1. Introduction

The severe decline in the real estate market, which began affecting the Italian economy in 2008, had significant impacts on the enhancement of public real-estate properties. For a long time, the issue of the exploitation of public property promoted supply procedures. In particular, attention has been placed on urban and financial procedures that can maximize the effectiveness of local authorities’ actions in relation to requests from developers [

1,

2,

3] Significant difficulties encountered by administrations in the enhancement of real-estate properties—a large number of deserted auctions, immovable property, stalemates, or projects under negotiation—induced a radical revision of the framework of similar policies.

The many cases of grassroots mobilization for the restoration and enhancement of public assets reflect a new development strategy: one that can also explore temporary alternative forms of use of public assets.

The proprietary administrations create value in completely renewed ways: they promote a new demand, they favor design and entrepreneurship, and assign resources otherwise destined to be unused or underused. It is not just about deregulating urban and building procedures, but also about providing real-estate resources to individuals capable of innovation in various sectors of economy and society.

In Italy, and internationally, the initiatives of self-organized local communities to regenerate abandoned spaces are increasingly widespread [

4,

5,

6,

7]. Activities in the third sector, profit and non-profit associations, cultural and creative industries, start-up incubators, and crafts are just a few of the activities that are hosted in the enhanced assets [

8]. At the heart of these experiences is the desire to encourage economic and social innovation. They are able to create new and stronger social relationships, while at the same time promoting synergy between public and private operators and supporting otherwise difficult development initiatives [

4,

9,

10].

Abandoned real-estate assets are thus transformed into a common resource that the community reuses, no longer with the aim of extracting an income but to experiment with new forms of economic and social development. Real-estate assets can thus be renewed by offering original opportunities for the formation of new economies [

11].

Bottom-up processes trigger human and social capital mobilization, and bottom-up enhancement processes in particular are associated with several different positive externalities. On the one hand, these processes contribute to the regeneration of abandoned or under-utilized areas and buildings; on the other, they produce employment and increase the network of relationships in the local community, contributing to the economic development of the area and providing welfare services that administrations are not more able to support.

From a purely real-estate point of view, upgrading operations are as significant at the social and cultural level as they are poorly evaluated in strictly appraisal terms. The aim of this paper is thus to estimate the value that bottom-up processes, structurally marked by high uncertainty, determine in the enhanced public real-estate asset.

The article is divided into five parts. The first summarizes the main characteristics of the enhancement processes through grassroots participation. The second deepens the methodology and elements of value generation together with the uncertainty that distinguishes them. The third section outlines the appraisal model used in the stochastic simulation to consider the uncertainty of value-based variables, taking into account a case study—an old fire station in Ferrara. The fourth part illustrates the results of the simulation, while the fifth one, finally, interprets the overall results of the research.

2. Value Determined by Participating Processes: Methodology, Choice of Variables, and Their Measurement Due to Uncertainty

In Italy, bottom-up processes assume a precise geography. In some areas, these mechanisms have now become widespread and consolidated, while others seem to lack the bases to stabilize similar processes. The launch of bottom-up collaborative practices is significantly related to the endowment of social capital in the territory [

6,

12], understood as the human propensity to cooperate [

13]. The international literature [

12] identifies the endowment of social capital within a territory as the main resource able to stimulate the local community to establish new businesses and to encourage the development of social entrepreneurial and cultural relations in the territory.

Bottom-up enhancement processes are incremental: they are carried out through programs and actions that are defined according to their partial outcomes [

14]. The uncertainty of the outcome makes the temporariness a determining factor for the development of these processes. The use of the asset for a short period makes it less risky—for the owner and users—to invest in social enterprises and, in the event of a positive outcome, the period may be prolonged [

15,

16,

17].

The legal forms to manage the assets reflect this uncertainty: properties and users are linked by flexible contracts. The bailment at no charge—or moderate rents—is a key element in promoting the development of bottom-up practices [

6]. The wide flexibility of these practices allows the opportunity to leave the property without any burdens and with an advantage associated with the important element of choice [

18,

19].

