1. Background

The measurement of operational efficiency of public services provision and the identification of optimal operational and business models have become major concerns of policy-makers and scholars over the last twenty years. These issues are particularly relevant in the water supply, sewerage and wastewater treatment industry because of its large size and the amount of financial resources involved [

1]. In Italy, for instance, the annual turnover of the water service industry in 2009 was about €6.5 billion, for about 5.5 billion cubic meters of water distributed, while according to some estimates, the water service supply industry will need about €65 billion of investment in the next thirty years, most of which will be needed to keep the operating infrastructure efficient. The infrastructure obsolescence and the scarce amount of network recovery work done in the past mean that the public sector has to allocate in the future budgeting plans a great amount of financial resources to deal with unplanned maintenance of the water service supply assets. It is clear that, in this context in which the necessary investment is greater than the available public resources, and the regulatory framework is extremely articulated and still evolving, it is important to stimulate and support the entrance into the water service supply industry of private actors, adopting new participative models more oriented to competition and the market. In terms of production technology, the provision of drinking water is dependent on a distribution infrastructure, the construction and maintenance of which represent the major costs, and all relevant stages of the service value chain—captation, treatment, distribution and waste water collection—are supported by this infrastructure. In theory, all these activities can be performed by single operators according to the principle of unbundling. However, the possibility to exploit complementarities and scope economies urged the Italian legislator to adopt—as the prevailing business model—the integrated supply of all services related to water management (drinking water, waste collection and depuration, and sewerage). As a consequence, the technical efficiency of the water service supply has become a major issue in this industry, much more than in other industries, and the identification of the technical and organizational solutions that minimize unit cost and the optimal plan of the type and size of plants are important goals. The improvement of the efficiency and quality of service provision, investment in technological innovation, reduction of operational costs, and the availability of resources from the financial markets may well be perfectly consistent with the need to preserve the nature of water as a public good. The entrance into the market of private actors might be the most effective (and, probably, the only) way to increase management efficiency and the amount of financial resources available for investment. The survey presented in a recent Blue Book by ANEA [

2] on the water service in Italy has indeed shown that the amount of investment is lower in those cases in which water service is provided through in-house management as a consequence of the difficult search for financial resources. In the same way, the Blue Book data show that investment is greater in the case of public-private companies, which, however, adopt a higher tariff regime.

However, in Italy the integrated water service still remains scarcely appealing to private providers for several reasons, i.e., the legal and regulatory uncertainty, the steadiness of the tariff regime, the still unsolved conflict of interest between the in-house providers and the local water authorities, and the unclear risk allocation in which private providers do not have to support demand uncertainty risks. Since 1994 when an in depth restructuring process of the industry was started with the Law No. 36/1994 (the so called Galli Law), the number of water service providers—both municipal departments, under direct municipal management (gestione in economia) and specialized firms—decreased from 7826 to 3351 in 2009, with a noticeable increase of the number of concessions for the supply of the integrated water service assigned to private providers (i.e., full private equity companies or mixed private-public equity companies established for the purpose). However, data show that the number of entirely private equity or mixed public-private equity companies is not growing as was estimated when the Government approved the Galli Law in 1994. Furthermore, given the public nature of good water and the diffused prejudice related to the involvement of private bodies in the provision of public services, several local municipalities are reluctant to let out on contract the urban water and sewage service to non public providers believing that a private nature of the management of service is associated with increased tariff, high and not justified profit, low efficiency, etc. So, the Galli Law was disregarded for many years because of the inertia and difficulty to transfer duties and responsibilities from a huge number of administrative bodies (e.g. number of municipalities) to 93 only (e.g., the number of ATO, Optimal Territorial Areas assumed as geographical and administrative reference units), and the first tender to involve private actors in the management of the service was held only in the second half of 2002. Now, a complex and variegated contractual framework characterizes the integrated water provision industry, and the integrated water service is still managed by a plethora of small companies operating either on the basis of the in-house rule, or as regimes of local exceptions, and several kinds of contractual agreements for the supply of integrated water services co-exist together, with the involvement of different bodies.

