Sustainable Entrepreneurial Orientation in Family Firms

Abstract

:1. Introduction

1.1. Corporate Social Responsibility (CSR)

- (1)

- The first block of research comprises studies that focus on comparative analyses of the different approaches to CSR in family and non-family firms [32,49,50,51]. The nature of family firms affects their behavior toward stakeholders [52,53,54,55]. Specifically, family firms are more likely to act in the interests of their stakeholders [56] because the behavior of family firms is simultaneously driven by financial and non-financial goals [52].

- (2)

- The second block of research comprises studies that focus on heterogeneity across family firms. Most of the studies try to analyze how the responsible behavior of the family companies improves their competitive position [57]. De la Cruz Déniz Déniz and Cabrera Suárez [58] analyzed the value system of family firms and the CSR actions they develop. Ding and Wu [59] found that the youngest family firms were concerned less with CSR than with socio-emotional wealth. Finally, some empirical studies have tried to link social responsibility and financial performance in family firms [60,61,62].

1.2. Entrepreneurial Orientation

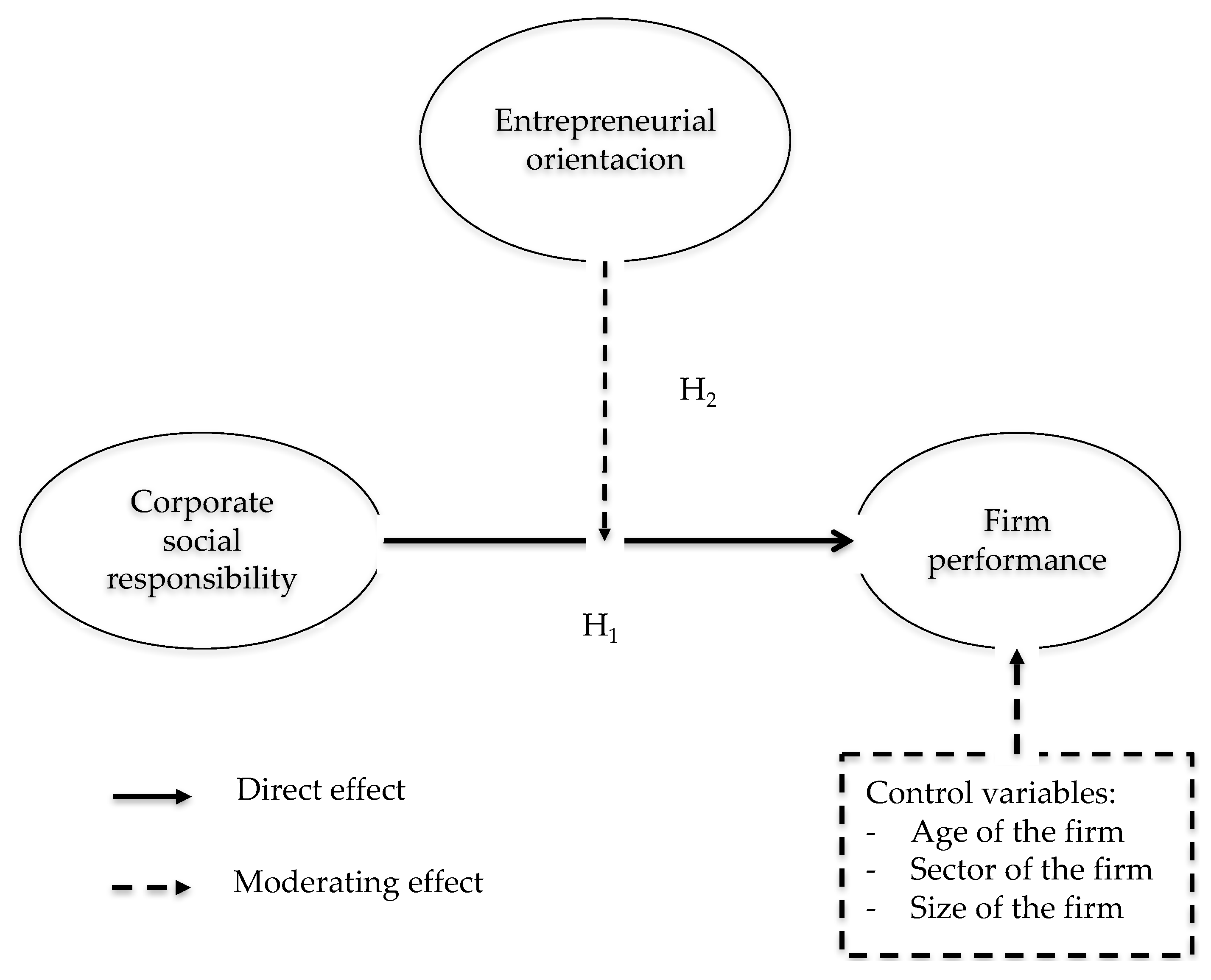

2. Materials and Methods

2.1. Data

2.2. Variable Measurement

2.2.1. Family Firm Performance

2.2.2. Corporate Social Responsibility (CSR)

2.2.3. Entrepreneurial Orientation

2.2.4. Control Variables

3. Results

- (1)

- evaluation of the measurement model, and

- (2)

- evaluation of the structural model.

