1. Introduction

Recently, in many countries, the commercialization of university-based technologies has led to an increase in the establishment of academic startups (for example, [

1,

2,

3]). Even in Japan, the number of ventures affiliated with universities has increased since the end of the 1990s, and the presence of such ventures in the Japanese economy has grown. Academic startups are able to provide innovative products and services because their businesses are frequently built on the commercialization of highly sophisticated academic research. In addition, because academic startups hire and procure raw materials locally, they frequently have a significant impact on the local economy relative to their firm size [

4]. In contrast, since the mid-2000s, the closing of such ventures has increased because of liquidation issues [

5]. To continuously grow a successful business with limited availability of corporate resources, it is necessary to implement a wide variety of managerial strategies. One such strategy is international business expansion, such as increasing direct sales in overseas markets and technological exchanges with overseas partners [

6].

A common understanding is that, before a venture expands its business overseas, it must first spend a significant amount of time growing its business in the domestic market, improving its balance sheet, and solidifying its business foundation [

7]. However, given the globalization of world economies and the development of information and communication technologies, it is no longer rare for even newly established ventures to expand their businesses beyond their domestic markets and develop overseas [

8]. Sapienza et al. [

9] further argue that younger firms possess learning and positional advantages over older firms in the new environment and hence internationalization can be an important strategic choice for early stage startups. This is also true for academic startups. A survey on university spinoffs in Italy shows that over 60% of the respondents performed business activities in foreign countries [

10]. According to Ogura and Fujita [

5], nearly half the academic startups included in the study indicated that they had already expanded their businesses overseas or are currently in the process of doing so. Including firms that indicated their interest in developing their businesses overseas, approximately 80% of the responding ventures have an interest in international business development.

Many existing studies examined the international expansion of new ventures (for example, [

11,

12]). However, few focused on academic startups, which have different characteristics from other startups. In this study, we regard four types of university-related ventures as academic startups: (1) ventures founded on patents invented by personnel affiliated with a university; (2) ventures founded on university-based research or technology; (3) ventures established by university personnel, such as professors or students, or with extensive involvement of university personnel; and (4) ventures established by an investment from universities, their Technology Licensing Organization (TLO), or university-related venture capital firms.

This study bridges this gap using original survey data on academic startups that are matched with regional information and the characteristics of affiliated parent universities, and identifies the factors that impact the orientation of academic startups to expand internationally. More specifically, various factors, such as the technological capabilities of academic startups, the business environment of their location, the academic research excellence of affiliated parent universities, and the availability and types of public support, are examined as determinants of the orientation toward global business development.

Using an ordered logit model to analyze the data, this study finds that academic startups are strongly oriented toward expanding their business internationally if they have significant technological capabilities, receive public support, are located in a region with a high ratio of exporting small and medium-sized enterprises (SMEs), or are affiliated with a parent university with excellent research. Moreover, by comparing different types of public support, this study finds that only financial support or the provision of equipment, facilities, and/or land can increase academic startups’ orientation toward international business development.

The remainder of this paper is organized as follows. The next section outlines and surveys existing research related to this topic.

Section 3 explains the dataset and framework for the empirical analysis.

Section 4 shows and discusses the empirical results. The final section concludes this paper.

2. Existing Research and Hypotheses

Since the 1990s, many studies have been conducted on the globalization of startups in the fields of international business administration and research into venture firms. Oviatt and McDougall [

13] introduced the concept of “International New Ventures”, which are characterized as organizations that are international from inception and that raise capital, and manufacture and sell products, across several countries to gain competitiveness. Moreover, they indicated the conditions necessary to create a globally oriented venture. They stated that a high level of knowledge intensity is necessary to gain an advantage when conducting business internationally, and having unique managerial resources is important for continuing business operations abroad. In addition, to explain the globalization of new ventures, Jones and Coviello [

8] examined the possibility of applying existing management theories to international business expansion. They considered the modern business environment that encourages internationalization and conceptualized the internationalization venture process.

In addition to these studies, research has been conducted to specifically identify the factors that shape startups’ orientation toward overseas business expansion. First, according to some empirical and case studies, managers of internationalized ventures have abundant manufacturing and overseas experience and place high value on product differentiation and innovation compared with ventures that operate only in domestic markets [

12]. Furthermore, investors who provide venture capital have been found to have a significant impact on whether or not the venture expands overseas [

11,

14]. For instance, international venture capital firms can provide access to foreign customers and opportunities of initial public offerings abroad [

15]. A study on 623 startups from Bulgaria found that having a vast domestic human network significantly strengthened the orientation of newly established ventures to expand their business operations overseas. However, the older the venture, the less likely it was impacted by this factor. This study also found that large ventures were more likely to expand overseas than small ventures, and the orientation toward international development differed across industries [

16].

