1. Introduction (Quantification Method II: QM II)

A credit scheme generally uses a scoring system that analyzes applicants’ historical experience with debtors to create a quantitative model to classify acceptable and unacceptable credit applications [

1,

2]. Lenders use this scheme for corporate loans, helping these firms grow. However, many small– medium-sized enterprises (SME) have difficulty benefitting from credit schemes because they have poor collateral or low credit scores. For this reason, many countries have developed various schemes to support SMEs.

One such scheme is a technology credit guarantee system to support loans to SMEs to develop their technologies. In this system, the government guarantees credit for SMEs based on their technology so they can borrow money from commercial banks without collateral. Under such a scheme, commercial banks can reduce the burden of credit risk while competitive SMEs easily receive funding based on their technology, when proper SMEs are screened. This is an important issue to both academics and policy-makers [

3].

For instance, Korea has a technology credit guarantee scheme that enables SMEs to obtain loans based on the potential of their technology. The technology credit scoring system evaluates four different aspects of a business: management, technology, profitability, and the marketability of its technology. This system does not require typical financial attributes (such as debt ratio, net income based on financial statements, etc.), as its main objective is to support SMEs based on their technology; thus, SMEs can be funded without the usual collateral. Such technology credit scoring models may help reduce wasteful public spending because they help select SMEs with technological competitiveness. Many studies focused on technology credit scoring models using logistic regression, neural networks, and survival analyses [

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15,

16].

These earlier studies formulated technology credit scoring models by fitting the probability of loan default as a function of individual evaluation attributes treated as interval-scale variables and actually measured on a categorical Likert-type scale [

17]. For example, technology experience in the technology factor represents the CEO’s number of years of experience in the relevant technology field. In this attribute, five points represent “over 15 years of experience” and three points mean “5 to 10 years of experience.” Treating a categorical Likert-type scale as an interval scale masks the different effects of the individual levels of each evaluation attribute in the response. To solve this problem, we can apply a categorical version of canonical correlation analysis (CCA), which can help identify significant linear relationships between two sets of variables [

18,

19]. Since CCA aims to untangle the multiple relationships between many dependent and independent variables, the canonical correlation statistical technique is an appropriate analytical tool [

20].

Existing technology credit scoring models [

4,

10,

11,

14] offer simple loan default predictions based on technology-oriented attributes, the economic environment, and the firms’ characteristics. In general, loan defaults can result from bankruptcies, closures, delays by owners, and the owners’ poor credit. Bankruptcy is the legal condition of financial failure, while closure is a permanent end to the company’s business. Delay occurs when the debtor asks for postponed redemption of a debt until it reaches a better state of corporate management. Poor credit represents the state of delinquency for more than three months. Thus, there are three outcome categories: non-default; loan default by an insolvent company (bankruptcy, closure); and loan default by an insolvent debtor (delay or bad credit) [

13,

21,

22,

23]. Considering a multi-level target can provide more valuable information compared to simple loan default predictions, such as default and non-default types.

The main purpose of this paper is to propose the Quantification Method II (QM II), one of the quantification methods introduced by Hayashi [

24,

25] as a categorical version of CCA. We use this method to capture the relationship between two sets of categorical variables (a set of loan default types and a set of evaluation attributes).

For multi-target problems, QM II has advantages over multinomial or ordinal logistic regression models because it is not limited to the parametric linear model, but allows for flexible relationships between two sets of variables. Previous research used quantification methods actively in a variety of subject areas; however, this is the first application of this new approach to technology credit scoring to the best of our knowledge.

The proposed quantification method should contribute toward the creation of an advanced credit rating system based on technology. In addition, we propose a technology credit scoring model based on the linear combination of the level of each technology-oriented attribute and the specific characteristics of each firm. Using the technology credit scoring model, we propose a technology credit rating system that deals with both the frequency distribution and the loan default proportion. Based on the proposed rating system, this study aims to help prevent wasted government funding on technology-based SMEs and increase their technological competitiveness.

The rest of the paper is organized as follows. In

Section 2, we review the related literature with reference to technology credit scoring models and quantification methods. In

Section 3, we propose a quantification method for technology credit scoring. In

Section 4, we summarize the results of the study and discuss areas of further study.

3. Quantification Method-Based Scoring

Technology-based SMEs without proper collateral have difficulties of borrowing money from banks. The Korean government established a technology credit guarantee fund (KTCGF) to support SMEs based on their technology, and evaluate applicants based on management, technology, and the marketability and profitability of their technology, which consist of several individual evaluation attributes measured on a Likert scale. The program is not limited to a specific type of technology, though the scorecard was designed to assign high scores for new technology with high market potential.

