Functional Differentiation and Sustainability: A New Stage of Development in the Chinese Container Port System

Abstract

:1. Introduction

2. Literature Review

2.1. Port System Study

2.2. China Port Development and System

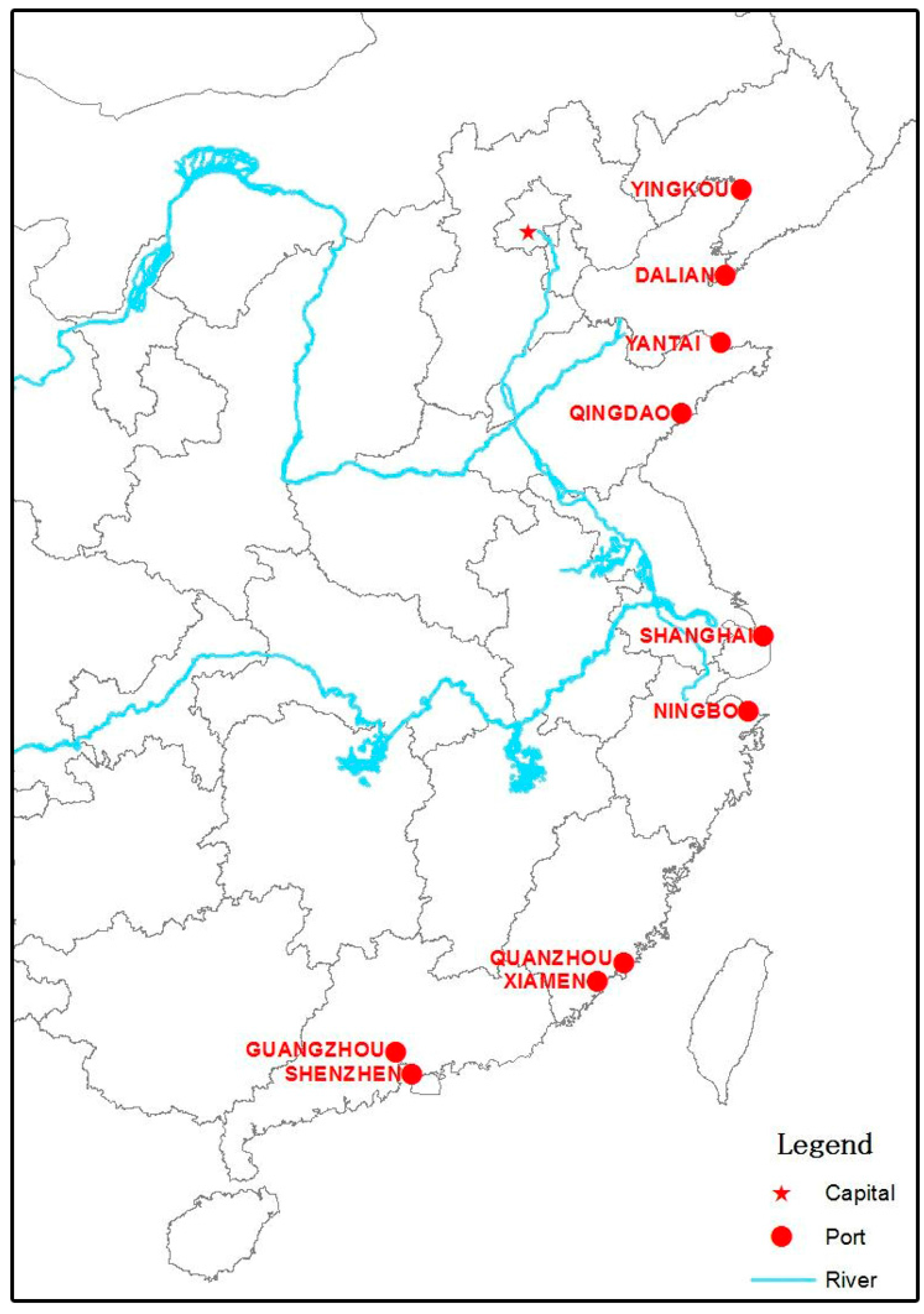

3. Research Target and Information

3.1. Research Target

3.2. Research Information

3.3. Research Methodology

4. China Port System Evolution

4.1. The First Layer: De-Concentration in Adjacent Ports

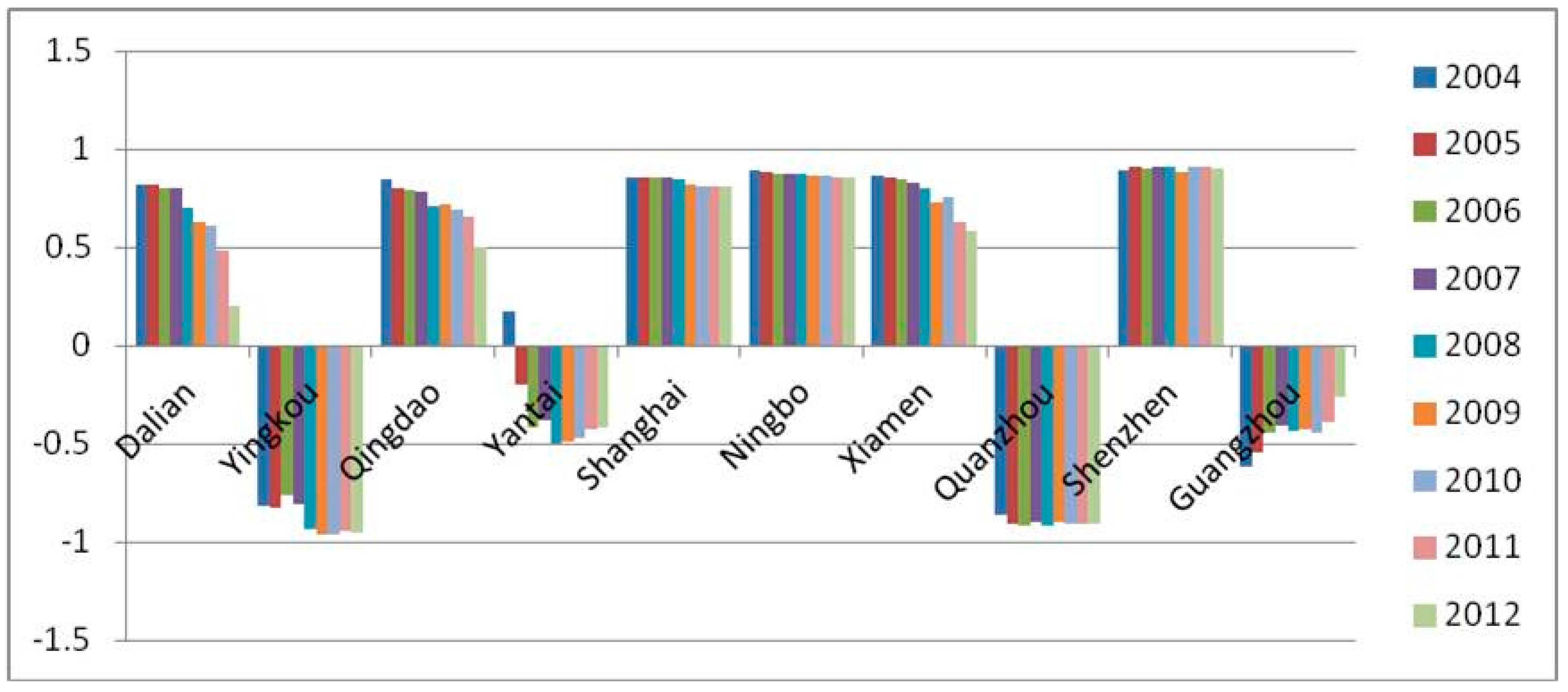

4.2. The Second Layer: Functional Differentiation in Foreign Container and Domestic Container

4.3. The Third Layer: Functional Differentiation in Foreign Transshipment and Domestic Transshipment

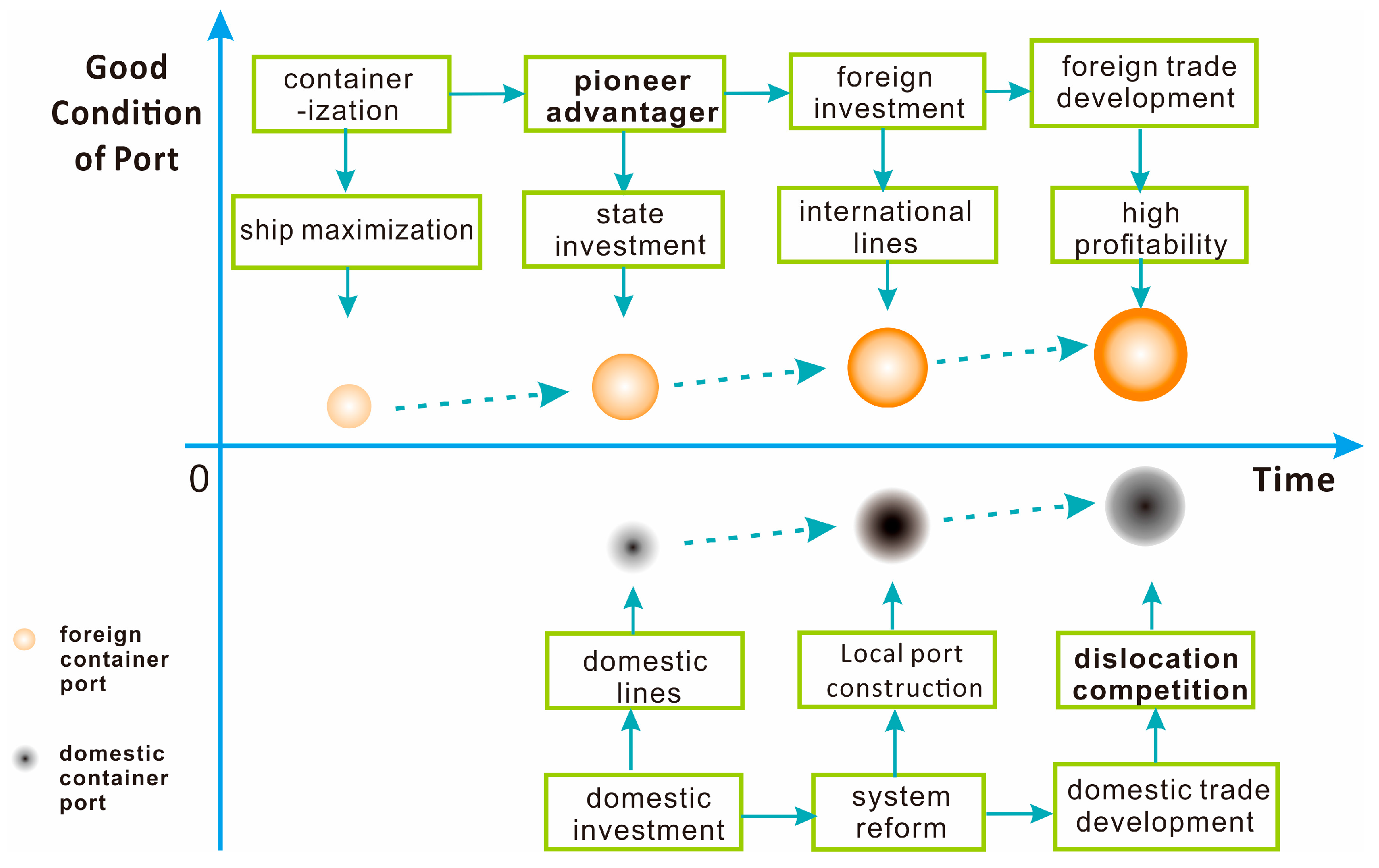

5. Functional Differentiation Mechanism

5.1. Deep Water Conditions for Different Port Development