3.1. Evaluation of the Measurement Model

3.2. Evaluation of the Structural Model

4. Discussion

Author Contributions

Conflicts of Interest

Appendix A

| 1 | 2 | 3 | 4 | 5 | |

| Innovativeness | |||||

| My company favors a strong emphasis on R&D, technological development and innovation. | |||||

| In the last 5 years, my company has started new businesses or introduced new products. | |||||

| My company has often made dramatic changes to products and services. | |||||

| Proactiveness | |||||

| My company typically responds to the actions initiated by competitors and rarely initiates changes in their sector. | |||||

| My organization is often the first business to introduce new products or services, administrative techniques, operating technologies, etc. | |||||

| My organization typically seeks to avoid competitive clashes, preferring a “live-and-let-live” posture. | |||||

| Risk Taking | |||||

| My company prefers to engage in investment projects with moderate risk because expectations for returns are better. | |||||

| Given the dynamic environment, my company prefers to engage in investments that show incremental behavior, starting with small investments and gradually increasing the commitment of resources. | |||||

| When confronted with decision-making situations involving uncertainty, my firm typically adopts a cautious, “wait-and-see” posture in order to minimize the probability of making costly decisions. | |||||

| 1 | 2 | 3 | 4 | 5 | |

| Economic dimension | |||||

| Purchases | |||||

| Monetary donations and taxes | |||||

| Economic reserves and balance sheet provisions | |||||

| Social dimension: | |||||

| Personal expenses | |||||

| Training expenses | |||||

| Employees with exclusion | |||||

| Certifications and awards | |||||

| Interest groups and external initiatives | |||||

| Environmental dimension | |||||

| Energy consumption | |||||

| Use of recycled material | |||||

| Recycling of products | |||||

| 1 | 2 | 3 | 4 | 5 | |

| Average annual sales growth in the last year | |||||

| Growth of market share in the last year | |||||

| Profit growth in the last year | |||||

| Growth in the return on capital |

References

- Lozano, R.; Carpenter, A.; Huisingh, D. A review of ‘theories of the firm’ and their contributions to Corporate Sustainability. J. Clean. Prod. 2015, 106, 430–442. [Google Scholar] [CrossRef]

- Herrera-Madueño, J.; Larrán-Jorge, M.; Martínez-Conesa, I.; Martínez-Martínez, D. Relationship between corporate social responsibility and competitive performance in Spanish SMEs: Empirical evidence from a stakeholders’ perspective. BRQ Bus. Res. Q. 2016, 19, 55–72. [Google Scholar] [CrossRef]

- Kramer, M.R.; Porter, M.E. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Baviera-Puig, A.; Gómez-Navarro, T.; García-Melón, M.; García-Martínez, G. Assessing the Communication Quality of CSR reports. A Case Study on Four Spanish Food Companies. Sustainability 2015, 7, 11010–11031. [Google Scholar] [CrossRef]

- Szczepankiewicz, E.I.; Múcko, P. CSR Reporting Practices of Polish Energy and Mining Companies. Sustainability 2016, 8, 126. [Google Scholar] [CrossRef]

- Kraus, S.; Rigtering, J.C.; Hughes, M.; Hosman, V. Entrepreneurial orientation and the business performance of SMEs: A quantitative study from the Netherlands. Rev. Manag. Sci. 2012, 6, 161–182. [Google Scholar] [CrossRef]

- Miller, D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Zahra, S.A. Predictors and financial outcomes of corporate entrepreneurship: An exploratory study. J. Bus. Ventur. 1991, 6, 259–285. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Vent. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Davis, J.L.; Greg Bell, R.; Tyge Payne, G.; Kreiser, P.M. Entrepreneurial orientation and firm performance: The moderating role of managerial power. Am. J. Bus. 2010, 25, 41–54. [Google Scholar] [CrossRef]

- Frank, H.; Kessler, A.; Fink, M. Entrepreneurial Orientation and Business Performance - A Replication Study. Schmalenbach Bus. Rev. 2010, 62, 175–198. [Google Scholar]

- Hernández-Perlines, F.; Moreno-García, J.; Yáñez-Araque, B. The mediating role of competitive strategy in international entrepreneurial orientation. J. Bus. Res. 2016, 69, 4714–4724. [Google Scholar] [CrossRef]

- Huarng, K.H.; Hui-Kuang Yu, T. Entrepreneurship, process innovation and value creation by a non-profit SME. Manag. Decis. 2011, 49, 284–296. [Google Scholar] [CrossRef]

- Ribeiro-Soriano, D.; Huarng, K.H. Innovation and entrepreneurship in knowledge industries. J. Bus. Res. 2013, 66, 1964–1969. [Google Scholar] [CrossRef]

- Ribeiro-Soriano, D.; Peris-Ortiz, M. Subsidizing technology: How to succeed. J. Bus. Res. 2011, 64, 1224–1228. [Google Scholar] [CrossRef]

- Mas-Tur, A.; Ribeiro-Soriano, D. The level of innovation among young innovative companies: The impacts of knowledge-intensive services use, firm characteristics and the entrepreneur attributes. Serv. Bus. 2014, 8, 51–63. [Google Scholar] [CrossRef]

- Alvarado Herrera, A.; Bigné Alcañiz, E.; Currás Pérez, R. Theoretical perspectives for studying corporate social responsibility: A rationality-based classification. Estud. Gerenc. 2011, 27, 115–138. [Google Scholar]

