An Analysis of the Influence of Property Tax on Housing Prices in the Apulia Region (Italy)

Abstract

:1. Introduction

2. Aim

3. Background

4. The Variables of the Model

- -

- the average unit housing price (Y), expressed in €/m2, that represents the dependent variable of the model;

- -

- the average unit housing rent (R), expressed in €/m2 per month;

- -

- the total property tax (T) collected in each municipality, expressed in €;

- -

- the taxable income per capita (I) in each municipality, expressed in Euro;

- -

- the number of cars (C) in circulation within the municipality;

- -

- the number of motorcycles (M) in circulation within the municipality;

- -

- the resident population (P), expressed as the number of inhabitants;

- -

- the average age (A) of the resident population, expressed in years;

5. The Method

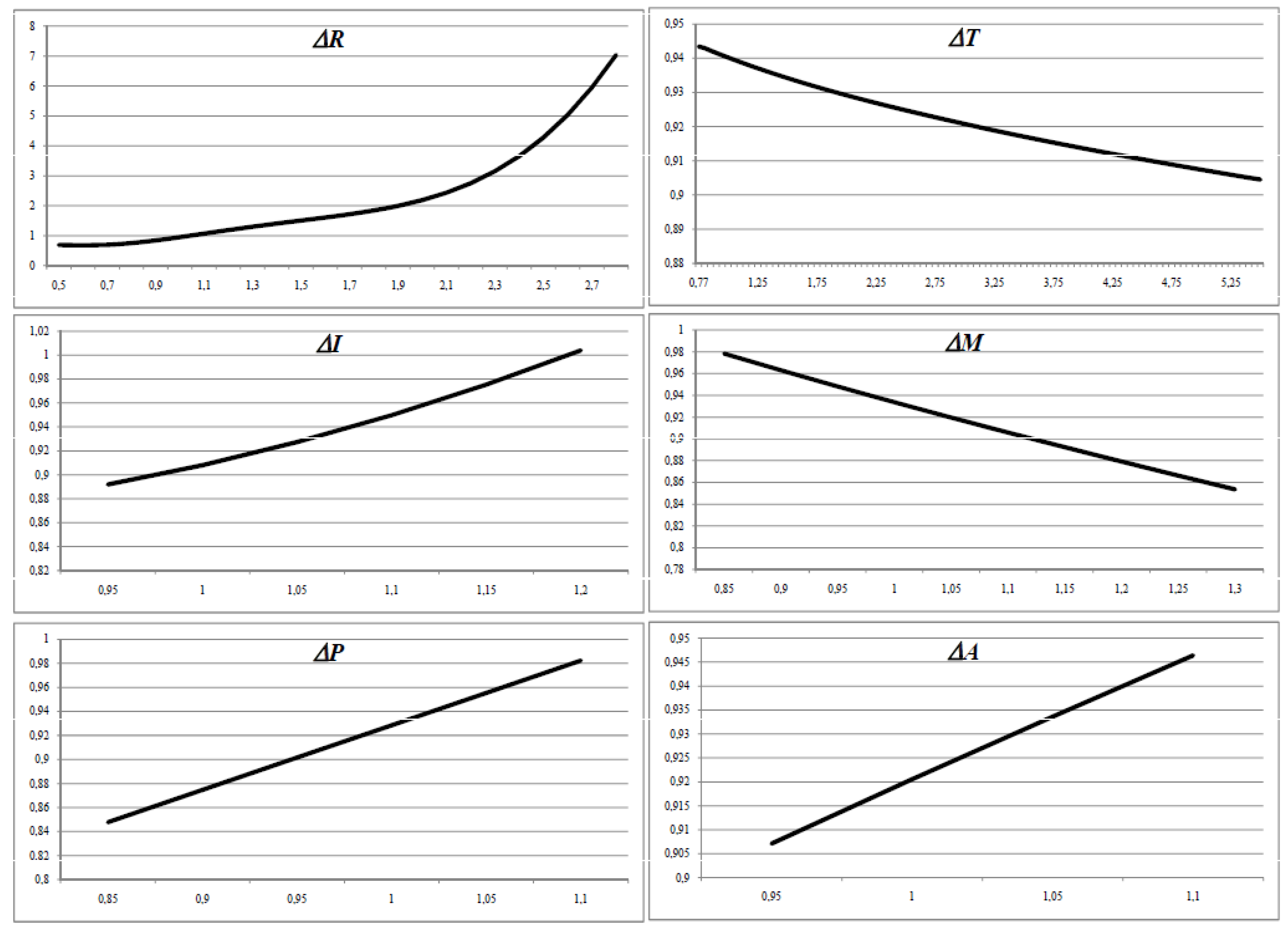

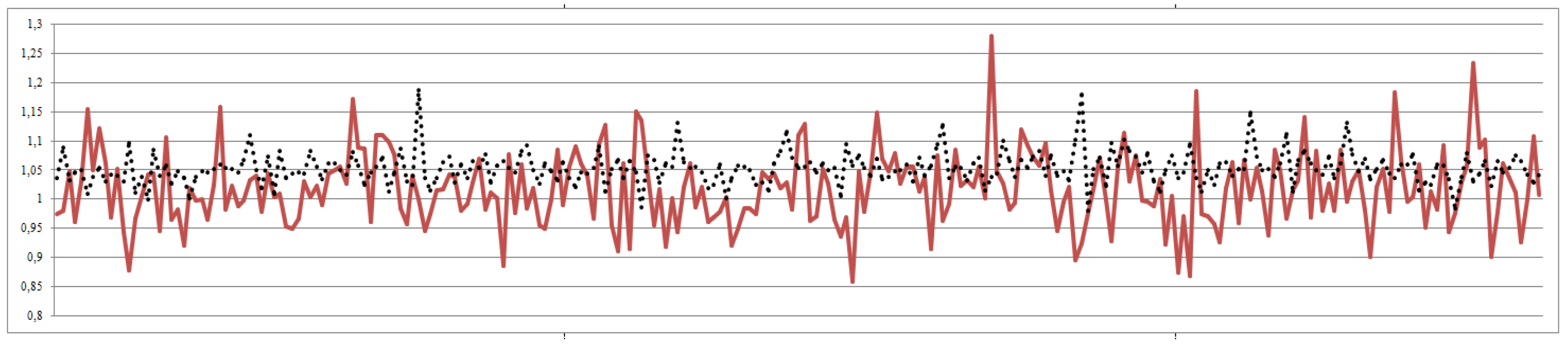

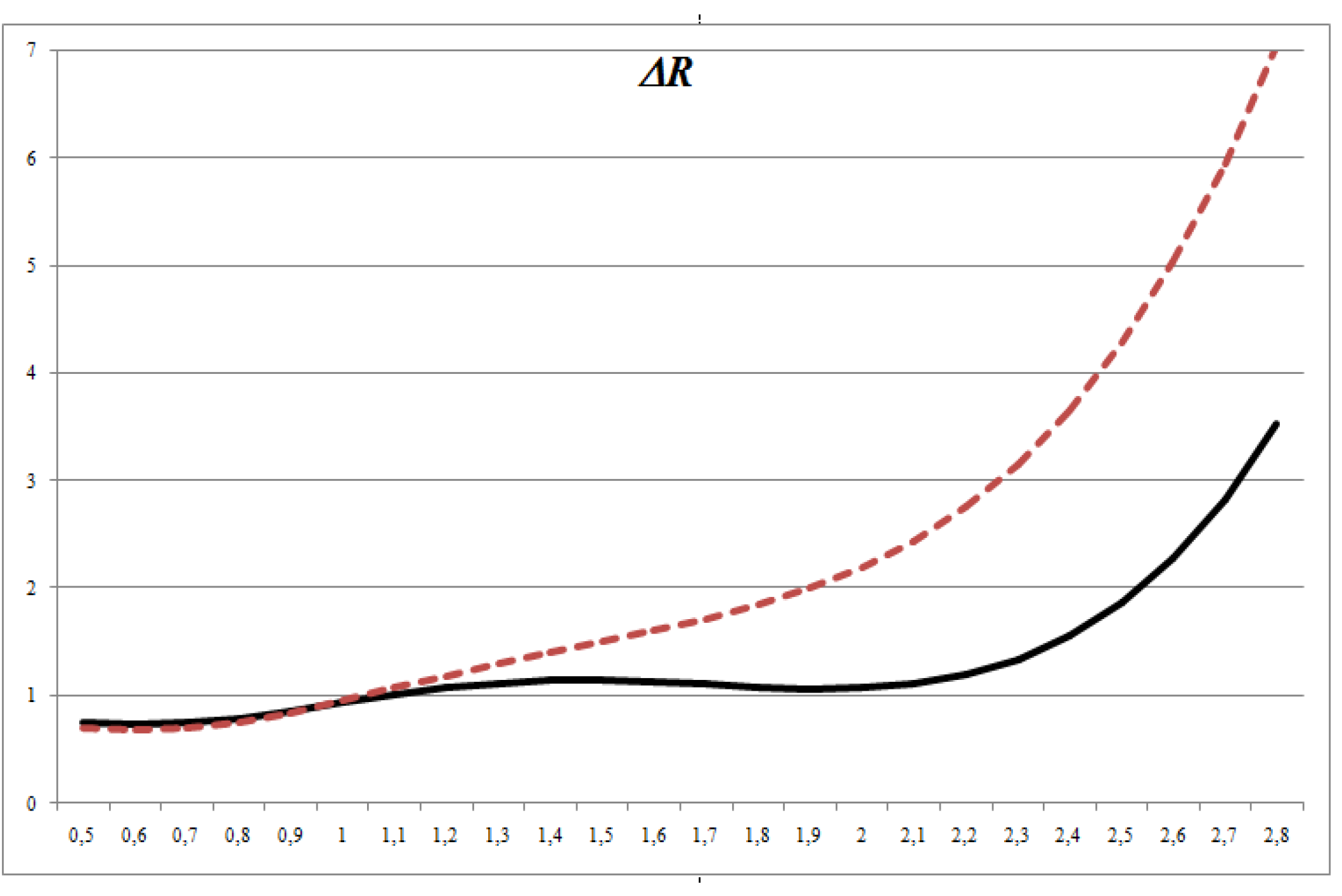

5.1. The Econometric Model Obtained

5.2. Interpretation of the Results