5.2. The Introduction of Foreign Investment and Routings

5.3. Port Administration Systems Changes and Government Pressure

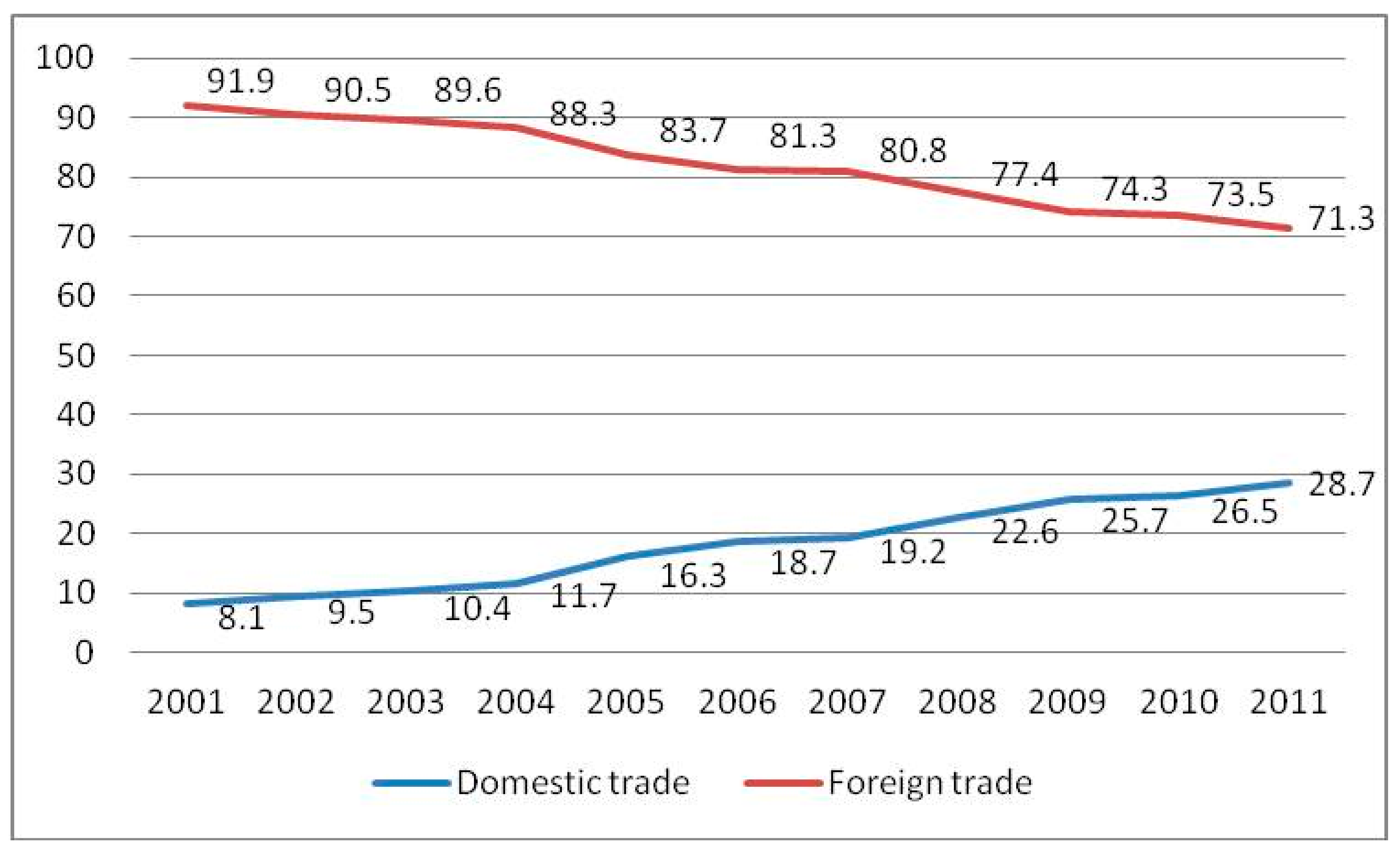

5.4. Domestic Trade and Port Systems Decentralization

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- UNCTAD. Review of Maritime Transport, United Nations Conference on Trade and Development. Available online: http://www.unctad.org (accessed on 6 February 2017).

- Hiranandani, V. Sustainable development in seaports: A multi-case study. WMU J. Marit. Aff. 2014, 13, 127–172. [Google Scholar] [CrossRef]

- Davarzani, H.; Fahimnia, B.; Bell, M.; Sarkis, J. Greening ports and maritime logistics: A review. Transp. Res. Part D 2016, 48, 473–487. [Google Scholar] [CrossRef]

- Sislian, L.; Jaegler, A.; Cariou, P. A literature review on port sustainability and ocean’s carrier network problem. Res. Transp. Bus. Manag. 2016, 19, 19–26. [Google Scholar] [CrossRef]

