Examining Trust and Risk in Mobile Money Acceptance in Uganda

Abstract

:1. Introduction

2. Literature Review

2.1. Mobile Money

2.2. Mobile Money Adoption in East Africa

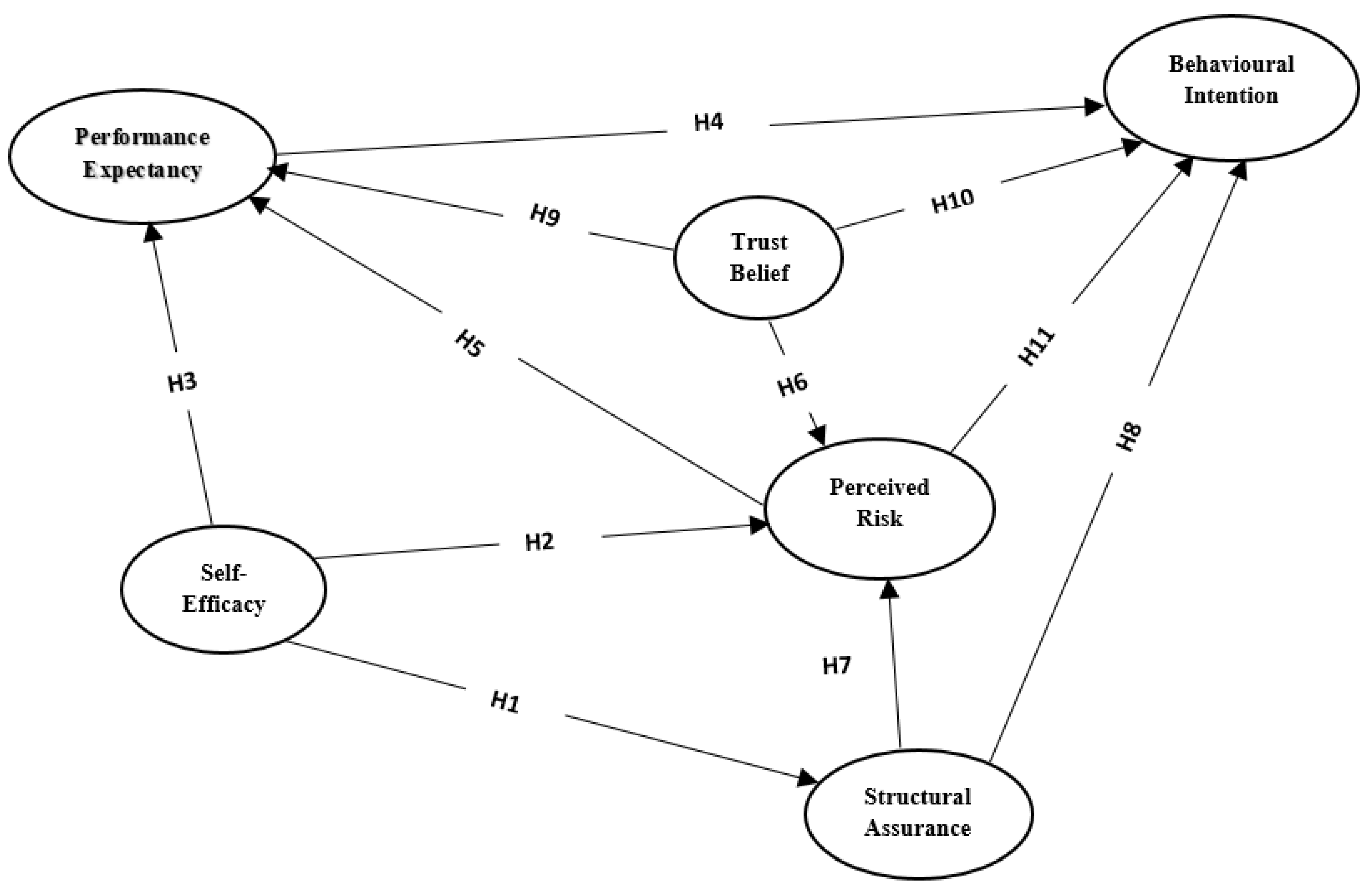

3. Conceptual Framework and Hypothesis Development

3.1. The Relevance of Trust in Mobile Money

3.2. Meaning of Trust in Mobile Money

3.3. Perceived Risk in Mobile Money

3.4. Self-Efficacy and Mobile Money

3.5. Self-Efficacy and Perceived Risk in Mobile Money

3.6. Performance Expectancy of Mobile Money

3.7. Performance Expectancy and Perceived Risk of Mobile Money

3.8. Trust Belief and Perceived Risk in Mobile Money

3.9. Structural Assurance, Perceived Risk and Behavioral Intention towards Mobile Money

3.10. Performance Expectancy and Trust Belief in Mobile Money

