How to Set the Allowance Benchmarking for Cement Industry in China’s Carbon Market: Marginal Analysis and the Case of the Hubei Emission Trading Pilot

Abstract

:1. Introduction

2. Cement Benchmarking in the Cap-and-Trade Program

2.1. Basic Benchmarking Principles

- (1)

- One product, one benchmark. Do not use technology-specific benchmarks for technologies producing the same product;

- (2)

- Do not differentiate between existing and new plants;

- (3)

- Do not apply corrections for plant age, plant size, raw material quality, and climatic circumstances;

- (4)

- Only use separate benchmarks for different products if verifiable production data is available, based on unambiguous and justifiable product classifications;

- (5)

- Use separate benchmarks for intermediate products if these products are traded between installations.

2.2. Benchmarking Approaches

3. Methodology

3.1. Data Collection

3.2. Basic Assumptions

- (1)

- The conversion factor for calculating electricity used in cement production: according to China Power Yearbook (2013), the net generation heat rate is 0.33, based on the year 2012, and the transition loss rate is 6.74%. The conversion factor from electricity to primary energy used in this study is 2.9 Kwh/kgce.

- (2)

- The carbon conversion factor for calculating CO2 emissions from energy: according to the Intergovernmental Panel on Climate Change (IPCC) Report (2013) and China Energy Yearbook 2013, the emission factors of electricity and fuel energy are 0.77 Kg/Kwh and 83.81 kG/GJ, respectively.

- (3)

- The price of fuel (coal) is set as 700 RMB/ton, which was obtained from China Coal Trading Market Website.

- (4)

- The price of electricity is set as 760 RMB/MWh, which was obtained from China Power Yearbook 2013.

- (5)

- The share of production to which the measure is applied: given that the adoption rate of BATs varies, the share of production to which the measure applies is estimated based on the total production of cement in Hubei plus the adoption rate of certain BATs.

- (6)

- The scope of benchmarking: clinker is chosen as the benchmarking product instead of cement due to data availability. Abatement based on clinker helps drive kiln and process efficiency upgrades but fails incentives for the use of clinker substitutes (such as fly ash and slag) in blending to reduce emissions. A benchmark based on cement would provide an incentive for the blending of clinker substitutes but could lead to restructuring of the cement industry. In particular, if the benchmark were only applied to cement, cement facilities may choose to no longer make emissions-incentive clinker themselves, importing it or else purchasing it from facilities that only grind clinker and do not make cement (therefore potentially exempting themselves from the cement-based benchmark. The EU ETS’s benchmark for cement manufacturing is based on clinker because the compliance is counted by installations, while in the California Cap-and-Trade program, the benchmark is based on cement production because the compliance is counted based on firms.

- (7)

- Direct or indirect CO2 emissions from cement production: a combination of direct and indirect CO2 emissions were chosen in this study. During the cement production process, there are direct CO2 emissions and indirect CO2 emissions. The direct emissions come from fuel use, combustion, and the calcination process, while the indirect emissions come from transportation and electricity, which accounts for about 10% of the total emissions during the production and transportation process.

- (8)

- The carbon price: the carbon price in this study is assumed to change between a price range, calculated based on the carbon price of the seven ETS pilots in China, which is not static. Another price factor considered, but not reflected in the MACC, is the difference of carbon allowances traded within the cement industry and those traded between the cement industry and other covered industries. In addition, the secondary carbon exchange market is too small to consider at this stage. Therefore, it is assumed that the cement industrial price equilibrium is achieved when the marginal abatement cost equals the marginal revenue from the carbon market, which is reflected in the macro carbon market.

