Biofuel-Food Market Interactions: A Review of Modeling Approaches and Findings

Abstract

:1. Introduction

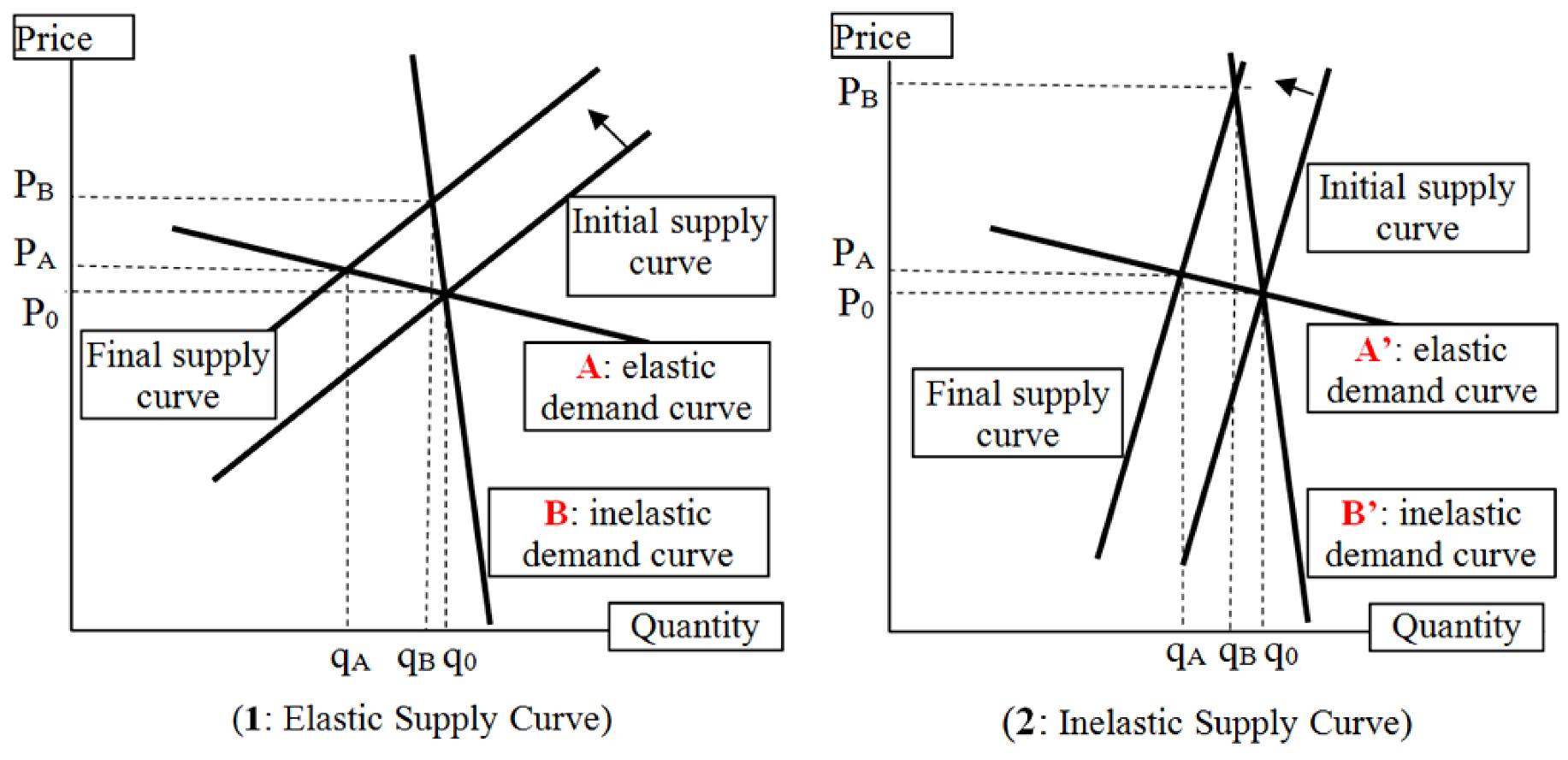

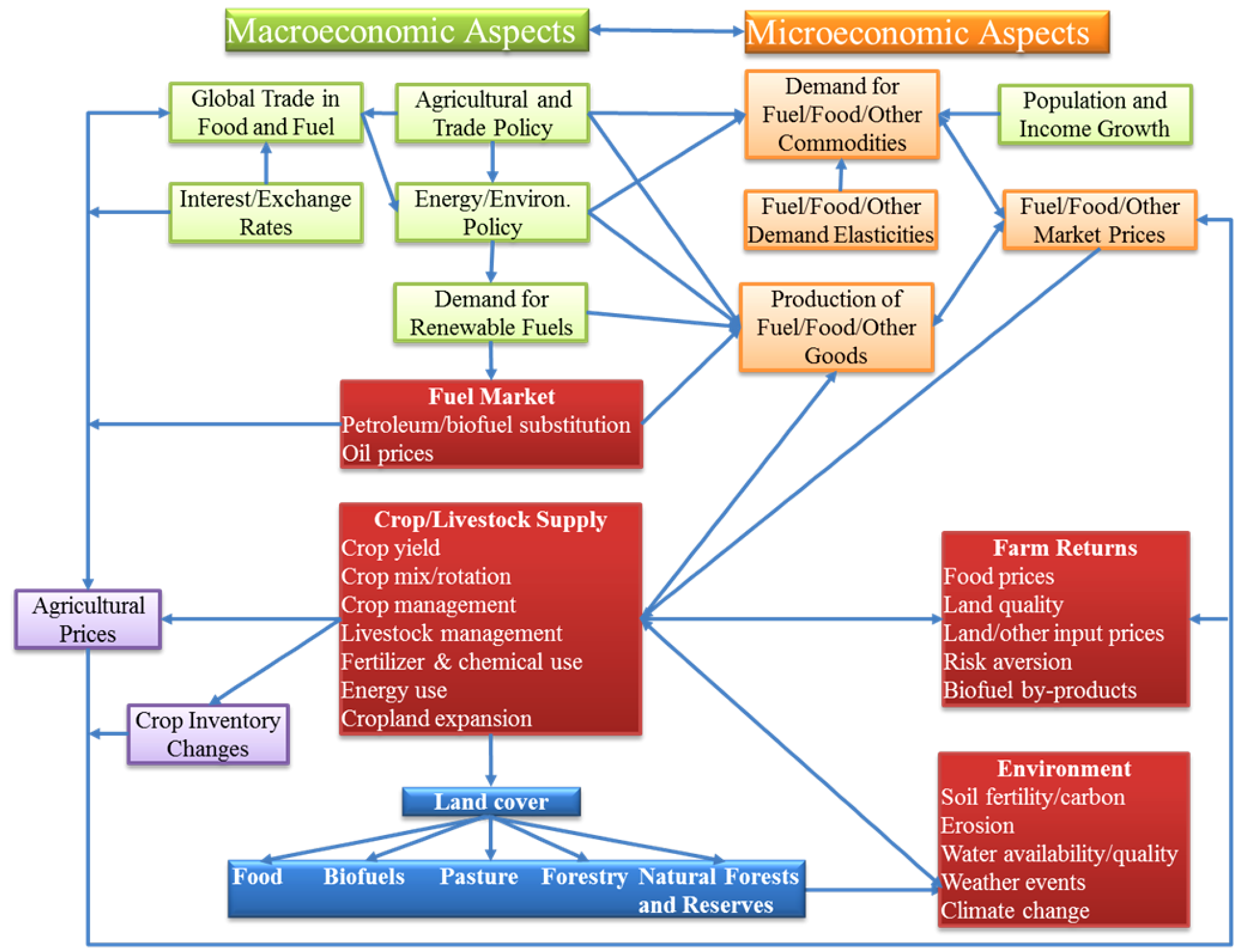

2. Biofuels and Food Market Interactions: A Theoretical Outline

2.1. Dimensions of Food Security

2.2. Framework for Analyzing Biofuel-Food Market Interactions

3. Review of the Empirical Literature on Biofuel-Food Market Interactions

3.1. Summary of Biofuel-Food Market Analyses with Structural Economic Models

3.2. Summary of Biofuel-Food Market Analyses with Non-Structural Economic Models

3.3. Sources of Differences in Estimates of the Impacts of Biofuels on Food Markets

4. Conclusions

- Initial conclusions attributing most of the spike in global food prices, particularly from 2005 to 2008, to biofuels have been revised.

- The transmission channels of the impacts of biofuels to food markets are confounded by a host of non-biofuel physical and economic factors, and their impacts should be isolated in order to adequately evaluate the role of biofuels. The role of these non-biofuel factors in the global food price spikes of the 2000s remains unclear.

- Existing estimates of the national, regional and global impacts of biofuels on food supply and prices span a wide range.

- International food price spikes are associated with a wide distribution of country-level food price changes, which produce disparate household welfare impacts around the world.

Acknowledgments

Supplementary Files

References

- Renewable Fuel Association. Renewable Fuel Association. Industry Statistics—Monthly Fuel Ethanol Production/Demand. Available online: http://ethanolrfa.org/pages/monthly-fuel-ethanol-production-demand (accessed on 18 December 2012).