3.11. Behavioral Intention and Trust/Risk Beliefs in Mobile Money

4. Research Methodology

4.1. Design of the Study and Sampling Distribution

4.2. Measurement Development

5. Data Analysis and Results

5.1. Descriptive Statistics

5.2. Analysis of Results

5.3. Measurement Model

5.3.1. Reliability

5.3.2. Validity

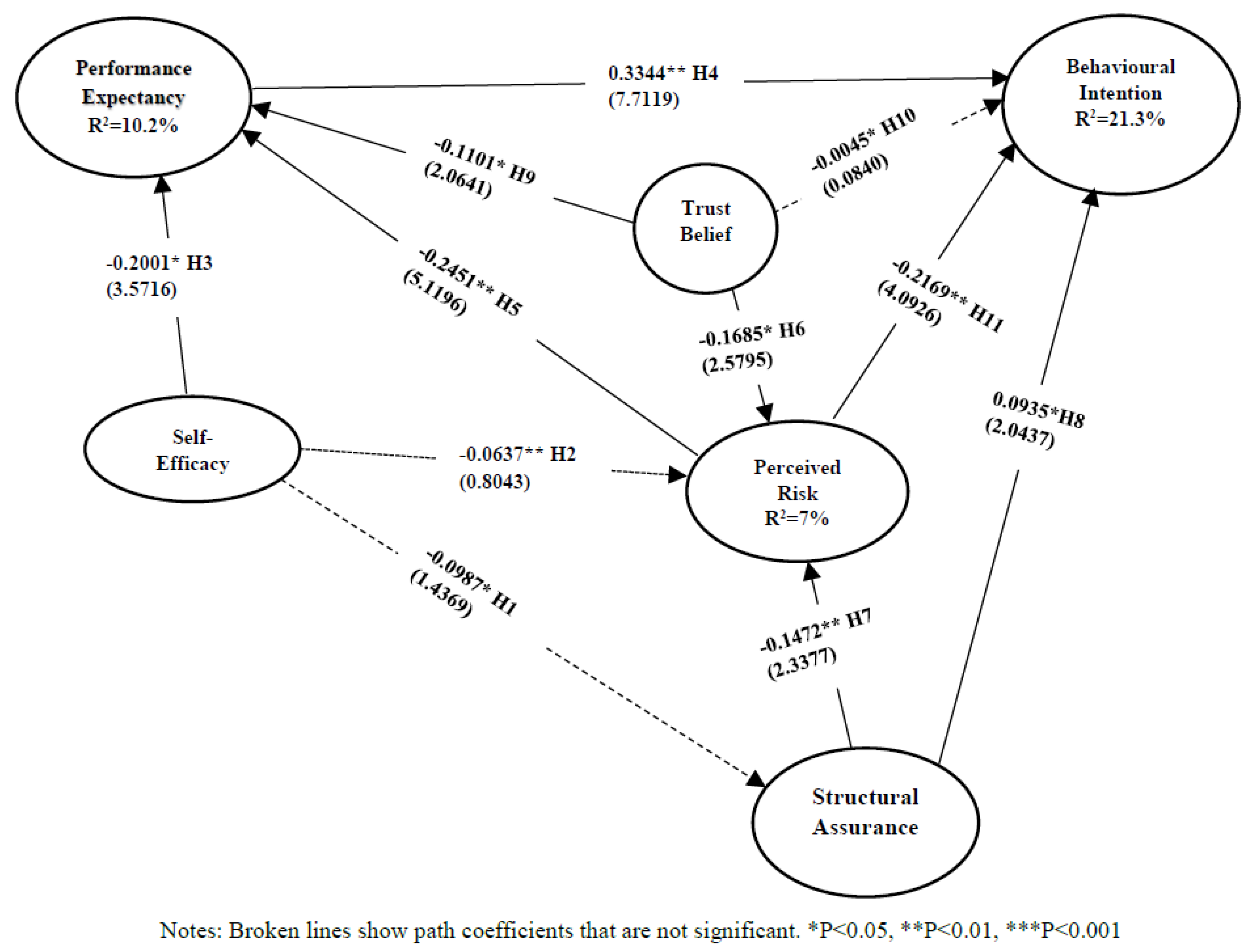

5.4. Structural Model

6. Discussion

6.1. Findings

6.2. Theoretical Contribution

6.3. Implications for Research

6.4. Implications for Practice

7. Limitations and Future Research Directions

8. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- GSMA (Global System for Mobile Association). The Mobile Economy 2017; Global System for Mobile Association: London, UK, 2017. [Google Scholar]

