Family Involvement and Sustainable Family Business: Analysing Their Effects on Diversification Strategies

Abstract

:1. Introduction

2. Materials and Methods

2.1. Diversification in Small Family Firms

2.2. Diversification and Family Involvement

2.3. Diversification and Family Managers

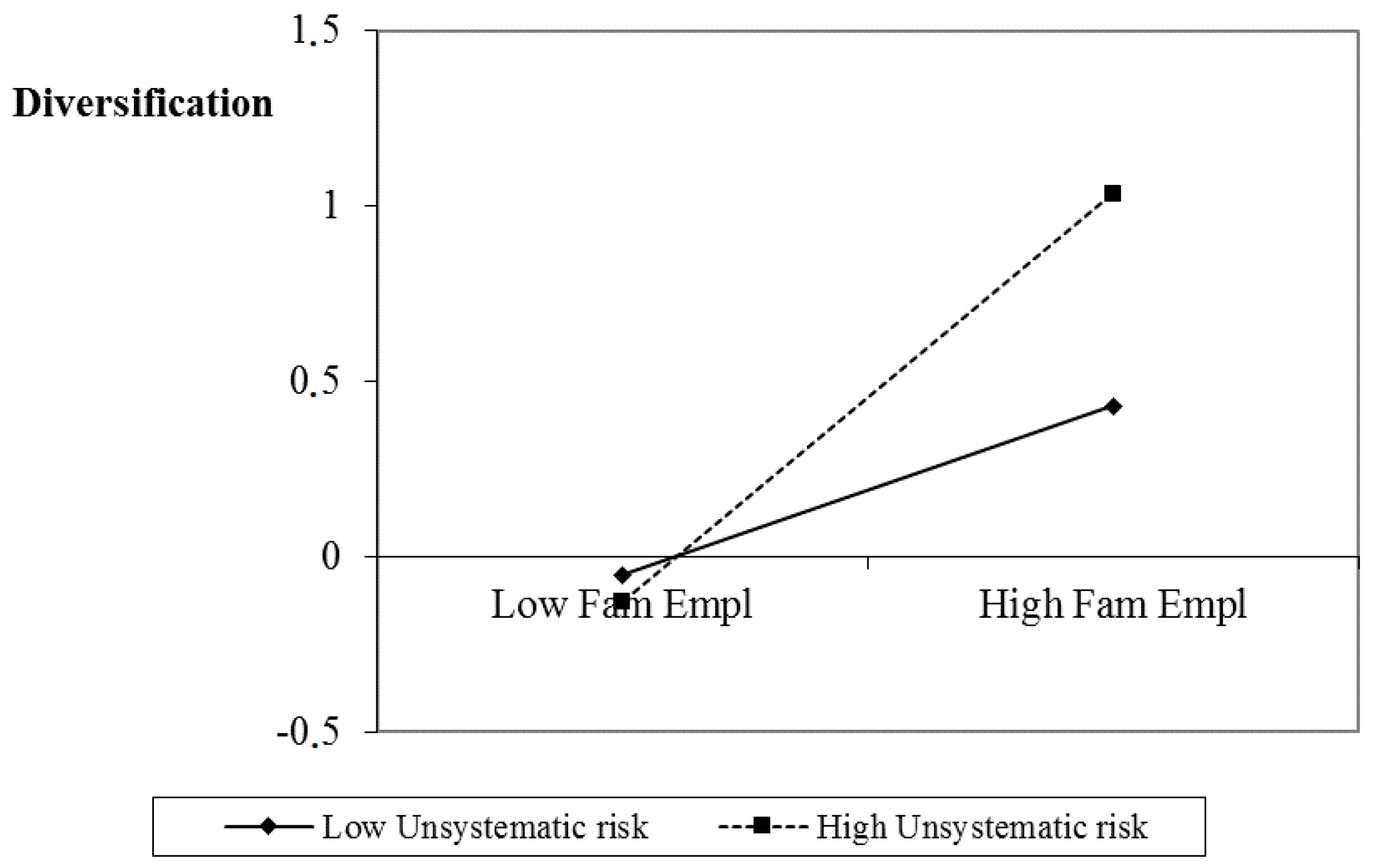

2.4. Diversification and Risk

2.5. Diversification and Performance Hazard

2.6. Data

2.7. Variables

2.7.1. Dependent Variable

2.7.2. Independent Variables

2.7.3. Control Variables

2.8. Methods

3. Results

4. Discussion

5. Conclusions

Acknowledgments

Conflicts of Interest

References

- Stern, I.; Henderson, A.D. Within-business diversification in technology-intensive industries. Strateg. Manag. J. 2004, 25, 487–505. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A. Feuding Families: When Conflict Does a Family Firm Good. Entrep. Theory Pract. 2004, 18, 209–228. [Google Scholar]

