1. Introduction

In the last three decades, different scholars have focused their efforts on arguing about the role of business in fulfilling realistic social and environmental issues. As such, the assumption under which corporations might recognize their social responsibilities towards their stakeholders and society requires new managerial and communication tools to address such responsibilities. Several studies have focused on the features and aims of sustainability disclosure within voluntary and mandatory reporting schemes, in order to give concreteness to the institutional role of corporate social responsibility (CSR). As a matter of fact, several sustainability guidance bodies and new standard setters are currently shaping the boundaries between voluntary and mandatory disclosure in such areas. For instance, the 2014/95/EU Directive is mandating that large EU companies include social and environmental information within their annual reports. In the US, since 2011, the Sustainability Accounting Standards Board (SASB) has provided mandatory industry guidelines for the disclosure of sustainability issues within mandatory Securities and Exchange Commission (SEC) companies’ filings. In South Africa, the Johannesburg Stock Exchange required the adoption of integrated reporting since 2011. As recently reported by the Task Force on Climate-related Financial Disclosures [

1], the disclosure and recognition of climate risks is useful for the identification of consistent opportunities. Of course, relevant scandals, such as the VW Diesel-gate in the automotive industry, Trashzilla wasting issues, or Rana Plaza’s collapse, show that there are evident discrepancies between a corporation’s communication and disclosure and its actual behaviour, actions, and sustainable performances. Moreover, scholars have argued that the failure of such managerial tools is due to the challenging features of today’s environment for the organizations, practitioners, and consultants, addressing such features as “VUCA”, which stands for “volatility, uncertainty, complexity, and ambiguity” [

2,

3]. Within a VUCA scenario, business operations and transactions involve interconnected parts and variables, challenges are unexpected or unstable, and causal relationships are completely unclear, though changes are still possible. Consequently, information retrieval throughout different channels and networks is an essential part of the risk assessment process, and in case of mitigation, it is essential to appraise the “true cost” of such impacts [

4]. Despite this scenario, few scholars have focused their studies on the risk disclosure required by such a new large set of sustainability reporting guidelines and policies. To reduce the risk of corporate “window dressing” and “green washing”, innovative research and predictive models are needed. The risk that corporations might produce reports that will be slight, unreal, or possess a “vague semblance of something—especially when the reporting guidelines are requiring very detailed information about risk disclosure—is indeed too high to face. For instance, according to a recent survey by KPMG (the KPMG name derives from predecessor company founders: Piet Klijnveld, William Barclay Peat, James Marwick, and Reinhard Goerdeler) [

5] on the world’s largest 250 corporations, the number of companies that clearly define and discuss trends, risks, and strategic responses (as opposed to simply referencing them) is growing. The survey highlights that companies that are aware of and discuss their risks are also the ones that try to deal with such risks. Financial capital’s providers agree with the need for additional and better information on businesses’ value creation and risks identification, as well as the related mitigation strategies. Furthermore, the importance of risks identification is already perceived as paramount by business leaders, politicians, and governments [

6], that in the next ten years foresee a significant negative impact on several countries and industries, and global trends that could contribute to the amplification of such global risks.

These issues call for attention and scrutiny, and therefore, our paper aims at providing an exploratory study on social and environmental risk disclosure. Specifically, our research question can be summarized as: What are the main variables affecting risk disclosure within the corporate practice of sustainability reporting? Our evidence is based on a sample of sustainability reports prepared by large public and private organizations.

