Technical Efficiency of Banks in Central and Eastern Europe

Abstract

:1. Introduction

Literature Review

2. Methodology

2.1. Empirical Methods

- i = 1, …, N = sectional index

- t = 1, …, T = time index,

- uit = random error

- α = omitted effects.

2.2. Sample and Variables

3. Results

3.1. Results of Correlation Analysis

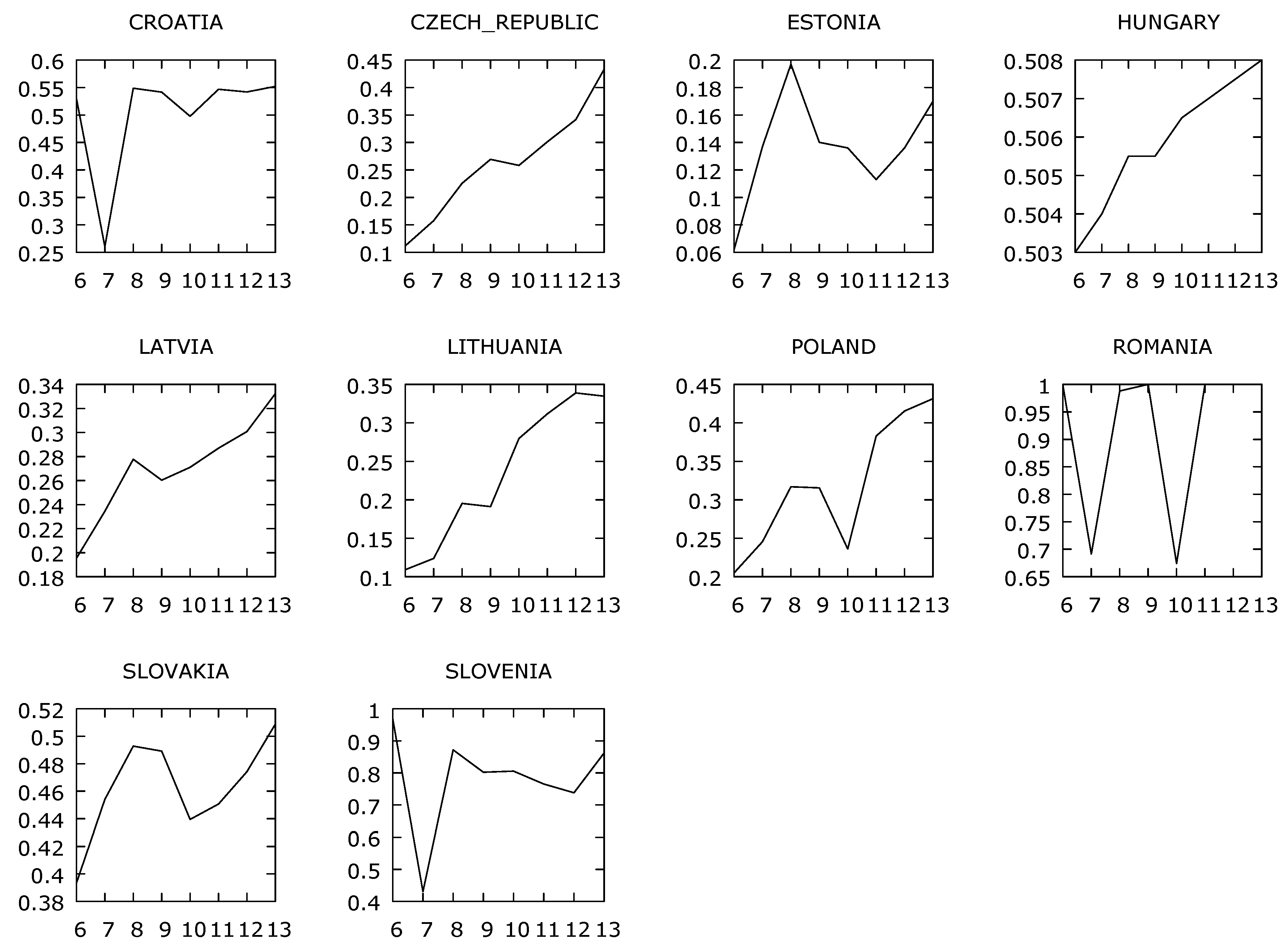

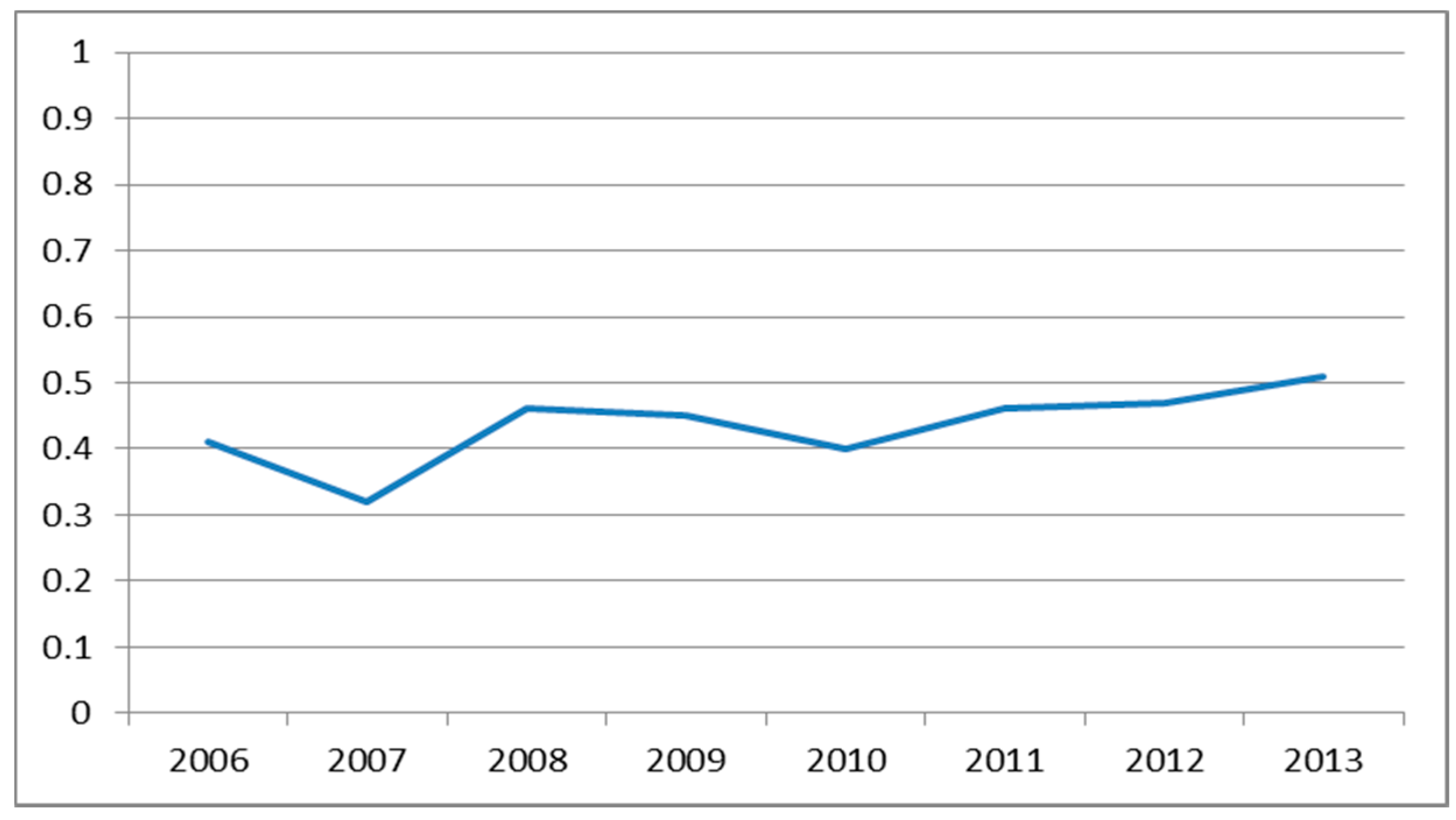

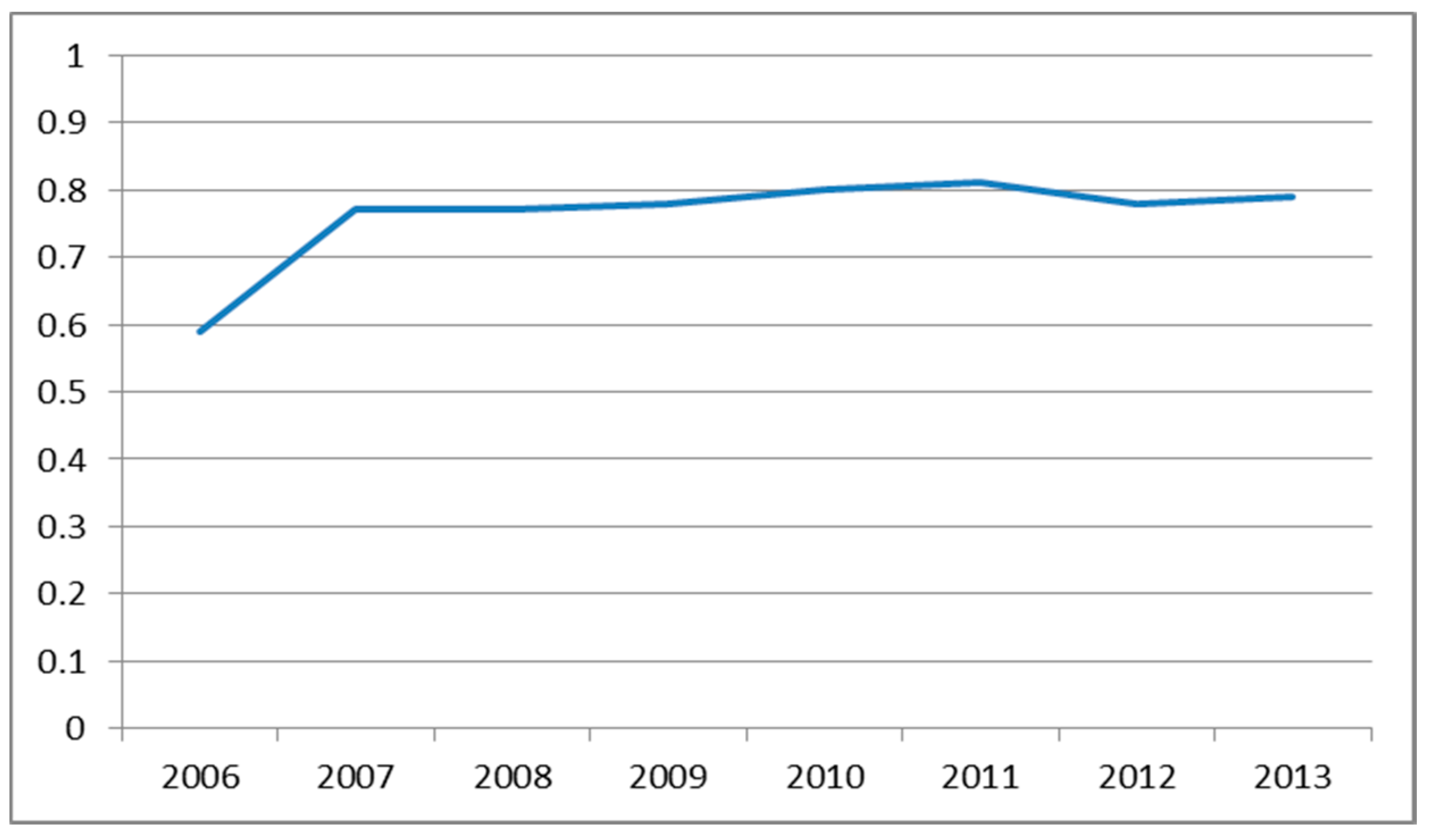

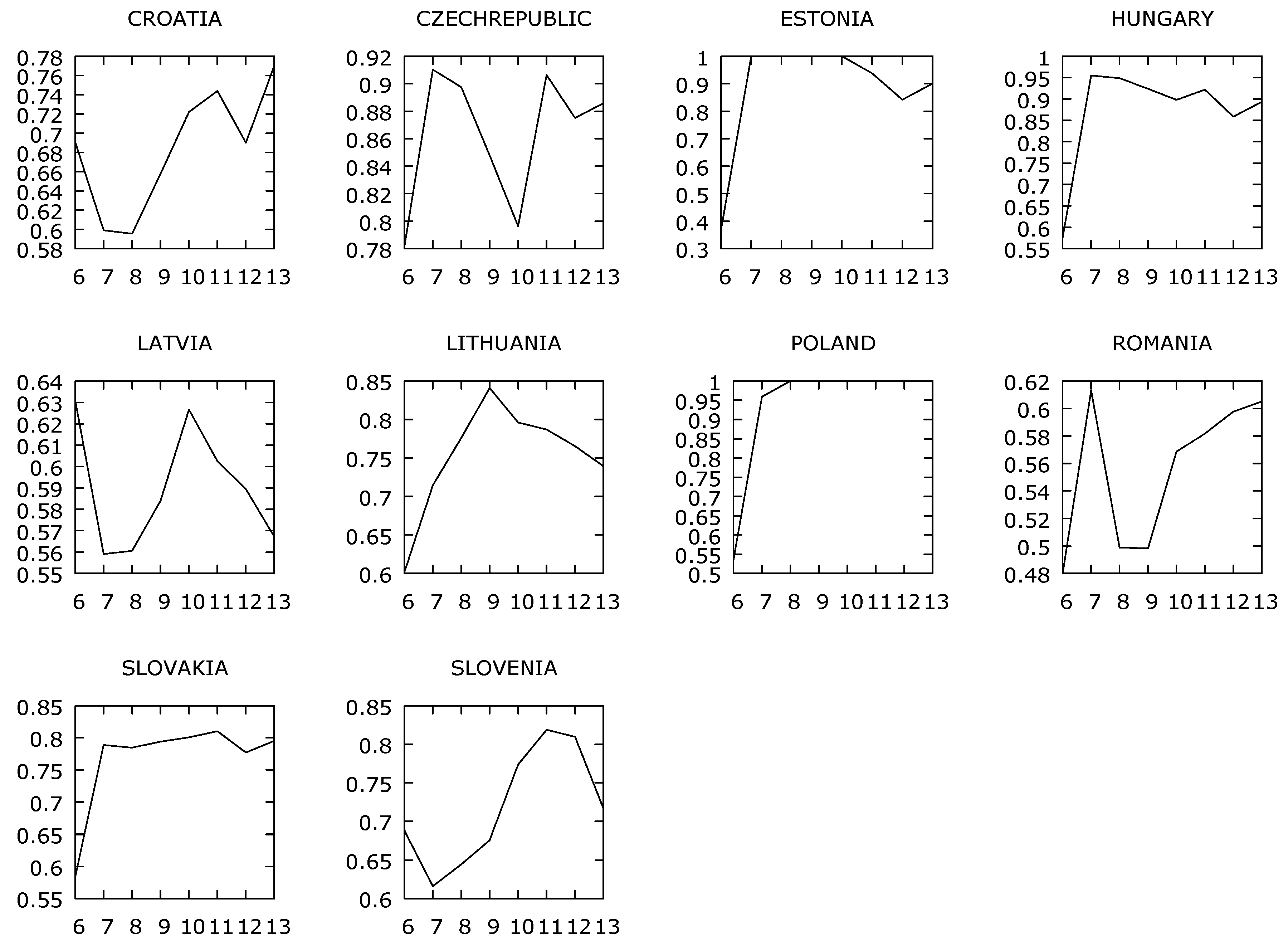

3.2. Results Related to the DEA (Data Envelope Analysis)

3.3. Regression Investigation

4. Conclusions

Supplementary Materials

Acknowledgments

Conflicts of Interest

Appendix A. List of Banks in the Analysis

References

- Ahmad, Rubi, Mohamed Ariff, and Michael J. Skully. 2008. Determinants of bank capital ratios in a developing economy. Asia-Pacific Financial Markets 15: 255–72. [Google Scholar] [CrossRef]

- Alqahtani, Faisal, David G. Mayes, and Kym Brown. 2017. Islamic bank efficiency compared to conventional banks during the global crisis in the GCC region. Journal of International Financial Markets, Institutions and Money 51: 58–74. [Google Scholar] [CrossRef]

- Altmann, Thomas Caspar. 2006. Cross-Border Banking in Central and Eastern Europe: Issues and Implications for Supervisory and Regulatory Organization on the European Level. Working Papers and other Publications Series Library of Congress. Working Paper 06–16; Philadelphia, PA, USA: University of Wharton, pp. 1–135. [Google Scholar]

- Anayiotos, George, Hovhannes Toroyan, and Athanasios Vamvakidis. 2010. The efficiency of emerging Europe’s banking sector before and after the recent economic crisis. Financial Theory and Practice 34: 247–67. [Google Scholar]