- US Government. The Energy Independence and Security Act of 2007 (H.R.6). Available online: http://www.gpo.gov/fdsys/pkg/BILLS-110hr6enr/pdf/BILLS-110hr6enr.pdf (accessed on 18 December 2012).

- Yaccoubi, B.D. Fuel Ethanol: Background and Public Policy Issues; Technical Report. Available online: http://www.nationalaglawcenter.org/assets/crs/RL33290.pdf (accessed on 18 December 2012).

- Sorda, G.; Banse, M.; Kemfert, C. An overview of biofuel policies across the world. Energy Policy 2010, 38, 6977–6988. [Google Scholar] [CrossRef]

- Trostle, R. Global Agricultural Supply and Demand: Factors Contributing to the Recent Increase in Food Commodity Prices; Technical Report for the Economic Research Service United States Department of Agriculture: Washington, DC, USA, 2008. [Google Scholar]

- Mueller, S.A.; Anderson, J.E.; Wallington, T.J. Impact of biofuel production and other supply and demand factors on food price increases in 2008. Biomass Bioenerg. 2011, 35, 1623–1632. [Google Scholar]

- Abbot, P.C.; Hurt, C.; Tyner, W.E. What’s Driving Food Prices? Issue Report for Farm Foundation: Oak Brook, IL, USA, 2008. [Google Scholar]

- Runge, C.; Senauer, B. How Ethanol Fuels the Food Crisis. Available online: http://www.foreignaffairs.com/articles/64909/c-ford-runge-and-benjamin-senauer/how-ethanol-fuels-the-food-crisis#,2008 (accessed on 18 December 2012).

- Mitchell, D. A Note on Rising Food Prices; Technical Report 4682 for the World Bank Development Prospects Group: Washington, DC, USA, 2008. [Google Scholar]

- Rosegrant, M. Biofuels and Grain Prices—Impacts and Policy Responses; Technical Report for International Food Policy Research Institute. 2008. Available online: http://www.ifpri.org/sites/default/files/publications/rosegrant20080507.pdf (accessed on 18 December 2012).

- Trostle, R.; Marti, D.; Rosen, S.; Westcott, P. Why Have Food Commodity Prices Risen Again? Technical Report for the Economic Research Service United States Department of Agriculture: Washington, DC, USA, 2011. [Google Scholar]

- Von Braun, J. The World Food Situation: New Driving Forces and Required Actions; Technical Report for International Food Policy Research Institute: Washington, DC, USA, 2008. [Google Scholar]

- Evans, A. Rising Food Prices: Drivers and Implications for Development; Technical Report; Chatham House: London, UK, 2008. [Google Scholar]

- Food and Agricultural Organization of the United Nations, Soaring Food Prices: Facts, Perspectives, Impacts and Actions Required; Technical Report HLC/08/INF/1 for the High-level Conference on World Food Security “The Challenges of Climate change and Bioenergy”; FAO: Rome, Italy, 2008.

- Von Braun, J. Food and Financial Crises: Implications for Agriculture and the Poor; Technical Report for International Food Policy Research Institute: Washington, DC, USA, 2008. [Google Scholar]

- Zhang, Z.; Luanne, L.; Escalante, C.; Wetzstein, M. Food versus fuel: What do prices tell us? Energy Policy 2008, 38, 445–451. [Google Scholar]

- Ajanovic, A. Biofuels versus food production: Does biofuels production increase food prices? Energy 2010, 36, 2070–2076. [Google Scholar] [CrossRef]

- Baffes, J.; Haniotis, T. Placing the 2006/08 Commodity Price Boom into Perspective; Technical Report 5371 for World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Kim, S.; Dale, B.E. Indirect land use change for biofuels: Testing predictions and improving analytical methodologies. Biomass Bioenergy 2011, 35, 3235–3240. [Google Scholar] [CrossRef]

- Gallagher, P.W. Corn ethanol growth in the USA without adverse foreign land-use change: Defining limits and devising policies. Biofuels Bioprod. Biorefining 2010, 4, 296–309. [Google Scholar] [CrossRef]

- Babcock, B.A. The Impact of US Biofuel Policies on Agricultural Price Levels and Volatility; International Centre for Trade and Sustainable Development (ICTSD): Geneva, Switzerland, 2011. Available online: http://www.iadb.org/intal/intalcdi/PE/2011/08442.pdf (accessed on 18 December 2012).