Meanwhile, in the academic world, a growing number of researchers are engaging in entrepreneurial activities and many academic institutions develop initiatives for commercialization of university technologies [

17,

18]. Increasing attention to the phenomenon has led to research specifically designed to study academic entrepreneurship [

19]. Academic entrepreneurship and commercialization of university knowledge contain a variety of activities such as patenting or licensing advanced technologies, engaging in consultancy, conducting collaborative or contract research, and founding startup companies.

Among the academic entrepreneurial activities, establishment of startups is the riskiest and most binding type of entrepreneurship [

20]. Despite the demanding nature of the activity, however, a considerable number of university researchers have been involved in founding academic startups in recent years. For instance, according to a study on academic entrepreneurship in Sweden and Ireland, 12% of Swedish academics, and 19% of Irish academics have engaged in spinoff activities [

21].

Shane [

4] conducted a comprehensive analysis of ventures derived from universities and research institutions. He found that the commercialization of academic research through startups allows for the versatile use of university-based research, that academic ventures are optimal for commercializing technological inventions still in their initial stages

1, and that commercialization of university research is most successful in industries with a large number of existing companies that effectively protect technological know-how through patents. Moreover, his study found that, to perform well, academic startups need to successfully adapt their university-derived technology to the demands of the market, have adequate fund raising capabilities, and be supported by parent universities.

Researchers explored the differences in firm characteristics and performance between academic and non-academic startups. For instance, a study of spinoffs from universities and firms in knowledge-intensive industries in Sweden during 1994–2002 demonstrated that corporate spinoffs on average show higher performance than university spinoffs in terms of survival and growth, whereas spinoffs that originated from universities benefit more from the industry experience of the founding members [

23]. Another study examined top management teams of high-technology ventures in the United States and found that university-based startups organized more homogenous top management teams than independent startups and performed poorly with regard to net cash flow and revenue growth [

24]. Furthermore, research using a sample of Italian high-tech startups focused on strategic differences between academic and non-academic startups and revealed that academic startups more strongly emphasize strategies to enhance scientific and technological competencies, whereas non-academic startups place greater importance on commercial aspects [

25].

Existing studies addressed the factors related to the international business expansion of academic startups. On the basis of the case studies, Styles and Genua [

26] used the framework introduced by Jones and Coviello [

8] to compare two ventures with international business operations with another two ventures with only domestic operations. They found that networks of ventures’ technological researchers are a factor that facilitates the international business expansion of academic startups. Bolzani et al. [

27] compared internationalized and non-internationalized academic spinoffs to investigate differences in internationalization patterns and firm characteristics between two groups, drawing on an Italian survey data. They found that internationalized spinoffs have a significantly larger amount of invested equity and sales revenues and a larger number of employees than their non-internationalized counterparts. However, little quantitative analysis has been done to explore the factors influencing the international business expansion of academic startups

2. Our study aims at adding a contribution to the research field in this respect.

The first possible determinant of the orientation toward the international development of business operations is a venture’s technological capabilities. Previous research found that, in general, innovative companies have an easier time exporting goods than companies that do not innovate [

29]. Moreover, to expand business operations overseas, having advantages over firms that already operate in the target markets is necessary [

30,

31]. An essential element for smaller ventures to gain such advantages over local firms is to develop strong technological capabilities. In addition, companies built on high-quality technology protected by patents are more likely to exchange technological skill and know-how with international organizations [

32]. Furthermore, in industries that value technology, companies with significant financial investments in research and development can more easily exchange technological knowledge with international partners and organizations compared with companies that do not invest in research and development [

33]. These arguments enable us to conclude that ventures with a competitive advantage and high-quality technological skills that can be exchanged with other organizations have an easier time expanding their business operations overseas, entering international markets, and participating in technological exchanges with international companies and organizations.

Hypothesis 1. Academic startups with strong technological capabilities have a stronger orientation toward international expansion of business operations than those with low technological capabilities.

It can be challenging for newly established ventures to appropriately handle managerial and administrative problems, especially with regard to maintaining financial stability. For this reason, it is incredibly beneficial for newly established firms to receive public support from national or local governments. In particular, during the initial stages after establishment, when private sector firms are hesitant to invest, academic startups significantly benefit from public support [

34]. Moreover, public support is effective in encouraging financial investments from private firms [

4]. Therefore, receiving public support is a vote of confidence for a startup’s financial stability. With this endorsement, the venture has the stability and strength necessary to handle the technological and market risk that comes with expanding its business. We assume that these arguments apply to academic ventures and present the following hypothesis.