- Kikulwe, E.M.; Fischer, E.; Qaim, M. Mobile Money, Smallholder Farmers, and Household Welfare in Kenya. PLoS ONE 2014, 9, e109804. [Google Scholar] [CrossRef] [PubMed]

- Firpo, J. E-Money—Mobile Money—Mobile Banking—What’s the Difference? Available online: http://blogs.worldbank.org/psd/e-money-mobile-money-mobile-banking-what-s-the-difference (accessed on 30 June 2017).

- Mugambi, A.; Njunge, C.; Yang, S.C. Mobile-Money Benefits and Usage: The Case of M-PESA. IT Prof. 2014, 16, 16–21. [Google Scholar] [CrossRef]

- Bank of Uganda. Bank of Uganda Annual Report FY 2015/2016; Bank of Uganda: Kampala, Uganda, 2015. [Google Scholar]

- Bisht, S.S.; Mishra, V. ICT-Driven Financial Inclusion Initiatives for Urban Poor in Developing Economy: Implications for Public Policy. Behav. Inf. Technol. 2016, 35, 817–832. [Google Scholar] [CrossRef]

- Chauhan, S. Acceptance of Mobile Money by Poor Citizens of India: Integrating Trust into the Technology Acceptance Model. Info 2015, 17, 58–68. [Google Scholar] [CrossRef]

- Kasekende, L. Bank of Uganda’s Role in Monetary Policy, Regulation and Financial Sector Development; Bank of Uganda: Kampala, Uganda, 2014. [Google Scholar]

- Malaquias, R.F.; Hwang, Y.-J. An Empirical Study on Trust in Mobile Banking: A Developing Country Perspective. Comput. Hum. Behav. 2016, 54, 453–461. [Google Scholar] [CrossRef]

- Njoroge, P. Financial Inclusion in Sub-Saharan Africa; Central Bankers’ Speeches; Central Bank of Kenya: Nairobi, Kenya, 2016.

- Tobbin, P.; Kuwornu, J.K.M. Adoption of Mobile Money Transfer Technology: Structural Equation Modeling Approach. Eur. J. Bus. Manag. 2011, 3, 59–78. [Google Scholar]

- Adapa, S.; Roy, S.K. Consumers’ Post-Adoption Behaviour towards Internet Banking: Empirical Evidence from Australia. Behav. Inf. Technol. 2017, 36, 1–14. [Google Scholar] [CrossRef]

- Al-Gahtani, S.S.; Hubona, G.S.; Wang, J. Information Technology (IT) in Saudi Arabia: Culture and the Acceptance and Use of IT. Inf. Manag. 2007, 44, 681–691. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.; Xu, X. Consumer Acceptance and User of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Q. 2012, 36, 157–178. [Google Scholar]

- Upadhyay, P.; Jahanyan, S. Analyzing User Perspective on the Factors Affecting Use Intention of Mobile-Based Transfer Payment. Internet Res. 2016, 26, 38–56. [Google Scholar] [CrossRef]

- Ssonko, G.W.; Tait, M. Effect of Mobile Money on Financial Inclusion. In Proceedings of the Southern African Institute of Management Scientists (SAIMS) Conference, Bloemfontein, South Africa, 10–12 September 2017; pp. 30–59. [Google Scholar]

- Mutebile, E.T. Mobile Money and the Economy; Central Bankers’ Speeches; Bank for International Settlements: Kampala, Uganda, 2015. [Google Scholar]

- Mutebile, E.T. Bank of Uganda’s 50th Anniversary; Central Bankers’ Speeches; Bank for International Settlements: Kampala, Uganda, 2016. [Google Scholar]

- Nampewo, D.; Tinyinondi, G.A.; Kawooya, D.R.; Ssonko, G.W. Determinants of Private Sector Credit in Uganda: The Role of Mobile Money. Financ. Innov. 2016, 2, 1–16. [Google Scholar] [CrossRef]

- Kasekende, L. Improving Financial Literacy in Uganda; Central Bankers’ Speeches; Bank for International Settlements: Kampala, Uganda, 2015. [Google Scholar]