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Guarini, M.; Battisti, F. A model to assess the feasibility of public-private partnership for social housing. Buildings 2017, 7, 44. [Google Scholar] [CrossRef]

- ISTAT. Rapporto Annuale 2015. La Situazione Del Paese. 2016. Available online: http://www.istat.it (accessed on 1 May 2017).

- Impresa Lavoro Centro Studi. Available online: http://www.impresalavoro.org (accessed on 1 May 2017).

- Osservatorio Mercato Immobiliare e Servizi Estimativi dell’Agenzia delle Entrate e dal Dipartimento delle Finanze. La Tassazione Immobiliare: Un Confronto Internazionale; 2015. Available online: http://www.agenziaentrate.gov.it (accessed on 1 May 2017).

- Italian Revenue Agency. Available online: http://www.agenziaentrate.gov.it (accessed on 1 May 2017).

- D’Acci, L. Measuring well-being and progress. Soc. Indic. Res. 2011, 104, 47–65. [Google Scholar] [CrossRef]

- Beltratti, A.; Morana, C. International house prices and macroeconomic fluctuations. J. Bank. Financ. 2010, 34, 533–545. [Google Scholar] [CrossRef]

- Berg, L. Prices on the second-hand market for Swedish family houses: Correlation, causation and determinants. Eur. J. Hous. Policy 2002, 2, 1–24. [Google Scholar] [CrossRef]

- Capozza, D.R.; Hendershott, P.H.; Mack, C.; Mayer, C.J. Determinants of Real House Price Dynamics; NBER: Cambridge, MA, USA, 2002; p. 9262. [Google Scholar]

- Conner, P.; Liang, Y.J. Income and cap rate effects on property appreciation. J. Portf. Manag. 2005, 31, 70–79. [Google Scholar] [CrossRef]

- Rosato, P.; Giupponi, C.; Breil, M.; Fassio, A. Evaluation of urban improvement on the islands of the venice lagoon: A spatially-distributed hedonic-hierarchical approach. In Valuing Complex Natural Resource Systems: The Case of the Lagoon of Venice; FEE Mattei: Milan, Italy, 2006; pp. 75–98. [Google Scholar]

- Rosato, P.; Alberini, A.; Zanatta, V.; Breil, M. Redeveloping derelict and underused historic city areas: Evidence from a survey of real estate developers. J. Environ. Plan. Manag. 2010, 53, 257–281. [Google Scholar] [CrossRef]

- Semeraro, P.; Fregonara, E. The impact of house characteristics on the bargaining outcome. J. Eur. Real Estate Res. 2013, 6, 262–278. [Google Scholar] [CrossRef]

