Implementing Environmental Practices for Accomplishing Sustainable Green Supply Chain Management

Abstract

:1. Introduction

2. Literature Review

2.1. Supply Disruprion Risk

2.2. Integration with Suppliers

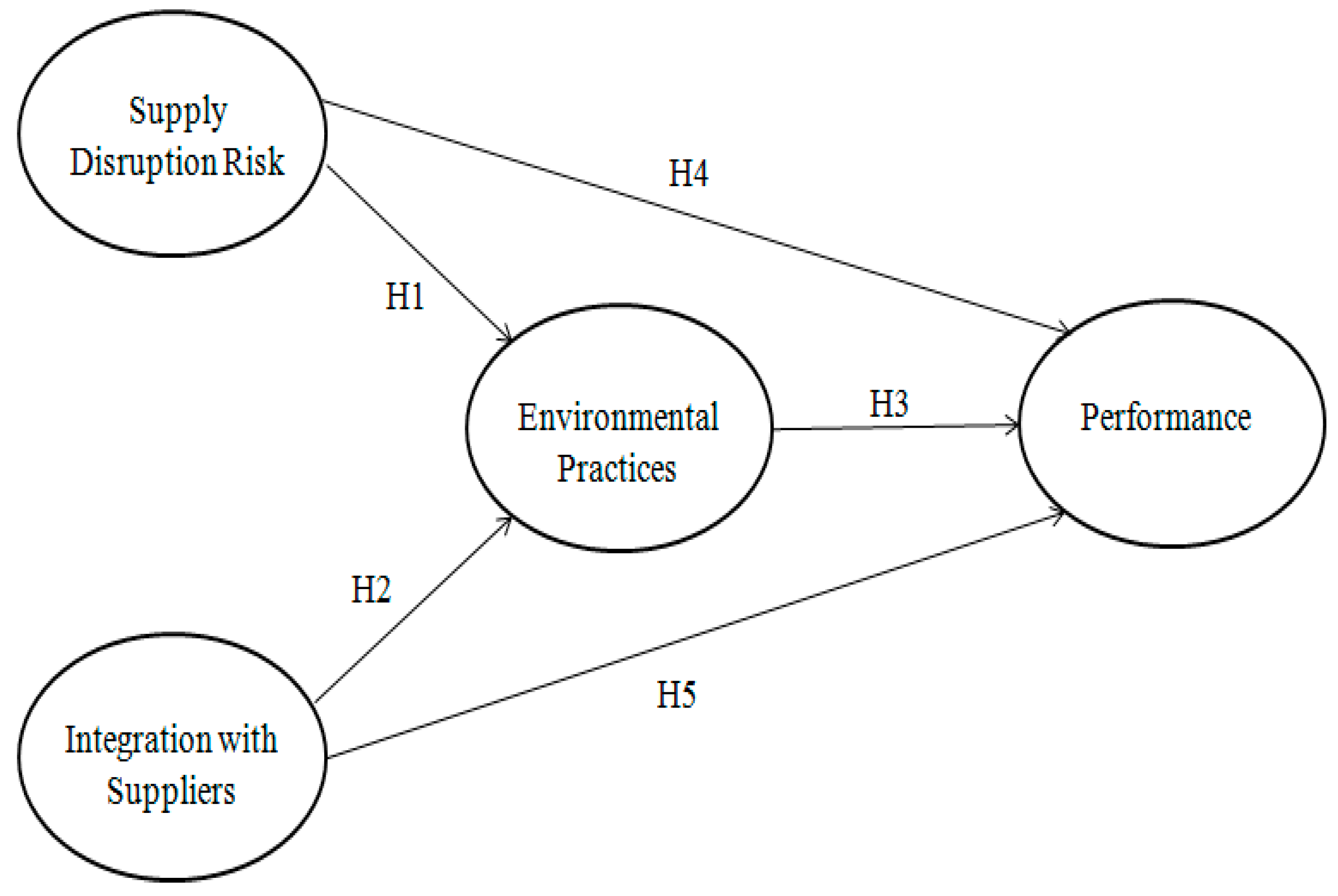

3. Research Model and Hypothesis

4. Methods

4.1. Instrument Development

4.2. Study Sample

5. Results

5.1. Measurement Model

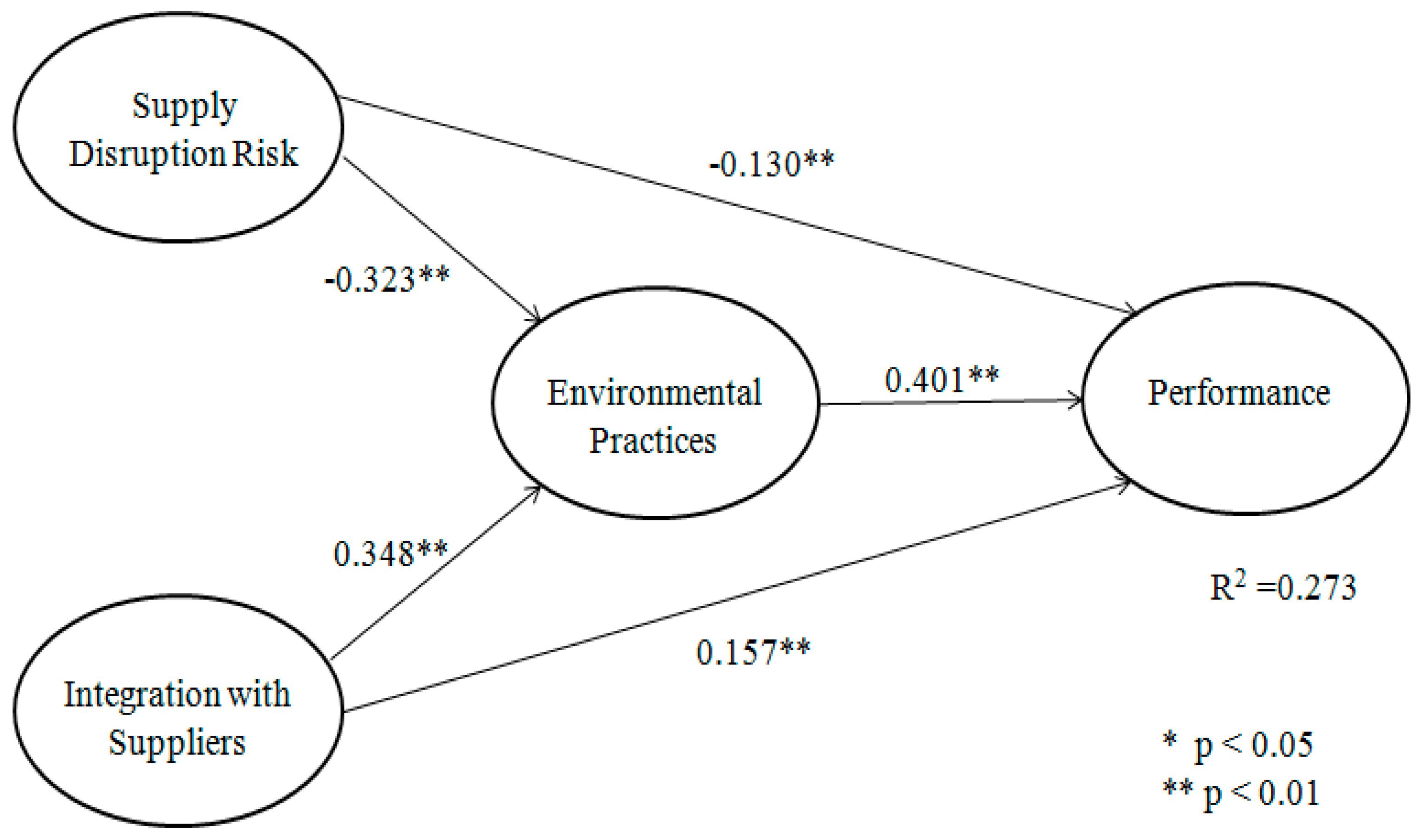

5.2. Structural Model

6. Discussion and Conclusions

Author Contributions

Conflicts of Interest

References

- Hofer, C.; Cantor, D.E.; Dai, J. The competitive determinants of a firm’s environmental management activities: Evidence from US manufacturing industries. J. Oper. Manag. 2012, 30, 69–84. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q.; Lai, K.-H. An organizational theoretic review of green supply chain management literature. Int. J. Prod. Econ. 2011, 130, 1–15. [Google Scholar] [CrossRef]

- Kocabasoglu, C.; Prahinski, C.; Klassen, R.D. Linking forward and reverse supply chain investments: The role of business uncertainty. J. Oper. Manag. 2007, 25, 1141–1160. [Google Scholar] [CrossRef]