- Arrow, K.J. Aspects of the Theory of Risk-Bearing; Yrjö Jahnssonin Säätiö: Finland, Helsinski, 1965; Available online: http://www.scirp.org/%28S%28351jmbntvnsjt1aadkposzje%29%29/reference/ReferencesPapers.aspx?ReferenceID=1641644 (accessed on 14 November 2017).

- Gedajlovic, M.H.; William, S. Crossing the Threshold from Founder Management to Professional Management: A Governance Perspective. J. Manag. Stud. 2004, 41, 899–912. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Nuñez-Nickel, M.; Gutierrez, I. The Role of Family Ties in Agency Contracts. Acad. Manag. J. 2001, 44, 81–95. [Google Scholar] [CrossRef]

- Naldi, L.; Nordqvist, M.; Sjöberg, K.; Wiklund, J. Entrepreneurial Orientation, Risk Taking, and Performance in Family Firms. Fam. Bus. Rev. 2007, 20, 33–47. [Google Scholar] [CrossRef]

- Sniezek, J.; Henry, R. Accuracy and confidence in group judgement. Organ. Behav. Hum. Decis. Process. 1989, 43, 1–28. [Google Scholar] [CrossRef]

- Villalonga, B.; Amit, R. How do family ownership, control and management affect firm value? J. Financ. Econ. 2006, 80, 385–417. [Google Scholar] [CrossRef]

- Lim, E.N.K.; Lubatkin, M.H.; Wiseman, R.M. A family firm variant of the behavioral agency theory. Strateg. Entrep. J. 2010, 4, 197–211. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Lester, R.H. Family and Lone Founder Ownership and Strategic Behaviour: Social Context, Identity, and Institutional Logics. J. Manag. Stud. 2011, 48, 1–25. [Google Scholar] [CrossRef]

- Carney, M.; Van Essen, M.; Gedajlovic, E.R.; Heugens, P.P.M.A.R. What do we know about private family firms? A meta-analytical review. Entrep. Theory Pract. 2015, 39, 513–544. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Makri, M.; Kintana, M.L. Diversification decisions in family-controlled firms. J. Manag. Stud. 2010, 47, 223–252. [Google Scholar] [CrossRef]

- Gómez-Mejía, L.R.; Haynes, K.T.; Núñez-Nickel, M.; Jacobson, K.J.; Moyano-Fuentes, J. Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Kellermanns, F.W.; Eddleston, K.A.; Barnett, T.; Pearson, A. An exploratory study of family member characteristics and involvement: Effects on entrepreneurial behavior in the family firm. Fam. Bus. Rev. 2008, 21, 1–14. [Google Scholar] [CrossRef]

- Herrero, I. Agency Costs, Family Ties, and Firm Efficiency. J. Manag. 2011, 37, 887–904. [Google Scholar] [CrossRef]

- Hilborn, R.; Maguire, J.-J.; Parma, A.M.; Rosenberg, A.A. The Precautionary Approach and risk management: Can they increase the probability of successes in fishery management? Can. J. Fish. Aquat. Sci. 2001, 58, 99–107. [Google Scholar] [CrossRef]

- Smith, M.D.; Wilen, J.E. Heterogeneous and correlated risk preferences in commercial fishermen: The perfect storm dilemma. J. Risk Uncertain. 2005, 31, 53–71. [Google Scholar] [CrossRef]

- Caputo, F.; Veltri, S.; Venturelli, A. Sustainability Strategy and Management Control Systems in Family Firms. Evidence from a Case Study. Sustainability 2017, 9, 977. [Google Scholar] [CrossRef]