- Garcia-Castro, R.; Ariño, M.A.; Canela, M.A. Does social performance really lead to financial performance? Accounting for endogeneity. J. Bus. Ethics 2010, 92, 107–126. [Google Scholar] [CrossRef]

- Miras-Rodríguez, M.M.; Carrasco-Gallego, A.; Escobar-Pérez, B. Are Socially Responsible Behaviors Paid Off Equally? A Cross-cultural Analysis. Corp. Soc. Res. Env. Ma. 2015, 22, 237–256. [Google Scholar] [CrossRef]

- Battaglia, M.; Testa, F.; Bianchi, L.; Iraldo, F.; Frey, M. Corporate social responsibility and competitiveness within SMEs of the fashion industry: Evidence from Italy and France. Sustainability 2014, 6, 872–893. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Sánchez-Infantes, J.P. Análisis del Efecto de la Responsabilidad Social Empresarial en los Resultados Empresariales de las Micro, Pequeñas y Medianas Empresas (Mipymes)/Analysis of Effect of Corporate Social Responsibility in the Business Results of Micro, Small and Medium-Sized Enterprises (MSMEs)/Análise do Efeito da Responsabilidade Social das Resultados do Negócio nas Micro, Pequenas e Médias Empresas (MPMEs). Rev. Glob. Compet. Gob. 2016, 10, 110–123. [Google Scholar]

- Urbano, D.; Toledano, N.; Ribeiro-Soriano, D. Socio-cultural factors and transnational entrepreneurship: A multiple case study in Spain. Int. Small Bus. J. 2011, 29, 119–134. [Google Scholar] [CrossRef]

- Klein Woolthuis, R.J. Sustainable entrepreneurship in the Dutch construction industry. Sustainability 2010, 2, 505–523. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.P. The corporate social-financial performance relationship: A typology and analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Andersen, M.L.; Dejoy, J.S. Corporate social and financial performance: The role of size, industry, risk, R&D and advertising expenses as control variables. Bus. Soc. Rev. 2011, 116, 237–256. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Transaction Publishers: London, UK, 1934. [Google Scholar]

- Kirzner, I.M. Competition and Entrepreneurship; University of Chicago Press: Chicago, IL, USA, 1973. [Google Scholar]

- Cohen, B.; Winn, M. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Vent. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Dean, T.J.; McMullen, J.S. Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. J. Bus. Vent. 2007, 27, 50–76. [Google Scholar] [CrossRef]

- Binder, J.; Belz, F.M. Sustainable entrepreneurship: A convergent process model. Bus. Strateg. Environ. 2014, 15, 402–415. [Google Scholar]

- Thompson, N.; Kiefer, K.; York, J.G. Distinctions not Dichotomies: Exploring Social, Sustainable, and Environmental Entrepreneurship. In Social and Sustainable Entrepreneurship (Advances in Entrepreneurship, Firm Emergence and Growth); Lumpkin, G.T., Katz, J.A., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2011; Volume 13, pp. 201–229. [Google Scholar]

- Larson, A.L. Sustainable innovation through an entrepreneurship lens. Bus. Strateg. Environ. 2000, 9, 304–317. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strateg. Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Young, W.; Tilley, F. Can businesses move beyond efficiency? The shift toward effectiveness and equity in the corporate sustainability debate. Bus. Strateg. Environ. 2006, 15, 402–415. [Google Scholar] [CrossRef]

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value Creation and Value Capture: A Multilevel Perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef]

- Belz, F.M. Shaping the future: Sustainable innovation and entrepreneurship. Soc. Bus. 2013, 3, 311–324. [Google Scholar] [CrossRef]

- Hall, J.; Daneke, G.; Lenox, M. Sustainable development and entrepreneurship: Past contributions and future directions. J. Bus. Vent. 2010, 25, 439–448. [Google Scholar] [CrossRef]

- Corona, J.; Del Sol, I. La Empresa Familiar en España (2015); Instituto de la Empresa Familiar: Barcelona, Spain, 2016; Available online: http://www.iefamiliar.com/upload/documentos/ubhiccx9o8nnzc7i.pdf (accessed on 6 May 2017).

- Lu, W.; Chau, K.W.; Wang, H.; Pan, W. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. J. Clean. Prod. 2014, 79, 195–206. [Google Scholar] [CrossRef]

- Barnard, C. The Functions of the Executive; Harvard University Press: Cambridge, MA, USA, 1938. [Google Scholar]

- Kreps, T.J. Measurement of the social performance of business. Ann. Am. Acad. Polit. Soc. Sci. 1962, 343, 20–31. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholders Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Admin. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Wu, M.L. Corporate Social Performance, Corporate Financial Performance, and Firm Size: A Meta-Analysis. J. Am. Acad. Bus. 2006, 8, 163–171. [Google Scholar]

- De Massis, A. Family Involvement and Procedural Justice Climate among Nonfamily Managers: The Effects of Affect, Social Identities, Trust, and Risk of Non-Reciprocity. Entrep. Theory Pract. 2012, 36, 1227–1234. [Google Scholar] [CrossRef]

- Dyer, W.G. The Family: The Missing Variable in Organizational Research. Entrep. Theory Pract. 2003, 27, 401–416. [Google Scholar] [CrossRef]

