1. Introduction

Economic inequality is a growing problem, and scientists across a broad range of disciplines are interested in investigating its origins, effects and solutions [

1,

2]. The literature suggests that there are many reasons for the existence of inequality, including policy reforms, variation in natural ability and discrimination [

3,

4]. Despite legislation and institutional policy aimed at reducing inequality, income disparity in the labor market still exists. For example, studies show that a wage gap among racial groups exists [

5,

6] and has increased over time [

7]. In addition, a gender pay gap remains, and the rate of convergence has slowed down noticeably since the 1990s [

8]. Moreover, the unemployment rate is substantially higher among most disadvantaged groups [

9,

10].

Many papers examine why inequality exists among different groups [

11,

12,

13,

14]. These studies shed light on understanding inequality among agents with different social identities, and policy implications have been discussed accordingly [

15]. Interestingly, experimental evidence suggests that discrimination (in this article, discrimination is defined as unsupportive actions against a certain group of individuals) is not only found between different groups, but also within the same group of individuals [

16,

17]. Surprisingly, such discrimination occurs even when it does not increase a participant’s own payoffs. This finding remains a puzzle that cannot be explained solely by either taste biasness suggested by Becker [

11] or productivity disparity proposed by Phelps [

18]. Intra-group discrimination has drawn much less attention than its inter-group counterpart and has been rarely investigated. However, understanding its causes could provide insights into why economic inequality is stubbornly persistent. Furthermore, better understanding of intra-group discrimination also informs what factors determine public support for equality-promoting policies and, therefore, helps policymakers use economic tools more effectively.

This study proceeds by proposing a theory to explain why some disadvantaged individuals do not have the incentive to support income equalization, followed by investigating the social acceptance for equality-enhancing policies that implement inter-group income transfers. Specifically, I examine under which conditions some members in an advantaged group would like to ameliorate income inequality, while some individuals in a disadvantaged group prefer the existence of inequality. To approach this problem, I analyze a model in which an individual values both his or her own absolute income and his or her relative income.

People think relatively when they make decisions [

19,

20] and measure wellbeing [

21]. Experiments provide evidence that relative income plays a part in individuals’ utility [

22,

23]. Using labor market data, Sloane and Williams [

24], Lévy-Garboua and Montmarquette [

25] and Ferrer-i-Carbonell [

26] find that job satisfaction is positively correlated with relative income using British, Canadian and German data, respectively. FitzRoy et al. [

27] also observe an empirical link between relative income and life satisfaction using British and German data. Duesenberry’s theory of consumption with emphasis on the importance of relative income is applied in many social studies [

28,

29,

30].

In the literature of public choice, relative income has gained much attention since the last decade. For example, relative consumption has been modeled into non-linear income taxation and public good provision optimization [

31,

32]. Furthermore, FitzRoy and Nolan [

33] extend the model to investigate majority voting preferences. In this paper, I incorporate both absolute and relative income into the individuals’ utility function. Specifically, relative income measures the ratio between one’s absolute income and the average income in the group to which he or she belongs. This setting is consistent with previous empirical findings that individuals adopt the income of “people like me” in their utility [

30,

34]. I assume two social groups in the economy; one is advantaged, and the other, naturally, is disadvantaged. There is an initial endowment difference between these groups. If the society is unequal, then the groups are segregated, and each individual compares his or her income more to others from the same group. Upon promoting equality, there is an income transfer from the advantaged to the disadvantaged group. In addition, if the society becomes more integrated, then individuals tend to compare their income to the average income of the entire population.

An advantaged individual would like to ameliorate income inequality if his or her utility in an equal society is higher than in the unequal system, even if the inter-group income transfer decreases his or her absolute income. A disadvantaged agent favors equality if his or her utility in an equal system is higher after accounting for the disutility he or she suffers from comparing more to the entire society. The model reveals that a disadvantaged individual does not always support ameliorating income inequality, even when an advantaged agent favors equality under the same conditions. In addition, we observe that the advantaged group’s propensity to support eliminating inequality is negatively affected by the amount of inter-group income transfer, but positively affected by how much the group values relative income and the initial endowment difference between two groups. These effects are reversed in the disadvantaged group. Nonetheless, the population ratio between the disadvantaged group and the advantaged group has a positive effect on both groups’ likelihood of favoring equality.