- Anderson, R.C.; Reeb, D.M. Founding-family ownership and firm performance. J. Financ. 2003, 58, 1301–1327. [Google Scholar] [CrossRef]

- Schulze, W.S.; Lubatkin, M.H.; Relationships, A.; Dino, R.N.; Buchholtz, A.K. Agency Relationships in Family Firms: Theory and Evidence. Organ. Sci. 2001, 12, 99–116. [Google Scholar] [CrossRef]

- Naldi, L.; Chirico, F.; Kellermanns, F.W.; Campopiano, G. All in the Family? An Exploratory Study of Family Member Advisors and Firm Performance. Fam. Bus. Rev. 2015, 28, 227–242. [Google Scholar] [CrossRef]

- Goel, S.; Jones, R.J. Entrepreneurial Exploration and Exploitation in Family Business. Fam. Bus. Rev. 2016, 29, 94–120. [Google Scholar] [CrossRef]

- Gray, C. Entrepreneurship, resistance to change and growth in small firms. J. Small Bus. Enterp. Dev. 2002, 9, 61–72. [Google Scholar] [CrossRef]

- Daily, C.M.; Dollinger, M.J. Family Firms Are Different. Rev. Bus. 1991, 13, 3. [Google Scholar]

- Claver, E.; Rienda, L.; Quer, D. Family firms’ risk perception: Empirical evidence on the internationalization process. J. Small Bus. Enterp. Dev. 2008, 15, 457–471. [Google Scholar] [CrossRef]

- Miller, D.; Breton-Miller, I.L.; Lester, R.H. Family ownership and acquisition behavior in publicly-traded companies. Strateg. Manag. J. 2010, 31, 201–223. [Google Scholar] [CrossRef]

- Zahra, S.A. Harvesting family firms’ organizational social capital: A relational perspective. J. Manag. Stud. 2010, 47, 345–366. [Google Scholar] [CrossRef]

- Cruz, C.C.; Gómez-Mejia, L.R.; Becerra, M. Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Acad. Manag. J. 2010, 53, 69–89. [Google Scholar] [CrossRef]

- Galve Górriz, C.; Salas Fumás, V. Ownership Structure and Firm Performance: Some Empirical Evidence from Spain. Manag. Decis. Econ. 1996, 17, 575–586. [Google Scholar] [CrossRef]

- Wiseman, R.M.; Gomez-mejia, L.R. A Behavioral Agency Model of Managerial Risk Taking. Acad. Manag. Rev. 1998, 23, 133–153. [Google Scholar]

- Le Breton-Miller, I.; Miller, D. Commentary: Family firms and the advantage of multitemporality. Entrep. Theory Pract. 2011, 35, 1171–1177. [Google Scholar] [CrossRef]

- Olson, P.D.; Zuiker, V.S.; Danes, S.M.; Stafford, K.; Heck, R.K.Z.; Duncan, K.A. The impact of the family and the business on family business sustainability. J. Bus. Ventur. 2003, 18, 639–666. [Google Scholar] [CrossRef]

- Cruz, C.; Justo, R.; De Castro, J.O. Does family employment enhance MSEs performance?. Integrating socioemotional wealth and family embeddedness perspectives. J. Bus. Ventur. 2012, 27, 62–76. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Mejia, L.R. Socioemotional Wealth in Family Firms: Theoretical Dimensions, Assessment Approaches, and Agenda for Future Research. Fam. Bus. Rev. 2012, 25, 258–279. [Google Scholar] [CrossRef]

- Schulze, W.S.; Lubatkin, M.H.; Dino, R.N. Altruism, agency, and the competitiveness of family firms. Manag. Decis. Econ. 2002, 23, 247–259. [Google Scholar] [CrossRef]

- Dyer, W.G.; Nenque, E.; Hill, E.J. Toward a theory of family capital and entrepreneurship: Antecedents and outcomes. J. Small Bus. Manag. 2014, 52, 266–285. [Google Scholar] [CrossRef]

- Schulze, W.S.; Lubatkin, M.H.; Dino, R.N. Exploring the agency consequences of ownership dispersion among the directors of private family firms. Acad. Manag. J. 2003, 46, 179–194. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.; Sharma, P. Succession and nonsuccession concerns of family firms and agency relationship with nonfamily managers. Fam. Bus. Rev. 2003, 16, 89–107. [Google Scholar] [CrossRef]