- Taltavull de La Paz, P.; Gabrielli, L. Housing supply and price reactions: A comparison approach to Spanish and Italian Markets. Hous. Stud. 2015, 30, 1036–1063. [Google Scholar] [CrossRef]

- Tsatsaronis, K.; Zhu, H. What Drives Housing Price Dynamics: Cross-Country Evidence. BIS Q. Rev. 2004, 65–78. [Google Scholar]

- Wheaton, W. Real estate cycles: Some fundamentals. Real Estate Econ. 1999, 27, 209–230. [Google Scholar] [CrossRef]

- Glaeser, E.L. Cities, Agglomeration and Spatial Equilibrium; Oxford University Press: Great Britain, UK, 2008. [Google Scholar]

- Taltavull de La Paz, P. Determinants of housing prices in Spanish cities. J. Prop. Invest. Financ. 2003, 21, 109–135. [Google Scholar] [CrossRef]

- Potepan, M.J. Explaining intermetropolitan variation in housing prices, rents and land prices. Real Estate Econ. 1996, 24, 219–245. [Google Scholar] [CrossRef]

- Gibler, K.M.; Tyvimaa, T.; Kananen, J. The relationship between the determinants of rental housing satisfaction and considering moving in Finland. Prop. Manag. 2014, 32, 104–124. [Google Scholar] [CrossRef]

- Kryvobokov, M. What location attributes are the most important for market value? Extraction of attributes from regression models. Prop. Manag. 2007, 25, 257–286. [Google Scholar]

- Bowes, D.R.; Ihlanfeldt, K.R. Identifying the impacts of rail transit stations on residential property values. J. Urban Econ. 2001, 50, 1–25. [Google Scholar] [CrossRef]

- Ding, C.; Simons, R.; Baku, E. The effect of residential investment on nearby property values: Evidence from Cleveland, Ohio. J. Real Estate Res. 2000, 19, 23–48. [Google Scholar]

- Glaeser, E.L.; Gyourko, J.; Saks, R.E. Why have housing prices gone up? Am. Econ. Rev. 2005, 95, 329–333. [Google Scholar] [CrossRef]

- Mikhed, V.; Zemčík, P. Do house prices reflect fundamentals? Aggregate and panel data evidence. J. Hous. Econ. 2009, 18, 140–149. [Google Scholar] [CrossRef]

- Ayuso, J.; Restoy, F. House prices and rents: An equilibrium asset pricing approach. J. Empir. Financ. 2006, 13, 371–388. [Google Scholar] [CrossRef]

- Manganelli, B.; Morano, P.; Tajani, F. House prices and rents. The Italian experience. WSEAS Trans. Bus. Econ. 2014, 11, 219–226. [Google Scholar]

- Sivitanides, P.; Southard, J.; Torto, R.; Wheaton, W. The Determinants of Appraisal Based Capitalization Rates. Real Estate Financ. 2001, 18, 27–38. [Google Scholar]

- Edelstein, R. The determinants of value in the Philadelphia housing market: A case study of the main line 1967–1969. Rev. Econ. Stat. 1974, 56, 319–328. [Google Scholar] [CrossRef]

- Orr, L.L. The incidence of differential property taxes on urban housing. Natl. Tax J. 1968, 21, 253–262. [Google Scholar]

- Rosen, H.S.; Fullerton, D.J. A note on local tax rates, public benefit levels, and property values. J. Political Econ. 1977, 85, 433–440. [Google Scholar] [CrossRef]

- Yinger, J.; Bloom, H.S.; Boersch-Supan, A. Property Taxes and House Values: The Theory and Estimation of Intrajurisdictional Property Tax Capitalization; Academic Press: San Diego, CA, USA, 2016. [Google Scholar]

- Wales, T.J.; Wiens, E.G. Capitalization of residential property taxes: An empirical study. Rev. Econ. Stat. 1974, 56, 329–333. [Google Scholar] [CrossRef]

- Brueckner, J.K.; Kim, H.A. Urban sprawl and the property tax. Int. Tax Public Financ. 2003, 10, 5–23. [Google Scholar] [CrossRef]

- Papke, L.E. Tax policy and urban development: Evidence from the Indiana enterprise zone program. J. Public Econ. 1994, 54, 37–49. [Google Scholar] [CrossRef]

