Real Effective Exchange Rate of Rouble and Competitiveness of Russian Agrarian Producers

Abstract

:1. Introduction

2. Methodology

- The calculation of the real effective exchange rate of Russian rouble.

- The analysis of Russian agro-producers’ competitiveness in internal markets.This section, in turn, consists of two subsections:

- -

- the calculation of average annual growth rates of industrial manufacturing (selected commodity groups) in Russia and average annual growth rates of corresponding Russian imports;

- -

- the calculation of domestic producers’ (selected commodity groups) market share.

- The analysis of Russian agro-producers’ competitiveness in external markets.

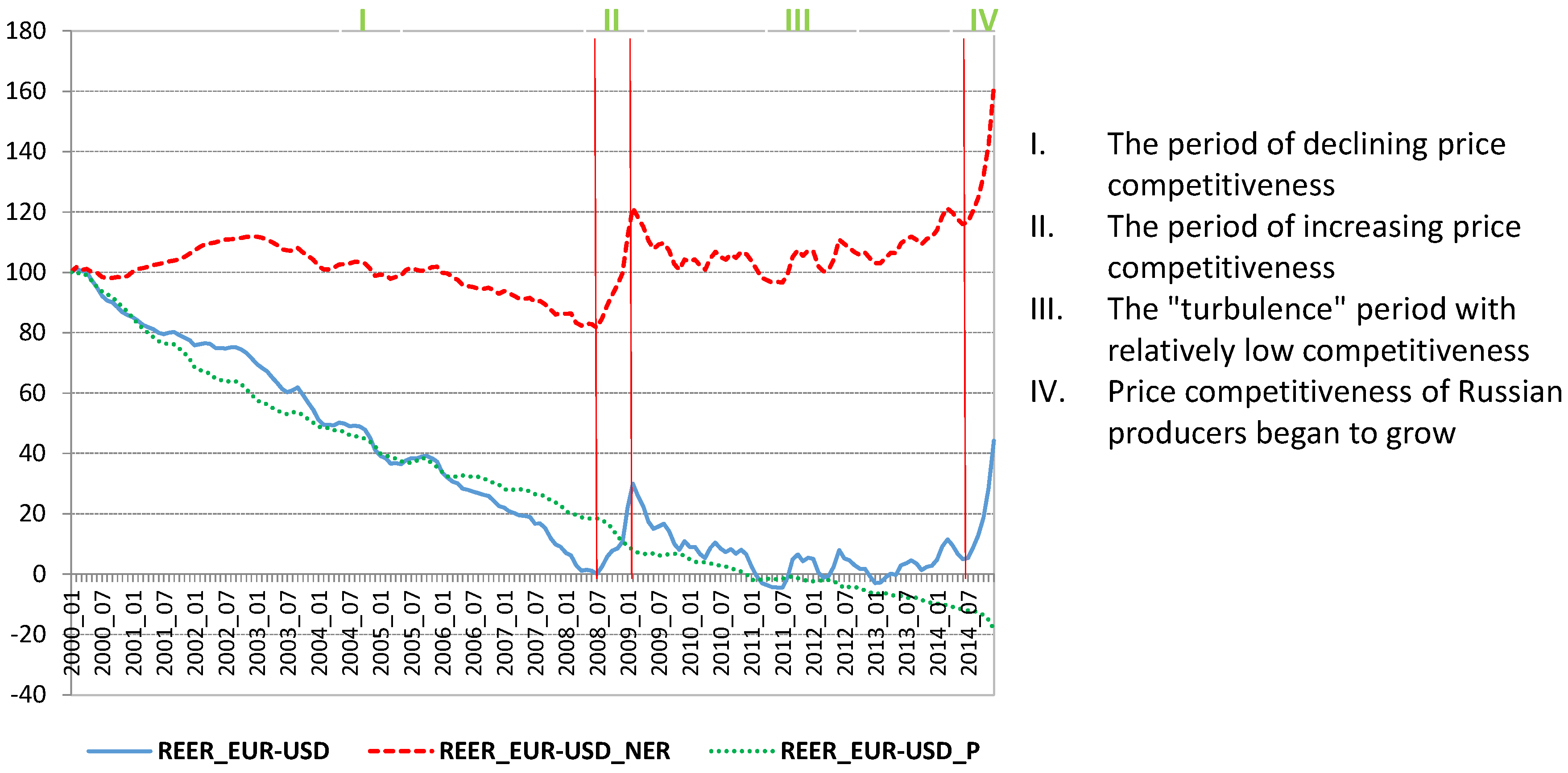

2.1. The calculation of the Real Effective Exchange Rate of Russian Rouble

2.2. Analysis of Russian Agro-Producers’ Competitiveness in Internal Markets

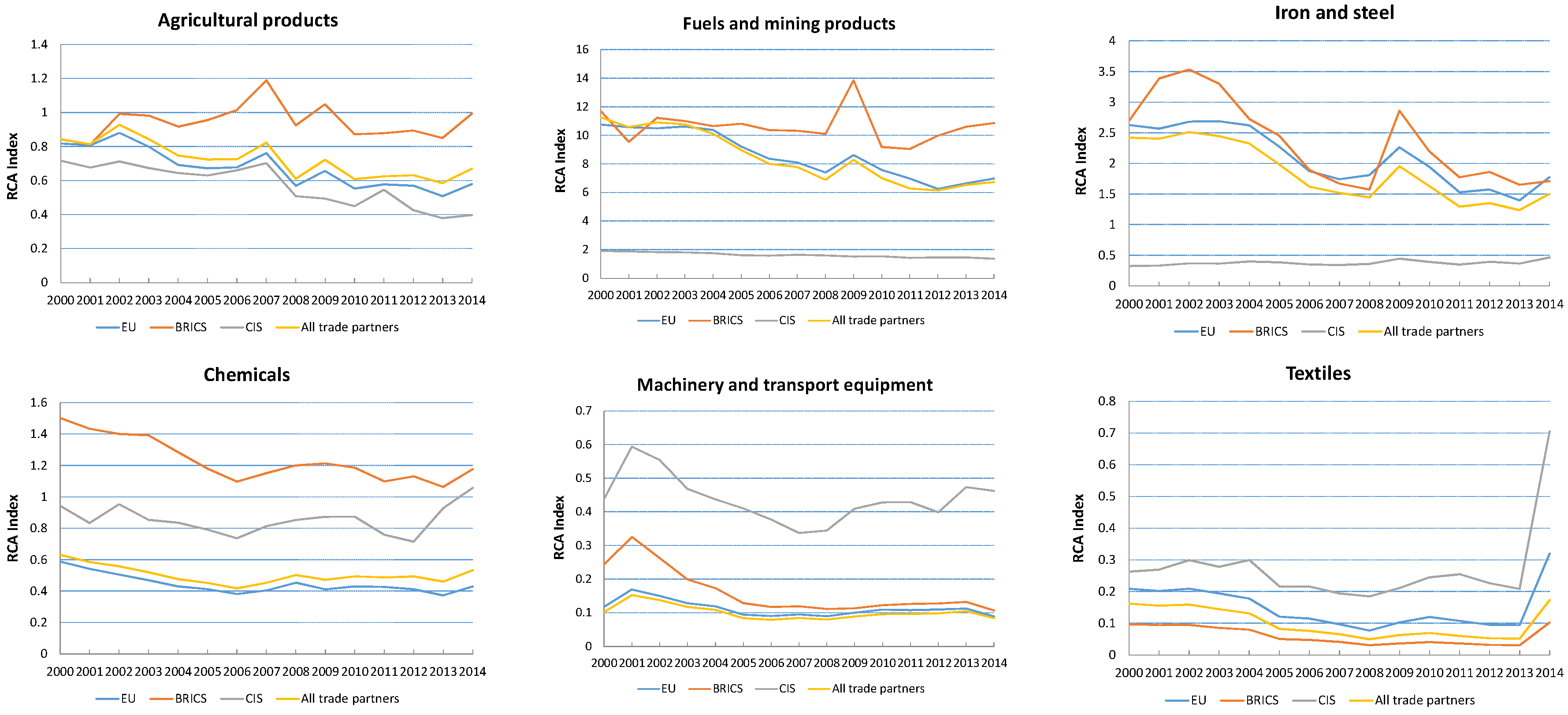

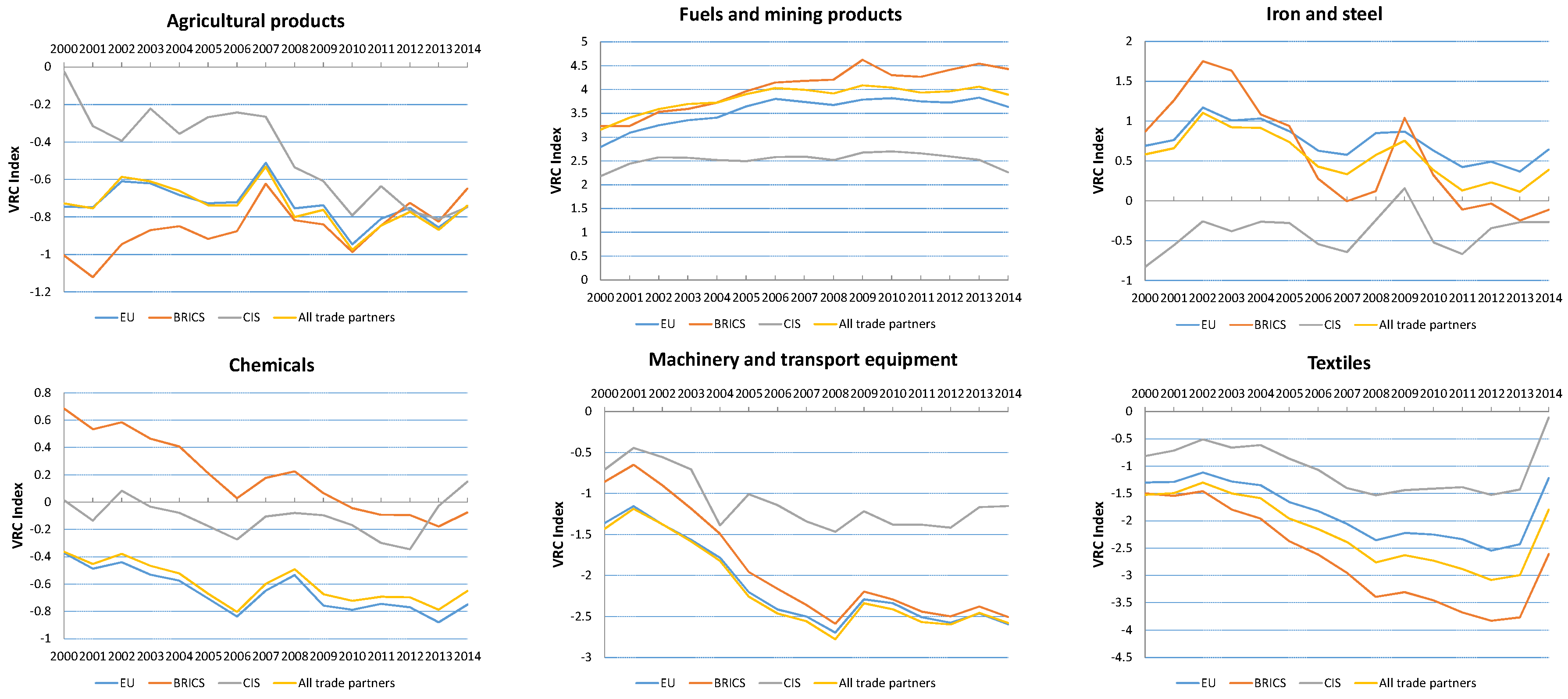

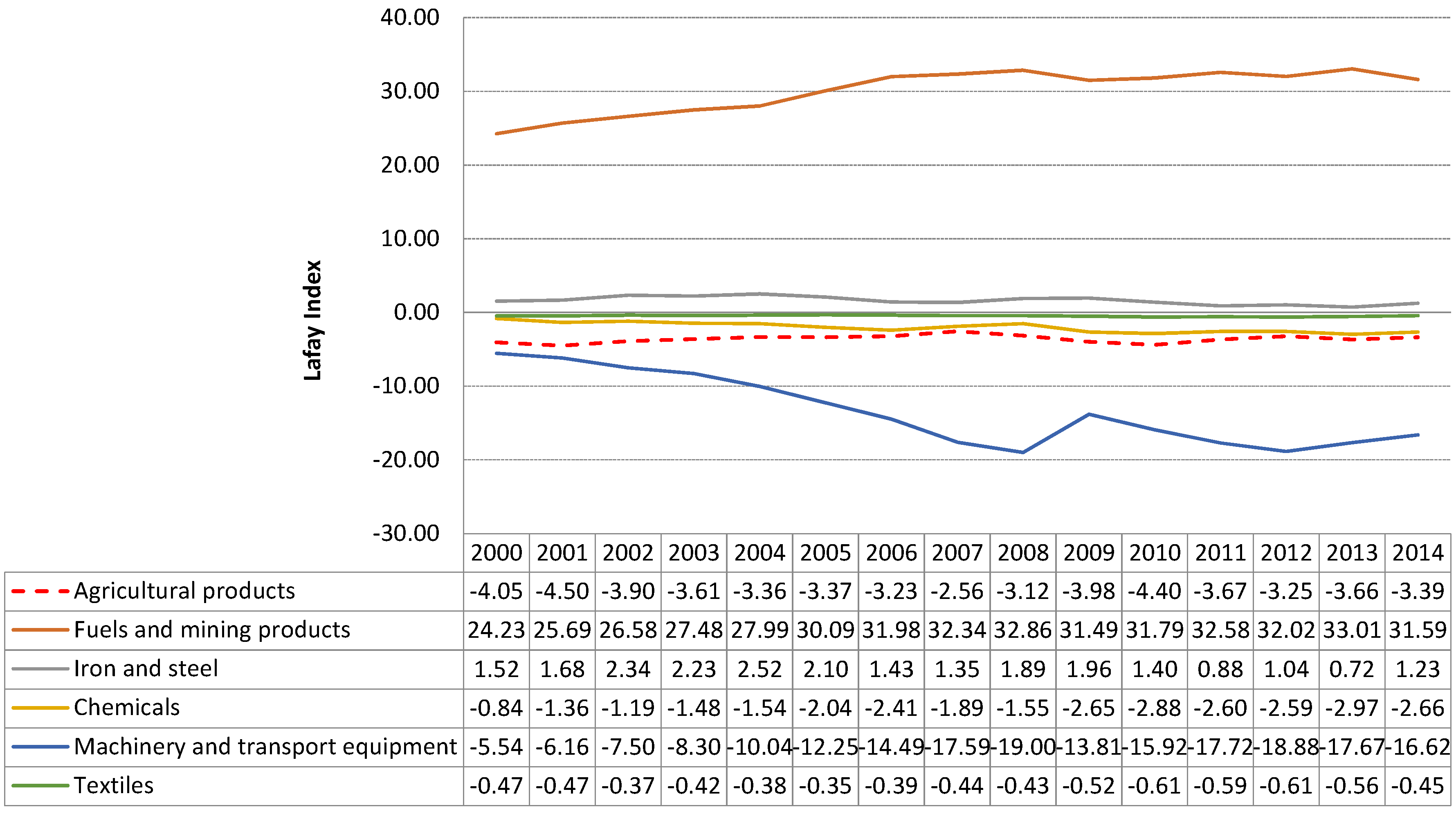

2.3. Analysis of Russian Agro-Producers’ Competitiveness in External Markets

3. Results and Discussion

3.1. Competitiveness of Russian Agro-Producers in Internal Markets