3.3. Estimation of the Total CO2 Emission Reduction

- : Total emission reduction

- : estimate CO2 emission

- : Free Allocation

3.4. CO2 Emission Marginal Abatement Cost Curve

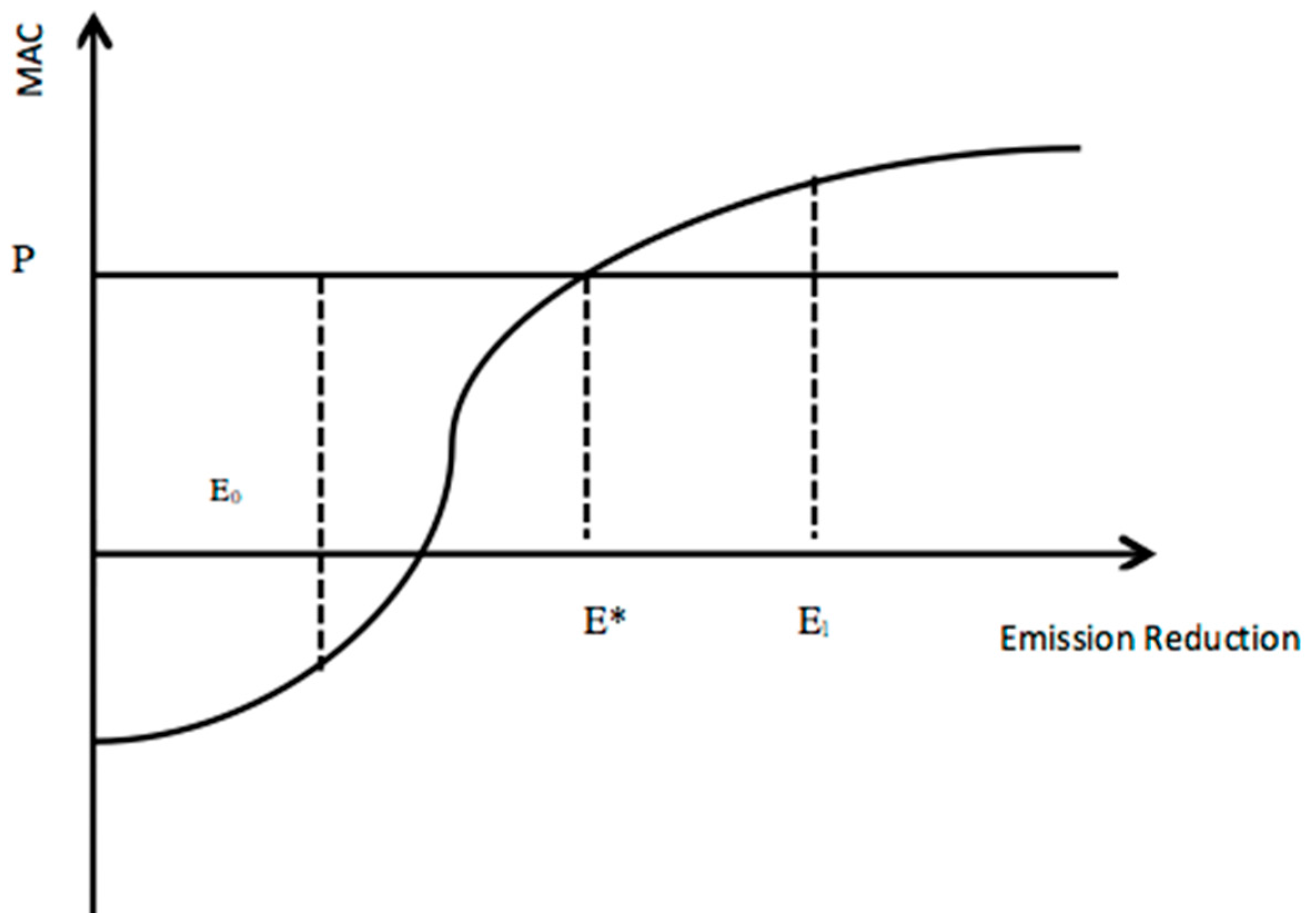

- (1)

- when BM0 leads to emission reduction E0, carbon price (P) > MACC

- (2)

- when BM* leads to E*, P = MACC

- (3)

