2.1. Literature Review

Rimmer and McLennan [

4] (p. 14) analyzed the challenges in intellectual property by exploring the legal aspects of the following emerging technologies:

- (1)

Medicine, biotechnology, and genomics;

- (2)

Biobanks, bioinformatics, and biobricks;

- (3)

Genetics, stem cells, and nanotechnology;

- (4)

Biodiversity, food security, and climate change.

Similarly, one study by Ejermo [

5] uses patent counts to examine the effects of environmental policies on technological innovation in renewable energy.

Aside from being used as an indicator of technological importance, patent citations can serve as a measure of the value of innovations. With this, following an empirical analysis of a particular innovation, patent citations can be significant indicators of the value of innovations such as computed tomography scanners [

6]. Trajtenberg, Henerson, and Jaffe [

7] stated that “importance” and “generality” are measures for the basicness of an innovation, while the degree of technological self-reliance and faithfulness to the innovational paths comprise the basicness of research [

7]. It is also through the analysis of patent citations that people can measure spillover, knowledge diffusion, and knowledge obsolescence [

8]. In addition, patent citations can serve as evidence of the level of the geographic localization of knowledge spillovers [

9].

In addition, it was discovered that modeling of the flow of patent citations could serve as a reflection of knowledge diffusion across institutional and geographic boundaries, such as that from universities and federal laboratories; moreover, patent citations also prove patterns of how knowledge flows from one country to another [

10,

11]. Through patent citation analysis, the effects of universities and federal laboratories on commercial innovation can be measured [

12,

13].

To analyze the technological closeness given the closeness of two IPC classes, both the main and supplementary classifications of patents have to be examined [

5]. From the main classification of a patent, “spillovers” can be inferred to the patent’s supplementary class [

14]. In addition, patent diversity, which is measured by classes or subclasses, can also be used as a predictor of regional innovation [

5]. Technological diversity, measured by patent data, such as “IPC co-occurrence” in class or subclass, was identified as a persistent innovator because of its contributions to product diversification and sales growth [

15]. With this, an “IPC co-occurrence” is when multiple IPC codes belonging to different technology fields exist in a single patent. Through patents, we can measure corporate market value; in fact, Chen and Chang [

16] identified that patent citations and relative patent position (RPP) were positively associated with corporate market value; however, the Herfindahl–Hirschman index of patents (HHI) was negatively associated with this value.

A company has a significantly higher intention to pursue among R & D collaborators, with smaller companies having higher numbers of patent applications than larger ones [

17]. Technical collaboration in invention activities by co-inventors and co-assignees can be measured through the co-invention index

, and the co-assignee index

[

18]. The HHI of patents can be used to evaluate the concentration of patents among patent classes as well as the concentration level of companies’ technological capability [

19]. According to the US pharmaceutical industry, the HHI values of patents and RPP in a relevant technological field have positive influences both nonlinearly and monotonically upon corporate performance, while the influence of patent citations is nonlinearly U-shaped [

20]. By analyzing citation networks and visualizing patent statistics, the position of applicants within citation networks can help explain applicant behavior in the marketplace, such as people’s cooperation or patent infringement trials [

21].

In a study in which the ratio of joint patent application cases among all patents of companies is defined as the breadth of OI, and in which the average of the patent applicants of each patent of a company is the depth of OI, the concept of collaboration of joint patent application is materialized as OI [

22]. Yun et al. [

22] use two concepts, the breadth of OI, which means the ratio of all people who gave positive answers to the survey of OI, and the depth of OI, which means the percentage of all people who gave positive answers about OI with high intensity, to develop the width and depth of OI and to connect this concept with joint patent application [

23]. To measure the synergy in an innovative system, such as OI and triple helix, it is necessary to consider diverse aspects of patents, such as citations, joint patent applications, etc. [

24]. To identify the kind of innovations necessary to secure our future, the proper patent characteristics, such as citation, applicant, and patent network, that are to be connected with which technology patent or business model patent must be identified [

25]. In addition, the process in which OI circulates through the complex adaptive system, and the evolutionary change dynamics, can be concretely analyzed through the time series change of a company, that is, the change of citations or of the patent network [

26]. Most of all, patent forward citations have become an established measure for the technological and economic value of patents in the empirical innovation literature [

27].