However, not all participatory enhancement processes are successful. The experimental nature of the initiatives and activities undertaken shows a wide variability in terms of success and development, as recent studies show [

6]. The lack of historical data on the degree of success of such experiences, and the wide heterogeneity of activities carried out with different outcomes, makes these processes uncertain and difficult to predict.

Capital appreciation determined by participatory processes can be evaluated through income estimation procedures. Using discounted cash flow analysis (DCFA), it is possible to consider the variability of economic and financial flows by assuming a time frame that can consider temporary processes and, at the same time, investments of a greater temporal amplitude.

In particular, the proposed procedure does not take into account the financial flows, which in most of the participating initiatives are very small or non-existent, but rather the economic benefits derived from the activities. They are represented by the interventions to restore and maintain the buildings, whose costs are borne by the beneficiaries of the assets.

The DCFA model to estimate the valorization process is based on the sum of the economic flows determined by the tenant’s actions. These flows are postponed and limited over time, assuming a temporal perspective linked to the contract with the administration.

Still, it is assumed that the property, at the end of the enhancement process through grassroots participation, returns to the market. However, this hypothesis does not exclude that the same social entrepreneur acquires it, this time in return for payment, from the same proprietary administration [

20,

21,

22,

23] (1):

where:

Ri represents the net economic benefits obtained during the contract term with the

social entrepreneur; qi represents the sum of the unity and discount rate of the economic and financial flows of the valorization process;

n reports the number of years for which the social entrepreneur rents the property;

Rf denotes the rent obtainable by the proprietary administration at the conclusion of the contract;

rf is the property capitalization rate when the property is transformed and put back on the market.

The first element of Equation (1) represents the sum of all the appropriately discounted economic flows, which contribute to the enhancement of the complex on the assumption that all the relevant costs of the property are borne by the tenant. The second element identifies the output value of the asset at the end of the period, assuming a contractually fixed value.

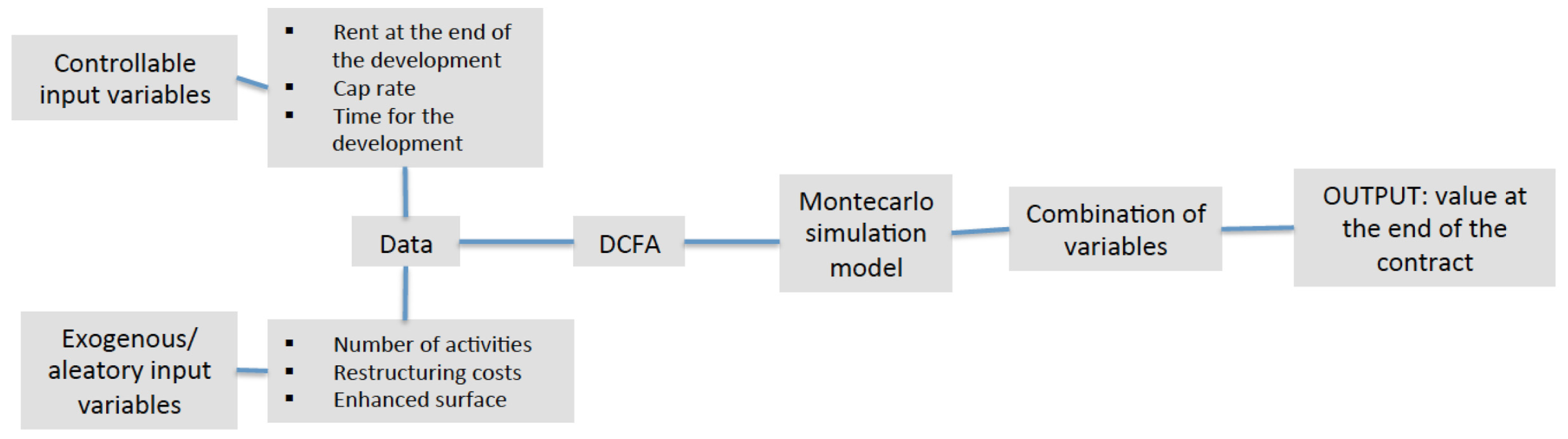

The procedure to evaluate the enhancement of public buildings through participatory processes must consider their particularly high uncertainty. For this purpose, in the DCFA model outlined, two distinct types of variables in the literature have to be distinguished: controllable input variables and aleatory (or exogenous) input variables [