Hypothesis 2. Academic startups that have received public support have a stronger orientation toward international business expansion than those with no public support.

The regional characteristics of a firm’s location, especially those supportive to small firms’ international business, play a significant role in a startup’s orientation toward international business expansion. For example, in regions with a large number of multinational firms, numerous companies and organizations provide services that are necessary for international business expansion. Moreover, in such regions, sophisticated transportation and infrastructure are available, making it easier for employees to go on overseas business trips or have overseas customers visit the ventures. Previous research found that academic startups located in large cities tend to have a wider international network of technological skill and know-how [

35]. In addition, a location that allows for access to specialized knowledge and personnel plays an important role in managing technology-based firms [

36,

37].

Thus, the regional environment is assumed to be important for the internationalization of firms in the region. An environment that is supportive of overseas expansion is especially crucial for small firms, including academic startups, because large firms typically have their own global networks and resources for internationalization. For these reasons, we expect that a regional environment that supports small firms’ international activities may also encourage the overseas business expansion of academic startups.

Hypothesis 3. A regional environment that is supportive of small firms’ international businesses leads to stronger orientation of academic startups toward globalizing business operations.

Characteristically, academic startups have relatively easy access to knowledge developed in universities and frequent interaction with university faculties. Thus, specific traits of ventures’ affiliated parent universities are expected to significantly affect academic startups and their orientation toward overseas business operations. Generally, the reputation of affiliated parent universities plays a large role in the economic activities of academic startups. For instance, academic startups affiliated with renowned research institutions and universities are more likely to receive external funds from private investors than are those affiliated with a less famous institution [

4]. Similarly, ventures affiliated with famous universities receive a high degree of recognition overseas, which is advantageous for expanding their business operations internationally. Moreover, universities with high research standards are highly involved in joint research with foreign institutions and have vast worldwide human networks. Because many researchers working for academic startups are often also affiliated with their parent universities, they are able to utilize these universities’ vast international human networks. In previous case studies, it was found that vast international human networks of researchers working in academic startups have a significant impact on ventures conducting business internationally [

26]. By considering these factors, it can be concluded that ventures originating from universities with high research standards are strongly oriented toward expanding their businesses overseas. Thus, we present the last hypothesis, which is unique to academic startups.

Hypothesis 4. Academic startups that are affiliated with parent universities with high research standards have a stronger orientation toward international business expansion than those affiliated with universities with low research standards.

3. Empirical Method and Sample

3.1. Model and Data

To test the hypotheses presented in the previous section, we conduct econometric analysis using unique survey data on academic startups established in Japan to identify the determinants of academic startups’ orientation toward expanding their businesses internationally. Specifically, varying levels of academic startups’ ambition to globalize are divided into four categories and analyzed to investigate the dependency on specific characteristics of the academic venture, the regional environment, and the affiliated parent university. The ordered logit model is used for the empirical analysis because the dependent variable is ordinal.

The following data are utilized for the empirical analysis. First, we obtained information on individual academic startups from the “Academic Startups Survey 2011”, implemented in 2011 by the National Institute of Science and Technology Policy (NISTEP) of the Ministry of Education, Culture, Sport, Science and Technology [

5]. This unique survey was developed by a national research institute for academic startups in Japan. Questionnaires were mailed to 1689 companies in operation in March of 2010 and whose location was known; of these, 535 companies responded.

The data obtained from a questionnaire survey can suffer from a possible bias caused by self-selection behavior of the respondents [

38,

39]. Since, for instance, successful firms may be more likely to respond to the survey; we need to carefully examine whether the responding firms can be regarded as appropriate representatives of the population [

40]. To examine the representativeness of the responding firms and a possible sample selection bias caused by the responding behavior, we attempted comparisons between the responding firms and the groups of companies that could be reasonably assumed as a population of academic startups in Japan

3.

We investigated the basic traits of the responding firms such as the year of the establishment and the affiliated parent university. “Academic Startups Survey 2011” provides simple comparison between the responding firms and more than two thousand academic startups whose brief information was collected in the survey research conducted by NISTEP in July-August of 2009 [

41]. The latter group apparently covers most of the existing academic startups in Japan. Concerning the establishment year, 2%, 7%, 43%, and 48% of the responding firms were established in the period of before 1995, 1995–1999, 2000–2004, and 2005–2009, respectively. For the ‘population’ startups, the corresponding percentages are 2%, 10%, 49%, and 39% for the period of before 1995, 1995–1999, 2000–2004, and 2005–2009, respectively. Although the share of the early-stage startups established during 2005–2009 is somewhat larger for the responding firm, we do not observe a remarkable difference between two groups. Similarly, 61%, 22%, and 7% of the responding firms are affiliated with national, private, and public universities, respectively. These percentages are 60%, 26%, and 6% for the ‘population’ startups. This again supports the fair representativeness of the responding startups.