- Andries, Alin Marius, and Bogdan Capraru. 2014. Convergence of Bank Efficiency in Emerging Markets: The Central and Eastern European Countries’ Experience (July 21, 2012). Emerging Markets Finance and Trade 50: 31. Available online: https://ssrn.com/abstract=2135506 (accessed on 25 October 2017). [CrossRef]

- Berger, Allen N., Robert DeYoung, Mark Flannery, David Lee, and Özde Öztekin. 2008. How do large banking organizations manage their capital ratios? Journal of Financial Services Research 34: 123–49. [Google Scholar] [CrossRef]

- Égert, Balázs, Peter Backé, and Tina Zumer. 2006. Credit Growth in Central and Eastern Europe: New (over) Shooting Stars? Working Paper Series 687; Frankfurt, Germany: European Central Bank. [Google Scholar]

- Cooper, William W., Lawrence M. Seiford, and Kaoru Tone. 2007. Data Envelopment Analysis: A Comprehensive Text with Models, Applications, References and DEA-Solver Software, 2nd ed. Cham: Springer International Publishing, ISBN 10-0-387-45281-8. [Google Scholar]

- Degl’Innocenti, Marta, Stavros A. Kourtzidis, Zeljko Sevic, and Nickolaos G. Tzeremes. 2017. Investigating bank efficiency in transition economies: A window-based weight assurance region approach. Economic Modelling 67: 23–33. [Google Scholar] [CrossRef] [Green Version]

- Diallo, Boubacar. 2018. Bank efficiency and industry growth during financial crises. Economic Modelling 68: 11–22. [Google Scholar] [CrossRef]

- Distinguin, Isabelle, Caroline Roulet, and Amine Tarazi. 2013. Bank regulatory capital and liquidity: Evidence from US and European publicly traded banks. Journal of Banking & Finance, Elsevier 37: 3295–17. [Google Scholar] [CrossRef] [Green Version]

