Confirmatory Factor Analysis of Assets That Influence Informal Garment Workers’ Livelihood Security in Laos

Abstract

:1. Introduction

2. Literature and Hypothesis Development

2.1. Household Characteristics

2.2. Social Assets

2.3. Financial Assets

2.4. Livelihood Security as Wellbeing

2.5. Study Hypothesis

3. Methods

3.1. Data Collection

3.2. Sample Size

3.3. Measurement

3.4. Statistical Analysis

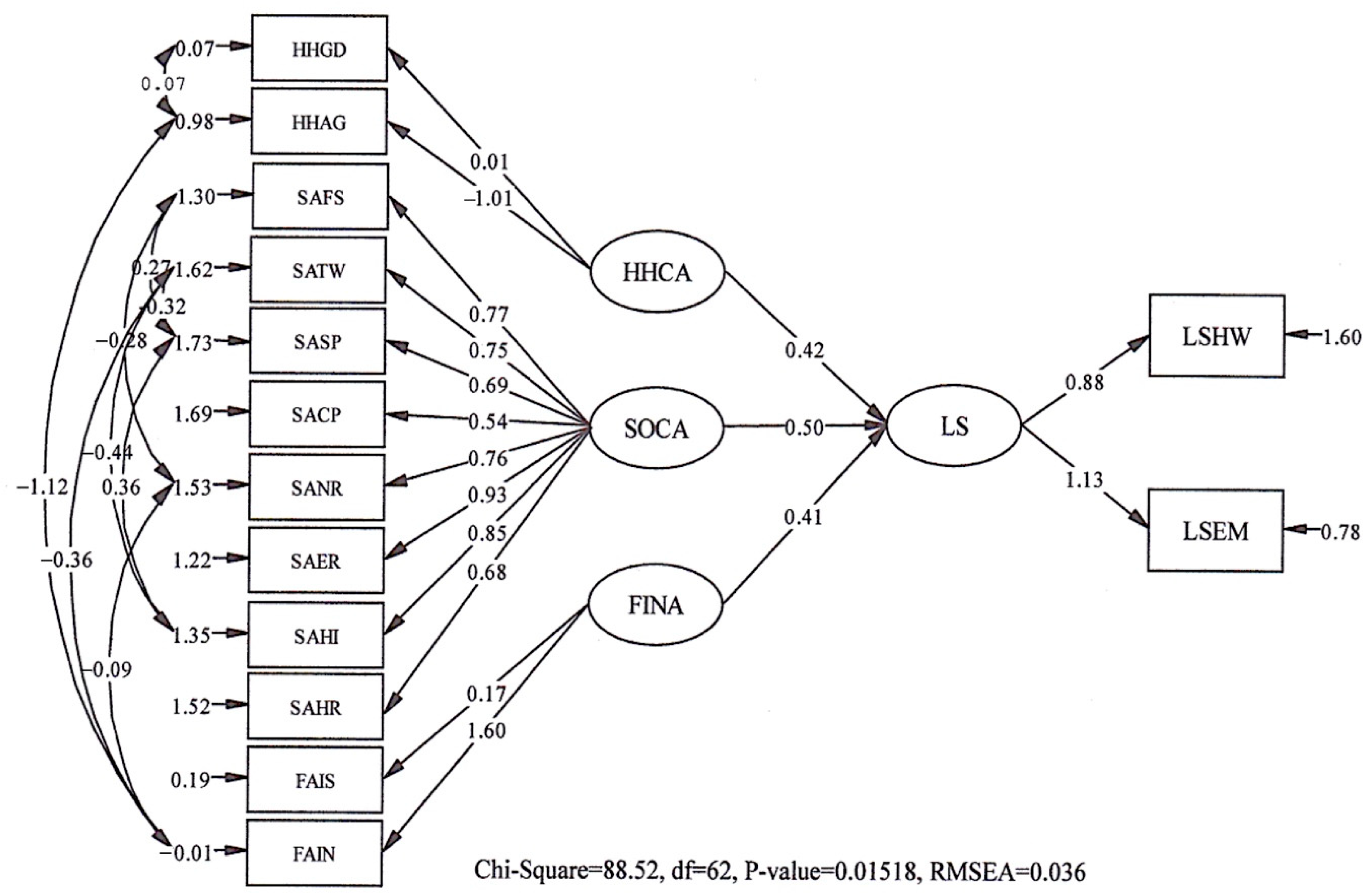

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- John, R.B. End of the beginning: Economic reform in Cambodia, Laos, and Vietnam. Contemp. Southeast Asia 1997, 19, 172–189. [Google Scholar] [CrossRef]