- Craighead, C.W.; Blackhurst, J.; Rungtusanatham, M.J.; Handfield, R.B. The Severity of Supply Chain Disruptions: Design Characteristics and Mitigation Capabilities. Decis. Sci. 2007, 38, 131–156. [Google Scholar] [CrossRef]

- Yates, J.F.; Stone, E.R. Risk appraisal. In Risk-Taking Behavior, 1st ed.; Yates, J.F., Ed.; John Wiley & Sons: New York, NY, USA, 1992; pp. 49–85. [Google Scholar]

- Ellis, S.C.; Henry, R.M.; Shockley, J. Buyer perceptions of supply disruption risk: A behavioral view and empirical assessment. J. Oper. Manag. 2010, 28, 34–46. [Google Scholar] [CrossRef]

- Trkman, P.; McCormack, K. Supply chain risk in turbulent environments—A conceptual model for managing supply chain network risk. Int. J. Prod. Econ. 2009, 119, 247–258. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Singhal, V.R. An Empirical Analysis of the Effect of Supply Chain Disruptions on Long-Run Stock Price Performance and Equity Risk of the Firm. Prod. Oper. Manag. 2005, 14, 35–52. [Google Scholar] [CrossRef]

- Yu, H.; Zeng, A.Z.; Zhao, L. Single or dual sourcing: Decision-making in the presence of supply chain disruption risks. Omega 2009, 37, 788–800. [Google Scholar] [CrossRef]

- Kleindorfer, P.R.; Saad, G.H. Managing disruption risks in supply chains. Prod. Oper. Manag. 2005, 14, 53–68. [Google Scholar] [CrossRef]

- Tomlin, B. On the value of mitigation and contingency strategies for managing supply chain disruption risks. Manag. Sci. 2006, 52, 639–657. [Google Scholar] [CrossRef]

- Wakolbinger, T.; Cruz, J. Supply chain disruption risk management through strategic information acquisition and sharing and risk-sharing contracts. Int. J. Prod. Res. 2011, 49, 4063–4084. [Google Scholar] [CrossRef]

- Kern, D.; Moser, R.; Hartmann, E.; Moder, M. Supply risk management: Model development and empirical analysis. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 60–82. [Google Scholar] [CrossRef]

- Alfalla-Luque, R.; Medina-Lopez, C.; Dey, P.K. Supply chain integration framework using literature review. Prod. Plan. Control 2012, 24, 800–817. [Google Scholar] [CrossRef]

- Braunscheidel, M.J.; Suresh, N.C. The organizational antecedents of a firm’s supply chain agility for risk mitigation and response. J. Oper. Manag. 2009, 27, 119–140. [Google Scholar] [CrossRef]

- Childerhouse, P.; Towill, D.R. Arcs of supply chain integration. Int. J. Prod. Res. 2011, 49, 7441–7468. [Google Scholar] [CrossRef]

- Danese, P.; Romano, P. Supply chain integration and efficiency performance: A study on the interactions between customer and supplier integration. Supply Chain Manag. 2011, 16, 220–230. [Google Scholar] [CrossRef]

- Droge, C.; Vickery, S.K.; Jacobs, M.A. Does supply chain integration mediate the relationships between product/process strategy and service performance? An empirical study. Int. J. Prod. Econ. 2012, 137, 250–262. [Google Scholar] [CrossRef]

- Flynn, B.B.; Huo, B.; Zhao, X. The impact of supply chain integration on performance: A contingency and configuration approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- Kannan, V.R.; Tan, K.C. Supply chain integration: Cluster analysis of the impact of span of integration. Supply Chain Manag. 2010, 15, 207–215. [Google Scholar] [CrossRef]

- Kim, S.W. An investigation on the direct and indirect effect of supply chain integration on firm performance. Int. J. Prod. Econ. 2009, 119, 328–346. [Google Scholar] [CrossRef]

- Wong, C.Y.; Boon-Itt, S.; Wong, C.W. The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J. Oper. Manag. 2011, 29, 604–615. [Google Scholar] [CrossRef]

- Gimenez, C.; van der Vaart, T.; Van Donk, D.P. Supply chain integration and performance: The moderating effect of supply complexity. Int. J. Oper. Prod. Manag. 2012, 32, 583–610. [Google Scholar] [CrossRef]

- Li, G.; Yang, H.; Sun, L.; Sohal, A.S. The impact of IT implementation on supply chain integration and performance. Int. J. Prod. Econ. 2009, 120, 125–138. [Google Scholar] [CrossRef]

