Quantitative Analyses of Transition Pension Liabilities and Solvency Sustainability in China

Abstract

:1. Introduction

2. The Public Pension System in China

3. Actuarial Assumptions and Data Source

3.1. Actuarial Assumptions

- (1)

- Age assumptions: Age assumptions include entry age, normal retirement age, and survival limit age. Similar to previous studies, we suppose the entry age for insurance is 20 over the long term. Under the current legal provisions of China, male workers retire at 60, women retire at 50, and female cadres retire at 55 [8,15]. However, with the implementation of policies for gradually postponing the retirement age of employees, the retirement age will increase. Thus, in the benchmark scenario, the retirement age is set at 60 for men and 55 for women. Furthermore, since the 2010 to 2013 life table [16] is used in this article, for consistency, we chose the 105 as the survival limit age.

- (2)

- Sex ratio at birth: According to the National Population Development Plan (2016–2030), the future objective of gender ratio is set at 112 in year 2020 and 107 in year 2030 [17], while the generally accepted theoretical value is 102 to 107 [18]. Thus, with the reduction of gender preference, the gender ratio of Chinese urban infants is projected to be 107 boys to 100 girls in the evaluation period.

- (3)

- Contribution rate: According to the State Council No. 38 document, the contribution rate of the social pooling fund is set at 20 percent of the taxable payroll during the evaluation period [14].

- (4)

- Coverage rate: In terms of the development of human resources and social security in the 13th Five-Year plan, the coverage rate of the plan will reach 90 percent. Therefore, the coverage rate of urban employees’ pension plan is set to increase every year to reach 90 percent during the evaluation period.

- (5)

- Urbanization rate: According to the data released by the National Bureau of Statistics, the urbanization rate of the population has increased from 17.92 percent in 1978 to 56.10 percent in 2015. The urban development report of China indicates that the urbanization rate of China will increase to more than 75 percent by 2050. Hence, the urbanization rate is set to increase year by year to reach 75 percent.

- (6)

- Urban employment rate: According to the Statistical Yearbook of China, the ratio of urban employment in the past year has remained at approximately 85 percent. Thus, this paper assumes that the future urban employment rate will remain at this level during the prediction interval.

- (7)

- The social pooling replacement rate: According to the State Council No. 38 document, the total replacement rate of an urban employee’s contributed payroll tax for more than 35 years is set at 59.2 percent of the social average wage, and the social pooling replacement rate is set at 35 percent of the social average wage [14].

- (8)

- Return rate: Referring to past study [8] and recent changes, we assume that the interest rate under the benchmark scenario is 0.03.

- (9)

- Growth rate of the social average wage: To predict the future pension debt, the future growth rate of social average wage is needed. However, based on the forecast of historical time series, the predicted value is inaccurate. Therefore, we refer to the research [19] to set 8 percent as the average wage growth benchmark.

- (10)

- Growth rate of pension benefit: According to the latest statistics announcement from the Ministry of Human Resources and Social Affairs (MHRSA), the pension growth rate was approximately 6.5 percent in 2016 and 5.5 percent in 2017. Therefore, in the predictable future, we assume the pension growth rate will remain at approximately 6 percent.

- (11)

- Actuarial parameters in the old pension system: The actuarial parameters in the old system include replacement rate () of the old retiree, the adjustment proportion (d) and the calculation coefficient (R) of the transition pension for the middle retiree. Based on reference to previous research [19], we suppose equals 75 percent, d equals 0.6, and R equals 1.3 percent.

3.2. Data Source

- (1)

- Life table: this research uses the China Life Insurance Mortality Table (2010–2013) [16] to obtain the survival rate of the insured population. Compared to the second set of life tables issued in 2005, life expectancy of the third set of tables for men and women, respectively, is 79.5 and 84.6; an increase of 2.8 and 3.7.

- (2)

- Initial population: the transition equations of population projections use age-sex specific population data of 2013 as the initial population vector. The data are obtained from China’s population and employment statistics yearbook [20].

- (3)

- The initial accumulated net assets of pension funds are obtained from a statistical bulletin on human resources and social security development [21]. The accumulated social pooling pension fund equals the total fund less the assets of individual accounts that have been partially repaid.