- Carment, D.; Landry, J.; Samy, Y.; Shaw, S. Towards a theory of fragile state transitions: Evidence from Yemen, Bangladesh and Laos. Third World Q. 2015, 36, 1316–1332. [Google Scholar] [CrossRef]

- Sondergaard, L.M. Lao Development Report; World Bank Group: Washington, DC, USA, 2014. [Google Scholar]

- National Human Development Report. Employment and Livelihoods Lao PDR; Ministry of Planning and Investment and UNDP Lao PDR: Vientiane, Laos, 2009; Available online: http://hdr.undp.org/sites/default/files/lao_nhdr_2009_en.pdf (accessed on 17 May 2018).

- Phouxay, K.; Tollefsen, A. Rural–urban migration, economic transition, and status of female industrial workers in Lao PDR. Popul. Space Place 2011, 17, 421–434. [Google Scholar] [CrossRef]

- Lao Statistics Bureau. Lao Population and Housing Census. 2015. Available online: http://lao.unfpa.org/sites/default/files/pub-pdf/Final%20report-editting-English1.pdf (accessed on 17 May 2018).

- Bourdet, Y. The dynamics of regional disparities in Laos: The poor and the rich. Asian Surv. 1998, 38, 629–652. [Google Scholar] [CrossRef]

- Dickerson, A.; Green, F. Fears and realisations of employment insecurity. Labour Econ. 2012, 19, 98–210. [Google Scholar] [CrossRef]

- Devereux, S. Livelihood insecurity and social protection: A re-emerging issue in rural development. Dev. Policy Rev. 2001, 19, 507–519. [Google Scholar] [CrossRef]

- Rahman, H.M.T.; Robinson, B.E.; Ford, J.D.; Hickey, G.M. How do capital asset interactions affect livelihood sensitivity to climatic stresses? Insights from the Northeastern floodplains of Bangladesh. Ecol. Econ. 2018, 150, 165–176. [Google Scholar] [CrossRef]

- Rakodi, C. A capital assets framework for analysing household livelihood strategies: Implications for policy. Dev. Policy Rev. 1999, 17, 315–342. [Google Scholar] [CrossRef]

- Singh, P.K.; Hiremath, B.N. Sustainable livelihood security index in a developing country: A tool for development planning. Ecol. Indic. 2010, 10, 442–451. [Google Scholar] [CrossRef]

- Fang, Y.; Fan, J.; Shen, M.; Song, M. Sensitivity of livelihood strategy to livelihood capital in mountain areas: Empirical analysis based on different settlements in the upper reaches of the Minjiang River, China. Ecol. Indic. 2014, 38, 225–235. [Google Scholar] [CrossRef]

- Hua, X.; Yan, J.; Zhang, Y. Evaluating the role of livelihood assets in suitable livelihood strategies: Protocol for anti-poverty policy in the Eastern Tibetan Plateau, China. Ecol. Indic. 2017, 78, 62–74. [Google Scholar] [CrossRef]

- You, H.; Zhang, X. Sustainable livelihoods and rural sustainability in China: Ecologically secure, economically efficient or socially equitable? Resour. Conserv. Recycl. 2017, 120, 1–13. [Google Scholar] [CrossRef]

- Arun, S.; Arun, T.; Devi, U. Transforming livelihoods and assets through participatory approaches: The Kudumbashree in Kerala, India. Int. J. Public Adm. 2011, 34, 171–179. [Google Scholar] [CrossRef]

- Kawaguchi, D. Human capital accumulation of salaried and self-employed workers. Labour Econ. 2003, 10, 55–71. [Google Scholar] [CrossRef] [Green Version]

- Print, M.; Coleman, D. Towards Understanding of Social Capital and Citizenship Education. Camb. J. Educ. 2003, 33, 123–149. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. The role of social capital in financial development. Am. Econ. Rev. 2004, 94, 526–556. [Google Scholar] [CrossRef]

- Emerson, J. The blended value proposition: Integrating social and financial returns. Calif. Manag. Rev. 2003, 45, 35–51. [Google Scholar] [CrossRef]

- Amanda, K.; Williams, N.; Thomas, M.; Hill, E.L. Self-reported mood, general health, wellbeing and employment status in adult with suspected DCD. Res. Dev. Dis. 2013, 34, 1357–1364. [Google Scholar] [CrossRef]