Evaluating the operational efficiency of the water supply service both at the industry and the company level, and assessing the influence that the typology of contracts regulating water supply and the nature of service operators have on efficiency is henceforth an interesting field of research for the implications related to the design of policy measures and public finance concerns. This paper reports the results of a performance study that adopts Data Envelopment Analysis (DEA) as a non-parametric technique to measure the operational efficiency of a sample of water service operators and investigate if there is an association between their operational efficiency and their characteristics in terms of management and equity ownership. Both financial and physical data are used as input and output variables, while conventional and bootstrapped DEA approaches are used to measure efficiency. The investigated sample includes 53 Italian water service operators, 21 private or public-private, and 32 public equity companies. The article is organized as follows. In

Section 2 major literature contributions on the topic of private

vs. public ownership and management are discussed, while

Section 3 illustrates the study setting. The results of the efficiency study are shown in

Section 4, and in

Section 5 some concluding remarks are presented.

2. Private vs. Public Ownership and/or Management of Water Provision Assets: Major Literature Contributions

Several scholars have focused their effort to understand what influence the typology of ownership and/or management—public

vs. private—may have on efficiency or, more generally, on performance of the water service provision industry [

3,

4,

5,

6,

7]. An in-depth literature review conducted by Berg and Marques [

8] reveals that the topic of the influence of water utilities ownership and management on performance and cost efficiency is one of the most studied by scholars. In fact, Saal and Parker ([

5], p. 66) claim: “[…] public ownership is usually associated with political and economic goals that may conflict with the efficient use of factor inputs […] at the same time, however, the extent of performance improvement resulting from privatization depends, at least in part, upon shareholders ability to monitor management effort in the pursuit of effecting gains […].”In the same way, Vinnari and Hukka ([

9], p. 86) point out: “Since the beginning of the 1990s, the international discussion on the management of water and wastewater undertakings has largely focused on the public-private partnership (PPPs) as a method of improving water services delivery, within the wider framework promoting the expansion of private sector participation in the sector. The main assumption underlying this approach has been a critique of public sector utilities, which were deemed unable to expand coverage and improve the quality of the services without the financial and technical inputs of the private sector.” In many countries, the entrance of private actors in the water supply industry has failed to achieve the expected goals of greater efficiency and, for this reason, the involvement of the private sector in the provision of the service has been subject to increasing criticism. The large number of empirical studies conducted from across the US, Europe and developing countries that used different methodologies such as econometric or multiple case studies, provided results that are often ambiguous and contradictory, even showing that privatization does not necessarily provide better cost service delivery [

10,

11]. Kirkpatrik and Parker [

12] even found that, in some cases the private sector participation in the water provision industry caused the cancellation of some services or an increase of water tariffs to the detriment of some consumer groups. The “privatization” concept itself remains often ambiguous, sometimes indicating the transfer of the asset ownership to a private body, other times only the award of a contract for the provision of water services to a private company, or even both of them. After reviewing 51 case-studies and 22 empirical tests, Pérard [

4] suggested that the involvement

per se of the private sector in water supply does not systematically have a significantly positive effect on efficiency. The in depth survey of many econometric studies which focused on the privatization issue in the water service supply industry since the early 1970s, and which was carried on by Bel and Warner [

13], is also unable to provide the hypothesis that privatization leads to reduced costs with acceptable justification. Indeed, only five of the eighteen studies discovered systematic cost savings with privatization. In the conclusion of their paper, the scholars emphasize that “[…] because there is no systematic optimal choice between public and private delivery, […] managers should approach the issue in a pragmatic way” ([

13], p. 1343). Given the natural monopoly characteristic of the water supply, “[…] the benefits from privatization would be expected to erode over time” ([

13], p. 1339).