Table 1 shows individual technology-oriented attributes as determined by a committee of experts and assessors [

11]. Each attribute was measured on a 5- or 10-point Likert-type scale depending on their degree of importance.

Table A1 in

Appendix A provides an example of technology-oriented attributes and description [

5].

We used an empirical dataset to propose both an advanced technology credit scoring model and a technology credit rating. Our dataset consisted of 4622 SMEs that received a technology credit guarantee by KOTEC based on their technology score as determined by the technology-oriented attributes used in Korea between 1999 and 2004. In this dataset, 1349 firms (29.18%) went into loan default after one to five years and 3273 firms (70.82%) did not default. We also divided the SMEs into those less than three years old (3576; 77.37%) and those greater than, or equal to, three years old (1046; 22.63%). For validation, we divided the data into a training set (70%) and a validation set (30%).

Table 2 provides a detailed description of the datasets.

We evaluated technology-oriented attributes using either a five- or 10-point Likert-type scales. Before the analysis, we adjusted all attributes to a five-point scale. However, the lowest and highest levels of an attribute generally have a substantially lower frequency compared to other attribute levels. Therefore, we modified the technology-oriented attributes by dividing them into three levels (low, medium, and high) to reduce frequency differences among the different levels of an attribute. Choi et al. [

43] also used this approach while investigating the effects of R and D funding using Hayashi’s QM II, and changed the five levels of measurement to three levels to address the frequency problem.

Table 3 shows the frequency of each of the three modified levels of each attribute, as well as the three types of loan default outcomes. We selected this approach based on previous research [

4,

21,

22,

23].

Before conducting QM II, we performed CCA to extract two significant pairs of canonical correlations; these two pairs had significant canonical correlations at the 5% confidence level. The first canonical correlation was 0.37, and the second was 0.14 (

Table 4).

We also derived two sets of canonical coefficients that represent two different linear relations between a set of default types and a set of technology-oriented attributes and firm-specific characteristic variables (

Table 4). We used these results in the QM II as follows. Based on the raw canonical coefficients, we calculated the quantification value (s

ij) following Equations (1) and (2) [

35]:

where

is the frequency of level j of the ith category variable,

is the total number of the ith categorical variables, and

is the raw canonical correlation coefficient.

where

is the quantification value of level j of the ith categorical variable.