- Creed, P.A.; Watson, T. Age, gender, psychological wellbeing and the impact of losing the latent and manifest benefits of employment in unemployed people. Aust. J. Psychol. 2003, 55, 95–103. [Google Scholar] [CrossRef]

- Bardasi, E.; Francesconi, M. The impact of atypical employment on individual wellbeing: Evidence from a panel of British workers. Soc. Sci. Med. 2004, 58, 1671–1688. [Google Scholar] [CrossRef]

- Borrella, C.; Muntanerb, C.; Benachc, J.; Artazcoza, L. Social class and self-reported health status among men and women: What is the role of work organisation, household material standards and household labour? Soc. Sci. Med. 2004, 58, 1869–1887. [Google Scholar] [CrossRef]

- Montgomery, M.R.; Gragnolati, M.; Burke, K.A.; Paredes, E. Measuring living standards with proxy variables. Demography 2000, 37, 155–174. [Google Scholar] [CrossRef] [PubMed]

- Zhang, A.C.; Fang, J.; Jacobsen, B.; Marshall, B.R. Peer effects, personal characteristics and asset allocation. J. Bank Financ. 2018, 90, 76–95. [Google Scholar] [CrossRef]

- Guenard, C.; Mesple-Somps, S. Measuring inequalities: Do household surveys paint a realistic picture? Rev. Income Wealth 2010, 56, 519–538. [Google Scholar] [CrossRef]

- Yohanis, Y.G.; Mondol, J.D.; Wright, A.; Norton, B. Real-life energy use in the UK: How occupancy and dwelling characteristics affect domestic electricity use. Energy Build. 2008, 40, 1053–10591. [Google Scholar] [CrossRef]

- Lang, T.; Ramírez, R. Building new social capital with scenario planning. Technol. Forecast. Soc. Chang. 2007, 124, 51–65. [Google Scholar] [CrossRef]

- Gerhard, P.; Gladstone, J.J.; Hoffmann, A.O.I. Psychological characteristics and household savings behavior: The importance of accounting for latent heterogeneity. J. Econ. Behav. Organ. 2018, 148, 66–82. [Google Scholar] [CrossRef]

- Kleinjans, K.J. The man of the house—How the use of household head characteristics may lead to omitted variable bias. Econ. Lett. 2013, 119, 133–135. [Google Scholar] [CrossRef]

- Portes, A. The two meanings of social capital. Sociol. Forum 2000, 15, 1–12. [Google Scholar] [CrossRef]

- Granberry, P.J.; Torres, M.I. Social capital accumulation among Puerto Rican mothers in urban neighborhoods. Societies 2017, 7, 1–12. [Google Scholar] [CrossRef]

- Uzzi, B. The sources and consequences of embeddedness for the economic performance of organizations: The network effect. Am. Soc. Rev. 1996, 61, 674–698. [Google Scholar] [CrossRef]

- Crudelia, L. Social capital and economic opportunities. J. Socio-Econ. 2006, 35, 913–927. [Google Scholar] [CrossRef]

- Brisson, D.S.; Usher, C.L. Bonding social capital in low-income neighborhoods. Fam. Relat. 2005, 54, 644–653. [Google Scholar] [CrossRef]

- Woolcock, W.; Narayan, D. Social capital: Implications for development theory, research, and policy. World Bank Res. Obs. 2000, 15, 225–249. [Google Scholar] [CrossRef]

- Villalonga-Olive, E.; Kawachi, I. The measurement of social capital. Gac. Sanit. 2015, 29, 62–64. [Google Scholar] [CrossRef] [PubMed]

- Leventhal, K.S.; Gillham, J.; DeMaria, L.; Andrew, G.; Peabody, J.; Leventhal, S. Building psychosocial assets and wellbeing among adolescent girls: A randomized controlled trial. J. Adolesc. 2015, 45, 284–295. [Google Scholar] [CrossRef] [PubMed]

- Winters, P.; David, B.; Carletto, G.; Covarrubias, K.; Quiñones, E.J.; Zezza, A.; Azzarri, C.; Stamoulis, K. Assets, activities and rural income generation: Evidence from a Multicountry Analysis. World Dev. 2009, 37, 1435–1452. [Google Scholar] [CrossRef]

- Ribeiro, R.S.M.; Palludeto, A.W.A. A neo-Kaleckian model of capital accumulation, income distribution and financial fragility. EconomiA 2016, 17, 279–290. [Google Scholar] [CrossRef]