- So, S.; Sun, H. An extension of IDT in examining the relationship between electronic-enabled supply chain integration and the adoption of lean production. Int. J. Prod. Res. 2011, 49, 447–466. [Google Scholar] [CrossRef]

- Chan, R.Y.; He, H.; Chan, H.K.; Wang, W.Y. Environmental orientation and corporate performance: The mediation mechanism of green supply chain management and moderating effect of competitive intensity. Ind. Mark. Manag. 2012, 41, 621–630. [Google Scholar] [CrossRef]

- Srivastava, S.K. Green supply chain management: A state of the art literature review. Int. J. Manag. Rev. 2007, 9, 53–80. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Sarkis, J.; Gonzalez-Torre, P.; Adenso-Diaz, B. Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. J. Oper. Manag. 2010, 28, 163–176. [Google Scholar] [CrossRef]

- Montabon, F.; Sroufe, R.; Narasimhan, R. An examination of corporate reporting, environmental management practices and firm performance. J. Oper. Manag. 2007, 25, 998–1014. [Google Scholar] [CrossRef]

- Porter, M.; van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Jacobs, B.W.; Singhal, V.R.; Subramanian, R. An empirical investigation of environmental performance and the market value of the firm. J. Oper. Manag. 2010, 28, 430–441. [Google Scholar] [CrossRef]

- Gonzalez, P.; Sarkis, J.; Adenso-Diaz, B. Environmental management system certification and its influence on corporate practices: Evidence from the automotive industry. Int. J. Oper. Prod. Manag. 2008, 28, 1021–1041. [Google Scholar] [CrossRef]

- Walton, S.V.; Handfield, R.B.; Melnyk, S.A. The green supply chain: Integrating suppliers into environmental management processes. J. Supply Chain Manag. 1998, 34, 2–11. [Google Scholar] [CrossRef]

- Hervani, A.A.; Helms, M.M.; Sarkis, J. Performance measurement for green supply chain management. Benchmarking 2005, 12, 330–353. [Google Scholar] [CrossRef]

- Holt, D.; Ghobadian, A. An empirical study of green supply chain management practices amongst UK manufacturers. J. Manuf. Technol. Manag. 2009, 20, 933–956. [Google Scholar] [CrossRef]

- Cousins, P.D.; Lamming, R.C.; Bowen, F. The role of risk in environment-related supplier initiatives. Int. J. Oper. Prod. Manag. 2004, 24, 554–565. [Google Scholar] [CrossRef]

- Lee, S.-Y. Drivers for the participation of small and medium-sized suppliers in green supply chain initiatives. Supply Chain Manag. 2008, 13, 185–198. [Google Scholar] [CrossRef]

- Vachon, S.; Klassen, R.D. Extending green practices across the supply chain: The impact of upstream and downstream integration. Int. J. Oper. Prod. Manag. 2006, 26, 795–821. [Google Scholar] [CrossRef]

- Zsidisin, G.A. A grounded definition of supply risk. J. Purch. Supply Manag. 2003, 9, 217–224. [Google Scholar] [CrossRef]

- Zsidisin, G.A. Managerial perceptions of supply risk. J. Supply Chain Manag. 2003, 39, 14–26. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Golicic, S.L.; Smith, C.D. A Meta-Analysis of Environmentally Sustainable Supply Chain Management Practices and Firm Performance. J. Supply Chain Manag. 2013, 49, 78–95. [Google Scholar] [CrossRef]

- Melnyk, S.A.; Sroufe, R.P.; Calantone, R. Assessing the impact of environmental management systems on corporate and environmental performance. J. Oper. Manag. 2003, 21, 329–351. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.-H. Confirmation of a measurement model for green supply chain management practices implementation. Int. J. Prod. Econ. 2008, 111, 261–273. [Google Scholar] [CrossRef]

- Rao, P.; Holt, D. Do green supply chains lead to competitiveness and economic performance? Int. J. Oper. Prod. Manag. 2005, 25, 898–916. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. The moderating effects of institutional pressures on emergent green supply chain practices and performance. Int. J. Prod. Res. 2007, 45, 4333–4355. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Singhal, V.R. Delays in new product intorudction and the market value of the firms: The consequences of being late to the market. Manag. Sci. 1997, 43, 422–436. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Singhal, V.R. The effect of supply chain glitches on shareholder wealth. J. Oper. Manag. 2003, 21, 501–522. [Google Scholar] [CrossRef]

