Determination of Systemically Important Companies with Cross-Shareholding Network Analysis: A Case Study from an Emerging Market

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

3.1. The Dataset

3.2. Methodology

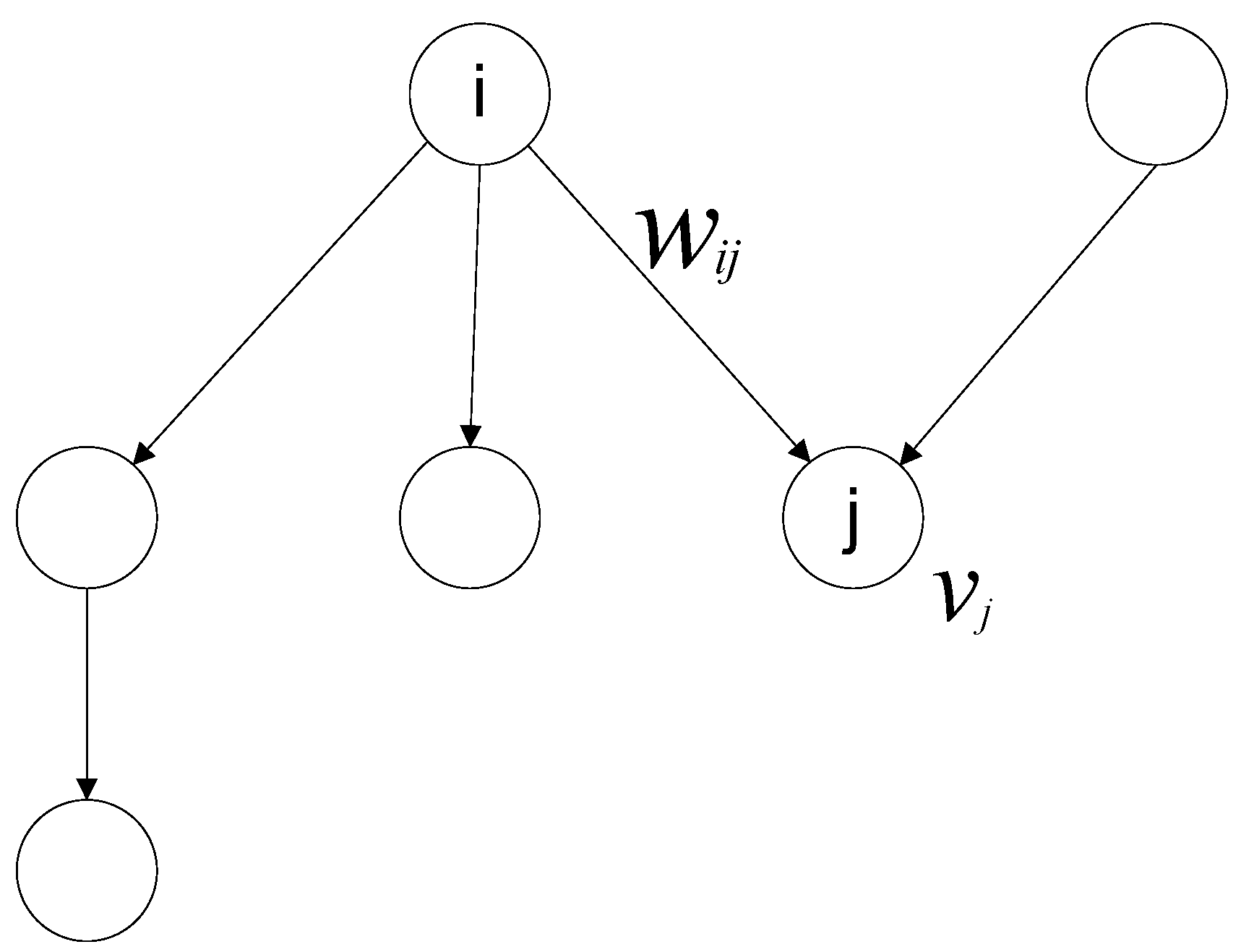

3.2.1. Network Notation

3.2.2. Networks Based Systemic Risk Indices

