The Contribution of China’s Outward Foreign Direct Investment (OFDI) to the Reduction of Global CO2 Emissions

Abstract

:1. Introduction

2. Methodology

3. Data Sources and Processing

4. Results and Discussion

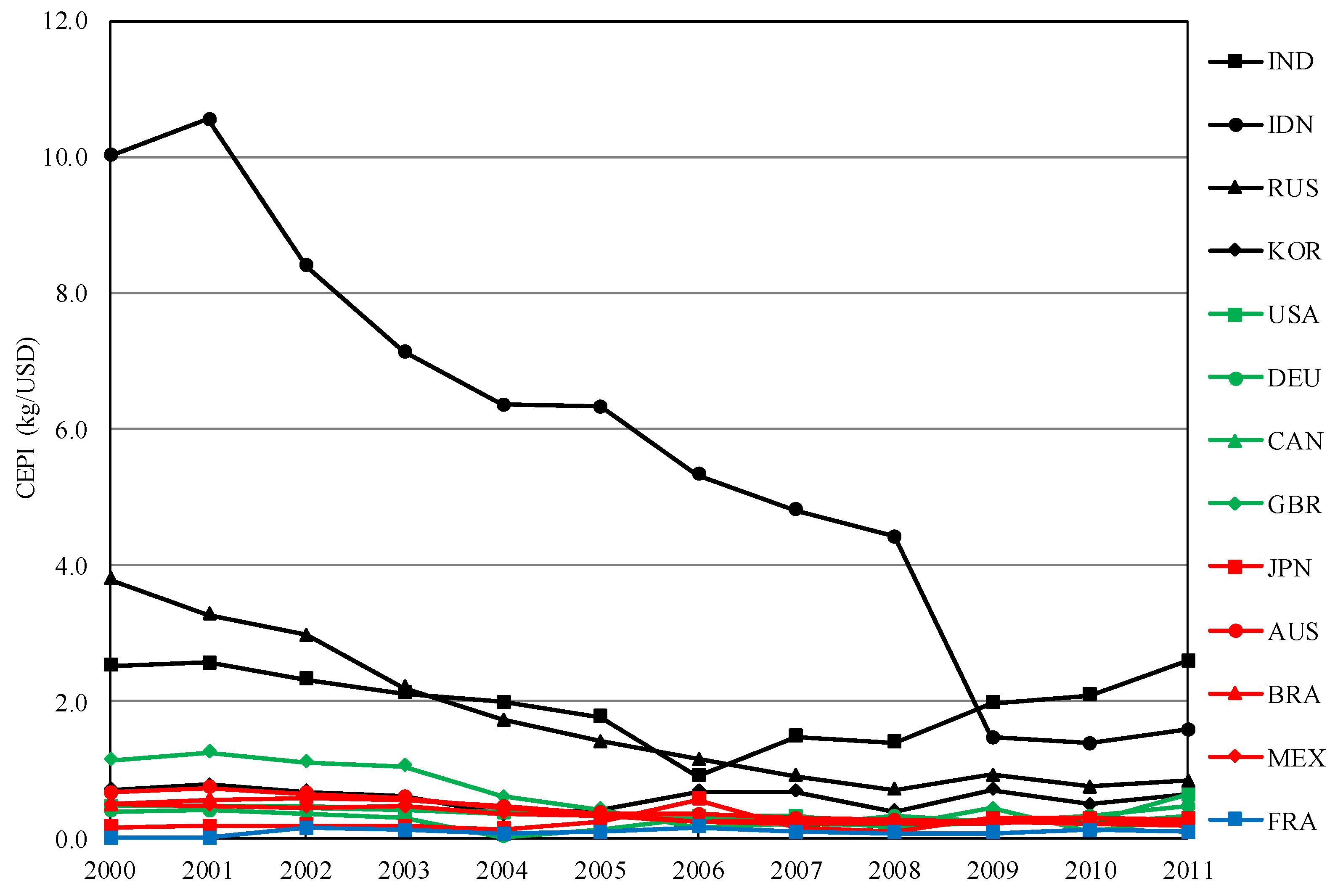

4.1. Host CO2 Emissions

4.2. Home CO2 Emissions

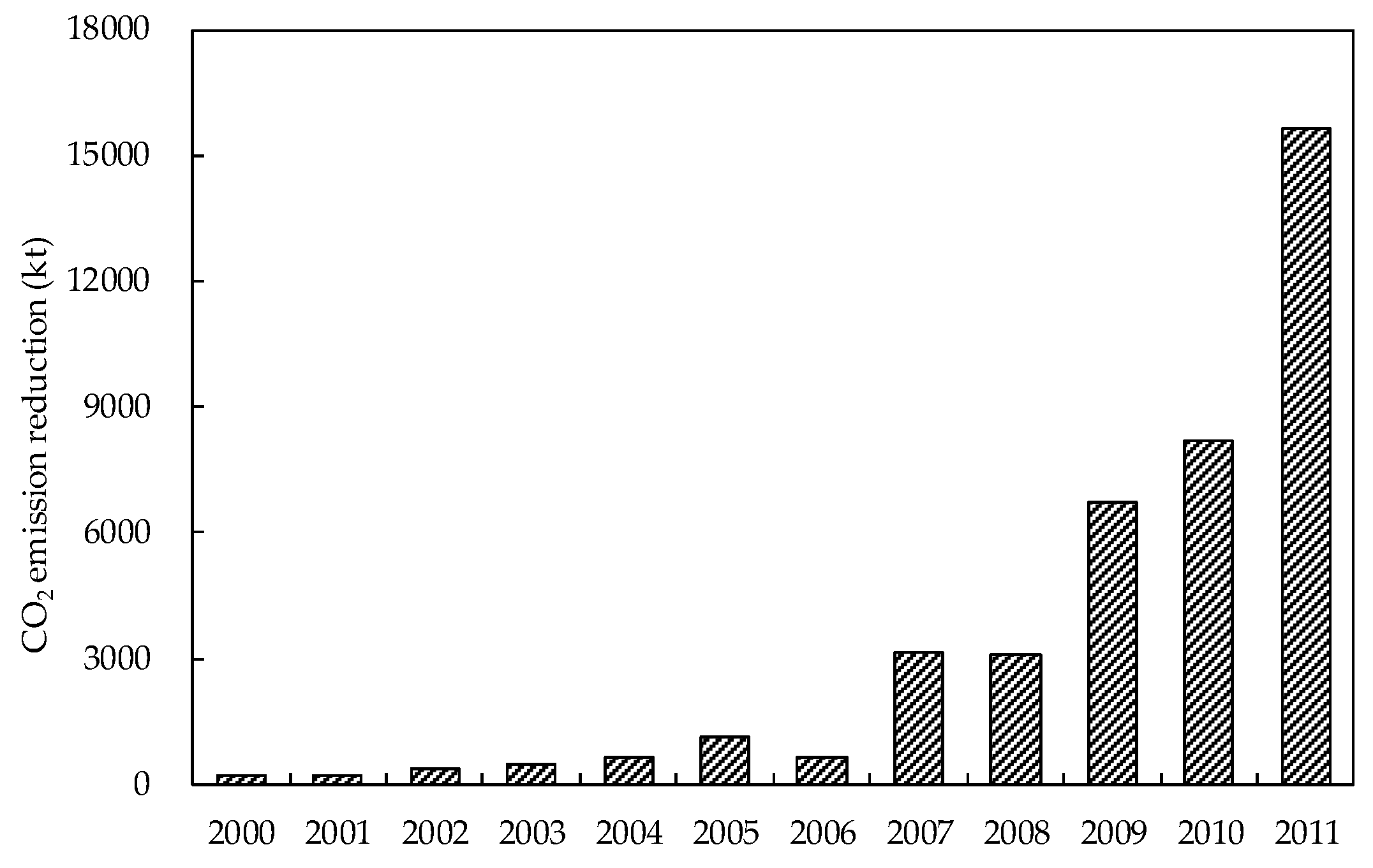

4.3. CO2 emissions Transfer

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- United Nations Conference on Trade and Development (UNCTAD). World Investment Report; United Nations Publication: Geneva, Switzerland, 2015. [Google Scholar]

- Dunning, J.H. Trade, Location of Economic Activity and the MNE: A Search for an Eclectic Approach; Palgrave Macmillan UK: London, UK, 1977; pp. 395–418. [Google Scholar]

- Dunning, J.H. Multinational Enterprises and the Global Economy; Addison-Wesley: Berkshire, UK, 1993. [Google Scholar]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Deng, P. Why do Chinese firms tend to acquire strategic assets in international expansion? J. World Bus. 2009, 44, 74–84. [Google Scholar] [CrossRef]

- Cheung, Y.W.; Qian, X. The Empirics of China’s Outward Direct Investment. CESifo Working Paper Series No. 2621. 2009. Available online: https://ssrn.com/abstract=1392186 (accessed on 29 April 2017).

