Real Estate Risk Analysis: The Case of Caserma Garibaldi in Milan

Abstract

:1. Introduction

2. Real Estate Risk

3. Methodology

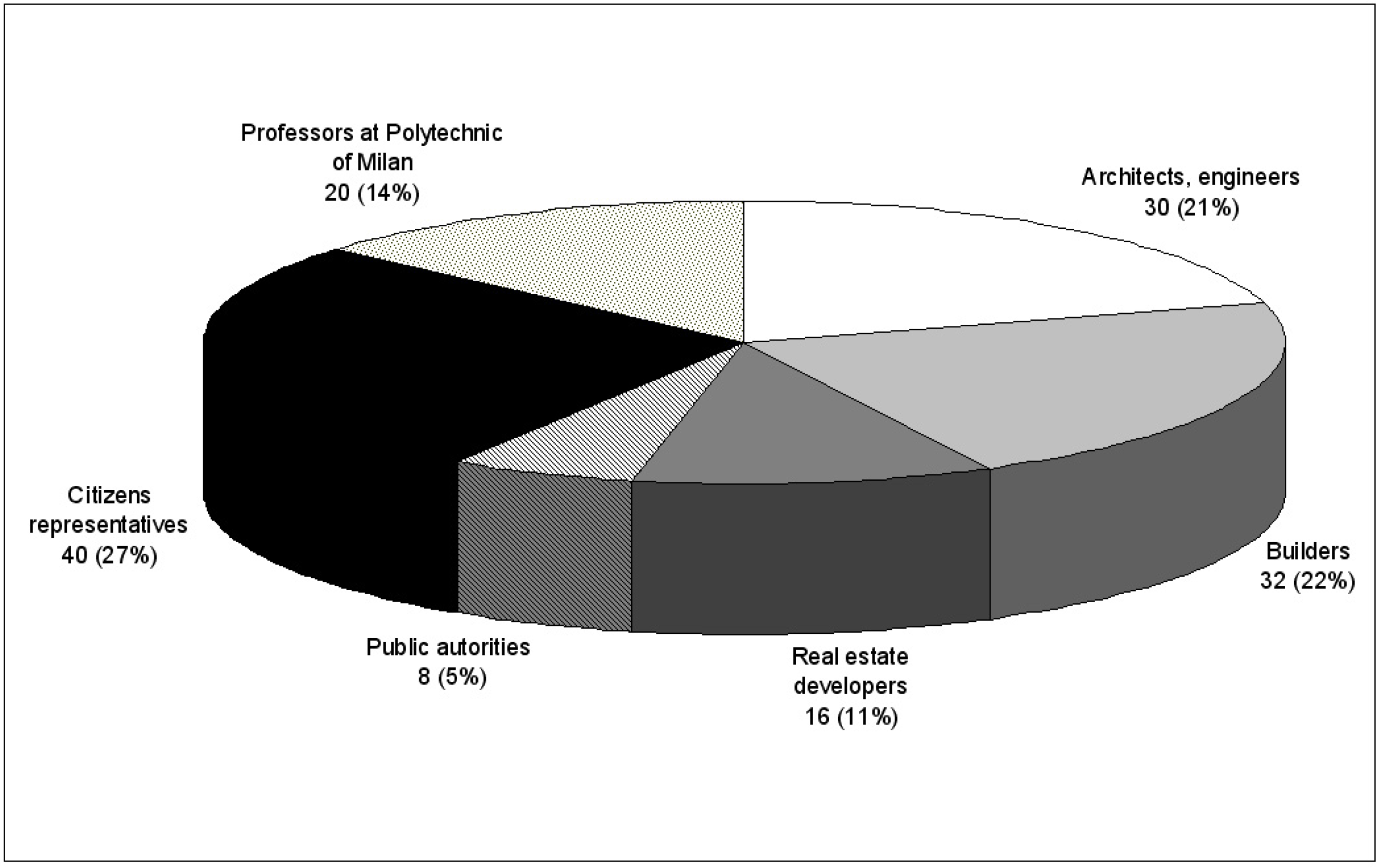

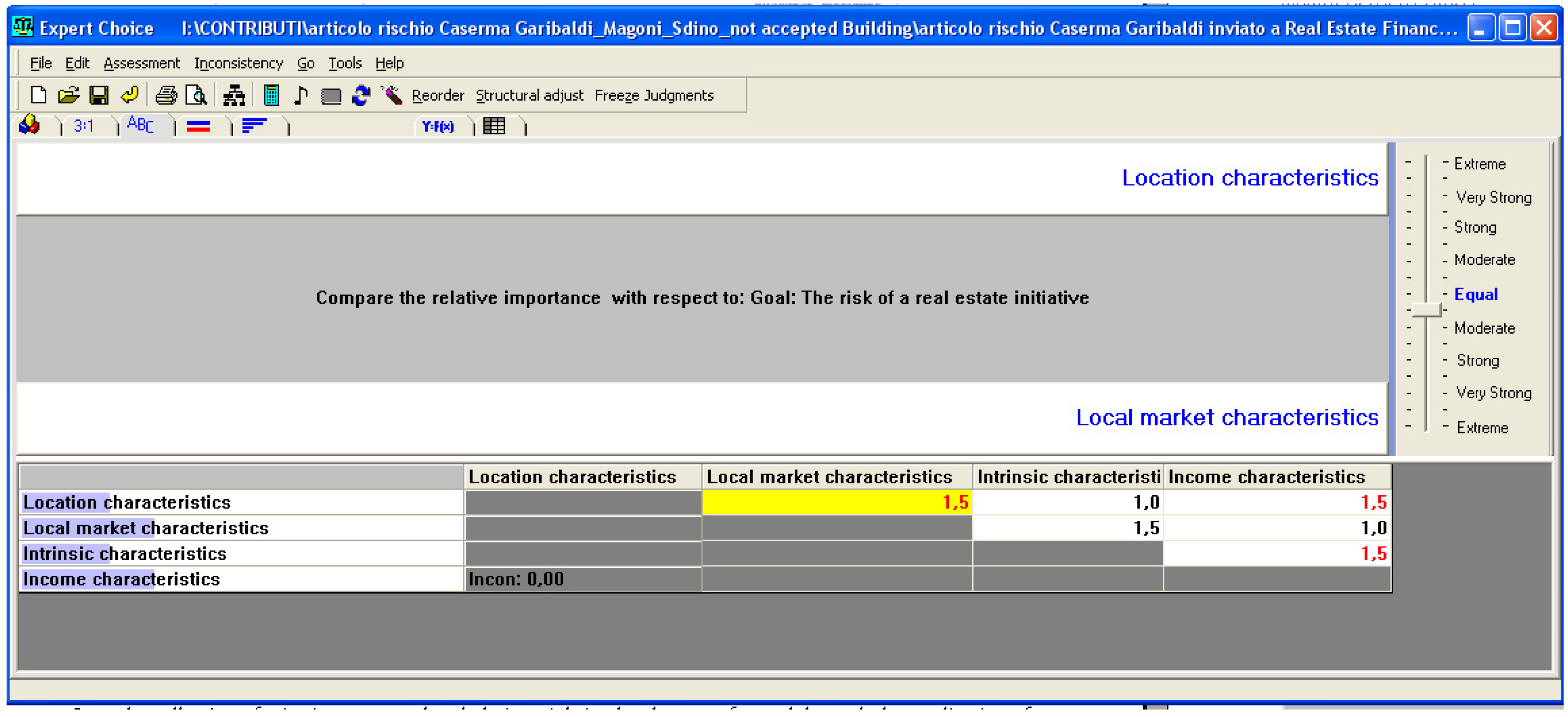

- First, to weight the four groups of macro-criteria (Location, Local market, Intrinsic and Income characteristics). The pairwise comparison is developed between the four groups (two at a time) and the prevalence expresses the influence of the group with respect to the result of the real estate initiative (Figure 2). The groups of criteria which result from the higher importance for the result of a real estate initiative, in terms of are those related to the conditions of the local real estate market (“Local market characteristics”) and the perceived profitability of the real estate asset (Income characteristics—Table 1), have 30% of the weight2;

- Second, to weight each of the 33 selected criteria (or characteristics) within each group. In the first group (Location characteristics), the criteria with the higher importance is “Overall economic development and international attractiveness” (GDP growth, inflation, infrastructures, etc.) has 40% of the weight, followed by “Political, law, taxation and currency conditions” with 25%; in the second group, the criteria “Use” has 30% of the weight, followed by the “Numbers of trades” with 20%; in the third group, the criteria “Spaces’ use efficiency” has 11% of the weight3 (Table 1).

4. Proposal of a Risk-Rating Tool

5. Risk Rating of the Caserma Garibaldi’s Re-Functionalization

- the risks connected to the university use (scenario 1); and

- the risk connected to the services use (offices; scenario 2).