24,

25]. Both variables are stochastic and are characterized by uncertainty. However, variables belong to the first category if, due to the large amount of historical data, they can be estimated following ordinary procedures and methodologies [

23]. In this simulation, these variables are the following: the time duration of the enhancement operation, the estimated rent at the end of the contract, and the capitalization rate.

Exogenous input variables are characterized by a high degree of uncertainty. For these variables, there are no historical data, and they solely depend on the choices and actions of the users of the assets. For these reasons, they need to be estimated through the information given directly by the users that occupy the spaces. These variables represent the main value drivers that contribute to the regeneration of the assets.

In particular, three exogenous variables were identified. The difficulty in measuring them is due to the absence of appropriate historical data to which to refer. These derive from the only enablers of bottom-up enhancement processes: the activities that take place in the building.

To be estimated and then included in the financial model, these variables require further analysis and explanation; this provides for the use of specific sources—in this case, privileged witnesses— through which it is possible to elaborate a detailed probabilities distribution of the same variables. In this way, significantly uncertain variables are represented by probability distributions that assume different forms. In particular, a single percentage of probability is attributed to each permissible value of the uncertain variable [

24,

26,

27,

28].

The first variable represents the number of activities that can be located on the property. In some real-estate assets regenerated through participatory processes, there is only one activity, while others have dozens of initiatives. Some of them can be replaced over time by new activities leaving their spaces before the end of the rental period.

The second element characterized by significant uncertainty represents the area used for each activity. Some activities occupy only one room, while others come to occupy hundreds of square meters. Some bottom-up experiences show how the entire surface of the asset has been enhanced, while in others more than half remains unoccupied.

The third and final uncertain variable represents the restructuring costs which contribute to increasing the value of the property. Usually, contracts between the administration and users do not include minimum costs of restructuring operations to be done in the spaces that they occupy. Sometimes, thanks to donations and offers, crowd funding, and public funding, tenants make substantial renovations to their spaces. In most cases, extraordinary maintenance operations are self-financed and thus the safety interventions of the assets are covered by the users. It may happen that some activities decide to transform the space available with costly restructuring interventions. Similarly, there may be entrepreneurs that, not having the necessary resources initially, decide to perform only the minimum interventions for the utilization of the spaces to begin with, and postpone the most expensive operations to the next few years. For this reason, this variable solely depends on the purposes and available financial resources of each user. Considering also the largely heterogeneous nature of the activities and their correspondent use of the spaces, this variable is uncertain and difficult to predict.

The three exogenous variables generate the highly uncertain aspect of bottom-up projects due to external factors of a random and aleatory nature. Consequently, it is necessary to proceed with estimating the value of the assets using an approach capable of considering the random dimensions of similar processes.

The appraisal model is thus composed on the one hand of the variables from which the value has been estimated on a traditional basis, and on the other hand by the probability distributions developed for the variables marked by higher uncertainty. To make the synthesis between different inputs possible, the Monte Carlo simulation model is used. This approach is the most widespread problem-solving methodology that involves uncertain variables. Monte Carlo simulation allows (see

Figure 1), through a repeated series of extractions from the different distributions, the development of a final probability distribution of the values derived from the participatory enhancement [

29].