- Zhang, X.; Daly, K. The determinants of China’s outward foreign direct investment. Emerg. Mark. Rev. 2011, 12, 389–398. [Google Scholar] [CrossRef]

- Berning, S.C.; Holtbrügge, D. Chinese outward foreign direct investment—A challenge for traditional internationalization theories? J. für Betriebswirtschaft 2012, 62, 169–224. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. What determines Chinese OFDI? J. World Bus. 2012, 47, 26–34. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research Working Paper Series, No. 3914; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 1991; Available online: https://www.nber.org/papers/w3914 (accessed on 29 April 2017).

- Letchumanan, R.; Kodama, F. Reconciling the conflict between the “pollution-haven” hypothesis and an emerging trajectory of international technology transfer. Res. Policy 2000, 29, 59–79. [Google Scholar] [CrossRef]

- Smarzynska, B.K.; Wei, S.J. Pollution Havens and Foreign Direct Investment: Dirty Secret or Popular Myth? National Bureau of Economic Research Working Paper Series, No. 8465; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2001; Available online: https://www.nber.org/papers/w8465 (accessed on 29 April 2017).

- Xing, Y.; Kolstad, C.D. Do lax environmental regulations attract foreign investment? Environ. Resour. Econ. 2002, 21, 1–22. [Google Scholar] [CrossRef]

- Eskeland, G.S.; Harrison, A.E. Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef]

- He, J. Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 2006, 60, 228–245. [Google Scholar] [CrossRef]

- Mielnik, O.; Goldemberg, J. Foreign direct investment and decoupling between energy and gross domestic product in developing countries. Energy Policy 2002, 30, 87–89. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Zhang, J. Growth, foreign direct investment, and the environment: Evidence from Chinese cities. J. Reg. Sci. 2011, 51, 121–138. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Hao, Y.; Liu, Y.M. Has the development of FDI and foreign trade contributed to China’s CO2 emissions? An empirical study with provincial panel data. Nat. Hazards 2014, 76, 1079–1091. [Google Scholar] [CrossRef]

- Lan, J.; Kakinaka, M.; Huang, X. Foreign direct investment, human capital and environmental pollution in China. Environ. Resour. Econ. 2012, 51, 255–275. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- Al-mulali, U. Factors affecting CO2 emission in the Middle East: A panel data analysis. Energy 2012, 44, 564–569. [Google Scholar] [CrossRef]

- List, J.A.; Co, C.Y. The effects of environmental regulations on foreign direct investment. J. Environ. Econ. Manag. 2000, 40, 1–20. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Al-mulali, U.; Chor, F.T. Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 2013, 60, 813–819. [Google Scholar] [CrossRef]

- Leontief, W.W. Quantitative input and output relations in the economic systems of the United States. Rev. Econ. Stat. 1936, 18, 105–125. [Google Scholar] [CrossRef]

- Leontief, W.W. Environmental repercussions and the economic structure: An input-output approach. Rev. Econ. Stat. 1970, 52, 262–271. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Muñoz, P.; Steininger, K.W. Austria’s CO2 responsibility and the carbon content of its international trade. Ecol. Econ. 2010, 69, 2003–2019. [Google Scholar] [CrossRef]

- Machado, G.; Schaeffer, R.; Worrell, E. Energy and carbon embodied in the international trade of Brazil: An input-output approach. Ecol. Econ. 2001, 39, 409–424. [Google Scholar] [CrossRef]

- Lin, B.; Sun, C. Evaluating carbon dioxide emissions in international trade of China. Energy Policy 2010, 38, 613–621. [Google Scholar] [CrossRef]

- Ning, Y.; Ding, T.; Li, X. Character of China embodied carbon emissions within the trade. Smart Sci. 2015, 3, 108–116. [Google Scholar] [CrossRef]

- Munksgaard, J.; Pade, L.L.; Minx, J.; Lenzen, M. Influence of trade on national CO2 emissions. Int. J. Glob. Energy Issues 2005, 23, 324–336. [Google Scholar] [CrossRef]

- Mongelli, I.; Tassielli, G.; Notarnicola, B. Global warming agreements, international trade and energy/carbon embodiments: An input-output approach to the Italian case. Energy Policy 2006, 34, 88–100. [Google Scholar] [CrossRef]

- Kondo, Y.; Moriguchi, Y.; Shimizu, H. CO2 emissions in Japan: Influences of imports and exports. Appl. Energy 1998, 59, 163–174. [Google Scholar] [CrossRef]

