Technology Forecasting Using a Diffusion Model Incorporating Replacement Purchases

Abstract

:1. Introduction

2. Model Specifications

3. Empirical Analysis and Results

3.1. Data Description

3.2. Model Estimation

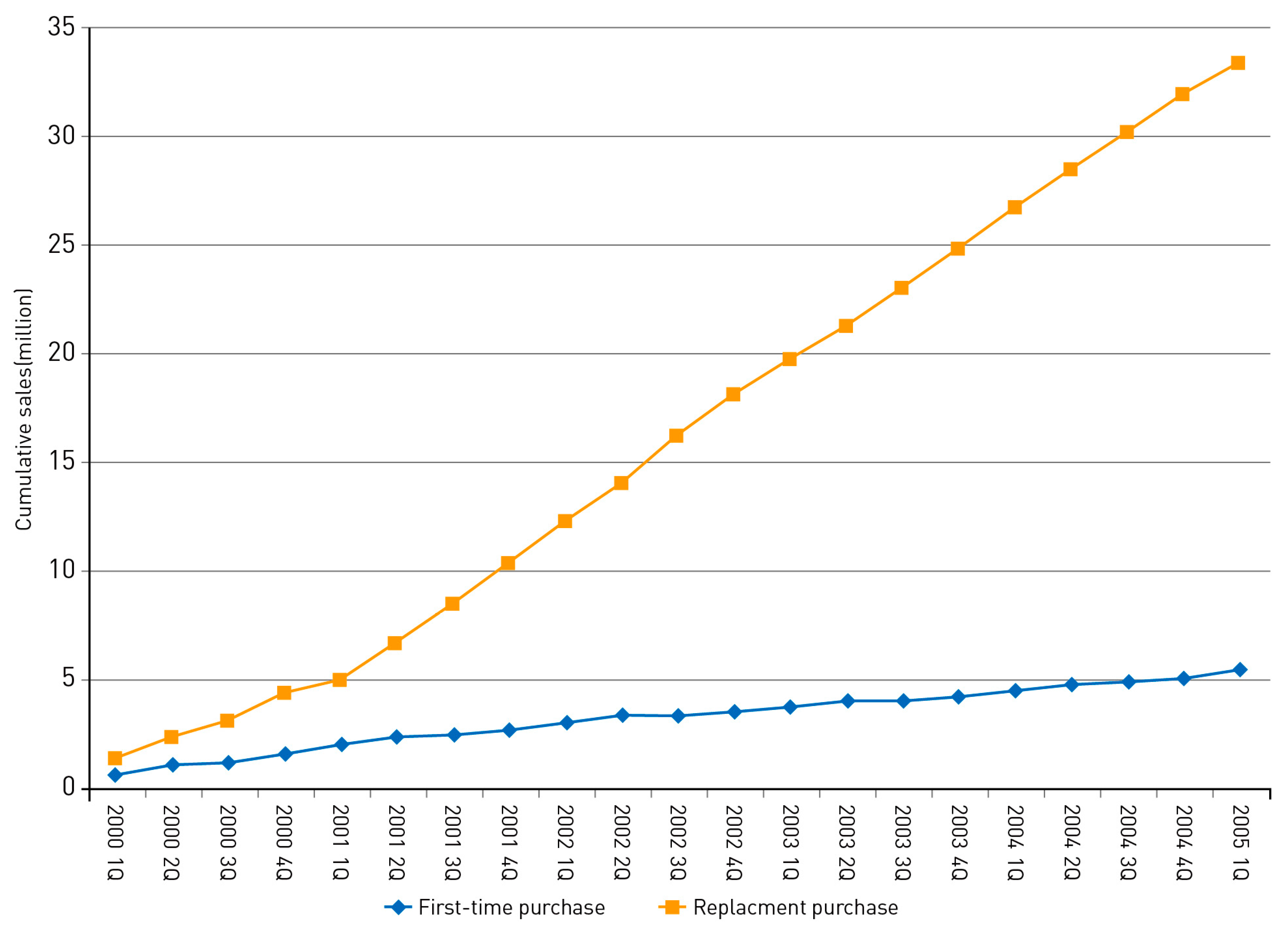

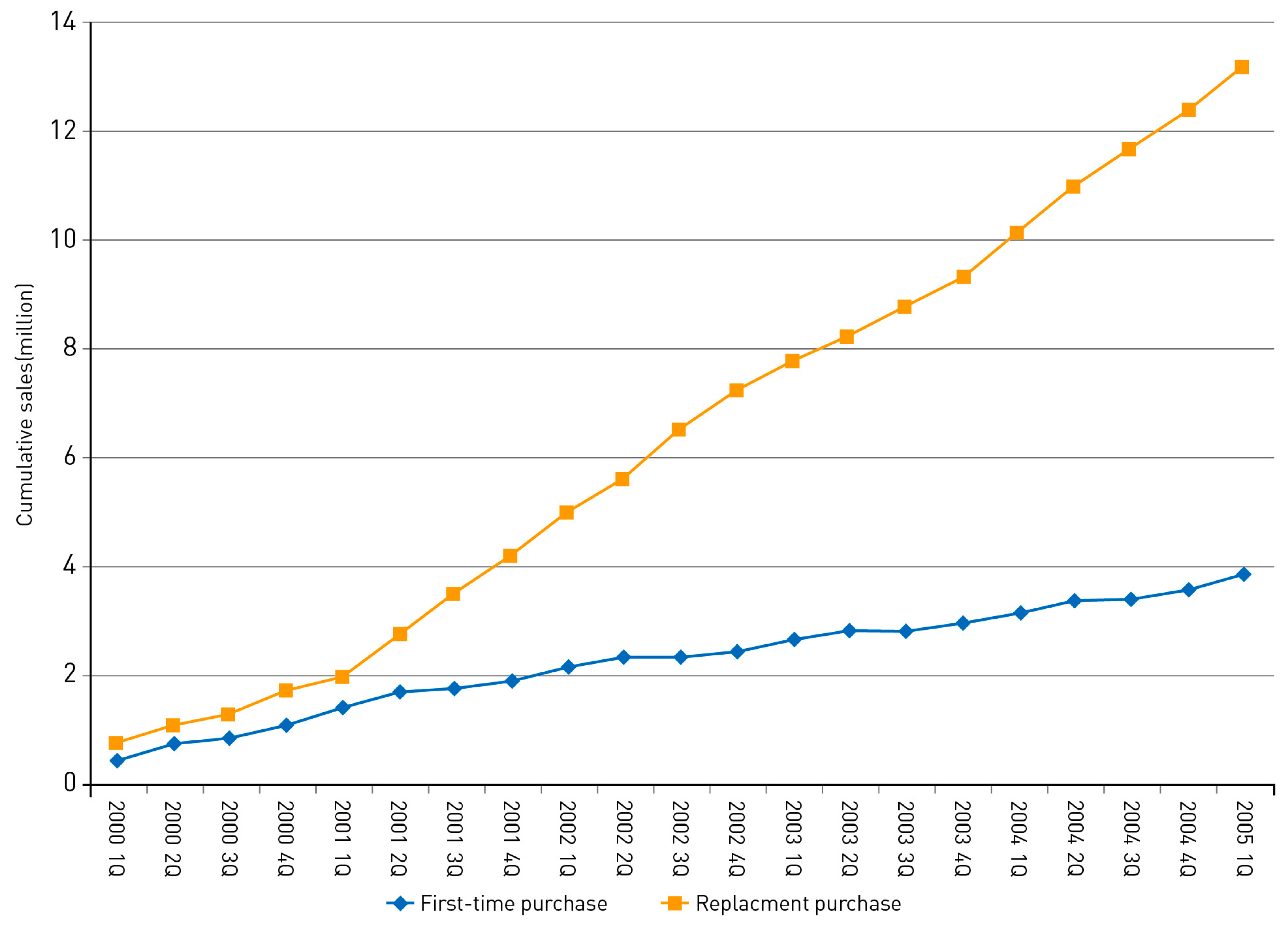

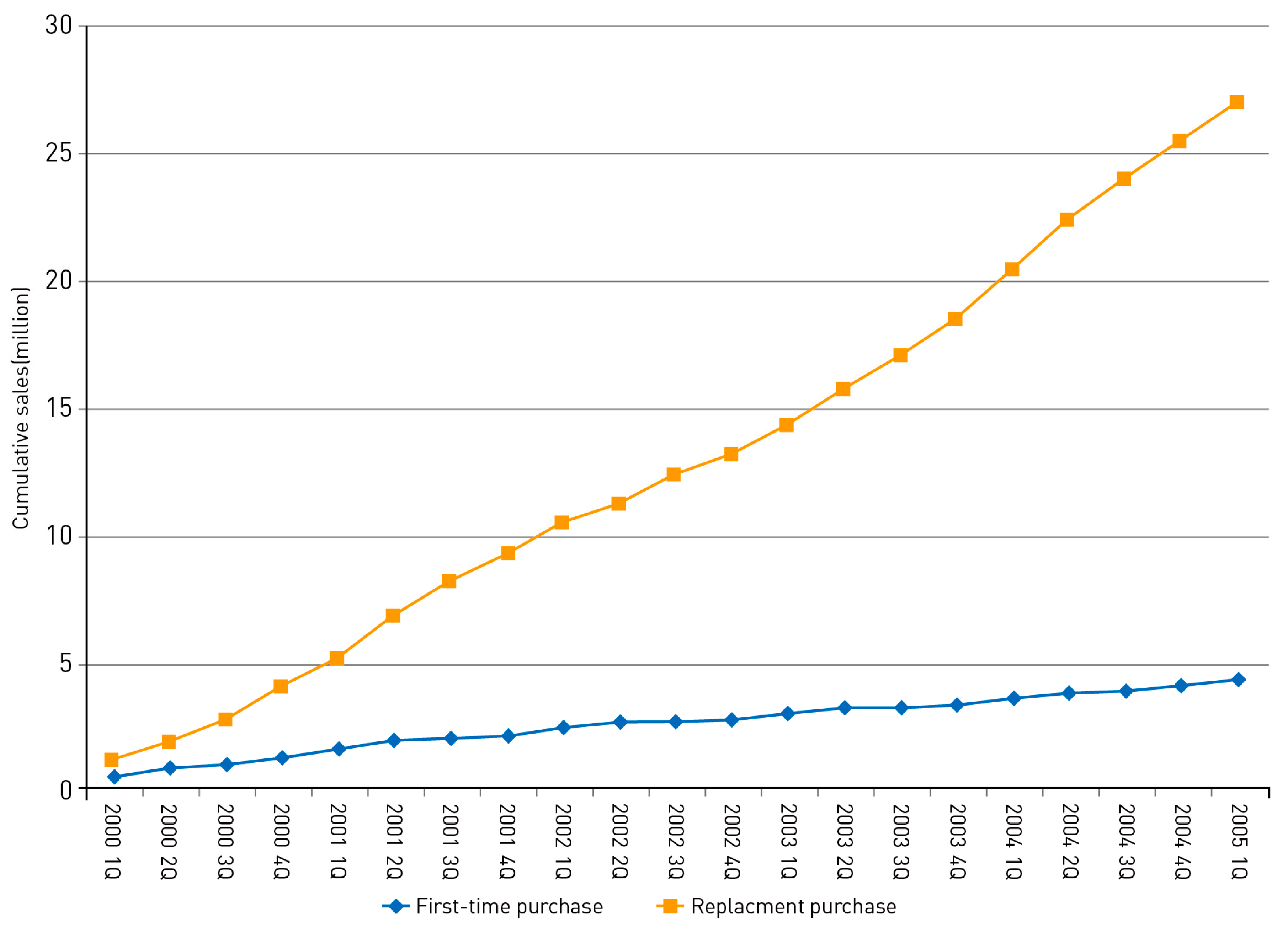

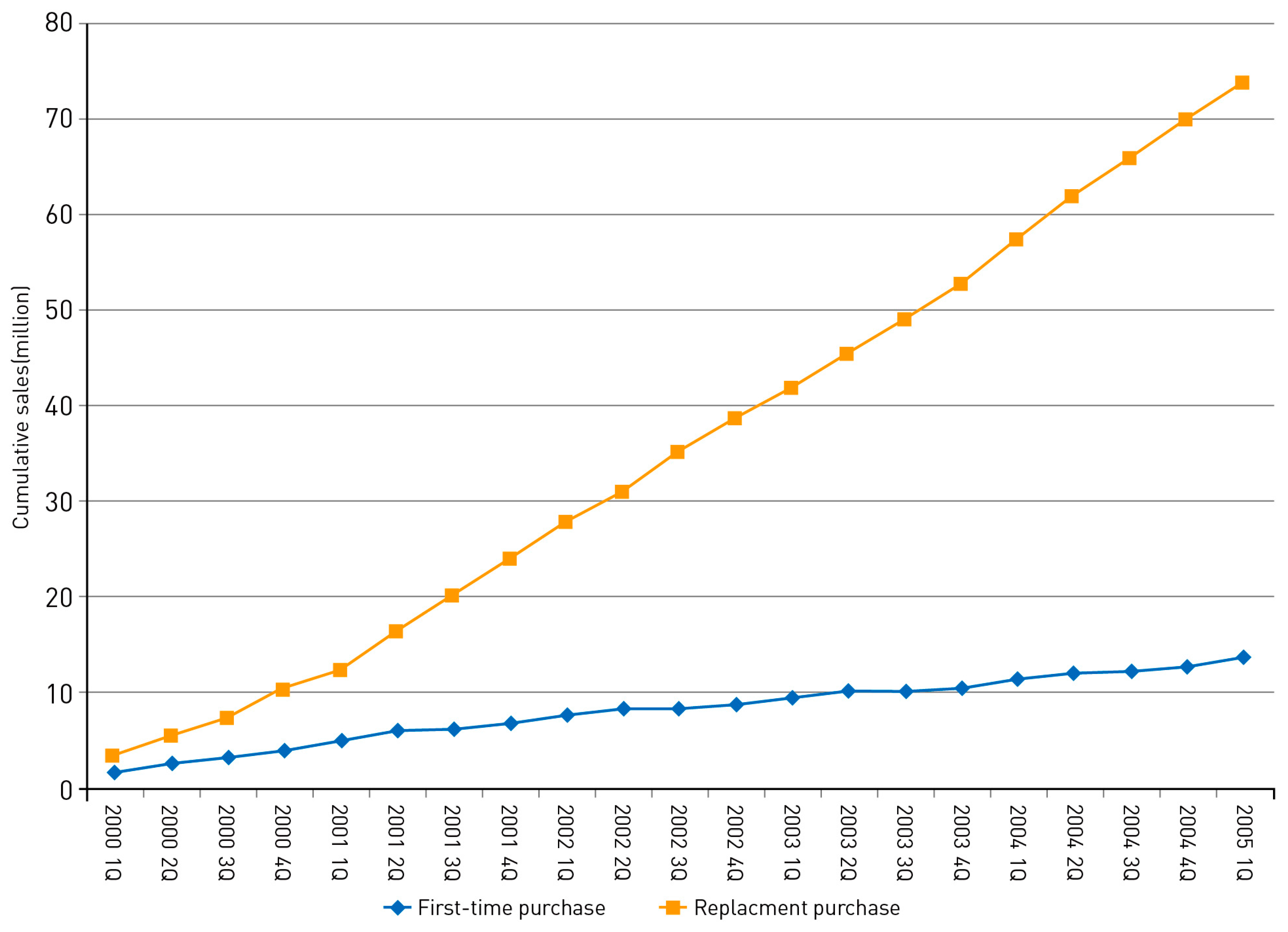

3.3. Sales to First-Time Purchasers and Replacement Purchasers in the Mobile Handset Market

3.4. Comparisons with Other Diffusion Models Incorporating Replacement Purchases

4. Discussion and Conclusions

Author Contributions

Conflicts of Interest

References