- Oladosu, G.; Kline, K.; Uria-Martinez, R.; Eaton, L. Sources of corn for ethanol production in the United States: A decomposition analysis of the empirical data. Biofuels Bioprod. Biorefining 2011, 5, 640–653. [Google Scholar]

- United States Department of Agriculture (USDA). US drought 2012: Farm and food impact. 2012. Available online: http://www.ers.usda.gov/newsroom/us-drought-2012-farm-and-food-impacts.aspx (accessed on 18 December 2012).

- Babcock, B. Updated Assessment of the Drought’s Impacts on Crop Prices and Biofuel Production; Technical Report 12-PB 8. Available online: http://www.card.iastate.edu/policy_briefs/display.aspx?id=1169 (accessed on 18 December 2012).

- Tyner, W.E.; Taheripour, F.; Hurt, C. Potential Impacts of a Partial Waiver of the Ethanol Blending Rules; Technical Report for Purdue University: West Lafayette, IN, USA, 2012. Available online: http://www.farmfoundation.org/news/articlefiles/1841-Purdue%20paper%20 final.pdf (accessed on 18 December 2012).

- Wisner, R. Implications for Ethanol and Other Corn Users of the Shrinking Corn Crop. Agricultural Marketing Resource Center Web site. 2012. Available online: http://www.agmrc.org/renewable_energy/ethanol/implications-for-ethanol-and-other-corn-users-of-the-shrinking-corn-crop/ (accessed on 18 December 2012).

- Cooper, G. The 2012 Corn Crop: Implications for Ethanol and the RFS; Technical Report for Renewable Fuel Association: Washington, DC, USA, 2012. Available online: http://www. adkinsenergy.com/pdfs/Renewable%20Fuels%20Association%20drought_RFS%20webinar.pdf (accessed on 18 December 2012).

- Food and Agriculture Organization of the United Nations. Food security. Policy Brief 2006, 2, 1-4. Available online: ftp://ftp.fao.org/es/ESA/policybriefs/pb_02.pdf (accessed on 18 December 2012).

- Tirado, M.C.; Cohen, M.J.; Aberman, N.; Meerman, J.; Thompson, B. Addressing the challenges of climate change and biofuel production for food and nutrition security. Food Res. Int. 2010, 43, 1729–1744. [Google Scholar]

- Webb, P.; Coates, J.; Frongillo, E.A.; Rogers, B.L.; Swindale, A.; Bilinsky, P. Measuring household food insecurity: Why it’s so important and yet so difficult to do. J. Nutr. 2006, 136, 1404S–1408S. [Google Scholar]

- Global Bioenergy Partnership, The Global Bioenergy Partnership Sustainability Indicators for Bioenergy, 1st ed; FAO: Rome, Italy, 2012.

- Rathmann, R.; Szklo, A.; Schaeffer, R. Land use competition for production of food and liquid biofuels: An analysis of the arguments in the current debate. Renew. Energy 2010, 35, 14–22. [Google Scholar] [CrossRef]

- Gilbert, C.L. How to understand high food prices. J. Agric. Econ. 2010, 61, 398–425. [Google Scholar] [CrossRef]

- Thompson, W.; Meyer, S.; Westhoff, P. The new markets for renewable identification numbers. Appl. Econ. Perspect. Policy 2010, 32, 588–603. [Google Scholar] [CrossRef]

- Hochman, G.; Rajagopal, D.; Timilsina, G.; Zilberman, D. The Role of Inventory Adjustments in Quantifying Factors Causing Food Price Inflation; Technical Report WPS5744 for World Bank: Washington, DC, USA, 2011. Available online: http://elibrary.worldbank.org/content/ workingpaper/10.1596/1813-9450-5744 (accessed on 18 December 2012).

- Ciaian, P.; Kancs, A. Interdependencies in the energy-bioenergy-food price systems: A cointegration analysis. Resour. Energy Econ. 2011, 33, 326–348. [Google Scholar] [CrossRef]

- Chakravorty, U.; Huber, M.; Moreaux, M.; Nostbakken, L. Do Biofuel Mandates Raise Food Prices? In Presentation at AERE Summer Conference, 9–10 June 2011, Seattle, WA, USA.

- Zhang, W.; Yu, E.; Rozelle, S.; Yang, J.; Msangi, S. The Impact of Biofuel Growth on Agriculture: Why is the Range of Estimates So Wide? Technical Report, 2009.

- United States Government Accountability Office, Biofuels: Potential Effects and Challenges of Required Increases in Production and Use; Technical Report GAO-09-446 for GAO: Washington, DC, USA, 2009.

