Oil in Syria between Terrorism and Dictatorship

Abstract

:1. Introduction

- Selling of crude oil and oil products to the Assad regime, rebels, and the world market through Turkey;

- Donations from financially strong individuals, mainly from countries in the Arabian Peninsula;

- Bank looting and extortion;

- Ransom money from the kidnapping of journalists and other people from Western countries;

- Returns from the sale of abducted women and girls;

- Trade in stolen cultural goods.

2. History of Oil and Gas Exploration—The Distribution of Oil and Gas Fields

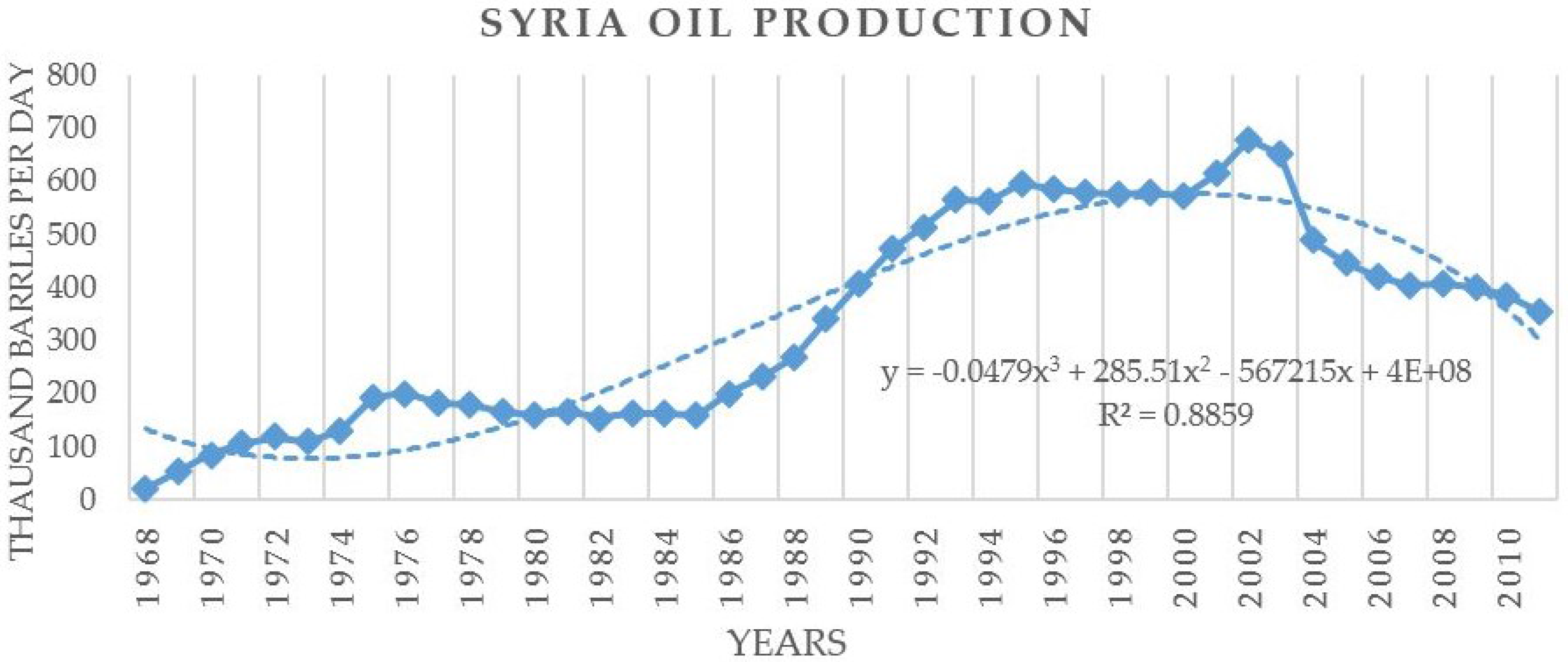

3. Trend of Oil Production (1968–2011)

4. Deterioration of Production during the on-Going Civil War (2011–2015)

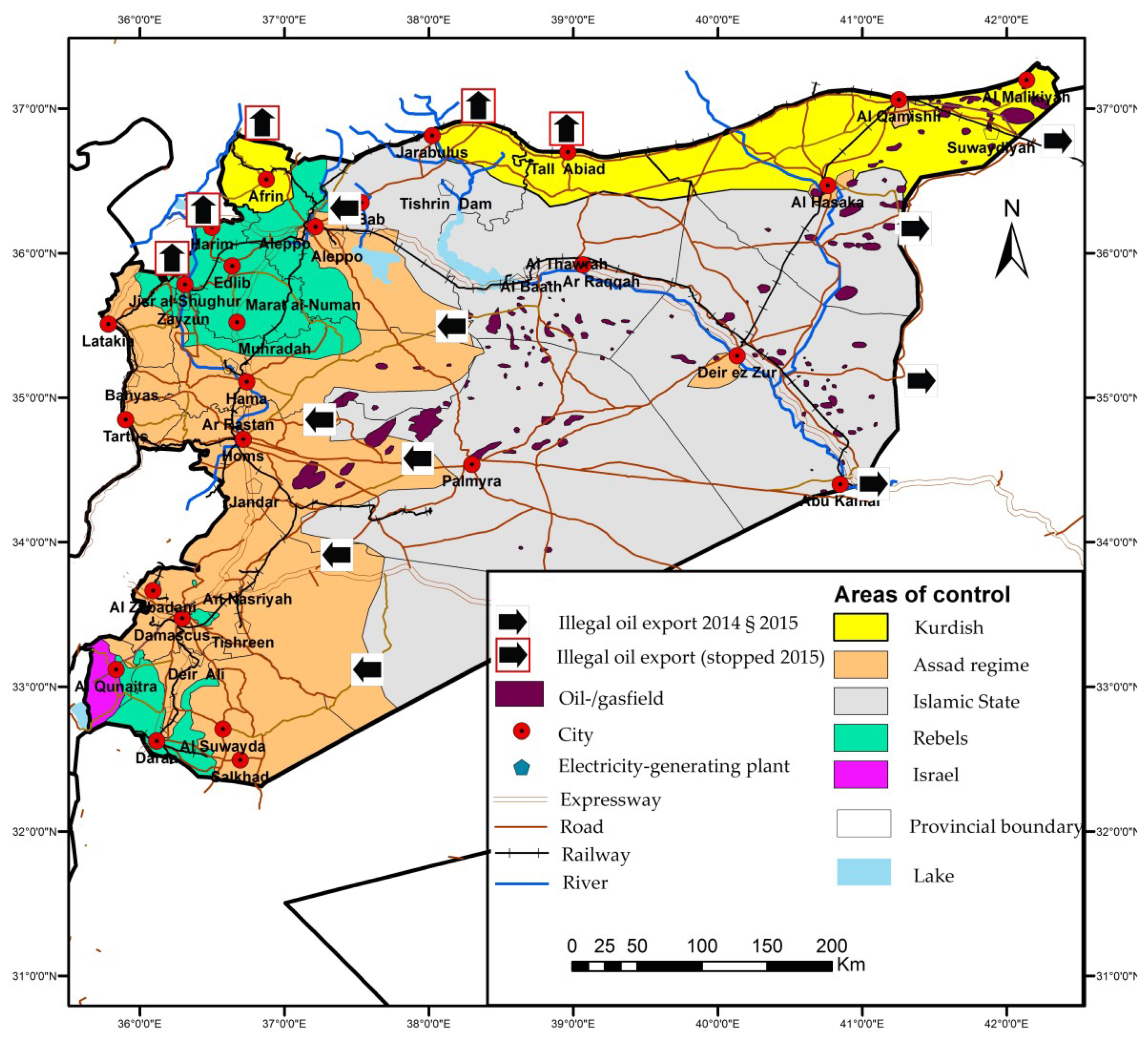

5. Geographical Distribution of the Control of Syrian Oil and Gas Fields by Forces

5.1. Oil and Gas under the Control of IS

The Sale of Oil and Gas and Smuggling by IS

5.2. Oil and Gas under the Control of Kurds

5.3. Oil and Gas under the Control of Assad Regime

6. Environmental and Social Impacts of Oil Refineries and Transportation

7. Conclusions

Author Contributions

Conflicts of Interest

References and Notes

- Carla E. Humud, Robert Pirog, and Liana Rosen. “Islamic State Financing and U.S. Policy Approaches.” Congressional Research Service. 2015. Available online: https://www.fas.org/sgp/crs/terror/R43980.pdf (accessed on 19 May 2015).

- U.S. Energy Information Administration (EIA). “Syria Country Analysis Brief.” In EIA; 2011. Available online: https://www.eia.gov/todayinenergy/detail.cfm?id=3110 (accessed on 13 November 2015). [Google Scholar]

- Abdullah Hammadeh, and Mohammed Alarabi Albakri. “Deadly Oil, Theft of Syria’s Future.” Economic Forum. 2015. Available online: http://www.syrianef.org/En/wp-content/uploads/2015/07/petrol_en.pdf (accessed on 23 November 2015).

- BP. “Statistical Review of World Energy 2015.” Available online: http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 15 September 2015).