- Makadok, R. Can first-mover and early-mover advantages be sustained in an industry with low barriers to entry/imitation? Strateg. Manag. J. 1998, 19, 683–696. [Google Scholar] [CrossRef]

- Adner, R.; Zemsky, P. A demand-based perspective on sustainable competitive advantage. Strateg. Manag. J. 2006, 27, 215–239. [Google Scholar] [CrossRef]

- Datar, S.; Jordan, C.C.; Kekre, S.; Rajiv, S.; Srinivasan, K. Advantages of time-based new product development in a fast-cycle industry. J. Mark. Res. 1997, 34, 36–49. [Google Scholar] [CrossRef]

- Wang, H.T.; Wang, T.C. Application of the grey Lotka-Volterra model to forecast the diffusion and competition analysis of the TV and smartphone industries. Technol. Forecast. Soc. Chang. 2016, 106, 37–44. [Google Scholar] [CrossRef]

- Linton, J.D. Forecasting the market diffusion of disruptive and discontinuous innovation. IEEE Trans. Eng. Manag. 2002, 49, 365–374. [Google Scholar] [CrossRef]

- Mansfield, E. Technical change and the rate of imitation. Econometrica 1961, 29, 741–766. [Google Scholar] [CrossRef]

- Bass, F.M. A new product growth for model consumer durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Olson, J.; Choi, S. A product diffusion model incorporating repeat purchases. Technol. Forecast. Soc. Chang. 1985, 27, 385–397. [Google Scholar] [CrossRef]

- Bayus, B.L.; Hong, S.; Labe, R.P. Developing and using forecasting models of consumer durables: The case of color television. J. Prod. Innov. Manag. 1989, 6, 5–19. [Google Scholar] [CrossRef]

