Oil Price and Economic Resilience. Romania’s Case

Abstract

:1. Introduction

2. Data and Results

2.1. Co-Integration Test Results

- H0: the series have/has unit root (the series are/is non-stationary)

- H1: series are/is stationary

- (1)

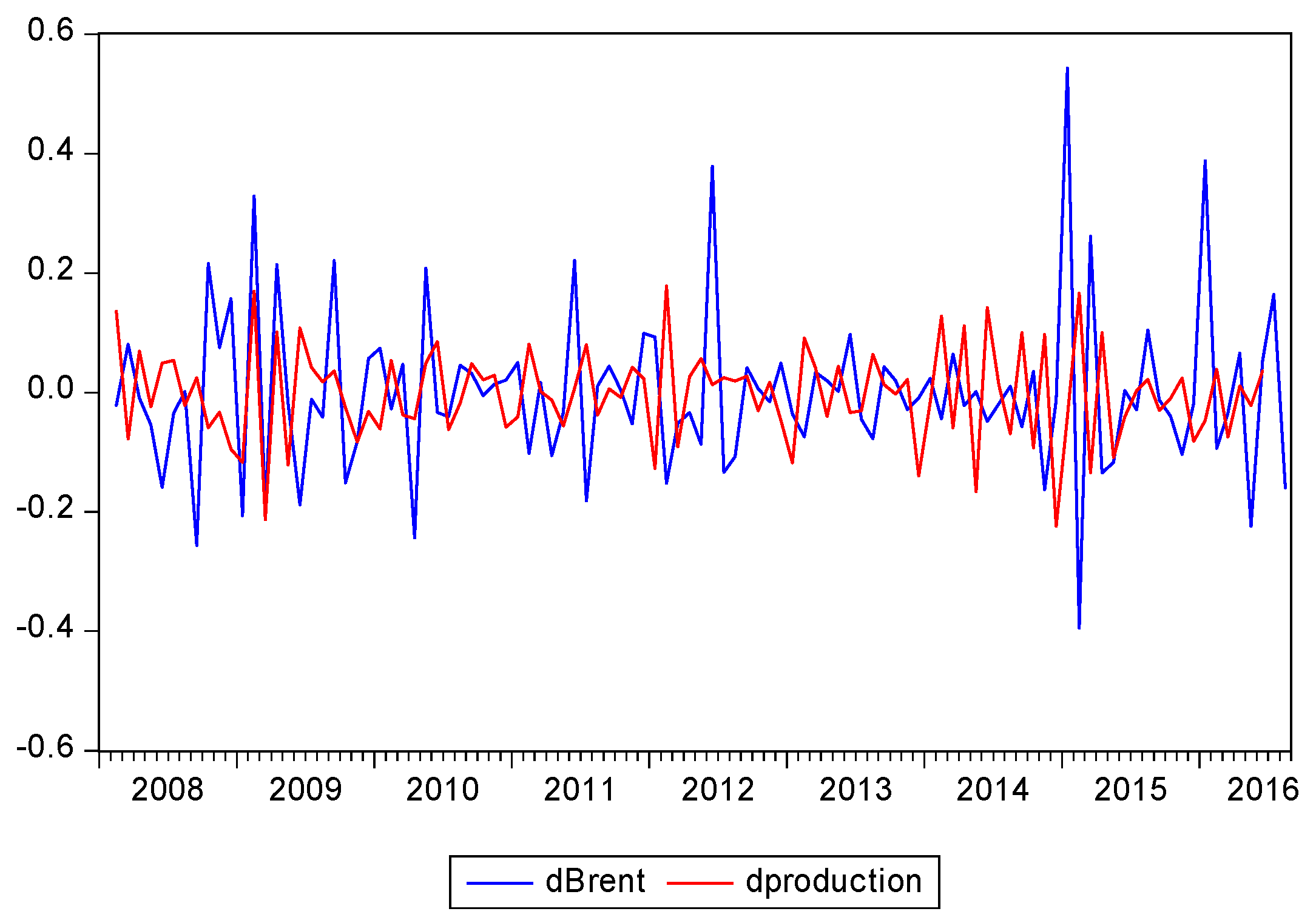

- Determining the integration order of the variables. In the first part of the paper we analysed the integration order of the two variables used (y and x1) in our analysis. Since the data series have to have the same integration order, we will use the integration order 1 (first difference) for both variables (because the Brent quotation is stationary on the first level, while the percentage change of the industrial production is stationary at its first difference).