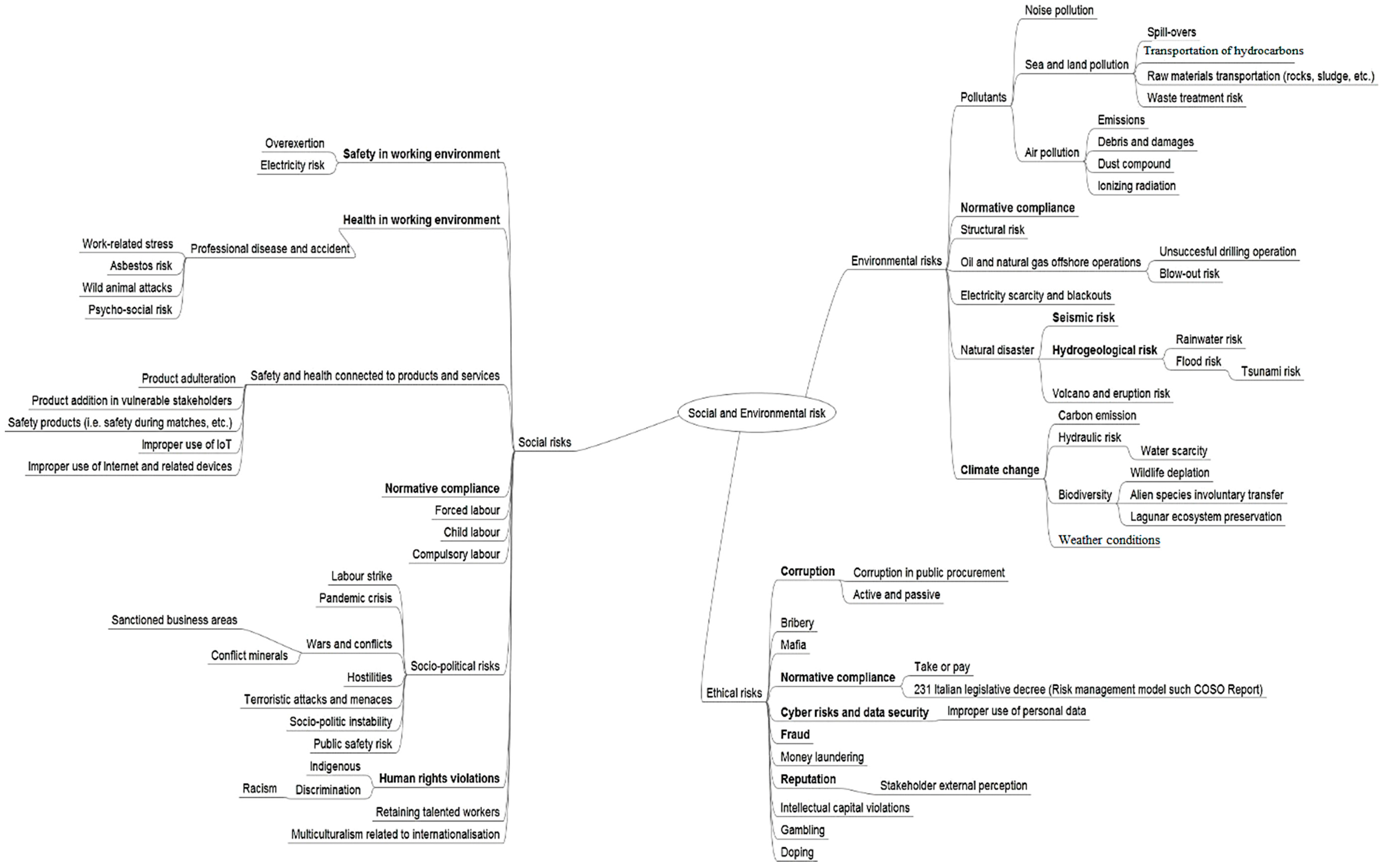

The remainder of the paper is structured as follows: first it discusses the state of the art of sustainability accounting and reporting tools as well as of risk assessment and disclosure, providing literature insights related to social, environmental, and ethical risks; furthermore, it presents the research design, followed by an exploratory study of sustainability risk disclosure based on the entire sample of Italian public and private organizations applying the G4 sustainability reporting guidelines issued by the GSSB in 2014 reports. The research methodology relies first on presenting a relational semantic map of the sustainability risks reported in the disclosure collected, which is then used to carry out the development and testing of a structural equation model with partial least squares (PLS-SEM). Finally, the paper presents the discussion of the results and argumentation about the importance of sustainability-related risks disclosures.