- Doan, Anh-Tuan, Kun-Li Lin, and Shuh-Chyi Doong. 2018. What drives bank efficiency? The interaction of bank income diversification and ownership. International Review of Economics & Finance 55: 203–19. [Google Scholar] [CrossRef]

- Fernandes, Filipa Da Silva, Charalampos Stasinakis, and Valeriya Bardarova. 2018. Two-stage DEA-Truncated Regression: Application in banking efficiency and financial development. Expert Systems with Applications 96: 284–301. [Google Scholar] [CrossRef]

- Gallizo, José Luis, Jordi Moreno, and Manuel Salvador. 2017. The Baltic banking system in the enlarged European Union: the effect of the financial crisis on efficiency. Baltic Journal of Economics 18: 1–24. [Google Scholar] [CrossRef]

- Gropp, Reint, and Florian Heider. 2010. The determinants of bank capital structure. Review of Finance 14: 587–622. [Google Scholar] [CrossRef]

- Halkos, E. George, and Dimitrios S. Salamouris. 2004. Efficiency measurement of the Greek commercial banks with the use of financial ratios: A data envelopment analysis approach. Management Accounting Research 15: 201–24. [Google Scholar] [CrossRef]

- Hasan, Iftekhar, and Katherin Marton. 2003. Development and Efficiency of the Banking Sector in a Transitional Economy: Hungarian Experience. Journal of Banking & Finance 27: 2249–71. [Google Scholar] [CrossRef]

- Jablonský, Josef, and Martin Dlouhý. 2004. Modely hodnocení efektivnosti produkčních jednotek. Praha: Professional Publishing, ISBN 80-86419-49-5. [Google Scholar]

- Jokipii, Terhi, and Alistair Milne. 2011. Bank Capital Buffer and Risk Adjustment Decisions. Journal of Financial Stability 7: 165–78. [Google Scholar] [CrossRef]