Next, we review only the key papers and books on open innovation which are required to develop the research questions of this paper because there is currently a broad awareness of open innovation and its relevance to corporate R & D [

28]. Open innovation is the use of purposive inflows and outflows of knowledge to accelerate internal innovation, and expand the markets for external use of innovation, respectively [

29]. So, Open innovation does not deter but motivates the active production and use of intellectual property [

30]. Open innovation indicates two inbound processes: sourcing and acquiring, and two outbound processes, revealing and selling [

31]. So, open innovation requires a creative interpretation and adaptation of the value propositions or business models in each situation, as open innovation coincides with the new business model in the third or fourth industrial revolution [

28,

32]. Regarding the open innovation paradigm, the necessity of allowing ideas to both flow out of the corporation in order to find better sites for their monetization, and flow into the corporation as new offerings and new business models, requires different ways of managing the open innovation processes, based on teamwork or task forces, and the different roles, which are more or less proactive in special industries such as telecommunication [

32,

33]. According to recent research, constraints on the application of firm resources decrease innovative performance of open innovation, but external knowledge increases the innovative performance of open innovation [

34].

2.2. Research Method

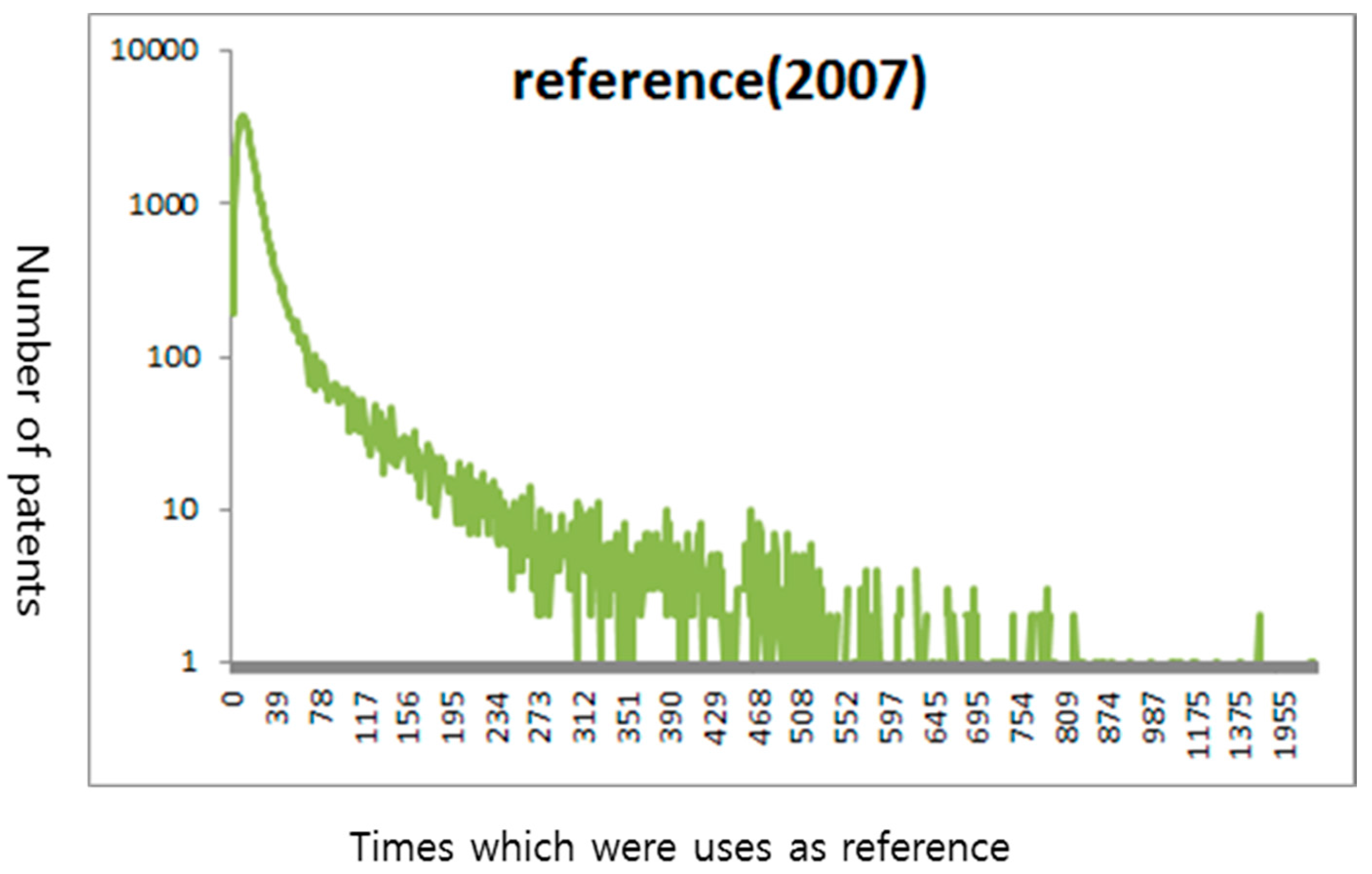

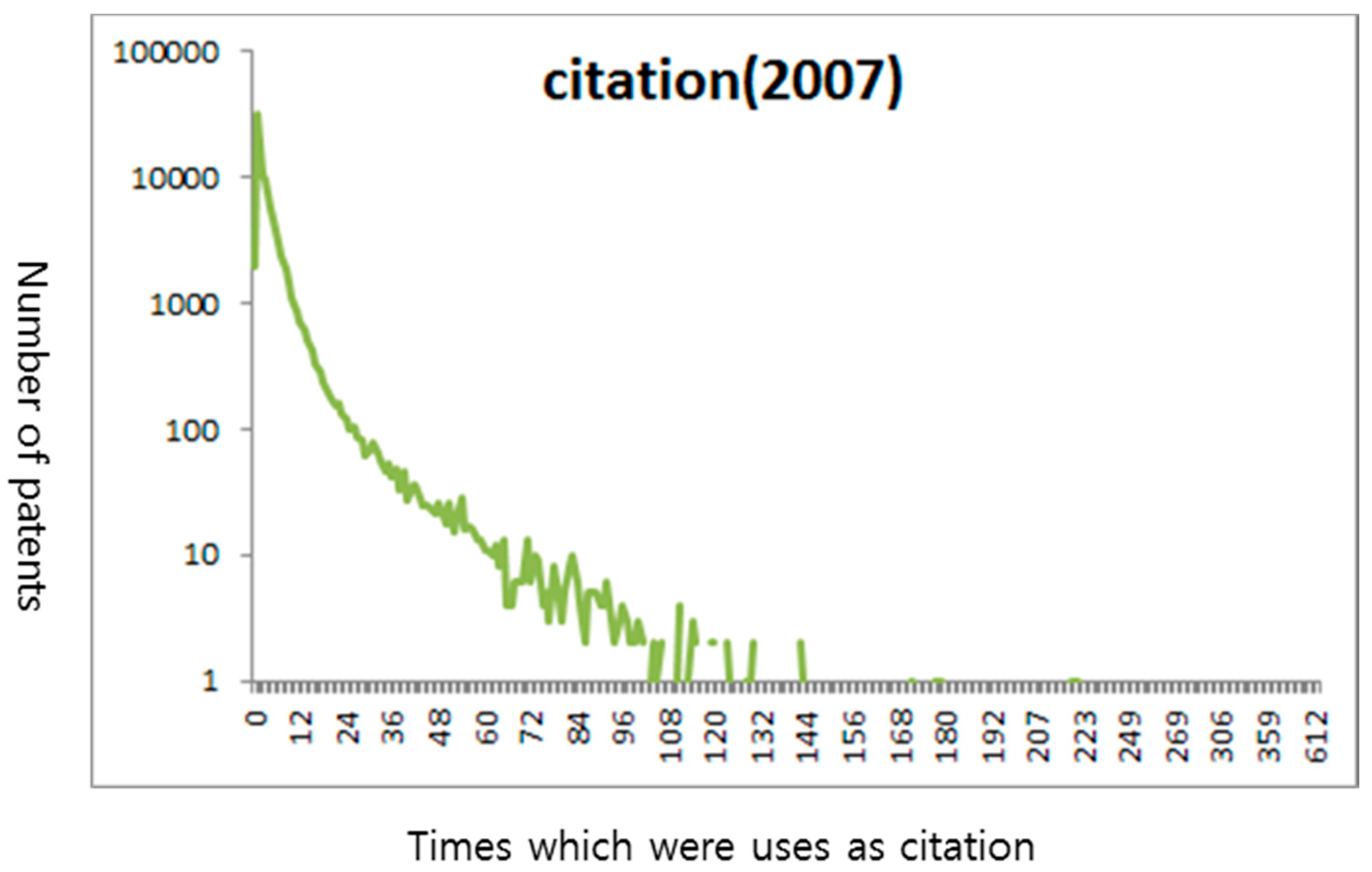

This study measured the distance between technology and the market of a patent for a subject using the size of its list of references and citations [