4. Findings and Discussion

To answer to the research question what are the main variables affecting sustainability risk disclosure? We firstly investigated the corporate reports used to disclose sustainability information.

The first preliminary outcome of this study is the acknowledgement that the organizations included in our sample—consistently selected from the GRI database even if just based in Italy—are disclosing sustainability information by different means of corporate reports. The majority provide such information by issuing a sustainability report; however, a slight minority—specifically those who achieved several years of experience in sustainability reporting—is now including such information in their annual report. Another slight minority provides sustainability disclosure within an integrated report according to the IIRC guidelines.

A great majority of the organisations in our sample belongs to the Energy/Utilities sector—an industry that has often been challenged by its environmental and sustainability outcomes. Another interesting finding is that all the selected organisations are private corporations except for the University of Torino, a public university, which is the first in Italy to have issued a sustainability report according to GRI4.

The average organisation produces a report which is 150 pages long and is written in English; however, there were some organisations (i.e., 7 out of 30, accounting for the ones linked via the GRI sustainability database) whose reports are just 18 pages long or only published in Italian.

Most of the sample (66%) stated a “Core” accordance with the GRI G4 guidelines, while a minority states a “comprehensive” accordance, and one did not state anything about its level of adherence. Only nine organisations used the service provided by GRI in the preparation of their report, and mainly in the areas of materiality disclosure and content indexing.

The presence of an external assurance provider is outlined by most the sample, with a preference for the service of the Big 4 accounting firms. However, for the majority of such organisations, the external assurance level has been only limited/moderate.

Table 4 provides information about the nature of the external assurance provider involved.

A minor number of organisations (only three of them) requested the opinion of a group of stakeholders, expert in the preparation of their disclosure.