Moreover, we compared the respondents’ company sizes with those of the sample firms in Teikoku Databank [

42] which had been selected on the basis of non-survey method. In the “Academic Startups Survey 2011”, 49% of these companies hire five or fewer employees, 26% hire six to 10 employees, and 25% hire 11 or more employees. These numbers are comparable to those presented in Teikoku Databank [

42] (57% with five or fewer employees, 18% with six to 10 employees, and 25% with 11 or more employees). Therefore, we do not observe a serious selection bias in the sample at least with regard to basic firm characteristics, and the responding firms in the “Academic Startups Survey 2011” would be reasonable representatives of the population.

Second, we collected data on the regional environment of academic startups from the “2012 White Paper on Small and Medium Enterprises in Japan” [

43], (p. 269, Endnote 2-2-2). Third, we extracted information regarding affiliated parent universities from the “Benchmarking Research & Development Capacity of Japanese Universities 2011” [

44], implemented by NISTEP

4. Again, this survey is unique for all universities in Japan. Most variables, including the dependent variable, were derived from the “Academic Startups Survey”, whereas two independent variables were constructed using data from other sources. The data from both NISTEP surveys were matched at the firm level, and the “Academic Startups Survey” data and the White Paper data were matched at the regional (prefecture) level.

In the “Academic Startups Survey 2011”, academic startups were asked whether they intended to develop or had already expanded their businesses overseas. The responses of “had already developed its business overseas”, “planning to pursue international expansion within three years”, “would someday like to expand its business internationally”, and “have never considered overseas business development” accounted for 20%, 24%, 37%, and 19%, respectively. Moreover, ventures that answered that they had already developed their business operations overseas or were planning to do so in the future were also asked about their concrete objectives and aims (multiple responses allowed) for international expansion as a follow-up question. Of the respondents, 84% aimed at market and sales expansion, 23% at research and development, 17% at gaining new technological skills and know-how, 9% at clinical studies, and 4% at others. These results show that academic startups’ two main objectives for international expansion are market and sales expansion and research and development activities (including acquisition of new technology and implementation of clinical studies).

3.2. Variables and Sample

The dependent variable is a categorical variable on the orientation of an academic startup to expand its business operations abroad. To obtain this variable, we used information from questions on international expansion in the “Academic Startups Survey 2011”. More specifically, academic startups were asked whether they intended to develop or had already expanded their businesses overseas. The highest score of 4 was given to the response that they had already developed their business overseas, a score of 3 was given to the response that they were planning to pursue international expansion within a year or intended to develop their businesses overseas during the subsequent two to three years, a score of 2 was given to the response that they would someday expand their businesses internationally, and a score of 1 was given to the response that they have never considered overseas business development. It is noteworthy that only the score of 4 indicated actual internationalization, whereas the other (lower) scores revealed levels of their intention.

The explanatory variables are constructed as follows. First, to examine the technological capabilities of academic startups (Hypothesis 1), a dummy variable, technological capability of startups, was created using information from the “Academic Startups Survey 2011”. This variable takes the value of 1 if the venture applied for a patent in the past, and 0 otherwise. Second, to test Hypothesis 2, we use a dummy variable, public support, which takes the value of 1 if the venture received public support from national and local governments, universities, and other public organizations, and 0 otherwise.

Various indicators can be used to test Hypothesis 3 regarding the regional environment that is favorable for SMEs’ international businesses. In this study, we use as a proxy the ratio of exporting SMEs in the manufacturing sector in the same prefecture (

ratio of exporting SMEs in region) because an environment that is supportive of SMEs’ international business would facilitate their exports and lead to higher ratios of exporting SMEs in the region

5.

Regarding the research standards of affiliated parent universities (Hypothesis 4), we use scientific publication data. In the “Academic Startups Survey 2011”, ventures were asked to identify the universities with which they had the strongest relationship. The universities identified as such are regarded as the ventures’ affiliated parent universities. To identify each parent university’s research standards, we use data from Saka and Kuwahara [

44]. We measure the research standard of each parent university using the average ratio of highly cited publications to the total number of publications in the natural sciences between 1997 and 2011

6. Given this information, we construct a dummy variable,

research standard of parent university, that takes the value 1 if this ratio is higher than the 75 percentile of all parent universities of the sample firms, and 0 otherwise.

