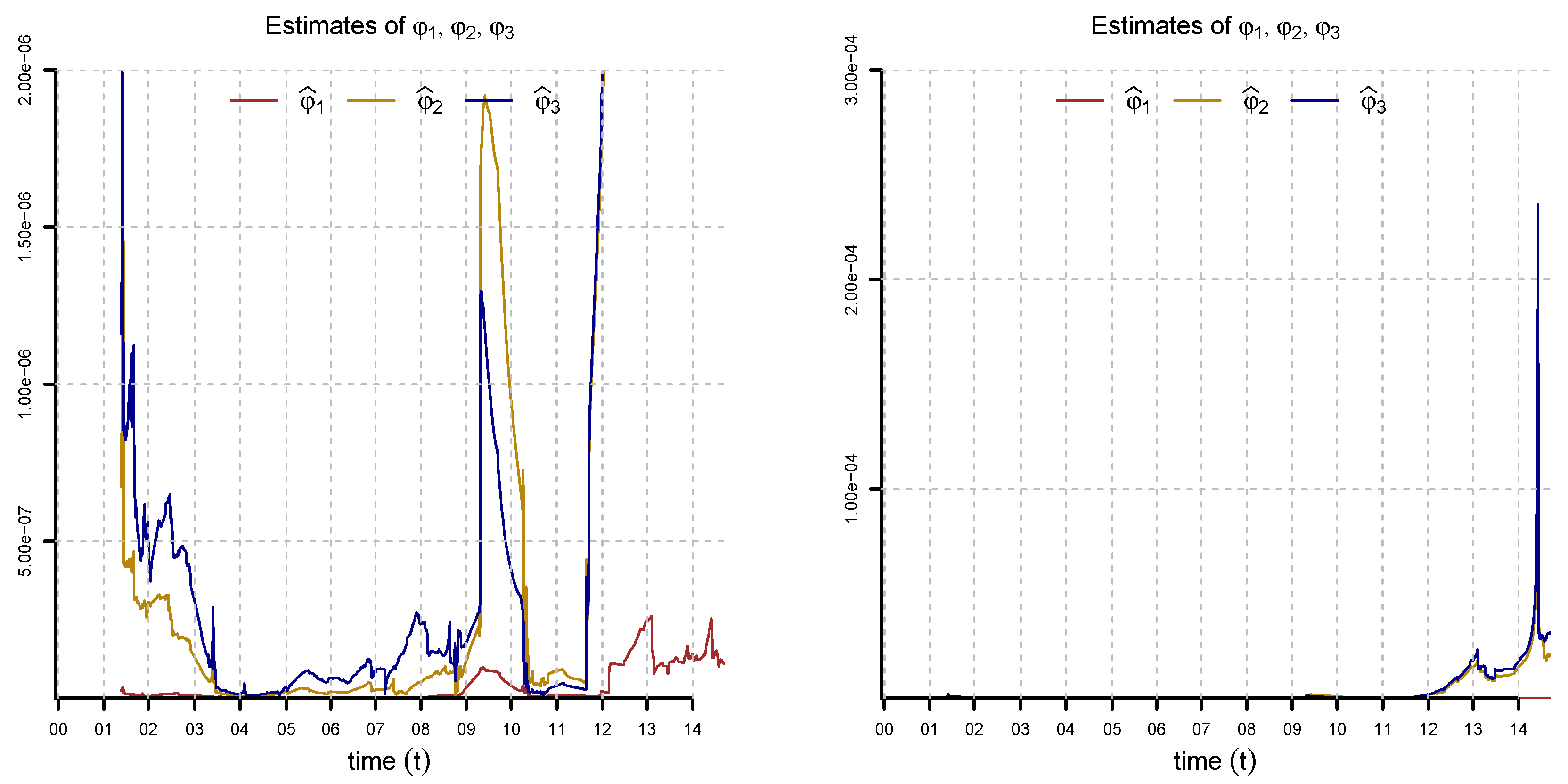

5.1.2. Instantaneous Variance

5.2. State Space Modeling Approach

5.2.1. Transition System

5.2.2. Measurement System

5.2.3. Anchoring

5.2.4. Forecasting the Measurement System

5.2.5. Bayesian Inference in the Transition System

5.2.6. Forecasting the Transition System

5.2.7. Likelihood Function

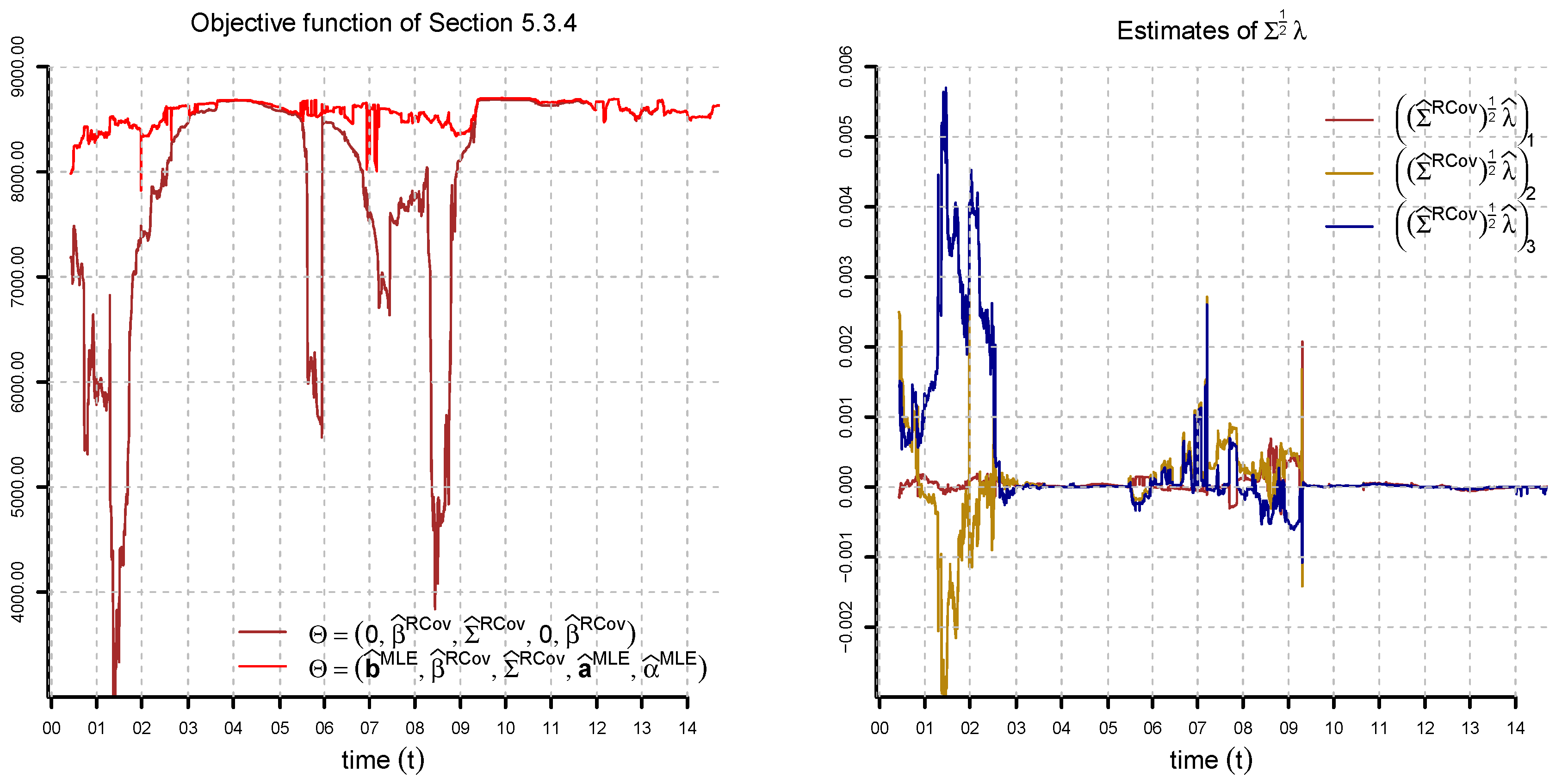

5.3. Estimation Motivated by Continuous Time Modeling

5.3.1. Rescaling the Time Grid

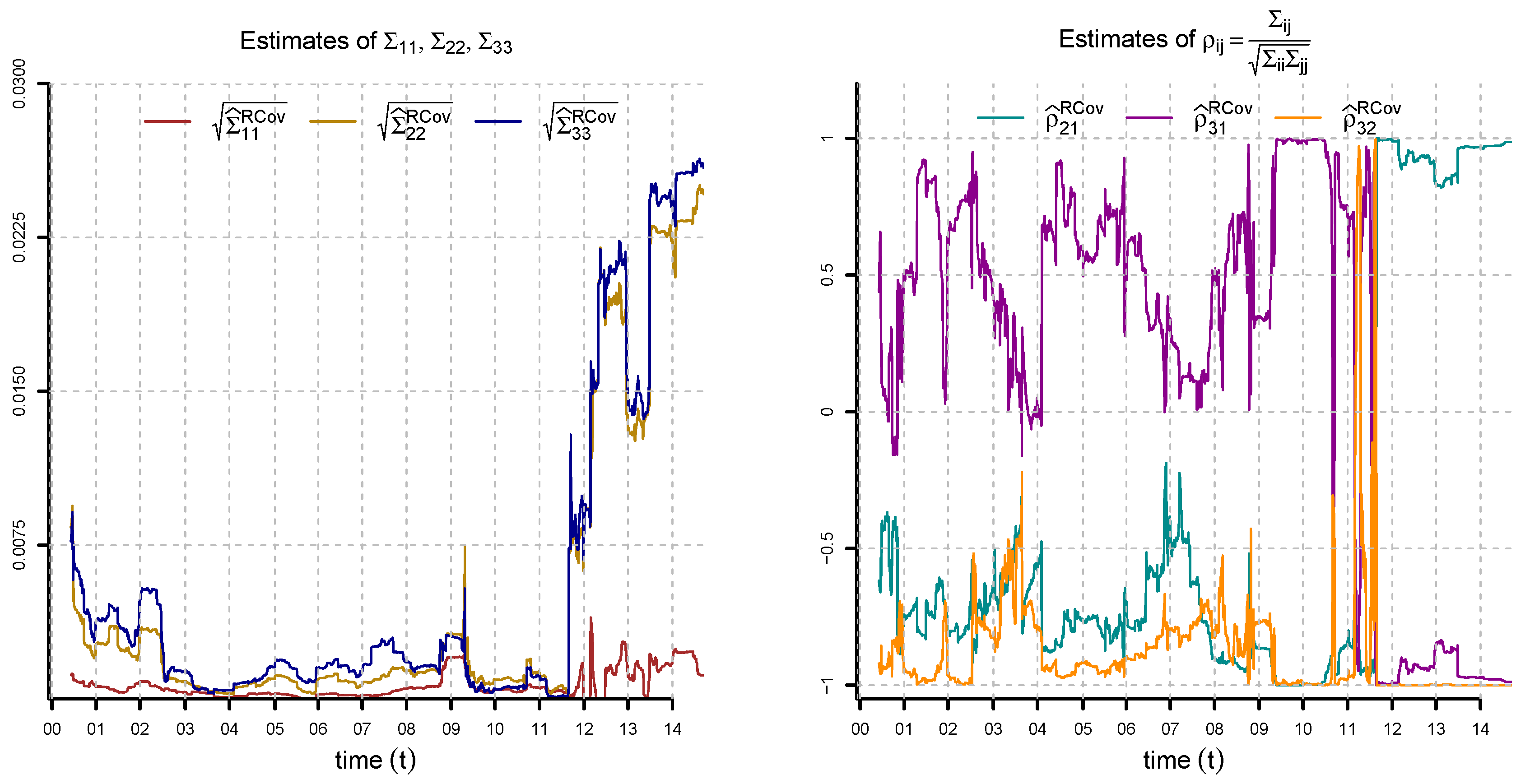

5.3.2. Longitudinal Realized Covariations of Yields

- It does not depend on the unobservable factors .

- It allows for direct cross-sectional estimation of β and Σ. That is, β and Σ can directly be estimated from market observations without knowing the market-price of risk.

- It is helpful to determine the number of factors needed to fit the model to market yield curve increments. This can be analyzed by principal component analysis.

- It can also be interpreted as a small-noise approximation for noisy measurement systems of the form (18).