- Norrman, A.; Jansson, U. Ericsson’s proactive supply chain risk management approach after a seriou sub-supplier accident. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 434–456. [Google Scholar] [CrossRef]

- Ritchie, B.; Brindley, C. Supply chain risk management and performance: A literature review. Int. J. Oper. Prod. Manag. 2007, 27, 303–322. [Google Scholar] [CrossRef]

- Wagner, S.M.; Bode, C. An emprical examination of supply chain performance along several dimensions of risk. J. Bus. Logist. 2008, 29, 307–325. [Google Scholar] [CrossRef]

- Lai, F.; Zhang, M.; Lee, D.M.; Zhao, X. The Impact of Supply Chain Integration on Mass Customization Capability: An Extended Resource-Based View. IEEE Trans. Eng. Manag. 2012, 59, 443–456. [Google Scholar]

- Ragatz, G.L.; Handfield, R.B.; Petersen, K.J. Benefits associated with supplier integration into new product development under conditions of technology uncertainty. J. Bus. Res. 2002, 55, 389–400. [Google Scholar] [CrossRef]

- Das, A.; Narasimhan, R.; Talluri, S. Supplier integration—finding an optimal configuration. J. Oper. Manag. 2006, 24, 563–582. [Google Scholar] [CrossRef]

- Narasimhan, R.; Kim, S.W. Effect of supply chain integration on the relationship between diversification and performance: Evidence from Japanese and Korean firms. J. Oper. Manag. 2002, 20, 303–323. [Google Scholar] [CrossRef]

- Richey Jr, R.G.; Chen, H.; Upreti, R.; Fawcett, S.E.; Adams, F.G. The moderating role of barriers on the relationship between drivers to supply chain integration and firm performance. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 826–840. [Google Scholar] [CrossRef]

- Devaraj, S.; Krajewski, L.; Wei, J.C. Impact of eBusiness technologies on operational performance: The role of production information integration in the supply chain. J. Oper. Manag. 2007, 25, 1199–1216. [Google Scholar] [CrossRef]

- Sezen, B. Relative effects of design, integration and information sharing on supply chain performance. Supply Chain Manag. 2008, 13, 233–240. [Google Scholar] [CrossRef]

- Yeung, A.C. Strategic supply management, quality initiatives, and organizational performance. J. Oper. Manag. 2008, 26, 490–502. [Google Scholar] [CrossRef]

- Doty, D.H.; Glick, W.H. Common methods bias: Does common methods variance really bias results? Organ. Res. Methods 1998, 1, 374–406. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Falk, R.F.; Miller, N.B. A Premier for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Haenliein, M.; Kaplain, A.M. A beginner’s guide to partial least square analysis. Underst. Stat. 2014, 3, 283–297. [Google Scholar] [CrossRef]

- Wold, H. Introduction to the Second Generation of Mutivate Analysis; Paragon House: New York, NY, USA, 1989. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hulland, J. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach for structural equation modeling. In Modern Methods for Business Research. Methodology for Business and Management; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Neely, A.; Gregory, M.; Platts, K. Performance measurement system design: A literature review and research agenda. Int. J. Oper. Prod. Manag. 2005, 25, 1228–1263. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Ketchen, D.J.; Cavusgil, T.; Calantone, R.J. Knowledge as a strategic resource in supply chains. J. Oper. Manag. 2006, 24, 458–475. [Google Scholar] [CrossRef]

| Factor | Measurement Items | Cronbach’s Alpha | Average Variance Extracted (AVE) | Composite Reliability (CR) |

|---|---|---|---|---|

| Supply Disruption Risk [6] | It is highly likely that we will experience an interruption in the delivery of supplies from our suppliers. | 0.844 | 0.719 | 0.876 |

| There is a high probability that our suppliers will fail to provide supplies. | ||||

| We worry that suppliers may not provide supplies as per the specifications in the purchase agreement. | ||||

| An interruption in supplies from our suppliers would have severe negative financial consequences for our business. | ||||

| Suppliers’ inability to provide supplies would jeopardize our business performance and information system sophistication. | ||||

| We would incur significant costs and/or losses in revenue if our suppliers failed to provide supplies and legal liabilities. | ||||

| Integration with Suppliers [15] | Our inventory levels are shared with our suppliers. | 0.855 | 0.834 | 0.888 |

| Our key suppliers deliver to our plant on a JIT basis. | ||||

| We have a high level of corporate communication regarding important issues with key suppliers. | ||||