As controls, the following variables are included. First, firm size, which is thought to have a strong effect on international expansion, is measured by the number of employees, including both full time and part time, and executive directors (as of 2011). Next, we control for firm age, which represents the development stages of the ventures and is measured as the number of operating years. Furthermore, we include a dummy variable for the venture’s past profitability (reported profitability). Drawing on the “Academic Startups Survey 2011”, this variable takes the value of 1 if the venture reported positive profit at least once in the past financial reports, and 0 otherwise.

Previous studies demonstrated that internationalization strategies of academic spinoffs can be affected by the characteristics of the management teams [

46]. Thus, we control not only for firm characteristics but also for a top manager’s characteristics by including two groups of dummy variables. We first constructed dummy variables,

CEO age, to capture ages of CEOs of the sample firms (30s or younger, 40s, 50s, and 60s or older). We also created dummy variables representing CEOs’ previous job types (academia, industry, and others). Lastly, to account for the variation across industries, six industry dummy variables are included: (1) manufacturers of pharmaceuticals and other medical products; (2) other manufacturing; (3) telecommunications; (4) services related to the manufacturing of pharmaceuticals and other medical services; (5) other services; and (6) other industries (including wholesale and retail, welfare services, and agriculture, forestry, and fishery). All control variables mentioned were constructed using data from the “Academic Startups Survey 2011”.

Construction of variables using data from a questionnaire survey possibly causes a common method bias [

47]. One of the typical common method biases is a bias caused by social desirability, a respondent’s tendency to respond considering social acceptability rather than expressing his or her true opinion. This causes a serious problem in a regression analysis when both of the dependent and explanatory variables contain the bias, which generates spurious correlations between them and hides the true relationship. Our study entails a potential risk of the social desirability bias since the question item on the orientation toward internationalization in the survey requires a partially subjective judgement and the responding firms could have reasonable motivations to express the higher orientation toward the future internationalization of their business. This might affect the level of the scores used as the dependent variable in this study. On the other hand, however, all the explanatory and control variables obtained from the survey were constructed on the basis of the firms’ responses related to the objective facts such as experience of patent applications, records of receiving public support, and the year of the company establishment, and it would be reasonable to assume that information provided by respondents is not affected by the social desirability. Moreover, the explanatory variables for Hypotheses 3 and 4 are constructed with regional data and scientific publication data, respectively, and thus not affected by the respondents’ subjective consideration. Therefore, the influence of the common method bias on our analysis would be limited.

The database including all of these variables was constructed by matching data from the “Academic Startups Survey 2011” using information on the prefectures and parent universities, resulting in a sample of 448 academic startups

7. Descriptive statistics and a correlation matrix of the variables are shown in

Table 1 and

Table 2. There are no extraordinarily high correlation coefficients between any of the explanatory variables except for dummy variables indicating categories; the highest value is found between

technological capability and

firm age (0.27).

We provide additional information on the sample firms. The average number of employees of the sample firms is 9.76, the lowest is 1, and the highest is 117. Average firm age is 6.99 years. Affiliated parent universities are national universities for 300 ventures (67.0%), prefectural and other public universities for 38 ventures (8.5%), and private universities for 110 ventures (24.6%). Clearly, national universities are affiliated with a large majority of academic startups.