- Zellweger, T. Time Horizon, Costs of Equity Capital, and Generic Investment Strategies of Firms. Fam. Bus. Rev. 2007, 20, 1–15. [Google Scholar] [CrossRef]

- Long, R.G.; Mathews, K.M. Ethics in the Family Firm: Cohesion through Reciprocity and Exchange. Bus. Ethics Q. 2011, 21, 287–308. [Google Scholar] [CrossRef]

- Kotlar, J.; De Massis, A. Goal Setting in Family Firms: Goal Diversity, Social Interactions, and Collective Commitment to Family-Centered Goals. Entrep. Theory Pract. 2013, 37, 1263–1288. [Google Scholar] [CrossRef]

- Reid, R.S.; Adams, J.S. Human resource management—A survey of practices within family and non-family firms. J. Eur. Ind. Train. 2001, 25, 310–320. [Google Scholar] [CrossRef]

- De Kok, J.M.P.; Uhlaner, L.M.; Thurik, A.R. Professional HRM Practices in Family Owned-Managed Enterprises. J. Small Bus. Manag. 2006, 44, 441–460. [Google Scholar] [CrossRef]

- Colombo, M.G.; De Massis, A.; Piva, E.; Rossi-Lamastra, C.; Wright, M. Sales and Employment Changes in Entrepreneurial Ventures with Family Ownership: Empirical Evidence from High-Tech Industries. J. Small Bus. Manag. 2014, 52, 226–245. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Mejia, L.R.; Larraza-Kintana, M. Socioemotional Wealth and Corporate Responses to Institutional Pressures: Do Family-Controlled Firms Pollute Less? Admin. Sci. Q. 2010, 55, 82–113. [Google Scholar] [CrossRef]

- Gémar, G.; Espinar, D. Communication about corporate social responsibility practices and return on equity. Revista de Empresa Familiar 2015, 5, 7–17. [Google Scholar]

- De la Cruz Déniz Déniz, M.; Cabrera Suárez, K. Corporate Social Responsibility and Family Business in Spain. J. Bus. Ethics 2005, 56, 27–41. [Google Scholar] [CrossRef]

- Niehm, L.S.; Swinney, J.; Miller, N.J. Community Social Responsibility and Its Consequences for Family Business Performance. J. Small Bus. Manag. 2008, 46, 331–350. [Google Scholar] [CrossRef]

- Ding, S.; Wu, Z. Family Ownership and Corporate Misconduct in U.S. Small Firms. J. Bus. Ethics 2014, 123, 183–195. [Google Scholar] [CrossRef]

- Dyer, W.G.; Whetten, D.A. Family Firms and Social Responsibility. Entrep. Theory Pract. 2006, 30, 785–802. [Google Scholar] [CrossRef]

- Hirigoyen, G.; Poulain-Rehm, T. The corporate social responsibility of family businesses: An international approach. Int. J. Financ. Stud. 2014, 2, 240–265. [Google Scholar] [CrossRef]

- Gamerschlag, R.; Möller, K.; Verbeeten, F. Determinants of voluntary CSR disclosure: Empirical evidence from Germany. Rev. Manag. Sci. 2011, 5, 233–262. [Google Scholar] [CrossRef]

- Campopiano, G.; De Massis, A. Corporate Social Responsibility Reporting: A Content Analysis in Family and Non-family Firms. J. Bus. Ethics 2015, 129, 511–534. [Google Scholar] [CrossRef]

- Chen, L.; Feldmann, A.; Tang, O. The relationship between disclosures of corporate social performance and financial performance: Evidences from GRI reports in manufacturing industry. Int. J. Prod. Econ. 2015, 170, 445–456. [Google Scholar] [CrossRef]

- Martín-Castejón, P.J.; Aroca-López, B. Corporate social responsibility in family SMEs: A comparative study. Eur. J. Fam. Bus. 2016, 6, 21–31. [Google Scholar] [CrossRef]

- Martínez-Campillo, A.; Cabeza-García, L.; Marbella-Sánchez, F. Responsabilidad social corporativa y resultado financiero: Evidencia sobre la doble dirección de la causalidad en el sector de las Cajas de Ahorros/Corporate social responsibility and results: Evidence of two-way causality in the Savings Bank sector. Cuad. Econ. Dir. Empres. 2013, 16, 54–68. [Google Scholar]

- Li, F.; Li, T.; Minor, D. CEO power, corporate social responsibility, and firm value: A test of agency theory. Int. J. Manag. Fin. 2016, 12, 611–628. [Google Scholar] [CrossRef]

- Pan, X.; Sha, J.; Zhang, H.; Ke, W. Relationship between corporate social responsibility and financial performance in the mineral Industry: Evidence from Chinese mineral firms. Sustainability 2014, 6, 4077–4101. [Google Scholar] [CrossRef]

- Pineiro-Chousa, J.; Vizcaíno-González, M.; López-Cabarcos, M. Reputation, Game Theory and Entrepreneurial Sustainability. Sustainability 2016, 8, 1196. [Google Scholar] [CrossRef]

- Elkington, J. Towards the sustainable corporation: Win-win-win business strategies for sustainable development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Pope, J.; Annandale, D.; Morrison-Saunders, A. Conceptualising sustainability assessment. Environ. Impact Assess. 2004, 24, 595–616. [Google Scholar] [CrossRef]