3. The Former Barracks of Ferrara Fire Station: The Determinants of Values and the Measurement of Uncertainty

Factory Grisù—a former fire station, located in Ferrara and converted into a business and cultural activities incubator—is the case study selected to estimate the value generated by the regeneration processes through grassroots participation. This case was selected because it fully reflects the typical characters of bottom-up processes in Italy The main representative characteristics in common with bottom-up processes are: some traditional enhancement experiences have failed, a high presence of social capital in the territory, the provisional nature of the initiative, an incremental process, a sole association able to coordinate all the activities, and rental contracts with no charge for bailment [

6,

30]. The former barracks extend over 4000 square meters (of which 2600 are built) in the center of Ferrara, near the railway station. Built at the beginning of ‘900, in 2004 it was officially decommissioned and the property passed to the Province of Ferrara, after which the buildings were placed in the real-estate assets alienation plan. An auction took place with the starting value of 3.5 million Euro, but received no offers.

Following years of inefficiency, in 2011, the Grisù association—created specifically to recover the buildings—presented a proposal to the Province to obtain the management of the fire station in order to create a space for the creative and cultural businesses of the entire Emilia Romagna. The former fire station was granted, starting in 2012, for five years with a legal stipulation of bailment at no charge and a clause that the barracks would remain subject to possible alienation. In return, the association honors the commitment of transforming and enhancing—at its own expense—the parts of the complex used by the association.

The association also has the task of recruiting entrepreneurial activities to entrust with the restructuring operations of occupied spaces, to manage the activities and events in the building, and to deal with the property. In 2016, the management of the property passed to Grisù Consortium with a new contract of use (with bailment at no charge) until 2023, extendable up to 2025.

Today, there are ten settled activities that have contributed to renovating approximately 800 square meters of the floor area. This experience highlights the opportunities of bottom-up processes, that are centered on culture and innovation, to return a role and function to a property that is otherwise destined for abandonment. In addition to these benefits, more than 20 jobs have been created. In addition, Factory Grisù offers new services for the local community, and this initiative allowed the redevelopment of an entire block that was abandoned and at risk of vandalism.

The success of Factory Grisù allowed the Province of Ferrara to win a grant from the Emilia Romagna Region, which has allocated €500,000 for interventions in public areas (renovation of the roofing and provision for connection to district heating). To date, however, not all of the property has been renovated. The first years of management have proceeded intermittently and since 2016, as a result of the change in management, the project progression is substantially increasing even though it is difficult to predict if and when the entire property can be fully recovered. The enhancement of the former fire station confirms the aleatory and highly uncertain nature of the regeneration approach promoted by grassroots mobilization.

Interviews with privileged witnesses allow us to overcome the issues related to the analysis and the prediction of values for aleatory variables. Many users of Factory Grisù were interviewed and contributed by identifying and describing risks associated with the variables. Interviews to the users of the assets are useful to implement Monte Carlo simulation in order to discover the uncertain elements that are difficult to verify by those do not have the knowledge and experience to do so [

29], information obtained through documents, and desk research, it was possible to estimate the probability distribution of the three variables that affect the uncertainty of the final outcome of this enhancement process.

The first uncertain element is the number of activities that are located in the complex. At the beginning of the project, six activities were based in the former fire station. To date, two activities have withdrawn, but six others have occupied other spaces, contributing to the renovation of 800 square meters of the floor area. Every year, the Consortium publishes two calls for new projects to be included in the building, and about two projects a year settle into the cultural incubator. The number of companies who will occupy or abandon the Factory from now until 2025 is not, however, a priori definable.

The second element of uncertainty is given by the occupied surface. Most of the initiatives occupy a commercial area of between 40 and 50 square meters. One of them occupies over 100 square meters and another over 250 square meters. It is not possible to predict today how many of these activities will expand during the loan. Similarly, it is difficult to predict the occupied surface of activities that could still settle in unused spaces.