4. Projection of Population

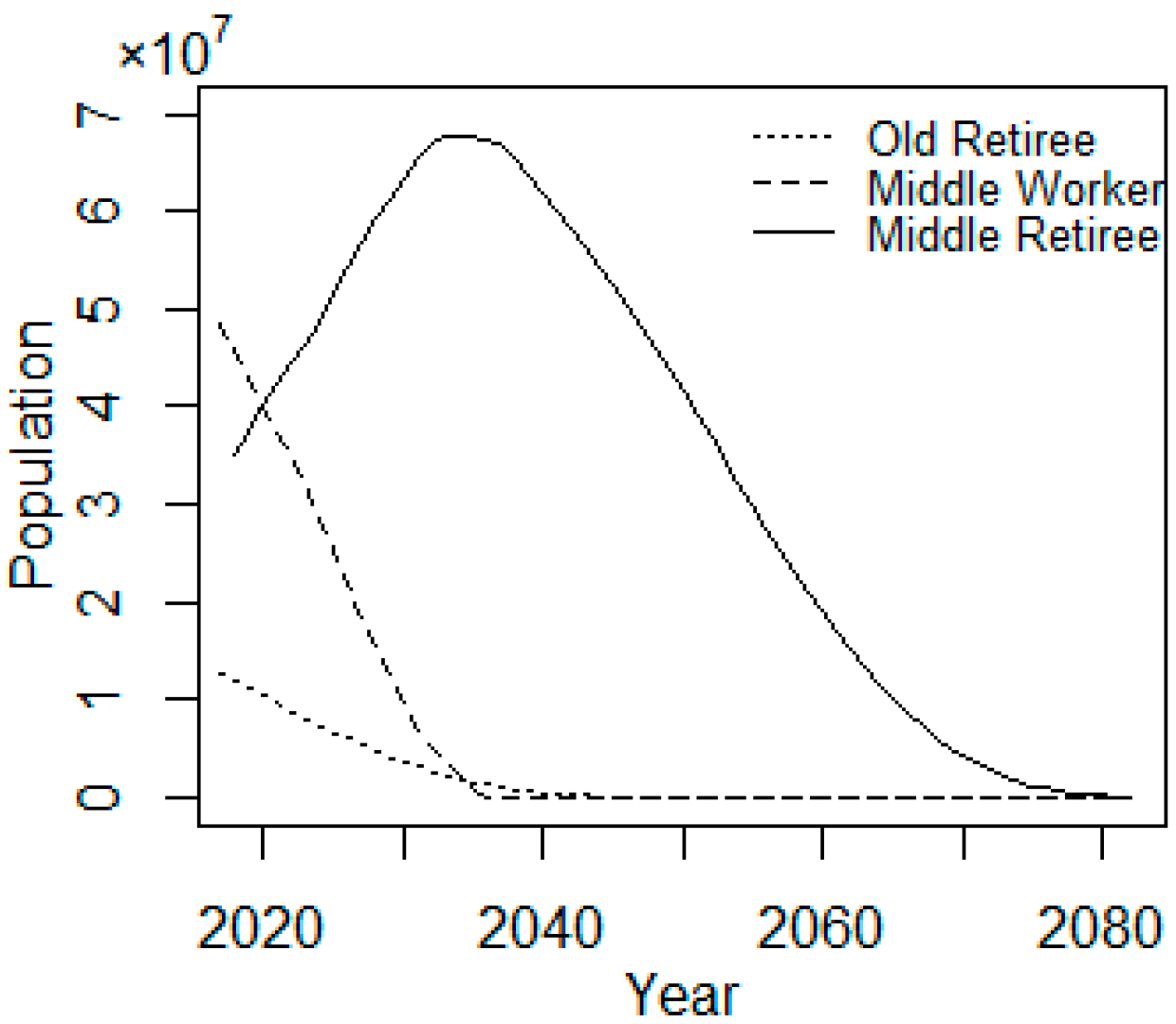

4.1. Projection of the Insured Population in the Old Pension System

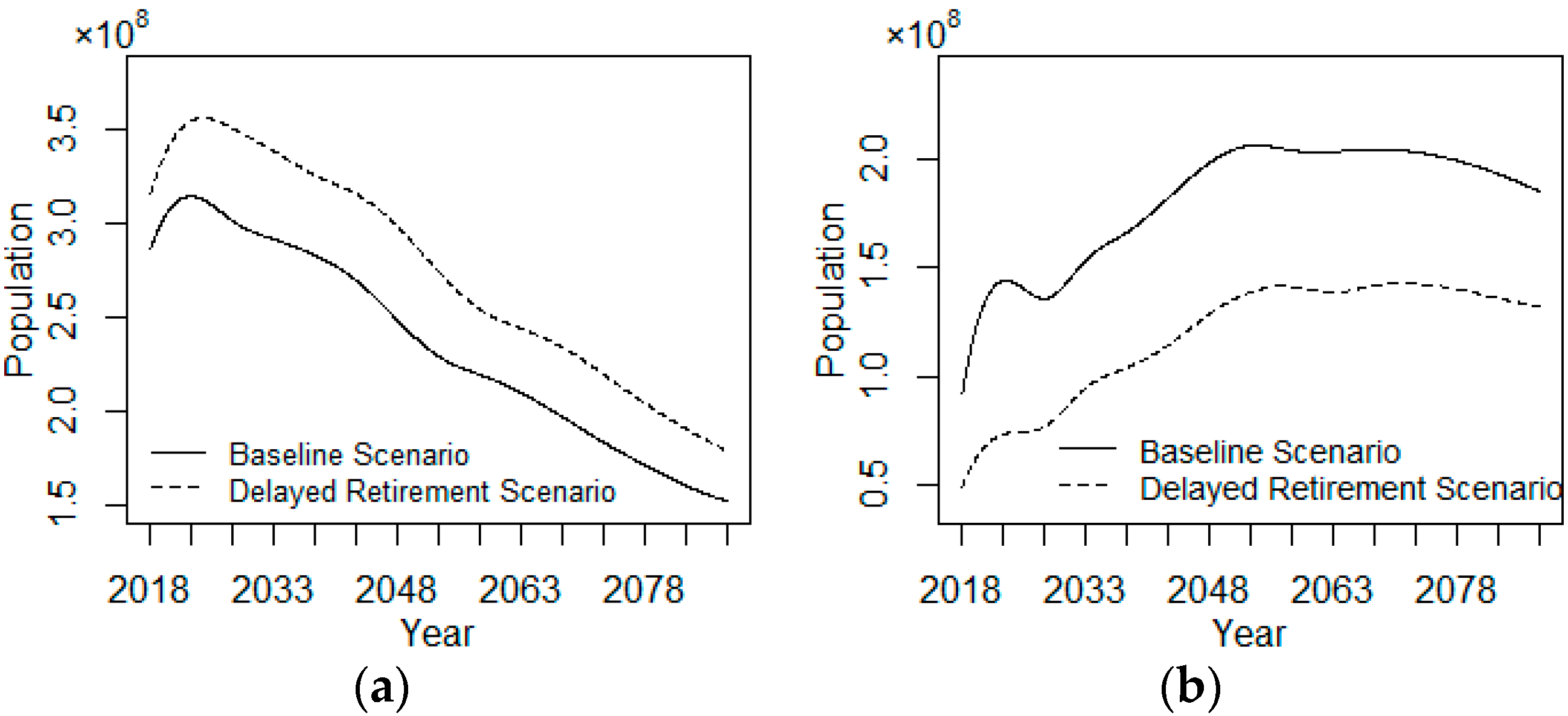

4.2. Projection of Total Insured Population in the New Pension System

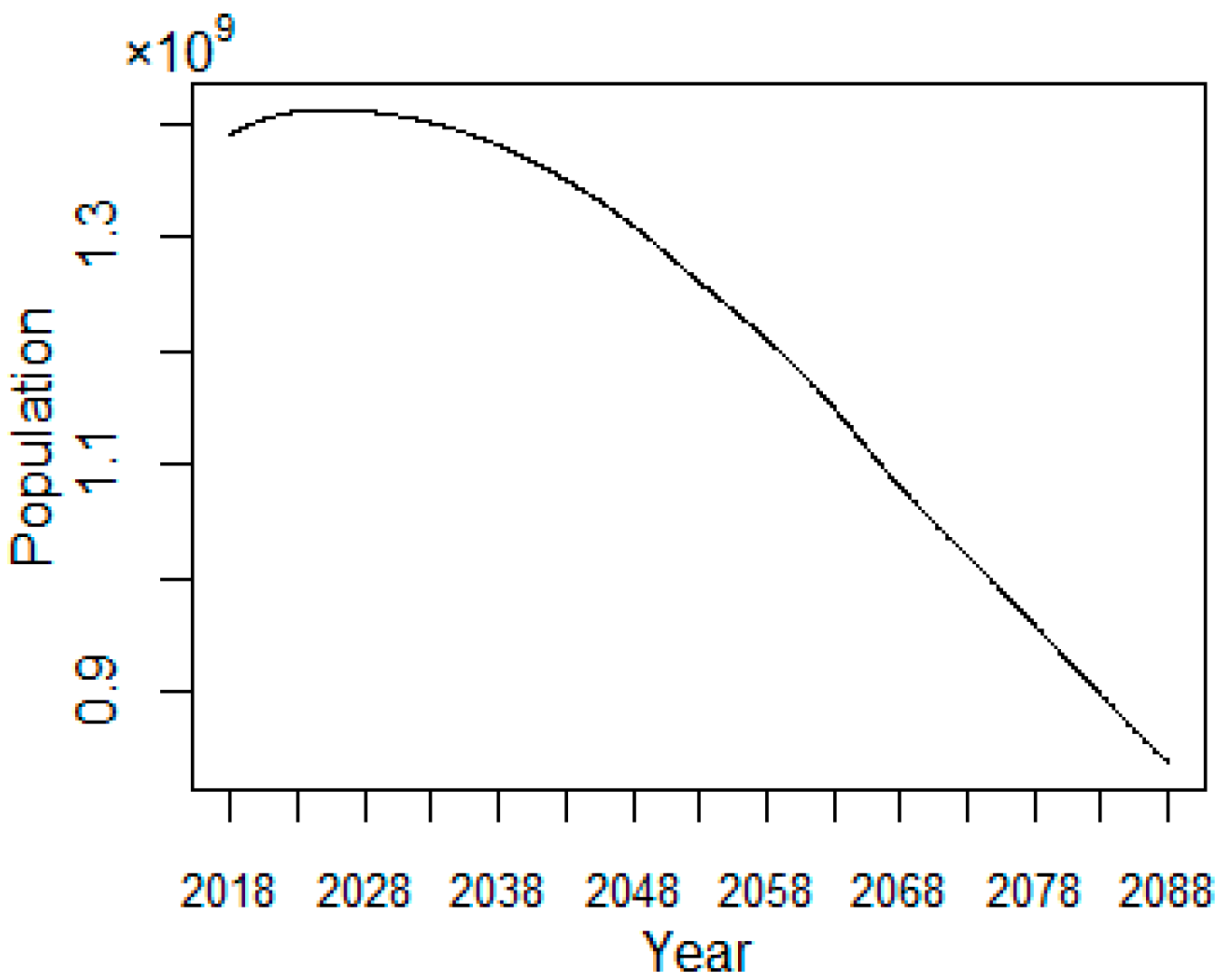

4.2.1. Projection of Age-Sex-Specific Population

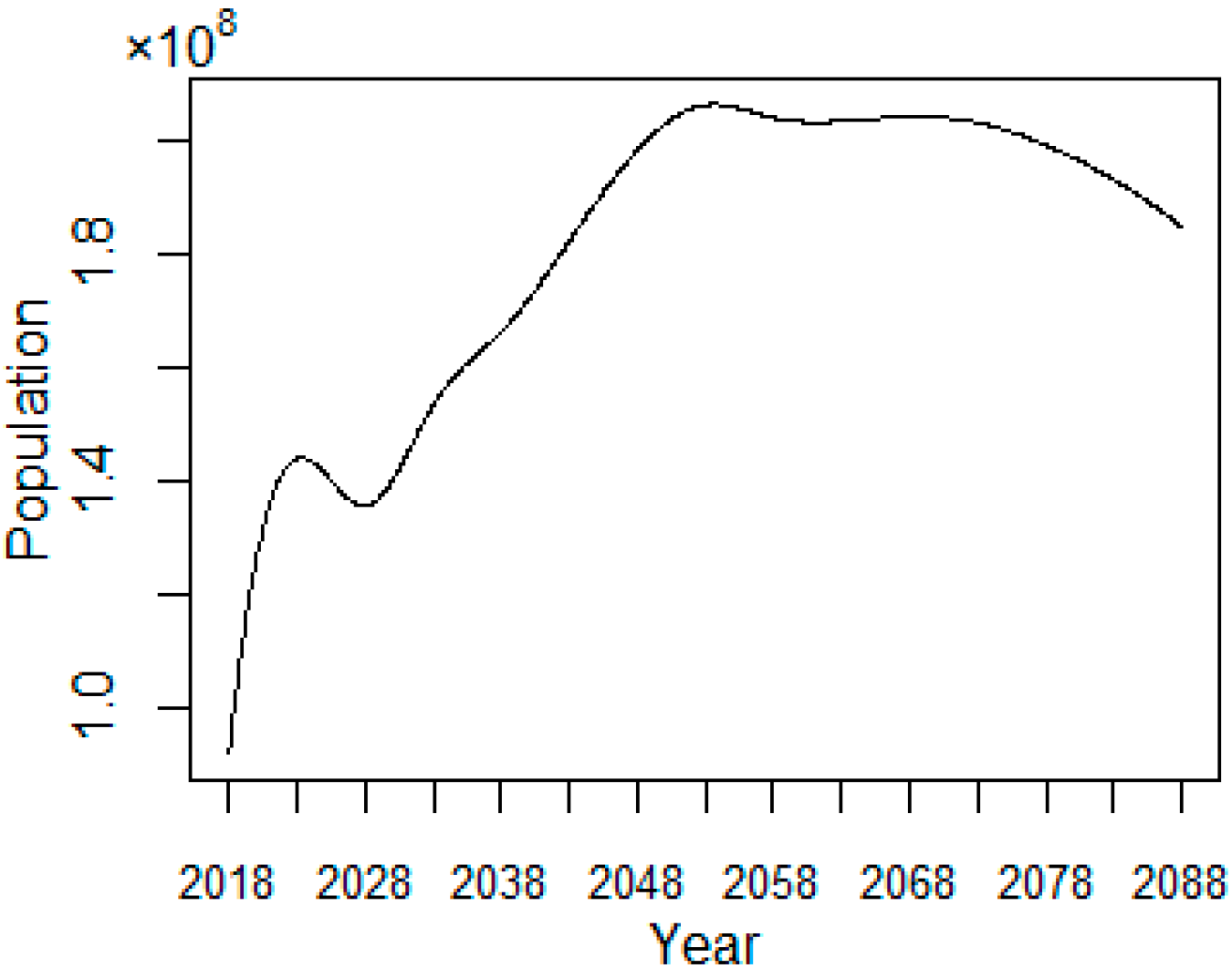

4.2.2. Projection of Insured Employees in the New Pension System

4.2.3. Projection of Insured Beneficiaries in the New Pension System

5. Modeling Transition Pension Liabilities and Pension Fund Solvency

5.1. Modeling Transition Pension Liabilities

5.1.1. Modeling Transition Pension Liability of Old Retiree Group

5.1.2. Modeling Transition Pension Liability of Middle Retiree Group

5.2. Modeling Social Pooling Pension Fund Solvency