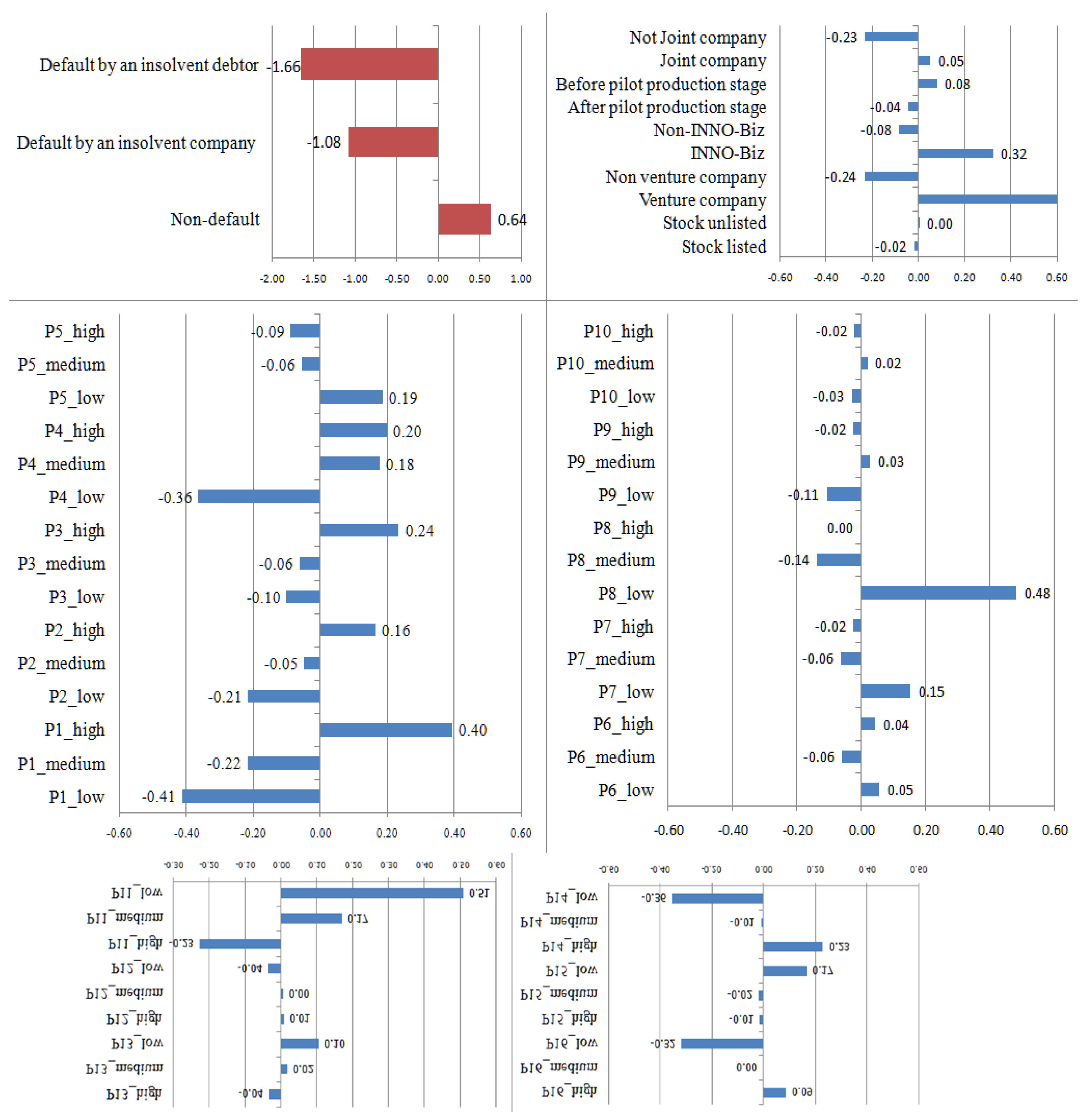

Figure 1 and

Figure 2 reveal how loan default types relate to technology-oriented attributes and a firm’s specific characteristics. In QM II, the range, sign, and pattern of the quantification score are analyzed [

43].

In the first set of quantification scores (

Figure 1), the loan default type was divided into either non-default or loan default due to an insolvent company/debtor. In addition, based on the range of the first quantification score, we concluded that knowledge management (P1), human resources (P4), new technology development (P8), market potential (P11), sales schedule (P14), return on investment/profitability (P16), and venture and innovation business registration are important predictors of loan default. In particular, the following factors are associated with loan default due to an insolvent company or debtor in the event of a negative score: a low knowledge-management score, a low funding-supply score, a medium new-technology-development score, high market potential, low sales schedule, a low return on investment/profitability, innovation business non-registration, and venture non-registration. In the event of a positive score, the following factors are associated with non-default: a high management score, high funding-supply score, low new-technology-development score, low market-potential score, high sales schedule, high return on investment/profitability, innovation business registration, and venture registration. Based on the first set of quantification scores, we found that the management and profitability factors are important in a technology credit scoring model. A low new-technology-development score was also related to non-default. Therefore, SMEs have a higher potential for success based on good management in an established area of technology. A high market-potential score typically indicates that an SME has technology with both high market potential and high risk because large firms participate in the same market [

10].