Regarding the restructuring costs, the operations were self-financed with an average cost of 300 Euro/sqm. The interventions concerned the refurbishment of electrical systems, the replacement of existing pavement, and the painting of spaces. Even this variable cannot be determined a priori: in the contract with the Province of Ferrara, no obligation has been established regarding the minimum costs of the interventions to be supported, and each initiative is free to choose which operations to support according to a schedule that remains at the discretion of those who occupy the spaces.

Table 1 describes the major variables to be searched, and the source from which we have found the value drivers for the enhancement of the former fire station. On the one hand, the controllable input variables, which include all inputs specified by the decider, are estimated using stochastic methods; on the other hand, the stochastic distribution of the exogenous input variables was determined on the basis of field interviews.

4. Measuring the Uncertainty of the Enhancement Process through a Monte Carlo Simulation

The Monte Carlo simulation is the method used to measure probability variables by re-elaborating the DCFA model, obtaining as a final output a range of market values representative of the enhancement process in place [

31].

In operational terms, the values of the exogenous input variables—which depend solely on the choices and actions of the tenants—are replaced in the calculation model with other values estimated on the basis of probability distributions previously determined randomly, recording in each operation the final output.

The DCFA model previously described has been included in the Crystal Ball© software to implement the simulation model [

27,

28]. The Monte Carlo simulation runs a sufficiently high number of times, typically between 10,000 and 100,000 simulations. In each operation, the values of exogenous variables randomly selected by the software are combined and extracted, generating the corresponding outputs in every simulation. The results of the simulation are represented in the form of a continuous distribution that expresses the output link with the input variables, thus representing the expected market values of the property [

27,

28,

32].

It is important to highlight how, due to the constitutive uncertainty of the exogenous variables, the distribution of the values assigned to these variables is dissimilar to a Gaussian distribution. To elaborate the probability distribution of the three uncertain variables, authors choose to use the triangular distribution. This methodology is very common and it is considered the best way to express the distribution of variables to be analyzed [

27,

28,

33].

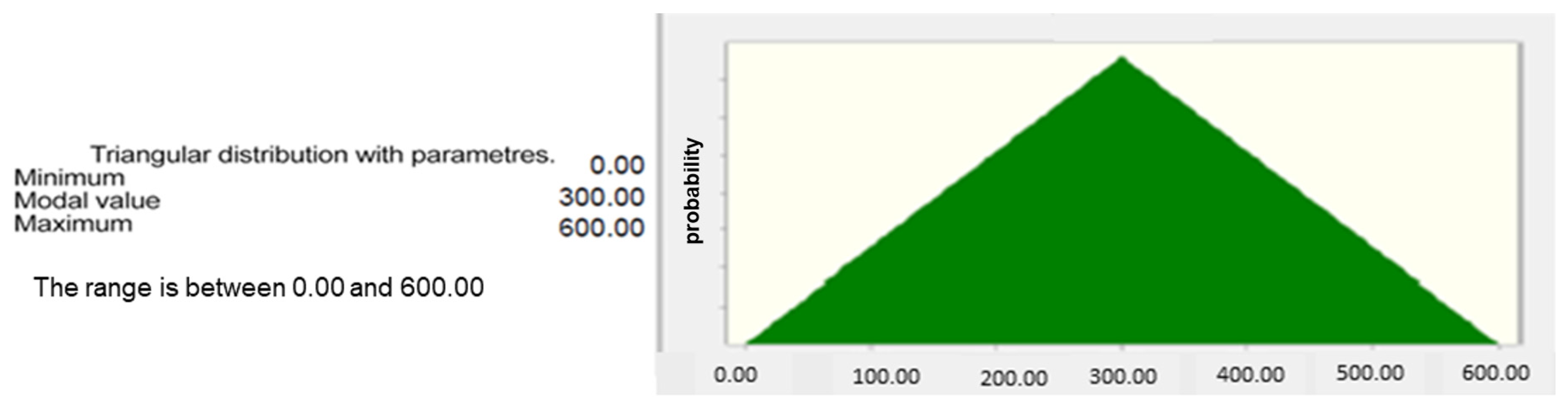

The triangular distribution differs from others used for the assignment of multiple values. In particular, to form the triangle it is necessary to assign three values that correspond to the vertices of the triangle. The first one is the intermediate value—represented by the most probable value—and depicts the vertex of the triangle. The other two values—of which one is higher and one lower than the intermediate value—correspond to the other two vertices, and the probability associated with them becomes zero. The function is linear in the traits between the minimum value and the most probable value, and between the latter and the maximum [

27,

28,

32].