- Luo, X.; Li, H.; Zhang, J.; Shim, J.P. Examining Multi-Dimensional Trust and Multi-Faceted Risk in Initial Acceptance of Emerging Technologies: An Empirical Study of Mobile Banking Services. Decis. Support Syst. 2010, 49, 222–234. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A Trust-Based Consumer Decision-Making Model in Electronic Commerce: The Role of Trust, Perceived Risk, and Their Antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Morawczynski, O. Exploring the Usage and Impact of “transformational” mobile Financial Services: The Case of M-PESA in Kenya. J. East. Afr. Stud. 2009, 3, 509–525. [Google Scholar] [CrossRef]

- Bank of Uganda. Bank of Uganda Annual Supervision Report; Bank of Uganda: Kampala, Uganda, 2016. [Google Scholar]

- Okuttah, M. Safaricom M-Pesa Transfers across Borders Hit Sh17bn. Business Daily, 4 January 2016. [Google Scholar]

- Nwaniki, C. Kenya Plans March Rollout of Mobile Phone-Based T-Bond. Business Daily, 11 January 2016. [Google Scholar]

- Laukkanen, T. Internet vs. Mobile Banking: Comparing Customer Value Perceptions. Bus. Process Manag. J. 2007, 13, 788–797. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Free Press: Glencoe, UK, 1962. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitudes & Predicting Social Behavior; Prentice Hall: Sydney, Australia, 1985. [Google Scholar]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Nduneseokwu, C.K.; Qu, Y.; Appolloni, A. Factors Influencing Consumers’ Intentions to Participate in a Formal E-Waste Collection System: A Case Study of Onitsha, Nigeria. Sustainability 2017, 9, 881. [Google Scholar] [CrossRef]

- Chung, N.-H.; Koo, C.-M.; Lee, K.-M. Assessing the Impact of Mobile Technology on Exhibition Attendees’ Unplanned Booth Visit Behaviour. Sustainability 2017, 9, 884. [Google Scholar] [CrossRef]

- Tobbin, P. The Adoption of Transformational Mobile Banking by the Unbanked. Digiworld Econ. J. 2012, 86, 103–223. [Google Scholar]

- Lu, J.; Yu, C.-S.; Liu, C.; Yao, J.E. Technology Acceptance Model for Wireless Internet. J. Internet Res. 2003, 13, 206–222. [Google Scholar] [CrossRef]

- Lee, K.-S.; Lee, H.-S.; Kim, S.-Y. Factors Influencing the Adoption Behavior of Mobile Banking: A South Korean Perspective. J. Internet Bank. Commer. 2007, 12, 92–114. [Google Scholar]

- Gefen, D.; Karahanna, E.; Straub, D.W. Trust and TAM in Online Shopping: An Integrated Model. MIS Q. 2003, 27, 51–90. [Google Scholar] [CrossRef]

- Chen, Y.; Yan, X.; Fan, W.; Gordon, M. The Joint Moderating Role of Trust Propensity and Gender on Consumers’ Online Shopping Behavior. Comput. Hum. Behav. 2015, 43, 272–283. [Google Scholar] [CrossRef]

- Jacoby, J.; Kaplan, L.B. The Components of Perceived Risk. Adv. Consum. Res. 1972, 3, 382–393. [Google Scholar]

- McKnight, D.H.; Choudhury, V.; Kacmar, C. Developing and Validating Trust Measures for E-Commerce: An Integrative Typology. Inf. Syst. Res. 2002, 13, 334–359. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile Payment: Understanding the Determinants of Customer Adoption and Intention to Recommend the Technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Duane, A.; O’Reilly, P.; Andreev, P. Realising M-Payments: Modelling Consumers’ Willingness to M-Pay Using Smart Phones. Behav. Inf. Technol. 2014, 33, 318–334. [Google Scholar] [CrossRef]

- Federal Reserve Bank. Current Use of Mobile Banking and Payments. Available online: https://www.federalreserve.gov/econresdata/mobile-devices/2012-current-use-mobile-banking-payments.htm (accessed on 30 June 2017).

- Kasekende, L. Mobile Money Services—Talking Points. Available online: http://nyucted.org/wp-content/uploads/2012/11/louis-kasekende-mobile-money-uganda2.pdf (accessed on 7 April 2017).

- Morawczynski, O. Fraud in Uganda: How Millions Were Lost to Internal Collusion. Available online: https://www.cgap.org/blog/fraud-uganda-how-millions-were-lost-internal-collusion (accessed on 30 June 2017).