- Hahn, M.; Park, S.; Krishnamurthi, L.; Zoltners, A.A. Analysis of new product diffusion using a four-segment trial-repeat model. Mark. Sci. 1994, 13, 224–247. [Google Scholar] [CrossRef]

- Danaher, P.J.; Hardie, B.G.S.; Putsis, W.P. Marketing-mix variables and the diffusion of successive generations of a technological innovation. J. Mark. Res. 2001, 38, 501–514. [Google Scholar] [CrossRef]

- Eliashberg, J.; Jeuland, A.P. The impact of competitive entry in a developing market upon dynamic pricing strategies. Mark. Sci. 1986, 5, 20–36. [Google Scholar] [CrossRef]

- Parker, P.; Gatignon, H. Specifying competitive effects in diffusion models: An empirical analysis. Int. J. Res. Mark. 1994, 11, 17–39. [Google Scholar] [CrossRef]

- Krishnan, T.V.; Bass, F.M.; Kumar, V. Impact of a late entrant on the diffusion of a new product/service. J. Mark. Res. 2000, 37, 269–278. [Google Scholar] [CrossRef]

- Parker, P.M. Price elasticity over the adoption life cycle. J. Mark. Res. 1992, 29, 358–367. [Google Scholar] [CrossRef]

- Islam, T.; Meade, N. Modelling diffusion and replacement. Eur. J. Oper. Res. 2000, 125, 551–570. [Google Scholar] [CrossRef]

- Dodson, J.A.; Muller, E. Models of new product diffusion through advertising and word-of-mouth. Manag. Sci. 1978, 24, 1568–1578. [Google Scholar] [CrossRef]