To process the triangular distribution, it is necessary to estimate three values: the minimum value, which corresponds to the lowest value of the variable; the maximum value, which coincides with the highest case; and the modal value—the most likely one. In the simulation, the variable can assume any value between the indicated extremes [

27,

28,

34].

Table 2 shows the minimum, maximum, and modal value of the three identified exogenous variables. For variables related to the 10 existing activities, based on interviews with tenants, it is expected that they will remain until the end of the contract without expanding the occupied space.

Based on historical data and the current state of development of Factory Grisù, it is estimated that by 2025, the number of activities will increase to 12 in the most probable hypothesis, and up to a maximum of 20 in the optimistic case. On the contrary, in a pessimistic scenario, the hypothesis of the model is that there is no new established activity.

The second element covers the surface occupied by the activity. For each of the existing businesses, the amount in square meters of occupied area has been identified. The area occupied by future activities, in the most probable case, coincides with the average value of the already existing initiatives, equal to 45 sqm. The minimum value attributed is 20 sqm, while the most optimistic case is 250 sqm.

The third variable concerns the restructuring costs, according to both the intrinsic characteristics of the compartments occupied—they do not all have the same maintenance quality conditions—and to the willingness to invest by the new users. The most likely investment value of the new initiatives was estimated at 300 Euro/sqm. The minimum value attributed to each transaction is equal to zero, assuming that the occupant considers the space appropriate to their needs. The maximum value was assumed to be 600 Euro/sqm (see

Figure 2). For the existing activities, it was estimated that some of them could yet make some improvements to their spaces. For these activities, a most likely value of 100 Euro/sqm, a minimum value of 0, and a maximum value equal to 150 Euro/sqm were assigned.

The restructuring costs were distributed in the first seven years, leaving the last two without benefits for the owner, under the assumption that occupants do not consider it more convenient to invest for only two years.

The Monte Carlo simulation proceeds by extracting probability distributions up to the number of iterations chosen by the evaluator: in this case, 50,000 [

27,

28,

35]. The output generated by each simulation allows the definition of the Monte Carlo outcome, which collects a range of probability distributions, as represented in

Figure 3 and in

Table 3.

The average value of Factory Grisù, following the enhancement process promoted by the activities, varies, with some approximation, from a minimum value of 1,463,000 Euro to a maximum value of 4,088,000 Euro. In unit terms, the average result returns a benefit of 1010 Euro/sqm.

The value of the former fire station in 90% of the simulations was between 2,122,000 and 3,166,000 Euros. At 70%, the final value is between 2,290,000 Euro and 2,950,000 Euro. Going down to 50% of the simulations, the range of values is reduced to between 2,400,000 and 2,830,000 Euros.

The asymmetry index is positive and equal to 0.260; this indicates how the output distribution form extends asymmetrically towards positive values [

27,

28,

36].

5. An Interpretation of the Monte Carlo Simulation

The enhancement of the former fire station in Ferrara reveals that bottom-up mechanisms can generate value in favor of otherwise abandoned spaces. The benefits that this project gives back to the community are many. First of all, it is an opportunity where it is possible to develop new ideas and projects with social and cultural purposes, while generating new jobs at the same time. Secondly, Factory Grisù is an opportunity to support projects that elsewhere would not have been able to manifest themselves. Thirdly, the new uses allowed the revival of a building that had been abandoned for a long time, wiping out acts of vandalism and degradation for the building and the neighborhood. Fourthly, restructuring operations allowed a partial recovery of the building, showing the citizenry a military asset that had never been open to the public. Another important opportunity is that Factory Grisù became a place where it is possible to develop networks and relationships among the local community. Finally, in addition to these advantages, this experience also shows benefits purely in terms of real-estate assets.