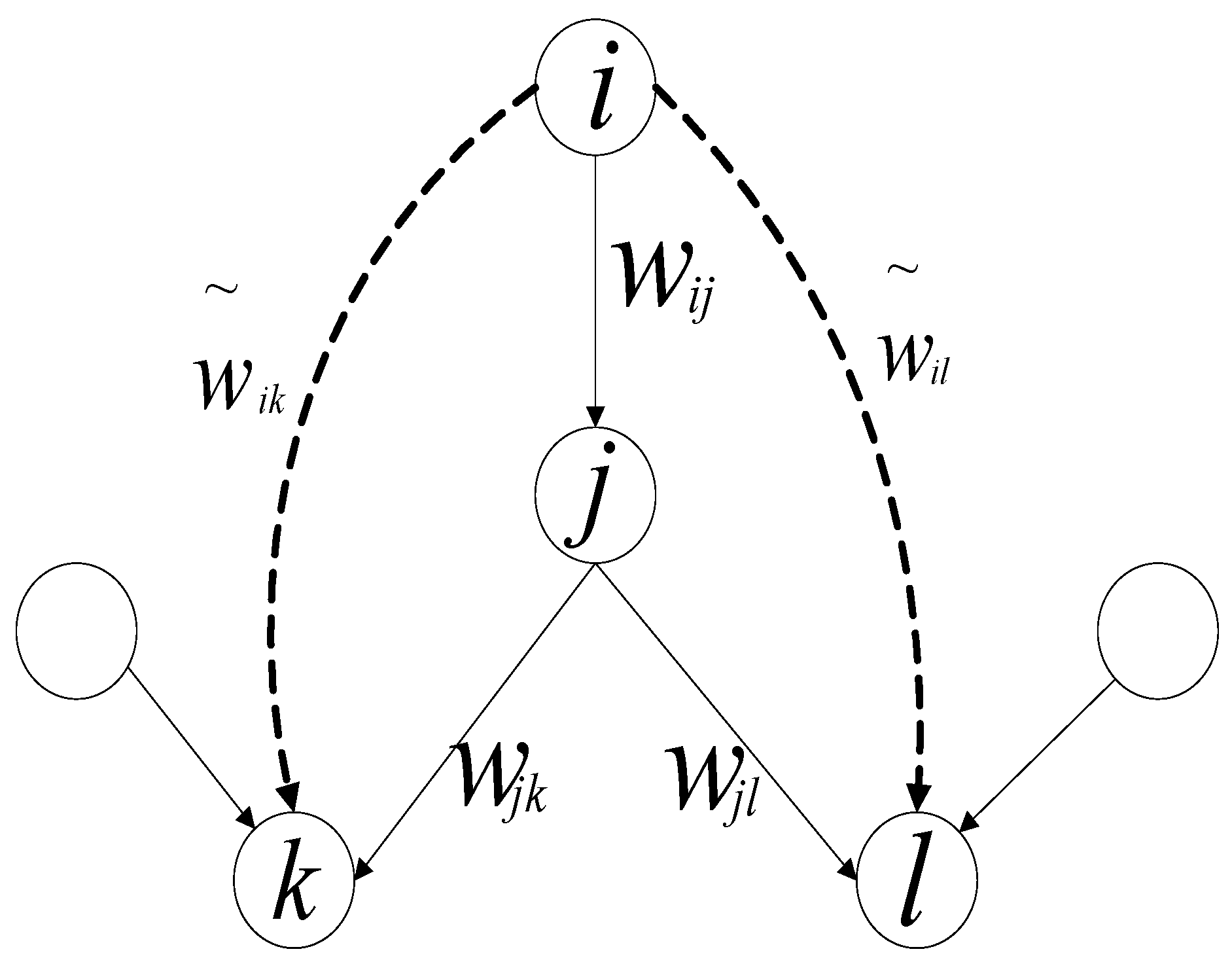

3.2.3. Integrated Market Value and Integrated Cross-Shareholding Matrix

4. Results and Analysis

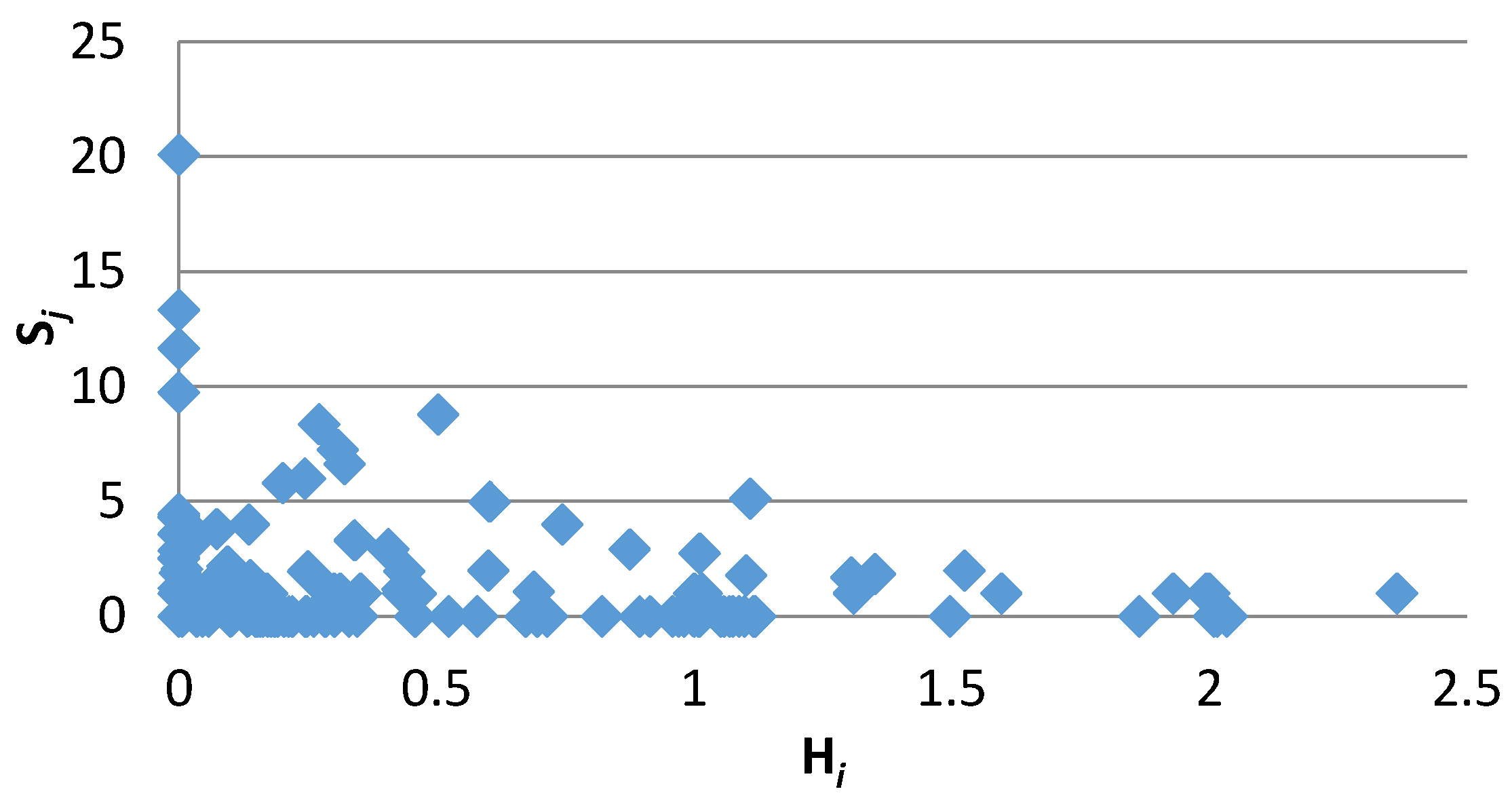

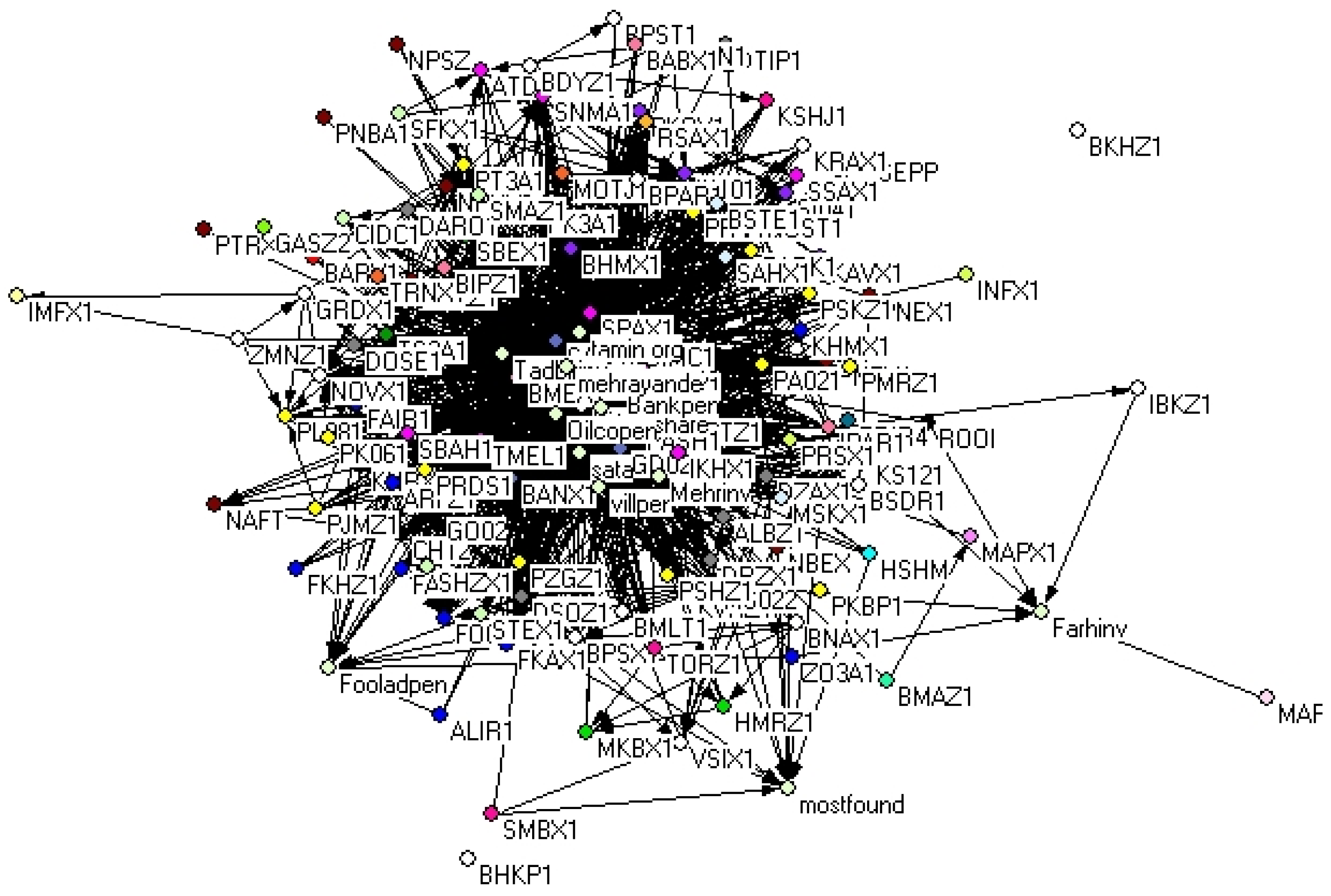

4.1. Direct Cross-Shareholding Network

4.2. Integrated Cross-Shareholding Network

5. Conclusions

Acknowledgment

Author Contributions

Conflicts of Interest

Appendix A: List of Considered Companies and Shareholders

| Company | Symbol | Sector | Company | Symbol | Sector | ||

| 1 | North Drilling | HSHM | Oil & Gas Drilling | 67 | Zagros Petro. | PZGZ1 | Petrochemical |

