Pricing Policies of a Dual-Channel Supply Chain Considering Channel Environmental Sustainability

Abstract

:1. Introduction

2. Model Formulation

3. Model Solution

3.1. Centralized Dual Channel

- (1)

- ;

- (2)

- ;

- (3)

- (Appendix B).

3.2. Decentralized Dual Channel

- (1)

- is jointly concave to and ;

- (2)

- When , is jointly concave to and , but is not jointly concave to , and (Appendix C).

- (1)

- ;

- (2)

4. Numerical Example

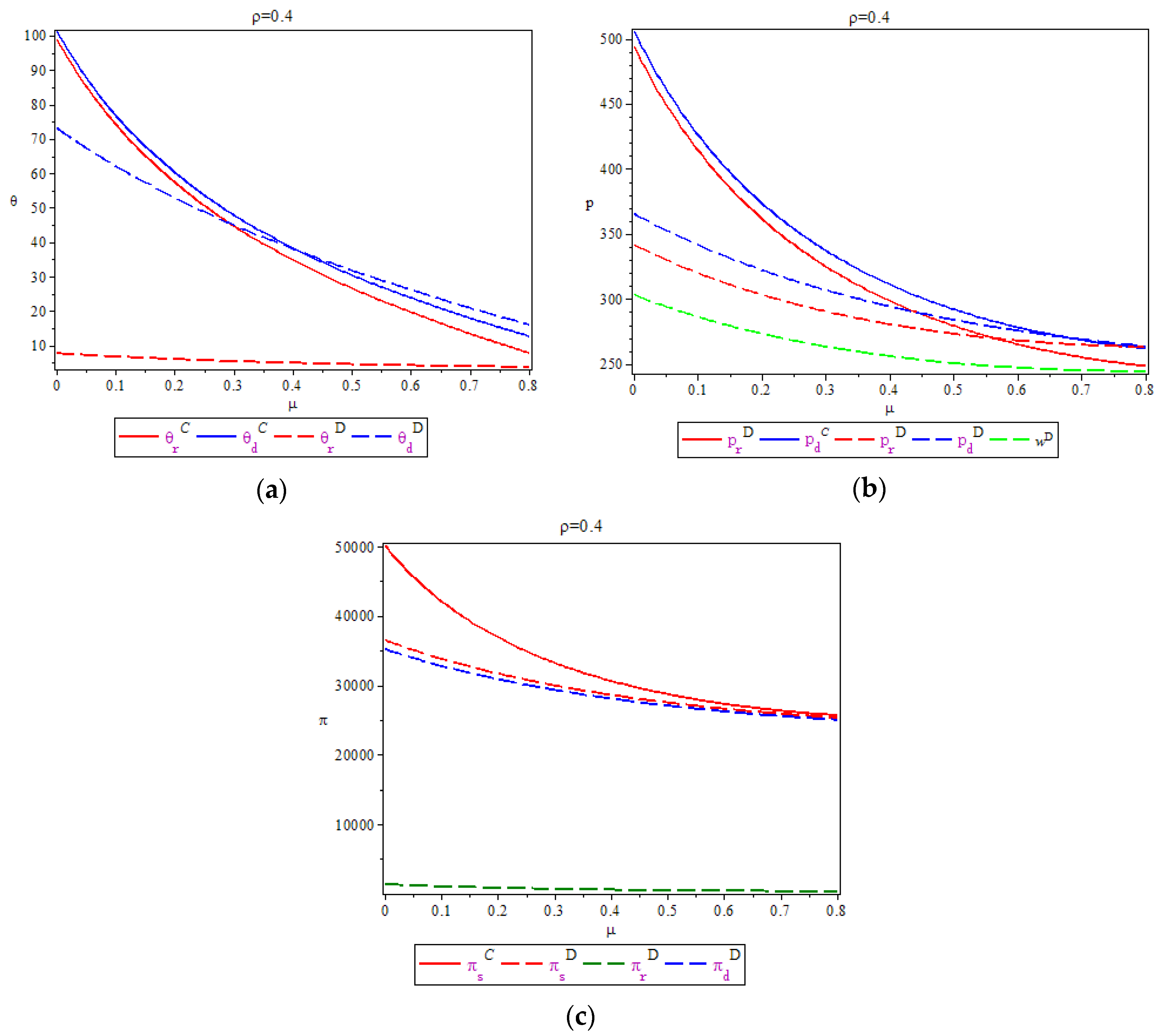

4.1. The Cross-Environmental-Sustainability Sensitivity Factor

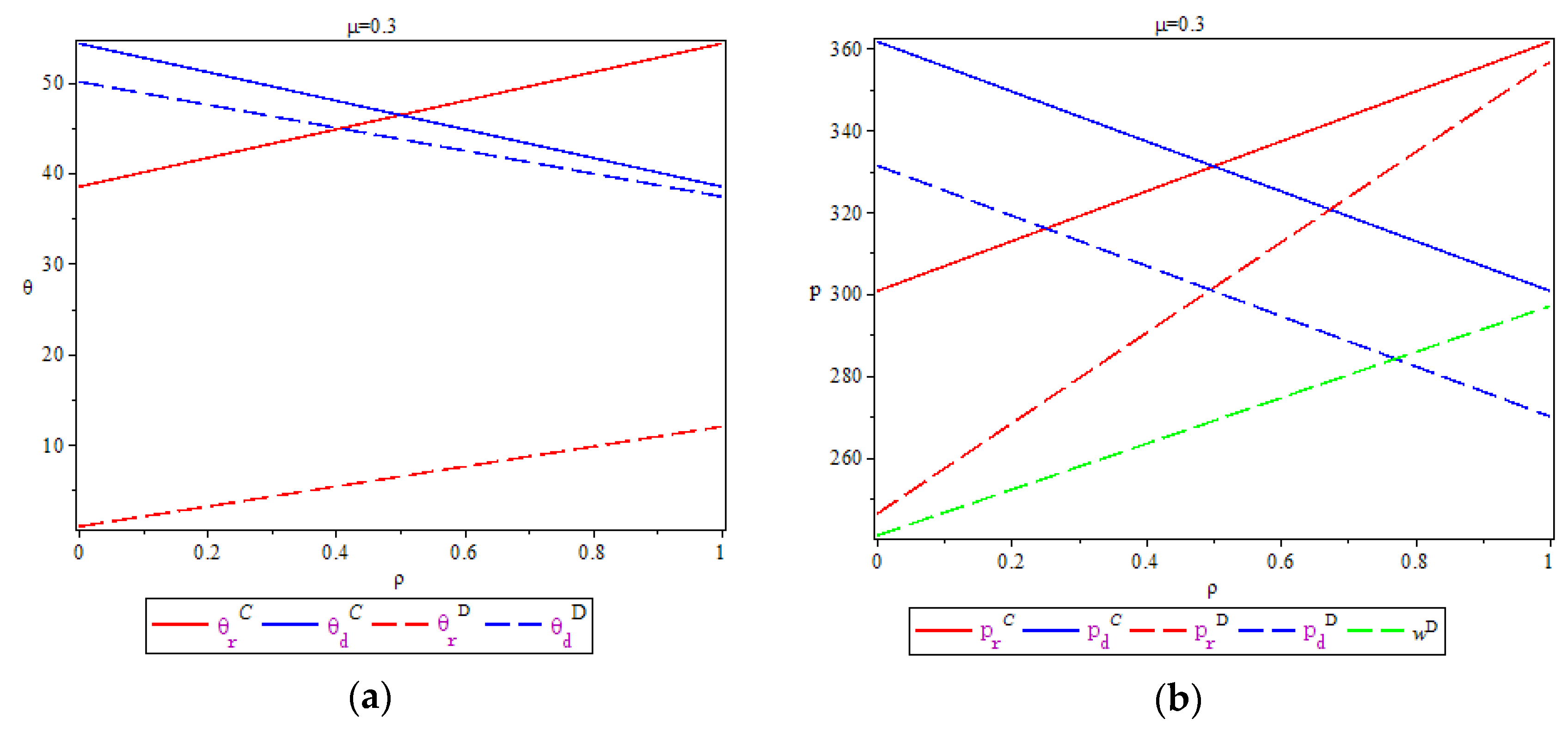

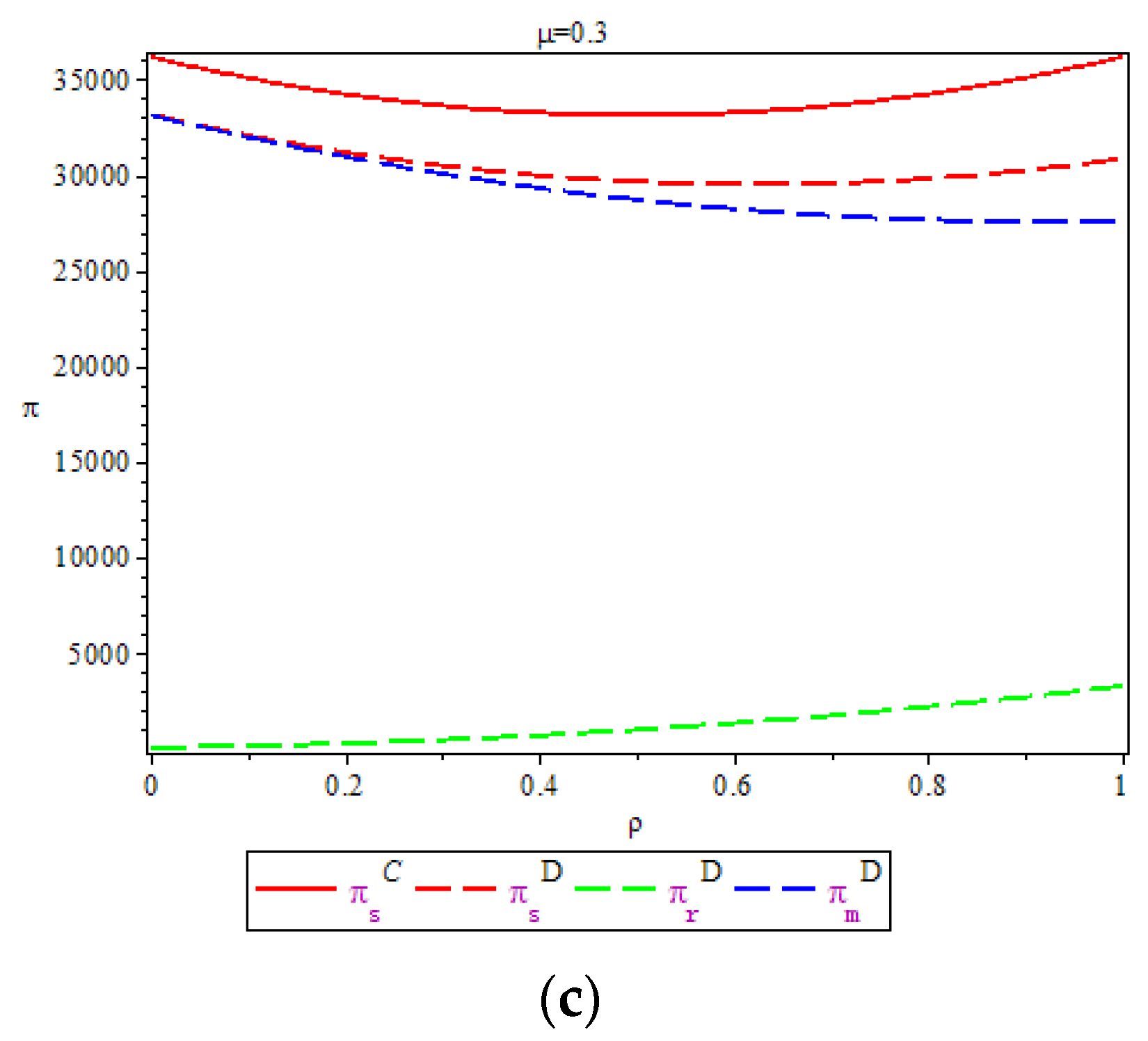

4.2. The Initial Proportion of Consumers Who Prefer the Retail Channel

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

References

- Saha, S. Channel characteristics and coordination in three-echelon dual-channel supply chain. Int. J. Syst. Sci. 2014, 47, 740–754. [Google Scholar] [CrossRef]

- O’Connell, V. “Green” goods, red flags. Wall Street Journal, 2010. [Google Scholar]

- European Commission. Attitudes of European Citizens towards the Environment; Special Eurobarometer 416; EC: Brussels, Belgium, 2014.