5.3.3. Cross-Sectional Estimation of β and Σ

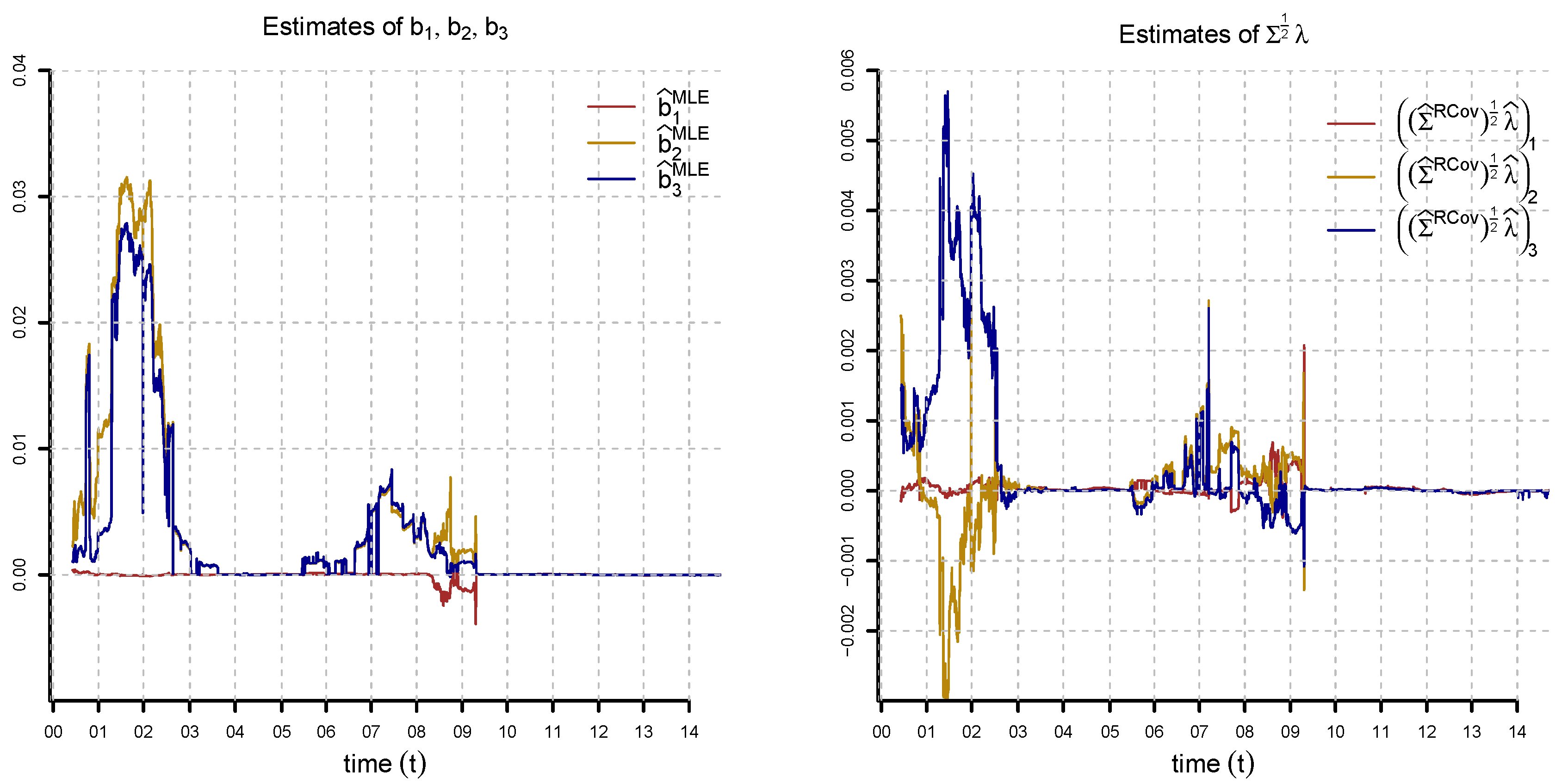

5.4. Inference on Market Price of Risk

6. Numerical Example for Swiss Interest Rates

6.1. Description and Selection of Data

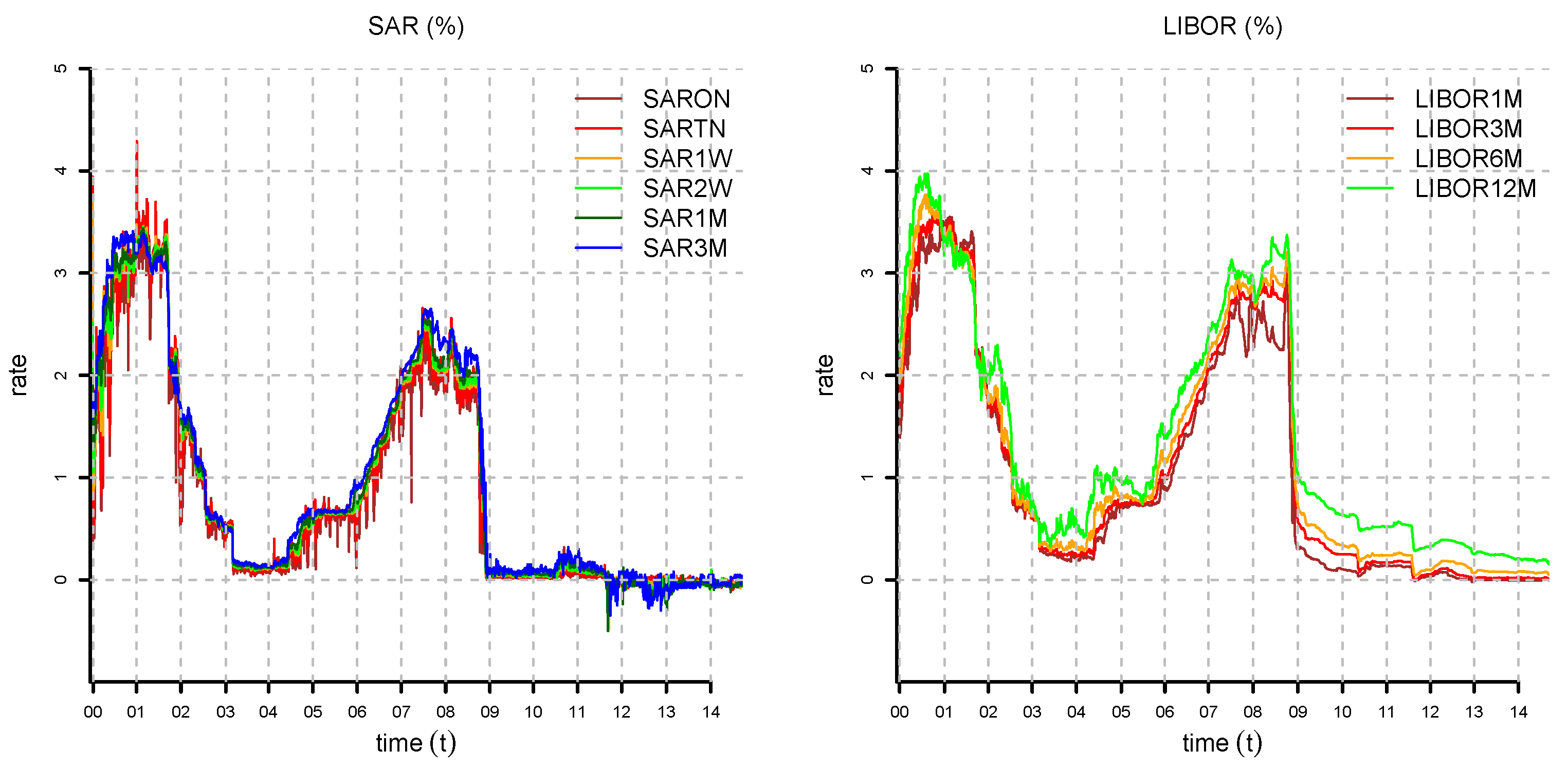

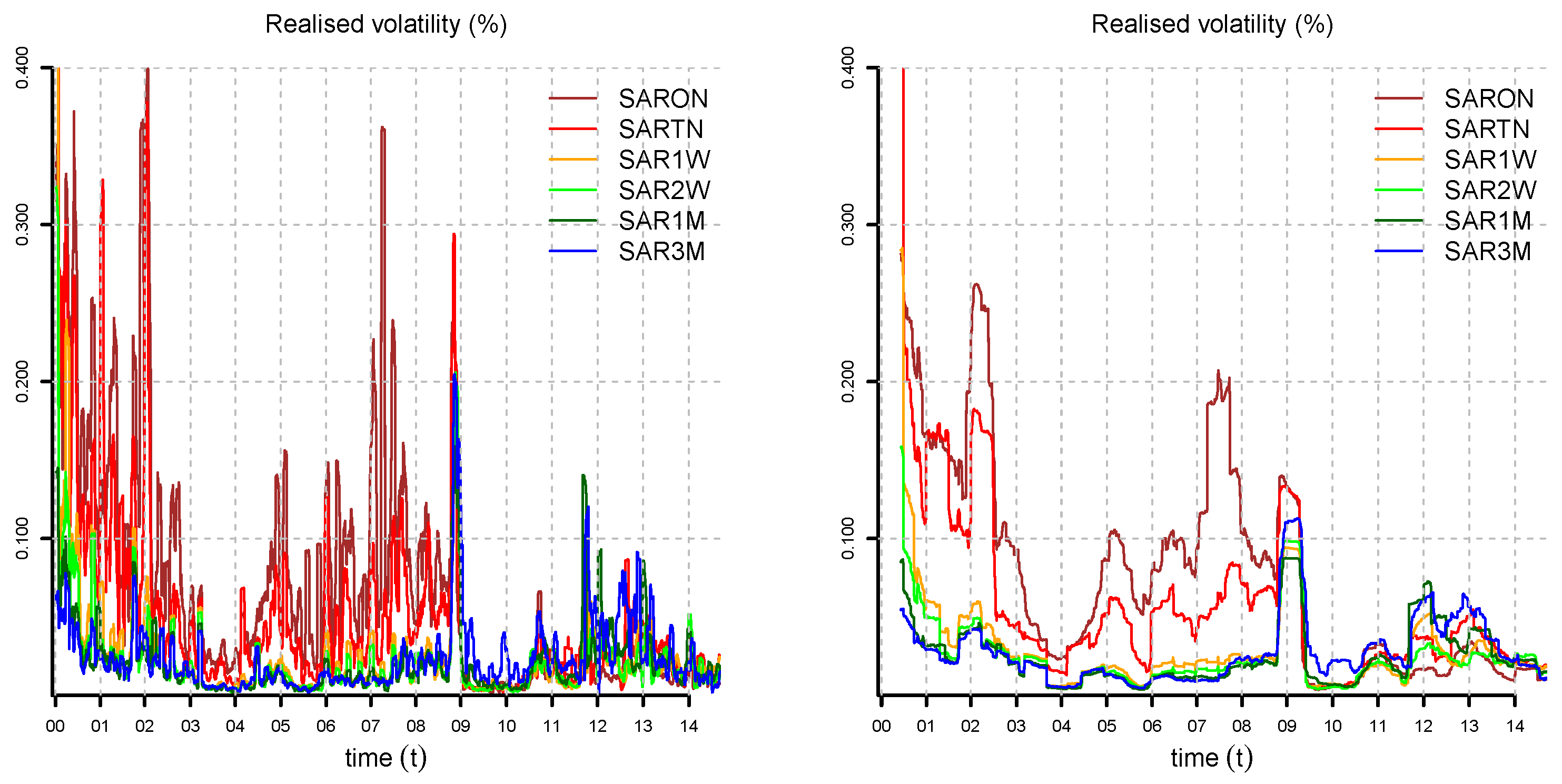

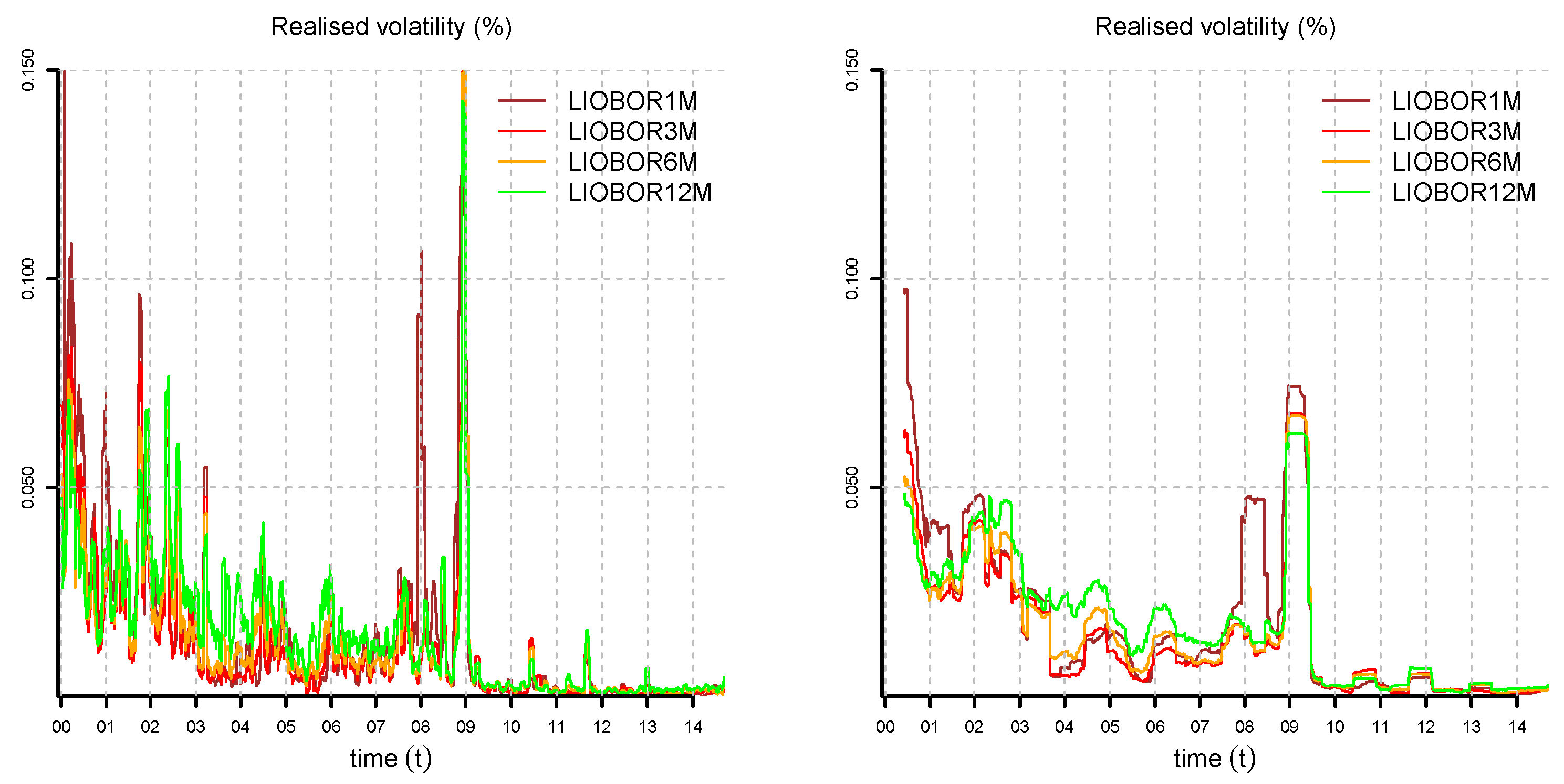

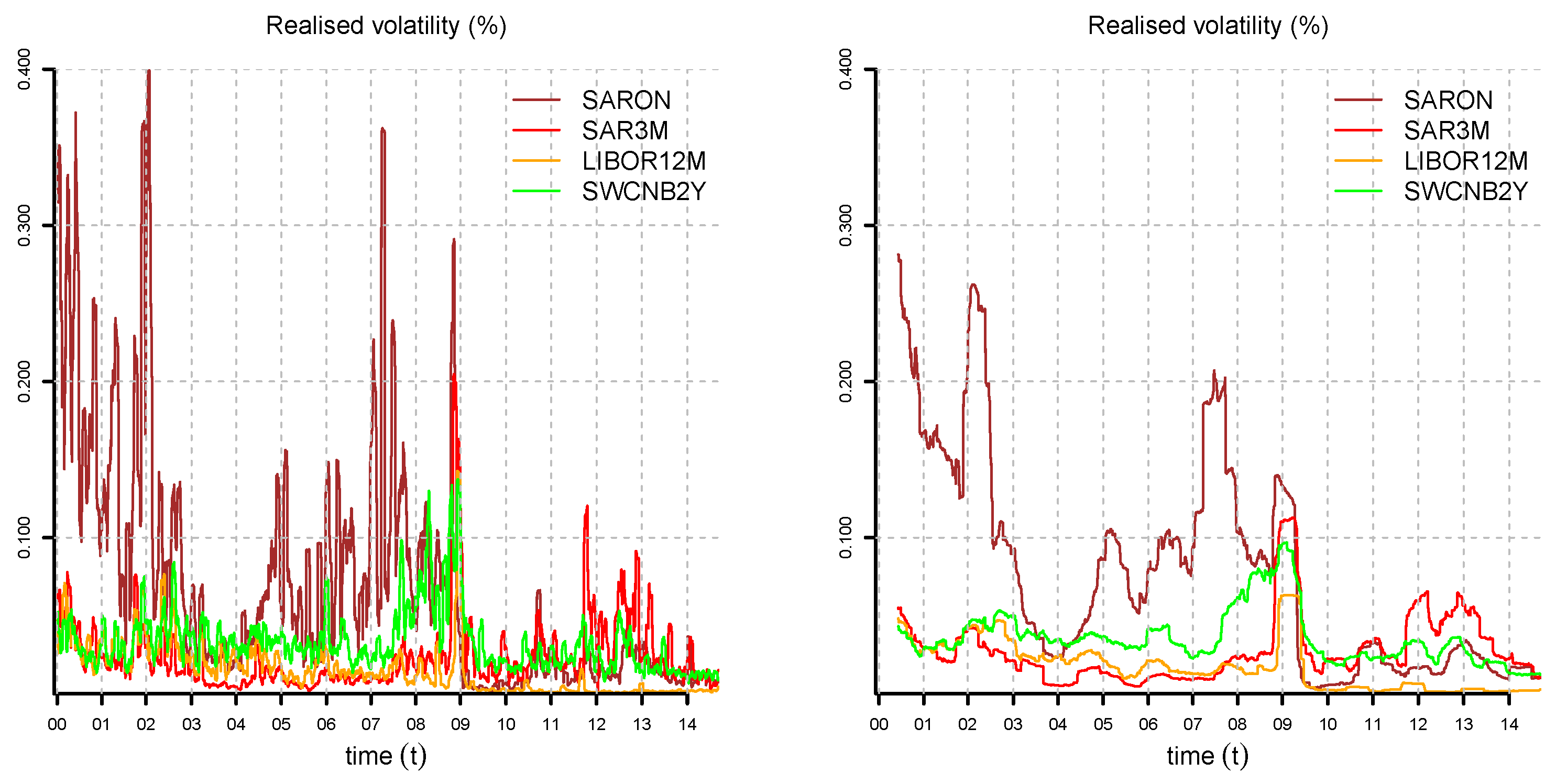

- Short times to maturity. The SAR is an ongoing volume-weighted average rate calculated by the Swiss National Bank (SNB) based on repo transactions between financial institutions. It is used for short times to maturity of at most three months. For SAR, we have the Over-Night SARONthat corresponds to a time to maturity of Δ (one business day) and the SAR Tomorrow-Next (SARTN) for time to maturity (two business days). The latter is not completely correct, because SARON is a collateral over-night rate and tomorrow-next is a call money rate for receiving money tomorrow, which has to be paid back the next business day. Moreover, we have the SAR for times to maturity of one week (SAR1W), two weeks (SAR2W), one month (SAR1M) and three months (SAR3M); see also [10].

- Short to medium times to maturity. The LIBOR reflects times to maturity, which correspond to one month (LIBOR1M), three months (LIBOR3M), six months (LIBOR6M) and 12 months (LIBOR12M) in the London interbank market.

- Medium to long times to maturity. The SWCNB is based on Swiss government bonds, and it is used for times to maturity, which correspond to two years (SWCNB2Y), three years (SWCNB3Y), four years (SWCNB4Y), five years (SWCNB5Y), seven years (SWCNB7Y), 10 years (SWCNB10Y), 20 years (SWCNB20Y) and 30 years (SWCNB30Y).