| 2 | Metals & Min. | MADN | Metal Mining | 68 | Shiraz Petr. | PSHZ1 | Petrochemical |

| 3 | Chadormalo | CH121 | Metal Mining | 69 | Maroon Petro. | PMRZ1 | Petrochemical |

| 4 | Gol-E-Gohar. | GO02 | Metal Mining | 70 | Fanavaran Petr. | PFAX1 | Petrochemical |

| 5 | Iran Zinc Mines | ROOI | Metal Mining | 71 | Amir Kabir Co. | PKBP1 | Petrochemical |

| 6 | Saba Noor | KNRX | Metal Mining | 72 | Ghassem Co. | GASZ2 | Retailing |

| 7 | Spahan Naft | SEPP | Oil Products | 73 | Cement INV. Co. | CIDC1 | Cement |

| 8 | Oil Ind. Inv. | NAFT | Oil Products | 74 | F. & Kh. Cement | SFKX1 | Cement |

| 9 | Iranol | NOLZ | Oil Products | 75 | Tehran Cement | STEX1 | Cement |

| 10 | Behran Oil | NBEX | Oil Products | 76 | Hormozgan Cem. | SHZX1 | Cement |

| 11 | NPSZ | NPSZ | Oil Products | 77 | Mazandaran Cem. | SMAZ1 | Cement |

| 12 | B.A Oil Refinie | PNBA1 | Oil Products | 78 | Cult. Herit. Inv | IMFX1 | Tourism |

| 13 | Isf. Oil Ref. Co. | PNEX1 | Oil Products | 79 | Saipa Inv. | SSAX1 | Investment Co. |

| 14 | Pars Oil | NPRX1 | Oil Products | 80 | Kharazmy Invest | IKHX1 | Investment Co. |

| 15 | Palayesh Tehran | PTRX1 | Oil Products | 81 | Atye Damavand | ATDM1 | Investment Co. |

| 16 | Tabriz. Oil. Refine | PNTX1 | Oil Products | 82 | Ind. & Mine Inv. | SNMA1 | Investment Co. |

| 17 | Palayesh Naft | PRZZ1 | Oil Products | 83 | Sepah Inv. | SPAX1 | Investment Co. |

| 18 | Kerman Tire | BARX1 | Tier & Plastic | 84 | Tosee Melli Inv. | TMEL1 | Investment Co. |

| 19 | Kavir Tire | KVRZ1 | Tier & Plastic | 85 | Bahman Inv. | SBAH1 | Investment Co. |

| 20 | Calcimine | KS121 | Metals | 86 | Iran N. Inv. | NIKX1 | Investment Co. |

| 21 | I. N. C. Ind | MS022 | Metals | 87 | Saderat Bank | BSDR1 | Banking |

| 22 | Mobarake | FO041 | Metals | 88 | Mellat Bank | BMLT1 | Banking |

| 23 | Esfahan Eteel | ZO3A1 | Metals | 89 | Tejarat Bank | BTEJ1 | Banking |

| 24 | Arfa Steel Co. | ARFZ1 | Metals | 90 | Hekmat Iranian | BHKP1 | Banking |

| 25 | Iran Aluminium | ALIR1 | Metals | 91 | Day Bank | BDYZ1 | Banking |

| 26 | Khavarmiane Mine | KHMX1 | Metals | 92 | Tourism Bank | GRDX1 | Banking |

| 27 | Khouz. Steel | FKHZ1 | Metals | 93 | Post Bank | BPST1 | Banking |

| 28 | Iran Fold | FAIR1 | Metals | 94 | Ansar Bank | BNAX1 | Banking |

| 29 | Amirkabir Steel. | FAJX1 | Metals | 95 | Pasargad Bank | BPSX1 | Banking |

| 30 | Khorasan Steel | FKAX1 | Metals | 96 | Iran Zamin Bank | ZMNZ1 | Banking |

| 31 | Arak M. Mfg. | MARX1 | Metal Products | 97 | Parsian Bank | BPAR1 | Banking |

| 32 | Iran Tractor | TRIR | Machines & Equipment | 98 | Sina Fin. Ins. | VSIX1 | Banking |

| 33 | Iran Transfo | TRNX1 | Electronic Machines | 99 | EN Bank | NOVX1 | Banking |

| 34 | Motogen | MOTJ1 | Electronic Machines | 100 | Karafarin Bank | KRAX1 | Banking |

| 35 | IranKhodro | IK101 | Car Prod. | 101 | Bank of M.E | BKHZ1 | Banking |

| 36 | Saipa | SI041 | Car Prod. | 102 | Investment Bank | IBKZ1 | Banking |

| 37 | Pars Khodro | PKOX1 | Car Prod. | 103 | Rayan Saipa | RSAX1 | Leasing |

| 38 | Bahman Group | BHMX1 | Car Prod. | 104 | Sina Marine srv | SMBX1 | Transportation |

| 39 | Iran Kh. Inv. | GOST1 | Car Prod. | 105 | Toucaril Co. | TORZ1 | Transportation |

| 40 | Iran Khodro D | KAVX1 | Car Prod. | 106 | IRI Marine Co. | KSHJ1 | Transportation |

| 41 | Bank Melli Inv. | BANX1 | Ind. Holdings | 107 | Iran Tele Co. | MKBX1 | Telecom |