- China Port Association. Chinese Port Yearbook (2014); Chinese Port Magazine Publisher: Shanghai, China, 2014. (In Chinese) [Google Scholar]

- China Port Association. Chinese Port Yearbook (2011–2013); Chinese Port Magazine Publisher: Shanghai, China, 2011–2013. (In Chinese) [Google Scholar]

- Subhan, M.; Ghani, A.B.A. An analytic hierarchy process approach in formulating growth strategy of a port system: A case study of Aceh ports in Indonesia. In Proceedings of the 3rd International Forum on Shipping, Ports and Airport, Chengdu, China, 15–18 October 2010; pp. 196–207.

- Fremont, A. Global maritime networks: The case of Maersk. J. Transp. Geogr. 2007, 15, 431–442. [Google Scholar] [CrossRef]

- Ng, A.K.Y. The evolution and research trends of port geography. Prof. Geogr. 2013, 65, 65–86. [Google Scholar] [CrossRef]

- Bird, J. Ports and Harbors, 2nd ed.; Hutchinson: London, UK, 1961. [Google Scholar]

- Bird, J. The Major Seaports of the United Kingdom; Hutchinson: London, UK, 1963. [Google Scholar]

- Bird, J. Seaports and Seaport Terminals; Hutchinson: London, UK, 1971. [Google Scholar]

- Taaffe, J.; Morrill, R.L.; Gould, P.R. Transport expansion in underdeveloped countries: A comparative analysis. Geogr. Rev. 1963, 53, 503–529. [Google Scholar] [CrossRef]

- Rimmer, P.J.; Comtois, C. China’s container-related dynamics, 1990–2005. GeoJournal 2009, 74, 35–50. [Google Scholar] [CrossRef]

- Wang, J.J.; Oliver, D.; Notteboom, T.; Slack, B. Ports, Cities and Global Supply Chains; Ashgate: Aldershot, UK, 2007. [Google Scholar]

- Mayer, H.M. Current trends in Great Lakes shipping. GeoJournal 1978, 2, 117–122. [Google Scholar] [CrossRef]