In an economy, population and the initial endowment difference are exogenous in the short run. However, the relative income valuation could be changed by treatments, such as education and information, and the inter-group income transfer could be adjusted by equality-enhancing policies, as discussed by the existing literature [

15]. The amount of income transfer determines if an individual has the incentive to support equal rights or not. For instance, as it increases, the advantaged group is less likely to favor equality, but the disadvantaged group is more likely to prefer the equalized system. Thus, when a policymaker assigns the value of inter-group income transfer, there exists a trade-off between the public support of the policy in different groups. To this end, I conduct a comparative statics analysis to investigate the effects of alternating the income transfer on the social acceptance of an equality-enhancing policy. The outcome depends on the initial endowment difference and the weight of relative income in both groups’ utility. Specifically, I find that such policies are supported by more individuals when the endowment difference becomes smaller, when the disadvantaged group values relative income less or when the advantaged group values it more. In addition, I analyze a special case in which there are equal numbers of individuals in each group. The results show that only when the advantaged group values relative income more than the disadvantaged group does do policies that promote equality gain more popularity by increasing the amount of inter-group income transfer.

In particular, this paper provides an explanation to the existence of intra-group discrimination. The insight of the proposed theory is three-fold: (1) it examines the conditions under which some advantaged individuals would like to ameliorate income inequality, while some disadvantaged individuals do not support inequality reduction; (2) it analyzes the factors that influence different social groups’ preference on equality; (3) it generates a discussion on how to implement economic tools to promote equality more effectively.

The remainder of this study proceeds as follows. The next section introduces the theoretical framework and analyzes individuals’ choice behavior.

Section 3 provides a comparison of the equilibria, analyzes comparative statics and discusses policy implications.

Section 4 concludes.

2. Theoretical Model

Consider a society with two groups: an advantaged group consisting of M individuals and a disadvantaged group consisting of N individuals, where and .

An individual takes into account both his or her absolute income and the relative income. Each agent’s utility function takes the form:

which is continuous and non-decreasing and is strictly quasiconcave in

and

. Individual

l from group

under an

r-type society has an absolute income

, where

;

,

;

where

advantaged,

disadvantaged};

1 where

= inequality,

equality};

2 and

,

.

represents the average income of group

g under an

r-type society. The income within each group is uniformly distributed, i.e.,

where

and

are the lower and upper bounds of income within each group, respectively. Define the “natural” income difference of both bounds between two groups as the initial endowment difference,

D, i.e.,

. Rearranging,

. There is an income transfer,

T, from the advantaged group to the disadvantaged group when an unequal society reforms to an equal one. Assume individuals within each group share the transfer equally. Thus,

where

.

Next, let us introduce the average income considered by each group. This study considers a circumstance under which the society is segregated, i.e., the system is unequal, an individual considers other members in the same group as “people like me” and only compares to them. However, when the society is integrated, i.e., the system reforms to an equal one, individuals are more open to the entire society, and each agent compares himself or herself to the overall population.

3 This setting is justified by previous findings using different datasets. Studies show that individuals compare more with whom they interact more. For example, [

35,

36] find differences in the well-being effects of comparisons to different groups. Knight et al. [

37] note that two-thirds of respondents in a survey of Chinese households report that their main comparison group consists of individuals in their own village. In addition, using European data, Clark and Senik [

38] test the intensity and direction of income comparisons. They find that individuals compare more to those with whom they interact more frequently. Society integration increases the interaction of different groups in many ways. For instance, it involves community merging, diversity in a certain occupation and educational environment. Hence, individuals compare more to initially different groups in an integrated society.

Therefore, under inequality, the average incomes considered by an advantaged and a disadvantaged individual are:

respectively. In the equalized system, the average income considered by individuals from both groups is:

2.1. Advantaged Group

Now, let us examine when an individual from the advantaged group would support equality. When choosing between discriminating or not, an advantaged individual

i solves:

This individual prefers the equal system if . That is, he or she would like to ameliorate income inequality if his or her utility in an equal system is higher than in the unequal one, despite the fact that there is an income transfer from him or her to the disadvantaged group. Lemma 1 describes the condition for an advantaged individual to favor equality.

Lemma 1. An advantaged individual supports ameliorating income inequality if the absolute income depreciation from the equalization is compensated by the relative income appreciation, i.e., .

An advantaged individual is more likely to support equality if: (1) decreases, indicating the amount of income transfer is lower; or (2) increases, indicating that the individual values relative income more or the initial endowment difference between two groups is larger.

