1. Introduction

According to statistics from the International Energy Agency, the transportation sector accounted for 28.37% of carbon dioxide (CO

2) emissions from fuel combustion in China [

1]. Along with the urbanization development in China, the growth of traditional vehicles is rapid, which will increase the proportion of CO

2 emissions from the transportation sector and lead to the serious air pollution and oil shortage. Electric vehicles (EVs) have prominent advantages of emission reduction and oil conservation in transportation sector. Therefore, many policy measures have been employed to support and encourage the development of EVs in China. Since 2009, China has established 25 pilot cities in batches and popularized EVs in the public domain such as the area of public buses, taxis, sanitation trucks and mail trucks [

2]. According to the Global EV Outlook of 2016 [

3], by the end of 2015, China had the second largest stock of EVs at 312,290. The large-scale development of EVs depends on the stable and continuous energy supply. The research of Sierzchula [

4] shows that constructing one charging station for every 100,000 residents can double the effect on EVs’ market promotion compared with providing 1000 dollars directly to every consumer. This demonstrates that the stable energy supply is significant to encourage the market penetration of EVs.

At present, the energy supply mode of EVs mainly includes direct charging mode and battery swapping mode [

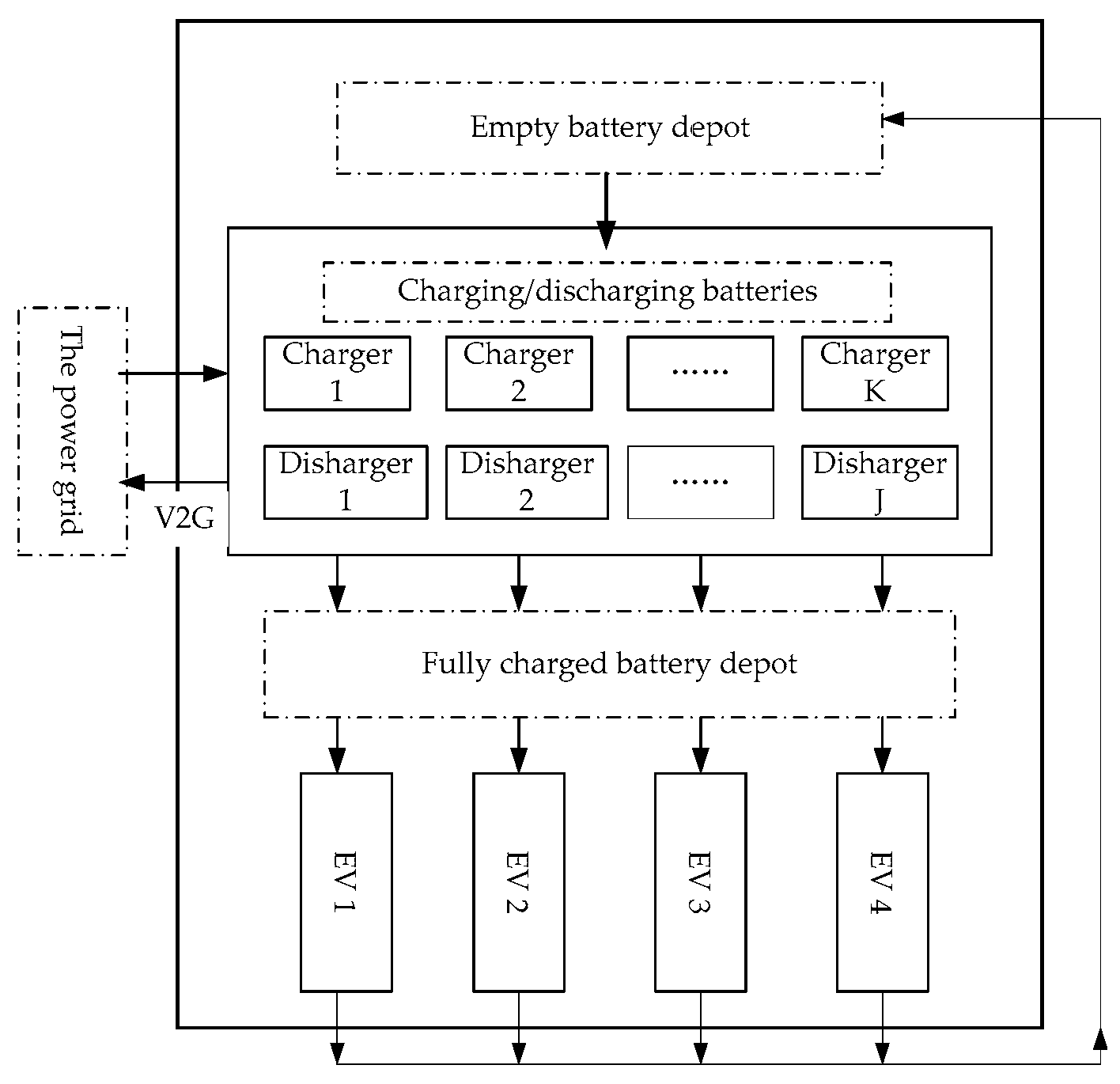

5]. Direct charging mode refers to the fact that the energy of EVs comes from the direct charging by charge piles and other charging equipment. Battery swapping mode is a way that the batteries of EVs are swapped by full-charged power batteries from centralized charging and swapping stations (CSSs). The swapping mode is applied in many pilot cities of China, such as Hangzhou, Beijing and Haikou. CSSs have the advantage of unified deployment and management for EV battery swapping service. Moreover, it can achieve the economic operation of CSSs and smooth the load of the power grid by unified charging and swapping strategy of batteries and the technology of vehicle to grid (V2G) [

6]. Therefore, China had completed construction on 3600 CSSs at the end of 2015 [

7]. Moreover, it plans to construct 12,000 centralized CSSs through 2020 [

8]. To promote the marketization of charging infrastructure, research on the economical operation of CSSs and the factors influencing operation, as well as the impact on the power grid load, is needed. When the operation of CSSs becomes profitable, more investment will be attracted to the construction of charging infrastructure. The increased number of CSSs can make consumer charging more convenient, which is conducive to the large-scale development of EVs. Thus, many scholars have noted research on the promotion of EV charging infrastructure. Those studies can be divided into two areas: the ordered charging/discharging of EVs and economic operation of CSSs.

The research on the ordered charging and discharging of EVs is concerned with the load forecasting and shifting of EVs. Based on the historical load data of electric bus charging stations, Zhang et al. [

9] considered the factors influencing the load of charging stations and forecasted the daily load of charging stations using fuzzy clustering and back propagation neural networks. According to the operating mechanism and charging power curve characteristics of electric bus charging stations, Wang et al. [

10] established a general mathematical model to determine the distribution capacity of electric bus charging stations. Shi [

11] took the power-demand-side management and electricity price theory into account, and designed a charge and discharge pricing scheme for EVs. To achieve the load-shifting effect of EVs, Li [