- Radomska, J. The concept of sustainable strategy implementation. Sustainability 2015, 7, 15847–15856. [Google Scholar] [CrossRef]

- Galbreath, J. Building corporate social responsibility into strategy. Eur. Bus. Rev. 2009, 21, 109–127. [Google Scholar] [CrossRef]

- Van Marrewijk, M.; Werre, M. Multiple levels of corporate sustainability. J. Bus. Ethics 2003, 44, 107–119. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. A conceptual model of entrepreneurship as firm behavior. Entrep. Theory Pract. 1991, 16, 7–25. [Google Scholar]

- Rauch, A.; Wiklund, J.; Lumpkin, G.T.; Frese, M. Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Covin, J.G.; Miller, D. International entrepreneurial orientation: Conceptual considerations, research themes, measurement issues, and future research directions. Entrep. Theory Pract. 2014, 38, 11–44. [Google Scholar] [CrossRef]

- Engelen, A.; Gupta, V.; Strenger, L.; Brettel, M. Entrepreneurial orientation, firm performance, and the moderating role of transformational leadership behaviors. J. Manag. 2015, 41, 1069–1097. [Google Scholar] [CrossRef]

- Huarng, K.H.; Ribeiro-Soriano, D.E. Developmental management: Theories, methods, and applications in entrepreneurship, innovation, and sensemaking. J. Bus. Res. 2014, 67, 657–662. [Google Scholar] [CrossRef]

- George, B.A.; Marino, L. The epistemology of entrepreneurial orientation: Conceptual formation, modeling, and operationalization. Entrep. Theory Pract. 2011, 35, 989–1024. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P. Strategy making and environment: The third link. Strateg. Manag. J. 1983, 4, 221–235. [Google Scholar] [CrossRef]

- Kropp, F.; Lindsay, N.J.; Shoham, A. Entrepreneurial, market, and learning orientations and international entrepreneurial business venture performance in South African firms. Int. Market. Rev. 2006, 23, 504–523. [Google Scholar] [CrossRef]

- Chandra, Y.; Styles, C.; Wilkinson, I. The recognition of first time international entrepreneurial opportunities: Evidence from firms in knowledge-based industries. Int. Market. Rev. 2009, 26, 30–61. [Google Scholar] [CrossRef]

- Naldi, L.; Nordqvist, M.; Sjöberg, K.; Wiklund, J. Entrepreneurial orientation, risk taking, and performance in family firms. Fam. Bus. Rev. 2007, 20, 33–47. [Google Scholar] [CrossRef]

- Casillas, J.C.; Moreno, A.M. The relationship between entrepreneurial orientation and growth: The moderating role of family involvement. Entrep. Reg. Dev. 2010, 22, 265–291. [Google Scholar] [CrossRef]

- Nordqvist, M.; Melin, L. Entrepreneurial families and family firms. Entrep. Reg. Dev. 2010, 22, 211–239. [Google Scholar] [CrossRef]

- Weismeier-Sammer, D. Entrepreneurial behavior in family firms: A replication study. J. Fam. Bus. Strateg. 2011, 2, 128–138. [Google Scholar] [CrossRef]

- Zellweger, T.; Sieger, P. Entrepreneurial orientation in long-lived family firms. Small Bus. Econ. 2012, 38, 67–84. [Google Scholar] [CrossRef]

- Cruz, C.; Nordqvist, M. Entrepreneurial orientation in family firms: A generational perspective. Small Bus. Econ. 2012, 38, 33–49. [Google Scholar] [CrossRef]

- Vecchiarini, M.; Mussolino, D. Determinants of entrepreneurial orientation in family-owned healthcare organizations. Int. J. Healthc. Manag. 2013, 6, 237–251. [Google Scholar] [CrossRef]

- Garcés-Galdeano, L.; Larraza-Kintana, M.; García-Olaverri, C.; Makri, M. Entrepreneurial orientation in family firms: The moderating role of technological intensity and performance. Int. Entrep. Manag. J. 2016, 12, 27–45. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Sarathy, R.; Murphy, F. Innovativeness in family firms: A family influence perspective. Small Bus. Econ. 2012, 38, 85–101. [Google Scholar] [CrossRef]

- Schepers, J.; Voordeckers, W.; Steijvers, T.; Laveren, E. The entrepreneurial orientation–performance relationship in private family firms: The moderating role of socioemotional wealth. Small Bus. Econ. 2014, 43, 39–55. [Google Scholar] [CrossRef]

- Zahra, S.A.; Covin, J.G. Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis. J. Bus. Vent. 1995, 10, 43–58. [Google Scholar] [CrossRef]

- Khedhaouria, A.; Gurău, C.; Torrès, O. Creativity, self-efficacy, and small-firm performance: The mediating role of entrepreneurial orientation. Small Bus. Econ. 2015, 44, 485–504. [Google Scholar] [CrossRef]

- Alfin, R. The role of entrepreneurial orientation as a mediating effect of the characteristics and culture of small-scale industries on the performance of small-scale industries in Pasuruan. Int. J. Appl. Bus. Econ. Res. 2015, 12, 219–227. [Google Scholar]