6. Scenario Analysis

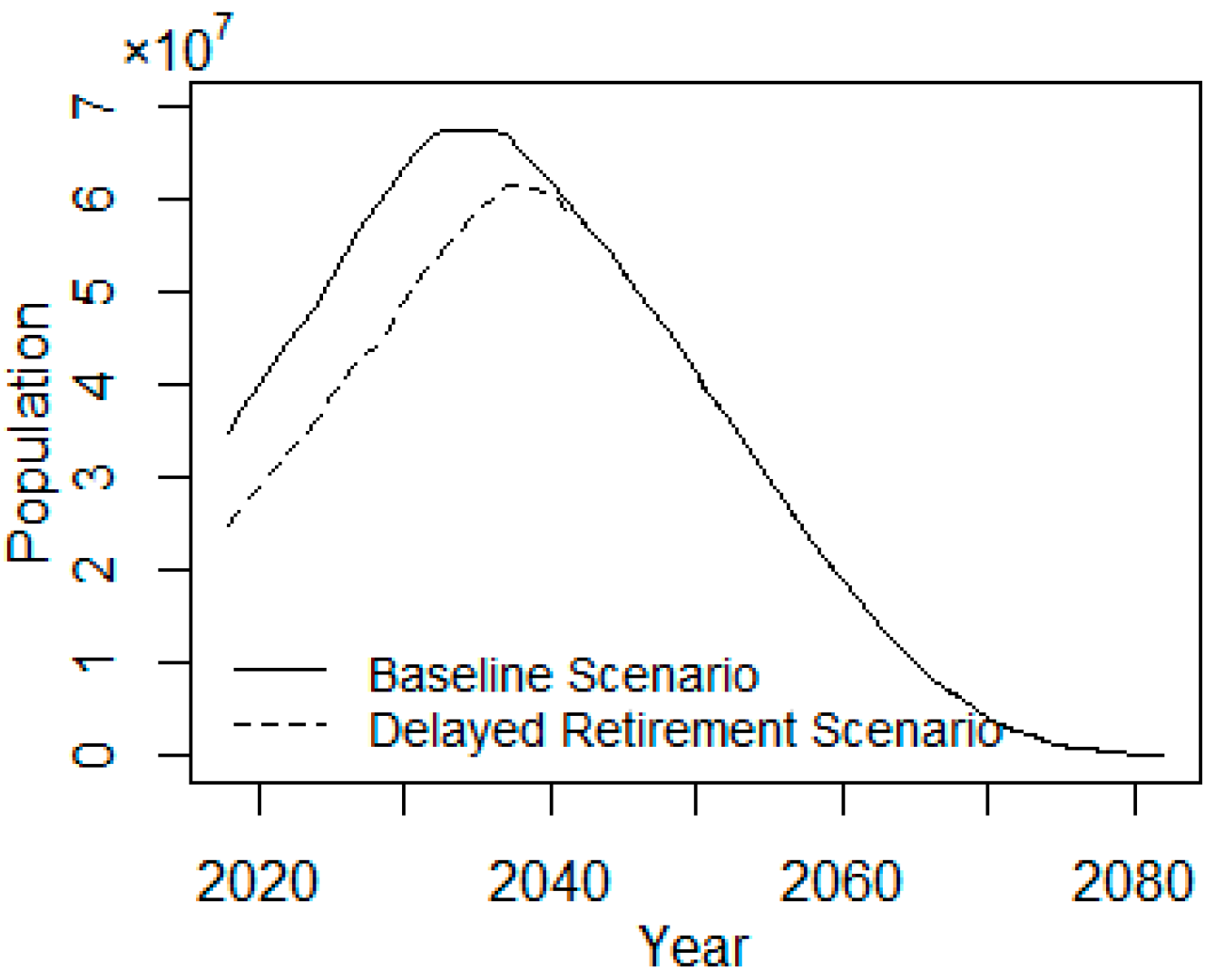

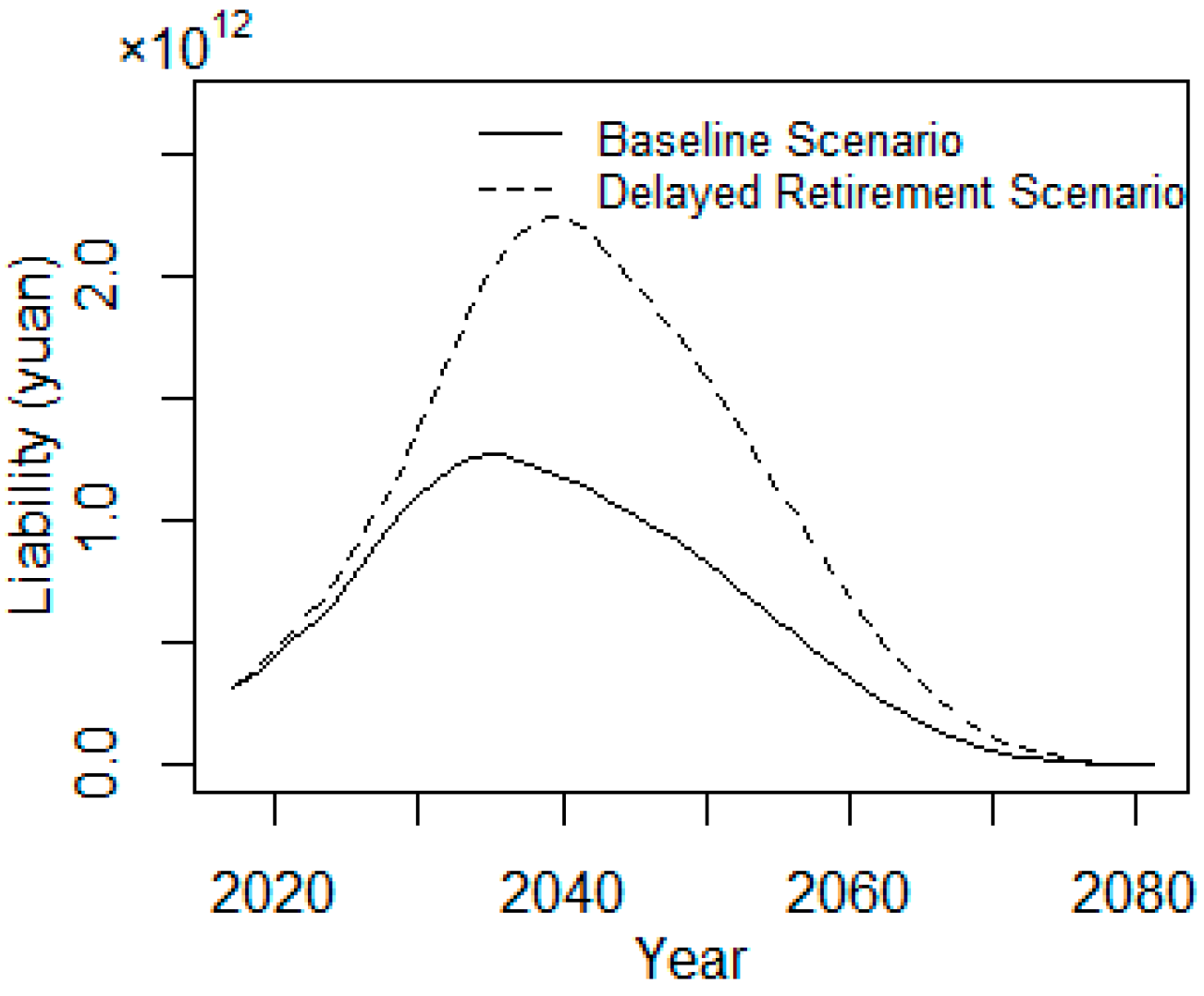

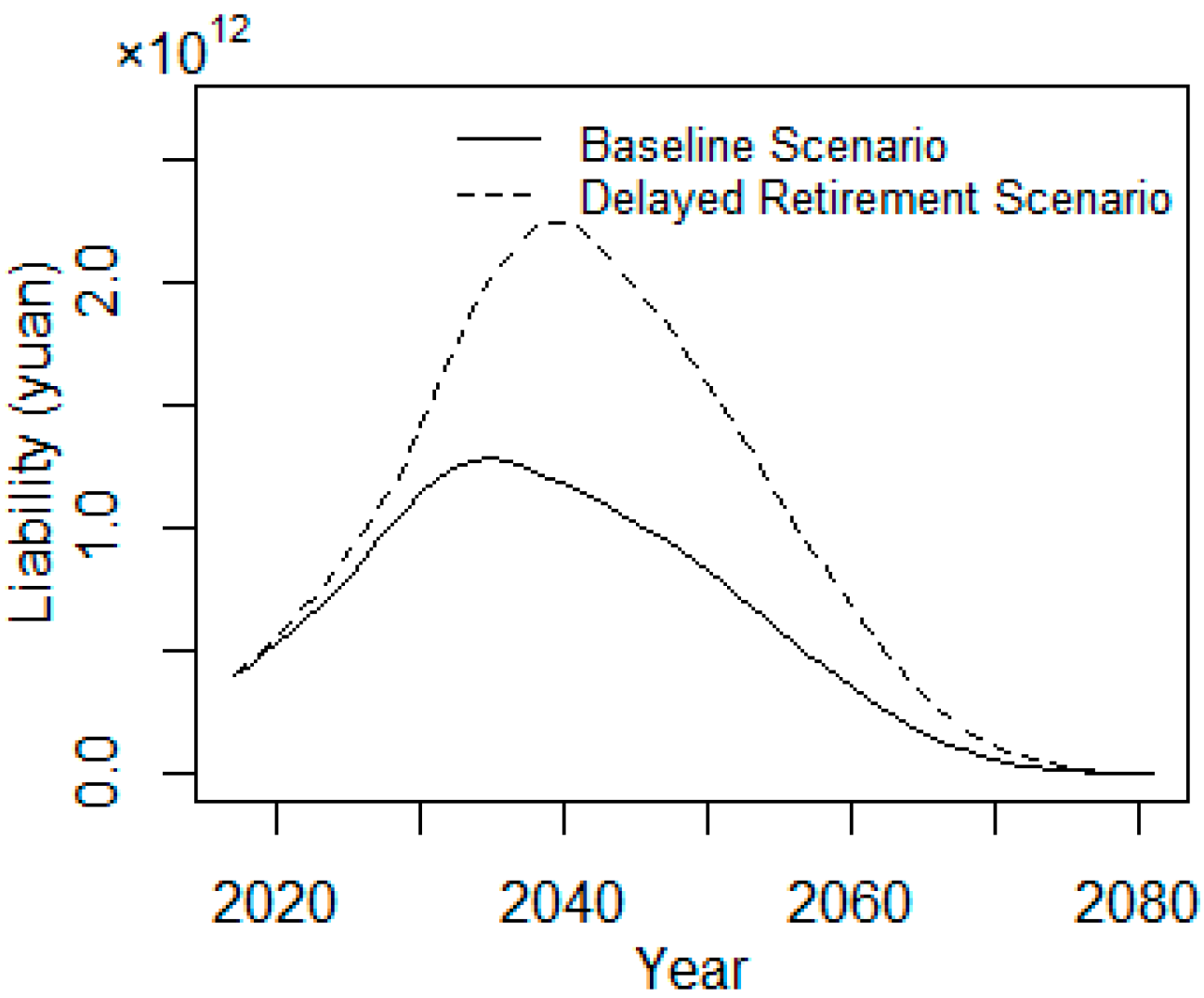

6.1. Scenario Analysis of Transition Pension Liability

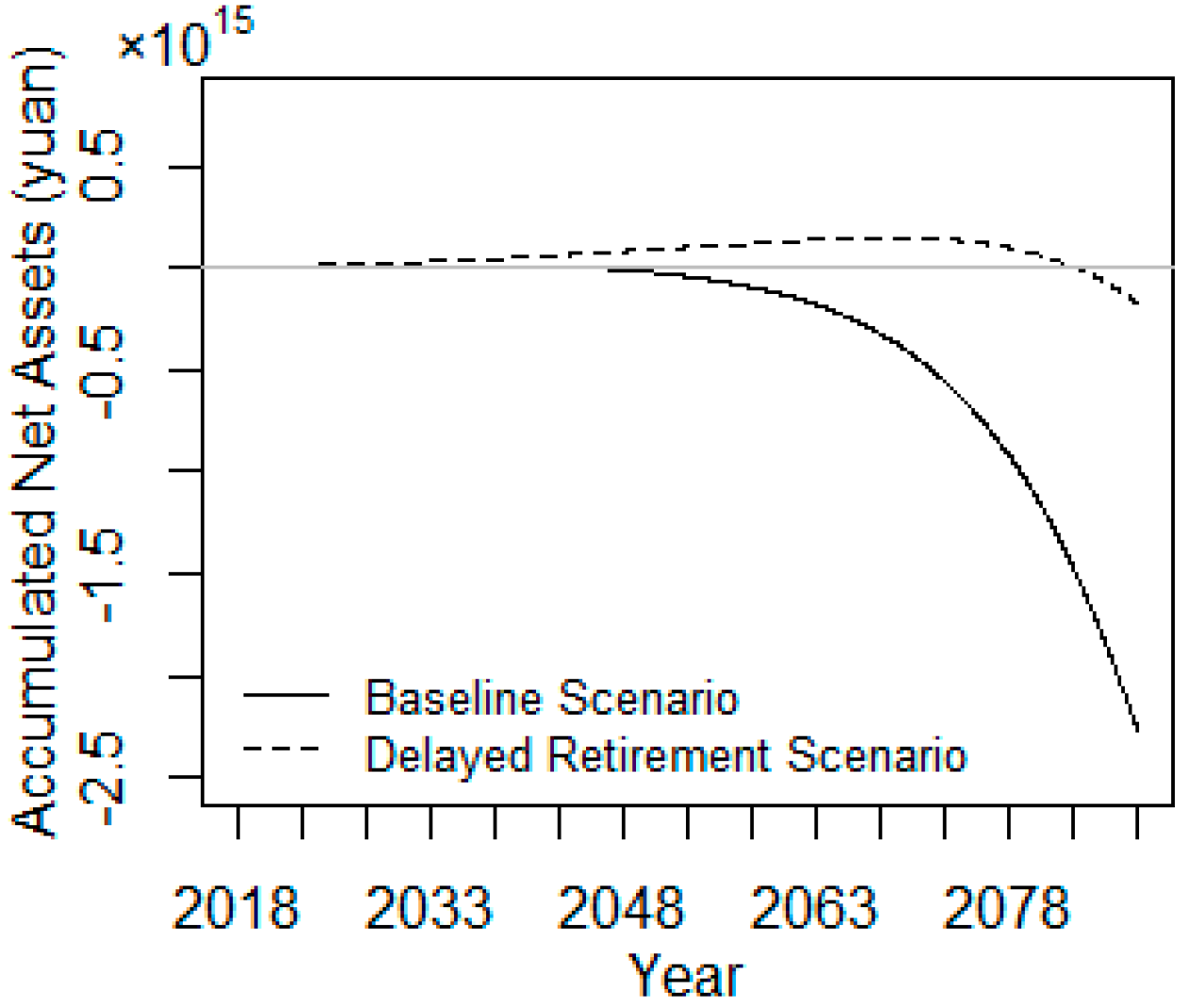

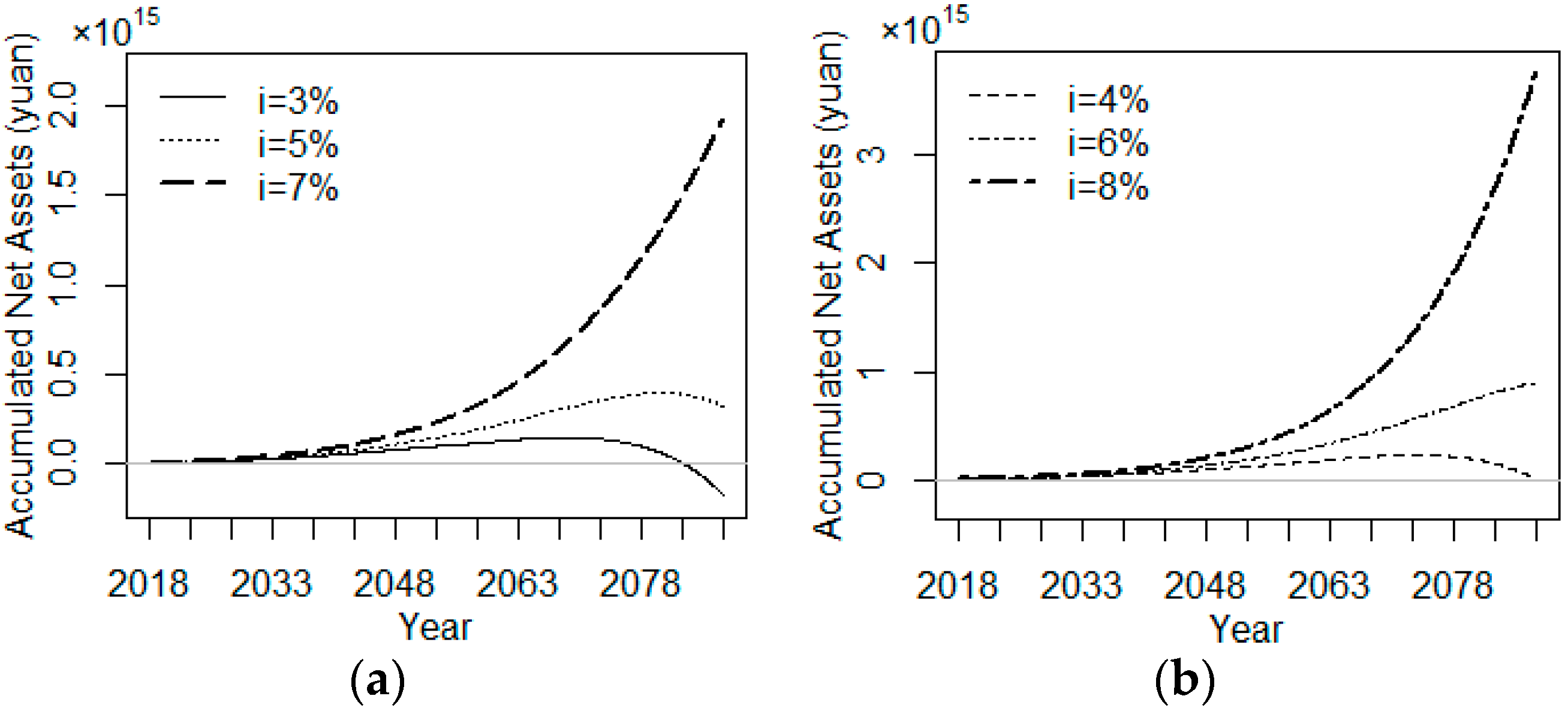

6.2. Scenario Analysis of Solvency Sustainability

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Feldstein, M. Social security pension reform in China. China Econ. Rev. 1999, 10, 99–107. [Google Scholar] [CrossRef]

- Yin, J.Z.; Lin, S.; Gates, D.F. Social Security Reform: Options for China; World Scientific Publishing Co. Pte. Ltd.: Singapore, 1999; pp. 223–259. ISBN 978-981-02-4104-9. [Google Scholar]

- Dorfman, M.C.; Holzmann, R.; O’Keefe, P.; Wang, D.; Sin, Y.; Hinz, R. China’s Pension System: A Vision; World Bank: Washington, DC, USA, 2013; pp. 15–75. [Google Scholar] [CrossRef]