An aspect that would provide insight into policy implications is how to increase a social group’s acceptance of equality-promoting policies. Therefore, in Proposition 1, I analyze the determinant factors of the probability for an advantaged individual to support equality and investigate their marginal effects.

Proposition 1. The probability for an advantaged individual to support equality is , where . Therefore, increases with , and D, but decreases with T.

A member of the advantaged group has a higher probability of favoring equality if he or she values relative income more, i.e., is larger. This could be explained by the more one values the relative social status, the higher utility he or she gets from a decrease in the average income by merging with the disadvantaged group. In addition, when the population ratio between the two groups gets larger, i.e., is higher, the advantaged group is more likely to support equality. This is due to the fact that when there is only a small group of minorities, the society integration does not largely decrease the average income to which an advantaged individual compares. Thus, when the disadvantaged population expands, the incentive to ameliorate income inequality gets higher since it reduces the relative income sufficiently to compensate the disutility from absolute income transfer. Furthermore, if the initial endowment difference increases, i.e., D is higher, then merging with the disadvantaged group decreases the average income more, and therefore, an advantaged individual is more likely to favor equality. Nonetheless, the likelihood of the advantaged group supporting equality decreases if the transfer made to the disadvantaged group rises, i.e., T increases, since it directly reduces an advantaged individual’s absolute income.

2.2. Disadvantaged Group

Next, let us examine the conditions under which an individual from the disadvantaged group would favor ameliorating inequality. An individual

j from the disadvantaged group solves:

The individual prefers the equal system if . That is, he or she would like to ameliorate income inequality if his or her utility in an equal system is higher than in the unequal one, despite the disutility from comparing himself or herself to a population with a higher average income. Lemma 2 describes the conditions for a disadvantaged individual to favor income equalization.

Lemma 2. A disadvantaged individual supports ameliorating income inequality if the absolute income appreciation from the equalization exceeds the relative income depreciation from comparing to the integrated society, i.e., .

A disadvantaged individual is more likely to support ameliorating income inequality if: (1) becomes larger, meaning the inter-group income transfer is higher; or (2) is smaller, indicating that the individual values relative income less or the initial endowment difference between the two groups is smaller.

In Proposition 2, I analyze the components that determine the probability of a disadvantaged individual favoring the equal system, followed by investigating their marginal effects.

Proposition 2. The probability for a disadvantaged individual to support equality is , where . Therefore, increases with T and , but decreases with and D.

A disadvantaged individual has a higher probability of supporting equality if there is a larger income transfer, T, from the advantaged group, since it directly increases his or her absolute income. In addition, he or she is more likely to favor equality if the population ratio, , becomes greater. This is due to the fact that when the advantaged group is relatively small, the average income growth is lower when the society integrates. Thus, the disutility from comparing to the entire population diminishes. However, the probability is negatively related to the degree that a disadvantaged individual values relative income, , and the initial endowment difference, D. That is, if a disadvantaged individual cares about his or her relative status more or the initial endowment gap is relatively low, his pr her disutility from comparing to the integrated society increases. Hence, he or she would be more likely to prefer staying under the unequal system.

Note that, , D and T have opposite effects on different groups, but the population ratio has a positive effect on both groups’ probabilities of favoring equality. However, the underlying reasons differ. For the advantaged group, when the number of disadvantaged individuals gets higher, the average income upon society integration becomes lower, and thus, the utility gained from relative income increases. For the disadvantaged group, the reason is that when the population in the advantaged group declines, the disutility from change in the relative income decreases.

3. Discussion and Policy Implication

In this section, I compare the conditions under which individuals from each group support ameliorating income inequality. In addition, from a policy perspective, I conduct a comparative statics analysis on the social acceptance of policies that implement an inter-group income transfer to promote equality.

3.1. Conditions to Incentivize Favoring Equalization

Let us compare the conditions under which individuals from different groups would support income equalization. Note that the probabilities for both groups to support equalization increase with the population ratio . Thus, the change in does not alter the sign of comparative static effects. Hence, without losing generality, let us normalize , i.e., assume there is an equal number of individuals in the advantaged and the disadvantaged groups.

An individual

i from the advantaged group supports equality when inequality Equation (1) holds; an individual

j from the disadvantaged group favors the equalized system when inequality Equation (2) holds.