- Timilsina, G.R.; Mevel, S.; Shrestha, A. Oil price, biofuels and food supply. Energy Policy 2011, 39, 8089–8105. [Google Scholar]

- Al-Riffai, P.; Dimaranan, B.; Laborde, D. Global Trade and Environmental Impact Study of the EU Biofuels Mandate; Technical Report by International Food Policy Research Institute (IFPRI) for the Directorate General on Trade of the European Commission: Brussels, Belgium, 2010. [Google Scholar]

- Oladosu, G.; Kline, K.; Leiby, P.; Uria-Martinez, R.; Davis, M.; Downing, M.; Eaton, L. Global economic effects of USA biofuel policy and the potential contribution from advanced biofuels. Future Sci. Biofuels 2012, 3, 703–723. [Google Scholar]

- Mosnier, A.; Havlik, P.; Valin, H.; Baker, J.S.; Murray, B.C.; Feng, S.; Obersteiner, M.; McCarl, B.A.; Rose, S.K.; Schneider, U.A. The Net Global Effects of Alternative US Biofuel Mandates; Nicholas Institute Technical Report for Duke University: Durham, NC, USA, 2012. [Google Scholar]

- Chen, X.; Khanna, M. Food vs. fuel: The effect of biofuel policies. Am. J. Agric. Econ. 2012, 95, 289–295. [Google Scholar] [CrossRef]

- Durham, C.; Davies, G.; Bhattacharyya, T. Can Biofuels Policy Work for Food Security? Technical Report for United Kingdom Department for Environment Food and Rural Affairs: London, UK, 2012. [Google Scholar]

- De Hoyos, R.E.; Medvedev, D. Poverty Effects of Higher Food Prices: A Global Perspective; Technical Report for World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Bouet, A.; Debucquet, D.L. Economics of Export Taxation in a Context of Food Crisis—A Theoretical and CGE Approach Contribution; Technical Report 00994 for IFPRI: Washington, DC, USA, 2010. [Google Scholar]

- Cha, K.S.; Bae, J.H. Dynamic impacts of high oil prices on the bioethanol and feedstock markets. Energy Policy 2011, 39, 753–760. [Google Scholar] [CrossRef]

- Qui, C.; Colson, G.; Escalante, C.; Wetztein, M. Considering macroeconomic indicators in the food before fuel nexus. Energy Econ. 2012, 34, 2021–2028. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Soytas, U. Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Econ. 2012, 34, 1098–1104. [Google Scholar] [CrossRef]

- Natanelov, V.; Alam, M.J.; McKenzie, A.M.; Huylenbroeck, G.V. Is there co-movement of agricultural commodities futures prices and crude oil? Energy Policy 2011, 39, 4971–4984. [Google Scholar]

- Nazlioglu, S. World oil and agricultural commodity prices: Evidence from nonlinear causality. Energy Policy 2011, 39, 2935–2943. [Google Scholar] [CrossRef]

- Harri, A.; Nally, L.; Hudson, D. The relationship between oil, exchange rates, and commodity prices. J. Agric. Appl. Econ. 2009, 41, 501–510. [Google Scholar]

- Von Braun, J.; Tadesse, G. Global Food Price Volatility and Spikes: An Overview of Costs,Causes and Solutions; Technical Report No. 161 for Zentrum für Entwicklungsforschung (ZEF): Bonn, Germany, 2012. [Google Scholar]

- Irwin, S.H.; Sanders, D.R. Index funds, financialization, and commodity futures markets. Appl. Econ. Perspect. Policy 2011, 33, 1–31. [Google Scholar] [CrossRef]

- Banse, M.; van Meijl, H.; Tabeau, A.; Woltjer, G. Will EU biofuel policies affect global agricultural markets? Eur. Rev. Agric. Econ. 2008, 35, 117–141. [Google Scholar] [CrossRef]

- Pindyck, R.; Rotemberg, J.J. The excess co-movement of commodity prices. Econ. J. 1990, 100, 1173–1189. [Google Scholar]

© 2013 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Oladosu, G.; Msangi, S. Biofuel-Food Market Interactions: A Review of Modeling Approaches and Findings. Agriculture 2013, 3, 53-71. https://doi.org/10.3390/agriculture3010053

Oladosu G, Msangi S. Biofuel-Food Market Interactions: A Review of Modeling Approaches and Findings. Agriculture. 2013; 3(1):53-71. https://doi.org/10.3390/agriculture3010053

Chicago/Turabian StyleOladosu, Gbadebo, and Siwa Msangi. 2013. "Biofuel-Food Market Interactions: A Review of Modeling Approaches and Findings" Agriculture 3, no. 1: 53-71. https://doi.org/10.3390/agriculture3010053