- Košak, Marko, and Peter Zajc. 2006. Determinants of Bank Efficiency Differences in the New EU Member Countries. Financial Stability Report, Expert Papers. Ljubljana: Bank of Slovenia. [Google Scholar]

- Matoušek, Roman, and Anita Taci. 2004. Efficiency in Banking: Empirical Evidence from the Czech Republic. Economic Change and Restructuring 37: 225–44. [Google Scholar] [CrossRef]

- Molnar, Márgit, and Daniel Holló. 2011. How Efficient Are Banks in Hungary? OECD Economics Department Working Papers 848. Paris, France: OECD Publishing. [Google Scholar]

- Novickytė, Lina, and Jolanta Droždz. 2018. Measuring the Efficiency in the Lithuanian Banking Sector: The DEA Application. International Journal of Financial Studies 6: 37. [Google Scholar] [CrossRef]

- Nurboja, Bashkim, and Marko Košak. 2017. Banking efficiency in South East Europe: Evidence for financial crises and the gap between new EU members and candidate countries. Economic Systems 41: 122–38. [Google Scholar] [CrossRef]

- Palečková, Iveta. 2015. Banking Efficiency in Visegrad Countries: A Dynamic Data Envelopment Analysis. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 63: 2085–91. [Google Scholar] [CrossRef]

- Pancurova, Dana, and Stefan Lyocsa. 2013. Determinants of Commercial Banks’ Efficiency: Evidence from 11 CEE Countries. Finance a Uver—Czech Journal of Economics and Finance 63: 152–79. [Google Scholar]

- Řepková, Iveta. 2014. Estimation of Banking Efficiency in the Czech Republic: Dynamic Data Envelopment Analysis. Danube 4: 261–75. [Google Scholar] [CrossRef]

- Stavárek, Daniel. 2005. Restrukturalizace bankovních sektorů a efektivnost bank v zemích Visegrádské skupiny. Karviná: Slezská univerzita, Obchodně podnikatelská fakulta, ISBN 80-7248-319-6. [Google Scholar]

- Svitalkova, Zuzana. 2014. Comparison and Evaluation of Bank Efficiency in Austria and the Czech Republic. Journal of Competitiveness 6: 15–29. [Google Scholar] [CrossRef] [Green Version]

- Tanda, Alessandra. 2015. The Effects of Bank Regulation on the Relationship Between Capital and Risk. Comparative Economic Studies, Palgrave Macmillan; Association for Comparative Economic Studies 57: 31–54. [Google Scholar] [CrossRef] [Green Version]

- Toloo, Mehdi, Maryam Allahyar, and Jana Hančlová. 2018. A non-radial directional distance method on classifying inputs and outputs in DEA. Expert Systems with Applications 92: 495–506. [Google Scholar] [CrossRef]

- VanHoose, David. 2007. Theories of bank behavior under capital regulation. Journal of Banking & Finance 31: 3680–97. [Google Scholar]

- Woznievska, Grazyna. 2008. Methods of Measuring the efficiency of Commercial Banks. An Example of Polish Banks. Ekonomika 84: 81–89. [Google Scholar]

- Zimková, Emília. 2014. Technical Efficiency and Super-Efficiency of the Banking Sector in Slovakia. Paper presented at Enterprise and the Competitive Environment 2014 Conference (ECE), Brno, Czech Republic, March 6–7; pp. 780–87. [Google Scholar]

| Variable (408 obs.) | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| Net_Loans | 3,330,957 | 5,200,090 | 33,200 | 2.52 × 107 |

| Fixed_Assets | 72,704.41 | 143,895.4 | 203.5802 | 854,087.8 |

| Total_Assets | 6,007,096 | 1.03 × 107 | 50,900 | 5.12 × 107 |

| Customer_Deposits | 3,862,094 | 7,310,269 | 2355.137 | 3.57 × 107 |

| Loan_Impairement_Charge | 68,879.19 | 337,403.1 | −80,600 | 4,057,277 |

| Pretax_Profit | 74,459.27 | 205,241.8 | −616,300 | 1,082,099 |

| Net_Interest_Margin | 2.511416 | 1.199684 | −0.634 | 7.75 |

| Personnel_Expenses | 63,276.83 | 144,561.1 | 1400 | 1,613,941 |

| Efficiency | 0.4267819 | 0.3941406 | 0.006 | 1 |

| FAtoTA | 0.0151592 | 0.0259411 | 0.0001375 | 0.3438067 |

| NLtoCD | 2.802042 | 11.08168 | 0.1620511 | 118.7907 |

| NLtoTA | 0.6102892 | 0.1542593 | 0.0527622 | 0.9532463 |

| CDtoLI | 0.5912198 | 0.2091098 | 0.0076442 | 0.9053834 |

| LICHtoNL | 0.0186461 | 0.0321562 | −0.0709684 | 0.2544897 |

| PEtoPP | 0.0117172 | 0.0058037 | 0.0013766 | 0.0352589 |

| Criteria | χ2 Value | H0 |

|---|---|---|

| Size of the bank (large or small) | 2.63 | Not rejection H0; There is no association |

| Criteria | χ2 Value | H0 |

|---|---|---|

| V4 Countries (Slovakia, Czech Republic, Hungary, Poland) | 9.71 | Rejection of H0; There is an association. |

| Baltic Countries (Estonia, Latvia, Lithuania) | 1.55 | Not rejection H0; There is no association. |

| Balkan Countries (Croatia, Slovenia, Romania) | 5.30 | Rejection of H0; There is an association. |

| Fernandes et al. (2018) | Nurboja and Košak (2017) | Degl’Innocenti et al. (2017) | Halkos and Salamouris (2004) | Stavárek (2005) | Molnar and Holló (2011) | Pancurova and Lyocsa (2013) | Zimková (2014) | Palečková (2015) | Toloo et al. (2018) | Diallo (2018) | Novickytė and Droždz (2018) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Inputs | ||||||||||||

| Fixed Assets | x | x | ||||||||||

| Personnel Expenses | x | x | x | x | x | x | x | x | ||||

| Equity | x | x | x | |||||||||

| Deposits | x | x | x | x | x | x | ||||||

| Number of Employees | x | |||||||||||

| Total Assets | x | |||||||||||

| Total Costs | x | |||||||||||

| Borrowed Funds | x | |||||||||||

| Physical Capital (property) | x | |||||||||||

| Interest Costs | x | x | ||||||||||

| Operating Costs | x | |||||||||||

| Financial Efficiency Ratios | x | |||||||||||

| Credit Risk | x | |||||||||||

| Variable position of inputs and outputs | ||||||||||||

| Deposits | x | x | x | |||||||||

| Outputs | ||||||||||||

| Credits | x | x | x | x | x | x | x | x | x | X | ||

| Securities | x | x | x | x | ||||||||

| Other Earning Assets | x | x | x | |||||||||

| Investments | x | X | ||||||||||

| Profit | x | |||||||||||

| Total Income | x | |||||||||||

| ROA (Return to Assets) | x | |||||||||||

| Net Interest Income | x | x | ||||||||||

| Non-Interest Income | x | x | ||||||||||

| Net Interest Margin | x | |||||||||||

| Financial Efficiency Ratios | x |

| Bank Nr. | Large (L)/Small (S) Bank | Assets (Thous. EUR) | Efficient (E) Non-Efficient (N) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | Average Efficiency of the Bank |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 1 | S | 2,398,762 | N | 0.041 | 0.051 | 0.058 | 0.072 | 0.083 | 0.088 | 0.093 | 0.096 | 0.07275 |