- Bruno, G.; Bonis, R.D.; Silvestrini, A. Do financial systems converge? New evidence from financial assets in OECD countries. J. Comp. Econ. 2012, 40, 141–155. [Google Scholar] [CrossRef]

- Kaewanuchit, C. A cross-sectional study on occupational stress of using Thai-JCQ among Thai immigrant employees in Bangkok: A path diagram. Pertan. J. Soc. Sci. Hum. 2017, 25, 189–204. [Google Scholar]

- Chi, W. Capital income and income inequality: Evidence from urban China. J. Comp. Econ. 2012, 40, 228–239. [Google Scholar] [CrossRef] [Green Version]

- Morales, M.C.; Morales, O.; Menchaca, A.C.; Sebastian, A. The Mexican drug war and the consequent population Exodus: Transnational movement at the U.S.-Mexican border. Societies 2013, 3, 80–103. [Google Scholar] [CrossRef]

- Stikeleather, B.R. When do employers benefit from offering workers a financial reward for reporting internal misconduct? Acc. Org. Soc. 2016, 52, 1–14. [Google Scholar] [CrossRef]

- Erbaugh, J.T.; Oldekop, J.A. Forest landscape restoration for livelihoods and well-being. Curr. Opin. Environ. Sustain. 2018, 32, 76–83. [Google Scholar] [CrossRef]

- Gautam, Y.; Andersen, P. Rural livelihood diversification and household well-being: Insights from Humla, Nepal. J. Rural Stud. 2016, 44, 239–249. [Google Scholar] [CrossRef]

- Rupasingha, A.; Goetz, S.; Freshwater, D. The production of social capital in US counties. J. Socio-Econ. 2006, 35, 83–101. [Google Scholar] [CrossRef]

- Promphakping, B. Weil-being of returning migrants in the rural northeast of Thailand: Process oriented methodology. Hist. Soc. Res. 2017, 42, 289–305. [Google Scholar] [CrossRef]

- Lubiano, M.A.; Salas, A.; Carleos, C.; Sáa, S.R.; Gil, M.A. Hypothesis testing-based comparative analysis between rating scales for intrinsically imprecise data. Int. J. Approx. Reason. 2017, 88, 128–147. [Google Scholar] [CrossRef]

- Boag, S. Personality assessment, ‘construct validity’, and the significance of theory. Pers. Indiv. Differ. 2015, 84, 36–44. [Google Scholar] [CrossRef]

- Mels, G. LISREL for Windows: Getting Started Guide; Scientific Software International, Inc.: Lincolnwood, IL, USA, 2006. [Google Scholar]

- Bentler, P.M. Comparative fit indexes in structural models. Psychol. Bull. 1990, 107, 238–246. [Google Scholar] [CrossRef] [PubMed]

- Pesaran, M.H.; Smith, R.J. A generalized R2 criterion for regression models estimated by the instrumental variables method. Econometrica 1994, 62, 705–710. [Google Scholar] [CrossRef]

- Pham, T.; Talavera, O. Discrimination, social capital, and financial constraints: The case of Viet Nam. World Dev. 2018, 102, 228–242. [Google Scholar] [CrossRef]

- Schinckus, C. Financial innovation as a potential force for a positive social change: The challenging future of social impact bonds. Res. Int. Bus. Financ. 2017, 39, 727–736. [Google Scholar] [CrossRef]

- Kaye, L.K.; Kowert, R.; Quinn, S. The role of social identity and online social capital on psychosocial outcomes in MMO players. Comput. Hum. Behav. 2017, 74, 215–222. [Google Scholar] [CrossRef]

- Xue, J.; Gao, W.; Guo, L. Informal employment and its effect on the income distribution in urban China. China Econ. Rev. 2014, 31, 84–93. [Google Scholar] [CrossRef]

- Teng, L.S.; Jayasingam, S.; Zain, K.N.M. Debunking the myth of money as motivator in a multigenerational workforce. Pertanika J. Soc. Sci. Hum. 2018, 26, 29–148. [Google Scholar]

- Cegarra-Navarro, J.; Reverte, C.; Gomez-Melero, E.; Wensley, A.K.P. Linking social and economic responsibilities with financial performance: The role of innovation. Eur. Manag. J. 2016, 34, 530–539. [Google Scholar] [CrossRef]