- when BM1 leads to E1, P < MACC

- P: Cement production

- c: CO2 emission reduction per ton cement

- PR: Penetration Rate

- TA: Technical Applicability

- MAC: Marginal Abatement Cost

- d: discount rate

- : capital cost

- : increased Operation and Maintenance cost

- n: lifetime of emission reduction technology

- : emissions reduction

4. Analysis and Discussion

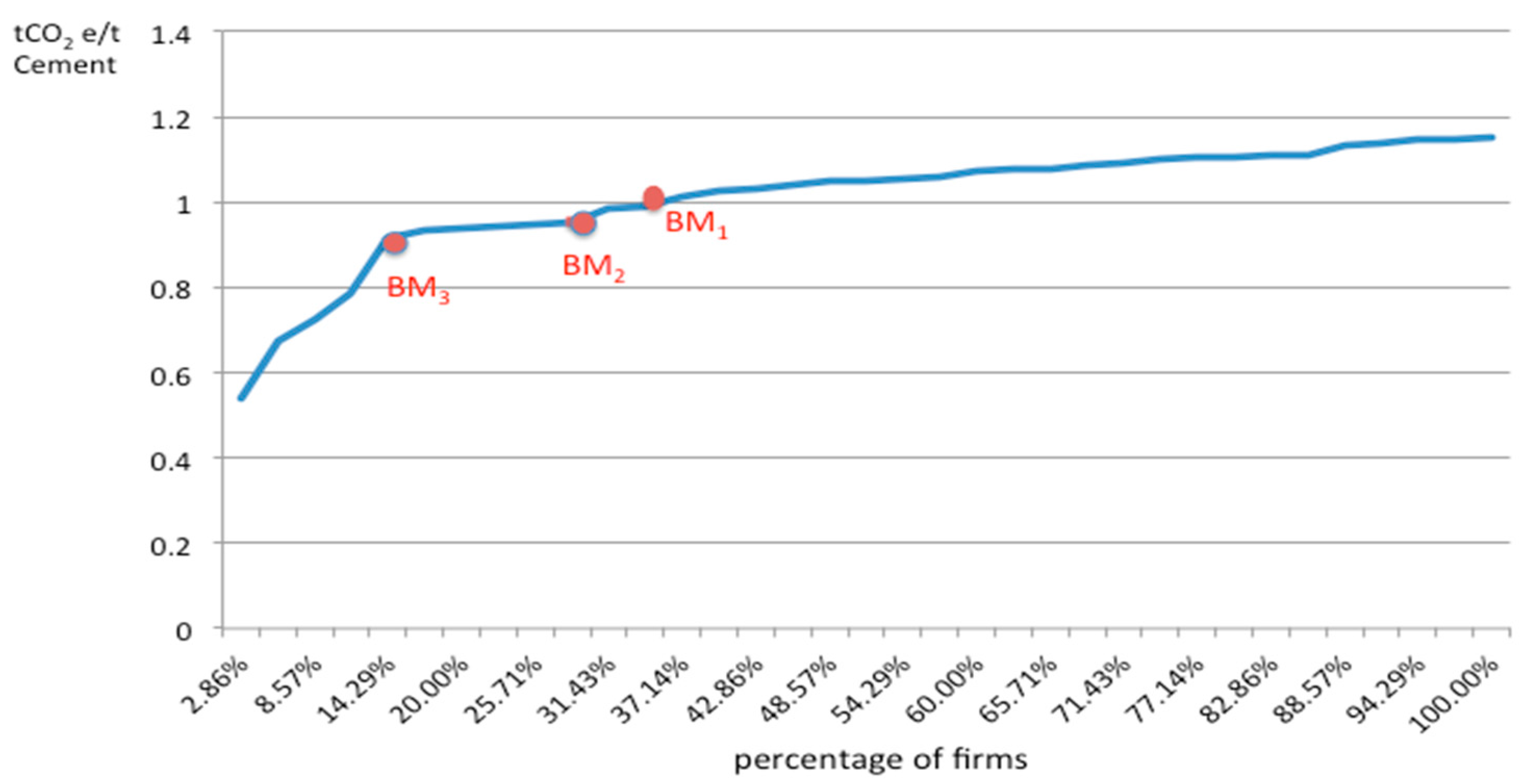