- Al-Jabri, I.M. The Intention to Use Mobile Banking: Further Evidence from Saudi Arabia. S. Afr. J. Bus. Manag. 2015, 46, 23–34. [Google Scholar]

- Zhou, T. Understanding the Determinants of Mobile Payment Continuance Usage. Ind. Manag. Data Syst. 2014, 114, 936–948. [Google Scholar] [CrossRef]

- McKnight, D.H.; Chervany, N.L. What Trust Means in E-Commerce Customer Relationships: An Interdisciplinary Conceptual Typology. Int. J. Electron. 2002, 6, 35–59. [Google Scholar] [CrossRef]

- Zhou, T. An Empirical Examination of Initial Trust in Mobile Payment. Wirel. Pers. Commun. 2014, 77, 1519–1531. [Google Scholar] [CrossRef]

- Lu, Y.; Yang, S.; Chau, P.Y.K.; Cao, Y. Dynamics between the Trust Transfer Process and Intention to Use Mobile Payment Services: A Cross-Environment Perspective. Inf. Manag. 2011, 48, 393–403. [Google Scholar] [CrossRef]

- Park, J.-K.; Gunn, F.; Han, S.-L. Multidimensional Trust Building in E-Retailing: Cross-Cultural Differences in Trust Formation and Implications for Perceived Risk. J. Retail. Consum. Serv. 2012, 19, 304–312. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.W. Consumer Trust in B2C E-Commerce and the Importance of Social Presence: Experiments in E-Products and E-Services. Omega 2004, 32, 407–424. [Google Scholar] [CrossRef]

- Lin, K.-M. Understanding Undergraduates’ Problems from Determinants of Facebook Continuance Intention. Behav. Inf. Technol. 2016, 35, 693–705. [Google Scholar] [CrossRef]

- Thakur, R.; Srivastava, M. Adoption Readiness, Personal Innovativeness, Perceived Risk and Usage Intention across Customer Groups for Mobile Payment Services in India. Internet Res. 2014, 24, 369–392. [Google Scholar] [CrossRef]

- Lee, M.S.Y.; McGoldrick, P.J.; Keeling, K.A.; Doherty, J. Using ZMET to Explore Barriers to the Adoption of 3G Mobile Banking Services. Int. J. Retail Distrib. Manag. 2003, 31, 340–348. [Google Scholar] [CrossRef]

- Nel, J.; Boshoff, C. The Impact of Cross-Channel Cognitive Evaluations on the Continued Use Intentions of Mobile Banking. Manag. Dyn. 2014, 23, 2–19. [Google Scholar]

- Kasekende, L. What Role Does Financial Inclusion Play in the Policy Agenda for Inclusive Growth in Sub-Saharan Africa? Development 2014, 57, 481–487. [Google Scholar] [CrossRef]

- Kim, K.K.; Prabhakar, B. Initial Trust, Perceived Risk, and the Adoption of Internet Banking. Proc. ICIS 2000, 1, 537–543. [Google Scholar]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.D. Modeling Consumers’ Adoption Intentions of Remote Mobile Payments in the United Kingdom: Extending UTAUT with Innovativeness, Risk, and Trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Yang, K. The Effects of Technology Self-Efficacy and Innovativeness on Consumer Mobile Data Service Adoption between American and Korean Consumers. J. Int. Consum. Mark. 2010, 22, 117–127. [Google Scholar] [CrossRef]

- Faqih, K.M.S. Exploring the Influence of Perceived Risk and Internet Self-Efficacy on Consumer Online Shopping Intentions: Perspective of Technology Acceptance Model. Int. Manag. Rev. 2013, 9, 67–78. [Google Scholar]

- Zhou, T. Examining Location-Based Services Usage From the Perspectives of Unified Theory of Acceptance and Use of Technology and Privacy Risk. J. Electron. Commer. Res. 2012, 13, 135–144. [Google Scholar]

- López-Nicolás, C.; Molina-Castillo, F.J.; Bouwman, H. An Assessment of Advanced Mobile Services Acceptance: Contributions from TAM and Diffusion Theory Models. Inf. Manag. 2008, 45, 359–364. [Google Scholar] [CrossRef]

- Zhou, T. Exploring Mobile User Acceptance Based on UTAUT and Contextual Offering. In Proceedings of the International Symposium on Electronic Commerce and Security, Guangzhou, China, 3–5 August 2008; pp. 241–245. [Google Scholar]