6.2. Model Selection

6.2.1. Discussion of Identification Assumptions

6.2.2. Determination of the Number of Factors

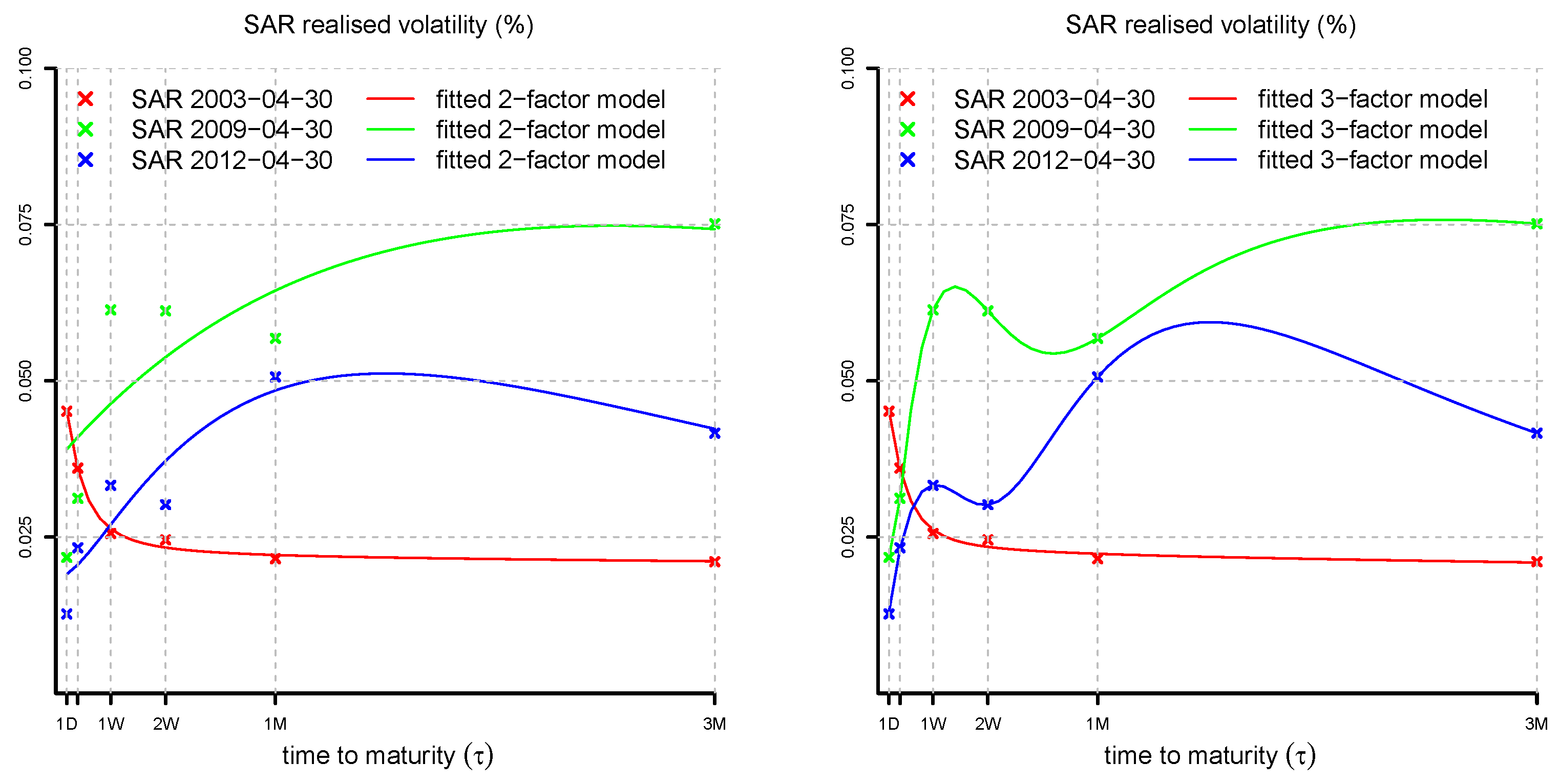

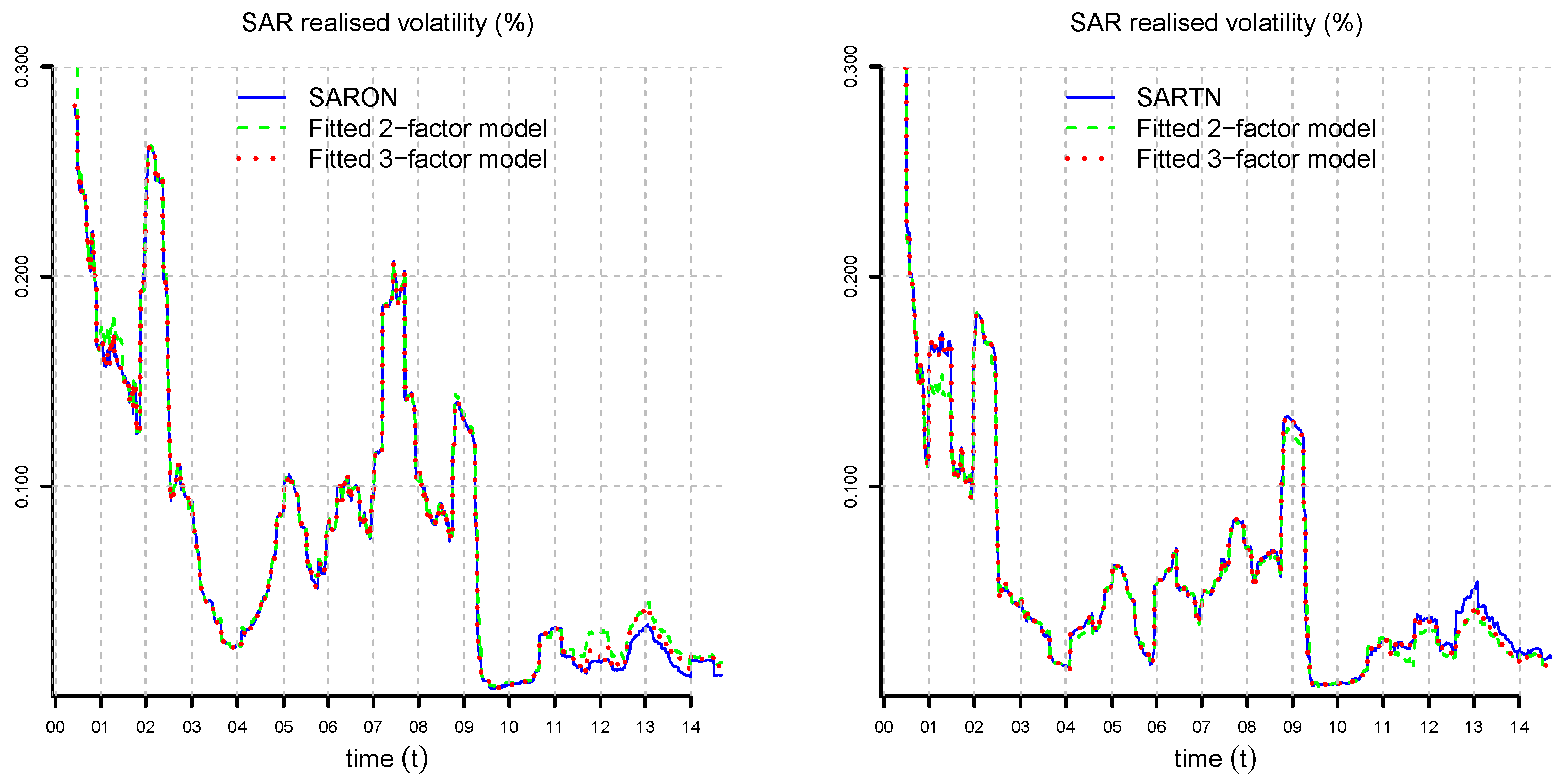

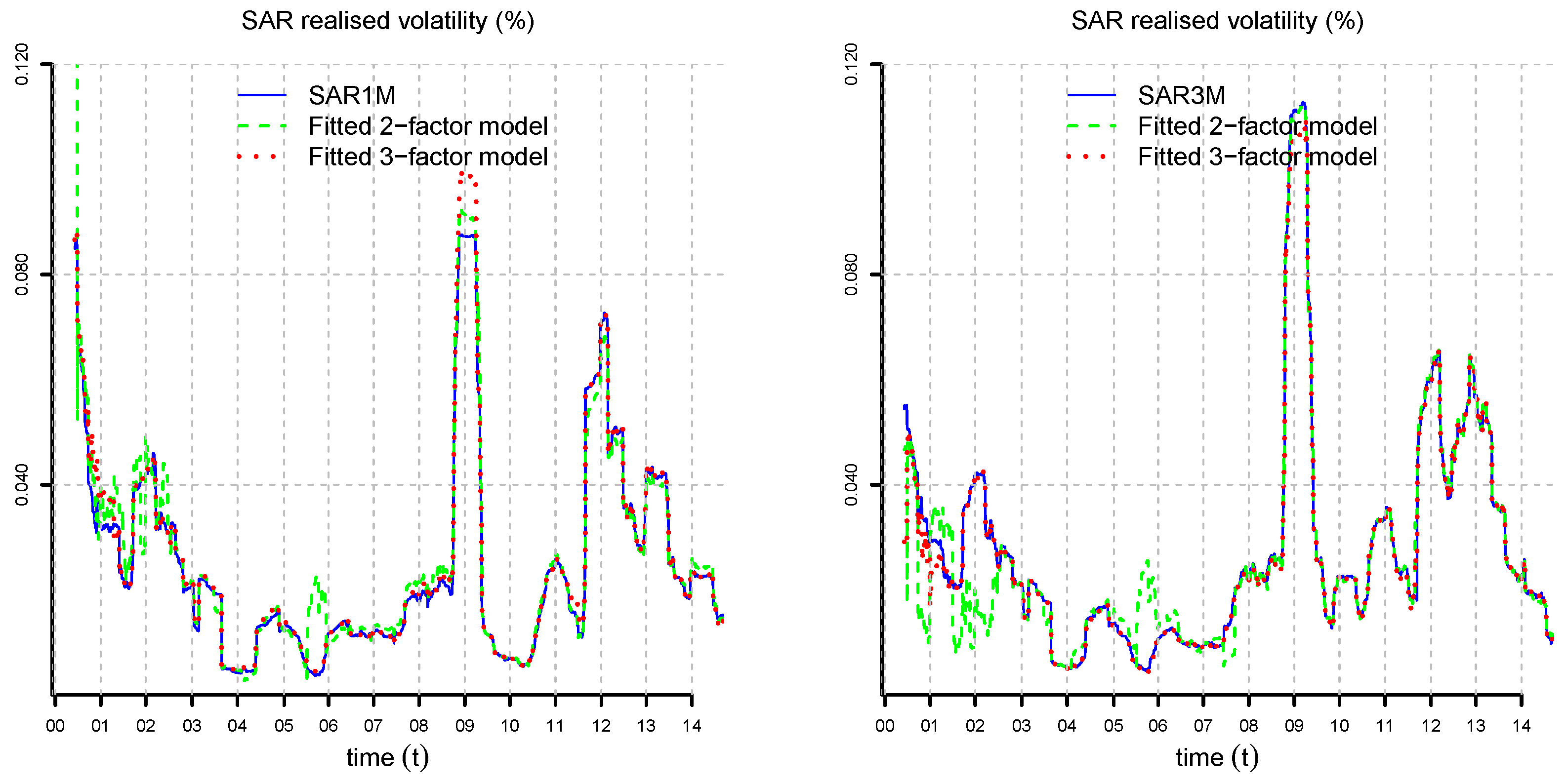

6.2.3. Determination of Vasiček Parameters

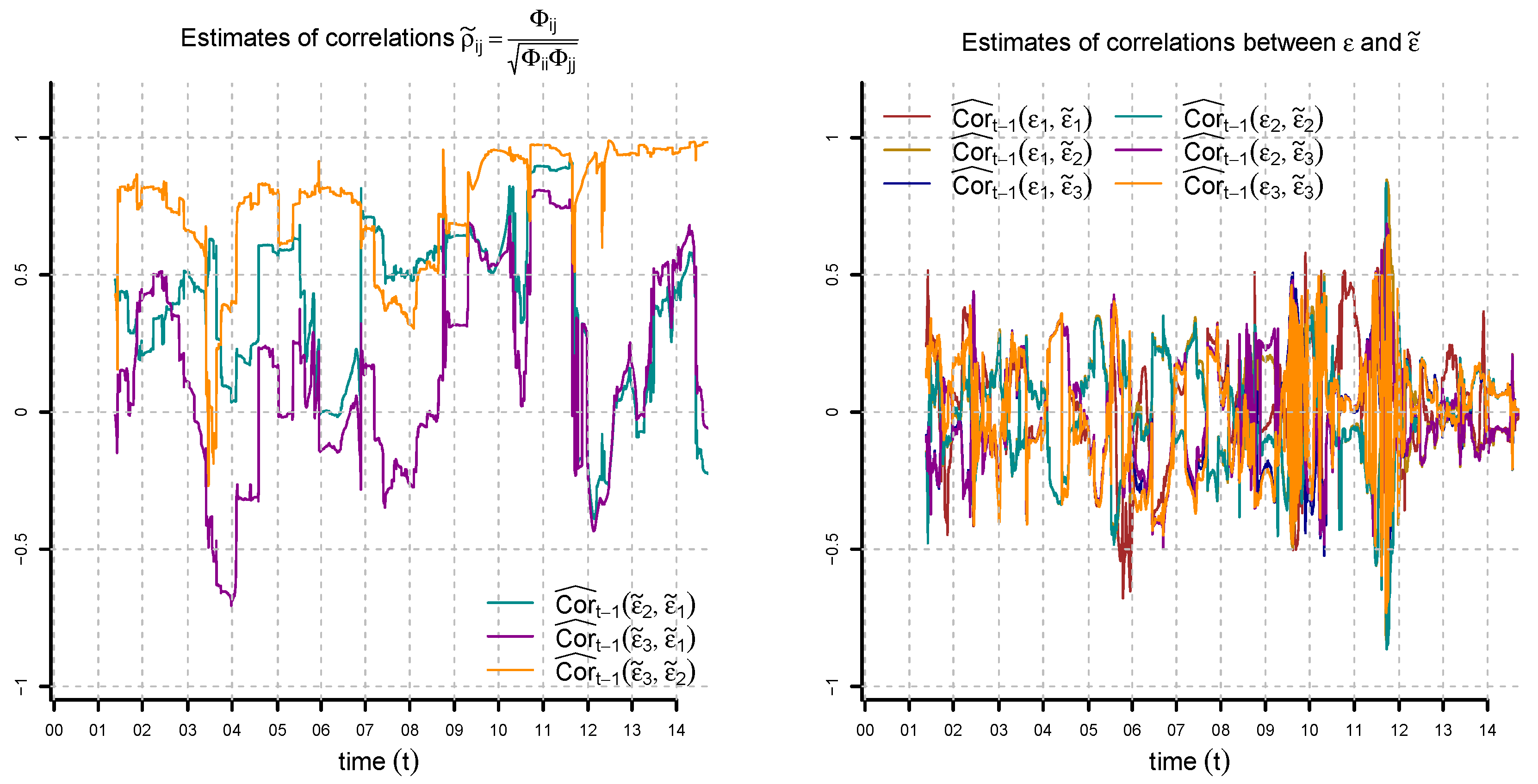

6.2.4. Selection of a Model for the Vasiček Parameters

6.3. Simulation and Back-Testing

6.3.1. Simulation

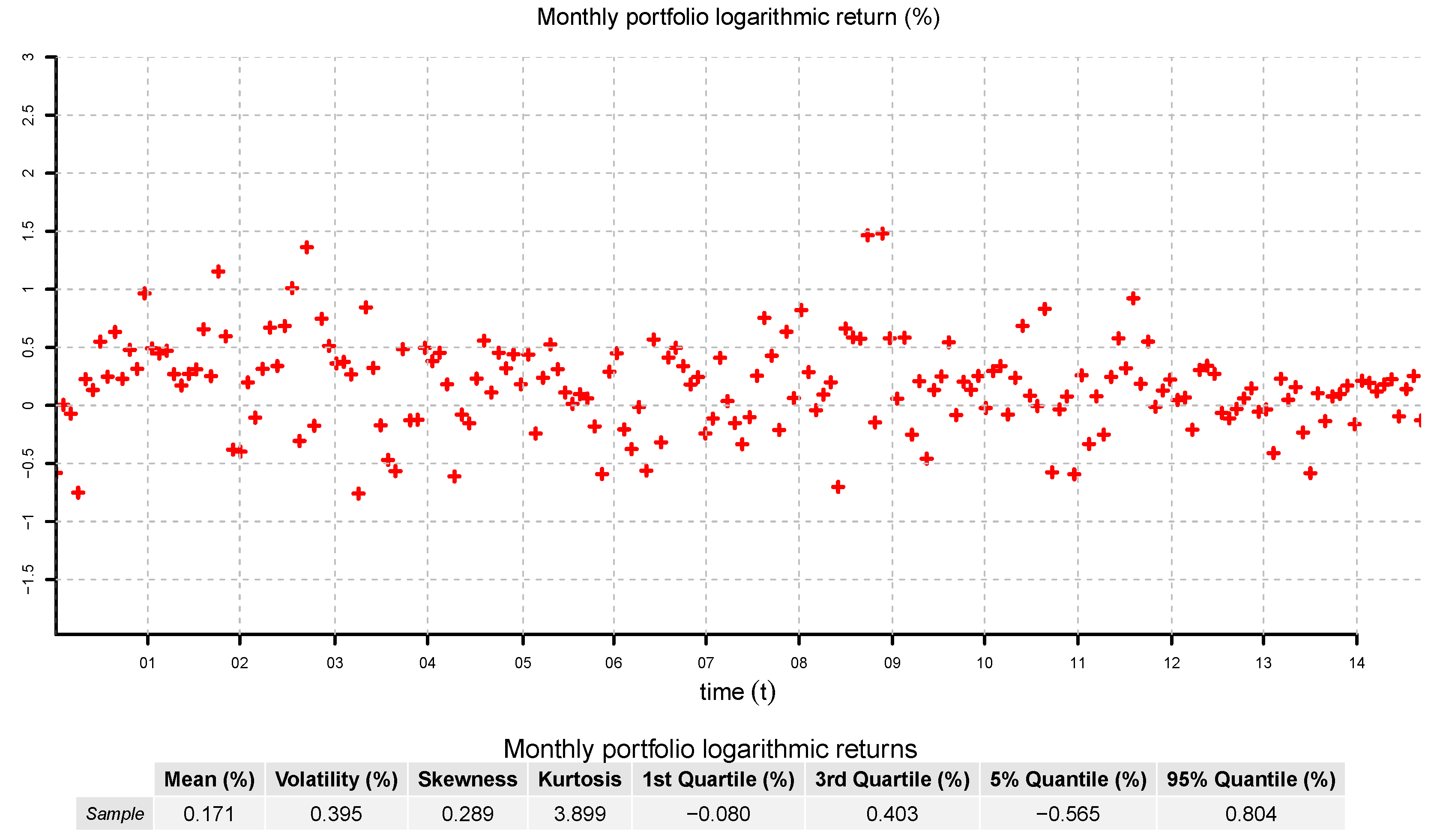

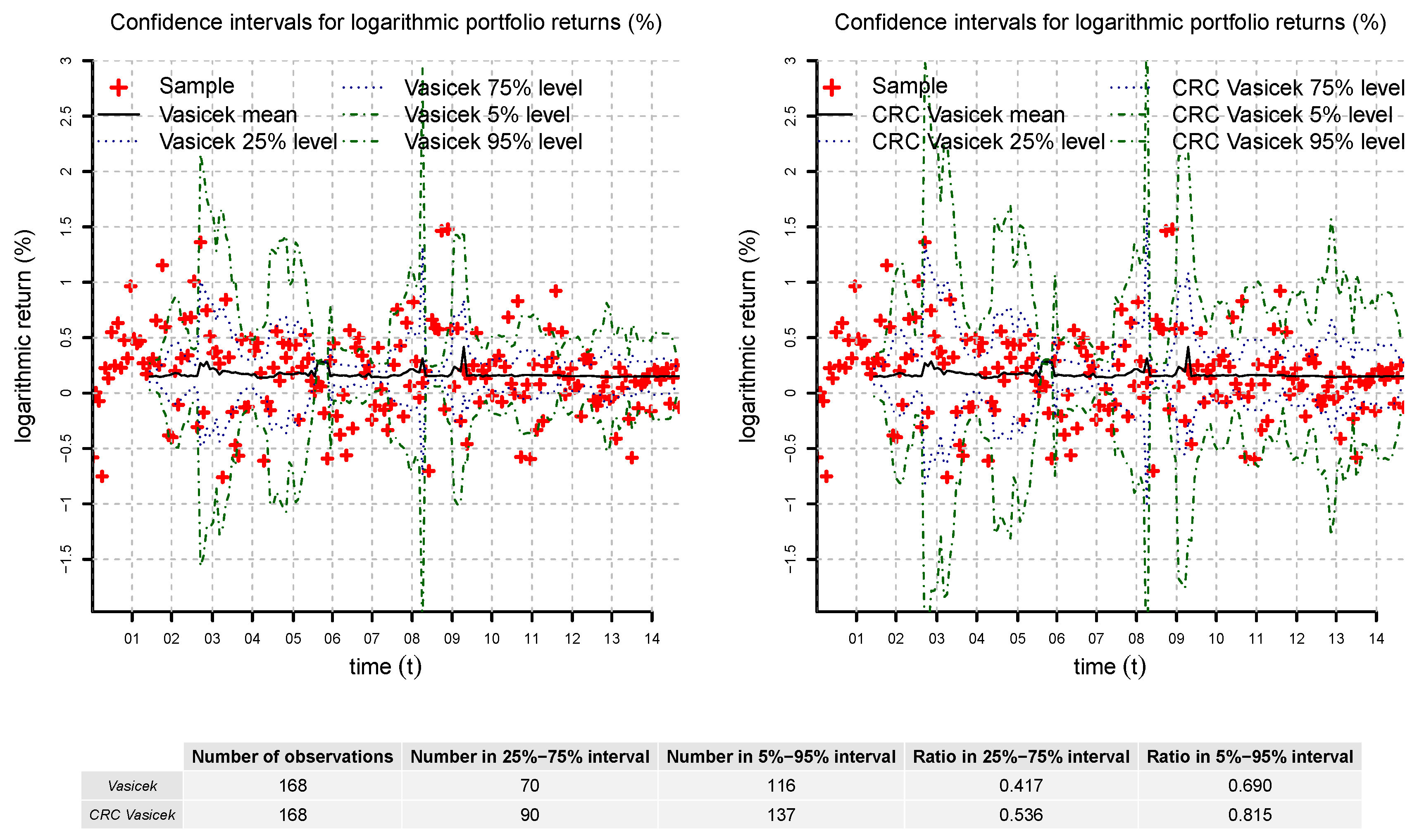

6.3.2. Back-Testing

6.3.3. Regulatory Framework

7. Conclusions

- Flexibility and tractability. Consistent re-calibration of the multifactor Vasiček model provides a tractable extension that allows parameters to follow stochastic processes. The additional flexibility can lead to better fits of yield curve dynamics and return distributions, as we demonstrated in our numerical example. Nevertheless, the model remains tractable. In particular, yield curves can be simulated efficiently using Theorem 5 and Corollary 6. This allows one to efficiently calculate model quantities of interest in risk management, forecasting and pricing.

- Model selection. CRC models are selected from the data in accordance with the robust calibration principle of [4]. First, historical parameters, market prices of risk and Hull–White extensions are inferred using a combination of volatility estimation, MLE