3.2. Competitiveness of Russian Agro-Producers in External Markets

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix

| Economic/Regional Unions | Countries (LCU) |

|---|---|

| European Union, EU | Germany (EUR), Netherlands (EUR), Spain (EUR), Austria (EUR), Finland (EUR), Italy (EUR), Sweden (EUR), France (EUR), Poland (PLN), United Kingdom (GBP), Czech Republic (CZK). |

| BRICS | Brazil (BRL), India (INR), China (CNY), Africa (ZAR). |

| Commonwealth Independent States, CIS | Belarus (BYR), Ukraine (UAH), Kazakhstan (KZT), Armenia (AMD). |

| Asia-Pacific Economic Cooperation, APEC | USA (USD), Japan (JPY), South Korea (KRW). |

References

- E.A. Shkarupa. “Razvitie gosudarstvennoy podderzhki selskogo hozjaistva (Development of the state support to agriculture).” Bull. Volgogr. State Univ. Ser. 3 Econ. Ecol. 2 (2010): 84–88. [Google Scholar]

- V.V. Batmanova, I.V. Mitrofanova, N.P. Ivanov, L.A. Kotova, and E.A. Shkarupa. “Agricultural Machinery in Russia: Risks and Prospects of the Development within the WTO (Сельскохозяйственное машиностроение в России: риски и перспективы развития в рамках ВТО).” Pensee J. 76 (2014): 78–86. [Google Scholar]