21,

23,

27]. As can be seen in

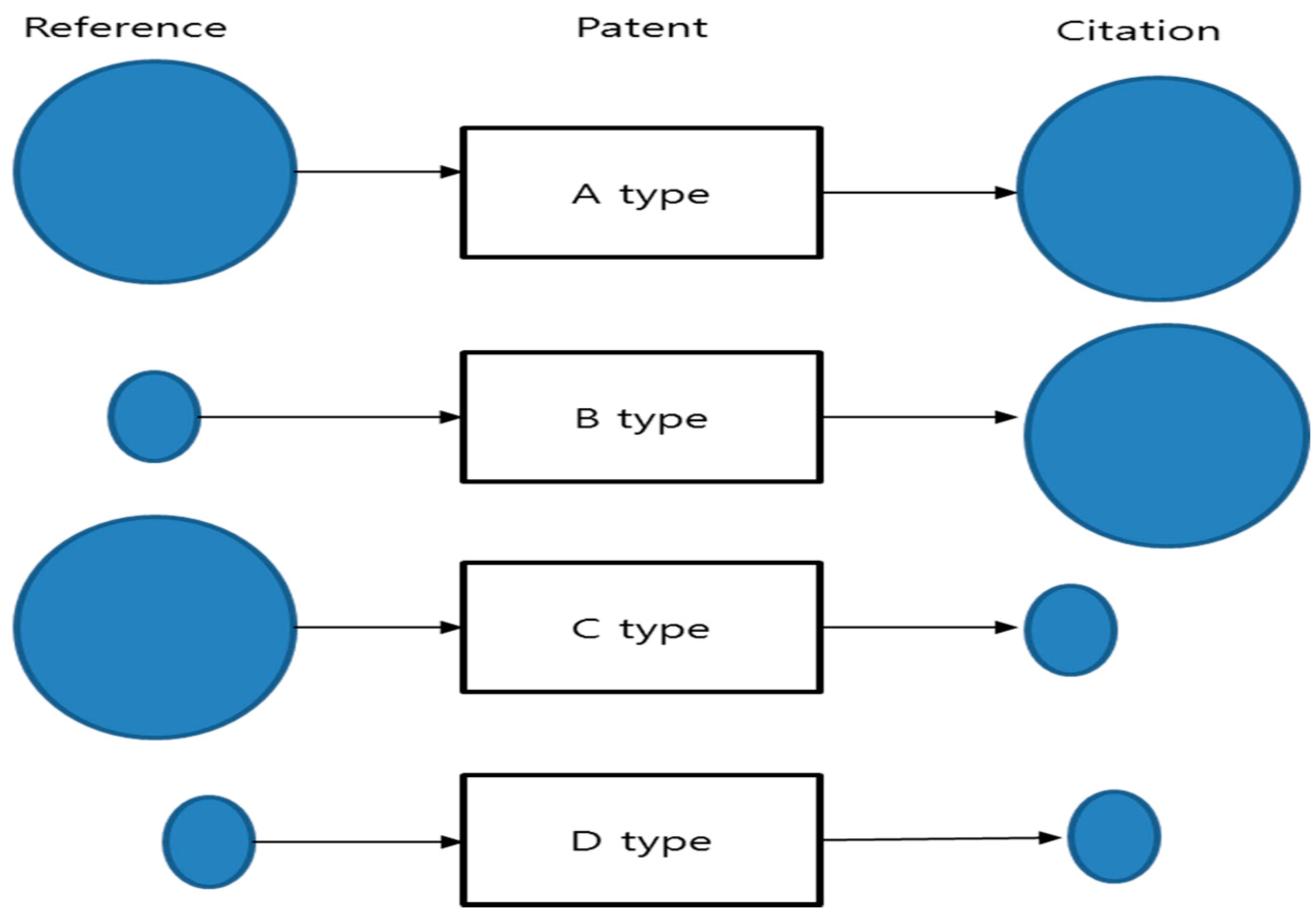

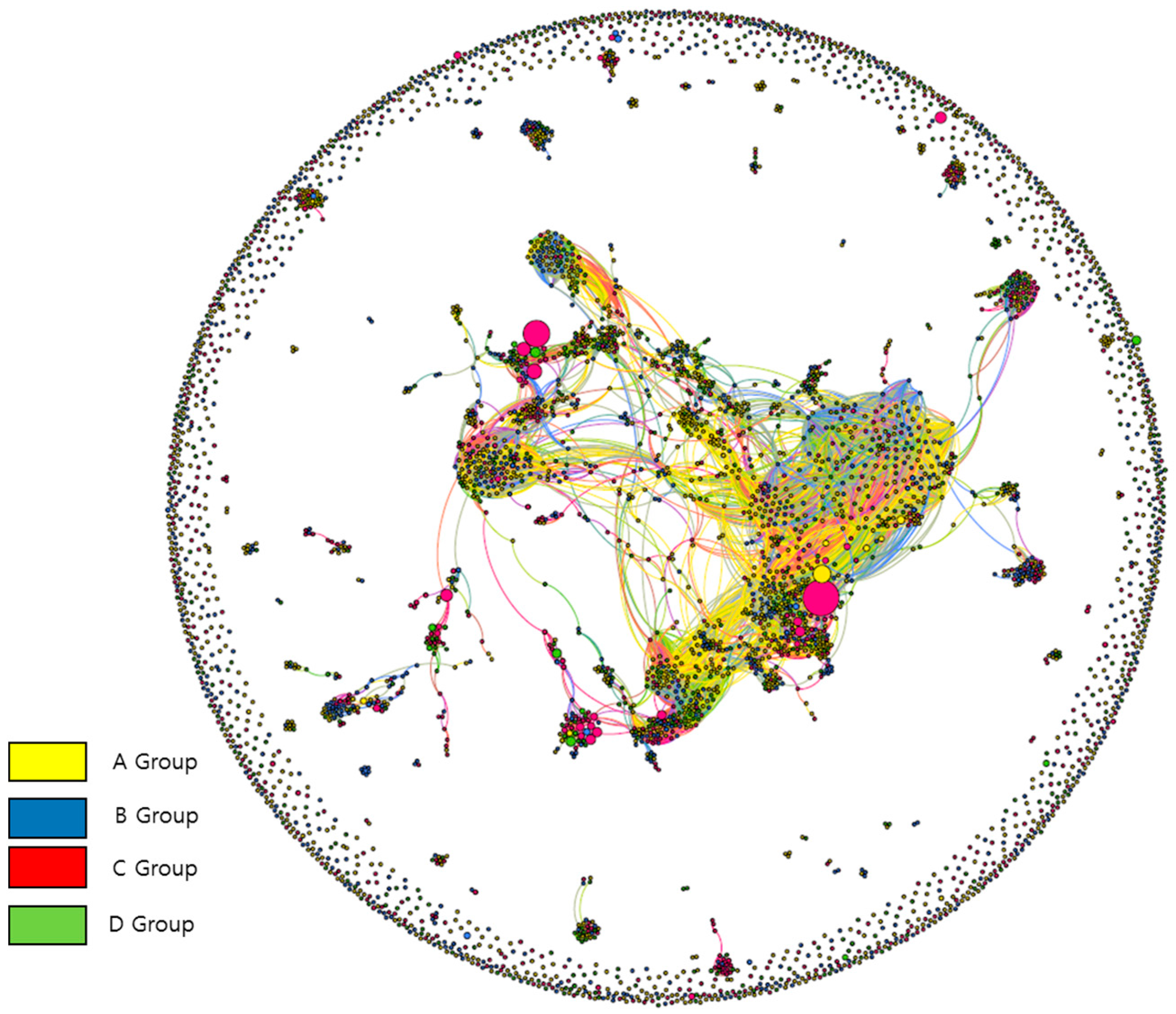

Figure 1, the A type, with many citations and references, was defined as the group with the shortest distance between technology and the market; the B type, with many citations and a small number of references, was the group with a slightly short distance between those two areas; the C type, with a small number of citations and many references, was the group with a slightly far distance between the two areas; and the D type, with small numbers of citations and references, was the group with the farthest distance.

The distance between technology, and the market was used in this study was summarized for each patent application subject and divided into four types, as shown in

Figure 1. The division criterion was the median value. Patents to analyze were classified into those of Fortune 500 companies, non-Fortune 500 companies, universities, laboratories, and start-ups (individual patent applicants), and the median of their citations and references for each of the top five subjects was calculated. In this study, it was defined that the A type had values the same as or higher than the median of the citations and references (the distance between technology and the market for these was closer than it was for the others). The B type had values the same or higher than the median of the citations and less than the median of the references (the distance was slightly closer than it was for the others, except for the A type). The C type had values less than the median of the citations and the same as or higher than the median of the references (the distance was slightly farther than it was for the others, except for the D type). The D type had values less than the median of the citations and the references (the distance was farther than it was for the others). Because, according to previous studies, market performance is determined depending on the references and citations, we can estimate the distance between technology and the market according to the structure of the references and citations [

18,

20]. While we can presume that many references mean a patent that was closer to markets and based on diverse technologies, it could be thought that many citations indicated the frequent use of the patent in a certain market. Thus, the B type is closer to the market than is the C type.