Some scholars also found that the relationship between ownership and efficiency may be moderated by a number of factors,

i.e., the output amount and size of operations (henceforth, scale economies) [

14], or the regulatory regime of the waters supply industry [

15]. The weight of these factors on efficiency may be even more important than ownership, and to achieve an acceptable efficiency rate an appropriate combination of incentives, governance mechanisms and penalties is necessary [

16].

When a country-focused perspective is adopted, the findings of the studies relative to the impact of the ownership and management typology on efficiency also remain ambiguous and contradictory. Several studies conducted in the US, Canada and the countries of Latin America since the 1970s did not discover any discernible difference between publicly and privately owned firms entrusted of service provision, either in terms of costs or efficiency [

17,

18,

19]. Using data collected from the American Water Workers Association, a number of studies that implemented either parametric or non-parametric techniques failed to ascertain whether private operators are more efficient than public ones. For instance, Mann and Mikesell [

20] found that private operator owned utilities had higher costs than government utilities, and findings from many empirical studies support the idea that public providers are more efficient than private ones [

21,

22,

23]. However, a different stream of studies showed that—on the contrary—public operators are less efficient, having higher costs than private ones [

15,

24,

25]. An empirical study related to the case of the water supply concessions in the district of Buenos Aires reveals that “[…] privatization of water supply services was motivated by a general discontent with the public sector performance as revealed by under investment, sluggish system expansion, poor service quality and long-standing operating deficits. Private sector involvement is aimed at overcoming government difficulties to impose service coverage […] [while] […] the remarkable increase in profits were originated almost exclusively by tariff increases, as the contribution of total factor productivity improvements and of input process have been negligible” ([

26], pp. 245–246). The results of multiple case study research relative to water service providers in Argentina carried on by Rais

et al. [

27] supports the idea that that the introduction of the private sector in the water service supply has a negative impact on the overall industry performance. As to the water and sewerage industry operators in Brazil, Sabbioni [

28] compared the operators that provide at the local (municipal) level. The scholar found that operations’ costs were associated with the legal status of the provider and in particular, that local public providers which had an organization similar to that of a corporate firm were more cost efficient than local public providers which were operated as not-for-profit organizations. His study also showed that privately-equity firms were highly efficient. On the contrary, da Silva e Souza

et al. [

29] estimated the relative efficiency of Brazilian publicly and private owned water utilities by implementing a stochastic cost frontier approach but no significant differences emerged between the two types of operators. Seroa da Mota and Moreira [

30] also found that ownership has no effect on efficiency gains in the provision of local municipal services, even though, after privatization, the local private operators have moved faster than public ones towards the efficient frontier.

Conflicting results have also emerged from empirical research conducted in Asia, Africa and Pacific regions. Estache and Rossi [

31] found that both public and private water operators achieve comparable efficiency rates. Dumol [

32] also found similar results analyzing multiple cases in the Philippines. Recently Wang

et al. [

33] performed an econometric study of the private sector participation in China urban water supply and found that the involvement of the private sector significantly improved the production capacity of urban water operators and water coverage rate of the water supply industry in the developed eastern cities, but there was no significant effect in the less developed central and western cities. Moreover, their study also showed that the participation of the private sector has no significant effect on the fixed asset investment. After implementing statistical parametric techniques, Estache and Kouassi [

34] found that private operators are more efficient than public ones in Africa, but, adopting both parametric and non-parametric techniques and using a larger sample, Kirpatrick

et al. [

12] showed that the public sector service providers perform better in terms of efficiency.