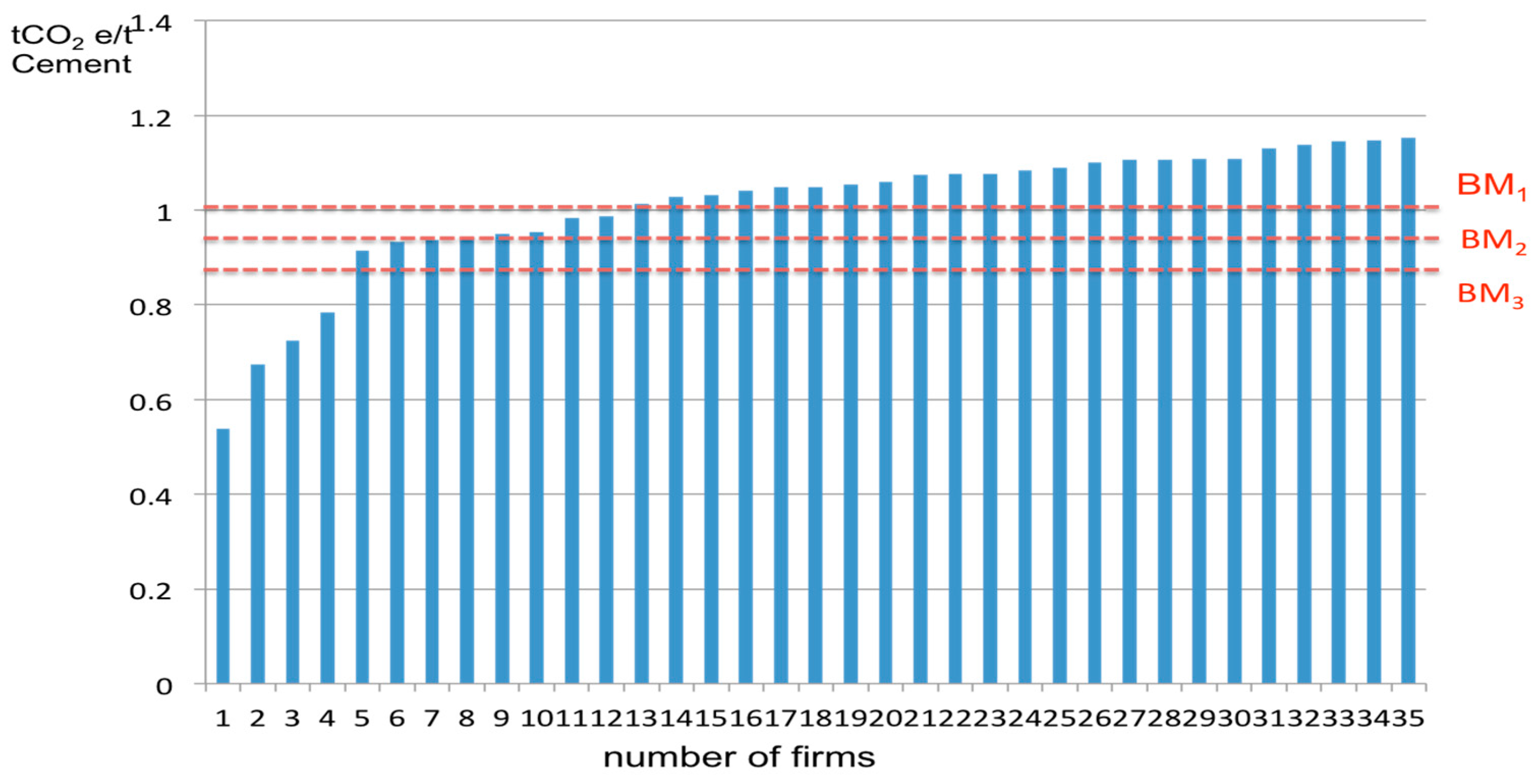

4.1. Benchmark Curve and Benchmarking Stringency

- (1)

- BM1: the Waxman-Markey Scenario (2009), which adopts the average benchmarking approach;

- (2)

- BM2: the EU ETS cement benchmark with 10% of the best performance;

- (3)

- BM3: the California Cap-and-Trade cement benchmark at the level of 90% of the average benchmarking approach.