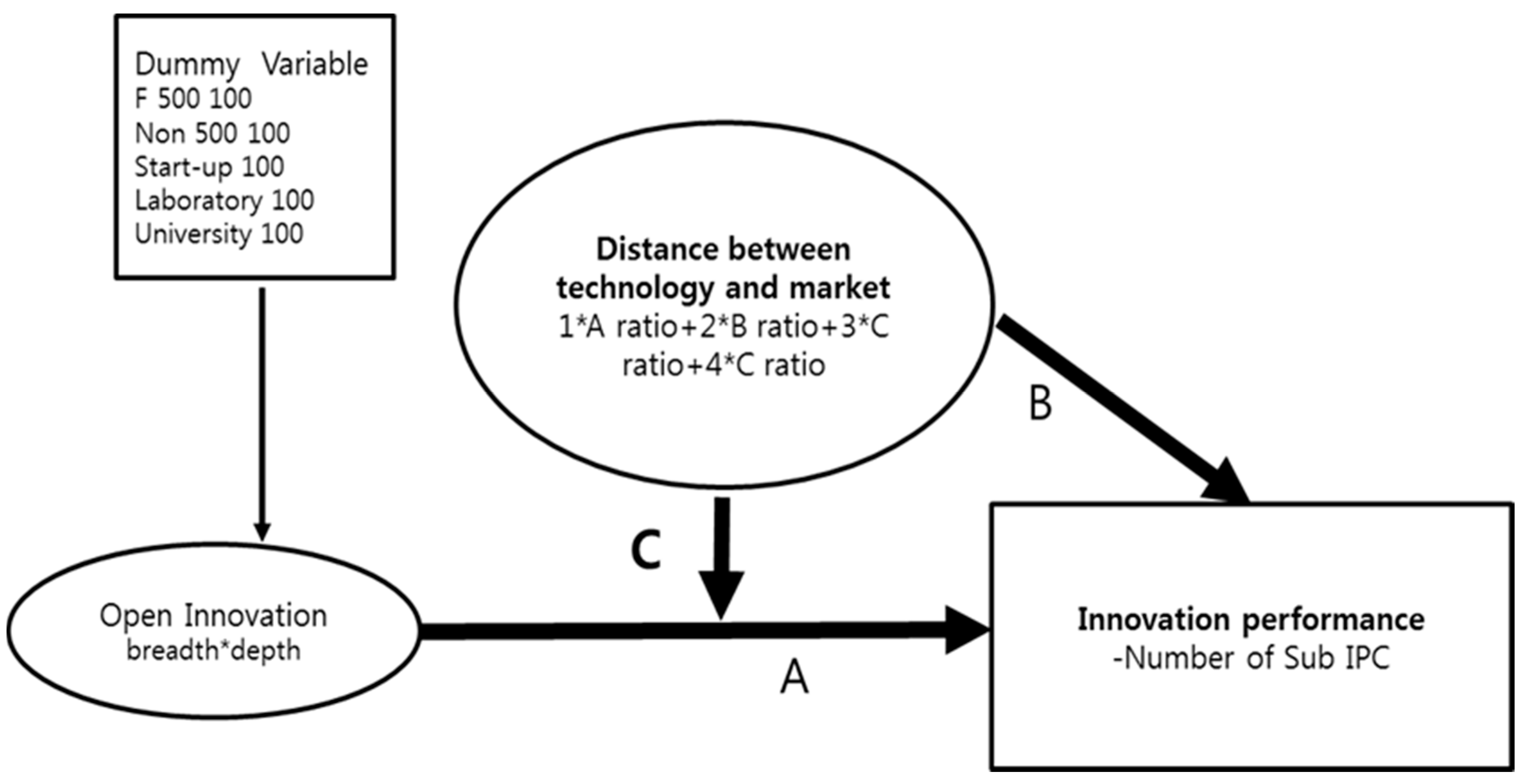

Second, for the level of OI, in the case of the A type, of patents with many references and citations, the number of patents of A type was set as the depth of OI, and the ratio of the patents to total patents including A type, B type, C type, and D type was set as the breadth of OI, considering that the patents were externally and frequently used. Second, in this study, the breadth of OI was measured according to the ratio of the A type of each subject, that is, how large a percentage of the patents of the A type was found among the patents applied for by the target organizations (e.g., universities, laboratories, etc.). In addition, the depth of OI was measured according to the number of the patents of the A type of the organization. The ratio of the A type, with many references and citations, of an organization was used to measure the width of OI, which meant how diverse the technical activities of the organization were that were connected to the outside. In addition, the number of A type patentscould be estimated and used to determine the strength of OI activities.

Third, based on previous studies, the performance of an organization was measured according to the number of sub-IPCs. In many previous studies, the ways in which technically creative and diverse patents were applied was used in various ways as a measurement index of the performance of an organization [

5,

14].

Fourth, based on the above three methods, the impact of OI on the company performance, and the moderating effect of the distance between technology and the market on the OI, were determined through statistical analysis [

28,

29,

30].