- Lilien, G.L.; Rao, A.G.; Kalish, S. Bayesian estimation and control of detailing effort in a repeat purchase diffusion environment. Manag. Sci. 1981, 27, 493–506. [Google Scholar] [CrossRef]

- Mahajan, V.; Wind, Y.; Sharma, S. An approach to repeat purchase diffusion analysis. In Proceedings of the American Marketing Educator’s Conference, Chicago, IL, USA, 1983. [Google Scholar]

- Kamakura, W.A.; Balasubramanian, S.K. Long-term forecasting with innovation diffusion models: The impact of replacement purchases. J. Forecast. 1987, 6, 1–19. [Google Scholar] [CrossRef]

- Jun, D.B.; Kim, J.I. A choice-based multi-product diffusion model incorporating replacement demand. Technol. Forecast. Soc. Chang. 2011, 78, 674–689. [Google Scholar] [CrossRef]

- Stummer, C.; Kiesling, E.; Günther, M.; Vetschera, R. Innovation diffusion of repeat purchase products in a competitive market: An agent-based simulation approach. Eur. J. Oper. Res. 2015, 245, 157–167. [Google Scholar] [CrossRef]

- Rao, A.G.; Yamada, M. Forecasting with a repeat purchase diffusion model. Manag. Sci. 1988, 34, 734–752. [Google Scholar] [CrossRef]

- Steffens, P.R. An aggregate sales model for consumer durables incorporating a time-varying mean replacement age. J. Forecast. 2001, 20, 63–77. [Google Scholar] [CrossRef]

- Kreng, V.B.; Wang, H.T. A technology replacement model with variable market potential: An empirical study of CRT and LCD TV. Technol. Forecast. Soc. Chang. 2009, 76, 942–951. [Google Scholar] [CrossRef]

- Gordon, B.R. A dynamic model of consumer replacement cycles in the pc processor industry. Mark. Sci. 2009, 28, 846–867. [Google Scholar] [CrossRef]

- Riikonen, A.; Smura, T.; Töyli, J. The effects of price, popularity, and technological sophistication on mobile handset replacement and unit lifetime. Technol. Forecast. Soc. Chang. 2016, 103, 313–323. [Google Scholar] [CrossRef]

- Bass, P.I.; Bass, F.M. Diffusion of Technology Generations: A Model of Adoption and Repeat Sales. Available online: www.bassbasement.org/F/N/.../Bass%20and%20Bass%202001.pdf (accessed on 14 June 2017).

- Bass, F.M.; Krishnan, T.V.; Jain, D.C. Why the Bass model fits without decision variables. Mark. Sci. 1994, 13, 203–223. [Google Scholar] [CrossRef]

- Bayus, B.L. Accelerating the durable replacement cycle with marketing mix variables. J. Prod. Innov. Manag. 1988, 5, 216–226. [Google Scholar] [CrossRef]

- Abrahamson, E.; Rosenkopf, L. Institutional and competitive bandwagons: Using mathematical modeling as a tool to explore innovation diffusion. Acad. Manag. Rev. 1993, 18, 487–517. [Google Scholar]

- Rohlfs, J.H. Bandwagon Effects in High-Technology Industries; MIT Press: Cambridge, MA, USA, 2001. [Google Scholar]

- Hamilton, J.D. Time Series Analysis; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Meade, N.; Islam, T. Forecasting the diffusion of innovations: Implications for time-series extrapolation. In Principles of Forecasting; Armstrong, J.S., Ed.; Kluwer Academic: Norwell, MA, USA, 2001; pp. 577–595. [Google Scholar]

- Kivi, A.; Smura, T.; Töyli, J. Technology product evolution and the diffusion of new product features. Technol. Forecast. Soc. Chang. 2012, 79, 107–126. [Google Scholar] [CrossRef]

- Entner, R. International Comparisons: The Handset Replacement Cycle. Available online: http://mobilefuture.org/wp-content/uploads/2013/02/mobile-future.publications.handset-replacement-cycle.pdf (accessed on 14 June 2017).