It is useful to compare the output values of the processing with the other values that a proprietary management is required to deal with. The first value is represented by the opening bid, on the basis of which the various auctions have failed. This value, estimated in 2011, amounted to 3,500,000 euros, with a unit value of 1346 Euro/sqm. The unrealistic nature of this value has been widely acknowledged: no developer has ever submitted a proposal to buy the building, even at recent market prices, which went down to 800–900 Euro/sqm.

To date, based on a synthetic comparative appraisal made with reference to the main official and unofficial sources of the local market, the former fire station could reach a value of 800–900 Euro/sqm, with a high chance of long marketing times.

This is basically unrealistic, but it is more likely that the value can be determined with reference to the Non-Performing Loan (NPL), where the assets are quoted at an average rating of just under 30% of the estimated value [

37,

38,

39,

40,

41]. To confirm such a position, it should be noted that, up to now, no offer for the purchase of the complex has been received by the Province of Ferrara since 2011, suggesting that the property has lost much of the value attributed in 2011.

In the absence of developers and investors willing to invest considerable resources to redevelop the unused public real-estate assets, governments may use two options. The first assumes that, for an administration averse to risk, the participatory processes are not an appropriate solution. Therefore, the administration may exercise the option to leave properties unused and sell them once buyers are found, such as NPLs, at a depreciation rate that corresponds to 30% of their estimated value. In the case of the fire brigade in Ferrara, its current value would be around 400 Euros/sqm This value was obtained by computing 30% of the appraisal value in 2011. for a total of 1,040,000 Euros, with a loss of about 2,500,000 Euros from the estimated value in 2011.

The second option for the administration is to promote the activation of participatory mechanisms. The uncertainty that characterizes similar processes does not allow us to estimate with accuracy how many enterprises will settle, nor the amount of the surface that will be occupied (and thus enhanced). Despite this high degree of uncertainty, the activities that set up in public buildings always make substantial improvements. In the case of Factory Grisù, activities have undergone several restructuring operations, transferring value to the property whose state of conservation has gone from bad to good Despite the interventions already made and those designed, there are still many operations that have not been budgeted. The operations still to be expected concern the replacement of the interior and exterior windows, the refurbishment of the internal and external façade, and the arrangement of the exterior courtyard. Considering the benefits that the Province of Ferrara obtained from restructuring operations, resulting from the Region’s funds and the interventions of individual operators, they greatly exceed the reference value of the NPL.

The enhancement of the former fire station in Ferrara, albeit with many elements of uncertainty, has shown how the participatory processes are able to confer new value to an abandoned property. The final value obtained from the Monte Carlo simulation (see

Figure 3), albeit far from the 2011 appraisal, demonstrates how Factory Grisù’s initiatives have produced a substantial revaluation of the property compared with it remaining unused or being sold according to current NPL values.

In general, convenience between the two options depends primarily on the location of the assets. In places with a flourishing real estate market and an administration averse to risk, it may be convenient to leave the building unused until more a fruitful use arises. That option is considered feasible only in areas marked by higher real-estate values, where the devaluation rate of NPL is far from 30%. In this context, the second option is also feasible and the favorable market conditions can make participatory operations an opportunity to launch real-estate development operations.

Base Ansaldo in Milan (cfr.

Table 4) is a representative case of how, in a flourishing city, rich in social and human capital and marked by a prosperous economy, the participatory processes can become generators of new economies. Oxa s.r.l. has a concession for the former factory for 12 years—renewable for a further six years—to initiate cultural activities in a large shared space (11,000 square meters). In addition to a reduced annual fee—amounting to 70,000 euros and 120,000 euros per year starting after the enlargement of the areas occupied, which is about a tenth of the real market value of similar goods—the concession agreement provides for an initial financial commitment by the municipality and the company to restructure the asset.