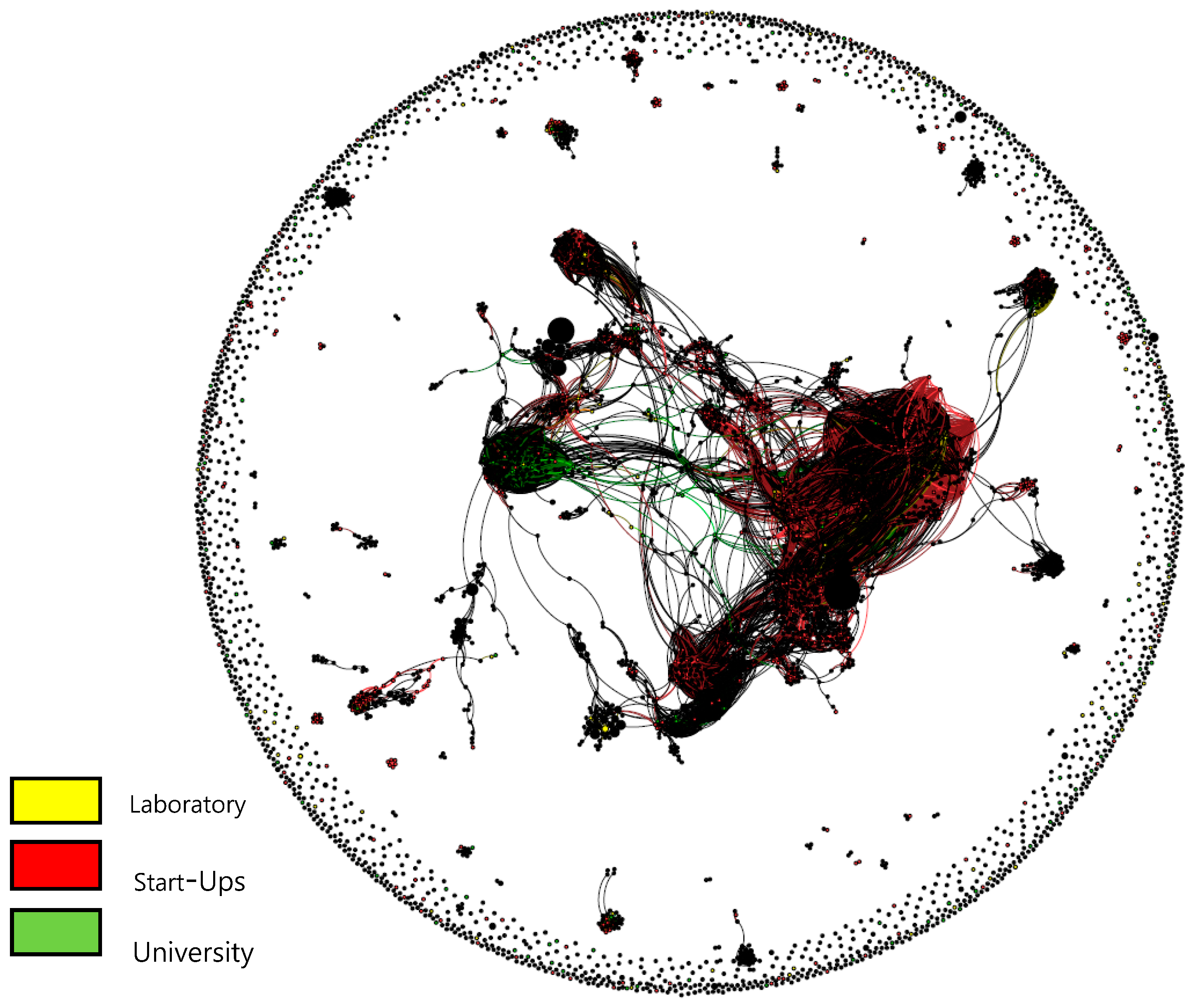

In addition, to display the OI network in the stage before statistical analysis, the OI network of patent application subjects was described based on the patent similarity, with a cosine value of 0.8 or higher and sub-IPC 7 digits. This study briefly estimated the visual characteristics of an OI network through the similarity network of sub-IPC, a dependent variable. By matching the locations of the five subjects in the OI network according to the similarity, the locations of statistically similar subjects in the network were analyzed through visual network analysis results. Furthermore, we analyzed the locations and characteristics of the five subjects, in particular looking at statistically similar subjects in modules and components in the network.