Empirical research conducted in Europe produced confusing results, too. Ashton [

35] showed that privatization positively influences the efficiency rate of the industry, but, on the contrary, Saal and Reid [

36] were unable to discover significant differences between operators belonging to the public and private sectors in terms of productivity and efficiency. Shaoul [

37] came to the same conclusion by performing financial analysis of water industry operators in England and Wales. The comparison between the experiences of the UK and France in the privatization process in the water supply industry does not provide any empirical evidence that the private sector has an advantage over the public sector in achieving higher efficiency levels [

38]. According to Dore

et al. ([

38], p. 49): “[…] although water quality improvements were associated with privatization, there is no demonstrable evidence that privatization resulted in lower prices. In fact, the evidence in both countries indicates higher prices because of privatization. It should be noted that the experience in both countries is similar to the privatization of local hydro utilities in the Province of Ontario, Canada, where costs increased significantly due to a similar private sector tenet of maximizing shareholder value. It seems that the regulated system in England and France did not work satisfactorily. With natural monopolies in water, private production requires adequate regulation. In the two countries examined, it is not possible to find that the private sector demonstrated absolute efficiency advantage.” In Spain, Garcia-Sanchez [

39] found no differences between public and private owned firms measuring efficiency of the municipal water services. In Portugal, Carvalho and Marques [

10] investigated the influence of environment factors on efficiency for sixty-six water utilities without finding any significant impact of asset ownership on efficiency. Rather, findings related to ownership resulted ambiguously. However, in a study conducted by Marques [

40], water services under private management were found to be outperforming and more productive when compared with the public ones. Finally, Vinnari and Hukka [

9] studied the influence of the Tallin water supply privatization in Finland; their study showed that the major effect induced by privatization was an increase of the water service tariff which decreased social efficiency for users.

In most of the empirical studies, it is taken for granted that the private sector is

naturally more efficient than the public one. Indeed, it is assumed that private operators have demonstrated their greater performance, and it is well accepted that the market—according to theory—is superior to the bureaucracy of the public sector organizations that are under political control. As a consequence, in the light of these assumptions, a large part of the debate related to policy-making on infrastructure and the supply of services in the water drinking industry considers the private management of the facilities as a desirable goal. However, as the International Monetary Fund claims ([

41], p. 14) “[…] Much of the case for PPPs rests on the relative efficiency of the private sector. While there is an extensive literature on this subject, the theory is ambiguous and the empirical evidence is mixed. But if a common theme emerges, it relates to the importance of competition as a source of efficiency in both the private and public sectors.” It is evident that a lot of ambiguity about the influence that the private sector involvement may have on the operational efficiency of the water supply industry still remains, and further research on this subject is necessary.

5. Discussion and Conclusions

5.1. Result Analysis

In terms of contribution to the literature about the weight that the private sector has on the improvement of the operational performance of the water supply industry in Italy, the findings of this study support the idea that greater efficiency can be associated with the involvement of private operators or the establishment of public-private partnerships, even though they do not indicate a preferential strategy [

86]. The Galli Law has the merit of having introduced important changes and innovation in the Italian water supply industry such as an industrial management approach to the production process and the service provision adopting as a business reference an extended territorial area supposed to be optimal (the so called ATO, or Territorial Optimal Area), the adoption of selection mechanisms of the operators based on market competition, the full covering of production costs by tariff revenues, and the regulation task carried on by a local public authority. Furthermore, the Government has made an attempt to set a legal and regulatory framework to stimulate the creation of public-private operators that would have been a good compromise between the traditional in-house water service management of the public sector and the complete service liberalization with the public sector acting only as the regulatory body. Following the orientation of the European Commission, the aim was to stimulate a greater collaboration among different actors providing services in the public utilities industry, public authorities, and private companies to share and collect together the experience and the managerial capabilities necessary to develop, renovate, and manage infrastructure assets and supply water services at an acceptable quality standard. In this new framework, the adoption of an in-house mechanism to award water services would have been pursued only exceptionally, when particular economical, social, environmental, geological or orographic constraints made the market demand unappealing to private operators.