- Franco, D. Pension Liabilities—Their Use and Misuse in the Assessment of Fiscal Policies; Working Paper; Directorate General for Economic and Financial Affairs, European Commission: Brussels, Belgium, 1995. [Google Scholar]

- Holzmann, R. Financing the Transition to Multipillar; Working Paper; World Bank: Washington, DC, USA, 1998. [Google Scholar]

- Yang, L.; Xiao, Z. China’s National Balance Sheet 2013: Theory, Methodology and Risk Assessment; China Social Sciences Publishing House: Beijing, China, 2013; pp. 214–215. ISBN 978-7516138199. [Google Scholar]

- Liu, X.; Zhang, Y.; Fang, L.; Li, Y.; Pan, W. Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting. Sustainability 2015, 7, 10876–10894. [Google Scholar] [CrossRef]

- Tian, Y.; Zhao, X. Stochastic Forecast of the Financial Sustainability of Basic Pension in China. Sustainability 2016, 8, 46. [Google Scholar] [CrossRef]

- Wang, L. Actuarial model and its application for implicit pension debt in China. Chaos Solitons Fractals 2016, 89, 224–227. [Google Scholar] [CrossRef]

- Casamatta, G.; Gondim, J.L.B. Reforming the Pay-As-You-Go Pension System: Who Votes for it? When? FinanzArchiv Public Financ. Anal. 2011, 67, 225–260. [Google Scholar] [CrossRef]

- Tabata, K. Population Aging and Growth: The Effect of Pay-as-You-Go Pension Reform. FinanzArchiv Public Financ. Anal. 2015, 71, 385–406. [Google Scholar] [CrossRef]

- Fanti, L.; Gori, L. Fertility and PAYG Pensions in the Overlapping Generations Model. J. Popul. Econ. 2012, 25, 955–961. [Google Scholar] [CrossRef] [Green Version]