- Polinsky, A.M.; Rubinfeld, D.L. The long-run effects of a residential property tax and local public services. J. Urban Econ. 1978, 5, 241–262. [Google Scholar] [CrossRef]

- Simon, H.A. The incidence of a tax on urban real property. Q. J. Econ. 1943, 57, 398–420. [Google Scholar] [CrossRef]

- Church, A.M. Capitalization of the effective property tax rate on single family residences. Natl. Tax J. 1974, 27, 113–122. [Google Scholar]

- Song, Y.; Zenou, Y. Property tax and urban sprawl: Theory and implications for US cities. J. Urban Econ. 2006, 60, 519–534. [Google Scholar] [CrossRef]

- Bartik, T.J. Business location decisions in the United States: Estimates of the effects of unionization, taxes, and other characteristics of states. J. Bus. Econ. Stat. 1985, 3, 14–22. [Google Scholar] [CrossRef]

- Schmenner, R.W. City Taxes and Industry Location. In Proceedings of the Annual Conference on Taxation Held under the Auspices of the National Tax Association-Tax Institute of America; National Tax Association: Washington, DC, USA, 1973; Volume 66, pp. 528–532. [Google Scholar]

- Hefferan, M.J.; Boyd, T. Property taxation and mass appraisal valuations in Australia—Adapting to a new environment. Prop. Manag. 2010, 28, 149–162. [Google Scholar] [CrossRef]

- Sirmans, S.; Gatzlaff, D.; Macpherson, D. The History of Property Tax Capitalization in Real Estate. J. Real Estate Lit. 2008, 16, 327–344. [Google Scholar]

- Meadows, G.R. Taxes, spending, and property values: A comment and further results. J. Political Econ. 1976, 84, 869–880. [Google Scholar] [CrossRef]

- Palmon, O.; Smith, B.A. A new approach for identifying the parameters of a tax capitalization model. J. Urban Econ. 1998, 44, 299–316. [Google Scholar] [CrossRef]

- Hyman, D.N.; Pasour, E.C., Jr. Property tax differentials and residential rents in North Carolina. Natl. Tax J. 1973, 26, 303–307. [Google Scholar]

- King, A.T. Estimating property tax capitalization: A critical comment. J. Political Econ. 1977, 85, 425–431. [Google Scholar] [CrossRef]

- Pollakowski, H.O. The effects of property taxes and local public spending on property values: A comment and further results. J. Political Econ. 1973, 81, 994–1003. [Google Scholar] [CrossRef]

- Lang, K.; Jian, T. Property taxes and property values: Evidence from Proposition 212. J. Urban Econ. 2004, 55, 439–457. [Google Scholar] [CrossRef]

- Oates, W.E. The effects of property taxes and local public spending on property values: An empirical study of tax capitalization and the Tiebout hypothesis. J. Political Econ. 1969, 77, 957–971. [Google Scholar] [CrossRef]

- Oates, W.E. The effects of property taxes and local public spending on property values: A reply and yet further results. J. Political Econ. 1973, 81, 1004–1008. [Google Scholar] [CrossRef]

- Italian Information System of the activities of Public Entities. Available online: http://www.siope.it (accessed on 1 May 2017).

- Elaboration of the Statistical Data Published for the Italian Municipalities. Available online: http://www.comuni-italiani.it (accessed on 1 May 2017).

- Giustolisi, O.; Savic, D. Advances in data-driven analyses and modelling using EPR-MOGA. J. Hydroinform. 2009, 11, 225–236. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F.; Locurcio, M. Land use, economic welfare and property values. An analysis of the interdependencies of the real estate market with zonal and socio-economic variables in the municipalities of the Region of Puglia (Italy). Int. J. Agric. Environ. Inf. Syst. 2015, 6, 16–39. [Google Scholar] [CrossRef]

- Tajani, F.; Morano, P.; Locurcio, M.; D’Addabbo, N. Property Valuations in Times of Crisis. Artificial neural Networks and Evolutionary Algorithms in Comparison. In Proceedings of the Annual Conference on Computational Science and Its Applications, LNCS; Springer International Publishing: Cham, Switzerland, 2015; Volume 9157 (part III), pp. 194–209. [Google Scholar]

- Tajani, F.; Morano, P.; Locurcio, M.; Torre, C.M. Data-driven techniques for mass appraisals. Applications to the residential market of the city of Bari (Italy). Int. J. Bus. Intell. Data Min. 2016, 11, 109–129. [Google Scholar] [CrossRef]