- Peters, G.P.; Hertwich, E.G. Pollution embodied in trade: The Norwegian case. Glob. Environ. Chang. 2006, 16, 379–387. [Google Scholar] [CrossRef]

- Sánchez-Chóliz, J.; Duarte, R. CO2 emissions embodied in international trade: Evidence for Spain. Energy Policy 2004, 32, 1999–2005. [Google Scholar] [CrossRef]

- Kander, A.; Lindmark, M. Foreign trade and declining pollution in Sweden: A decomposition analysis of long-term structural and technological effects. Energy Policy 2006, 34, 1590–1599. [Google Scholar] [CrossRef]

- Fu, F.; Ma, L.; Li, Z.; Polenske, K.R. The implications of China’s investment-driven economy on its energy consumption and carbon emissions. Energy Convers. Manag. 2014, 85, 573–580. [Google Scholar] [CrossRef]

- Peters, G.P.; Hertwich, E.G. Post-Kyoto greenhouse gas inventories: Production versus consumption. Clim. Chang. 2008, 86, 51–66. [Google Scholar] [CrossRef]

- Metz, B. Climate Change 2001: Mitigation: Contribution of Working Group III to the Third Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2001. [Google Scholar]

- Jayanthakumaran, K.; Liu, Y. Bi-lateral CO2 emissions embodied in Australia-China trade. Energy Policy 2016, 92, 205–213. [Google Scholar] [CrossRef]

- Wyckoff, A.W.; Roop, J.M. The embodiment of carbon in imports of manufactured products. Energy Policy 1994, 22, 187–194. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). Enhanced Actions on Climate Change: China’s Intended Nationally Determined Contributions. 2015. Available online: http://www4.unfccc.int/Submissions/INDC/Published Documents/China/1/China's INDC - on 30 June 2015.pdf (accessed on 29 April 2017).

- United Nations (UN). Handbook of Input-Output Table Compilation and Analysis; Studies in Methods, Handbook of National Accounting, Series F, No. 74; United Nations Publication: New York, NY, USA, 1999. [Google Scholar]

- Su, B.; Ang, B.W. Input-output analysis of CO2 emissions embodied in trade: Competitive versus non-competitive imports. Energy Policy 2013, 56, 83–87. [Google Scholar] [CrossRef]

- Guo, J.; Zou, L.L.; Wei, Y.M. Impact of inter-sectoral trade on national and global CO2 emissions: An empirical analysis of China and US. Energy Policy 2010, 38, 1389–1397. [Google Scholar] [CrossRef]

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; Vries, G.J. An illustrated user guide to the world input-output database: The case of global automotive production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- United Nations Statistics Division (UNSD). Energy Statistics Database. Available online: http://unstats.un.org/unsd/ (accessed on 29 April 2017).

- Intergovernmental Panel on Climate Change (IPCC). 2006 IPCC Guidelines for National Greenhouse Gas Inventories; Institute for Global Environmental Strategies: Hayama, Japan, 2006. [Google Scholar]

- Ministry of Commerce, PRC (MOFCOM). 2003~2015 Statistical Bulletin of China’s Outward Foreign Direct Investment. Available online: http://hzs.mofcom.gov.cn/article/Nocategory/201512/20151201223578.shtml (accessed on 29 April 2017).

| Industries | |

|---|---|

| Agriculture | Hotels and restaurants |

| Mining | Transport, post and telecommunications |

| Manufacturing | Finance |

| Electricity, gas and water supply | Real estate |

| Construction | Renting and business services |

| Wholesale and retail trade | Others |

| Energy Types | |

|---|---|

| Hard coal | Light fuel oil |

| Brown coal | Heavy fuel oil |

| Coke | Naphta |

| Crude oil | Other petroleum |

| Diesel | Natural gas |

| Gasoline | Other gas |

| Jet fuel | Waste |

| Regions | Abbreviation | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | AUS | 10.2 | 10.1 | 48.6 | 30.4 | 125.0 | 193.1 | 87.6 | 531.6 | 1892.2 | 2436.4 | 1701.7 | 3165.3 |

| Austria | AUT | 0.0 | 0.2 | 0.9 | 0.4 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.5 | 20.2 |

| Belgium | BEL | 0.0 | 1.0 | 0.0 | 0.3 | 0.1 | 0.0 | 0.1 | 4.9 | 0.0 | 23.6 | 45.3 | 35.9 |

| Brazil | BGR | 0.0 | 0.0 | 0.0 | 0.4 | 0.4 | 1.7 | 0.0 | 0.0 | 0.0 | −2.4 | 16.3 | 53.9 |