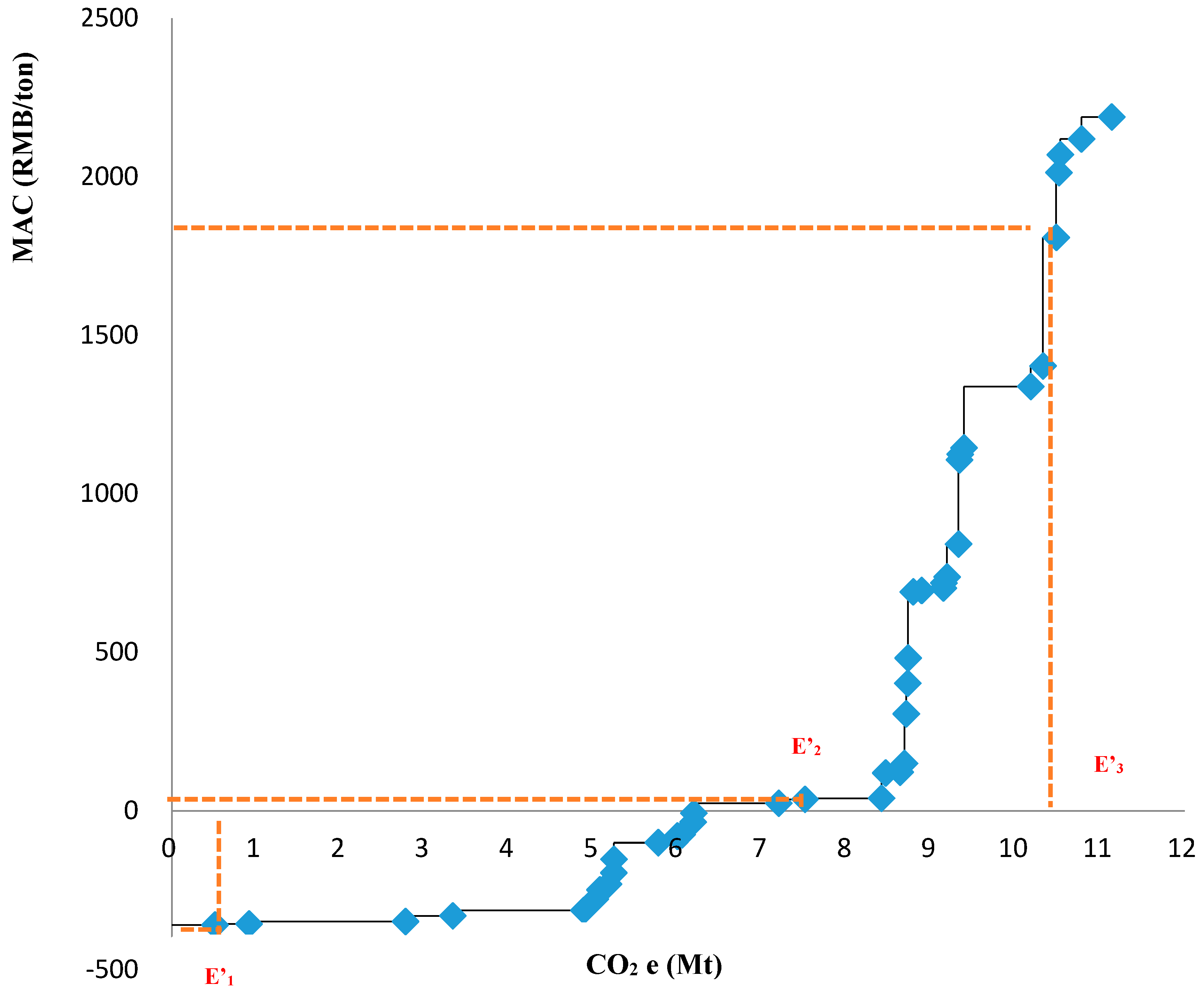

4.2. Expected CO2 Emissions Reduction

- (1)

- If the Waxman-Markey benchmark is adopted in Hubei, the expected carbon emission reduction (E’1) is about 0.51 million tons CO2e, wherein the marginal abatement cost of reducing the per ton carbon emission is below zero (about –RMB 360/t CO2e), which means that the carbon market in Hubei does not provide any incentive for cement producers to mitigate their carbon emission by adopting advanced technologies;

- (2)

- If the EU ETS cement benchmark is adopted in Hubei, the expected carbon emission reduction (E’2) is about 7.4 million tons CO2e, wherein the marginal abatement cost of reducing the per ton carbon emission is between 24 to 36 RMB/t CO2e, which is within the actual price range of ETS pilots in China. To achieve this level of carbon emission reduction, about 18 BATs will need to be applied in cement production. Under this scenario, the market is predictable and provides certain incentives to adopt advanced technologies to mitigate the emissions;

- (3)

- If the California cement benchmark is adopted in Hubei, the expected carbon emission reduction (E’3) is about 10.4 million tons CO2e, wherein the marginal abatement cost of reducing the per ton carbon emission is about 1400 RMB/t CO2e, which is much more than the current price in either China (24–55 RMB/t CO2e) or Hubei’s market (the average price is about 24 RMB/t CO2e). To achieve this level of carbon emission reduction, about 37 BATs would need to be applied in cement production. Under this scenario, most cement producers would have to choose to purchase the carbon allowances to emit because the marginal abatement cost is much higher than the price of carbon. The scarcity of carbon emission allowances would be a tremendous problem for the functioning of Hubei’s carbon market if Hubei uses California’s cement benchmarking approach. However, there is the potential to drive down the marginal abatement cost if the cost of single technologies goes down, which means the California cement benchmarking approach is a better fit for more technologically ready and advanced places rather than the current Hubei cement industry and its carbon market.

5. Conclusions and Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. The List of Energy-Efficiency BATs for the Cement Industry in Hubei