- Rimmer, P.J. Recent changes in the status of seaports in the New Zealand coastal trade. Econ. Geogr. 1967, 43, 231–243. [Google Scholar] [CrossRef]

- Hilling, I.D. The evolution of a port system: The case of Ghana. Geography 1977, 62, 97–105. [Google Scholar]

- Ogundana, B. The location factor in changing seaport significance in Nigeria. Niger. Geogr. 1971, 14, 71–88. [Google Scholar]

- Hoyle, B.; Charlier, J. Inter-port competition in developing countries: An East African case study. J. Transp. Geogr. 1995, 3, 87–103. [Google Scholar] [CrossRef]

- Rimmer, P.J. The changing status of New Zealand seaports, 1853–1960. Ann. Assoc. Am. Geogr. 1967, 57, 88–100. [Google Scholar] [CrossRef]

- Rimmer, P.J. The search for spatial regularities in the development of Australian seaports 1861–1961. Geogr. Ann. Ser. B Hum. Geogr. 1967, 49, 42–54. [Google Scholar] [CrossRef]

- Hayuth, Y. Containerization and the load center concept. Econ. Geogr. 1981, 57, 160–176. [Google Scholar] [CrossRef]

- Notteboom, T.E.; Rodrigue, J.P. Port regionalization: Towards a new phase in port development. Marit. Policy Manag. 2005, 32, 297–313. [Google Scholar] [CrossRef]

- Ducruet, C. Going West? Spatial polarization of the North Korean port system. J. Transp. Geogr. 2009, 17, 357–368. [Google Scholar] [CrossRef]

- Notteboom, T.E. Challenges for container river services on the Yangtze River: A case study for Chongqing. Res. Transp. Econ. 2012, 35, 41–49. [Google Scholar] [CrossRef]

- Yuen, C.L.A.; Zhang, A.; Cheung, W. Port competitiveness from the users’ perspective: An analysis of major container ports in China and its neighboring countries. Res. Transp. Econ. 2012, 35, 34–40. [Google Scholar] [CrossRef]

- Wang, J.J.; Slack, B. The evolution of a regional container port system: The Pearl River Delta. J. Transp. Geogr. 2000, 8, 263–275. [Google Scholar] [CrossRef]

- Slack, B.; Fremont, A. Fifty years of organizational change in container shipping: Regional shifts and the role of family firms. GeoJournal 2009, 74, 23–34. [Google Scholar] [CrossRef]

- Chan, W.Y.T.; Yip, T.L. Port spatial development and theory of constraints. In Proceedings of the 3rd International Forum on Shipping, Ports and Airport, Chengdu, China, 24–27 May 2009; pp. 421–430.

- Cullinane, K.; Teng, Y.; Wang, T. Port competition between Shanghai and Ningbo. Marit. Policy Manag. 2005, 32, 331–346. [Google Scholar] [CrossRef]

- Lee, S.Y.; Rodrigue, J.P. Trade reorientation and its effects on regional port systems: The Korea–China link along the Yellow Sea Rim. Growth Chang. 2006, 37, 597–619. [Google Scholar] [CrossRef]

- Comtois, C.; Dong, J. Port competition in the Yangtze River Delta. Asia Pac. Viewp. 2007, 48, 299–311. [Google Scholar] [CrossRef]

- Notteboom, T.E. Strategic challenges to container ports in a changing market environment. In Devolution, Port Governance and Port Performance; Brooks, M.R., Cullinane, K., Eds.; Elsevier: Oxford, UK; Amsterdam, The Netherlands, 2007; pp. 29–52. [Google Scholar]

- Wang, J.J.; Oliver, D. Shanghai and Ningbo: In search of an identity for the Changjiang Delta Region. In Asian Container Ports. Development, Competition and Co-Operation; Cullinane, K., Song, D.W., Eds.; Palgrave Macmillan Ltd.: New York, NY, USA, 2007; pp. 183–197. [Google Scholar]

- Cheung, R. The transition from freight consolidation to logistics: The case of Hong Kong. J. Transp. Geogr. 2003, 11, 245–253. [Google Scholar] [CrossRef]

- Loo, B.P.Y.; Hook, B. Interplay of international, national and local factors in shaping container port development: A case study of Hong Kong. Transp. Rev. 2002, 22, 219–233. [Google Scholar] [CrossRef]

- Cao, Y.; Cao, W.; Jin, S. The evolution mechanism of the coastal container port system of China. Acta Geogr. Sin. 2003, 58, 424–432. (In Chinese) [Google Scholar]

- Cao, Y.; Li, H.; Chen, W. The spatial structure and the competition pattern of the container port system of China. Acta Geogr. Sin. 2004, 59, 1020–1027. (In Chinese) [Google Scholar]