- Des Rosiers, F.; Lagana, A.; TheÂriault, M.; Beaudoin, M. Shopping centers and house values: An empirical investigation. J. Prop. Valuat. Invest. 1996, 14, 41–63. [Google Scholar] [CrossRef]

- Grieson, R.E.; White, J.R. The existence and capitalization of neighbourhood externalities: A reassessment. J. Urban Econ. 1989, 25, 68–76. [Google Scholar] [CrossRef]

- Guntermann, K.L.; Colwell, P.F. Property values and accessibility to primary schools. Real Estate Apprais. Anal. 1983, 49, 62–68. [Google Scholar]

- Hickman, E.P.; Gaines, J.P.; Ingram, F.J. The influence of neighbourhood quality on residential values. Real Estate Apprais. Anal. 1984, 50, 36–42. [Google Scholar]

- Waddell, P.; Berry, B.J.L.; Hoch, I. Residential property values in a multinodal urban area: New evidence on the implicit price of location. J. Real Estate Financ. Econ. 1993, 7, 117–141. [Google Scholar] [CrossRef]

- Walden, M. Magnet schools and the differential impact of school quality on residential property values. J. Real Estate Res. 1990, 5, 221–230. [Google Scholar]

- Banca D’italia. Available online: http://www.bancaditalia.it (accessed on 1 May 2017).

- Garnier, G.; Gyorgy, E.; Heineken, K.; Mathe’, M.; Puglisi, L.; Ruà, S.; Skonieczna, A.; Van Mierlo, A. A wind of change? Reforms of Tax Systems since the launch of Europe 2020. Reflets et Perspectives De La Vie Économique 2014, 53, 75–111. [Google Scholar] [CrossRef]

- Del Giudice, V.; De Paola, P.; Cantisani, G.B. Rough Set Theory for real estate appraisals: An application to Directional District of Naples. Buildings 2017, 7, 12. [Google Scholar] [CrossRef]

- Del Giudice, V.; De Paola, P.; Cantisani, G.B. Valuation of real estate investments through Fuzzy Logic. Buildings 2017, 7, 26. [Google Scholar] [CrossRef]