- Chen, K.-Y.; Chang, M.-L. User Acceptance of “near Field Communication” Mobile Phone Service: An Investigation Based on the “Unified Theory of Acceptance and Use of Technology” Model. Serv. Ind. J. 2013, 33, 609–623. [Google Scholar] [CrossRef]

- Featherman, M.S.; Pavlou, P.A. Predicting E-Services Adoption: A Perceived Risk Facets Perspective. Int. J. Hum. Comput. Stud. 2003, 59, 451–474. [Google Scholar] [CrossRef]

- Wang, E.S.-T.; Lin, R.-L. Perceived Quality Factors of Location-Based Apps on Trust, Perceived Privacy Risk, and Continuous Usage Intention. Behav. Inf. Technol. 2016, 36, 2–10. [Google Scholar] [CrossRef]

- Jarvenpaa, S.; Tractinsky, N.; Saarinen, L. Consumer Trust in an Internet Store: A Cross-Cultural Validation. J. Comput. Commun. 1999, 5, 1–35. [Google Scholar] [CrossRef]

- Jack, W.; Suri, T. Risk Sharing and Transactions Costs: Evidence from Kenya’s Mobile Money Revolution. Am. Econ. Rev. 2014, 104, 183–223. [Google Scholar] [CrossRef]

- Zhu, Y.; Chen, H. Service Fairness and Customer Satisfaction in Internet Banking. Internet Res. 2012, 22, 482–498. [Google Scholar] [CrossRef]

- Zhou, T. An Empirical Examination of Initial Trust in Mobile Banking. Internet Res. 2011, 21, 527–540. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Belief, Attitude, Intention, and Behaviour: An Introduction to Theory and Research; Addison-Wesley: Reading, MA, USA, 1975. [Google Scholar]

- Kwee-Meier, S.; Butzler, J.; Schlick, C. Development and Validation of a Technology Acceptance Model for Safety-Enhancing, Wearable Systems. Behav. Inf. Technol. 2016, 35, 394–409. [Google Scholar] [CrossRef]

- Malhotra, N.K.; Kim, S.-S.; Agarwal, J. Internet Users’ Information Privacy Concerns (IUIPC): The Construct, the Scale, and a Causal Model. Info Sys. Res. 2004, 15, 336–355. [Google Scholar] [CrossRef]

- Chuchird, R.; Sasaki, N.; Abe, I. Influencing Factors of the Adoption of Agricultural Irrigation Technologies and the Economic Returns: A Case Study in Chaiyaphum Province, Thailand. Sustainability 2017, 9, 1524. [Google Scholar] [CrossRef]

- Zikmund, W.G. Business Research Methods, 7th ed.; Thomson/South-Western: Cincinnati, OH, USA, 2003. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modelling (PLS-SEM); SAGE Publications, Inc.: London, UK, 2014. [Google Scholar]

- Anderson, J.; Gerbing, D. Structural Equation Modelling in Practice: A Review and Recommended Two-Step Approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Park, J.-Y.; Sung, C.-S.; Im, I. Does Social Media Use Influence Entrepreneurial Opportunity? A Review of Its Moderating Role. Sustainability 2017, 9, 1593. [Google Scholar] [CrossRef]

- Chin, W.W.; Newsted, P.R. Structural Equation Modeling Analysis with Small Samples Using Partial Least Squares. In Statistical Strategies for Small Sample Research; Hoyle, R.H., Ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 1999. [Google Scholar]

- Lu, J.; Wei, J.; Yu, C.-S.; Liu, C. How Do Post-Usage Factors and Espoused Cultural Values Impact Mobile Payment Continuation? Behav. Inf. Technol. 2016, 36, 140–164. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The Use of Partial Least Squares Path Modeling in International Marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar]

- Chin, W.W. The Partial Least Squares Approach for Structural Equation Modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates: Hillsdale, NJ, USA, 1998. [Google Scholar]

- Hair, J.F.; Bill, B.; Barry, B.; Rolph, E.A. Multivariate Data Analysis; Pearson: Englewood Cliffs, NJ, USA, 2009. [Google Scholar]