- Ahmad Aldahik. “Crude Oil Families in the Euphrates Graben Petroleum System.” Ph.D. Thesis, Technical University of Berlin, Berlin, Germany, 2010. [Google Scholar]

- Abd Alrauf Rahban. “Geographical Evaluation of Oil and Gas Resources in Syria.” Damascus University Journal 25 (2009): 259–90. [Google Scholar]

- OpenOil. “Syria Oil Almanac.” OpenOil. 2013. Available online: http://openoil.net/?wpdmact=process&did=MTkuaG90bGluaw== (accessed on 13 June 2015).

- Abdulrahman S. Alsharhan, and Alan E. M. Nairn. Sedimentary Basins and Petroleum Geology of the Middle East, 1st ed. Amsterdam: Elsevier Science, 1997. [Google Scholar]

- Manfred Hafner, Simone Tagliapietra, and EL Habib El Andaloussi. “Outlook for Electricity and Renewable Energy in Southern, and Eastern Mediterranean Countries.” MEDPRO Technical Report No. 16. October 2012. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2156872 (accessed on 13 November 2015).

- Maher Hasan, and Jemma Dridi. “The Impact of Oil-Related Income on the Equilibrium Real Exchange Rate in Syria.” International Monetary Fund. 2008. Available online: https://www.imf.org/external/pubs/ft/wp/2008/wp08196.pdf (accessed on 19 September 2015).

- U.S. Energy Information administration (EIA). “Overview of oil and natural gas in the Eastern Mediterranean region.” In EIA; 2013. Available online: https://www.eia.gov/beta/international/regions-topics.cfm?RegionTopicID=EM (accessed on 13 November 2015). [Google Scholar]

- David Butter. “Syria’s Economy: Picking up the Pieces.” Chatham House, the Royal Institute of International Affairs. 2015. Available online: https://www.chathamhouse.org/sites/files/chathamhouse/field/field_document/20150623SyriaEconomyButter.pdf (accessed on 20 November 2015).

- SANA. “Syria’s Oil Production of 9500 Barrels in the First Quarter of 2015.” 2015. Available online: http://www.sana.sy/?p=198857 (accessed on 14 November 2015).

- Oil & Gas Journal. “Worldwide Refining Survey.” Oil & Gas Journal, November 2015. [Google Scholar]

- Middle East Economic Survey. “Damascus Cash Crunch as Crude below 10,000 b/d.” Middle East Economic Survey. 2015. Available online: http://www.worldbank.org/en/country/syria/overview (accessed on 13 December 2015).

- U.S. Energy Information Administration (EIA). “Syria International Energy Data and Analysis.” In EIA; 2015. Available online: http://www.eia.gov/beta/international/analysis.cfm?iso=SYR (accessed on 13 November 2015). [Google Scholar]

- Transport Department GIS Office. “Ministry of Communications, Transport, and Industry in the Syrian Interim Government.” 2015. Available online: http://syriaig.org/syr14/images/art_04_2015/cov_2015_01165.jpg (accessed on 13 December 2015).

- Mohamed Ahmed, and (Refinery owner in Manbij, Aleppo, Syria). Personal communication, 2015.

- George Kiourktsoglou, and Alec D. Couthroubis. “ISIS export gateway to global crude oil markets.” Maritime Security Review. 2015. Available online: http://www.marsecreview.com/wp-content/uploads/2015/03/PAPER-on-CRUDE-OIL-and-ISIS.pdf (accessed on 26 June 2015).

- Keith Johnson. “Has the U.S. Turned off the Islamic State’s Oil spigot? ” Foreign Policy. 2014. Available online: http://foreignpolicy.com/2014/10/07/has-the-u-s-turned-off-the-islamic-states-oil-spigot/ (accessed on 19 May 2015).

- Mohammed Alhussein, and (University of Aleppo, Aleppo, Syria). Personal communication, 2015.

- Fares Mahmud, and (University of Aleppo, Aleppo, Syria). Personal communication, 2015.

- IS Members, and (Deir ez Zor, Syria). Personal communication, 2015.

- Charles Lister. “Profiling the Islamic State.” Brookings Doha Centre Analysis Paper 13. Washington, DC, USA: Brookings Institution, November 2014. Available online: http://www.brookings.edu/~/media/Research/Files/Reports/2014/11/profiling%20islamic%20state%20lister/en_web_lister.pdf (accessed on 21 May 2015).

- Jennifer G. Hickey. “ISIS’ Sources of Revenue Unclear, But Group Well Financed.” NEWSMAX. 2015. Available online: http://www.newsmax.com/Newsfront/oil-ISIS-revenue-Islamic-State/2015/02/16/id/625045/ (accessed on 21 August 2015).