- Han, Z. Distribution and container transportation network in China. Acta Geogr. Sin. 2002, 57, 479–488. (In Chinese) [Google Scholar]

- Wang, C. The Evolution Mechanism of Container Port Network; Science Press: Beijing, China, 2012. [Google Scholar]

- Notteboom, T.E. Traffic inequality in seaport systems revisited. J. Transp. Geogr. 2006, 14, 95–108. [Google Scholar] [CrossRef]

- Yap, W.Y.; Lam, J.S.L. Competition dynamics between container ports in East Asia. Transp. Res. Part A 2006, 40, 35–51. [Google Scholar] [CrossRef]

- Cheon, S.H.; Dowall, D.E.; Song, D.W. Evaluating impacts of institutional reforms on port efficiency changes: Ownership, corporate structure, and total factor productivity changes of world container ports. Transp. Res. Part E 2010, 46, 546–561. [Google Scholar] [CrossRef]

- Veenstra, A.; Notteboom, T. The development of the Yangtze River container port system. J. Transp. Geogr. 2011, 19, 772–781. [Google Scholar] [CrossRef]

- Hayuth, Y. Rationalization and de-concentration of the U.S. container port system. Prof. Geogr. 1988, 40, 279–288. [Google Scholar] [CrossRef]

- Cidell, J. Concentration and decentralization: The new geography of freight distribution in US metropolitan areas. J. Transp. Geogr. 2010, 18, 363–371. [Google Scholar] [CrossRef]

- Ducruet, C.; Lee, S.W.; Ng, A.K.Y. Centrality and vulnerability in liner shipping networks: Revisiting the Northeast Asian port hierarchy. Marit. Policy Manag. 2010, 37, 17–36. [Google Scholar] [CrossRef]

- Zhou, M. (Ed.) The World Atlas of Port Traffic; Sino Maps Press: Beijing, China, 2016. (In Chinese)

- Deardorff, A. The general validity of the law of comparative advantage. J. Political Econ. 1980, 88, 941–957. [Google Scholar] [CrossRef]

- Li, K.X.; Luo, M.; Yang, J. Container port system in China and the USA: A comparative study. Marit. Policy Manag. 2012, 39, 461–478. [Google Scholar] [CrossRef]

- Heaver, T.D. The evolving roles of shipping lines in international logistics. Int. J. Marit. Econ. 2002, 4, 210–230. [Google Scholar] [CrossRef]

- Lau, Y.Y. An application of the Porter’s diamond framework: The case of Hong Kong airfreight industry. In Proceedings of the 3rd International Forum of Shipping, Ports and Airports, Hong Kong, China, 24–27 May 2009.

- Tian, X. The Study on the Developing Strategy for China Container Port; Dalian Maritime University: Dalian, China, 2001. (In Chinese) [Google Scholar]

- Sun, B. The present situation and prospect of the foreign container trade shipment in Nansha District of Guangzhou port. China Ports 2008, 11, 24–27. (In Chinese) [Google Scholar]

- Zhi, Y. Yingkou port: The successful road-map of domestic container. Marit. China 2012, 7, 32–34. (In Chinese) [Google Scholar]

- Cheng, Z. Quanzhou Port Enter into the Era of Ship Maximization. Available online: http://www.fjjtxw.com/show.aspx?id=235&cid=12 (accessed on 6 February 2017). (In Chinese)

- Yang, Y. Foreign investment is taking a gamble in China’s wharfs. Foreign Invest. China 2002, 9, 16–18. (In Chinese) [Google Scholar]

- Zhang, T.; Cao, L. Domestic Containers Drive the New Development of China’s Ports. Available online: http://www.chyxx.com/news/2012/0709/160478.html (accessed on 6 February 2017). (In Chinese)

- Liu, L. The competition and cooperation of domestic trade containers in Pearl River Delta. Containerization 2012, 23, 4–6. (In Chinese) [Google Scholar]

- Cai, Z. Expand the development path with own characteristics. China Port 2008, 1, 5–7. (In Chinese) [Google Scholar]

| Dalian | Yingkou | Qingdao | Yantai | Shanghai | Ningbo | Xiamen | Quanzhou | Shenzhen | Guangzhou | |

|---|---|---|---|---|---|---|---|---|---|---|

| Throughout (Ten thousand TEU) | 806.4 | 485.1 | 1450 | 185.04 | 3252.9 | 1683 | 720.17 | 169.69 | 2294.13 | 1474.4 |

| Rank in China | 7 | 10 | 5 | 11 | 1 | 3 | 8 | 14 | 2 | 4 |

| Rank in province | 1 | 2 | 1 | 2 | 1 | 1 | 1 | 3 | 1 | 2 |

| Distance on the sea (nautical mile) | 184 | 219 | 109 | 84 | 57 | |||||

| Distance onshore (kilometer) | 225 | 229 | 235 | 140 | 163 | |||||

| Dalian/Yingkou | Qingdao/Yantai | Shanghai/Ningbo | Xiamen/Quanzhou | Shenzhen/Guangzhou | |