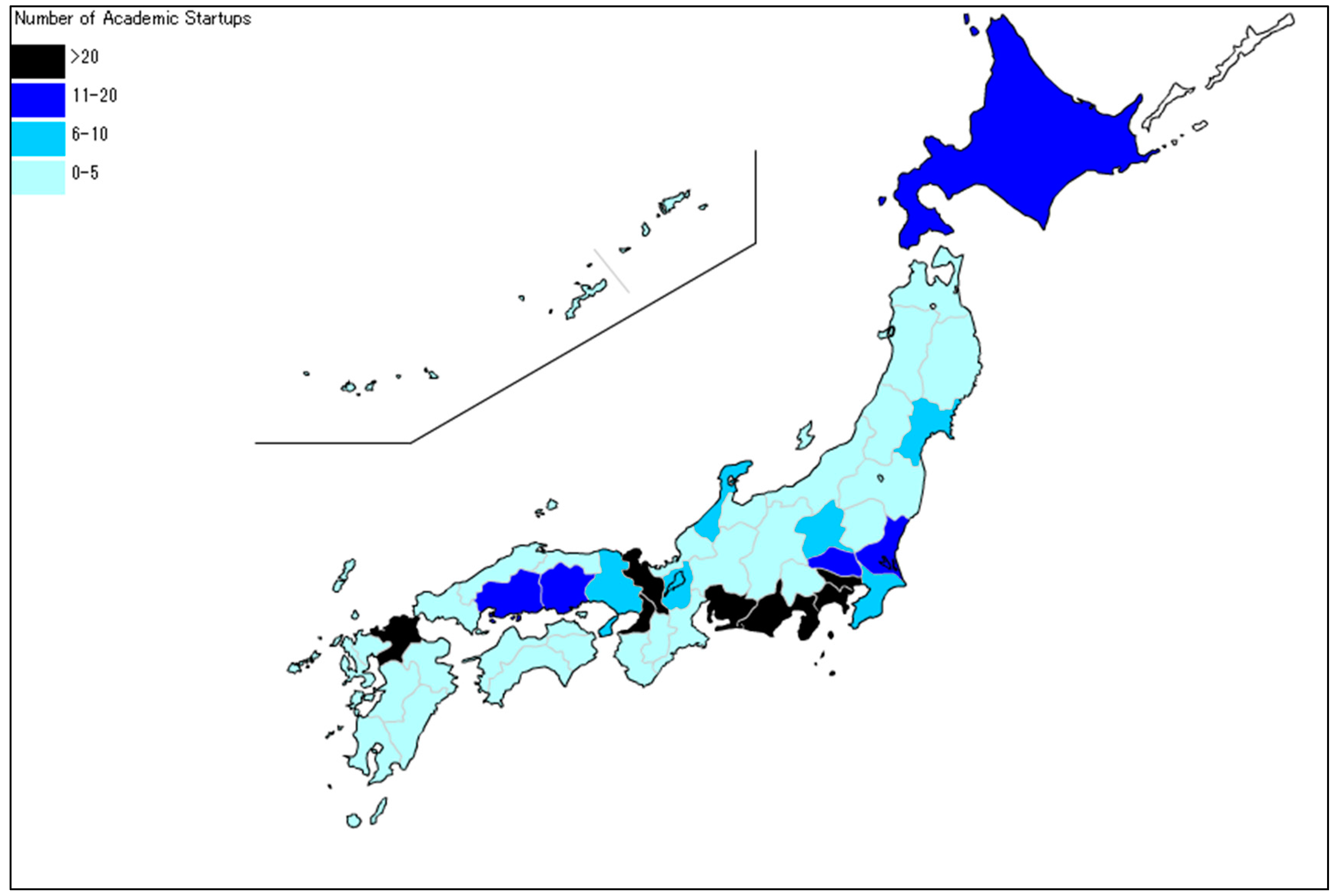

Figure 1 provides the visual representation of the distribution of ventures in the sample by prefecture. The largest number of ventures is found in Tokyo, with 98 companies or 21.9% of the entire sample. Tokyo is followed by Osaka (42 firms) and Kanagawa (29 firms), indicating that many academic startups are located in large cities. Concerning the distribution of ventures in the sample by industry, the largest number of ventures is classified as being in “other manufacturing” industries, at 148 firms (33.0%), followed by “other services” (92 firms, 20.5%) and “telecommunications” (83 firms, 18.5%)

8.

4. Empirical Results

Table 3 shows the results of the ordered logit estimation on the determinants of academic startups’ orientation to expand their businesses internationally in six different specifications. Model 1 excludes and Model 6 includes all key variables that are directly related to our hypotheses, whereas Models 2 to 5 include each of the four key variables.

The coefficients of the variable technological capability are positive and statistically significant in Models 2 and 6. These results suggest that academic startups with strong technological skills are strongly oriented toward expanding their businesses internationally. The coefficients of the variable public support are also positive and statistically significant in Models 3 and 6. Therefore, it can be concluded that academic startups that received public support are more oriented toward international business expansion than those that did not.

Furthermore, the coefficients of the variable ratio of exporting SMEs in region are positive and statistically significant in Models 4 and 6. These results suggest that academic startups in a regional environment favorable for SMEs’ exports are more strongly oriented toward international business expansion than those in a less favorable environment. Finally, the coefficients of the variable research standard of parent university are positive and statistically significant in Models 5 and 6. These results suggest that higher research standards of parent universities result in stronger orientation of affiliated academic startups to expand internationally.

The results of the control variables indicate that firm size significantly impacts a venture’s orientation toward international business expansion, whereas firm age, CEO previous job, and industry dummies had no significant effects. Dummy variables of CEO age show positive and significant effects on the internationalization orientation.

These results support all hypotheses. Academic startups have a strong orientation toward international business expansion when they have strong technological capabilities, received public support, are located in regions with high shares of exporting SMEs, and are affiliated with parent universities with high research standards

9.