and calibration to the prevailing yield curve via Formulas (23–26, 10). The only choices in this inference procedure are the number of factors of the Vasiček model and the window length K. Then, as a second step, the time series of estimated historical parameters are used to select a model for the parameter evolution. This results in a complete specification of the CRC model under the real world and the pricing measure.

- Application to modeling of Swiss interest rates. We fitted a three-factor Vasiček CRC model with stochastic volatility to Swiss interest rate data. The model achieves a reasonably good fit in most time periods. The tractability of CRC allowed us to compute several model quantities by simulation. We looked at the historical performance of a representative buy and hold portfolio of Swiss bonds and concluded that a multifactor Vasiček model is unable to describe the returns of this portfolio accurately. In contrast, the CRC version of the model provides the necessary flexibility for a good fit.

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| CRC | Consistent re-calibration |

| HJM | Heath–Jarrow–Morton |

| ZCB | zero-coupon bond |

Appendix A Proofs

- First component . We have , and:see Theorem 3. Solving the last equation for , we have:From (6) and the equation for in Theorem 2, we obtain:This is equivalent to:

- Recursion . Assume we have determined for . We want to determine . We have , and iteration of the recursive formula for in Theorem 3 implies:Solving the last equation for and using , we have:From (6) and the equation for in Theorem 2, we obtain:This is equivalent to:

References

- O. Vasiček. “An equilibrium characterization of the term structure.” J. Financ. Econ. 5 (1997): 177–188. [Google Scholar] [CrossRef]

- J.C. Cox, J.E. Ingersoll, and S.A. Ross. “A theory of the term structure of interest rates.” Econometrica 53 (1985): 385–407. [Google Scholar] [CrossRef]

- D. Heath, R. Jarrow, and A. Morton. “Bond pricing and the term structure of interest rates: A new methodology for contingent claim valuation.” Econometrica 60 (1992): 77–105. [Google Scholar] [CrossRef]

- P. Harms, D. Stefanovits, J. Teichmann, and M.V. Wüthrich. “Consistent re-calibration of yield curve models.” 2015. Available online: arxiv.org/abs/1502.02926 (accessed on 1 May 2016).

- Bank for International Settlements (BIS), and Basel Committee on Banking Supervision (BCBS). “Basel II: International convergence of capital measurement and capital standards. A revised framework—Comprehensive version.” 2006. Available online: http://www.bis.org/publ/bcbs128.htm (accessed on 1 May 2016).

- P.J. Brockwell, and R.A. Davis. Time Series: Theory and Methods. Berlin/Heidelberg, Germany: Springer, 1991. [Google Scholar]

- J. Hull, and A. White. “Branching out.” Risk 7 (1994): 34–37. [Google Scholar]