- Ministry of Information and Communication. Available online: http://english.msip.go.kr (accessed on 15 June 2017).

- National Statistical Office. Available online: http://kostat.go.kr/portal/eng/index.action (accessed on 31 June 2005).

- Cetizen. Available online: http://www.cetizen.com (accessed on 3 June 2005).

- Hatanaka, M. Time-Series-Based Econometrics; Oxford University Press: New York, NY, USA, 1996. [Google Scholar]

- Greene, W.H. Econometric Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 2003. [Google Scholar]

- Zellner, A.; Theil, H. Three-stage least squares: Simultaneous estimation of simultaneous equations. Econometrica 1962, 30, 54–78. [Google Scholar] [CrossRef]

- Seoul Digital Forum. Available online: http://sdf.sbs.co.kr/english (accessed on 15 June 2005).

- Norton, J.A.; Bass, F.M. A diffusion theory model of adoption and substitution for successive generations of high-technology products. Manag. Sci. 1987, 33, 1069–1086. [Google Scholar] [CrossRef]

- Peterson, R.A.; Mahajan, V. Multi-product growth models. In Research in Marketing; Sheth, J., Ed.; JAI Press: Greenwich, CT, USA, 1978; pp. 201–231. [Google Scholar]

- Kohli, C.; Suri, R. The price is right? Guidelines for pricing to enhance profitability. Bus. Horiz. 2011, 54, 563–573. [Google Scholar] [CrossRef]

- Huh, S.Y.; Lee, C.Y. Diffusion of renewable energy technologies in South Korea on incorporating their competitive interrelationships. Energy Policy 2014, 69, 248–257. [Google Scholar] [CrossRef]

| Parameter | Coefficient | Standard Error | t-Statistic |

|---|---|---|---|

| β1 | 0.401 *** | 0.127 | 3.156 |

| β2 | 0.280 *** | 0.078 | 3.594 |

| 0.024 | 0.066 | 0.364 | |

| 0.176 ** | 0.073 | 2.410 | |

| 0.008 | 0.010 | 0.745 | |

| ξ1band | 0.599 *** | 0.228 | 2.626 |

| ξ1price | 1.11 × 10−6 ** | 5.03 × 10−7 | 2.214 |

| ξ1diver | −5.84 × 10−3 * | 3.08 × 10−3 | −1.899 |

| ξ2band | 0.367 | 0.280 | 1.311 |

| ξ2price | 4.78 × 10−7 ** | 2.15 × 10−7 | 2.220 |

| ξ2diver | −1.05 × 10−3 | 7.78 × 10−4 | −1.352 |

| LRK | MWS | HPKZ | Proposed Model | |

|---|---|---|---|---|

| (a) Fitted BIC | ||||

| Player 1 | 11.55 | 12.05 | 11.50 | 11.43 |

| Player 2 | 10.97 | 11.05 | 10.93 | 10.86 |

| Player 3 | 11.73 | 11.62 | 11.67 | 11.74 |

| (b) Forecast MAPE | ||||

| Player 1 | 9.68 | 9.15 | 9.62 | 8.38 |

| Player 2 | 48.52 | 16.63 | 16.21 | 51.89 |

| Player 3 | 85.29 | 24.68 | 39.05 | 2.33 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, C.-Y.; Huh, S.-Y. Technology Forecasting Using a Diffusion Model Incorporating Replacement Purchases. Sustainability 2017, 9, 1038. https://doi.org/10.3390/su9061038

Lee C-Y, Huh S-Y. Technology Forecasting Using a Diffusion Model Incorporating Replacement Purchases. Sustainability. 2017; 9(6):1038. https://doi.org/10.3390/su9061038

Chicago/Turabian StyleLee, Chul-Yong, and Sung-Yoon Huh. 2017. "Technology Forecasting Using a Diffusion Model Incorporating Replacement Purchases" Sustainability 9, no. 6: 1038. https://doi.org/10.3390/su9061038