- Mokhtar, N.; Husniyah, A.R. Determinants of financial well-being among public employees in Putrajaya, Malaysia. Pertanika J. Soc. Sci. Hum. 2017, 25, 1241–1260. [Google Scholar]

- Lei, J.; Qiu, J.; Wan, C. Asset tangibility, cash holdings, and financial development. J. Corp. Financ. 2018, 50, 223–242. [Google Scholar] [CrossRef]

- Holtkamp, C.R.; Weaver, R.G. Quantifying the relationship between social capital and economic conditions in Appalachia. Appl. Geogr. 2018, 90, 175–186. [Google Scholar] [CrossRef]

- Binder, J.F.; Sutcliffe, A.G. The best of both worlds? Online ties and the alternating use of social network sites in the context of migration. Societies 2014, 4, 753–769. [Google Scholar] [CrossRef]

- Myroniuk, T.W.; Vearey, J. Social capital and livelihoods in Johannesburg: Differential advantages and unexpected outcomes among foreign-born migrants, internal migrants, and long-term South African residents. Int. Migr. Rev. 2014, 48, 243–273. [Google Scholar] [CrossRef]

- Yaméogo, T.B.; Fonta, W.M.; Wünscher, T. Can social capital influence smallholder farmers’ climate-change adaptation secisions? Evidence from three semi-arid communities in Burkina Faso, West Africa. Soc. Sci. 2018, 7, 1–20. [Google Scholar] [CrossRef]

- Bebbington, A.; Perreault, T. Social capital, development, and access to resources in highland Ecuador. Econ. Geogr. 1999, 75, 395–418. [Google Scholar] [CrossRef]

- Lyons, M.; Snoxell, S. Sustainable Urban Livelihoods and Marketplace Social Capital: Crisis and Strategy in Petty Trade. Urban Stud. 2005, 42, 1301–1320. [Google Scholar] [CrossRef]

- Lyon, F. Trust, networks and norms: The creation of social capital in agricultural economies in Ghana. World Dev. 2000, 28, 663–681. [Google Scholar] [CrossRef]

- Brown, S.; Taylor, K. Household debt and financial assets: Evidence from Germany, Great Britain and the USA. J. R. Stat. Soc. Ser. A 2008, 171, 615–643. [Google Scholar] [CrossRef]

- Daovisan, H.; Promphakping, B.; Chamaratana, T. Selling labour-domain livelihood assets: A qualitative approach to non-subcontracting home-based garment workers in the Lao PDR. Kasetsart J. Soc. Sci. 2018, 1–7. [Google Scholar] [CrossRef]

- Dunn, T.; Holtz-Eakin, D. Financial capital, human capital, and the transition to self-employment: Evidence from intergenerational links. J. Labor Econ. 2000, 18, 282–305. [Google Scholar] [CrossRef]

- Erenstein, O.; Hellin, J.; Chandna, P. Poverty mapping based on livelihood assets: A meso-level application in the Indo-Gangetic Plains, India. Appl. Geogr. 2010, 30, 112–125. [Google Scholar] [CrossRef]

- McLean, J.E. Beyond the pentagon prison of sustainable livelihood approaches and towards livelihood trajectories approaches. Asia Pac. Viewp. 2015, 56, 380–391. [Google Scholar] [CrossRef]

- Scoones, I. Livelihoods perspectives and rural development. J. Peasant Stud. 2009, 36, 171–196. [Google Scholar] [CrossRef] [Green Version]

- Becker, G.S. Investment in human capital: A theoretical analysis. J. Polit. Econ. 1962, 70, 9–49. [Google Scholar] [CrossRef]

- Costanza, R.; Daly, H.E. Natural capital and sustainable development. Conserv. Biol. 1992, 6, 37–46. [Google Scholar] [CrossRef]

- Su, F.; Shang, H.Y. Relationship analysis between livelihood assets and livelihood strategies: A Heihe river basin example. Sci. Cold Arid Reg. 2012, 4, 0265–0274. [Google Scholar] [CrossRef]