- Chitra, K. In search of the green consumers: A perceptual study. J. Serv. Res. 2007, 7, 173–191. [Google Scholar]

- Siikavirta, H.; Punakivi, M.; Kärkkäinen, M.; Linnanen, L. Effects of E-Commerce on Greenhouse Gas Emissions. J. Ind. Ecol. 2003, 6, 83–91. [Google Scholar] [CrossRef]

- Jay, R.; Brown, A.L.G. Carbon emissions comparison of last mile delivery versus customer pickup. Int. J. Logist. Res. Appl. 2014, 17, 503–521. [Google Scholar]

- Loon, P.V.; Dekelete, L.; Dewaela, J.; Mckinnon, A.; Rutherford, A. A comparative analysis of carbon emissions from online retailing of fast moving consumer goods. J. Clean. Prod. 2015, 106, 478–486. [Google Scholar] [CrossRef]

- Matthews, H.; Hendrickson, C.; Soh, D. Environmental and economic effects of e-commerce: A Case Study of Book Publishing and Retail Logistics. Transp. Res. Rec. 2001, 1763, 6–12. [Google Scholar] [CrossRef]

- Edwards, J.B.; Mckinnon, A.C.; Cullinane, S.L. Comparative analysis of the carbon footprints of conventional and online retailing: A “last mile” perspective. Int. J. Phys. Distrib. Logist. Manag. 2010, 40, 103–123. [Google Scholar] [CrossRef]

- Edwards, J.; Mckinnon, A.; Cullinane, S. Comparative carbon auditing of conventional and online retail supply chains: A review of methodological issues. Supply Chain Manag. Int. J. 2011, 16, 57–63. [Google Scholar] [CrossRef]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S.; Basu, M. Corporate social responsibility, coordination and profit distribution in a dual-channel supply chain. Pac. Sci. Rev. 2014, 16, 235–249. [Google Scholar] [CrossRef]

- Liu, H.; Lei, M.; Deng, H.; Leong, G.K.; Huang, T. A dual channel, quality-based price competition model for the WEEE recycling market with government subsidy. Omega 2016, 59, 290–302. [Google Scholar] [CrossRef]

- Shu, T.; Liao, H.; Chen, S.; Wang, S.; Lai, K.K.; Gan, L. Analysing remanufacturing decisions of supply chain members in uncertainty of consumer preferences. Appl. Econ. 2016, 48, 3208–3227. [Google Scholar] [CrossRef]

- Hong, X.; Wang, Z.; Wang, D.; Zhang, H. Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. Int. J. Adv. Manuf. Technol. 2013, 68, 1851–1865. [Google Scholar] [CrossRef]

- Huang, M.; Song, M.; Lee, L.H.; Ching, W.K. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Zhang, Z.Z.; Wang, Z.J.; Liu, L.W. Retail Services and Pricing Decisions in a Closed-Loop Supply Chain with Remanufacturing. Sustainability 2015, 7, 2373–2396. [Google Scholar] [CrossRef]

- Carrillo, J.E.; Vakharia, A.J.; Wang, R. Environmental implications for online retailing. Eur. J. Oper. Res. 2014, 239, 744–755. [Google Scholar] [CrossRef]

- Chiang, W.Y.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. J. Inst. Oper. Res. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Ding, Q.; Dong, C.; Pan, Z. A hierarchical pricing decision process on a dual-channel problem with one manufacturer and one retailer. Int. J. Prod. Econ. 2016, 175, 197–212. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J.; Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Xiao, T.; Choi, T.M.; Cheng, T.C.E. Product variety and channel structure strategy for a retailer-Stackelberg supply chain. Eur. J. Oper. Res. 2014, 233, 114–124. [Google Scholar] [CrossRef]

- Wang, W.; Li, G.; Cheng, T.C.E. Channel selection in a supply chain with a multi-channel retailer: The role of channel operating costs. Int. J. Prod. Econ. 2016, 173, 54–65. [Google Scholar] [CrossRef]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S.; Wang, X.; Wu, Y.; Zhou, F. Pricing Policies of a Dual-Channel Supply Chain Considering Channel Environmental Sustainability. Sustainability 2017, 9, 382. https://doi.org/10.3390/su9030382

Chen S, Wang X, Wu Y, Zhou F. Pricing Policies of a Dual-Channel Supply Chain Considering Channel Environmental Sustainability. Sustainability. 2017; 9(3):382. https://doi.org/10.3390/su9030382

Chicago/Turabian StyleChen, Shan, Xu Wang, Yingbo Wu, and Fuli Zhou. 2017. "Pricing Policies of a Dual-Channel Supply Chain Considering Channel Environmental Sustainability" Sustainability 9, no. 3: 382. https://doi.org/10.3390/su9030382