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Baroni, Michel, Fabrice Barthélémy, and Mahdi Mokrane. 2008. Un nouvel indice de risque immobilier pour le marché résidentiel parisien. Revue Économique 59: 99–118. [Google Scholar] [CrossRef]

- Benedetto, Manganelli. 2015. Real Estate Investing: Market Analysis, Valuation Techniques and Risk Management. Cham: Springer International Publishing. [Google Scholar]

- Bourassa, Steven C., Donald R. Haurin, Jessica L. Haurin, Martin Hoesli, and Jian Sun. 2009. House price changes and idiosyncratic risk: The impact of property characteristics. Real Estate Economics 37: 259–78. [Google Scholar] [CrossRef]

- Bravi, Marina, and Elena Fregonara. 2008. Promozione e Sviluppo Immobiliare. Analisi dei Processi e Tecniche di Valutazione. Torino: Celid. [Google Scholar]

- Cacciamani, Claudio. 2003. IL Rischio Immobiliare—Una Soluzione di Rating Dell’investimento Immobiliare. Milano: Egea. [Google Scholar]

- Capozza, Dennis R., and Gregory M. Schwann. 1990. The value of risk in real estate markets. Journal of Real Estate Finance and Economics 3: 117–40. [Google Scholar] [CrossRef]

- Cecconi, Fulvio Re, Lavinia C. Tagliabue, Sebastiano Maltese, and Martina Zuccaro. 2017. A Multi-criteria framework for decision process in retrofit optioneering through interactive data flow. Procedia Engineering 180: 859–69. [Google Scholar] [CrossRef]

- D’alpaos, Chiara, and Rubina Canesi. 2014. Risk assessment in Real Estate investments in times of global crisis. WSEAS Transactions on Business and Economics 11: 369–78. [Google Scholar]

- de FSM Russo, Rosaria, and Roberto Camanho. 2015. Criteria in AHP: A systematic review of literature. Procedia Computer Science 55: 1123–32. [Google Scholar] [CrossRef]

- Degennaro, Emanuele. 2008. La Finanziarizzazione del Mercato Immobiliare. Bari: Cacucci. [Google Scholar]

- del Territorio, Agenzia. 2014. Rapporto Immobiliare 2014—II Settore Residenziale; Roma: Osservatorio del Mercato Immobiliare e Servizi Estimativi, Agenzia delle Entrate.

- Festa, Maurizio, Erika Ghiraldo, and Alessandra Storniolo. 2012. Analisi dei cicli del mercato immobiliare: Un’applicazione sui dati italiani. Territorio Italia 1: 89–109. [Google Scholar]

- Haimes, Yacov Y., and Mark R. Leach. 1984. Risk assessment and management in a multiobjective framwork. In Decision Making with Multiple Objectives. Edited by Yacov Y. Haimes and Vira Chankong. Berlin and Heidelberg: Springer. [Google Scholar]

- Ho, William. 2008. Integrated analytic hierarchy process and its applications—A literature review. European Journal of Operational Research 186: 211–28. [Google Scholar] [CrossRef]

- Ho, William, and Xin Ma. 2017. The state of the art integrations and applications of the analytic hierarchy process. European Journal of Operational Research, 1–16. [Google Scholar] [CrossRef]

- Ho, Daniel, Graeme Newell, and Anthony Walker. 2005. The importance of Property-specific attributes in assessing CBD office building quality. Journal of Property Investment & Finance 23: 424–44. [Google Scholar]

- International Valuation Standards Council. 2013. International Valuation Standards. London: International Valuation Standards Council. [Google Scholar]

- Janssen, Jos, Bert Kruijt, and Barrie Needham. 1994. The honeycomb Cycle in Real Estate. The Journal of Real Estate Research 9: 237–52. [Google Scholar]

- Jiang, Gen-mou, Zhen-peng Hu, and Jun-yan Jin. 2007. Quantitative evaluation of real estate’s risk based on AHP and simulation, systems engineering. Theory & Practice 27: 77–81. [Google Scholar]

- Knight, Frank Hyneman. 1921. Risk, Uncertainty, and Profit. New York: Hart, Scaffner and Marx. [Google Scholar]

- Kozioł-Kaczorek, Dorota. 2014. The use of combined multicriteria method forthe valuation of real estate. Optimum, Studia Ekonomiczne 5: 219–35. [Google Scholar]

- Kušar, Matej, Maruška Šubic Kovač, and Jana Šelih. 2013. Selection of efficient retrofit scenarios for public buildings. Procedia Engineering 57: 651–56. [Google Scholar] [CrossRef]