- L.E. Svensson. Estimating and Interpreting forward Interest Rates: Sweden 1992–1994. Cambridge, MA, USA: National Bureau of Economic Research, 1994. [Google Scholar]

- M.V. Wüthrich, and M. Merz. Financial Modeling, Actuarial Valuation and Solvency in Insurance. Berlin/Heidelberg, Germany: Springer, 2013. [Google Scholar]

- T.J. Jordan. “SARON—An innovation for the financial markets.” Launch event for Swiss Reference Rates, Zurich, 25 August 2009. Available online: https://www.snb.ch/en/mmr/speeches/id/ref_20090825_tjn_1 (accessed on 1 May 2016).

- S.L. Heston. “A closed-form solution for options with stochastic volatility with applications to bond and currency options.” Rev. Financ. Stud. 6 (1993): 327–343. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Harms, P.; Stefanovits, D.; Teichmann, J.; Wüthrich, M.V. Consistent Re-Calibration of the Discrete-Time Multifactor Vasiček Model. Risks 2016, 4, 18. https://doi.org/10.3390/risks4030018

Harms P, Stefanovits D, Teichmann J, Wüthrich MV. Consistent Re-Calibration of the Discrete-Time Multifactor Vasiček Model. Risks. 2016; 4(3):18. https://doi.org/10.3390/risks4030018

Chicago/Turabian StyleHarms, Philipp, David Stefanovits, Josef Teichmann, and Mario V. Wüthrich. 2016. "Consistent Re-Calibration of the Discrete-Time Multifactor Vasiček Model" Risks 4, no. 3: 18. https://doi.org/10.3390/risks4030018