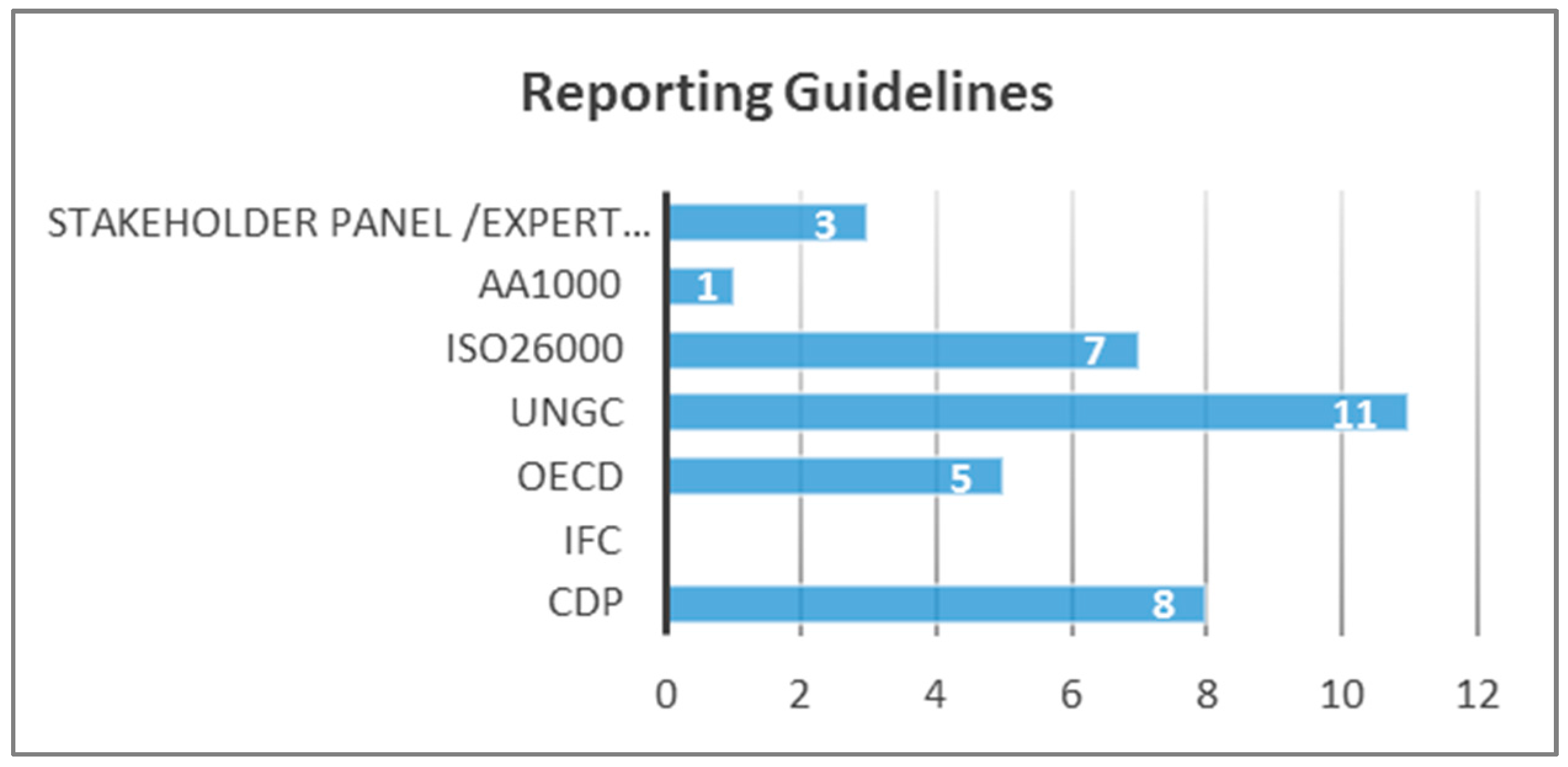

In addition to GRI G4, most reports stated the compliance of their organizations to UN Global Compact, whose principles include a strong business orientation to prevent possible harmful direct and indirect behaviour towards several violations of human rights, labour rights, environmental protection, and unethical behaviour. Interestingly, none of the organizations in our sample adopted the sustainability framework developed by the International Finance Corporation (IFC), an entity which is part of the World Bank Group. A large number of organisations were compliant with CDP’s reporting framework as well as the ISO 26000 guidance on social responsibility (of course, several companies have adopted social and environmental management systems such SA8000, ISO14001, and EMAS, with related risk disclosures).

Figure 2 provides a chart outlining the guidelines/frameworks adopted by the organisations in our sample, as well as the presence of the opinion of a stakeholder or expert panel.

The content analysis of the reports allowed the computation of a sustainability risk disclosure score according to the content items presented in the previous section. We analysed the Shapiro–Wilk test for normality, and the SRD score was negatively skewed, and therefore not normally distributed.

The descriptive statistics of the SRD score, together with the other variables included in the multivariate analysis, are provided in

Table 5.