- 1

- Energy management and process control in grinding

- 2

- Dry cement kiln energy monitoring system technology optimization

- 3

- Grinding efficient energy-saving technology optimization

- 4

- Upgrade clinker cooler

- 5

- Efficient transport system for raw materials preparation

- 6

- Combustion system improvements

- 7

- Four-channel PCI combustion energy-saving technology

- 8

- Energy efficient separator technology

- 9

- Multi-channel combustion technology

- 10

- Adjustable speed drives

- 11

- Increasing number of preheater stages in rotary klins

- 12

- The new energy-saving technologies cement pre-grinding system

- 13

- Alternative fuel

- 14

- Product and speed stock change

- 15

- New efficient coal separator

- 16

- High solid-gas ratio of cement suspension preheater decomposition

- 17

- Slag powder production

- 18

- Low temperature heat recovery for power generation

- 19

- Installation of variable frequency drive

- 20

- Klin shell heat loss reduction

- 21

- Leaf Curl series centrifugal fan technology

- 22

- Flexible drive permanent magnetic vortex energy-saving technology

- 23

- Energy management and process control in clinker making

- 24

- High efficiency motors

- 25

- ERP system

- 26

- Optimize grate cooler

- 27

- Efficient grate cooler technology

- 28

- High efficiency drying for slag

- 29

- Replacing vertical shaft klins with new suspension

- 30

- Flue gas heat recovery for power generation

- 31

- High pressure roller press for ball mill pregrinding

- 32

- Raw mill blending system

- 33

- Steady popularity propelled clinker cooling technology

- 34

- Conversion to grate cooler

- 35

- Saving copper clad aluminum busbar technology

- 36

- Raw material vertical mill technology

- 37

- Low pressure drop cyclones for suspension preheater

- 38

- High efficiency classifiers

- 39

- Efficient roller and mills

- 40

- Vertical cement grinding mill technology

References

- Erickson, P.; Lazarus, M.; Hermann, H. Issues and Options for Benchmarking Industrial GHG Emissions. Available online: http://www.sei-us.org/Publications_PDF/SEI-BenchmarkingWAWhitePaper-10.pdf (accessed on 10 November 2014).

- Bushnell, J.; Peterman, C.; Wolfram, C. Local Solutions to Global Problems: Climate Change Policies and Regulatory Jurisdiction. Rev. Environ. Econ. Policy 2008, 2, 175–193. [Google Scholar] [CrossRef]

- Yu, Y.; Pan, G. Problems in China’s Cap-and-Trade program. Eastern Law J. 2009, 6, 78–86. [Google Scholar]

- Hasanbeigi, A.; Price, L.; Lin, E. Emerging energy-efficiency and CO2 emission-reduction technologies for cement and concrete production: A technical review. Renew. Sustain. Energy Rev. 2012, 16, 6220–6238. [Google Scholar] [CrossRef]

- Hong, G.; Ma, C.; Hsiao, C.; Chang, C. A case study of greenhouse gas inventory and mitigation measures in the cement industry of Taiwan. Carbon Manag. 2015, 6, 141–150. [Google Scholar] [CrossRef]

- Kajaste, R.; Hurme, M. Cement industry greenhouse gas emissions—Management options and abatement cost. J. Clean. Prod. 2016, 112, 4041–4052. [Google Scholar] [CrossRef]

- PMR, ICAP & World Bank. Emissions Trading in Practice: A Handbook on Design and Implementation. 2016. Available online: https://icapcarbonaction.com/en/component/content/article?id=379:icap-pmr-ets-handbook (accessed on 25 October 2016).

- The European Commission (EC). The EU Emission Trading System. 2017. Available online: http://ec.europa.eu/clima/policies/ets_en (accessed on 14 February 2017).

- Center for Climate and Energy Solutions (C2ES). The American Clean Energy and Security Act (Waxman-Markey Bill). 2017. Available online: https://www.c2es.org/federal/congress/111/acesa (accessed on 14 February 2017).

- EC. Proposal for a Regulation on Indices Used as Benchmarks in Financial Instruments and Financial Contracts—Frequently Asked Questions. 2013. Available online: http://europa.eu/rapid/press-release_MEMO-13–799_en.htm (accessed on 11 December 2014).

- California Air Resource Board (CARB). Cap-and-Trade: Market Oversight and Enforcement, Appendix B: Development of Product Benchmarks for Allowance Allocation. 2011. Available online: www.arb.ca.gov (accessed on 11 December 2014). [Google Scholar]

- EIA. Cement Roadmap. 2009. Available online: https://www.iea.org/publications/freepublications/publication/etp2010.pdf (accessed on 10 November 2014).

- Criqui, P.; Mima, S.; Viguier, L. Marginal abatement costs of CO2 emission reductions, geographical flexibility and concrete ceilings: An assessment using the POLES model. Energy Policy 1999, 27, 585–601. [Google Scholar] [CrossRef]

- Kong, L.; Hasanbeigi, A.; Price, L.; Liu, H. Analysis of Energy-Efficiency Opportunities for the Pulp and Paper Industry in China. Available online: https://eetd.lbl.gov/publications/analysis-energy-efficiency-opportunities-pulp-and-paper-industry-china (accessed on 16 February 2017).

- Wyns, T. Benchmarking in an Emission Trading System, Hubei, China. 2013. Available online: http://ccap.org/assets/Introduction-and-Application-of-a-Benchmarking-Approach_Tomas-Wyns_CCAP.pdf (accessed on 20 December 2014).

- ECOFYS. Methodology for the Free Allocation of Emission Allowances in the EU ETS Post 2012. Available online: https://ec.europa.eu/clima/sites/clima/files/ets/allowances/docs/bm_study-project_approach_and_general_issues_en.pdf (accessed on 20 February 2017).