- Artige, L.; Cavenaile, L.; Pestieau, P.; SSRN. The Macroeconomics of PAYG Pension Schemes in an Aging Society. 2014. Available online: http://dx.doi.org/10.2139/ssrn.2438689 (accessed on 10 October 2017).

- The State Council of China. Available online: http://www.gov.cn/zhuanti/2015-06/13/content_2878967.htm (accessed on 19 September 2017).

- Yang, D.U.; Wang, M. Demographic Ageing and Employment in China; ILO Employment Working Paper No. 57; Employment Sector, International Labor Office: Geneva, Switzerland, 2010. [Google Scholar]

- China Insurance Regulatory Commission. Available online: http://www.circ.gov.cn/web/site0/tab5213/info4054990.Htm (accessed on 12 October 2017).

- The State Council of China. Available online: http://www.gov.cn/zhengce/content/2017-01/25/content_5163309.htm (accessed on 19 October 2017).

- Jiang, Y.Y. Construction of Intergenerational Accounting System and Social Insurance System Reform in China; Peking University Press: Beijing, China, 2015; p. 22. ISBN 978-7301254592. [Google Scholar]

- Zhang, Y.B.; Liu, Z.-X.; Bai, M.-Y.; Luo, Q.-Y. China’s Basic Implicit Pension Debt Trends Analysis—Based on the Improved Actuarial Calculation Model Empirical Study. Chin. J. Manag. Sci. 2013, 21, 40–49. [Google Scholar]

- National Bureau of Statistics of the People’s Republic of China. Available online: http://www.stats.gov.cn/tjsj/ndsj/2014/indexch.htm (accessed on 12 September 2017).

- Ministry of Human Resources and Social Security of the People’s Republic of China. Available online: http://www.mohrss.gov.cn/.2014 (accessed on 15 October 2017).