- Bagozzi, R.P.; Yi, Y.-J. On the Evaluation of Structural Equation Models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.W.; Boudreau, M.-C. Structural Equation Modeling and Regression: Guidelines for Research and Practice. CAIS 2000, 4, 1–70. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. 1981, 1, 39–50. [Google Scholar] [CrossRef]

| Construct | Item Code | Survey Statement | Likert Scale | Source |

|---|---|---|---|---|

| Structural assurance (SA) | SA1 | MM has enough safeguards to make me feel comfortable using it to transact personal business. | Strongly Disagree/Strongly Agree | McKnight et al. [40] |

| SA2 | I feel assured of the legal and technological structure of MM to protect me from financial losses. | |||

| SA3 | I feel confident that encryption and other technological advances of MM make it safe for me to do business there. | |||

| Trust belief (TB) | TB1 | Based on my experience with MM service providers in the past, I know they are honest. | Strongly Disagree/Strongly Agree | Gefen et al. [37] |

| TB2 | Based on my experience with MM service providers in the past, I know they care about customers. | |||

| TB3 | Based on my experience with MM service providers in the past, I know they are not opportunistic. | |||

| Self-efficacy (SE) | SE1 | I could complete a job or task using MM application if there was no one around to tell me what to do. | Strongly Disagree/Strongly Agree | Venkatesh et al. [29] |

| SE2 | I could complete a job or task using MM application if I could call someone for help if I got stuck. | |||

| SE3 | I could complete a job using MM application if I had a lot of time to complete the task for which the application was provided. | |||

| Performance expectancy (PE) | PE1 | Using MM enables me to accomplish tasks more quickly. | Strongly Disagree/Strongly Agree | Venkatesh et al. [29] |

| PE2 | Using MM increases my productivity. | |||

| PE3 | If I use MM, I will increase my chances of getting a pay rise. | |||

| Behavioral intention (BI) | BI1 | I intend to use MM in the next 3 months. | Strongly Disagree/Strongly Agree | Venkatesh et al. [29] |

| BI2 | I predict I would use MM in the next 6 months. | |||

| BI3 | I plan to use MM in the next 12 months. | |||

| Perceived risk (PR) | PR1 | What are the chances that you stand to lose money if you use MM? | Low/high chance | Chen et al. [38]; Featherman and Pavlou [66]; Jacoby and Kaplan [39] |

| PR2 | What is the likelihood that there will be something wrong with the performance of MM? | Low/high risk | ||

| PR3 | What are the chances that using MM will cause you to lose control over the privacy of your payment information? | Improbable/probable | ||

| PR4 | Usage of MM would lead to a psychological loss for me because it would not fit in well with my self-image or self-concept | Improbable/probable | ||

| PR5 | What are the chances that using MM will negatively affect the way others think of you? | Low/high risk | ||

| PR6 | If you had begun to use MM, what are the chances that you will lose time due to having to switch to a different payment method like using Banks? | Low/high loss | ||

| PR7 | On the whole, considering all sorts of factors combined, about how risky would you say it would be to sign up for and use MM? | Not risky at all/very risky |

| Measure | Items | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 208 | 47.49 |

| Female | 230 | 52.51 | |

| Age | 18–30 | 276 | 63.01 |

| 31–40 | 117 | 26.71 | |

| 41–50 | 40 | 9.13 | |

| 51–60 | 5 | 1.14 | |

| Mobile Money experience | Less than 1 year | 84 | 19.18 |

| 1–5 years | 273 | 62.33 | |

| 6–10 years | 77 | 17.58 | |

| More than 10 years | 4 | 0.91 | |

| MM Service provider preference | Airtel Money | 188 | 42.92 |

| Orange Money | 16 | 3.65 | |

| MTN Mobile Money | 203 | 46.35 | |

| M-Sente | 11 | 2.51 | |

| Ezee-Money | 16 | 3.65 | |

| M-Cash | 4 | 0.91 | |

| Level of Education | Primary School | 34 | 7.76 |

| Secondary School | 241 | 55.02 | |

| University Degree | 157 | 35.84 | |

| Postgraduate (Masters) | 6 | 1.37 |

| Constructs | CR | AVE | BI | PE | PR | SA | SE | TB |

|---|---|---|---|---|---|---|---|---|

| Behavioral Intention (BI) | 0.9130 | 0.7793 | 0.8828 | |||||

| Performance Expectancy (PE) | 0.8606 | 0.6737 | 0.3926 | 0.8208 | ||||

| Perceived Risk (PR) | 0.7675 | 0.5241 | −0.3009 | −0.2026 | 0.7239 | |||

| Structural Assurance (SA) | 0.8713 | 0.6939 | 0.1815 | 0.1470 | −0.1845 | 0.8330 | ||

| Self-Efficacy (SE) | 0.7476 | 0.6012 | −0.1269 | −0.2049 | −0.0904 | −0.0987 | 0.7754 | |