- Lin, Chin-Tsai, and Jun-Kun Lin. 2013. Fuzzy-GIS approach for applying the AHP multi-criteria decision-making model to evaluate real estate purchases. Journal of Testing and Evaluation 41: 978–89. [Google Scholar] [CrossRef]

- Maggi, Maurizio. 2014. La Casa Non è Più il Bene Rifugio. Ora è Diventata un Incubo. January 16. Available online: http://espresso.repubblica.it/affari/2014/01/13/news/la-casa-non-e-piu-il-bene-rifugio-ora-e-diventata-un-incubo-1.148598 (accessed on 16 February 2017).

- Manganelli, Benedetto, Pierluigi Morano, and Francesco Tajani. 2014. Risk assessment in estimating the capitalization rate. WSEAS Transactions on Business and Economics 11: 199–208. [Google Scholar]

- Nassim, Nicholas Taleb. 2007. The Black Swan: The Impact of the Highly Improbable. London: Penguin. [Google Scholar]

- Palicki, Sławomir. 2015. Multi-criteria assessment of public space from the social perspective. Real Estate Management and Valuation 23: 24–34. [Google Scholar] [CrossRef]

- Peng, Liang, and Thomas G. Thibodeau. 2017. Idiosyncratic risk of house prices: Evidence from 26 million home sales. Real Estate Economics 45: 340–75. [Google Scholar] [CrossRef]

- Reddy’s Group. 2016. IL Mercato Immobiliare resIdenziale Italiano. March. Available online: http://www.golfpeople.eu/wp-content/uploads/2016/05/Il-mercato-imm.-italiano-mar-2016.pdf (accessed on 25 May 2017).

- Ribeiro, Mónica I. F., Fernando A. F. Ferreira, Marjan S. Jalali, and Ieva Meidutė-Kavaliauskienė. 2017. A fuzzy knowledge-based framework for risk assessment of residential real estate investments. Technological and Economic Development of Economy 23: 140–56. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 1980. The Analytic Hierarchy Process. New York: McGraw-Hill. [Google Scholar]

- Saaty, Thomas L. 1988. Multicriteria Decision Making—The Analytic Hierarchy Process. Planning, Priority Setting, Resource Allocation. Pittsburgh: RWS Publishing. [Google Scholar]

- Saaty, Thomas L. 1990. Decision Making for Leaders—The Analytic Hierarchy Process for Decisions in a Complex World. Pittsburgh: RWS Publishing. [Google Scholar]

- Shao, Adam W., Katja Hanewald, and Michael Sherris. 2015. Reverse mortgage pricing and risk analysis allowing for idiosyncratic house price risk and longevity risk. Insurance: Mathemathics and Economics 63: 76–90. [Google Scholar] [CrossRef]

- Tecnoborsa. 2011. Codice Delle Valutazioni Immobiliari—Italian Property Valuation Standard, 4th ed. Roma: Tecnoborsa, S.c.p.a. [Google Scholar]

- TEGoVA. 2003. European Property and Market Rating. Bruxelles: TEGoVA. [Google Scholar]

- TEGoVA. 2012. European Valuation Standards. Bruxelles: TEGoVA. [Google Scholar]

- Wang, Cheng. 2013. Family house-purchase decision model based on analytic hierarchy process. Applied Mechanics and Materials 423–26: 2973–76. [Google Scholar] [CrossRef]

- Zheng, Xian, K. W. Chau, and C. M. Eddie. 2015. Liquidity risk and cross-sectional return in the housing market. Habitat International 49: 426–34. [Google Scholar] [CrossRef]

| 1 | Each group components must answer at this questions: “Which are the characteristics whose presence/absence or quality level can represent a risk to a good result of a real estate initiative?” The concept of “good result” is declined in different way by each group (e.g.: private operators like “builders” or “real estate promoters“ have considered a “good result” the economic sustainability of the initiative while the “public authorities” the social sustainability. |

| 2 | All the pairwise comparison are developed using the software Export Choice (expert choice®-USA). |

| 3 | The weight of a single criteria respect to the overall result of the real estate initiative can be obtained by multiplying the relative weight of each criteria with the weight of the membership group (e.g., the overall weight of “Use” is 9% (30% × 30%). |

| 4 | For the scenario 1 (university use): Rc1 = 4 × 0.20 + 2 × 0.30 + 3 × 0.20 + 3 × 0.30 = 3; for the scenario 2 (services use): Rc2 = 4 × 0.20 + 6 × 0.30 + 10 × 0.20 + 6 × 0.30 = 6. |