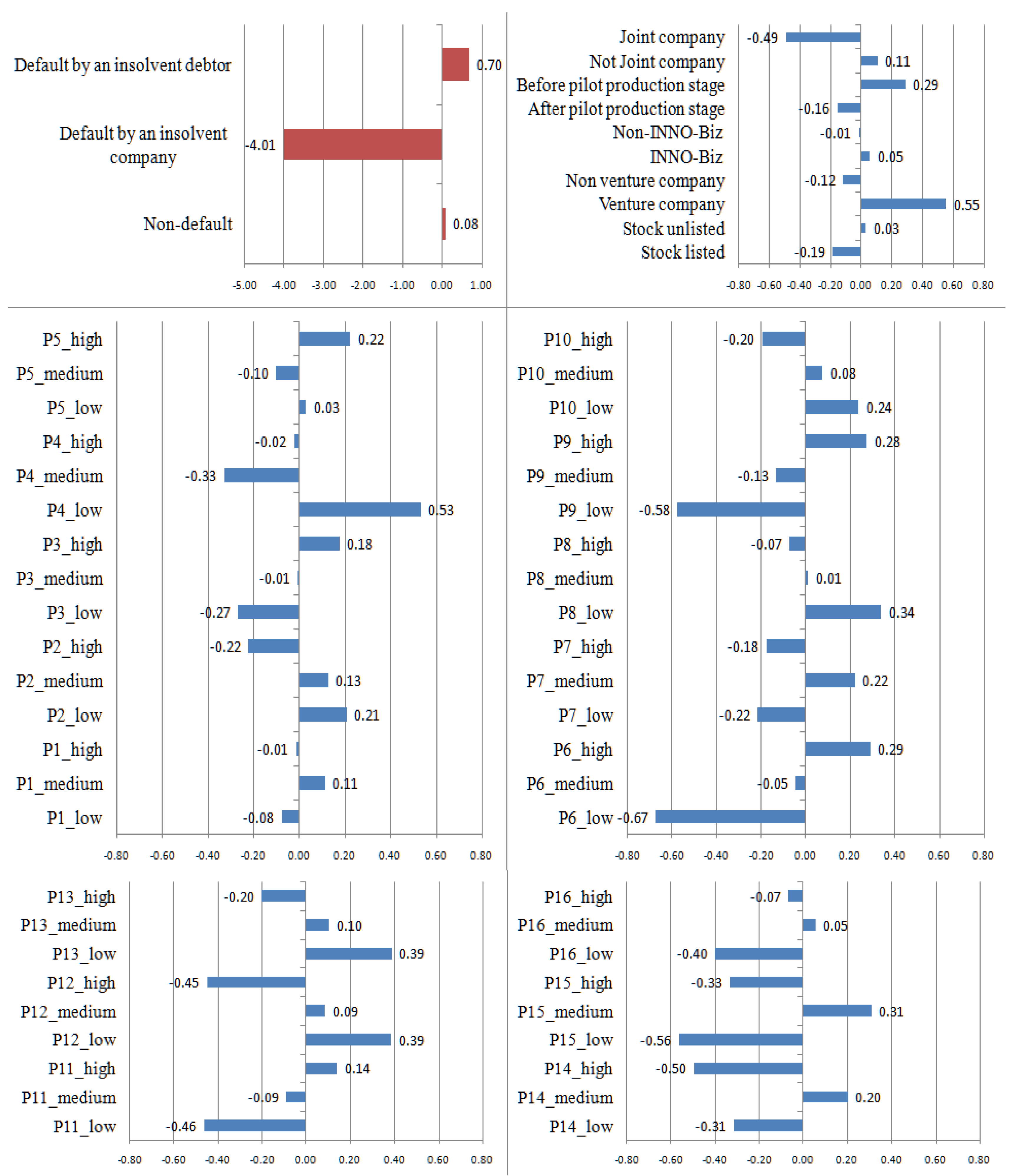

In the second set of quantification scores (

Figure 2), we divided loan default types into two classes: (1) loan default due to company insolvency and (2) loan default due to an insolvent debtor, with non-default. Based on the range of quantification scores, we identified factors related to the loan default type: funding supply (P4), the technology development environment (P6), technological superiority (P9), market potential (P11), market characteristics (P12), product competitiveness (P13), sales schedule (P14), business progress/amount of sales (P15), venture registration, and joint venture. When the score was negative, we determined that the following factors are associated with loan defaults due to company insolvency: a low environment-of-technology-development score, a low technological-superiority score, a low market-potential score, a high market characteristics score, product competitiveness, sales schedule, non-venture registration, and non-joint-venture company. Thus, SMEs with low scores on the environment of technological development and technological superiority had a higher loan default rate due to company insolvency, despite the fact that they had higher scores in market characteristics, product competitiveness, and sales schedule.

We proposed a method to determine a technology credit score using a linear combination of quantification values of technology-oriented variables and firm characteristic variables derived by the first set of quantification variables. When this technology credit score is low, one can predict non-default, whereas a high value represents default due to an insolvent debtor or company. Based on the technology credit scores, we created technology credit risk ratings.

First, we confirmed the predictive power of the proposed model compared to a logistic regression model, which are widely used for credit rating systems. We created two logistic regression models based on the same variables in the quantification model. In the logistic regression model, we assumed the technology-oriented attributed as a five-point Likert scale. To solve the multi-collinearity problem, one model had no exploratory factor analysis (EFA), and the other was based on EFA.