- California Air Resource Board (CARB). Appendix J: Allowance Allocation. 2010. Available online: https://www.arb.ca.gov/cc/capandtrade/allowanceallocation/allowanceallocation.htm (accessed on 11 December 2014). [Google Scholar]

- Tsinghua University of China, Assisting Developing Country Climate Negotiators through Analysis and Dialogue: Report of Energy Saving and CO2 Emission Reduction Analysis in China Cement Industry. 2008. Available online: http://ccap.org/assets/Energy-Saving-and-CO2-Emission-Reduction-Analysis-in-China-Cement-Industry_CCAP-Nov-2008.pdf (accessed on 20 December 2014).

- Worrell, E.; Kermeli, K.; Galitsky, C. Energy Efficiency Improvement and Cost Saving Opportunities for Cement Making An ENERGY STAR® Guide for Energy and Plant Managers; USEPA Document, Number 430-R-13-009; United States Environmental Protection Agency: Washington, DC, USA, 2013.

- National Development and Reform Commission (NDRC). National Extension Directory of Important Energy Conservation Technology 1. 2008. Available online: http://www.sdpc.gov.cn/zcfb/zcfbgg/200806/t20080617_217974.html (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- NDRC. National Extension Directory of Important Energy Conservation Technology 2. 2009. Available online: http://www.sdpc.gov.cn/fzgggz/hjbh/jnjs/201001/W020100111473815430168.pdf (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- NDRC. National Extension Directory of Important Energy Conservation Technology 3. 2010. Available online: http://www.ndrc.gov.cn/zcfb/zcfbgg/201012/t20101208_385094.html (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- NDRC. National Extension Directory of Important Energy Conservation Technology 4. 2011. Available online: http://www.ccchina.gov.cn/WebSite/CCChina/UpFile/File1177.pdf (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- NDRC. National Extension Directory of Important Energy Conservation Technology 5. 2012. Available online: http://www.sdpc.gov.cn/zcfb/zcfbgg/201212/W020121225564226268616.pdf (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- NDRC. National Extension Directory of Important Energy Conservation Technology 6. 2013. Available online: http://www.sdpc.gov.cn/zcfb/zcfbgg/201401/W020140110618068932215.pdf (accessed on 16 February 2017). (In Chinese) [Google Scholar]

- Qi, S.; Chen, S. The 2015 Annual Review of Low Carbon Development in China. 2015. Available online: https://www.brookings.edu/events/reviewing-chinas-low-carbon-development-and-tackling-climate-change/ (accessed on 16 February 2017).

| Methodology | Value | Units | Conditions | Relevant Emissions |

|---|---|---|---|---|

| Product-based | Depends on product | t CO2/unit product | If a product benchmark is available | Emissions within the system boundaries of the product |

| Heat benchmark | 62.3 | t CO2/TJ | If no product benchmark is available If heat is measurable | Emissions relating to production of the consumed measurable heat, not covered by a product benchmark |

| Fuel benchmark | 56.1 | t CO2/TJ | If no product benchmark is available If heat is not measurable If fuel is combusted | Emission originating from the combustion of fuels, not covered by product or heat production benchmark |

| Process emission approach | 97% of historical emissions (t CO2) | t CO2/TJ | If no product benchmark is available If heat is not measurable If emissions do not result from combustion of fuel If emissions are ‘process emissions’ | All emissions with the installation not covered by the previously mentioned approaches |

| Approach | Period | Applied Unit | Benchmark Product | Stringency |

|---|---|---|---|---|

| Waxman-Markey benchmark | Defeated in 2009 | Firms | Cement | Average of performance |

| EU ETS benchmark | 3rd phase of the EU ETS (2013–2020) | Installations | Clinker (Without consideration of the level of blending with mineral additives) | Average 10% of the best performance |

| California Cement benchmark | Post-2013 | Firms | Cement | 90% of average performance |

| Year | 2009 | 2010 | 2011 |

|---|---|---|---|

| Total cement production (Mt) | 29.5 | 45.5 | 54.4 |

| Total CO2 emission (Mt) | 36. 6 | 47.0 | 54.9 |

| Energy Efficiency Technology/Measure | Fuel Saving (PJ) | Electricity Saving (Kwh/ton) | CO2 Reduction (Mt) | Current Adoption Rate |

|---|---|---|---|---|

| Fuel Preparation | ||||

| Four-channel PCI combustion energy-saving technology | 0.6 | - | 0.05 | 0.01 |

| Installation of variable frequency drive | 0.6 | - | 0.05 | 0.05 |

| New efficient coal separator | 0.09 | 0.36 | 0.01 | 0.30 |

| Raw Materials Preparation | ||||

| Efficient transport system for raw materials preparation | 18.55 | - | 1.55 | 0.15 |