Furthermore, to measure the economic impact of the explanatory variables on the ventures’ international orientation, we calculated the marginal effects of these variables. For instance, the marginal effect of each variable on the probability to have already expanded the business internationally is as follows: technological capability 0.08; public support 0.06; ratio of exporting SMEs in the region 0.05; and research standard of parent university 0.04. For example, according to these results, academic startups with strong technological capabilities are 8% more likely to have conducted business operations internationally than those with low technological capabilities.

As a supplementary analysis regarding Hypothesis 2, we examine whether different types of public support have different effects on the orientation of academic startups toward overseas business expansion. In the “Academic Startups Survey 2011”, the ventures that received public support were asked further to identify the type of support they received. More specifically, they were asked whether they received financial support or technological advice, used equipment, facilities, and/or land of public organizations, or obtained other types of support (multiple responses allowed). Using this information, we investigate the type of public support that yielded the strongest effect on academic startups’ orientation to expand their businesses internationally.

In the analysis, the dummy variable

public support is replaced with the dummy variables for each type of public support received:

Financial support,

Advice,

Use of equipment, facilities, and/or land, and

Other support10.

The results of this analysis, which are presented in

Table 4, show that only financial support and the use of equipment, facilities, and/or land have positive and significant effects on the orientation of academic startups to expand abroad. Other types of public support do not have a significant impact on the ventures’ orientations. Hence, it can be concluded that public support affects academic startups’ international orientation only if it is provided in a monetary or physical form.

Our sample includes different types of academic ventures. Moreover, the effects of the investigated factors are expected to differ across these types. To explore these differences, we conducted sub-sample analyses that compare the different types.

First, we examined how differently the key factors influence academic startups’ orientation toward foreign expansion according to the type of parent universities. As shown in

Section 3, 67% of the sample firms have a national university as its parent university, whereas 33% are affiliated with other types of universities (that is, public universities established by regional governments or private universities). In Japan, national universities tend to play leading roles especially in research activities. For instance, all of the Nobel laureates in natural sciences who are from Japan graduated from national universities. Therefore, considering the heterogeneity in Japanese universities, we compared the sub-samples of those affiliated with national universities and those affiliated with others.

The results are reported in

Table 5. Technological capability has a positive and significant impact on the orientation toward the foreign expansion of ventures affiliated with national universities, but not on that of startups affiliated with other types of universities. We conducted the statistical test to examine the significance of the difference in the coefficient between two sub-samples (for example, see [

49]) and the result indicates that the coefficients are significantly different at the 10 percent level. In contrast, the effect of public support is significant only for ventures from private and public (non-national) universities. The ratio of exporting SMEs in the regions has a positive and significant effect in both sub-samples. The result of an F-test to examine the equality of the overall coefficients shows a significant difference between two subsamples at the 5 percent level. These results imply that ventures from national universities tend to seek overseas expansion on the basis of their excellent technologies, whereas ventures from private and public universities can improve opportunities for foreign expansion through public support.

Second, we compared early startups with more “matured” ventures because international orientation in an early stage may have different factors from that in a later stage. We divided the sample into two groups of early-stage ventures (with less than six years of operation) and more matured ones (with six years or more), where the median firm age of the sample is six years. The results in

Table 6 show that the effect of public support is positive and significant only for early-stage ventures. These results suggest the possibility that early-stage ventures’ orientation toward international expansion is more likely to be affected by public support. This support may enable them to gain a stable business foundation for aiming to expand overseas. However, we do not observe a statistically significant difference in the coefficients between two groups and thus the outcome need to be carefully interpreted.

Third, we investigated whether any of the key factors in our analysis has a complementary or substitutive effect on another factor. For this purpose, we conduct an additional analysis to examine the interplay between the variables included in the regression. Specifically, we focused on the relationship between a firm’s technological orientation and regional characteristics. A substituting effect is expected between these factors because technologically advanced ventures may be able to overcome difficulties in the international expansion given a disadvantageous location. Technological capability could weaken the effect of regional characteristics on internationalization orientation. To reveal the relationship, we added in our main model the interaction term between the technological orientation and the ratio of exporting SMEs in regions. The result is shown in

Table 7. The interaction term has a negative and significant coefficient, suggesting a negative moderating effect of a venture’s technological capability. Therefore, firms’ technological capability could weaken the effect of regional characteristics on the orientation toward foreign expansion.

5. Conclusions

This paper investigated the determinants of academic startups’ orientation to expand their businesses internationally, including ventures’ technological capabilities, public support, the regional environment, and the research standards of affiliated parent universities. We presented and tested four hypotheses regarding these factors using an ordered logit model and based on unique survey data of 448 academic startups.