The left-hand side of the second version in inequality Equation (1) and Equation (2) represent the normalized utility change resulting from the absolute income transfer, and the right-hand sides measure the normalized utility change from the respective relative incomes. Solving for

T, we find that an advantaged individual prefers equality if:

and the disadvantaged individual is willing to support equality if:

When the unequal system is reformed to an equal one, if the income transfer is smaller than , then an advantaged individual gets more benefits from relative income than losses from absolute income. In addition, if , then a disadvantaged individual gets more benefits from the absolute income change than losses from the relative income augmentation. Corollary 1 discusses these conditions.

Corollary 1. There exist four equilibria:

When , both the advantaged and the disadvantaged individuals favor equality.

When , neither of the groups of individuals support equality.

When and , only the disadvantaged individual supports equality.

When and , only the advantaged individual prefers the equal system.

Let us first focus on the case in which

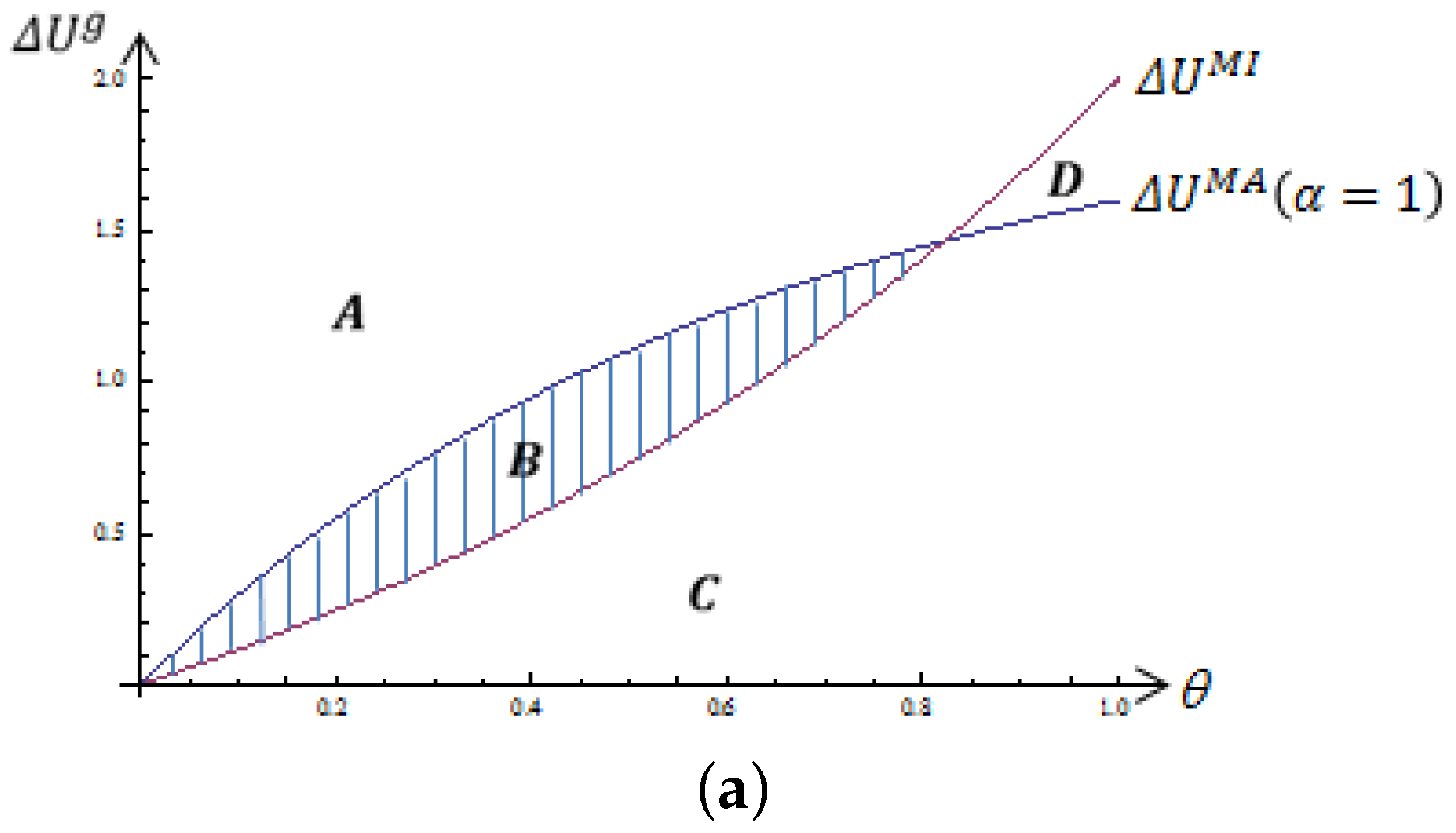

, i.e., two social groups have the same valuation on relative income. As shown in