| Trust Belief (TB) | 0.8629 | 0.7601 | 0.0328 | −0.1047 | −0.2221 | 0.2585 | 0.2449 | 0.8718 |

| BI | PE | PR | SA | SE | TB | |

|---|---|---|---|---|---|---|

| BI1 | 0.9215 | 0.3731 | −0.3150 | 0.2001 | −0.1493 | 0.0924 |

| BI2 | 0.9551 | 0.3802 | −0.2820 | 0.1841 | −0.1319 | 0.0240 |

| BI3 | 0.7592 | 0.2726 | −0.1782 | 0.0710 | −0.0302 | −0.0601 |

| PE1 | 0.2775 | 0.7581 | −0.0930 | 0.1413 | −0.2219 | −0.1805 |

| PE2 | 0.2956 | 0.8290 | −0.1563 | 0.1350 | −0.1333 | 0.0200 |

| PE3 | 0.3797 | 0.8712 | −0.2331 | 0.0947 | −0.1521 | −0.0883 |

| PR1 | −0.1945 | −0.1974 | 0.7016 | −0.2201 | 0.0433 | −0.0486 |

| PR2 | −0.2236 | −0.0656 | 0.7479 | −0.1407 | −0.1788 | −0.2548 |

| PR7 | −0.2342 | −0.1861 | 0.7216 | −0.0454 | −0.0464 | −0.1660 |

| SA1 | 0.0667 | 0.0144 | −0.1718 | 0.7503 | −0.0408 | 0.2962 |

| SA2 | 0.1271 | 0.0705 | −0.1725 | 0.8770 | −0.0909 | 0.2248 |

| SA3 | 0.2284 | 0.2373 | −0.1295 | 0.8659 | −0.1028 | 0.1607 |

| SE1 | −0.1588 | −0.2019 | −0.0163 | −0.1212 | 0.8720 | 0.2363 |

| SE2 | −0.0110 | −0.1008 | −0.1556 | −0.0120 | 0.6649 | 0.1281 |

| TB1 | 0.0871 | −0.0659 | −0.2474 | 0.2473 | 0.1542 | 0.9402 |

| TB2 | −0.0734 | −0.1412 | −0.1088 | 0.1985 | 0.3301 | 0.7976 |

| Hypothesis | Path Coefficients () | t Values | Conclusions |

|---|---|---|---|

| H1. Self-efficacy positively impacts structural assurance. | −0.0987 | 1.4369 | p > 0.05 (Not-supported) |

| H2. Self-efficacy negatively impacts perceived risk in mobile money. | −0.0637 | 0.8043 | p > 0.01 (Not-supported) |

| H3. Self-efficacy is positively related to Performance expectancy of mobile money. | −0.2001 | 3.5716 | p < 0.05 (Supported) |

| H4. Performance expectancy positively impacts behavioral intention to adopt mobile money. | 0.3344 | 7.7119 | p < 0.01 (Supported) |

| H5. Perceived risk negatively impacts performance expectancy of mobile money. | −0.2451 | 5.1196 | p < 0.01 (Supported) |

| H6. Trust belief will negatively impact perceived risk in mobile money. | −0.1685 | 2.5795 | p < 0.05 (Supported) |

| H7. Structural assurance is negatively related to perceived risk in mobile money. | −0.1472 | 2.3377 | p < 0.01 (Supported) |

| H8. Structural assurance positively impacts behavioral intention towards mobile money. | 0.0935 | 2.0437 | p < 0.05 (Supported) |

| H9. Trust belief is positively related to performance expectancy of mobile money. | −0.1101 | 2.0641 | p < 0.05 (Supported) |

| H10. Trust belief positively impacts behavioral intention to adopt mobile money. | −0.0045 | 0.0840 | p > 0.05 (Not-supported) |

| H11. Perceived risk is negatively related to behavioral intention to adopt mobile money. | −0.2169 | 4.0926 | p < 0.01 (Supported) |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baganzi, R.; Lau, A.K.W. Examining Trust and Risk in Mobile Money Acceptance in Uganda. Sustainability 2017, 9, 2233. https://doi.org/10.3390/su9122233

Baganzi R, Lau AKW. Examining Trust and Risk in Mobile Money Acceptance in Uganda. Sustainability. 2017; 9(12):2233. https://doi.org/10.3390/su9122233

Chicago/Turabian StyleBaganzi, Ronald, and Antonio K. W. Lau. 2017. "Examining Trust and Risk in Mobile Money Acceptance in Uganda" Sustainability 9, no. 12: 2233. https://doi.org/10.3390/su9122233