The empirical analysis provided the following results. First, academic startups with strong technological capabilities and public support are strongly oriented toward expanding their business operations abroad. Moreover, academic startups located in regions with a high ratio of exporting SMEs have a strong orientation toward globalizing their businesses. Furthermore, academic startups affiliated with parent universities with high research standards are more likely to expand their businesses overseas than those affiliated with lower-ranked universities.

In addition, regarding the effects of public support, we compared the impact of different types of public support and found that only financial and physical support (for example, provision of equipment for business operations) strengthened the orientation of academic startups to globalize their business. Moreover, our sub-sample analyses revealed that the determinants of international orientation differ according to academic startup types: technological capability enhances the orientation toward the foreign expansion of more matured academic ventures, but not that of early-stage ventures. Public support would strengthen the orientation toward foreign expansion of academic startups affiliated with private universities and regional public universities, but not those affiliated with national universities.

One of the important suggestions from these findings is the role of public support provided by external organizations in startups’ international expansions. Prior studies pointed out that commercialization of academic knowledge or technology transfer to industry can be promoted by appropriate initiatives or support mechanisms offered by parent universities [

17] or national or regional governments [

15,

50]. If these initiatives and measures facilitate the establishment of academic startups and increase their orientation toward internationalization, our empirical results are consistent with the findings of this strand of the literature, broadening the scope of the investigation of academic startups’ strategies into the domain of international expansion. In contrast, Meoli and Vismara [

51] pointed out that academic staff tend to set up a new academic startup as a reaction to a disadvantageous environment when support from their university is inadequate. Although our analysis did not cover this aspect, it would be quite possible that a similar mechanism works when startups make decisions regarding internationalization. For instance, startups facing difficulties in conducting medical examinations domestically because of strict regulations by or insufficient support from the government might result in them seeking new opportunities in foreign countries with less strict rules.

A possible key concept that explains such complexity and leads to effective operationalization of public support to academic startups is the level of centralization of policy initiatives to assist the activities of university startups. Using survey data of 21 European countries, Munari et al. [

52] explored effective use of policy instruments for filling the lack of private funding sources in the transition of early-stage university technologies, which is called gap-funding instruments, and found a U-shaped relationship between the level of centralization of gap-funding instruments and the country’s implementation of technology transfer practices. This outcome suggests that the highest level of decentralization in the use of gap-funding instruments is associated with intermediate levels of development of technology transfer practices, and that the optimal level of policy centralization could be different across countries depending on the situation of each country. Meanwhile, our findings from the subsample analysis of the startups affiliated with national universities and those affiliated with other types of universities indicate that the effect of public support is different between these groups. Considering the varying impacts of public support on the different types of universities, a decentralized and flexible gap-funding policy would be more appropriate for enhancing the business activities of the Japanese academic startups. This implication is consistent with the idea that the application of rigid uniform rules to different types of institutions may impede the entrepreneurial activities of those institutions [

53].

A major contribution of the present study is that it provides the first empirical evidence on the determinants of academic startups’ orientation toward foreign expansion, which has not been explicitly addressed to date despite receiving increasing attention. Bolzani et al. [

27] pointed out that the internationalization of academic spinoffs is driven not only by observable traits of the management teams but also by unobservable characteristics such as opportunity perception and motivation. By focusing on an unobservable factor of venture management, namely startups’ orientation toward internationalization, our study sheds light on the unexplored issue in the field.

However, limitations remain in the study. One of the main limitations is that the details of each venture’s business expansion are unknown because such information was not asked in the questionnaire. Therefore, the concrete activities that the ventures conducted or planned to conduct in foreign countries, such as setting up a foreign office, finding new customers, exploring new exporting routes, cooperating in R&D, transferring technology, and licensing, are unclear. Another limitation is the lack of information regarding the timeframe during which ventures first expanded their businesses abroad. For a more detailed analysis of the relationship between the orientation toward foreign expansion and the factors examined in the present research, it would be necessary to keep these limitations in mind and interpret the results prudently.

A possible agenda for future research is the effect of the founder’s or top manager’s attributes on international orientation. According to previous research, top managers’ occupational backgrounds have a significant impact on firm management (for example, [

4]). Information regarding the occupational background (such as work experience in foreign countries or private companies) of venture managers can be used to examine the effects on the orientation for academic startups to expand their business operations internationally. Another promising agenda item is comparing the propensities of academic startups from different countries toward foreign expansion. Our sample firms in the present research consist solely of Japanese academic startups; thus, the conclusions could be generalized only to a limited extent. For a deeper understanding of the foreign expansion of academic startups, an international comparison considering the special circumstances of each country would be helpful.