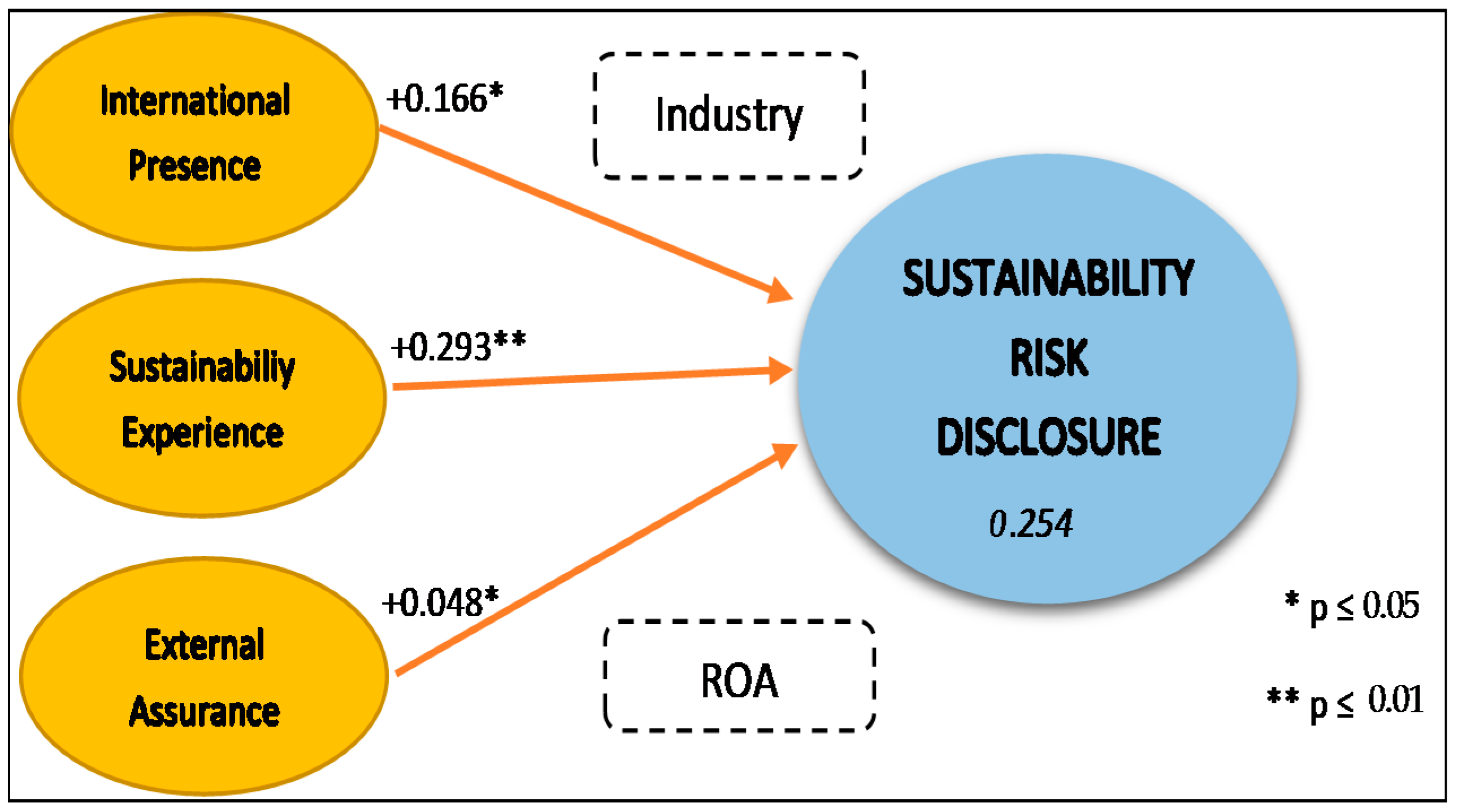

Specifically, we developed a PLS-SEM model according to the relevant features arising from the study. The model tests the effect of the presence of external assurance, international presence, and sustainability experience on the level of risk sustainability disclosure (measured by the SRD score) by moderating/controlling the effect of the industry and financial performance (in terms of return on assets, ROA). In detail, we tested if a latent concept like

International Presence could be explained by indicators such as the number of countries where the organisation is located, and by the percent of overseas revenue compared to the Italian one; or the concept of Sustainability Experience, measured by the total periods of sustainability reporting and the number or pages of the last report. We tested for the collinearity of such indicators using SPSS software, and we found that the variance inflation factors (VIF) values were lower than 5 and their tolerance values were higher than 0.2 [

88].

Therefore, the analysis of such latent concepts’ different variables had high loadings on their respective construct, confirming convergent validity. Moreover, all items had low cross-loadings, which verified discriminant validity, ensuring that a construct has the strongest relationships with its own indicators (e.g., in comparison with than any other construct). Moreover, in order to test for the reliability of the model, it is possible to compute the composite reliability index (CR) rather than Cronbach alpha because the latter is criticized for its lower bound value, which underestimates the true reliability [

89]. In our case, all CR indexes exceeded 0.8 that means that all constructs have internal consistency [

90]. Furthermore, we computed the average variances extracted (AVE) as the sum of each squared factor loading divided by the number of indicators, in order to test for the convergent validity of the model. AVE’s results were all higher than the recommended value of 0.5 [

91], confirming convergent validity. These PLS-SEM results are presented in

Table 6, providing the different indicator loadings, reliability, and latent variables’ composite reliability and AVE scores, while the resulting model and its paths are provided in

Figure 2.