- Tao, M.; Qi, Y. An actuarial analysis on the implicit pension debt in social pension system of China. Popul. J. 2011, 4, 68–74. [Google Scholar] [CrossRef]

- Thomas, J.R.; Clark, S.J. More on the cohort-component model of population projection in the context of HIV/AIDS: A Leslie matrix representation and new estimates. Demogr. Res. 2011, 25, 39–101. [Google Scholar] [CrossRef] [PubMed]

- Tian, F. Demographic Probabilistic Forecast Method and Its Application. Northwest Popul. J. 2011, 5, 9–13. [Google Scholar] [CrossRef]

- Pânzaru, C. On the Sustainability of the Romanian Pension System in the Light of Population Declining. Procedia Soc. Behav. Sci. 2015, 183, 77–84. [Google Scholar] [CrossRef]

- Bernardelli, H. Population Waves. J. Burma Res. Soc. 1941, 31, 1–18. [Google Scholar] [CrossRef]

- Lewis, E.G. On the Generation and Growth of a Population. Sankhya Indian J. Stat. 1942, 6, 93–96. [Google Scholar] [CrossRef]

- Leslie, P.H. Some Further Notes on the Use of Matrices in Population Mathematics. Biometrika 1948, 35, 213–245. [Google Scholar] [CrossRef]

- Ministry of Human Resources and Social Security of China. Available online: http://www.mohrss.gov.cn/SYrlzyhshbzb/shehuibaozhang/zcwj/yanglao/ (accessed on 9 August 2017).

- Wang, X.J. China’s Pension System and Its Actuarial Evaluation; Economic Science Press: Beijing, China, 2000; pp. 172–177. ISBN 978-7505820289. [Google Scholar]

- Cheng, A.W.; Miller, M.L.; Morris, M.; Schultz, J.P.; Skirvin, J.P.; Walder, D.P. A Stochastic Model of the Long-Range Financial Status of the OASDI Program; Annual Report; Pub. No. 11-11555; Office of the Chief Actuary, U.S. Social Security Administration: Washington, DC, USA, 2004.

- Rauh, J.D.; Novymarx, R. Policy Options for State Pension Systems and Their Impact on Plan Liabilities. J. Pension Econ. Financ. 2011, 10, 173–194. [Google Scholar] [CrossRef]

- National Council for Social Security Fund of the People’s Republic of China. Available online: http://www.ssf.gov.cn/cwsj/ndbg/201706/t20170612_7277.html (accessed on 20 October 2017).

| Year | i = 3% | i = 4% | i = 5% | i = 6% | i = 7% | i = 8% |

|---|---|---|---|---|---|---|

| 2018 | 4.43 | 4.57 | 4.71 | 4.86 | 5.02 | 5.18 |

| 2023 | 6.09 | 6.52 | 6.97 | 7.46 | 7.99 | 8.57 |

| 2028 | 8.49 | 9.35 | 10.30 | 11.40 | 12.60 | 14.00 |

| 2033 | 9.91 | 11.40 | 13.20 | 15.30 | 17.80 | 20.70 |

| 2038 | 9.63 | 12.10 | 15.00 | 18.70 | 23.10 | 28.50 |

| 2043 | 4.79 | 8.31 | 12.80 | 18.60 | 26.00 | 35.50 |

| 2048 | −10.60 | −6.08 | 0.18 | 8.73 | 20.30 | 36.00 |

| 2053 | −42.90 | −37.90 | −30.30 | −18.80 | −2.00 | 22.40 |

| 2058 | −95.70 | −92.20 | −84.70 | −71.20 | −48.90 | −13.30 |

| 2063 | −182.00 | −183.00 | −179.00 | −166.00 | −139.00 | −90.30 |

| 2068 | −325.00 | −337.00 | −342.00 | −337.00 | −310.00 | −247.00 |

| 2073 | −558.00 | −590.00 | −618.00 | −631.00 | −615.00 | −543.00 |

| 2078 | −920.00 | −993.00 | −1060.00 | −1120.00 | −1140.00 | −1070.00 |

| 2083 | −1470.00 | −1610.00 | −1760.00 | −1900.00 | −2000.00 | −1980.00 |

| 2088 | −2270.00 | −2530.00 | −2810.00 | −3110.00 | −3370.00 | −3480.00 |

| Year | i = 3% | i = 4% | i = 5% | i = 6% | i = 7% | i = 8% |

|---|---|---|---|---|---|---|

| 2018 | 6.02 | 6.16 | 6.30 | 6.45 | 6.61 | 6.77 |

| 2023 | 11.60 | 12.10 | 12.70 | 13.25 | 13.88 | 14.56 |

| 2028 | 19.80 | 21.10 | 22.60 | 24.14 | 25.88 | 27.80 |

| 2033 | 30.30 | 33.00 | 36.10 | 39.57 | 43.57 | 48.12 |

| 2038 | 44.00 | 49.00 | 54.90 | 61.83 | 69.97 | 79.57 |

| 2043 | 61.70 | 70.40 | 80.80 | 93.47 | 108.87 | 127.65 |

| 2048 | 81.50 | 95.60 | 113.00 | 135.06 | 162.68 | 197.55 |

| 2053 | 101.00 | 122.00 | 150.00 | 186.86 | 234.24 | 296.30 |

| 2058 | 118.00 | 150.00 | 194.00 | 251.61 | 330.11 | 436.94 |

| 2063 | 138.00 | 184.00 | 248.00 | 337.21 | 463.41 | 642.58 |

| 2068 | 149.00 | 213.00 | 306.00 | 441.25 | 639.82 | 933.51 |

| 2073 | 141.00 | 227.00 | 359.00 | 558.24 | 865.41 | 1340.12 |

| 2078 | 98.90 | 213.00 | 393.00 | 682.08 | 1149.78 | 1906.14 |

| 2083 | 6.39 | 149.00 | 392.00 | 804.68 | 1504.52 | 2690.08 |

| 2088 | −173.00 | 4.81 | 325.00 | 898.00 | 1930.00 | 3770.00 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Y.; Bai, M.; Liu, Y.; Hao, J. Quantitative Analyses of Transition Pension Liabilities and Solvency Sustainability in China. Sustainability 2017, 9, 2252. https://doi.org/10.3390/su9122252

Zhao Y, Bai M, Liu Y, Hao J. Quantitative Analyses of Transition Pension Liabilities and Solvency Sustainability in China. Sustainability. 2017; 9(12):2252. https://doi.org/10.3390/su9122252

Chicago/Turabian StyleZhao, Yueqiang, Manying Bai, Yali Liu, and Junzhang Hao. 2017. "Quantitative Analyses of Transition Pension Liabilities and Solvency Sustainability in China" Sustainability 9, no. 12: 2252. https://doi.org/10.3390/su9122252