- Barua, A.; Katyaini, S.; Mili, B.; Gooch, P. Climate change and poverty: Building resilience of rural mountain communities in South Sikkim, Eastern Himalaya, India. Reg. Environ. Chang. 2014, 14, 267–280. [Google Scholar] [CrossRef]

| Index | Acceptable Values | Initial Model | Fitness Model | ||

|---|---|---|---|---|---|

| Value | Acceptability | Value | Acceptability | ||

| χ2 | χ2/df < 5.00 | 71 | – | 62 | + |

| NFI | >0.90 | 0.809 | – | 0.950 | + |

| CFI | >0.90 | 0.873 | – | 0.968 | + |

| GFI | >0.90 | 0.928 | – | 0.969 | + |

| AGFI | >0.90 | 0.894 | – | 0.947 | + |

| SRMR | <0.08 | 0.0807 | – | 0.0422 | + |

| RMSEA | <0.05 | 0.0673 | Mis | 0.0358 | + |

| Factor | Variable | Mean | Std. Dev. | Min | Max | N |

|---|---|---|---|---|---|---|

| 1 | 1 | 0.081 | 0.273 | 0.000 | 1.000 | 333 |

| 2 | 2.997 | 1.424 | 1.000 | 5.000 | 333 | |

| 2 | 3 | 2.892 | 1.378 | 1.000 | 5.000 | 333 |

| 4 | 2.991 | 1.432 | 1.000 | 5.000 | 333 | |

| 5 | 3.009 | 1.409 | 1.000 | 5.000 | 333 | |

| 6 | 2.925 | 1.480 | 1.000 | 5.000 | 333 | |

| 7 | 3.135 | 1.402 | 1.000 | 5.000 | 333 | |

| 8 | 2.904 | 1.449 | 1.000 | 5.000 | 333 | |

| 9 | 3.039 | 1.471 | 1.000 | 5.000 | 333 | |

| 10 | 3.105 | 1.443 | 1.000 | 5.000 | 333 | |

| 3 | 11 | 3.312 | 1.423 | 1.000 | 5.000 | 333 |

| 12 | 3.081 | 1.423 | 1.000 | 5.000 | 333 | |

| 4 | 13 | 3.492 | 1.530 | 1.000 | 5.000 | 333 |

| 14 | 3.492 | 1.420 | 1.000 | 5.000 | 333 |

| Factor | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| 1 | 1.000 | |||

| 2 | 0.297 ** | 1.000 | ||

| 3 | 0.829 ** | 0.486 ** | 1.000 | |

| 4 | 0.198 ** | −0.880 | 0.311 ** | 1.000 |

| Factor | 1 | 2 | 3 |

|---|---|---|---|

| 1 | 0.371 | 0.436 | 0.365 |

| (0.047) | (0.054) | (0.044) | |

| 7.968 | 8.069 | 8.255 | |

| 2 | 0.475 | 0.559 | 0.468 |

| (0.066) | (0.064) | (0.062) | |

| 7.167 | 8.695 | 7.606 |

| Factor | Variable | β | SS | t-Value | p |

|---|---|---|---|---|---|

| 1 | 1 | 0.014 | 0.051 | 0.89 | ** |

| 2 | −1.014 | −0.715 | −17.25 | ||

| 2 | 3 | 0.770 | 0.560 | 13.83 | ** |

| 4 | 0.753 | 0.509 | 14.62 | ** | |

| 5 | 0.690 | 0.465 | 11.34 | ** | |

| 6 | 0.544 | 0.386 | 11.68 | ** | |

| 7 | 0.758 | 0.523 | 9.52 | ** | |

| 8 | 0.931 | 0.644 | 13.33 | ** | |

| 9 | 0.847 | 0.589 | 12.22 | ** | |

| 10 | 0.677 | 0.481 | 16.09 | ** | |

| 3 | 11 | 0.169 | 0.366 | 7.14 | ** |

| 12 | 1.596 | 1.001 | 8.89 | ** | |

| 4 | 13 | 0.884 | 0.564 | 14.55 | ** |

| 14 | 1.134 | 0.782 | 18.54 | ** |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Daovisan, H.; Chamaratana, T. Confirmatory Factor Analysis of Assets That Influence Informal Garment Workers’ Livelihood Security in Laos. Societies 2018, 8, 45. https://doi.org/10.3390/soc8030045

Daovisan H, Chamaratana T. Confirmatory Factor Analysis of Assets That Influence Informal Garment Workers’ Livelihood Security in Laos. Societies. 2018; 8(3):45. https://doi.org/10.3390/soc8030045

Chicago/Turabian StyleDaovisan, Hanvedes, and Thanapauge Chamaratana. 2018. "Confirmatory Factor Analysis of Assets That Influence Informal Garment Workers’ Livelihood Security in Laos" Societies 8, no. 3: 45. https://doi.org/10.3390/soc8030045