|---|---|---|---|---|---|

| 2004 | 3.68217 | 16.90412 | 3.748674 | 5.258674 | 5.942204 |

| 2005 | 3.007309 | 10.07021 | 3.424452 | 5.247581 | 4.821663 |

| 2006 | 2.776552 | 7.227458 | 3.031507 | 4.472802 | 3.526394 |

| 2007 | 2.674885 | 8.42988 | 2.756799 | 4.089552 | 2.882006 |

| 2008 | 2.340432 | 7.15981 | 2.561907 | 3.768581 | 2.39639 |

| 2009 | 1.989344 | 8.228677 | 2.441246 | 3.33566 | 2.072999 |

| 2010 | 1.888751 | 8.930064 | 2.273834 | 2.94949 | 2.299585 |

| 2011 | 1.621835 | 9.010811 | 2.225592 | 3.730142 | 2.008294 |

| 2012 | 1.677914 | 10.08928 | 2.041581 | 3.925868 | 1.92134 |

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Dalian | Foreign | 91.00 | 91.15 | 90.08 | 90.02 | 85.18 | 81.29 | 80.34 | 74.15 | 60.08 |

| Domestic | 9.00 | 8.85 | 9.92 | 9.98 | 14.82 | 18.71 | 19.66 | 25.85 | 39.92 | |

| Yingkou | Foreign | 9.29 | 8.73 | 12.01 | 9.63 | 3.28 | 2.08 | 1.79 | 2.58 | 2.27 |

| Domestic | 90.71 | 91.27 | 87.99 | 90.37 | 96.72 | 97.92 | 98.21 | 97.42 | 97.73 | |

| Qingdao | Foreign | 92.16 | 89.98 | 89.43 | 89.12 | 85.68 | 86.00 | 84.79 | 82.89 | 74.94 |

| Domestic | 8.51 | 11.13 | 11.82 | 12.21 | 16.72 | 16.28 | 17.94 | 20.64 | 33.44 | |

| Yantai | Foreign | 58.66 | 40.07 | 29.13 | 31.09 | 24.93 | 25.68 | 26.45 | 28.67 | 29.26 |

| Domestic | 41.34 | 59.93 | 70.87 | 68.91 | 75.07 | 74.32 | 73.55 | 71.33 | 70.74 | |

| Shanghai | Foreign | 92.78 | 92.81 | 92.75 | 92.79 | 92.48 | 90.80 | 90.61 | 90.67 | 90.40 |

| Domestic | 7.79 | 7.19 | 7.81 | 7.21 | 8.13 | 9.20 | 10.36 | 9.33 | 10.61 | |

| Ningbo | Foreign | 94.67 | 93.96 | 93.73 | 93.75 | 93.61 | 93.07 | 93.29 | 92.74 | 92.85 |

| Domestic | 5.33 | 6.04 | 6.27 | 6.25 | 6.39 | 6.93 | 6.71 | 7.26 | 7.15 | |

| Xiamen | Foreign | 93.32 | 92.79 | 92.53 | 91.62 | 90.26 | 86.52 | 87.68 | 81.22 | 79.31 |

| Domestic | 6.68 | 7.21 | 7.47 | 8.38 | 9.74 | 13.48 | 12.32 | 18.78 | 20.69 | |

| Quanzhou | Foreign | 6.95 | 4.81 | 3.94 | 4.99 | 3.92 | 5.15 | 4.41 | 4.54 | 4.79 |

| Domestic | 93.05 | 95.19 | 96.06 | 95.01 | 96.08 | 94.85 | 95.59 | 95.46 | 95.21 | |

| Shenzhen | Foreign | 94.72 | 95.40 | 95.19 | 95.58 | 95.59 | 94.15 | 95.59 | 95.66 | 95.07 |

| Domestic | 5.28 | 4.60 | 4.81 | 4.42 | 4.41 | 5.85 | 4.41 | 4.34 | 4.93 | |

| Guangzhou | Foreign | 19.12 | 22.70 | 27.86 | 29.58 | 28.18 | 28.88 | 27.74 | 30.50 | 37.08 |

| Domestic | 80.88 | 77.30 | 72.14 | 70.42 | 71.82 | 71.12 | 72.26 | 69.50 | 62.92 | |