Figure 1a, where the vertical axis depicts

and potential values of

T and the horizontal axis represents

, there are four candidate outcomes in the system. Areas

B and

D represent the cases in which both individuals prefer equality and inequality, respectively. Area

A represents the outcome in which only the disadvantaged individual supports equality. In Area

C, the advantaged individual favors equality, but the disadvantaged individual prefers to stay under the unequal system. That is, if inequality Equation (3) holds, but Equation (4) does not hold, then the advantaged individual supports equality, but the disadvantaged individual opposes it.

Figure 1b depicts the amount of

T that incentivizes each individual to favor equality under different parameter values. As

increases, the threshold of

T that incentivizes a disadvantaged agent to support equality becomes higher. In the meantime, the upper bound of

T for an advantaged individual to support equality also increases, but at a lower rate. As

increases, the upper bound of the income transfer that triggers the advantaged individual to support equality becomes higher. Therefore, the area in which both groups support equality becomes larger.

3.2. Comparative Statics

Understanding the social acceptance rate of the imposition of an inter-group income transfer is essential to policymakers. Therefore, let us analyze how

and

change comparatively upon varying the amount of income transfer,

T. Recall that

; the probabilities for individuals from each group to favor equality become:

Therefore, Equation (7) represents the comparative statics derived from Equations (3) and (4).

If , then through changing T, one unit increase in results in less than one unit decrease in . Therefore, under this condition, the policymaker could increase the amount of income transfer in order to induce more individuals to support equality.

In Theorem 1, I examine when the above condition holds. Let be the relative endowment difference, where .

Theorem 1. A policymaker could increase the inter-group income transfer to promote equality if . This condition holds only if , where and .

Intuitively, only if holds, then by varying T, an increase in results in a smaller decrease in ; or equivalently, the initial endowment difference between two groups is upper bounded by a function of and . This constraint is relaxed if gets larger or becomes smaller. Intuitively, if the disadvantaged group weighs the relative income less or the advantaged group is more concerned about it, an equality-promoting policy that reduces the income difference between two social groups is more likely to succeed in terms of public support.

Lemma 3 discusses a special case in which the sizes of both group coincide.

Lemma 3. When there are equal numbers of individuals in each social group, a policymaker could enhance the public support for a policy by increasing the inter-group income transfer only when .

Note that the advantaged group caring more about relative income compared to the disadvantaged group, i.e., , is a necessary condition. It indicates that in a society with equally-sized disadvantaged and advantaged groups, no equality-promoting policy could gain higher social acceptance by increasing the amount of the inter-group income transfer.

3.3. Policy Implication

Public support is essential to policy implementations. Thus, let us identify the conditions under which a policymaker could implement inter-group income transfer in order to gain more social popularity. Let

represent the upper bound of the initial endowment difference that sustains

.