| 42 | Ghadir Inv. | GD021 | Ind. Holdings | 108 | Iran Mobile Tele | HMRZ1 | Telecom |

| 43 | SANDOGH | SA3A1 | Ind. Holdings | 109 | Alborz Bimeh | BABX1 | Insurance Co. |

| 44 | Omid Inv. Mng | OIMC1 | Ind. Holdings | 110 | Parsian | IPAR1 | Insurance Co. |

| 45 | Bargh Mapna Co. | BMAZ1 | Electricity Supp. | 111 | Mellat Insur. | BMEX1 | Insurance co. |

| 46 | Behshahr | TS3A1 | Food Prod. | 112 | Pasargad Insur. | BIPZ1 | Insurance co. |

| 47 | Behshahr Ind. | SBEX1 | Food Prod. | 113 | Shahed Inv. | SAHX1 | Housing |

| 48 | Tamin Daroo | DTIP1 | Medicine | 114 | Housing Inv. | MSKX1 | Housing |

| 49 | Alborz Inv. | ALBZ1 | Medicine | 115 | Int. Const. | BSTE1 | Housing |

| 50 | Sobhan Pharm. | DSOZ1 | Medicine | 116 | Inf. Services | INFX1 | Computer & IT |

| 51 | Osvah Pharm. | DOSE1 | Medicine | 117 | Parsian E-Commerce | PRSX1 | Computer & IT |

| 52 | Razak Lab. | DRZX1 | Medicine | 118 | MAPNA | MAPX1 | Computer & IT |

| 53 | Zahravi Phar. | DZAX1 | Medicine | 119 | Goverment | Gov | Ext. Shareholder |

| 54 | Daroupakhsh | DARO1 | Medicine | 120 | Tamin Organization | Tamin Org | Ext. Shareholder |

| 55 | Tamin Petro | PT3A1 | Petrochemical | 121 | Army Pen. Fund | Sata | Ext. Shareholder |

| 56 | Ir.Inv.Petr. | IPTZ1 | Petrochemical | 122 | Adalat Shares | Adashare | Ext. Shareholder |

| 57 | KhalijFars | PL081 | Petrochemical | 123 | Mostazafin Foundation | Mostfound | Ext. Shareholder |

| 58 | ParsianOil | PA021 | Petrochemical | 124 | Oil Comp Pen. fund | Oilcopen | Ext. Shareholder |

| 59 | Shazand Petr. | PARK1 | Petrochemical | 125 | Tadbir Inv. | Tadbirinv | Ext. Shareholder |

| 60 | Pardis Petr. | PRDZ1 | Petrochemical | 126 | Farhangian Inv. | Farhinv | Ext. Shareholder |

| 61 | Paksho | PASH1 | Petrochemical | 127 | Villager Pen. Fund | Villpen | Ext. Shareholder |

| 62 | Khorasan Petro | PSKZ1 | Petrochemical | 128 | Foolad Pen. Fund | Fooladpen | Ext. Shareholder |

| 63 | Khark Petr. | PK061 | Petrochemical | 129 | Mehr Inv. Co. | Mehrinv | Ext. Shareholder |

| 64 | Iran Chem. Ind. | SSIN1 | Petrochemical | 130 | Banks Pen Find | Bankpen | Ext. Shareholder |

| 65 | Jam Petr. | PJMZ1 | Petrochemical | 131 | Mehreayande Inv. | Mehrayande | Ext. Shareholder |