- (2)

- Estimating the long-run (equilibrium) equation:where is the error term; is the percentage change of the industrial production integrated by order 1; is the percentage change of the oil Brent price integrated by order 1; and t is the time trend. The ordinary least squares (OLS) residuals from Equation (1) are a measure of the imbalance:We must check if the residuals of Equation (2) are stationary. The simple linear regression model (Equation (1)) was statistically valid because Prob (F-statistic) = 0.03 was less than 0.05, and the residuals were normally distributed (the Jarque-Bera probability was 65%, showing that the null hypothesis cannot be rejected). We used the ADF test to validate the stationarity of the residuals. The results of the ADF test showed that the residuals are stationary (tADF < tcalculate (1%, 5%, 10%) and the associated probability (0.0001) is smaller than 0.05), meaning that y and x1 have a long equilibrium relationship.

- (3)

- As the variables y and x1 are co-integrated, we estimated the ECM (error correction model) as shown below:where is the intercept, is the short-run coefficient, v is the white noise error term, and is an error correction term that guides the variables (y and x1) of the system to restore the balance. In our case, the coefficient was negative (−1.48) and statistically significant (the probability of this coefficient was less than 1%). In this case, between y and x1 there is a long-term, balanced relationship. We can state that the industrial production adjusts in a current month as a consequence of a past monthly imbalance. We used the Jarque-Bera test to test for the normal distribution of the ECM residuals. It showed that the residuals were normally distributed (the Jarque-Bera test probability was 25%).

2.2. VECM (Vector Error Correction) Analysis

2.3. Asymmetry Tests

- -

- the Lagrange Multiplier (LM) test for serial correlation. It showed there is no serial correlation in the residual (because of this we used a one-period lag of the dependent variable);

- -

- the Jarque-Bera test for the normality of the residuals (the probability was 35%, showing that the null hypothesis cannot be rejected);

- -

- the White test for heteroskedasticity;

- -

- the augmented Dickey-Fuller (ADF) test for stationarity of the variables. The y, x2, and x3 variables are integrated by order one. All tests showed that the results of the regression equation are valid.

3. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Gisser, M.; Goodwin, T.H. Crude oil and the macroeconomy: Tests of some popular notions: Note. J. Money Credit Bank. 1986, 18, 95–103. [Google Scholar] [CrossRef]

- Dotsey, M.; Reid, M. Oil shocks, monetary policy, and economic activity. FRB Richmond Econ. Rev. 1992, 78, 14–27. [Google Scholar]

- Brown, S.P.; Yücel, M.K. Energy prices and aggregate economic activity: An interpretative survey. Q. Rev. Econ. Financ. 2002, 42, 193–208. [Google Scholar] [CrossRef]

- Aguiar-Conraria, L.; Wen, Y. Understanding the large negative impact of oil shocks. J. Money Credit Bank. 2007, 39, 925–944. [Google Scholar] [CrossRef] [Green Version]

- Burbidge, J.; Harrison, A. Testing for the effects of oil-price rises using vector autoregressions. Int. Econ. Rev. 1984, 25, 459–484. [Google Scholar] [CrossRef]

- Hamilton, J.D. What is an oil shock? J. Econ. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Zhang, D. Oil shock and economic growth in Japan: A nonlinear approach. Energy Econ. 2008, 30, 2374–2390. [Google Scholar] [CrossRef]

- Romero-Meza, R.; Coronado, S.; Serletis, A. Oil and the economy: A cross bicorrelation perspective. J. Econ. Asymmetr. 2014, 11, 91–95. [Google Scholar] [CrossRef]

- International Monetary Fund. World Economic Outlook. Tensions from the Two-Speed Recovery Unemployment, Commodities, and Capital Flows; International Monetary Fund: Washington, DC, USA, 2011; pp. 89–123. [Google Scholar]

- Engemann, K.M.; Owyang, M.T.; Wall, H.J. Where is an oil shock? J. Reg. Sci. 2014, 54, 169–185. [Google Scholar] [CrossRef]

- Serletis, A.; Istiak, K. Is the oil price–output relation asymmetric? J. Econ. Asymmetr. 2013, 10, 10–20. [Google Scholar] [CrossRef]

- Cuñado, J.; de Gracia, F.P. Do oil price shocks matter? Evidence for some European countries. Energy Econ. 2003, 25, 137–154. [Google Scholar] [CrossRef]

- Ferderer, J.P. Oil price volatility and the macroeconomy. J. Macroecon. 1997, 18, 1–26. [Google Scholar] [CrossRef]