- Roxas, B.; Chadee, D. Effects of formal institutions on the performance of the tourism sector in the Philippines: The mediating role of entrepreneurial orientation. Tour. Manag. 2013, 37, 1–12. [Google Scholar] [CrossRef]

- Rosenbusch, N.; Rauch, A.; Bausch, A. The mediating role of entrepreneurial orientation in the task environment–performance relationship: A meta-analysis. J. Manag. 2013, 39, 633–659. [Google Scholar] [CrossRef]

- Luu, T. Psychological contract and knowledge sharing: CSR as an antecedent and entrepreneurial orientation as a moderator. Corp. Com. Int. J. 2016, 21, 2–19. [Google Scholar] [CrossRef]

- Celec, R.; Globocnik, D.; Kruse, P. Resources, capabilities, export performance and the moderating role of entrepreneurial orientation in the context of SMEs. Eur. J. Int. Manag. 2014, 8, 440–464. [Google Scholar] [CrossRef]

- Wales, W.J.; Parida, V.; Patel, P.C. Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strateg. Manag. J. 2013, 34, 622–633. [Google Scholar] [CrossRef]

- Mehdivand, M.; Zali, M.R.; Madhoshi, M.; Kordnaeij, A. Intellectual Capital and Nano-Businesses Performance: The Moderating Role of Entrepreneurial Orientation. Eur. J. Econ. Fin. Admin. Sci. 2012, 52, 147–162. [Google Scholar]

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

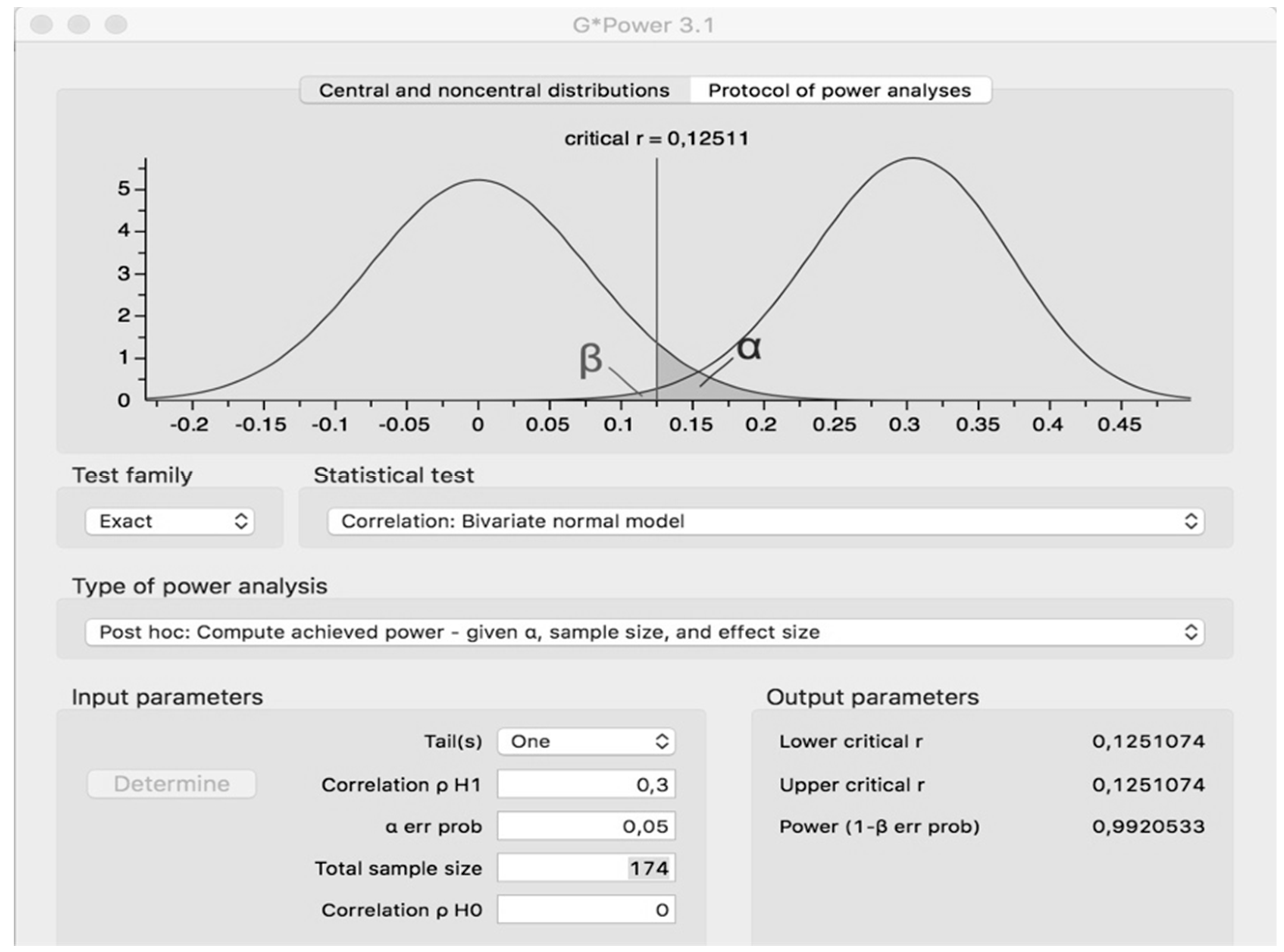

- Cohen, J. A power primer. Psychol. Bull. 1992, 112, 155–159. [Google Scholar] [CrossRef] [PubMed]