| 66 | Kerman | PK3A1 | Petrochemical |

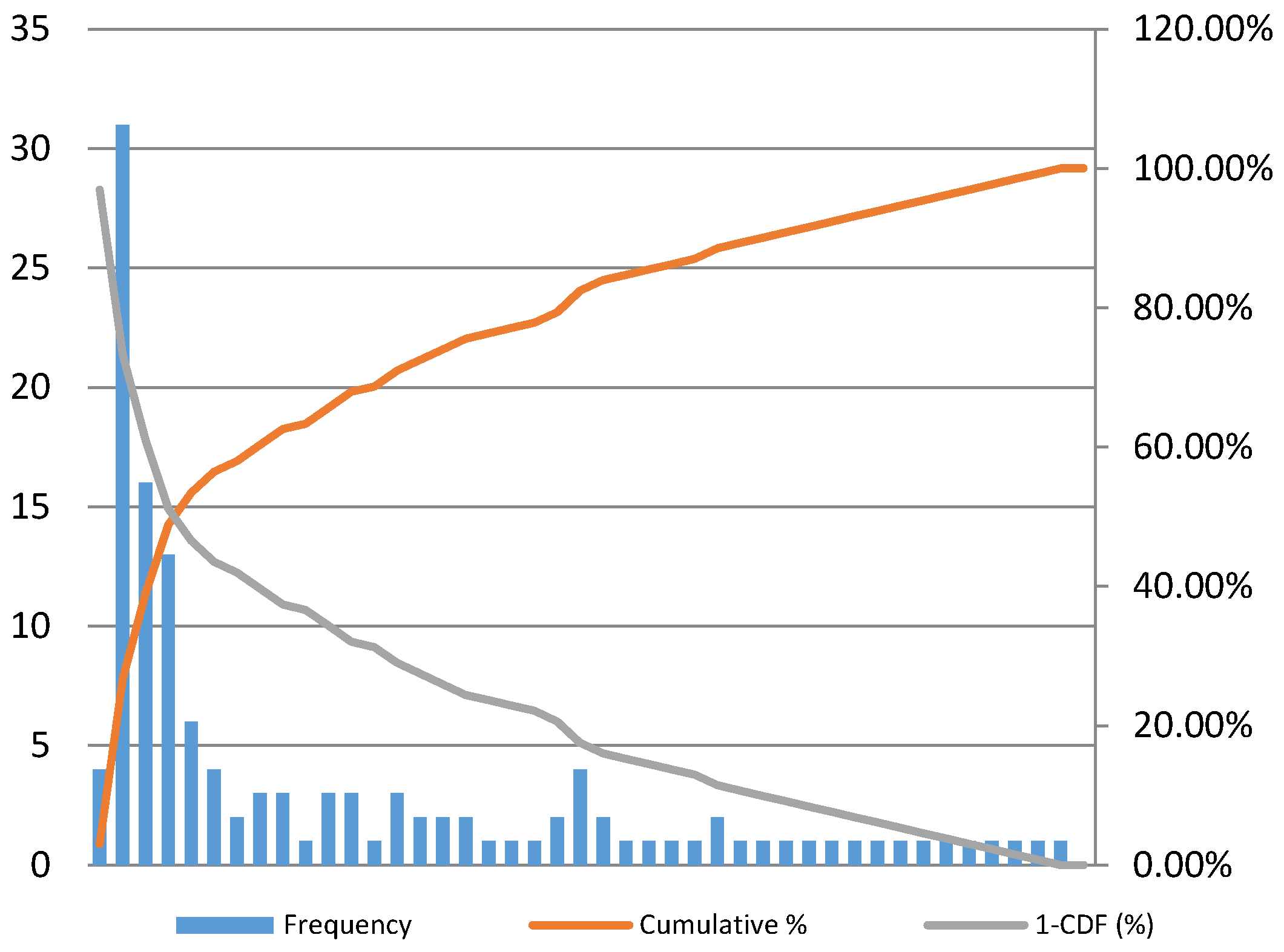

Appendix B: Histogram and Cumulative Distribution of Systemic Risk Measures

Appendix C: Complement of Cumulative Distribution of Systemic Risk in Log-Log Scale

References

- N. Pecora, and A. Spelta. “Shareholding relationships in the Euro Area banking market: A network perspective.” Phys. A 434 (2015): 1–12. [Google Scholar] [CrossRef]

- A.G. Haldane, and R.M. May. “Systemic risk in banking ecosystems.” Nature 469 (2011): 351–355. [Google Scholar] [CrossRef] [PubMed]

- P. Smaga. The Concept of Systemic Risk. Systemic Risk Centre Working Paper; London, UK: London School of Economics, 2014. [Google Scholar]

- V. Boginski, S. Butenko, and P.M. Pardalos. “Mining market data: A network approach.” Comput. Oper. Res. 33 (2006): 3171–3184. [Google Scholar] [CrossRef]

- F.X. Diebold, and K. Yilmaz. “On the Network Topology of Variance Decompositions: Measuring the Connectedness of Financial Firms.” J. Econom. 182 (2014): 119–134. [Google Scholar] [CrossRef]

- C. Upper. “Simulation methods to assess the danger of contagion in interbank markets.” J. Financ. Stab. 7 (2011): 111–125. [Google Scholar] [CrossRef]

- J.P. Onnela, A. Chakraborti, K. Kaski, and J. Kertesz. “Dynamic asset trees and black Monday.” Phys. A Stat. Mech. Appl. 324 (2003): 247–252. [Google Scholar] [CrossRef]

- X.F. Liu, and C.K. Tse. “Dynamics of network of global stock market.” Account. Finance Res. 1 (2012): 1–12. [Google Scholar] [CrossRef]

- F. Allen, and D. Gale. “Financial Contagion.” J. Political Econ. 108 (2000): 1–33. [Google Scholar] [CrossRef]

- G. Hałaj, and C. Kok. “Assessing interbank contagion using simulated networks.” Comput. Manag. Sci. 10 (2013): 157–186. [Google Scholar] [CrossRef]

- S. Lenzu, and G. Tedeschi. “Systemic risk on different interbank network topologies.” Phys. A 391 (2012): 4331–4341. [Google Scholar] [CrossRef]

- J.B. Glattfelder. “Ownership Networks and Corporate Control: Mapping Economic Power in a Globalized World.” Available online: https://www.sg.ethz.ch/media/medialibrary/2013/12/james_glatteth-2007-02.pdf (accessed on 2 September 2014).

- A. Westphal. “Systemic Risk in the European Union: A Network Approach to Banks’ Sovereign Debt Exposures.” Int. J. Financ. Stud. 3 (2015): 244–279. [Google Scholar] [CrossRef]

- S. Battiston, and J.B. Glattfelder. “Backbone of complex networks of corporations: The flow of control.” Phys. Rev. E 80 (2009): 036104. [Google Scholar]

- S. Vitali, J.B. Glattfelder, and S. Battiston. “The network of global corporate control.” PLoS ONE 6 (2011): e25995. [Google Scholar] [CrossRef] [PubMed]

- S. Battiston. “Inner structure of capital control networks.” Phys. A 338 (2004): 107–112. [Google Scholar] [CrossRef]

- Y.Y. Ma, X.T. Zhuang, and L.X. Li. “Research on the relationships of the domestic mutual investment of China based on the cross-shareholding networks of the listed companies.” Phys. A 390 (2011): 749–759. [Google Scholar] [CrossRef]