- C.G. Gaddy. “Perspectives on the Potential of Russian Oil.” Eur. Geogr. Econ. 45 (2004): 346–351. [Google Scholar] [CrossRef]

- M. Kuboniwa. “Growth and diversification of the Russian economy in light of Input-Output tables.” J. Econom. Study Northeast Asia 7 (2011): 1–16. [Google Scholar]

- S. Barsukova. “Russian Agrocomplex: Reality and Future.” Univ. Russ. 22 (2013): 3–28. (In Russian)[Google Scholar]

- M. Maitah, and L. Smutka. “Restoration and Growth of the Russian Sugar Market.” Sugar Tech. 2 (2016): 115–123. [Google Scholar] [CrossRef]

- L. Smutka, E. Zhuravleva, J. Pulkrabek, I. Benesova, and M. Maitah. “Russian Federation- Sugar Beet and Sugar Production.” Listy Cukrovarnicke a Reparske 2 (2015): 72–77. [Google Scholar]

- M. Maitah, H. Rezbova, L. Smutka, and K. Tomsik. “European Sugar Production and its Control in the World Market.” Sugar Tech. 3 (2016): 236–241. [Google Scholar] [CrossRef]

- A. Boltho. “The assessment: International competitiveness.” Oxf. Rev. Econ. Policy 12 (1996): 1–16. [Google Scholar] [CrossRef]

- S. Lall. “Competitiveness indices and developing countries: An economic evaluation of the Global Competitiveness Report.” World Dev. 29 (2001): 1501–1525. [Google Scholar] [CrossRef]

- E. Klvačová. “Měření konkurenceschopnosti zemí: Teoretické základy a praktické výsledky.” Acta Econom. Prag. 2 (2005). Available online: https://www.vse.cz/aop/175 (accessed on 8 August 2015). [Google Scholar] [CrossRef]

- V. Ajevskis, R. Rimgailaite, U. Rutkaste, and O. Tkacevs. “The equilibrium real exchange rate: Pros and cons of different approaches with application to Latvia.” Balt. J. Econ. 14 (2014): 101–123. [Google Scholar] [CrossRef]

- A. Kudrin. “Realniy effektivniy kurs rublya: Problemy rosta (The real effective course of rouble: The problems of growth).” Vopr. Ekon. 10 (2006): 4–18. [Google Scholar]

- E. Sanidas, and Y. Shin. “Comparison of Revealed Comparative Advantage Indices with Application to Trade Tendencies of East Asian Countries.” 2010. Available online: http://www.akes.or.kr/eng/papers(2010)/24.full.pdf (accessed on 25 December 2015).

- R.H. Ballance, H. Forstner, and T. Murray. “Consistency tests of alternative measures of comparative advantage.” Rev. Econ. Stat. 69 (1987): 157–161. [Google Scholar] [CrossRef]

- M. Panilov. “Raschet i analiz dinamiki realnogo effektivnogo kursa rublya (Calculation and the analysis of the real effective rouble exchange rate dynamics).” Audit Finans. Anal. 2 (2009). Available online: http://www.auditfin.com/fin/2009/2/Panilov/Panilov%20.pdf (accessed on 13 August 2015). [Google Scholar]

- A. Blank, E. Gurvich, and A. Ulyukaev. “Exchange Rate and Competitiveness of Russia’s Industries.” Vopr. Ekon. 6 (2006): 4–24. [Google Scholar]

- S. Bender, and K.W. Li. The Changing Trade and Revealed Comparative Advantages of Asian and Latin American Manufacture Exports. Yale University, Economic Growth Center Discussion Paper No. 843. 2002. Available online: http://www.econ.yale.edu/growth_pdf/cdp843.pdf (accessed on 12 December 2015).