| High efficiency classifiers | 0.19 | 5.08 | 0.02 | 0.90 |

| Raw mill blending system | 0.10 | 2.66 | 0.01 | 0.900 |

| Raw material vertical mill technology | 1.9 | 9 | 0.16 | 0.45 |

| Clinker Making | ||||

| Conversion to grate cooler | 9.44 | 25.93 | 0.79 | 0.03 |

| Dry cement kiln energy monitoring system technology optimization | 4.82 | - | 0.40 | 0.00 |

| Efficient grate cooler technology | 3.0 | 2 | 0.25 | 0.10 |

| Energy efficient separator technology | 1.2 | 5.0 | 0.10 | 0.35 |

| Energy management and process control in clinker making | 0.22 | 1.47 | 0.02 | 0.60 |

| ERP system | 0.7 | 2 | 0.06 | 0.05 |

| Flexible drive permanent magnetic vortex energy-saving technology | 0.25 | - | 0.02 | 0.01 |

| Flue gas heat recovery for power generation | 1.6 | - | 0.14 | 0.50 |

| High solid-gas ratio of cement suspension preheater decomposition | 12.0 | - | 1.01 | 0.20 |

| Increasing number of preheater stages in rotary klins | 6.28 | 2.5 | 0.53 | 0.05 |

| Klin shell heat loss reduction | 2.03 | 6 | 0.17 | 0.1 |

| Low pressure drop cyclones for suspension preheater | 0.39 | 2.6 | 0.03 | 0.6 |

| Low temperature heat recovery for power generation | 10.8 | 36 | 0.91 | 0.20 |

| Multi-channel combustion technology | 0.7 | - | 0.06 | 0.05 |

| Optimize grate cooler | 1.20 | 8 | 0.10 | 0.6 |

| Replacing vertical shaft klins with new suspension | 0.46 | 6.1 | 0.04 | 0.8 |

| Saving copper clad aluminum busbar technology | 1.73 | - | 0.15 | 0.10 |

| Steady popularity propelled clinker cooling technology | 0.6 | 1.5 | 0.05 | 0.02 |

| Upgrade clinker cooler | 6.69 | - | 0.56 | 0.3 |

| Finish Grinding | ||||

| Efficient roller and mills | 3.0 | 10 | 0.25 | 0.20 |

| Energy management and process control in grinding | 6.08 | −7.2 | 0.51 | 0.9 |

| Leaf Curl series centrifugal fan technology | 0.6 | - | 0.05 | 0.01 |

| The new energy-saving technologies cement pre-grinding system | 2.71 | - | 0.23 | 0.01 |

| Vertical cement grinding mill technology | 4.3 | 12 | 0.36 | 0.05 |

| Grinding efficient energy-saving technology optimization | 22.1 | 40.0 | 1.85 | 0.20 |

| High pressure roller press for ball mill pregrinding | 0.11 | 1 | 0.01 | 0.7 |

| General Measures | ||||

| Adjustable speed drives | 0.02 | 0.13 | 0.00 | 0.5 |

| Alternative fuel | 0.66 | 2.5 | 0.06 | 0.3 |

| Combustion system improvements | 1.60 | −2 | 0.13 | 0.5 |

| High efficiency motors | 0.05 | 0.16 | 0.00 | 0.20 |

| Product Change | ||||

| High efficiency drying for slag | 0.09 | 1.2 | 0.01 | 0.80 |

| Slag powder production | 3.72 | 11 | 0.31 | 0.10 |

| Product and speed stock change | 1.55 | 4.58 | 0.13 | 0.10 |

| Benchmark Stringency (t CO2e per ton product) | BM1 | BM2 | BM3 |

| 1.00 | 0.95 | 0.89 | |

| Allocation of CO2 Emission allowances (Mt CO2e) | AL1 | AL2 | AL3 |

| 54.4 | 47.5 | 44.5 | |

| Expected CO2 Emission reduction (Mt CO2e) | E’1 | E’2 | E’3 |

| 0.5 | 7.4 | 10.4 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dai, F.; Xiong, L.; Ma, D. How to Set the Allowance Benchmarking for Cement Industry in China’s Carbon Market: Marginal Analysis and the Case of the Hubei Emission Trading Pilot. Sustainability 2017, 9, 322. https://doi.org/10.3390/su9020322

Dai F, Xiong L, Ma D. How to Set the Allowance Benchmarking for Cement Industry in China’s Carbon Market: Marginal Analysis and the Case of the Hubei Emission Trading Pilot. Sustainability. 2017; 9(2):322. https://doi.org/10.3390/su9020322

Chicago/Turabian StyleDai, Fan, Ling Xiong, and Ding Ma. 2017. "How to Set the Allowance Benchmarking for Cement Industry in China’s Carbon Market: Marginal Analysis and the Case of the Hubei Emission Trading Pilot" Sustainability 9, no. 2: 322. https://doi.org/10.3390/su9020322