| 2 | L | 3,919,225 | N | 0.031 | 0.041 | 0.057 | 0.036 | 0.040 | 0.039 | 0.046 | 0.053 | 0.042875 |

| 3 | S | 186,926.6 | N | 0.324 | 0.460 | 0.671 | 0.841 | 0.774 | 0.788 | 0.860 | 0.939 | 0.707125 |

| 4 | S | 405,488.9 | N | 0.174 | 0.248 | 0.362 | 0.474 | 0.404 | 0.394 | 0.416 | 0.442 | 0.36425 |

| 5 | L | 3,570,356 | N | 0.021 | 0.029 | 0.042 | 0.043 | 0.053 | 0.057 | 0.065 | 0.070 | 0.0475 |

| 6 | S | 203,417.4 | E | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1 |

| 7 | L | 13,917,242 | N | 0.006 | 0.008 | 0.011 | 0.011 | 0.013 | 0.014 | 0.015 | 0.016 | 0.01175 |

| 8 | S | 1,146,893 | N | 0.056 | 0.084 | 0.103 | 0.113 | 0.117 | 0.124 | 0.123 | 0.139 | 0.107375 |

| 9 | L | 4,002,900 | N | 0.080 | 0.114 | 0.146 | 0.141 | 0.124 | 0.097 | 0.091 | 0.098 | 0.111375 |

| 10 | S | 274,907 | E | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1 |

| 11 | L | 22,435,283 | N | 0.008 | 0.007 | 0.010 | 0.009 | 0.011 | 0.013 | 0.013 | 0.016 | 0.010875 |

| 12 | S | 3,315,400 | N | 0.065 | 0.081 | 0.146 | 0.121 | 0.131 | 0.156 | 0.161 | 0.159 | 0.1275 |

| 13 | S | 80,5100 | N | 0.402 | 0.484 | 0.624 | 0.622 | 0.461 | 0.753 | 0.818 | 0.847 | 0.626375 |

| 14 | S | 2,311,800 | N | 0.075 | 0.103 | 0.136 | 0.132 | 0.123 | 0.108 | 0.132 | 0.144 | 0.119125 |

| 15 | S | 336,656 | E | 0.747 | 1.000 | 1.000 | 1.000 | 0.801 | 0.898 | 1.000 | 1.000 | 0.93075 |

| 16 | S | 295,800 | E | 0.079 | 0.117 | 0.164 | 0.149 | 0.194 | 0.441 | 0.569 | 1.000 | 0.339125 |

| 17 | S | 340,100 | E | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1 |

| 18 | S | 792,900 | N | 0.124 | 0.251 | 0.412 | 0.407 | 0.220 | 0.223 | 0.287 | 0.531 | 0.306875 |

| 19 | S | 2,920,500 | N | 0.063 | 0.059 | 0.157 | 0.132 | 0.152 | 0.144 | 0.181 | 0.165 | 0.131625 |

| 20 | L | 4,134,500 | N | 0.039 | 0.063 | 0.086 | 0.091 | 0.117 | 0.106 | 0.131 | 0.117 | 0.09375 |

| 21 | L | 3,486,000 | N | 0.034 | 0.039 | 0.056 | 0.057 | 0.061 | 0.061 | 0.065 | 0.067 | 0.055 |

| 22 | L | 6,837,100 | N | 0.036 | 0.056 | 0.066 | 0.060 | 0.072 | 0.075 | 0.104 | 0.089 | 0.06975 |

| 23 | S | 287,896 | N | 0.244 | 0.232 | 0.422 | 0.426 | 0.575 | 0.609 | 0.680 | 0.738 | 0.49075 |

| 24 | S | 1,401,981 | E | 0.231 | 0.282 | 0.384 | 0.390 | 0.775 | 1.000 | 1.000 | 1.000 | 0.63275 |

| 25 | S | 1,520,800 | N | 0.116 | 0.135 | 0.196 | 0.182 | 0.206 | 0.187 | 0.212 | 0.167 | 0.175125 |

| 26 | L | 5,610,150 | N | 0.019 | 0.031 | 0.039 | 0.052 | 0.061 | 0.055 | 0.062 | 0.060 | 0.047375 |

| 27 | S | 254,800 | N | 0.438 | 0.454 | 0.608 | 0.529 | 0.691 | 0.863 | 0.850 | 0.957 | 0.67375 |

| 28 | S | 810,417 | E | 0.742 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.96775 |

| 29 | S | 3,059,359 | N | 0.269 | 0.339 | 0.514 | 0.364 | 0.276 | 0.221 | 0.299 | 0.412 | 0.33675 |

| 30 | S | 3,624,832 | N | 0.037 | 0.039 | 0.044 | 0.038 | 0.044 | 0.051 | 0.063 | 0.068 | 0.048 |

| 31 | S | 1,612,257 | N | 0.081 | 0.068 | 0.082 | 0.086 | 0.097 | 0.116 | 0.140 | 0.158 | 0.1035 |

| 32 | S | 2,644,139 | N | 0.026 | 0.027 | 0.041 | 0.040 | 0.041 | 0.047 | 0.056 | 0.075 | 0.044125 |

| 33 | S | 1,027,138 | N | 0.106 | 0.108 | 0.123 | 0.187 | 0.165 | 0.141 | 0.132 | 0.148 | 0.13875 |

| 34 | S | 1,900,400 | N | 0.040 | 0.044 | 0.048 | 0.047 | 0.064 | 0.089 | 0.105 | 0.112 | 0.068625 |

| 35 | S | 1,560,900 | N | 0.062 | 0.137 | 0.197 | 0.140 | 0.136 | 0.113 | 0.136 | 0.170 | 0.136375 |

| 36 | S | 3,910,000 | N | 0.016 | 0.021 | 0.029 | 0.028 | 0.033 | 0.035 | 0.042 | 0.061 | 0.033125 |

| 37 | S | 1,186,900 | N | 0.103 | 0.133 | 0.152 | 0.126 | 0.144 | 0.142 | 0.156 | 0.188 | 0.143 |

| 38 | S | 2,451,000 | N | 0.026 | 0.040 | 0.054 | 0.054 | 0.058 | 0.059 | 0.066 | 0.073 | 0.05375 |

| 39 | S | 2,488,600 | N | 0.088 | 0.153 | 0.138 | 0.110 | 0.125 | 0.080 | 0.096 | 0.114 | 0.113 |

| 40 | L | 41,292,890 | E | 1.000 | 0.506 | 1.000 | 0.960 | 1.000 | 1.000 | 0.933 | 0.937 | 0.917 |

| 41 | L | 48,302,441 | E | 1.000 | 0.348 | 1.000 | 1.000 | 0.761 | 1.000 | 1.000 | 1.000 | 0.888625 |

| 42 | L | 49,182,578 | E | 0.962 | 0.383 | 0.949 | 1.000 | 0.898 | 1.000 | 1.000 | 1.000 | 0.899 |

| 43 | L | 4,639,270 | E | 1.000 | 0.570 | 1.000 | 1.000 | 0.253 | 1.000 | 1.000 | 1.000 | 0.852875 |

| 44 | L | 16,736,237 | E | 1.000 | 0.872 | 1.000 | 1.000 | 0.444 | 1.000 | 1.000 | 1.000 | 0.9145 |

| 45 | L | 11,151,378 | E | 1.000 | 0.323 | 0.952 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.909375 |