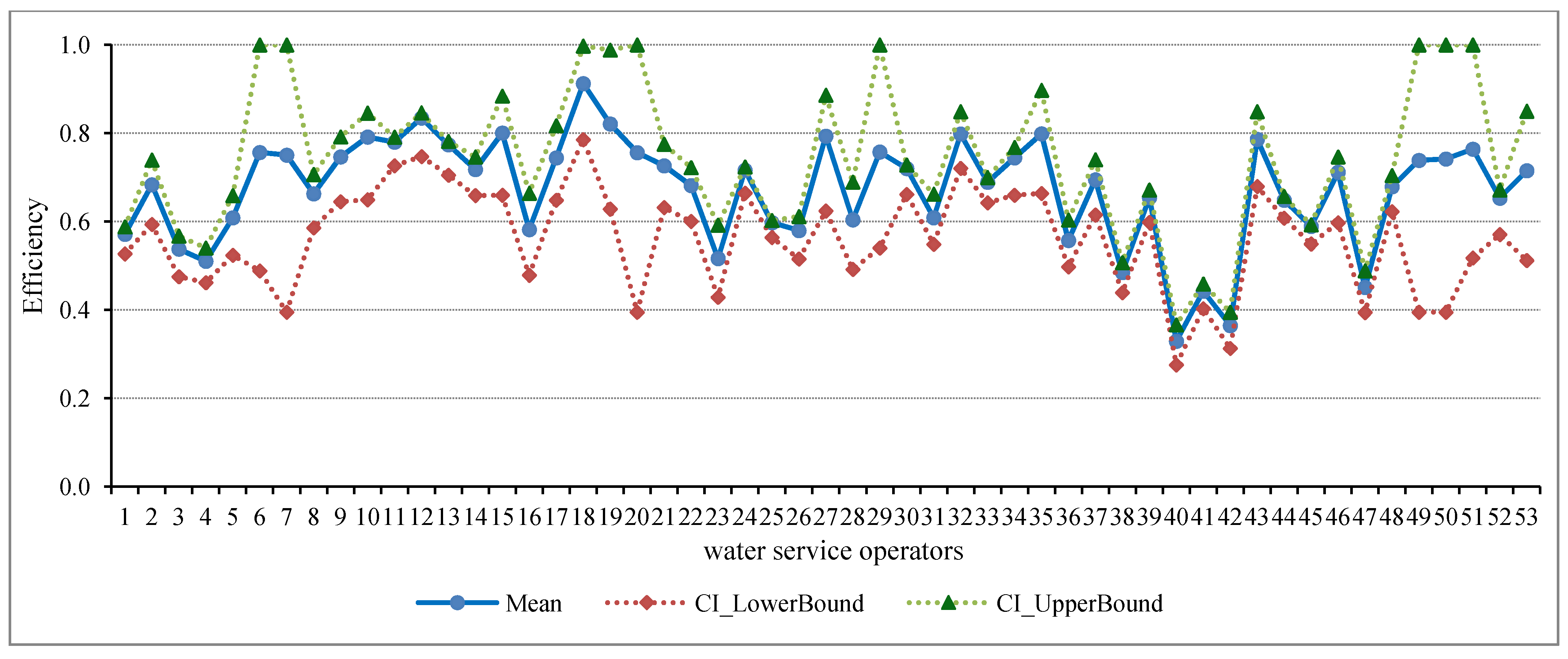

However, the performance study presented in this paper shows that the Italian integrated water supply industry is still characterized by operational inefficiencies of service operators. Thus a major problem is the amount of input used for a certain amount of output delivered. These inefficiencies are common to private or public-private and public operators. The conventional average BCC DEA efficiency for the private or public-private equity operators and the public equity operators are respectively 79.7% and 71.0%, while the corresponding bootstrapped BCC DEA efficiencies are 71.7% and 64.4%. Scale inefficiencies are a major concern in both groups, and scale dis-economies (=decreasing returns to scale) are dominant among public operators. Only a small amount of water suppliers operate at an optimal scale, seven in the public operators group and three in the private/public-private group. The efficiency measures disavow the assumption that in order to achieve an acceptable efficiency and exploit scale economies for every ATO only one operator should be awarded the concession of service. In addition, they question the present size of the ATO. The analysis of the effect of the environmental factors on efficiency has shown that the economies of agglomeration or density can be as important as economies of scale in the search for better organizational design and management setting to improve performance. These findings raise a number of concerns in terms of policy implications.