- D. Garlaschelli, S. Battiston, M. Castri, V.D.P. Servedio, and G. Caldarelli. “The scale-free topology of market investments.” Phys. A 350 (2005): 491–499. [Google Scholar] [CrossRef]

- C. Comet, and N. Pizarro. “The cohesion of inter-corporate networks in France.” Procedia Soc. Behav. Sci. 10 (2011): 52–61. [Google Scholar] [CrossRef]

- H. Li, W. Fang, H. An, and L. Yan. “The shareholding similarity of the shareholders of the worldwide listed energy companies based on a two-mode primitive network and a one mode derivative holding-based network.” Phys. A 415 (2014): 525–532. [Google Scholar] [CrossRef]

- H. Li, H. An, X. Gao, J. Huang, and Q. Xu. “On the topological properties of the cross shareholding networks of listed companies in China: Taking shareholders’ cross-shareholding relationships into account.” Phys. A 6 (2014): 80–88. [Google Scholar] [CrossRef]

- “Official Website of Tehran Stock Exchange.” Available online: http://www.tsetmc.com/Loader.aspx?ParTree=15 (accessed on 20 January 2015).

- S.M. Jaramillo, B.A. Kabadjova, B.B. Benitez, and J.P.S. Margain. “An empirical study of the Mexican banking system’s network and its implications for systemic risk.” J. Econ. Dyn. Control 40 (2014): 242–265. [Google Scholar] [CrossRef]

- R. Cont, A. Moussa, and E.B. Santos. “Network Structure and Systemic Risk in Banking Systems, 2010.” Available online: http://ssrn.com/abstract=1733528 or http://dx.doi.org/10.2139/ssrn.1733528 (accessed on 5 June 2015).

- T.O. Kuzubaş, I. Ömercikoğlu, and B. Saltoğlu. “Network centrality measures and systemic risk: An application to the Turkish financial crisis.” Phys. A Stat. Mech Appl. 405 (2014): 203–215. [Google Scholar] [CrossRef]

- M.E.J. Newman. “Analysis of weighted networks.” Phys. Rev. E 70 (2004): 056131. [Google Scholar] [CrossRef] [PubMed]

- T. Opsahl, F. Agneessens, and J. Skvoretz. “Node centrality in weighted networks: Generalizing degree and shortest paths.” Soc. Netw. 32 (2010): 245–251. [Google Scholar] [CrossRef]

- C.H. Hubbell. “An Input-Output Approach to Clique Identification.” Sociometry 28 (1965): 377–399. [Google Scholar] [CrossRef]

- F. Brioschi, L. Buzzacchi, and M.G. Colombo. “Risk Capital Financing and the Separation of Ownership and Control in Business Groups.” J. Bank. Finance 13 (1989): 747–772. [Google Scholar] [CrossRef]

- M. Elliott, B. Golub, and M.O. Jackson. “Financial Networks and Contagion.” Am. Econ. Rev. 104 (2014): 3115–3153. [Google Scholar] [CrossRef]

| Row | Sector | Number of Companies | Market Share (%) | Row | Sector | Number of Companies | Market Share (%) |

|---|---|---|---|---|---|---|---|

| 1 | Oil & Gas Drilling | 1 | 0.37 | 15 | Retailing | 1 | 0.13 |

| 2 | Metal Mining | 5 | 4.99 | 16 | Cement | 5 | 0.8 |

| 3 | Oil Products | 11 | 10.63 | 17 | Tourism | 1 | 0.2 |

| 4 | Tier & Plastic | 2 | 0.34 | 18 | Investment Co. | 8 | 1.7 |

| 5 | Metals | 11 | 10.13 | 19 | Banking | 16 | 10.86 |

| 6 | Metal Products | 1 | 0.19 | 20 | Leasing | 1 | 0.13 |

| 7 | Machines and Equipment | 1 | 0.12 | 21 | Transportation | 3 | 1.63 |

| 8 | Electronic Machines | 2 | 0.43 | 22 | Telecommunication | 2 | 6.58 |

| 9 | Car Production | 6 | 2.26 | 23 | Insurance Co. | 4 | 0.47 |

| 10 | Industrial Holdings | 4 | 6.65 | 24 | Housing | 3 | 0.39 |

| 11 | Electricity Supply | 1 | 0.24 | 25 | Computer & IT | 2 | 1.06 |

| 12 | Food Production | 2 | 0.53 | 26 | Engineering Services | 1 | 2 |

| 13 | Medicine | 7 | 1.34 | 27 | External Shareholders | 13 | - |

| 14 | Petrochemical | 17 | 27.34 |

| Degree | In-Degree | Out-Degree | |||

|---|---|---|---|---|---|

| Min. Degree | 0 | Min. In-Degree | 0 | Min. Out-Degree | 0 |

| Max. Degree | 40 | Max. In-Degree | 40 | Max. Out-Degree | 8 |

| Avg. Degree | 5.88 | Avg. In-Degree | 2.94 | Avg. Out-Degree | 2.94 |

| Top Five Nodes | Degree | Top Five Nodes | In-Degree | Top Five Nodes | Out-Degree |