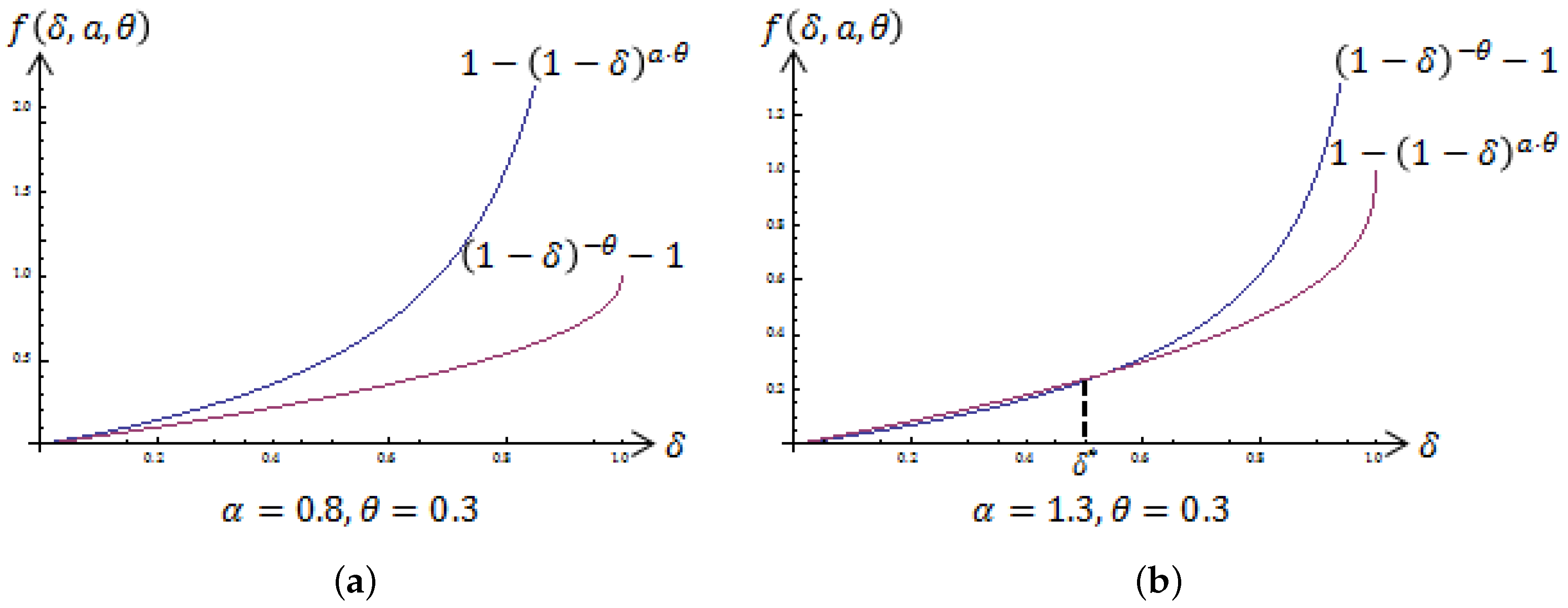

Figure 2 depicts the level of

under different parameter values.

Figure 2a indicates that when

, the above condition does not sustain under any parameter value. Therefore, an increase in the inter-group income transfer does not yield higher social support. Comparing

Figure 2b,d, we observe that when

increases, the range of

is enlarged. This indicates that the more majorities value the relative income, the larger the range of the initial endowment difference is for a policy to be able to enhance public support by raising the amount of inter-group income transfer. In addition, comparing

Figure 2c,d, we observe that when

gets smaller, the level of

increases. That is, when the disadvantaged group values the relative income less, the range of

that allows a policymaker to promote equality by implementing inter-group income transfer is larger.

4. Conclusions

This paper investigates when individuals from advantaged and disadvantaged groups are in favor of reducing income inequality. I analyze a model in which people take into account both absolute income and relative income. Each individual maximizes his or her utility by choosing either to stay under the unequal society or to support an equal system in which an income transfer is made from the advantaged to the disadvantaged group. The results indicate that, if the utility gained from the absolute income increase does not compensate the disutility from comparing oneself with a society that has a higher average income, some members in the disadvantaged group would prefer the system to stay unequal. Surprisingly, under the same conditions, some individuals from the advantaged group favor the equal system. Therefore, the proposed theory explains a seemingly counterintuitive phenomenon in which disadvantaged individuals do not always have the incentive to support equality-enhancing policies.

A comparative statics analysis is conducted for policy implications. The result suggests that a policy can gain more public support to increase the inter-group income transfer only if the initial endowment difference between two groups is lower than a function of the positional effect from individual’s relative income. The constraint is relaxed if the advantaged group puts more weight on relative income, but it becomes more restrictive if the disadvantaged group values relative income more. In a special case where there are equal numbers of individuals in the advantaged and disadvantaged groups in the society, these policies could increase social support for equality only when the advantaged group values relative income more than the disadvantaged group does. Therefore, policies and educational treatments that enlarge the advantaged individual’s or reduces the disadvantaged individual’s valuation on relative income would enhance the social acceptance for equality-promoting policies that implement inter-group income transfer.

There are several directions for future research. This paper assumes uniform income distributions for both the advantaged and disadvantaged groups, which can be extended in future studies. In addition, a model that considers more than two social groups can be developed to achieve a more comprehensive prediction of public choice. Furthermore, this study analyzes a model in which individuals do not value the comparative income of a group that they do not belong to under the status quo. This assumption can be relaxed according to different social structures. Empirical evidence on the aforementioned aspects can be incorporated into the model for policy implications under specific conditions.