5.2. Policy Implications

On the one hand, the findings of this study shed light on the debate about the effect that the particular nature of the water service concessionaire and management of the infrastructure assets has on the operational efficiency, and suggest that the involvement of the private sector alone or as a partner of the public sector may be a possible way to increase efficiency. On the other hand, they bring up further questions related to, for instance, the choice of the optimal scale of operations and the target demand amount (i.e., number of connections or water volume) that the single operator should satisfy according to the service contract, the boundary delimitation of the area where the service will be economically delivered, and the consequent identification of the infrastructure sections to be allotted to the operator, and so on. Indeed, the Galli Law has often given privilege to either political or rigid administrative criteria to portion out the total demand of water service to be awarded to different concessionaires, rather than pure economical criteria. The study has shown that large scale is not always associated with cost savings and, consequently, to efficiency improvement, and in particular, a great number of public providers operate at a scale that is above the optimal one. However, often several contextual factors set physical constraints and economical opportunities that cannot be left out from the decision-making process yielding territorial and assets allotment. There is no doubt that the territorial characteristics influence the costs associated with the supply of water. For instance, the origin of the abducted water affects the water purification costs, while the orography, urban agglomeration, population density are all factors that influence the infrastructure network length and articulation, and, as a consequence, determine the cost of using it (for instance, the energy cost to move the water mass). Furthermore, many urban settlements have very obsolete water distribution and sewage networks, with high dispersion rates that in the worst cases are about at 40%. All such issues should be taken into consideration when plans and decisions are made relative to the optimal allotment of areas and infrastructure assets among potential service providers. On the contrary, decision-making might be biased and lead to unacceptable social and economical consequences. The performance analysis has showed how the research question relative to the impact on efficiency of the kind of management approach (public vs. private) in the provision of the water service even though correct might be irrelevant. Indeed, there are public and private providers that may be equally high efficient and, at the same time, there are public and private providers that are unable to achieve acceptable efficiency scores. The true question should be henceforth under what conditions can both public and private operators can become more efficient? The water service has peculiar characteristics that require the adoption of business and management models that differ from those used in other industries, as the public sector has to guarantee full access to service to all citizens under conditions of efficiency and effectiveness and, at the same time, environment protection. The outcome of this study points out that there is no unique efficient business and management model in the Italian water industry. Therefore, the way the business and management models for water supply are identified has to be assessed with great attention to take into account contingent needs and contextual characteristics. For instance, the public-private partnership model might be implemented when the financial resources of the public sector are scarce, and keeping the water network infrastructure in operation needs a large amount of investment from the private sector. The drinking water industry is a capital intensive sector because of the huge amount of investment and long depreciation time, and for these reasons high economical efficiency may be achieved by reducing the cost of capital. The cost of debt in the private sector is generally higher in comparison to that in the public sector. Moreover, investment is irreversible as there are no alternative uses for the infrastructure assets allowing the borne costs to be covered. The underground arrangement of 70%–80% of the infrastructure assets makes any estimation about the state of the network infrastructure difficult and costly; that makes investment by the private sector very risky and accomplishable only if high revenue rates are guaranteed by the tariff system, public subsidies, and the eventual re-negotiation of the contract. Finally, access to good water has to be assured to citizens whatever their income. Transferring subsidies to concessionaires may therefore be necessary to keep tariffs low.