| Bulgaria | BRA | 21.1 | 31.8 | 9.3 | 6.7 | 6.4 | 15.1 | 10.1 | 51.1 | 22.4 | 116.3 | 487.5 | 126.4 |

| Canada | CAN | 31.7 | 3.5 | 1.2 | −7.3 | 5.1 | 32.4 | 34.8 | 1032.6 | 7.0 | 613.1 | 1142.3 | 554.1 |

| Cyprus | CYP | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.0 | 0.0 | 0.0 | 89.5 |

| Czech Republic | CZE | 2.3 | 0.2 | 0.0 | 0.0 | 0.5 | 0.0 | 9.1 | 5.0 | 12.8 | 15.6 | 2.1 | 8.8 |

| Germany | DEU | 1.6 | 3.5 | 2.8 | 25.1 | 27.5 | 128.7 | 76.7 | 238.7 | 183.4 | 179.2 | 412.4 | 512.4 |

| Denmark | DNK | 0.0 | 0.0 | 0.0 | 73.9 | −7.8 | 10.8 | −58.9 | 0.3 | 1.3 | 2.6 | 1.6 | 5.9 |

| Spain | ESP | 0.1 | 0.0 | 1.8 | 0.0 | 1.7 | 1.5 | 7.3 | 6.1 | 1.2 | 59.9 | 29.3 | 139.7 |

| Finland | FIN | 0.0 | 0.0 | 3.3 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.7 | 1.1 | 18.0 | 1.6 |

| France | FRA | 0.0 | 0.0 | 11.4 | 0.5 | 10.3 | 6.1 | 5.6 | 9.6 | 31.1 | 45.2 | 26.4 | 3482.3 |

| United Kingdom | GBR | 6.3 | 3.1 | 0.0 | 2.1 | 29.4 | 24.8 | 35.1 | 566.5 | 16.7 | 192.2 | 330.3 | 1419.7 |

| Greece | GRC | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.4 |

| Hungary | HUN | 2.0 | 0.0 | 0.3 | 1.2 | −0.1 | 0.7 | 0.4 | 8.6 | 2.2 | 8.2 | 370.1 | 11.6 |

| Indonesia | IDN | 8.0 | 0.6 | 3.7 | 26.8 | 62.0 | 11.8 | 56.9 | 99.1 | 174.0 | 226.1 | 201.3 | 592.2 |

| India | IND | 3.1 | 2.6 | 2.3 | 0.2 | 0.4 | 11.2 | 5.6 | 22.0 | 101.9 | −24.9 | 47.6 | 180.1 |

| Ireland | IRL | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 25.3 | 0.2 | 42.3 | −1.0 | 32.9 | 16.9 |

| Italy | ITA | 5.8 | 3.9 | 7.8 | 0.3 | 3.1 | 7.5 | 7.6 | 8.1 | 5.0 | 46.1 | 13.3 | 224.8 |

| Japan | JPN | 0.3 | 1.7 | 18.2 | 7.4 | 15.3 | 17.2 | 39.5 | 39.0 | 58.6 | 84.1 | 338.0 | 149.4 |

| Republic of Korea | KOR | 4.2 | 0.8 | 83.4 | 153.9 | 40.2 | 588.8 | 27.3 | 56.7 | 96.9 | 265.1 | 𢈒721.7 | 341.7 |

| Luxembourg | LUX | 0.0 | 0.0 | 0.9 | 0.0 | 0.0 | 0.0 | 0.0 | 4.2 | 42.1 | 2270.5 | 3207.2 | 1265.0 |

| Latvia | LVA | 0.0 | 0.0 | 0.0 | 1.6 | 0.0 | 0.0 | 0.0 | −1.7 | 0.0 | 0.0 | 0.0 | 0.0 |

| Mexico | MEX | 19.8 | 0.2 | 2.0 | 0.0 | 27.1 | 3.6 | −3.7 | 17.2 | 5.6 | 0.8 | 26.7 | 41.5 |

| Malta | MLT | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 | 0.0 | 0.1 | −0.1 | 0.5 | 0.2 | −2.4 | 0.3 |

| Netherlands | NLD | 0.0 | 0.0 | 0.1 | 4.5 | 1.9 | 3.8 | 5.3 | 106.8 | 92.0 | 101.5 | 64.5 | 167.9 |

| Poland | POL | 0.0 | 0.0 | 0.0 | 1.6 | 0.1 | 0.1 | 0.0 | 11.8 | 10.7 | 10.4 | 16.7 | 48.7 |