- Elder, J.; Serletis, A. Oil price uncertainty. J. Money Credit Bank. 2010, 42, 1137–1159. [Google Scholar] [CrossRef]

- Hooker, M.A. What happened to the oil price-macroeconomy relationship? J. Monet. Econ. 1996, 38, 195–213. [Google Scholar] [CrossRef]

- Kilian, L. A comparison of the effects of exogenous oil supply shocks on output and inflation in the G7 countries. J. Eur. Econ. Assoc. 2008, 6, 78–121. [Google Scholar] [CrossRef]

- Husain, M.A.M.; Arezki, M.R.; Breuer, M.P.; Haksar, M.V.; Helbling, M.T.; Medas, P.A.; Sommer, M. Global Implications of Lower Oil Prices; No. 15; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Bumpass, D.; Ginn, V.; Tuttle, M.H. Retail and wholesale gasoline price adjustments in response to oil price changes. Energy Econ. 2015, 52, 49–54. [Google Scholar] [CrossRef]

- Ec.europa.eu. Available online: https://ec.europa.eu/energy/en/data-analysis/weekly-oil-bulletin (accessed on 29 August 2016).

- National Institute of Statistics. Available online: http://statistici.insse.ro/shop/?lang=en (accessed on 10 June 2016).

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation, and testing. Econom. J. Econ. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Asteriou, D.; Hall, S.G. Applied Econometrics; Palgrave Macmillan: New York, NY, USA, 2015. [Google Scholar]

- Juselius, K. The Cointegrated VAR Model: Methodology and Applications; Oxford University Press: New York, NY, USA, 2006. [Google Scholar]

- Chen, H.; Chong, T.T.L.; Bai, J. Theory and applications of TAR model with two threshold variables. Econ. Rev. 2012, 31, 142–170. [Google Scholar] [CrossRef]

- Silvey, S.D. The Lagrangian multiplier test. Ann. Math. Stat. 1959, 30, 389–407. [Google Scholar] [CrossRef]

| Test Augment Dikey-Fuller | Probability | Test Phillips-Peron | Probability | |

|---|---|---|---|---|

| LEVEL | ||||

| y | −1.6 | 0.47 | −2.86 | 0.05 |

| x1 | −8.48 | 0.000 | −8.51 | 0.0000 |

| FIRST DIFFERENCE | ||||

| y | −17.46 | 0.000 | −19.63 | 0.000 |

| x1 | - | - | - | - |

| Test critical values: 1% (−3.49); 5% (−2.89); 10% (−2.58) | ||||

| Eigen Value | Trace Statistic | 0.05 Critical Value | Max—Eigen Statistic | Probability | |

| None | 1.0000 | 3544.56 | 15.49 | 1.0000 | 1.0000 |

| At most 1 | 0.169 | 17.83 | 3.84 | 0.1695 | 0.000 |

| Eigen Value | Trace Statistic | 0.05 Critical Value | Max—Eigen Statistic | Probability | |

| None | 1.0000 | 3526.73 | 14.26 | 1.0000 | 1.0000 |

| At most 1 | 0.169 | 17.83 | 3.84 | 0.1695 | 0.0000 |

| Variable | Coefficient | T-Statistic | Probability | Std. Error |

|---|---|---|---|---|

| Increase (X2) | −0.14 | −2.38 | 0.016 | 0.09 |

| Decrease (X3) (lag 6) | 0.23 | 2.33 | 0.0217 | 0.11 |

| Test Statistic | Value | Probability |

|---|---|---|

| t-statistic | −0.46 | 0.64 |

| F-Statistic | 0.213 | 0.64 |

| Chi-square | 0.213 | 0.64 |

| Null Hypothesis: c(1) = c(2) | ||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dudian, M.; Mosora, M.; Mosora, C.; Birova, S. Oil Price and Economic Resilience. Romania’s Case. Sustainability 2017, 9, 273. https://doi.org/10.3390/su9020273

Dudian M, Mosora M, Mosora C, Birova S. Oil Price and Economic Resilience. Romania’s Case. Sustainability. 2017; 9(2):273. https://doi.org/10.3390/su9020273

Chicago/Turabian StyleDudian, Monica, Mihaela Mosora, Cosmin Mosora, and Stefanija Birova. 2017. "Oil Price and Economic Resilience. Romania’s Case" Sustainability 9, no. 2: 273. https://doi.org/10.3390/su9020273