| Information sharing via the Internet is important for our supply chain. | ||||

| We work with our suppliers to seamlessly integrate our inter-firm processes. | ||||

| Our supply chain employs rapid response initiatives. | ||||

| We jointly develop new products/services with our suppliers. | ||||

| Environmental Practice [29] | Reduction in the variety of materials employed in manufacturing the company’s products. | 0.902 | 0.891 | 0.925 |

| Reduction in raw materials (the use of recycled material) to manufacture products. | ||||

| Avoidance of materials that are considered harmful, but not illegal. | ||||

| Use of LCA for product design. | ||||

| Use of easy-to-break joins between components to facilitate disassembly. | ||||

| Clear identification of materials (colors, codes, etc.) to facilitate disassembly. | ||||

| Use of standardized components to facilitate their reuse. | ||||

| Recycling of solid wastes. | ||||

| Environmental management procedures for internal use. | ||||

| Use of advanced prevention and safety systems at work. | ||||

| Performance [58,59,60] | Average return on assets. | 0.878 | 0.796 | 0.864 |

| Average profit. | ||||

| Percent defects during production. | ||||

| Delivery reliability. | ||||

| Ability to respond to and accommodate periods of poor supplier performance. | ||||

| Total cost of distribution, including transportation and handling costs. |

| Factors | SDR | IS | EP | PER |

|---|---|---|---|---|

| SDRa | 0.779 | 0.147 | 0.215 | 0.191 |

| SDRb | 0.769 | 0.214 | 0.046 | 0.156 |

| SDRc | 0.804 | 0.325 | 0.135 | 0.144 |

| SDRd | 0.870 | 0.286 | 0.152 | 0.110 |

| SDRe | 0.864 | 0.225 | 0.157 | 0.206 |

| SDRf | 0.745 | 0.118 | 0.001 | 0.299 |

| ISa | 0.250 | 0.852 | 0.217 | 0.198 |

| ISb | 0.213 | 0.897 | 0.331 | 0.142 |

| ISc | 0.339 | 0.893 | 0.234 | 0.183 |

| ISd | 0.321 | 0.883 | 0.459 | 0.083 |

| ISe | 0.370 | 0.876 | 0.204 | 0.104 |

| ISf | 0.309 | 0.907 | 0.293 | 0.180 |

| ISg | 0.280 | 0.808 | 0.357 | 0.234 |

| EPa | 0.234 | 0.259 | 0.829 | 0.306 |

| EPb | 0.381 | 0.334 | 0.877 | 0.335 |

| EPc | 0.412 | 0.386 | 0.847 | 0.295 |

| EPd | 0.411 | 0.343 | 0.928 | 0.325 |

| EPe | 0.295 | 0.250 | 0.886 | 0.264 |

| EPf | 0.277 | 0.264 | 0.861 | 0.393 |

| EPg | 0.270 | 0.249 | 0.857 | 0.252 |

| EPh | 0.204 | 0.339 | 0.779 | 0.250 |

| EPi | 0.301 | 0.102 | 0.910 | 0.112 |

| Epj | 0.178 | 0.057 | 0.845 | 0.211 |

| PERa | 0.356 | 0.326 | 0.198 | 0.862 |

| PERb | 0.274 | 0.335 | 0.223 | 0.802 |

| PERc | 0.045 | 0.006 | 0.106 | 0.921 |

| PERd | 0.089 | 0.053 | 0.221 | 0.812 |

| PERe | 0.163 | 0.422 | 0.043 | 0.854 |

| PERf | 0.365 | 0.259 | 0.172 | 0.773 |

| Variables | SDR | IS | EP | PER |

|---|---|---|---|---|

| SDR | 0.848 | |||

| IS | 0.214 | 0.913 | ||

| EP | 0.397 | 0.416 | 0.944 | |

| PER | 0.242 | 0.404 | 0.401 | 0.892 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, M.; Chai, S. Implementing Environmental Practices for Accomplishing Sustainable Green Supply Chain Management. Sustainability 2017, 9, 1192. https://doi.org/10.3390/su9071192

Kim M, Chai S. Implementing Environmental Practices for Accomplishing Sustainable Green Supply Chain Management. Sustainability. 2017; 9(7):1192. https://doi.org/10.3390/su9071192

Chicago/Turabian StyleKim, Minkyun, and Sangmi Chai. 2017. "Implementing Environmental Practices for Accomplishing Sustainable Green Supply Chain Management" Sustainability 9, no. 7: 1192. https://doi.org/10.3390/su9071192