The non-parametric efficiency estimation emphasizes a remarkable variance of the technical efficiency score across the single water providers, leaving room for the implementation of benchmarking practices and adoption of a (yardstick) comparative competition. The regulatory authority would stimulate competition in the market in order to select

ex-ante the more efficient providers to be awarded the service within a circumscribed territorial area. In addition, the adoption of benchmarking practices and yardstick competition that stimulate the improvement of the operational performance and quality standards might favorably influence the behavior of water suppliers that are already operating in the market with their movement toward the production efficiency frontier. Of course, both benchmarking practices and competition mechanisms should be extended to public equity operators [

87]. Collecting data and monitoring the quality, and economical and social efficiency of service is of paramount importance in the water provision industry, as in all other public utility sectors, because the contractual incompleteness which is typical of concession contracts might induce the concessionaire to adopt opportunistic behavior to the detriment of users. Even though standards and targets are generally well identified in the contract clauses, evaluating the quality and efficiency of the water supply service remains usually a complex and uncertain activity for the public sector, in particular for the local governments, because of the performance measuring capability limitations of the public sector. Greater transparency and the involvement of the users themselves are required as a mitigation measure for that. The Galli Law itself introduced an Observation Agency for the Water Services whose mission was to collect, process and diffuse data related to financial records, quality standards, tariff, and investment carried on by service operators. However, this evaluation body has never been set up.

The Law 42/2010 (the so-called Financial Law) decreed the cancellation of the ATOs as the local regulatory administrative units by the end of 2011, but without introducing a new organization of the water supply industry, but rather adding more ambiguity and contradiction to the legal framework. The recent Referendum held in 2011 has introduced further stickiness in the industry, and no incentives to the entrance of new private players into the water services market, with the partial repeal of regulations governing the determination of the water service tariff. In particular, the Referendum outcome overturned both Art. 15 of the so-called “Ronchi Decree” according to which private companies that wished to enter the public water services industry could do so with “equal treatment and no discrimination”, encouraged to buy up to 70% of any listed public water company, and Article 154 of the “Environmental Code” which established that private water companies could charge as much as they needed to guarantee an adequate return on invested capital and high profit. These new contextual factors put a limitation on the possibility of having recurrent competition in the industry to enhance efficiency and innovation. The absence of effective selection mechanisms based on tendering procedures should be balanced by the introduction of a strong regulation body to evaluate and promote service efficiency, as for example OFWAT in the UK.

5.3. Conclusions

The efficiency analysis has shown that the involvement of the private sector in the management of the infrastructure assets and water services delivery either alone or as a partner of the public sector may contribute to the improvement of the water industry efficiency. However, this is not the only way to gain efficiency because several contextual factors may be equally important as the kind of management implemented. The analysis of the environmental factors found also that both the geographical localization of the concessionaire and agglomeration economies have an influence on the efficiency measurement. The efficiency analysis has also indicated that economies of scale are a relevant economical factor. The unexpected result of this empirical study is the general dominance of scale dis-economies, and in particular, of the decreasing returns connected to scale. A great number of water service operators should henceforth reduce the size of operations in order to increase their operational efficiency. This unexpected outcome of the study contrasts the findings of similar studies that investigated scale economies in the water provision industry, and specifically in the Italian water industry [

56,

63,

88].

The efficiency model implemented did not include any measure of service quality. The quality of service should be an important output of the efficiency model. However, it is not always easy to find information from the operators. In some studies a dispersion index of the infrastructure network is used as a measure of service quality [

56,

89]. Moreover, in Italy, even though the infrastructure network dispersion may be very relevant, it cannot be often used as a quality index because it does not generally depend on the provider capability.

This study has adopted the perspective of the service operator, focusing on the performance (e.g., operational efficiency) of its production activities, avoiding taking into account the user perspective (e.g., without introducing in the analysis any variable associated to a measure of social benefit, such as the tariff paid by users). Therefore, the results offer a limited picture of the industry and the impact of the service provider typology on performance. This issue merits a more in depth investigation. Indeed, as Pérard [

4] claims, most theories on private sector participation in the water provision industry are based on the supposed difference between the private and the public sector in terms of operational efficiency. However, we have to acknowledge that the choice between public and private water service management cannot only be a matter of operational efficiency.