| Romania | ROU | −0.3 | 4.9 | 0.4 | 0.6 | 2.7 | 2.9 | 9.6 | 6.8 | 12.0 | 5.3 | 10.8 | 0.3 |

| Russia | RUS | 13.9 | 12.4 | 35.4 | 30.6 | 77.3 | 203.3 | 452.1 | 477.6 | 395.2 | 348.2 | 567.7 | 715.8 |

| Slovak Republic | SVK | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.5 | 5.9 |

| Sweden | SWE | 0.0 | 0.0 | 1.0 | 0.2 | 2.6 | 1.0 | 5.3 | 68.1 | 10.7 | 8.1 | 1367.2 | 49.0 |

| Turkey | TUR | 0.0 | 2.0 | 0.0 | 1.5 | 1.6 | 0.2 | 1.2 | 1.6 | 9.1 | 293.3 | 7.8 | 13.5 |

| United States | USA | 23.1 | 53.7 | 151.5 | 65.1 | 119.9 | 231.8 | 198.3 | 196.0 | 462.0 | 908.7 | 1308.3 | 1811.4 |

| Regions | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AUS | 6.8 | 7.4 | 31.1 | 17.8 | 55.1 | 69.7 | 30.1 | 151.1 | 488.0 | 577.6 | 353.7 | 729.4 |

| AUT | 0.0 | 0.0 | 0.2 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.1 |

| BEL | 0.0 | 0.3 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.7 | 0.0 | 2.2 | 3.2 | 1.9 |

| BGR | 0.0 | 0.0 | 0.0 | 0.3 | 0.3 | 1.3 | 0.0 | 0.0 | 0.0 | −0.7 | 16.2 | 127.5 |

| BRA | 10.1 | 18.0 | 5.5 | 3.6 | 2.9 | 5.1 | 2.5 | 10.3 | 4.3 | 22.7 | 135.4 | 24.9 |

| CAN | 14.3 | 1.6 | 0.6 | −3.0 | 1.8 | 10.3 | 9.6 | 273.7 | 1.1 | 137.0 | 237.8 | 180.8 |

| CYP | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 22.9 |

| CZE | 5.0 | 0.3 | 0.0 | 0.0 | 0.3 | 0.0 | 5.0 | 1.2 | 4.0 | 13.0 | 1.3 | 39.1 |

| DEU | 0.6 | 1.4 | 1.0 | 7.5 | 0.2 | 13.8 | 22.9 | 41.2 | 57.1 | 41.3 | 126.4 | 236.9 |

| DNK | 0.0 | 0.0 | 0.0 | 2.9 | −1.9 | 6.5 | −11.8 | 0.1 | 0.5 | 0.4 | 0.1 | 0.6 |

| ESP | 0.0 | 0.0 | 0.5 | 0.0 | 0.4 | 0.9 | 1.6 | 3.3 | 0.3 | 20.7 | 3.8 | 16.9 |

| FIN | 0.0 | 0.0 | 1.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.1 | 2.6 | −0.2 |

| FRA | 0.0 | 0.0 | 1.6 | 0.1 | 0.6 | 0.5 | 0.8 | 0.9 | 2.2 | 2.9 | 2.9 | 272.7 |

| GBR | 7.2 | 3.9 | 0.0 | 2.2 | 17.5 | 10.1 | 5.4 | 119.1 | 2.8 | 83.9 | 31.2 | 421.6 |

| GRC | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 2.1 |

| HUN | 0.5 | 0.0 | 0.0 | 0.2 | 0.0 | 0.1 | 0.1 | 2.1 | 0.3 | 2.2 | 278.4 | 0.9 |

| IDN | 80.1 | 6.7 | 31.1 | 191.4 | 394.2 | 74.8 | 303.4 | 476.3 | 767.8 | 332.4 | 277.1 | 937.2 |

| IND | 7.8 | 6.6 | 5.3 | 0.3 | 0.7 | 19.8 | 5.1 | 32.5 | 142.7 | −49.3 | 99.8 | 468.7 |

| IRL | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 3.2 | 0.0 | 0.5 | −0.1 | 2.0 | 0.4 |