Figure 3 shows the receiver-operating curve (ROC) based on training data. When comparing the area under the ROC (AUROC) of the three models, the proposed model (0.7396) exhibited a slightly better performance than the other two (logistic regression model with EFA: 0.7258; logistic regression model without EFA: 0.72519).

Table 5 shows the classification based on the best fit to predict defaults. Additionally, we conducted McNemar’s test to check for significant differences in the predictive power between the proposed quantification model and the previous models [

44]. The results show that the suggested model has significant differences: the logistic regression model without EFA (

value: 3.7532,

p-value: 0.0527) and the logistic regression model with EFA (

value: 70.4093,

p-value: <0.0001). Based on the results, we see that the predictive power of the proposed model is greater than that of the others. Therefore, we conclude that our proposed technology credit scoring model based on QM II is acceptable.

Generally, a credit rating system has 10 grades, from AAA to D. Instead of allocating 10 categories by the same interval score, we incorporated both the frequency distribution and the loan default proportion to create a more acceptable technology credit rating system. In addition, the loan default proportion continually increased from AAA to D. To validate this process, we applied the quantification score for each attribute to the validation data.

Figure 4 and

Figure 5 show the technology credit rating and default rate of each grade obtained by both the training and validation datasets, both of which show a similar distribution pattern, except for the default rate of firms having a AAA rating, which accounts for the smallest proportion of cases. Typically, any category above B is considered acceptable [

45]. In

Figure 5, when we compare the default rate of firms above B-grade, there is little difference between the training data (19.15%) and the validation data (20.22%). Therefore, our proposed quantification model satisfies the validation test.

4. Conclusions

In many cases, SMEs have difficulty borrowing money from banks due to a lack of collateral. Governments offer technology credit guarantee schemes to address this issue. However, reckless financial support can lead to the waste of such government funding.

Previous studies of technology credit scoring models focused on predicting loan default risk or on a firm’s survival period. These studies developed models by fitting the probability of loan default as a function of the individual evaluation attributes considered on an interval scale, but actually measured on a categorical, Likert-type scale. This approach can yield biased results. To overcome this limitation, we applied a QM II and canonical correlation analysis to find loan default patterns. Using the quantification method, we analyzed two types of defaults.

We used QM II to isolate the two sets of canonical variables. The first quantification score identified important variables in the event of loan default due to an insolvent debtor or company: knowledge management, human resources, new technology development, market potential, sales schedule, profitability, and venture and innovation business registration. In particular, we found that high scores on management, funding supply, return on investment/profitability, and venture and innovation business registration are associated with non-default. In particular, knowledge management was the most important factor. Therefore, evaluators should assess aspects of knowledge management in more detail to prevent loan defaults. Additionally, based on the second quantification score, we uncovered important factors in loan defaults due to company insolvency: funding supply, technology development environment, technological superiority, market potential, market characteristics, product competitiveness, sales schedule, and business progress/amount of sales. Previous studies did not find that technology factors, such as technology development environment and technological superiority, significantly affected loan survival probability and time. However, our study is the first to find that these attributes are closely related to the defaults by insolvent debtors. When analyzing the results of both quantification scoring models, management is an important factor in both loan default types.

While previous studies suggested a technology credit rating system that considers both the overall default rate and its frequency distribution, a new rating system developed using our quantification method covers not only the advantages offered by previous studies, but also the relationship between different default types and the scores of technology attributes measured in on Likert scales. Specifically, our proposed model improved accuracy by 3% compared to earlier models. Using McNemar’s test, we confirmed that the predictive power of the proposed model is higher than previous models. Prior studies found that a high degree of market potential especially increases the loan default due to intense competition with large enterprises in the same market. However, our study’s results indicate that this happens only in defaults by an insolvent debtor. Therefore, we can infer that intense competition with large companies causes delay or bad credit. In addition, when applying our proposed model based on the quantification method, we revealed a complicated non-linear relationship that other approaches could not detect.

Since we measured technology-oriented attributes on a Likert-type scale, and we considered two types of defaults, a typical regression with continuous explanatory variables is not appropriate. We proposed a new technology credit scoring model based on a categorical version of CCA. The proposed model allows different weights for different levels of individual technology-oriented variables. In addition, the default prediction power is significantly higher than existing models.

Although this paper offers significant contributions, it also has limitations. Due to the nature of the quantification method, we did not consider non-categorical variables such as economic indicators. In addition, the canonical correlation was not very high. Therefore, future research should investigate more evaluation variables and a greater variety of default types.