In particular, during these years, Oxa s.r.l. invested about 8 million Euros against a municipal investment of just over 5 million Euros. The investment, of considerable magnitude on both sides, was intended to regenerate an area, located in a strategic position in Milan, by redeveloping an abandoned property. The renovation of the spaces was conducted and coordinated by Oxa. The activities, in turn, are required to pay a rent with rates that differ according to their income and the agreements with the company. Some pay a nominal rent (social rent), others pay a commercial rent that corresponds with market values, and most have a rent that is positioned in the middle of the two (partner rate). Thanks to these rents, Oxa s.r.l. was able to finance the work and to pursue a big business project which now has a reputation on a national scale.

On the contrary, the former Fadda area shows that similar processes—when located in a small town characterized by a weak social and human capital, with low real-estate-market prices and, consequently, with a depreciation rate of NPL tending to 100%—still represent the only economic solution feasible. Located in San Vito dei Normanni, the former Fadda area was a former oenological establishment which is now transformed into a creative and cultural lab entrusted to Sandei s.r.l in 2011 by the Pulia Region with a contract with bailment at no charge. The interventions on the property, while being in a discrete state of preservation, have been largely financed by Laboratories Urbani program (Euro 50,000), partly financed by Sandei and manufactured by local citizens through self-recovery. The administration’s mission in this case was primarily social: to create jobs, promote youth entrepreneurship, and regenerate an area. Users do not have to restructure spaces, and they only have the obligation to pay a symbolic monthly rent, which can vary from year to year depending on the success of the activity. The rent may also be in the form of professional performance. Revenues from rents amount to about €14,000 per year, which is not sufficient to cover annual management costs. For this reason, Something Different Onlus was founded; thanks to the revenues from its social restaurant, it contributes significantly to the total costs. In case these economic resources are not sufficient, additional subsidies are sometimes outsourced.

6. Conclusions

Bottom-up valuation processes create social and cultural benefits in the territory and for the local community. In addition to these, the present work aimed to estimate the purely financial benefits that similar initiatives generated in the enhanced real-estate assets.

The impossibility to know the future outcome of the activities and their natural variability imposed the use of an appraisal criterion that took into account the high degree of uncertainty of these systems. Monte Carlo simulation allowed the evaluation of the current value of Factory Grisù by measuring the uncertainty of exogenous variables—the number of companies, restructuring costs, and the renovated surface—by randomizing them with a large number of simulations. The final output was 2,625,000 Euros.

In addition to the positive externalities that the bottom-up processes produce at the social and cultural level, these experiences are also able to increase the value of the enhanced assets. From a null value, comparable to a NPL, the Consortium Grisù made significant restructuring interventions, revitalizing the former fire station and making it a nationally-known cultural incubator.

The situation of Factory Grisù can be considered representative of many Italian realities. Once the hope of selling the unused property to private investors was abandoned, the administration chose to donate the building to the community. At the same time, the administration continues to sell the property. Other experiences, such as the Ansaldo Base case, demonstrate how participatory processes can go further, realizing a costly real estate development operation. Such operations are rare and occur mainly in places where it is still economically advantageous to invest considerable resources in recovering such assets. Participation in this case is a useful expedient to repopulate and give a new identity to an abandoned place. Conversely, in locations with a low endowment of social capital and fragile economic conditions, the enhancement of public property through grassroots participation is the only way to recover the abandoned real-estate assets. Sometimes, the weak economy that characterizes these places makes the activities that set up the building rather fragile. For this reason, similar initiatives need to be stimulated and encouraged by the government through specific public policies and funding that will allow the initiation of these projects and their maintenance over time.

Further research will focus on various areas. From an estimation point of view, it could measure the actual value that the bottom-up processes generate based on the characteristics of the places and of the social capital. From an urban point of view, all the benefits that self-organized communities can bring to a territory can be evaluated.