| ITA | 1.2 | 0.8 | 1.5 | 0.1 | 1.2 | 2.6 | 1.5 | 1.5 | −0.5 | 7.0 | 2.0 | 24.9 |

| JPN | 0.0 | 0.3 | 3.2 | 1.2 | 1.9 | 4.1 | 21.9 | 5.7 | 5.8 | 23.5 | 98.6 | 40.4 |

| KOR | 3.0 | 0.6 | 55.8 | 92.1 | 13.9 | 247.9 | 18.4 | 38.6 | 37.5 | 186.8 | −348.5 | 217.8 |

| LUX | 0.0 | 0.0 | 0.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 | 2.8 | 183.2 | 224.0 | 78.4 |

| LVA | 0.0 | 0.0 | 0.0 | 0.5 | 0.0 | 0.0 | 0.0 | −0.2 | 0.0 | 0.0 | 0.0 | 0.0 |

| MEX | 9.8 | 0.1 | 0.9 | 0.0 | 9.6 | 1.1 | −0.8 | 4.3 | 1.2 | 0.2 | 5.4 | 7.7 |

| MLT | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | −0.3 | 0.1 |

| NLD | 0.0 | 0.0 | 0.0 | −0.2 | 1.2 | 0.9 | 0.6 | 14.8 | 76.4 | 57.9 | −12.5 | 30.7 |

| POL | 0.0 | 0.0 | 0.0 | 2.1 | 0.1 | 0.1 | 0.0 | 5.8 | 5.2 | 5.8 | 19.4 | 40.3 |

| ROU | −0.3 | 5.7 | 0.4 | 0.5 | 1.7 | 1.5 | 4.3 | 2.2 | 3.1 | 1.3 | 7.4 | 0.3 |

| RUS | 52.6 | 40.7 | 105.6 | 67.7 | 133.2 | 286.3 | 518.3 | 434.0 | 280.8 | 321.1 | 426.7 | 601.7 |

| SVK | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 1.9 |

| SWE | 0.0 | 0.0 | 0.3 | 0.0 | −0.1 | 0.1 | 0.7 | 6.3 | 0.9 | 0.6 | 45.6 | 0.1 |

| TUR | 0.0 | 1.6 | 0.0 | 0.9 | 0.6 | 0.1 | 0.3 | 0.4 | 2.6 | 212.0 | 8.7 | 19.2 |

| USA | 10.7 | 24.9 | 65.1 | 26.3 | 44.2 | 79.8 | 62.8 | 62.4 | 83.7 | 224.3 | 306.9 | 1135.0 |

| Regions | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AUS | 23.2 | 22.0 | 104.1 | 67.1 | 262.6 | 378.7 | 158.6 | 840.4 | 2566.8 | 3283.3 | 2521.8 | 4121.3 |

| AUT | 0.0 | 0.4 | 2.5 | 1.1 | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.0 | 0.6 | 16.8 |

| BEL | 0.0 | 2.2 | 0.0 | 0.6 | 0.0 | 0.0 | 0.3 | 5.9 | 0.0 | 15.9 | 32.0 | 21.6 |

| BGR | 0.0 | 0.0 | 0.0 | 0.5 | 0.4 | 2.0 | 0.0 | 0.0 | 0.0 | −1.7 | 16.6 | 71.6 |

| BRA | 73.7 | 103.2 | 29.4 | 17.8 | 16.5 | 36.2 | 28.0 | 77.1 | 28.7 | 155.4 | 768.4 | 190.6 |

| CAN | 59.7 | 6.2 | 2.1 | −12.2 | 8.2 | 48.1 | 46.1 | 1164.7 | 4.0 | 515.9 | 1160.0 | 775.0 |

| CYP | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.0 | 0.0 | 0.0 | 130.2 |

| CZE | 8.4 | 0.5 | 0.0 | 0.0 | 0.9 | 0.0 | 10.5 | 3.8 | 15.8 | 30.9 | 2.0 | 35.8 |

| DEU | 3.5 | 7.2 | 5.6 | 50.1 | 32.3 | 110.8 | 91.2 | 210.3 | 213.1 | 191.7 | 409.0 | 514.6 |

| DNK | 0.0 | 0.0 | 0.0 | 79.9 | −8.8 | 30.0 | -50.2 | 0.3 | 1.9 | 1.4 | 0.7 | 5.9 |

| ESP | 0.1 | 0.0 | 2.6 | 0.0 | 3.1 | 5.9 | 8.5 | 21.4 | 2.2 | 160.3 | 27.2 | 118.0 |

| FIN | 0.0 | 0.0 | 4.4 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 6.8 | 0.3 | 19.5 | −1.0 |