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||

|---|---|---|---|---|---|---|---|---|---|

| Dalian | Foreign | 100.00 | 100.00 | 92.04 | 90.49 | 78.84 | 81.67 | 70.07 | 62.86 |

| Domestic | 0.00 | 0.00 | 7.96 | 9.51 | 21.16 | 18.33 | 29.93 | 37.14 | |

| Yingkou | Foreign | 0.00 | 0.00 | 0.00 | 0.01 | 0.39 | 0.00 | 0.00 | 15.11 |

| Domestic | 100.00 | 100.00 | 100.00 | 99.99 | 99.61 | 100.00 | 100.00 | 84.89 | |

| Qingdao | Foreign | 0.00 | 100.00 | 100.00 | 97.27 | 98.46 | 99.10 | 100.00 | 90.47 |

| Domestic | 0.00 | 0.00 | 0.00 | 2.73 | 1.54 | 0.90 | 0.00 | 9.53 | |

| Yantai | Foreign | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 0.27 | 1.21 | 1.23 |

| Domestic | 0.00 | 0.00 | 99.96 | 100.00 | 100.00 | 99.73 | 98.79 | 98.77 | |

| Shanghai | Foreign | 86.63 | 82.56 | 85.81 | 85.14 | 81.03 | 93.77 | 80.64 | 80.91 |

| Domestic | 13.37 | 17.44 | 14.19 | 14.86 | 18.97 | 6.23 | 19.36 | 19.09 | |

| Ningbo | Foreign | 62.61 | 75.98 | 98.30 | 98.31 | 99.01 | 94.58 | 88.91 | 88.10 |

| Domestic | 37.39 | 24.02 | 1.70 | 1.69 | 0.99 | 5.42 | 11.09 | 11.90 | |

| Xiamen | Foreign | 88.09 | 84.01 | 81.78 | 60.53 | 50.18 | 62.18 | 51.41 | 50.86 |

| Domestic | 11.91 | 15.99 | 18.22 | 39.47 | 49.82 | 37.82 | 48.59 | 49.14 | |

| Quanzhou | Foreign | 0.00 | 0.58 | 0.61 | 0.95 | 4.66 | 1.88 | 1.57 | 6.25 |

| Domestic | 100.00 | 99.42 | 99.39 | 99.05 | 95.34 | 98.12 | 98.43 | 93.75 | |

| Shenzhen | Foreign | 91.36 | 94.51 | 95.88 | 88.41 | 80.46 | 86.53 | 84.58 | 79.33 |

| Domestic | 8.64 | 5.49 | 4.12 | 11.59 | 19.54 | 13.47 | 15.42 | 20.67 | |

| Guangzhou | Foreign | 0.00 | 0.00 | 32.87 | 27.45 | 25.05 | 0.35 | 4.23 | 7.16 |

| Domestic | 100.00 | 100.00 | 75.26 | 78.46 | 79.97 | 99.65 | 95.94 | 93.32 | |

| Port | Foreign Company (Time) |

|---|---|

| Shenzhen | SITC (1990); CMHI (1991); Swire (1991); P&O (1991); HPH (1994); CMHI (2002); Allegro investments (2003); MTL (2005) |

| Shanghai | HPH (1993); APM (2002); HPH (2003); HPH (2005) |

| Dalian | PSA (1996); PSA (1999); PSA (2004); APM (2004); NYK (2007) |

| Xiamen | HPH (1996); NWS (1997); APM (2005) |

| Qingdao | P&O (1999); Maersk (1999); PE (2009) |

| Guangzhou | PSA (2001) |

| Ningbo | HPH (2001); Cyber Chic Company Limited (2003); Ninterin Ltd. (2004); Lloyd Triestino (2004); OOCL (2006) |

| Yantai | Dubai Port World (2003); ICTSI Hong Kong (2005) |

| Port | Company (Time) |

|---|---|

| Guangzhou | PSA (2001); CSCL (2003); COSCO (2006) |

| Yantai | Dubai Port World (2003); ICTSI Hong Kong (2005) |

| Yingkou | COSCO (2004); CSCL (2007) |

| Quanzhou | COSCO (2006); COSCO (2008) |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Notteboom, T.; Lau, Y.-y.; Ng, A.K.Y. Functional Differentiation and Sustainability: A New Stage of Development in the Chinese Container Port System. Sustainability 2017, 9, 328. https://doi.org/10.3390/su9030328

Wang L, Notteboom T, Lau Y-y, Ng AKY. Functional Differentiation and Sustainability: A New Stage of Development in the Chinese Container Port System. Sustainability. 2017; 9(3):328. https://doi.org/10.3390/su9030328

Chicago/Turabian StyleWang, Liehui, Theo Notteboom, Yui-yip Lau, and Adolf K. Y. Ng. 2017. "Functional Differentiation and Sustainability: A New Stage of Development in the Chinese Container Port System" Sustainability 9, no. 3: 328. https://doi.org/10.3390/su9030328