| 5 | For the scenario 1: Rc1 = 3 + 3 × (1 − 1) = 3; for the scenario 2: Rc2 = 6 + 3 × (1 − 0.5) = 7.5. |

| CRITERIA | WEIGHT | |||

|---|---|---|---|---|

| 1. LOCATION CHARACTERISTICS | ||||

| Economic, social, and environmental influence of the context in which the object of the rating is placed; in the first section, “National environment”, this context is meant at a macro scale, national, then, in the “extrinsic characteristics” section, at the scale of the city, neighborhood, and specific area. | ||||

| National Environment | ||||

| 1. Natural events |

| 15% | 25% | 20% |

| 2. Demographic and social development |

| 20% | ||

| 3. Overall economic development and international attractiveness |

| 40% | ||

| 4. Political, law, taxation, and currency conditions |

| 25% | ||

| Extrinsic Characteristics | ||||

| 5. Size of the urban center | 15% | 75% | ||

| 6. Closeness to the city center | 15% | |||

| 7. Social environment | 10% | |||

| 8. Environmental context | 8% | |||

| 9. Public transportations | 10% | |||

| 10. Free parking places | 8% | |||

| 11. Public services | 13% | |||

| 12. Commercial services | 12% | |||

| 13. Closeness to attracting poles (natural/artistic/recreational) | 10% | |||

| 2. LOCAL MARKET CHARACTERISTICS | ||||

| Overall market performance, with reference to the specific area of the object of rating. It is an assessment carried out at an intermediate scale, in which the characteristics of the asset are not considered. | ||||

| 14. Use | 30% | 30% | ||

| 15. Municipal taxation | 10% | |||

| 16. Number of trades | 20% | |||

| 17. Sector’s rental fees | 15% | |||

| 18. Demand/supply alignment | 25% | |||

| 3. INTRINSIC CHARACTERISTICS | ||||

| Characteristics of the specific asset; some are hardly quantifiable and are attributable to design choices and property management approaches. They relate to the building’s appearance, its conservation status, its efficiency and usability. | ||||

| 19. Aesthetic attractiveness | 10% | 20% | ||

| 20. Attractiveness—Innovation | 5% | |||

| 21. Main facilities and services (heating/electrical/water installations) | 10% | |||

| 22. Ancillary facilities and services | 7% | |||

| 23. Installations maintenance | 10% | |||

| 24. Energy efficiency | 8% | |||

| 25. Accessibility | 12% | |||

| 26. Materials and constructive choices | 10% | |||

| 27. Spaces’ use efficiency | 11% | |||

| 28. Fungibility | 10% | |||

| 29. Building maintenance | 7% | |||

| 4. INCOME CHARACTERISTICS | ||||

| Characteristics of the positive cash flows that are expected to guarantee the financial sustainability of the operation. | ||||

| 30. Conditions of the lessor/occupier |

| 30% | 30% | |

| 31. Condition of vacancy/release/default | 25% | |||

| 32. Non-recoverable operational costs | 20% | |||

| 33. Current legislation | 25% | |||

| SCENARIO | |||

|---|---|---|---|

| 1 UNIVERSITY | 2 SERVICES | ||

| 1. LOCATION CHARACTERISTICS | 4 | 4 | |

| National environment | 7 | 7 | |

| 1. Natural events | 8 | 8 | |

| 2. Demographic and social development | 7 | 7 | |

| 3. Overall economic development and international attractiveness | 6 | 6 | |

| 4. Political, law, taxation and currency conditions | 8 | 8 | |

| Extrinsic characteristics | 3 | 3 | |

| 5. Size of the urban center | 1 | 1 | |

| 6. Closeness to the city center | 1 | 1 | |

| 7. Social environment | 4 | 4 | |

| 8. Environmental context | 4 | 4 | |

| 9. Public transportations | 2 | 2 | |

| 10. Free parking places | 7 | 7 | |

| 11. Public services | 1 | 1 | |

| 12. Commercial services | 3 | 3 | |

| 13. Attracting poles | 1 | 1 | |

| 2. LOCAL MARKET CHARACTERISTICS | 2 | 6 | |

| 14. Use | University: there is almost no risk since the change of use to a university is already envisaged by the Territorial Government Plan and there is an interested buyer (Catholic University of Sacred Heart). Services: in Milan (in 2015), there is an overabundance of the offer within this specific market sector. This leads to an increase of the discount applied within the negotiation of 13.5–15%, to a stabilization of the average selling times in around 9.3 months, and to the average rental times in around seven months. These data reveal the poor health of the sector. However, as concerns the annual average rate of return guaranteed by the sub-sector this is proven a good source of investments, being outperformed only by retail. | 1 | 5 |