| FRA | 0.0 | 0.0 | 14.2 | 0.6 | −1.8 | 7.7 | 7.6 | 8.7 | 26.4 | 26.9 | 37.9 | 5536.8 |

| GBR | 46.1 | 21.3 | 0.1 | 14.4 | 109.0 | 64.6 | 33.7 | 940.2 | 20.2 | 519.0 | 236.0 | 2948.8 |

| GRC | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | 0.9 |

| HUN | 1.9 | 0.0 | 0.3 | 1.0 | −0.1 | 0.9 | 0.4 | 14.5 | 1.9 | 15.6 | 1014.8 | 2.3 |

| IDN | 89.8 | 6.6 | 37.9 | 281.7 | 535.9 | 92.5 | 477.3 | 676.6 | 952.2 | 472.6 | 588.0 | 1456.0 |

| IND | 7.6 | 5.9 | 5.2 | 0.3 | 0.7 | 20.4 | 6.4 | 32.6 | 119.2 | −37.6 | 74.8 | 314.5 |

| IRL | 0.0 | 0.0 | 0.0 | 0.2 | 0.0 | 0.0 | 55.4 | 0.2 | 7.6 | −0.6 | 15.4 | 11.5 |

| ITA | 10.1 | 6.3 | 12.2 | 0.5 | 10.1 | 23.2 | 13.0 | 11.1 | −3.9 | 57.1 | 18.4 | 215.4 |

| JPN | 0.3 | 1.9 | 19.8 | 7.8 | 12.4 | 10.7 | 64.4 | 22.9 | 24.9 | 68.4 | 68.4 | 27.5 |

| KOR | 7.7 | 1.4 | 137.5 | 252.7 | 40.7 | 570.0 | 29.6 | 66.0 | 76.2 | 222.4 | −714.5 | 333.7 |

| LUX | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.4 | 26.2 | 1401.7 | 2178.1 | 870.9 |

| LVA | 0.0 | 0.0 | 0.0 | 2.1 | 0.0 | 0.0 | 0.0 | −1.6 | 0.0 | 0.0 | 0.0 | 0.0 |

| MEX | 43.2 | 0.5 | 3.9 | 0.1 | 45.8 | 5.3 | −4.8 | 19.5 | 5.5 | 0.7 | 27.8 | 40.1 |

| MLT | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 0.0 | 0.1 | −0.1 | 0.4 | 0.2 | −2.4 | 0.4 |

| NLD | 0.0 | 0.0 | 0.0 | −0.6 | 5.2 | 5.0 | 2.7 | 77.8 | 445.8 | 442.2 | −127.1 | 215.4 |

| POL | 0.0 | 0.0 | 0.0 | 4.3 | 0.2 | 0.2 | 0.0 | 12.9 | 13.2 | 13.5 | 28.3 | 64.3 |

| ROU | −0.4 | 7.0 | 0.5 | 0.8 | 3.4 | 3.4 | 10.2 | 6.1 | 9.2 | 3.7 | 11.1 | 0.4 |

| RUS | 15.6 | 13.2 | 36.8 | 31.3 | 74.2 | 179.4 | 354.7 | 310.3 | 215.7 | 191.9 | 502.8 | 721.4 |

| SVK | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 1.2 | 9.1 |

| SWE | 0.0 | 0.0 | 3.4 | 0.6 | −2.7 | 1.0 | 10.5 | 85.4 | 15.6 | 5.8 | 270.3 | −16.2 |

| TUR | 0.0 | 4.8 | 0.0 | 3.6 | 2.7 | 0.3 | 1.5 | 1.7 | 9.4 | 630.2 | 16.5 | 30.4 |

| USA | 43.6 | 94.6 | 257.1 | 109.0 | 192.2 | 343.5 | 263.2 | 221.1 | 266.0 | 764.7 | 1328.5 | 2533.7 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, T.; Ning, Y.; Zhang, Y. The Contribution of China’s Outward Foreign Direct Investment (OFDI) to the Reduction of Global CO2 Emissions. Sustainability 2017, 9, 741. https://doi.org/10.3390/su9050741

Ding T, Ning Y, Zhang Y. The Contribution of China’s Outward Foreign Direct Investment (OFDI) to the Reduction of Global CO2 Emissions. Sustainability. 2017; 9(5):741. https://doi.org/10.3390/su9050741

Chicago/Turabian StyleDing, Tao, Yadong Ning, and Yan Zhang. 2017. "The Contribution of China’s Outward Foreign Direct Investment (OFDI) to the Reduction of Global CO2 Emissions" Sustainability 9, no. 5: 741. https://doi.org/10.3390/su9050741