- Astrachan, J.H.; Klein, S.B.; Smyrnios, K.X. The F-PEC Scale of Family Influence: A Proposal for Solving the Family Business Definition Problem. Fam. Bus. Rev. 2002, 15, 45–58. [Google Scholar] [CrossRef]

- Sharma, P.; Chrisman, J.J.; Chua, J. Strategic Management of the Family Business: Past Research and Future Challenges. Fam. Bus. Rev. 1997, 10, 1–35. [Google Scholar] [CrossRef]

- Arregle, J.L.; Hitt, M.A.; Sirmon, D.G.; Very, P. The development of organizational social capital: Attributes of family firms. J. Manag. Stud. 2007, 44, 73–95. [Google Scholar] [CrossRef]

- Brannon, D.L. A Socioemotional Wealth Perspective in Small Family Firms. Acad. Entrep. J. 2016, 22, 51–65. [Google Scholar]

- Barney, J.B.; Ouchi, W. Organizational Economics; Jossey Bass: San Francisco, CA, USA, 1986. [Google Scholar]

- Eisenhardt, K.M. Agency theory: An assessment and review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar]

- Schulze, W.S.; Gedajlovic, E.R. Whither Family Business? J. Manag. Stud. 2010, 47, 191–204. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurial risk taking in family firms. Fam. Bus. Rev. 2005, 18, 23–40. [Google Scholar] [CrossRef]

- Miller, J.S.; Wiseman, R.M.; Gomez-Mejia, L.R. The fit between CEO compensation design and firm risk. Acad. Manag. J. 2002, 45, 745–756. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Lester, R.H.; Cannella, A.A. Are family firms really superior performers? J. Corp. Financ. 2007, 13, 829–858. [Google Scholar] [CrossRef]

- March, J.G.; Shapira, Z. Variable risk preferences and the focus of attention. Psychol. Rev. 1992, 99, 172–183. [Google Scholar] [CrossRef]

- Miller, K.D.; Chen, W.R. Variable organizational risk preferences: Tests of the March-Shapira model. Acad. Manag. J. 2004, 47, 105–115. [Google Scholar] [CrossRef]

- Kasperski, S.; Holland, D.S. Income diversification and risk for fishermen. Proc. Natl. Acad. Sci. USA 2013, 110, 2076–2081. [Google Scholar] [CrossRef] [PubMed]

- Crowder, L.B.; Murawski, S.A.; Crowder, B.L.B.; Murawski, S.A. Fisheries Bycatch: Implications for Management Fisheries Bycatch: Implications for Management. Fisheries 1998, 23, 8–17. [Google Scholar] [CrossRef]

- Smith, C.L.; McKelvey, R. Specialist and Generalist: Roles for Coping with Variability. N. Am. J. Fish. Manag. 1986, 6, 88–99. [Google Scholar] [CrossRef]

- Beehr, T.A.; Drexler, J.A.; Faulkner, S. Working in small family business: Empirical comparisons to nonfamily business. J. Organ. Behav. 1997, 18, 297–312. [Google Scholar] [CrossRef]

- Pascoe, S.; Cannard, T.; Jebreen, E.; Dichmont, C.M.; Schirmer, J. Satisfaction with fishing and the desire to leave. Ambio 2015, 44, 401–411. [Google Scholar] [CrossRef] [PubMed]

- Hilborn, R. Fleet dynamics and individual variation: Why some people catch more fish than others. Can. J. Fish. Aquat. Sci. 1985, 42, 2–13. [Google Scholar] [CrossRef]

- Hilborn, R.; Walters, C.J. A general model for simulation of stock and fleet dynamics in spatially heterogeneous fisheries. Can. J. Fish. Aquat. Sci. 1987, 44, 1366–1370. [Google Scholar] [CrossRef]

- Mc Fadden, D. Conditional logit analysis of qualitative choice behavior. In Frontiers in Econometrics; Zarembka, P., Ed.; Academic Press: New York, NY, USA, 1973. [Google Scholar]