- B. Balassa. “Trade Liberalisation and “Revealed” Comparative Advantage.” Manch. Sch. 33 (1965): 99–123. [Google Scholar] [CrossRef]

- M. Svatoš, and L. Smutka. “Development of Agricultural Trade of Visegrad Group Countries in Relation to EU and Third Countries.” Agris On-Line Pap. Econ. Inform. 4 (2012). Available online: http://online.agris.cz/files/2012/agris_on-line_2012_3_svatos_smutka.pdf (accessed on 8 August 2015). [Google Scholar]

- T. Vollrath. “A theoretical evaluation of alternative trade intensity measures of revealed comparative advantage.” Rev. World Econ. 127 (1991): 265–280. [Google Scholar] [CrossRef]

- G. Lafay. The Measurement of Revealed Comparative Advantages. Edited by M.G. Dagenais and P.-A. Muet. London, UK: Chapman & Hall, 1992. [Google Scholar]

- L. Smutka, M. Maitah, and E.A. Zhuravleva. “The Russian Federation—Specifics of the Sugar Market.” Agris On-Line Pap. Econ. Inform. 6 (2014): 73–86. [Google Scholar]

- A. Zaghini. “Trade advantages and specialization dynamics in acceding countries.” Eur. Cent. Bank Work. Pap., 2003, 4–15. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp249.pdf?4ed34bff923d6655e2de4fc12eb144c1 (accessed on 26 December 2015). [Google Scholar]

- Moscow Interbank Currency Exchange. “Historic Exchange Rates.” August 2015. Available online: https://www.micex.ru/marketdata/quotes?group=currency_selt&data_type=history/ (accessed on 14 August 2015).

- Statbureau. “Eurozone Inflation Rate.” Available online: https://www.statbureau.org/ru/eurozone/inflation/2015 (accessed on 14 August 2015).

- Statbureau. “Inflation Rate in Russia.” Available online: https://www.statbureau.org/en/russia/inflation (accessed on 14 August 2015).

- All-Russian Market Research Institute. “Foreign Exchange Policy and the Exchange Rate Performance.” Available online: http://www.afrocom.ru/en/russia_outlook/economy (accessed on 8 August 2015).

- The Central Bank of the Russian Federation (Bank of Russia). “Information Notice: On Parameters of Bank of Russia Exchange Rate Policy.” November 2014. Available online: http://www.cbr.ru/eng/press/PR.aspx?file=10112014_122958eng_dkp2014-11-10T12_26_04.htm (accessed on 9 August 2015).

- B. Brodsky. “O vliyanii realnogo obmennogo kursa rublya na rossiyskuu ekonomiku (The Influence of the Ruble Real Exchange Rate on the Russian Economy).” Prikl. Ekon. 4 (2006): 90–104. [Google Scholar]

- Federal State Statistics Service. “National Accounts.” June 2015. Available online: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/# (accessed on 13 August 2015).

- The World Trade Organization’s Statistics Database. “International Trade in Merchandise Data.” Available online: http://stat.wto.org/StatisticalProgram/WSDBViewData.aspx?Language=E (accessed on 13 August 2015).

- Federal Customs Service. “Foreign Trade of the Russian Federation.” No Date. Available online: http://www.customs.ru/index.php?id=13858&Itemid=2095&option=com_content (accessed on 08 August 2015).

- E.L. Domnich. “Ekonomicheskoe polozhenie otrasley mashinostroeniya Dalnevostochnogo Federalnogo okruga v 2008–2009 (Economic situation of machinery industry in the Far Eastern Federal District in 2008–2009).” Prostranstv. Ekon. 2 (2011): 146–168. [Google Scholar]

| Year | REER | REER_NER | REER_P |

|---|---|---|---|

| 2000 | 15.10 | 8 | 92 |

| 2001 | 8.64 | 30 | 70 |

| 2002 | 5.99 | 31 | 69 |

| 2003 | 18.48 | 47 | 53 |

| 2004 | 13.89 | 42 | 58 |

| 2005 | 3.94 | 29 | 71 |

| 2006 | 15.80 | 61 | 39 |

| 2007 | 14.24 | 50 | 50 |

| 2008 | −1.94 | 51 | 49 |

| 2009 | −1.59 | 56 | 44 |

| 2010 | 4.27 | 23 | 77 |

| 2011 | 0.63 | 41 | 59 |

| 2012 | 6.08 | 38 | 62 |

| 2013 | −3.69 | 66 | 34 |

| 2014 | −35.55 | 82 | 18 |

| Foodstuffs and Agricultural Raw Materials (Except Textile) | Mineral Products | Chemical Products, Rubber | Hides and Skins, Furs and Products from Them | Timber and Pulp and Paper Products | Textiles, Textile Products and Footwear | Precious Metals, Precious Stones and Products from Them | Metals and Products from Them | Machinery, Equipment and Vehicles | |