- FATF. “Financing of the Terrorist Organization Islamic State in Iraq and the Levant (ISIL).” FATF. 2015. Available online: www.fatfgafi.org/topics/methodsandtrends/documents/financing-of-terrorist-organisation-isil.html (accessed on 21 November 2015).

- Omran for Strategic Studies. “The fuel crisis and the challenge of economic security in northern Syria.” Omran for Strategic Studies. 2015. Available online: https://www.omrandirasat.org/portfolio (accessed on 15 December 2015).

- Yezid Sayigh. “The War over Syria’s Gas Fields.” Carnegie Endowment for International Peace. 2015. Available online: http://carnegieendowment.org/syriaincrisis/?fa=60316 (accessed on 10 December 2015).

- Yezid Sayigh. “Syria Feature: The Islamic State’s War for Gas and Electricity.” EA WorldView. 2015. Available online: http://eaworldview.com/2015/06/syria-feature-the-islamic-states-war-for-gas-and-electricity/ (accessed on 10 November 2015).

- Scott Lassan. “How the Islamic State of Iraq and Syria Gets Funding.” RAMEN IR. 2014. Available online: http://ramenir.com/2014/09/21/how-the-islamic-state-of-iraq-and-syria-gets-funding/ (accessed on 12 November 2015).

- Elena Holodny, and Michael B. Kelley. “The Gas Pipeline ISIS Just Blew up Shows Its Extraordinary Leverage on the Syrian Regime.” Business Insider UK. 2015. Available online: http://uk.businessinsider.com/isis-blows-up-syrian-gas-pipeline-2015-6?r=US&IR=T#ixzz3j5RlCou3 (accessed on 19 September 2015).

- The Telegraph. “The Oil Middleman between the Syrian Regime and IS.” The Telegraph. 2015. Available online: http://www.businessinsider.com/revealed-the-oil-middleman-between-the-syrian-regime-and-isis-2015-3#ixzz3j5QsWLET (accessed on 13 November 2015).

- Bahzad Haj Hamo. “Syrian Kurds Struggle with Islamist Factions.” AlMonitor. 2014. Available online: http://www.almonitor.com/pulse/security/2014/02/syria-kurds-oil-struggle-armed-islamist-factions.html (accessed on 21 May 2015).

- RUDAW. “PYD Announces Surprise Interim Government in Syria’s Kurdish Regions.” RUDAW. 2013. Available online: http://rudaw.net/english/middleeast/syria/13112013 (accessed on 15 May 2015).

- Alaa Halabi. “Syria’s Oil Producing Regions Suffer from Theft, Pollution.” AlMonitor. 2013. Available online: http://www.almonitor.com/pulse/business/2013/10/oil-theft-in-rebel-held-syria.html# (accessed on 23 May 2015).

- The National World. “Syrian Kurds Refine Oil for Themselves for First Time.” The National World. 2015. Available online: http://www.thenational.ae/world/middle-east/syrian-kurds-refine-oil-for-themselves-for-first-time (accessed on 14 November 2015).

- Khurshid Aliko. “The Importance of Swedish Gas Field in Kurdistan Syria.” Yekiti-Media. 2014. Available online: http://ara.yekitimedia.org/category/newspaper/page/2/ (accessed on 22 May 2015).

| Province | Field | Production (b/d) |

|---|---|---|

| Deir ez Zor | Omar | 15,000 |

| Tank | 7000 | |

| Jafra | 3000 | |

| Al Kharrata | 1000 | |

| Derro | 500 | |

| Ward, Ahmer, Akash, and Ratka | 7000 | |

| Atallah | 500 | |

| Tayyani, Maleh, Sijan, and Azraq | 12,000 | |

| Thayyem | 700 | |

| Other fields | 1000 | |

| Hasaka | Margada | 3000 |

| Al Jubaissah | 3500 | |

| Gouna | 1000 | |

| Tishreen | 2000 | |

| Raqq | Wahab, Habbari, Deilla, and Fadeh | 2000 |

| Homs | Jazal–Heil | 2500 |

| 61,700 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almohamad, H.; Dittmann, A. Oil in Syria between Terrorism and Dictatorship. Soc. Sci. 2016, 5, 20. https://doi.org/10.3390/socsci5020020

Almohamad H, Dittmann A. Oil in Syria between Terrorism and Dictatorship. Social Sciences. 2016; 5(2):20. https://doi.org/10.3390/socsci5020020

Chicago/Turabian StyleAlmohamad, Hussein, and Andreas Dittmann. 2016. "Oil in Syria between Terrorism and Dictatorship" Social Sciences 5, no. 2: 20. https://doi.org/10.3390/socsci5020020