| 46 | L | 11,664,515 | E | 0.993 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.999125 |

| 47 | S | 1,420,781 | E | 0.972 | 0.303 | 0.790 | 0.803 | 0.817 | 0.745 | 0.728 | 1.000 | 0.76975 |

| 48 | L | 9,453,403 | E | 1.000 | 0.543 | 0.943 | 0.864 | 1.000 | 0.858 | 0.783 | 0.733 | 0.8405 |

| 49 | S | 3,843,009 | E | 1.000 | 0.636 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.9545 |

| 50 | S | 2,031,665 | N | 0.869 | 0.285 | 0.733 | 0.659 | 0.619 | 0.610 | 0.587 | 0.719 | 0.635125 |

| 51 | L | 15,422,623 | E | 1.000 | 0.387 | 0.895 | 0.685 | 0.592 | 0.614 | 0.592 | 0.861 | 0.70325 |

| Median | 3,919,225 | - | - | - | - | - | - | - | - | 0.426782 | ||

| Average efficiency | 0.389 | 0.307 | 0.443 | 0.436 | 0.408 | 0.455 | 0.468 | 0.504 |

| Bank Nr. | Efficient (E) Not-Efficient (N) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | Average Efficiency of the Bank |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 1 | N | 1.0000 | 0.9976 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9801 | 0.9801 | 0.9947 |

| 2 | N | 0.4684 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9335 |

| 3 | N | 0.7929 | 0.4899 | 0.4329 | 0.3534 | 0.3605 | 0.4964 | 0.6070 | 0.6027 | 0.5169 |

| 4 | N | 1.0000 | 1.0000 | 0.9523 | 0.7335 | 0.4173 | 0.9420 | 0.6635 | 0.7319 | 0.8051 |

| 5 | N | 1.0000 | 0.9739 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9967 |

| 6 | E | 0.8606 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9826 |

| 7 | N | 0.4864 | 0.8054 | 0.9117 | 0.8697 | 0.8952 | 0.7740 | 0.6902 | 0.6015 | 0.7543 |

| 8 | N | 0.1562 | 0.4805 | 0.4686 | 0.5087 | 0.4672 | 0.5554 | 0.5556 | 0.7590 | 0.4939 |

| 9 | N | 0.4085 | 0.1343 | 0.2111 | 0.2845 | 0.3180 | 0.3887 | 0.4542 | 0.4362 | 0.3295 |

| 10 | E | 1.0000 | 0.4669 | 0.4986 | 0.5951 | 0.7337 | 0.4882 | 0.5718 | 0.6109 | 0.6206 |

| 11 | N | 0.4072 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9259 |

| 12 | N | 0.7538 | 0.4135 | 0.3943 | 0.4685 | 0.4842 | 0.6210 | 0.6003 | 0.6310 | 0.5458 |

| 13 | N | 0.6650 | 0.9182 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9479 |

| 14 | N | 0.7368 | 0.6451 | 0.6206 | 0.7304 | 0.7654 | 0.7661 | 0.7777 | 0.7801 | 0.7278 |

| 15 | E | 1.0000 | 0.7653 | 0.7881 | 0.8183 | 0.9425 | 0.8248 | 0.8575 | 0.8331 | 0.8537 |

| 16 | E | 0.4264 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9283 |

| 17 | E | 0.6166 | 0.7868 | 0.5827 | 0.7936 | 0.7942 | 1.0000 | 0.6983 | 0.7575 | 0.7537 |

| 18 | N | 0.8237 | 0.7220 | 0.8481 | 0.9915 | 1.0000 | 0.8171 | 0.7123 | 0.8382 | 0.8441 |

| 19 | N | 1.0000 | 0.8308 | 1.0000 | 1.0000 | 0.9488 | 0.9099 | 0.8515 | 0.9129 | 0.9317 |

| 20 | N | 0.4009 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9251 |

| 21 | N | 1.0000 | 0.4654 | 0.7126 | 0.8584 | 0.6497 | 0.5256 | 0.4523 | 0.4936 | 0.6447 |

| 22 | N | 0.3432 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9179 |

| 23 | N | 0.7182 | 0.6374 | 0.6115 | 0.8810 | 0.7935 | 0.9646 | 0.8134 | 0.6385 | 0.7573 |

| 24 | E | 0.3938 | 0.7327 | 0.7327 | 0.7763 | 0.7369 | 0.7053 | 0.7617 | 0.7482 | 0.6984 |

| 25 | N | 0.3540 | 0.3345 | 0.3763 | 0.3702 | 0.4427 | 0.4043 | 0.4779 | 0.3825 | 0.3928 |

| 26 | N | 0.2402 | 0.3688 | 0.3837 | 0.3814 | 0.3373 | 0.2838 | 0.3122 | 0.2119 | 0.3149 |

| 27 | N | 1.0000 | 0.3029 | 0.3341 | 0.3614 | 0.2449 | 0.1724 | 0.1565 | 0.1735 | 0.3432 |

| 28 | E | 0.3810 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9946 | 0.8913 | 0.9084 |

| 29 | N | 0.5021 | 0.1452 | 0.1569 | 0.1593 | 0.2672 | 0.2534 | 0.2142 | 0.2566 | 0.2444 |

| 30 | N | 1.0000 | 0.5220 | 0.6110 | 0.5746 | 1.0000 | 0.8515 | 1.0000 | 1.0000 | 0.8199 |

| 31 | N | 0.2588 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9074 |

| 32 | N | 0.2966 | 0.3130 | 0.3152 | 0.4037 | 0.2865 | 0.2977 | 0.2605 | 0.1684 | 0.2927 |

| 33 | N | 1.0000 | 0.4267 | 0.4275 | 0.5016 | 0.5627 | 0.5638 | 0.4261 | 0.4620 | 0.5463 |

| 34 | N | 1.0000 | 0.9530 | 0.8171 | 0.8740 | 0.9405 | 1.0000 | 0.9410 | 0.9403 | 0.9332 |

| 35 | N | 0.3720 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9377 | 0.8421 | 0.9007 | 0.8816 |