- Faul, F.; Erdfelder, E.; Buchner, A.; Lang, A.G. Statistical power analyses using G* Power 3.1: Tests for correlation and regression analyses. Behav. Res. Methods 2009, 41, 1149–1160. [Google Scholar] [CrossRef] [PubMed]

- Hair Jr, J.F.; Sarstedt, M.; Hopkins, L.G.; Kuppelwieser, V. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair, J.F. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. J. Fam. Bus. Strateg. 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Jöreskog, K.G.; Wold, H.O. Systems under Indirect Observation: Causality, Structure, Prediction; North Holland: Amsterdam, The Netherlands, 1982. [Google Scholar]

- Astrachan, C.B.; Patel, V.K.; Wanzenried, G. A comparative study of CB-SEM and PLS-SEM for theory development in family firm research. J. Fam. Bus. Strateg. 2014, 5, 116–128. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Market. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. Smart PLS 3. 2015; Boenningstedt: SmartPLS GmbH. Available online: http://www.smartpls.com (accessed on 6 May 2017).

- Chirico, F.; Sirmon, D.G.; Sciascia, S.; Mazzola, P. Resource orchestration in family firms: Investigating how entrepreneurial orientation, generational involvement, and participative strategy affect performance. Strateg. Entrep. J. 2011, 5, 307–326. [Google Scholar] [CrossRef]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Schadewith, H.; Niskala, M. Communication via Responsibility Reporting and its Effect on Firm Value in Finland. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 96–106. [Google Scholar]

- Chang, D.S.; Kuo, L.C.R. The effects of sustainable development on firms’ financial performance—an empirical approach. Sustain. Dev. 2008, 16, 365–380. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Sharma, P. Trends and directions in the development of a strategic management theory of the family firm. Entrep. Theory Pract. 2005, 29, 555–576. [Google Scholar] [CrossRef]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; Mora, M., Gelman, O., Steenkamp, A., Raisinghani, M.S., Eds.; IGI Global: Hershey, PA, USA, 2012; pp. 193–221. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage Publications: Thousand Oaks, CA, USA, 1979; Volume 17. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Wright, R.T.; Campbell, D.E.; Thatcher, J.B.; Roberts, N. Operationalizing multidimensional constructs in structural equation modeling: Recommendations for IS research. Com. Assoc. Inf. Sys. 2012, 30, 367–412. [Google Scholar]

- Diamantopoulos, A.; Riefler, P.; Roth, K.P. Advancing formative measurement models. J. Bus. Res. 2008, 61, 1203–1218. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Winklhofer, H.M. Index construction with formative indicators: an alternative to scale development. J. Mark. Res. 2001, 38, 269–277. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Kupper, L.L.; Muller, K.E.; Nizam, A. Applied Regression Analysis and Other Multivariable Methods; PWS-Kent Publishing Co.: Boston, MA, USA, 1988; pp. 341–386. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Chin, W.W. How to Write up and Report PLS Analyses; Springer: Berlin, Germany, 2010. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Fit indices in covariance structure modeling: Sensitivity to under parameterized model misspecification. Psychol. Methods 1998, 3, 424–453. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A.; Vurro, C. Deconstructing the relationship between corporate social and financial performance. J. Bus. Ethics 2011, 102, 59–76. [Google Scholar] [CrossRef]

- Martínez-Ferrero, J.; Rodríguez-Ariza, L.; García-Sánchez, I.M. Corporate social responsibility as an entrenchment strategy, with a focus on the implications of family ownership. J. Clean. Prod. 2016, 135, 760–770. [Google Scholar] [CrossRef]

- Cohen, B.; Smith, B.; Mitchell, R. Toward a sustainable conceptualization of dependent variables in entrepreneurship research. Bus. Strateg. Environ. 2008, 17, 107–119. [Google Scholar] [CrossRef]

- Hahn, T.; Figge, F.; Pinkse, J.; Preuss, L. Trade-offs in corporate sustainability: You can’t have your cake and eat it. Bus. Strateg. Environ. 2010, 19, 217–229. [Google Scholar] [CrossRef]

- Choi, D.; Gray, E. The venture development processes of “sustainable” entrepreneurs. Manag. Res. News 2008, 8, 558–569. [Google Scholar] [CrossRef]

- Keskin, D.; Carel, D.J.; Molenaar, N. Innovation process of new ventures driven by sustainability. J. Clean. Prod. 2013, 45, 50–60. [Google Scholar] [CrossRef]

- Berchicci, L.; Bodewes, W. Bridging environmental issues with new product development. Bus. Strateg. Environ. 2005, 14, 272–285. [Google Scholar] [CrossRef]

- Belz, F.M.; Peattie, K. Sustainability Marketing: A Global Perspective; Wiley: Chichester, UK, 2012. [Google Scholar]

- Benavides-Espinosa, M.; Ribeiro-Soriano, D. Cooperative learning in creating and managing joint ventures. J. Bus. Res. 2014, 67, 648–655. [Google Scholar] [CrossRef]

- Dienes, D.; Velte, P. The Impact of Supervisory Board Composition on CSR Reporting. Evidence from the German Two-Tier System. Sustainability 2016, 8, 63. [Google Scholar] [CrossRef]