12] developed an optimization model of demand-side response strategies for EVs using the genetic algorithm. Yao et al. [

13] proposed layering and zoning EVs, optimizing the dispatch of regional agents and controlling users’ charging and discharging time to realize the objective of peak load shifting. Zhang [

14] established an ordered charging and discharging model to maximize the profits of EVs’ third-party agents and applied the particle swarm optimization algorithm to attain optimal scheduling results.

The second research area is mainly focused on the analysis of CSSs’ economic operation. Zhang et al. [

15] shrank the adjustment frequency of thermal power and enhanced the security and economy of the power grid by optimizing the charging and discharging process of battery swapping stations (BSSs). Luo et al. [

5] established a two-phase optimization model for battery swapping modes: The first phase is based on the objective of minimizing the charging fee, and the second phase is aimed at minimizing the fluctuation of daily load curves by using the objective of the first phase as the constraint. Deng [

16] proposed a bi-level programing approach to coordinate EVs’ charging with the network load and electricity price. Soares [

17] designed a coordination optimization model to minimize the total costs by considering the new energy generation costs, EV charging costs and discharging incomes. Based on the driving mode of large-scale EVs, Du et al. [

18] developed a dynamic economic dispatch model to minimize the generating costs using the traditional mathematical programming method. Sun et al. [

19] analyzed the operation mode of BBSs and developed a profit model based on the objective of maximizing the operating profits of BBSs. Additionally, many studies have proposed profitable business modes for CSSs. To achieve a win–win situation for the public sector and market departments, Yang et al. [

20] developed a public–private partnership mode based on their long-term cooperation. Robinson et al. [

21] designed several models of solar powered charging stations for major entities including industry, the federal and state government, utilities, universities, and public parking. Zhang and Rao [

22] developed five commercial modes for a battery swapping and leasing service and analyzed their profits. Other researchers concern on the energy source of EVs. To increase the participation of renewable energy, Diaz [

23] explored the option of coupling EVs as a distributed energy storage system in Tenerife Island and used a model simulator to evaluate the introduction of renewable energy and EVs. Zhang et al. [

24] used the linear programming to maximize the sustainability performance of ecology zones.

In summary, previous studies on the ordered charging and discharging of EVs mainly consider the perspective of the power grid’s stable operation. The battery swapping mode is an important energy-supply method for EVs [

25] by which users can replenish EV batteries in a short time and achieve the load-shifting effect by energy storage. Previous studies on the economic operation of BSSs have focused more on regarding BSSs as a part of the power grid and intended to realize the economical operation of the power grid through the ordered charging of batteries in the BSS, while focusing less on the economical operation of the BSS itself. In China, in particular, the market of constructing and managing BSSs is monopolized by the State Grid and the Southern Power Grid. With the large-scale development of EVs, however, China will gradually open the market to stakeholders [

26], and BBS investors will not only be the power grid but also cover private capitalists, battery manufacturers and gasoline enterprises [

24].