| 15. Municipality taxation | 7 | 7 | |

| 16. Number of trades | University: there is almost no risk since the buyer has already been identified. Services: with a NTN (number of normalized transactions) of 629 and an IMI (index of intensity of the real estate market) of 1.51% the health of Milan’s tertiary sector is relatively better than the national sector’s average, but it shows signs of the crisis that affects the whole market (del Territorio 2014). | 1 | 4 |

| 17. Sector’s rental fees | 3 | 3 | |

| 18. Demand/supply alignment | University: the demand is guaranteed by the interest shown by the Catholic University of the Sacred Heart. Services: in its proposal, the State Property Agency does not investigate the eventual existence of an active demand for the asset and, consequently, the potential absorption of a property of such size and type. Moreover, the stillness of the tertiary segment emerges from the imbalance between supply and demand, with situations of unsold and vacancy of over 12% (Saaty 1990). | 1 | 9 |

| 3. INTRINSIC CHARACTERISTICS | 5 | 10 | |

| 19. Aesthetic attractiveness | 1 | 1 | |

| 20. Attractiveness—Innovation | 8 | 8 | |

| 21. Main facilities and services | 7 | 7 | |

| 22. Ancillary facilities and services | 7 | 7 | |

| 23. Installations maintenance | 7 | 7 | |

| 24. Energy efficiency | 7 | 7 | |

| 25. Accessibility | 2 | 2 | |

| 26. Materials and constructive choices | 4 | 4 | |

| 27. Spaces’ use efficiency | The property is bound by the D.Lgs. n. 42/2004 (Legislative Decree); according to that, the spatial setting of the property cannot be deeply transformed. This asset is thus poorly usable for every destination except the public ones, as it would result in a large waste of surface. | 3 | 10 |

| 28. Fungibility | In recognition of the artistic and historical value of the good, no intervention that alters its typological system is permitted, in accordance with the D.lgs. n. 42/2004 (Legislative Decree). In this sense, in the case of a change in the users’ needs, substantial adaptations are prevented. The wide corridors are a limit to the flexibility of spaces since they cannot be adjusted even if they are poorly effective. In addition, allowed interventions are difficult and long to complete because of the building’s traditional style. It is, therefore, desirable, for the accommodation of new functions, a future use that is consistent with the original interior distribution. | 3 | 9 |

| 29. Building maintenance | 7 | 7 | |

| 4. INCOME CHARACTERISTICS | 3 | 6 | |

| 30. Conditions of the lessor/occupier | University: there is almost no risk since the buyer has already been identified. Services: since the lessee has not yet been identified, this sector cannot be evaluated; this implies the presence of a medium-high risk due to the uncertainty of the object of the rating. | 1 | 6 |

| 31. Condition of vacancy/release/default | University: there is almost no risk since the buyer has already been identified. Services: since the lessee has not yet been identified, his solvency cannot be evaluated; this implies the presence of a medium-high insolvency risk due to the uncertainty of the object of the rating. | 1 | 8 |

| 32. Non-recoverable operational costs | 6 | 6 | |

| Current legislation | 6 | 6 | |

| TOTAL RISK-RATING: Rc | 3 | 6 | |

| SCENARIO | ||

|---|---|---|

| 1 UNIVERSITY | 2 SERVICES | |

| Operation’s stage of completion: coefficient “a” | 100% | 50% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sdino, L.; Rosasco, P.; Magoni, S. Real Estate Risk Analysis: The Case of Caserma Garibaldi in Milan. Int. J. Financial Stud. 2018, 6, 7. https://doi.org/10.3390/ijfs6010007

Sdino L, Rosasco P, Magoni S. Real Estate Risk Analysis: The Case of Caserma Garibaldi in Milan. International Journal of Financial Studies. 2018; 6(1):7. https://doi.org/10.3390/ijfs6010007

Chicago/Turabian StyleSdino, Leopoldo, Paolo Rosasco, and Sara Magoni. 2018. "Real Estate Risk Analysis: The Case of Caserma Garibaldi in Milan" International Journal of Financial Studies 6, no. 1: 7. https://doi.org/10.3390/ijfs6010007