- García-Sánchez, E.; García-Morales, V.J.; Martín-Rojas, R. Analysis of the influence of the environment, stakeholder integration capability, absorptive capacity, and technological skills on organizational performance through corporate entrepreneurship. Int. Entrep. Manag. J. 2017, 13, 1–33. [Google Scholar] [CrossRef]

| Sample Size | 1045 |

| Context | Spain |

| Responses Received | 174 |

| Sampling Procedure | Simple random sampling |

| Confidence Level | 95%, p = q = 50%; α = 0.05 |

| Response Rate | 16.65% |

| Sample Error | 6.79% |

| Data Collection Period | November 2015 to February 2016 |

| Composite/Indicators | Factor Loading | Composite Reliability | Cronbach’s Alpha | AVE |

|---|---|---|---|---|

| CSR (second-order type a composite) | 0.827 | 0.882 | 0.809 | |

| Economic Dimension (first-order type a composite) | 0.873 | 0.880 | 0.844 | 0.760 |

| Social Dimension (first-order type a composite) | 0.893 | 0.923 | 0.914 | 0.732 |

| Environmental Dimension (first-order type a composite) | 0.908 | 0.875 | 0.836 | 0.775 |

| Composite/Indicators | Factor Loading | Composite Reliability | Cronbach’s Alpha | AVE |

|---|---|---|---|---|

| Entrepreneurial Orientation (second-order type b composite) | 0.850 | 0.733 | 0.756 | |

| Innovativeness (first-order type a composite) | 0.910 | 0.851 | 0.770 | |

| Innovativeness 1 | 0.872 | |||

| Innovativeness 2 | 0.878 | |||

| Innovativeness 3 | 0.883 | |||

| Proactiveness (first-order type a composite) | 0.772 | 0.765 | 0.612 | |

| Proactiveness 1 | 0.720 | |||

| Proactiveness 2 | 0.897 | |||

| Proactiveness 3 | 0.855 | |||

| Risk-Taking (first-order type a composite) | 0.768 | 0.750 | 0.630 | |

| Risk-Taking 1 | 0.775 | |||

| Risk-Taking 2 | 0.836 | |||

| Risk-Taking 3 | 0.749 |

| Composite/Indicators | Factor Loading | Composite Reliability | Cronbach’s Alpha | AVE |

|---|---|---|---|---|

| Business Performance (first-order type a composite) | 0.906 | 0.870 | 0.656 | |

| Business performance 1 | 0.852 | |||

| Business performance 2 | 0.793 | |||

| Business performance 3 | 0.857 | |||

| Business performance 4 | 0.825 |

| Economic Dimension | Social Dimension | Environmental Dimension | |

|---|---|---|---|

| Economic Dim. | 0.871 | ||

| Social Dim. | 0.667 | 0.855 | |

| Environmental Dim. | 0.597 | 0.648 | 0.880 |

| Innovativeness | Proactiveness | Risk-Taking | |

|---|---|---|---|

| Innovativeness | 0.877 | ||

| Proactiveness | 0.440 | 0.782 | |

| Risk-Taking | 0.463 | 0.348 | 0.793 |

| CSR | EO | FP | |

|---|---|---|---|

| CSR | |||

| EO | 0.743 | ||

| FP | 0.636 | 0.702 |

| Original Data (O) | Mean (M) | 5.0% | 95.0% | Mean (M) | Bias | 5.0% | 95.0% | |

|---|---|---|---|---|---|---|---|---|

| CSR → FP | 0.636 | 0.622 | 0.275 | 0.657 | 0.412 | −0.014 | 0.277 | 0.658 |

| EO → FP | 0.702 | 0.696 | 0.258 | 0.758 | 0.414 | −0.006 | 0.247 | 0.754 |

| Factor | Loadings (λ) | VIF |

|---|---|---|

| Innovativeness | 0.478 | 1.905 |

| Proactiveness | 0.429 | 1.703 |

| Risk-Taking | 0.308 | 1.28 |

| R2 | B | T Value | |

|---|---|---|---|

| Model 1: CSR → FP | 0.658 | 0.736 | 16.672 |

| Model 2: CSR → FP EO → FP | 0.678 | 0.415 | 5.094 |

| 0.413 | 4.632 | ||

| Model 3: CSR × EO → FP | 0.707 | 0.398 | 4.657 |

| 0.396 | 5.076 | ||

| 0.210 | 5.019 |

| Variable | β | T Value |

|---|---|---|

| Age | −0.099 | 0.670 |

| Sector | −0.092 | 0.525 |

| Size | −0.058 | 0.403 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hernández-Perlines, F.; Rung-Hoch, N. Sustainable Entrepreneurial Orientation in Family Firms. Sustainability 2017, 9, 1212. https://doi.org/10.3390/su9071212

Hernández-Perlines F, Rung-Hoch N. Sustainable Entrepreneurial Orientation in Family Firms. Sustainability. 2017; 9(7):1212. https://doi.org/10.3390/su9071212

Chicago/Turabian StyleHernández-Perlines, Felipe, and Nina Rung-Hoch. 2017. "Sustainable Entrepreneurial Orientation in Family Firms" Sustainability 9, no. 7: 1212. https://doi.org/10.3390/su9071212