Therefore, the model presented in

Figure 3 highlights that the latent exogenous constructs significantly explain more than 25% of the variance of the SRD score (adjusted R2 0.254). Specifically, the presence of external assurance does not have a significant effect on the SRD score, while both International Presence (coefficient of +0.17,

p <0.05) and relevant Sustainability Experience (coefficient of +0.29,

p <0.01) have significant positive influence on the SRD Score. In other words, the greater the number of sustainability reports published during the last twenty years and the larger the international presence of the organisation, the greater the likelihood of a higher level of sustainability risk disclosure.

Finally, controlling for industry effects and the financial performance of the organisation (average of the latest two ROA) did not provide any significant influence on the PLS model. The latent variables defined in the PLS-SEM model were discriminant valid. This test has been carried out by checking if the square root of the variables’ AVE is larger than the correlation scores between the other latent variables [

92]. Accordingly,

Table 7 provides the results of this test.

Given these results, we were able to answer our research question and define which are the main variables that affect risk disclosure in sustainability reporting—namely the international presence of the organization and its experience in the practice of sustainability reporting. The presence of external assurance, the industry, or the financial performance did not play a relevant role in the level of risk disclosure.

5. Conclusions

Our study reveals the intricate relationships between sustainability reporting and ethical–social–environmental risk disclosure. The impossibility of tackling and planning strategies towards social and environmental risks is a consequence of companies’ operations during VUCA times, or under Beck’s definition of today’s world risk society. However, the companies and organizations can improve their awareness of social and environmental issues (e.g., by applying and adhering to global sustainability movements, adopting codes of ethics and conduct, social and environmental management systems, or a sustainability control system). Of course, these tools do not guarantee a complete insurance towards pure risks and adverse events, otherwise they represent a competitive advantage to set up strategies to prevent or limit the negative impacts towards societies and the environment. The adoption of management systems does not imply the disclosure of strategic information or managerial strategies. Therefore, the paper deepens the knowledge of corporate disclosure behaviour over specific social and environmental risks. As such, our study does not include the disclosure of business risks, market risks, financial risks, business continuity risks, etc. Importantly, we addressed the main sustainability reporting features and related risk disclosure practices of a sample of 30 Italian organizations that—although limited—represent Italian organization in general. Furthermore, which variables influenced their sustainability risk disclosure was tested by computing a score based on the content analysis of their latest sustainability report. Findings show that international presence and sustainability experience are important factors contributing to the quality of risk disclosure in sustainability reporting; on the contrary, the presence of external assurance did not seem to affect risk disclosure quality. The international presence is one of the most important factors, in line with the relevant literature over sustainability risk management along supply chains—especially in developing countries. The sustainability experience is explained as the organizational learning dimension, involved in accounting the relations between the organization and the external environment.

Given its exploratory nature, our study is not free from limitations: above all, we need to increase the size of the sample and control for cross-country behaviours by including, for instance, other European organizations. Because our sample is composed of Italian companies adopting international reporting standard guidelines, it is slightly influenced by a normative approach towards risk management regulated by the legislative Decree n. 231/2001 that in Italy requires large companies to adopt environmental management systems that cover a wide range of ethical and SE issues. The collection of further evidence should relate to the disclosure of risk management tools, the typology of ethical, social, and environmental risks that have been illustrated in the reports and the typologies of social and environmental impact forecasts.

However, despite such limitations, this study provides a preliminary contribution in sustainability and risk management research, discussing the role of risk disclosure, and the variables that can influence it from a reporting perspective. Furthermore, it demonstrates the level of usefulness of sustainability reporting as an external decision tool for banks, investors, rating agencies, and all the stakeholders interested in businesses’ internal processes and mechanisms that can affect corporate performances against risk avoidance.