| Gov. | 40 | Gov. | 40 | MADN | 8 |

| Tamin Org | 31 | Tamin Org | 31 | MS022 | 8 |

| SA3A1 | 27 | SA3A1 | 24 | PK061 | 8 |

| Oilcopen | 23 | Oilcopen | 23 | GD021 | 7 |

| NIKX1 | 22 | NIKX1 | 17 | FO041 | 7 |

| Top Five Sector | Avg Degree | Top Five Sector | Avg In-Degree | Top Five Sector | Avg Out-Degree |

| Industrial Holdings | 17.25 | Industrial Holdings | 13.5 | Metal Mining | 5.6 |

| Ext Shareholders | 13 | Ext Shareholders | 13 | Insurance Co. | 5.25 |

| Investment Co. | 10.125 | Investment Co. | 6.75 | Drilling | 5 |

| Metal Mining | 8 | Metal Mining | 2.4 | Cement | 4.4 |

| Insurance Co. | 6 | Bank | 2 | Basic Metals | 4 |

| (Million Rials) | |||||

| Min. | 0 | Min. | 0 | Min. | 0 |

| Max. | 20.1 | Max. | 2.36 | Max. | 424,000,000 |

| Avg. | 1.63 | Avg. | 0.51 | Avg. | 17,600,000 |

| Top Five Nodes | Top Five Nodes | Top Five Nodes | (Million Rials) | ||

| Gov. | 20.1 | TORZ1 | 2.36 | Adalat Share | 424,000,000 |

| Adalat Share | 13.33 | ARFZ1 | 2.03 | Gov. | 354,000,000 |

| Tamin Org | 11.66 | BDYZ1 | 2.02 | Tamin Org | 218,000,000 |

| Oilcopen | 9.75 | SMAZ1 | 2.01 | Oilcopen | 142,000,000 |

| SA3A1 | 8.78 | KS121 | 2 | SA3A1 | 115,000,000 |

| Top Five Sector | Avg. | Top Five Sector | Avg | Top Five Sector | Avg (Million Rials) |

| Ext. Shareholders | 6.48 | Insurance Co. | 1.29 | Ext Shareholders | 109,000,000 |

| Ind. Holdings | 6.22 | Metal Mining | 1.16 | Ind. Holdings | 72,100,000 |

| Investment Co. | 3.42 | Transportation | 1.09 | Telecommunication | 54,400,000 |

| Metal Mining | 1.76 | Electricity | 1 | Petrochemical | 13,100,000 |

| Car Production | 1.65 | Basic Metals | 0.78 | Metal Mining | 11,100,000 |

| Integrated Market Value (Million Rials) | Integrated Portfolio Value (Million Rials) | ||

|---|---|---|---|

| Min. | 3,000,000 | Min. | 0 |

| Max. | 900,000,000 | Max. | 750,000,000 |

| Avg. | 60,000,000 | Avg. | 27,500,000 |

| Top Five Nodes | Top Five Nodes | ||

| Adashare | 900,000,000 | SA3A1 | 750,000,000 |

| Gov. | 860,000,000 | Gov. | 507,000,000 |

| SA3A1 | 785,000,000 | Adashare | 486,000,000 |

| Tamin Org | 569,000,000 | Tamin Org | 350,000,000 |

| Sata | 299,000,000 | Sata | 192,000,000 |

| Top Five Sector | Avg. | Top Five Sector | Avg. |

| Ind. Holdings | 312,000,000 | Ind. Holdings | 250,000,000 |

| Ext. Shareholders | 259,000,000 | Ext. Shareholders | 150,000,000 |

| Tele-Communication | 172,000,000 | Tele-Communication | 55,000,000 |

| Engineering Services | 78,500,000 | Petrochemical | 13,400,000 |

| Petrochemical | 70,400,000 | Bank | 11,200,000 |

| Min. | 0 | Min. | 0 |

| Max. | 36.69 | Max. | 2.53 |

| Avg. | 2.73 | Avg. | 0.51 |

| Top Five Nodes | Top Five Nodes | ||

| Gov. | 38.69 | KS121 | 2.53 |

| Tamin Org | 24.26 | ARFZ1 | 2.21 |

| Adashare | 20.09 | TORZ1 | 2.16 |

| Bankpen | 19.10 | SMAZ1 | 2.13 |

| Mehrayande | 17.50 | BDYZ1 | 2.01 |

| Top Five Sector | Avg | Top Five Sector | Avg |

| Ext. Shareholders | 13.46 | Insurance Co. | 1.21 |

| Ind. Holdings | 9 | Metal Mining | 1.08 |

| Investment Co. | 7.03 | Transportation | 1.04 |

| Car Production | 2.09 | Electricity | 1 |

| Metal Mining | 1.9 | Basic Metals | 0.83 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dastkhan, H.; Shams Gharneh, N. Determination of Systemically Important Companies with Cross-Shareholding Network Analysis: A Case Study from an Emerging Market. Int. J. Financial Stud. 2016, 4, 13. https://doi.org/10.3390/ijfs4030013

Dastkhan H, Shams Gharneh N. Determination of Systemically Important Companies with Cross-Shareholding Network Analysis: A Case Study from an Emerging Market. International Journal of Financial Studies. 2016; 4(3):13. https://doi.org/10.3390/ijfs4030013

Chicago/Turabian StyleDastkhan, Hossein, and Naser Shams Gharneh. 2016. "Determination of Systemically Important Companies with Cross-Shareholding Network Analysis: A Case Study from an Emerging Market" International Journal of Financial Studies 4, no. 3: 13. https://doi.org/10.3390/ijfs4030013