| 36 | N | 0.8952 | 0.3763 | 0.3565 | 0.3513 | 0.3926 | 0.4450 | 0.5366 | 0.5754 | 0.4911 |

| 37 | N | 0.3418 | 0.6838 | 0.6779 | 0.9198 | 1.0000 | 1.0000 | 0.8557 | 0.8562 | 0.7919 |

| 38 | N | 0.2338 | 0.3835 | 0.4320 | 0.4614 | 0.6445 | 0.6480 | 0.4129 | 0.8142 | 0.5038 |

| 39 | N | 0.8063 | 0.2656 | 0.2059 | 0.2287 | 0.3166 | 0.4116 | 0.3687 | 0.4681 | 0.3839 |

| 40 | E | 1.0000 | 0.6062 | 0.5797 | 0.6433 | 0.7001 | 0.7026 | 0.6568 | 0.6762 | 0.6956 |

| 41 | E | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| 42 | E | 0.5578 | 0.8780 | 0.9165 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9190 |

| 43 | E | 0.5261 | 0.7536 | 0.7343 | 0.9267 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.8676 |

| 44 | E | 0.5337 | 0.5396 | 0.5525 | 0.4172 | 0.5225 | 0.5249 | 0.5205 | 0.5364 | 0.5184 |

| 45 | E | 0.5378 | 0.6937 | 0.4176 | 0.4104 | 0.4992 | 0.4932 | 0.5101 | 0.4849 | 0.5058 |

| 46 | E | 0.3227 | 0.4655 | 0.2911 | 0.2387 | 0.2526 | 0.3088 | 0.3601 | 0.3994 | 0.3299 |

| 47 | E | 0.6277 | 0.4899 | 0.5313 | 0.5560 | 0.6080 | 0.6985 | 0.6684 | 0.6092 | 0.5986 |

| 48 | E | 0.3893 | 0.6241 | 0.6020 | 0.6566 | 0.7398 | 0.7518 | 0.6845 | 0.5333 | 0.6227 |

| 49 | E | 0.6414 | 0.5248 | 0.5725 | 0.6149 | 0.7923 | 0.9148 | 0.9781 | 0.9002 | 0.7424 |

| 50 | N | 0.7837 | 0.6231 | 0.6347 | 0.6659 | 0.7281 | 0.7289 | 0.7486 | 0.7097 | 0.7028 |

| 51 | E | 1.0000 | 0.8186 | 0.8820 | 0.8849 | 1.0000 | 1.0000 | 0.9691 | 0.8305 | 0.9231 |

| Average | 0.6482 | 0.6737 | 0.6779 | 0.7111 | 0.7370 | 0.7485 | 0.7244 | 0.7282 | 0.7061 |

| Model 1 “Pooling” | Model 2 “Pooling” | Model 3 “Pooling” | Model 4 “Pooling” | Model 5 “Pooling” | Model 6 “Pooling” | Model 7 “Pooling” | |

|---|---|---|---|---|---|---|---|

| (Intercept) | 13.957 * (6.584) (2.119) | 34.62 *** (5.542) (6.247) | 10.729 (6.896) (1.555) | 21.839 ** (6.67) (3.274) | 28.016 *** (5.548) (5.049) | 47.287 *** (4.549) (10.393) | 29.21 *** (5.993) (4.874) |

| Net_Loans | −0.159 ** (0.053) (6.247) | −0.1322 * (0.055) (−2.397) | |||||

| Total_Assets | 0.1838 *** (0.047) (3.983) | 0.1629 ** (0.049) (3.323) | 0.1725 *** (0.049) (3.510) | 0.1764 *** (0.049) (−0.538) | |||

| Customer_Deposits | 0.2488 *** (0.048) (5.184) | 0.288 *** (0.053) (5.388) | 0.2405 *** (0.048) (5.002) | 0.242 *** (0.05) (4.804) | 0.227 *** (0.049) (4.587) | 0.2565 *** (0.055) (4.654) | 0.2328 *** (0.051) (4.596) |

| Personnel_Expenses | 0.0740 (0.049) (1.505) | ||||||

| Loan_Impairment_Charge | 0.1703 *** (0.046) (3.629) | 0.178 *** (0.048) (3.697) | 0.1725 *** (0.049) (3.690) | 0.150 ** (0.048) (3.083) | |||

| Fixed_Assets | −0.026 (0.026) (−0.538) | ||||||

| R-Squared: | 0.243 | 0.212 | 0.255 | 0.184 | 0.172 | 0.134 | 0.173 |

| F-statistic: | 14.979 | 12.526 | 11.902 | 10.560 | 14.623 | 10.970 | 9.796 |

| Model 1 “Fixed” | Model 2 “Fixed” | Model 3 “Pooling” | Model 4 “Fixed” | Model 5 “Pooling” | Model 6 “Random” | Model 7 “Fixed” | |

|---|---|---|---|---|---|---|---|

| Intercept | - | 90.121 *** 11.782 7.648 | 93.215 *** (11.219) (8.308) | 47.700 *** (9.867) (4.834) | |||

| Total_Assets | 0.1414 ** (0.043) (3.240) | 0.152 *** (0.043) (3.495) | 0.1429 ** (0.044) | 0.146 ** (0.044) 3.308 | 0.1455 (0.083) (−2.94) | 0.118 ** (0.044) (2.636) | 0.138 ** (0.044) (3.097) |

| Gross_Loans | −0.076 * (0.035) (−2.124) | −0.077 * (0.036) (−2.137) | −1.158 * 0.068 −2.303 | −0.071 (0.036) −1.926 | −0.151 * (0.067) (−2.238) | −0.077 * (0.036) (−1.892) | −0.069 0.036 −1.892 |

| Common_Equity | 0.0701 (0.043) (1.629) | −0.193 * (0.085) (−2.249) | 0.033 (0.043) (0.773) | 0.048 (0.043) (1.119) | |||

| Personnel_Expenses | −0.061 (0.047) (−1.277) | −0.061 (0.047) (−1.286) | −0.174 * (0.082) (2.120) | −0.072 (0.048) (−1.485) | −0.197 * (0.081) (2.418) | −0.055 (0.048) (−1.129) | −0.072 (0.048) (−1.494) |

| Loan_Impairment_Charge | −0.010 (0.031) −0.349) | −0.226 (0.030) | −0.052 (0.077) −0.677 | −0.0102 (0.030) (−0.335) | −0.076 (0.076) (−0.996) | −0.006 (0.032) (−0.192) | −0.00095 (0.031) (−0.0303) |

| Fixed_Assets | 0.11 * (0.042) (2.567) | 0.095 * (0.030) (2.254) | −0.229 ** (0.086) (−2.663) | 0.091 * (0.042) (−1.485) | −0.248 ** (0.084) (−2.940) | 0.085 (0.044) (1.926) | 0.101 * (0.043) (2.320) |