|---|---|---|---|---|---|---|---|---|---|

| GRAiGO | 2.31 | 8.38 | 4.13 | −1.36 | 2.02 | −3.96 | 0.32 * | −1.71 * | 4.00 |

| GRAiIM | 3.57 | −3.11 | 9.33 | 11.69 | 3.86 | 10.00 | 7.95 * | 2.73 * | 11.86 |

| Dif | −1.26 | 11.49 | −5.2 | −13.05 | −1.84 | −13.96 | −7.63 * | −4.44 * | −7.86 |

| HS Code | Commodity Sector | 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01–24 | Foodstuffs and Agricultural Raw Materials (Except Textile) | 74% | 75% | 74% | 74% | 75% | 76% | 74% | 74% | 74% | 74% | 73% |

| 25–27 | Mineral Products | 87% | 77% | 86% | 91% | 73% | 95% | 93% | 95% | 92% | 96% | 94% |

| 28–40 | Chemical Products, Rubber | 59% | 52% | 51% | 54% | 54% | 54% | 54% | 55% | 52% | 50% | 49% |

| 41–43 | Hides and Skins, Furs and Products from them | * | 63% | 60% | 57% | 52% | 57% | 50% | 47% | 41% | 41% | 41% |

| 44–49 | Timber and Pulp and Paper Products | * | 73% | 75% | 76% | 77% | 77% | 78% | 78% | 81% | 80% | 77% |

| 50–67 | Textiles, Textile Products and Footwear | * | 49% | 47% | 38% | 35% | 36% | 34% | 30% | 26% | 27% | 27% |

| 71 | Precious Metals, Precious Stones and Products from them | * | 97% | 98% | 98% | 98% | 98% | 98% | 97% | 97% | 96% | 95% |

| 72–83 | Metals and Products from them | * | 83% | 83% | 82% | 82% | 83% | 83% | 84% | 80% | 80% | 81% |

| 84–90 | Machinery, Equipment and Vehicles | 74% | 55% | 52% | 50% | 46% | 52% | 52% | 52% | 50% | 52% | 50% |

| Comparative Advantage is Revealed | EU | CIS | BRICS | All Trade Partners |

|---|---|---|---|---|

| Agricultural Products | ||||

| RCA > 1 | NO | NO | YES (2006, 2007, 2009) 1 | NO |

| VRC > 0 | NO | NO | NO | NO |

| LFI > 1 | - | - | - | NO |

| Fuels and Mining Products | ||||

| RCA > 1 | YES | YES | YES | YES |

| VRC > 0 | YES | YES | YES | YES |

| LFI > 1 | - | - | - | YES |

| Iron and Steel | ||||

| RCA > 1 | YES | NO | YES | YES |

| VRC > 0 | YES | YES (2009) | YES (2000–2010) | YES |

| LFI > 1 | - | - | - | YES |

| Chemicals | ||||

| RCA > 1 | NO | YES (2014) | YES | NO |

| VRC > 0 | YES (2000, 2002, 2014) | YES (2000–2009) | ||

| LFI > 1 | - | - | - | NO |

| Machinery and Transport Equipment | ||||

| RCA > 1 | NO | NO | NO | NO |

| VRC > 0 | NO | NO | NO | NO |

| LFI > 1 | - | - | - | NO |

| Textiles | ||||

| RCA > 1 | NO | NO | NO | NO |

| VRC > 0 | NO | NO | NO | NO |

| LFI > 1 | - | - | - | NO |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maitah, M.; Kuzmenko, E.; Smutka, L. Real Effective Exchange Rate of Rouble and Competitiveness of Russian Agrarian Producers. Economies 2016, 4, 12. https://doi.org/10.3390/economies4030012

Maitah M, Kuzmenko E, Smutka L. Real Effective Exchange Rate of Rouble and Competitiveness of Russian Agrarian Producers. Economies. 2016; 4(3):12. https://doi.org/10.3390/economies4030012

Chicago/Turabian StyleMaitah, Mansoor, Elena Kuzmenko, and Lubos Smutka. 2016. "Real Effective Exchange Rate of Rouble and Competitiveness of Russian Agrarian Producers" Economies 4, no. 3: 12. https://doi.org/10.3390/economies4030012