| Variable | Mean | Standard Deviation | Levels/Intervals | Frequence [%] |

|---|---|---|---|---|

| Housing price [€/m2] | 905.74 | 431.90 | <650 | 31.6 |

| 650–1200 | 49.0 | |||

| >1200 | 19.4 | |||

| Housing rent [€/m2 x month] | 3.27 | 1.46 | <2.5 | 44.5 |

| 2.5–4.0 | 29.6 | |||

| >4 | 25.9 | |||

| Property tax [€] | 2,030,187.14 | 4,686,525.46 | <500,000 | 35.2 |

| 500,000–1,000,000 | 21.5 | |||

| >1,000,000 | 43.3 | |||

| Income [€] | 13,648.52 | 1991.99 | <13,000 | 38.4 |

| 13,000–15,000 | 38.0 | |||

| >15,000 | 23.6 | |||

| Number of cars [n.] | 9112.43 | 16,577.21 | <2500 | 28.3 |

| 2500–7500 | 36.9 | |||

| >7500 | 34.8 | |||

| Number of motorcycles [n.] | 1170.33 | 2728.30 | <500 | 47.4 |

| 500–1500 | 37.2 | |||

| >1500 | 15.4 | |||

| Population [n.] | 16,105.56 | 29,013.90 | <5000 | 31.2 |

| 5,000–50,000 | 62.7 | |||

| >50,000 | 6.1 | |||

| Age [years] | 42.51 | 2.52 | <41 | 27.9 |

| 41–44 | 48.6 | |||

| >44 | 23.5 |

| Variable | Mean | Standard Deviation | Levels/Intervals | Frequence [%] |

|---|---|---|---|---|

| Housing price [€/m2] | 830.49 | 392.06 | <650 | 49.0 |

| 650–1200 | 34.4 | |||

| >1200 | 16.6 | |||

| Housing rent [€/m2 x month] | 3.18 | 1.51 | <2.5 | 49.4 |

| 2.5–4.0 | 28.3 | |||

| >4 | 22.3 | |||

| Property tax [€] | 4,168,374.97 | 9,424,887.46 | <500,000 | 19.8 |

| 500,000–1,000,000 | 16.2 | |||

| >1,000,000 | 64.0 | |||

| Income [€] | 14,356.11 | 2003.60 | <13,000 | 23.0 |

| 13,000–15,000 | 42.2 | |||

| >15,000 | 34.8 | |||

| Number of cars [n.] | 9001.41 | 16,092.92 | <2500 | 28.3 |

| 2500–7500 | 36.4 | |||

| >7500 | 35.3 | |||

| Number of motorcycles [n.] | 1160.10 | 2618.40 | <500 | 45.7 |

| 500–1500 | 38.9 | |||

| >1500 | 15.4 | |||

| Population [n.] | 16,267.38 | 29,770.14 | <5000 | 31.2 |

| 5000–50,000 | 62.7 | |||

| >50,000 | 6.1 | |||

| Age [years] | 43.83 | 2.42 | <41 | 11.3 |

| 41–44 | 43.3 | |||

| >44 | 45.4 |

| Variable | Mean | Standard Deviation | Levels/Intervals | Frequence [%] |

|---|---|---|---|---|

| ΔY [€/m2] | 0.92 | 0.18 | <0.9 | 42.0 |

| 0.9–1.0 | 30.0 | |||

| >1.0 | 28.0 | |||

| ΔR [€/m2 per month] | 0.97 | 0.20 | <0.9 | 28.0 |

| 0.9–1.0 | 26.0 | |||

| >1.0 | 46.0 | |||

| ΔT [€] | 2.05 | 0.74 | <1.6 | 27.0 |

| 1.6–2.2 | 40.0 | |||

| >2.2 | 33.0 | |||

| ΔI [€] | 1.05 | 0.02 | <1.04 | 30.0 |

| 1.04–1.06 | 36.0 | |||

| >1.06 | 34.0 | |||

| ΔC [n.] | 0.99 | 0.02 | <0.98 | 24.0 |

| 0.98–1.00 | 35.0 | |||

| >1.00 | 41.0 | |||

| ΔM [n.] | 0.99 | 0.06 | <0.98 | 29.0 |

| 0.98–1.00 | 43.0 | |||

| >1.00 | 28.0 | |||

| ΔP [n.] | 1.01 | 0.02 | <0.99 | 32.0 |

| 0.99–1.01 | 40.0 | |||

| >1.01 | 28.0 | |||

| ΔA [years] | 1.03 | 0.01 | <1.03 | 44.0 |

| 1.03–1.04 | 39.0 | |||

| >1.04 | 17.0 |

| Variable | ΔR | ΔT | ΔI | ΔC | ΔM | ΔP | ΔA |

|---|---|---|---|---|---|---|---|

| ΔR | 1 | −0.005 | 0.059 | −0.033 | −0.051 | 0.004 | 0.005 |

| ΔT | −0.005 | 1 | 0.061 | −0.062 | 0.031 | −0.087 | −0.112 |

| ΔI | 0.059 | 0.061 | 1 | 0.040 | −0.080 | −0.114 | −0.101 |

| ΔC | −0.033 | −0.062 | 0.040 | 1 | 0.127 | 0.131 | 0.118 |

| ΔM | −0.051 | 0.031 | −0.080 | 0.127 | 1 | 0.062 | −0.025 |

| ΔP | 0.004 | −0.087 | −0.114 | 0.131 | 0.062 | 1 | −0.035 |

| ΔA | 0.005 | −0.112 | −0.101 | 0.118 | −0.025 | −0.035 | 1 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tajani, F.; Morano, P.; Torre, C.M.; Di Liddo, F. An Analysis of the Influence of Property Tax on Housing Prices in the Apulia Region (Italy). Buildings 2017, 7, 67. https://doi.org/10.3390/buildings7030067

Tajani F, Morano P, Torre CM, Di Liddo F. An Analysis of the Influence of Property Tax on Housing Prices in the Apulia Region (Italy). Buildings. 2017; 7(3):67. https://doi.org/10.3390/buildings7030067

Chicago/Turabian StyleTajani, Francesco, Pierluigi Morano, Carmelo Maria Torre, and Felicia Di Liddo. 2017. "An Analysis of the Influence of Property Tax on Housing Prices in the Apulia Region (Italy)" Buildings 7, no. 3: 67. https://doi.org/10.3390/buildings7030067