Therefore, this paper regards the maximization of the BSS’s daily profits as the objective value from the perspective of the economic benefits of BSS investors. In addition, it considers the main factors that impact the operational management of BSSs and designs an ordered charging and discharging strategy to make BSSs more profitable. Furthermore, this paper analyzes the load of the BSS and the charging arrangement of the BSS’s batteries in different scenarios with ordered charging and discharging strategies based on the electricity price of the peak-valley time-of-use tariff (TOU) and the demand response (DR). There are several major contributions of this study: (1) from the perspective of BSS investors, the operation mode should aim to maximize the daily profits of the BSS; (2) considering the profitable operation of BSSs, we propose the ordered charging and discharging strategies for batteries in BSSs; (3) the optimal operation scheme for BSSs is carried out based on the scenario analysis; and (4) the sensitive factors affecting the operation of BSSs are determined by the sensitivity analysis.

The purpose of this study is to analyze the operation profits of BSSs and proposes an appropriate charging and discharging strategy for BSSs. The work is organized as follows. The operation mode of BSSs is analyzed in

Section 2. The optimal operation model is introduced in

Section 3. In

Section 4, the results of the scenario simulation and sensitivity analysis are discussed, and the effects of two ordered charging and discharging strategies are tested.

Section 5 concludes the paper.

3. Operation Model of BSS

3.1. Objective Function

The objective function seeks to maximize the profits of the BSS. Without considering the V2G technology, the function of BSS’s profits in a day is expressed as:

If the BSS can earn from feeding electricity into the power grid with V2G technology, the function of BSS’s profits in a day should be defined as:

3.2. Constraint Conditions

We set the following constraints to achieve the operation of BSS:

(1) Constraint of battery swapping demand:

The BSS should meet the battery swapping demand of users, which means that the number of fully charged batteries in the BSS cannot be less than the number of swapping batteries:

where

S(

t) is the number of fully charged batteries in the BSS at

t, and

β is the battery number of one EV. It supposes that EVs are the same model and that they replace all the batteries each time.

(2) Constraint of the number of chargers:

The number of charging batteries at

t (

F(

t)) should not be more than the number of chargers (

K) in the BSS:

(3) Constraint of the number of discharging devices:

The number of discharging batteries (

W(

t)) should not be more than the number of discharging devices (

J):

(4) Constraint of the number of batteries:

The number of batteries in the BSS is certain. The number of fully charged, empty (

E(

t)), charging and discharging batteries on the charger and discharger should not be more than the total number of batteries. Empty batteries means swapped batteries or discharged batteries:

(5) Constraint of the battery charging process:

It takes

Tf hours for empty batteries to be fully charged, and

Tf is a positive integer that can be divided into

Tf charging stages of 1, 2, …,

Tf. The number of charging batteries in each stage is

F(1)(

t),

F(2)(

t), …, and

F(Tf)(

t), respectively. The constraint can be expressed as follows:

The number of fully charged batteries in a day can be expressed as:

(6) Constraint of the battery discharging process:

This presumes that the fully charged batteries take

Tw hours to fully discharge.

Tw is a positive integer that can be divided into

Tw discharging stages of 1, 2, …,

Tw. The number of discharging batteries in each stage is

W(1)(

t),

W(2)(

t), …, and

W(Tw)(

t), respectively. The constraint can be described as follows:

The total number of discharged batteries in a day is expressed as:

(7) Constraint of the number of fully charged batteries:

The number of fully charged batteries should maintain a dynamic balance in the BSS:

(8) Constraint of the number of empty batteries:

The number of empty batteries should maintain a dynamic balance in the BSS:

(9) Integer constraint of number of batteries:

S(t), F(t), W(t), E(t), F(i)(t), W(j)(t), N(t), β, K, D, Z are all positive integers. i represents 1, 2, …, Tf, and j represents 1, 2, …, Tw.

3.3. Assumptions

The following assumptions simplify the model without affecting the operation of BSS:

- (1)

Once batteries are put on chargers, the charging power of the chargers is considered as their rated charging power (

Pc). Taking account of the charging efficiency of batteries (

ηc), the actual charging power can be defined as:

where

Pd is the rated discharging power of discharging devices, and

ηd is the discharging efficiency of batteries. The actual discharging power is expressed as:

- (2)

A charger can only charge one battery at a time.

- (3)

The time that a mechanical arm swaps batteries for EVs and puts them on the charger is between four and six minutes, a much shorter period than the charging or discharging period of one hour. It can therefore be ignored here. Based on the previous assumption conditions, Equation (7) can be simplified as follows:

Taking account of the discharging of BSS, Equation (8) can be expressed as:

Since there are many parameters in the papers, the nomenclature of the parameters are shown in

Table A1 (

Appendix A).