| Pretax_Profit | −0.082 ** (0.031) (−2.652) | −0.072 * (0.030) (−2.369) | −0.57 (0.075) (−0.764) | ||||

| R-Squared: | 0.214 | 0.195 | 0.198 | 0.155 | 0.225 | 0.122 | 0.164 |

| F-statistic: | 4.354 | 4.571 | 5.315 | 4.192 | 6.241 | 3.015 | 3.71 |

| Model 1 “Pooling” | Model 2 “Between” Model | Model 3 “Fixed” Model | Model 4 “Pooling” | Model 5 “Fixed” Model | Model 6 “Random” Model | Model 7 “Fixed” Model | |

|---|---|---|---|---|---|---|---|

| Intercept | 92.261 *** (13.178) (7.000) | 235.990 *** (20.313) (11.617) | - | 65.079 *** (15.606) (4.170) | 58.824 *** (10.258) (5.734) | ||

| Net_Loans | −0.112 (0.064) (−1.7204) | −0.067 (0.088) (−0.764) | −0.051 (0.026) (−1.965) | −0.205 ** (0.069) (−2.939) | −0.044 (0.024) (−1.799) | −0.050 (0.025) (−1.971) | −0.059 * (0.027) (−2.183) |

| Total_Assets | −0.201 ** (0.074) (−2.715) | −0.183 (0.098) (−1.857) | 0.017 (0.032) (0.538) | −0.157 (0.082) (−1.909) | 0.010 (0.029) (0.341) | 0.002 (0.030) (0.084) | |

| Customer_Deposits | 0.073 (0.065) (1.122) | 0.114 (0.082) (−1.388) | |||||

| Personnel_Expenses | 0.026 (0.078) (0.342) | −0.040 (0.081) (−0.490) | −0.125 (0.085) (−1.459) | −0.099 (0.093) (−1.060) | −0.069 (0.078) (−0.888) | −0.049 (0.075) (−0.655) | |

| Loan_Impairment_Charge to Net_Loans | 0.012 (0.069) (0.166) | −2.173 *** (0.190) (−11.394) | 0.066 (0.034) (1.933) | 0.028 (0.089) (0.312) | 0.062 * (0.028) (2.160) | 0.064 * (0.029) (2.166) | |

| Fixed_Assets to Total_Assets | −0.328 *** (0.092) (3.535) | −0.350 *** (0.077) (−4.508) | −0.279 *** (0.076) (−3.672) | ||||

| Net_Loans to Customer_Deposits | −0.098 (0.062) (−1.570) | −0.558 ** (0.083) (−6.714) | 0.076 * (0.034) (2.258) | −0.043 (0.106) (−0.410) | −0.001 (0.033) (−0.05) | ||

| Customer_Deposits to Liabilities | 0.098 (0.067) (1.469) | 0.150 (0.059) (2.552) | 0.117 ** (0.043) (2.727) | −0.036 (0.113) (−0.318) | 0.118 * (0.049) (2.400) | 0.123 * (0.050) (2.437) | 0.195 *** (0.040) (4.884) |

| R-Squared: | 0.361 | 0.98 | 0.353 | 0.206 | 0.414 | 0.343 | 0.211 |

| F-statistic: | 6.631 | 37.779 | 5.576 | 3.870 | 9.196 | 7.768 | 14.751 |

| Model 1 “Pooling” | Model 2 “Between” | Model 3 “Fixed” | Model 4 “Random” | Model 5 “Pooling” | Model 6 “Between” | Model 7 “Fixed” | |

|---|---|---|---|---|---|---|---|

| Intercept | 71.814 ** (25.019) (2.870) | 105.091 (115.949) (0.906) | - | 147.749 *** (13.864) (10.656) | 74.531 ** (24.812) (3.008) | 134.437 (106.643) (1.260) | |

| Net_Loans | −0.060 (0.032) (−1.854) | −0.213 (0.127) (−1.670) | 0.005 (0.013) (0.438) | 0.005 (0.013) (0.409) | −0.058 (0.032) −1.792) | −0.233 (0.127) (−1.836) | 0.003 (0.013) (0.453) |

| Customer_Deposits | 0.158 *** (0.031) (5.049) | 0.252 * (0.123) (2.038) | 0.018 (0.012) (1.432) | 0.020 (0.012) (1.569) | 0.155 *** (0.031) (4.926) | 0.260 * (0.120) (2.161) | |

| Personnel_Expenses | 0.093 ** (0.033) (2.797) | 0.068 (0.107) (0.639) | 0.011 (0.015) (0.760) | 0.014 (0.015) (0.957) | 0.0911742 ** (0.033) (2.722) | 0.072 (0.108) (0.665) | |

| Customer_Deposits to Liabilities | 0.197 *** (0.035) (5.524) | 0.203 (0.115) (1.767) | 0.078 *** (0.023) (3.408) | 0.095 *** (0.022) (4.222) | 0.1 272 *** 0.0357501 (5.592) | 0.234 * (0.108) (2.152) | 0.085 *** (0.022) (3.443) |

| Loan_Impairment_Charge to Net_Loans | −0.091 (0.058) (−1.570) | 0.005 (0.020) (0.265) | 0.0325 (0.016) (1.952) | −0.0531313 (0.057) (−0.931) | −0.513 (0.303) (−1.691) | 0.032 (0.020) (1.904) | |

| Fixed_Assets to Total_Assets | −0.005 (0.061) (−0.093) | 0.143 (0.192) (0.745) | −0.191 *** (0.041) (−4.619) | −0.170 *** (0.040) (−4.184) | 0.010 (0.061) (0.177) | 0.215 (0.186) (1.157) | −0.188 *** (0.042) (−4.031) |

| Net_Loans to Total_Assets | −0.159 *** (0.035) (−4.490) | −0.227 (0.133) (−1.700) | −0.058 ** (0.018) (−3.154) | −0.067 *** (0.018) (−3.627) | −0.145 *** (0.035) (−4.132) | ||

| Personnel_Expenses to Pretax_Profit | −0.002 (0.011) (−0.182) | −0.001 (0.011) (−0.087) | −0.002 (0.032) (−0.087) | −0.117564 0.162467 −0.7236 | −0.017 (0.011) (−1.531) | ||

| R-Squared: | 0.245 | 0.424 | 0.154 | 0.204 | 0.230 | 0.391 | 0.136 |

| F-statistic: | 10.693 | 2.824 | 7.741 | 12.472 | 11.883 | 3.091 | 12.703 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horvatova, E. Technical Efficiency of Banks in Central and Eastern Europe. Int. J. Financial Stud. 2018, 6, 66. https://doi.org/10.3390/ijfs6030066

Horvatova E. Technical Efficiency of Banks in Central and Eastern Europe. International Journal of Financial Studies. 2018; 6(3):66. https://doi.org/10.3390/ijfs6030066

Chicago/Turabian StyleHorvatova, Eva. 2018. "Technical Efficiency of Banks in Central and Eastern Europe" International Journal of Financial Studies 6, no. 3: 66. https://doi.org/10.3390/ijfs6030066