- Sharma, P. An Overview of the Field of Family Business Studies: Current Status and Directions for the Future. Fam. Bus. Rev. 2004, 17, 1–36. [Google Scholar] [CrossRef]

- Schulze, W.S.; Lubatkin, M.H.; Dino, R.N. Toward a theory of agency and altruism in family firms. J. Bus. Ventur. 2003, 18, 473–490. [Google Scholar] [CrossRef]

- Dyer, G.W. Examining the “Family Effect”on Firm Performance. Fam. Bus. Rev. 2006, 19, 253–273. [Google Scholar] [CrossRef]

- Dudley, R.G. A Basis for Understanding Fishery Management Dynamics. Syst. Dyn. Rev. 2008, 24, 1–29. [Google Scholar] [CrossRef]

- Van Putten, I.E.; Kulmala, S.; Thébaud, O.; Dowling, N.; Hamon, K.G.; Hutton, T.; Pascoe, S. Theories and behavioural drivers underlying fleet dynamics models. Fish Fish. 2012, 13, 216–235. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Rung-Hoch, N. Sustainable entrepreneurial orientation in family firms. Sustainability 2017, 9, 1212. [Google Scholar] [CrossRef]

- McConaughy, D.L.; Matthews, C.H.; Fialko, A.S. Founding family controlled firms: Performance, risk, and value. J. Small Bus. Manag. 2001, 39, 31–49. [Google Scholar] [CrossRef]

| Variable | Mean | St Deviat. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Diversification | 0.202 | 0.356 | 1 | ||||||||||

| 2 | Firm capacity (GRT) | 6.228 | 2.859 | 0.333 ** | 1 | |||||||||

| 3 | Firm capacity (HP) | 125.841 | 75.386 | 0.289 ** | 0.633 ** | 1 | ||||||||

| 4 | Skipper’s age | 43.476 | 11.150 | 0.052 † | −0.119 ** | −0.132 ** | 1 | |||||||

| 5 | Fam Employees (FE)(1) | 1.059 | 1.435 | 0.027 | 0.101 ** | −0.015 | −0.104 ** | 1 | ||||||

| 6 | Fam Firm | 0.501 | 0.500 | −0.053 † | −0.016 | −0.055 * | −0.008 | 0.737 ** | 1 | |||||

| 7 | Beta risk | 363.229 | 102.692 | 0.058 * | 0.015 | 0.009 | 0.003 | −0.007 | −0.001 | 1 | ||||

| 8 | Perf. hazard | −0.055 | 0.185 | −0.081 ** | −0.021 | −0.008 | 0.040 | 0.165 ** | 0.012 | −0.002 | 1 | |||

| 9 | Epsilon risk | 317.662 | 119.199 | 0.115 ** | 0.369 ** | 0.186 ** | −0.110 ** | −0.060 * | 0.036 | 0.041 | −0.262 ** | 1 | ||

| 10 | Generations | 1.490 | 0.796 | −0.027 | 0.176 ** | 0.007 | −0.150 ** | 0.107 ** | 0.161 ** | −0.008 | 0.096 ** | 0.030 | 1 | |

| 11 | Family manager | 0.398 | 0.490 | 0.065 * | 0.189 ** | 0.100 ** | 0.117 ** | 0.019 | 0.118 ** | 0.034 | 0.046 | 0.461 ** | 0.001 | 1 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coeff | St Err | Coeff | St Err | Coeff | St Err | Coeff | St Err | Coeff | St Err | Coeff | St Err | Coeff | St Err | ||||||||

| Constant | −4.684 | 0.582 | *** | −4.783 | 0.589 | *** | −4.403 | 0.610 | *** | −4.622 | 0.599 | *** | −4.804 | 0.619 | *** | −4.793 | 0.592 | *** | −4.902 | 0.599 | *** |

| Firm capacity | 0.221 | 0.033 | *** | 0.208 | 0.034 | *** | 0.235 | 0.035 | *** | 0.220 | 0.033 | *** | 0.208 | 0.034 | *** | 0.228 | 0.036 | *** | 0.210 | 0.034 | *** |

| Vessels power | 0.003 | 0.001 | *** | 0.004 | 0.001 | *** | 0.003 | 0.001 | *** | 0.003 | 0.001 | *** | 0.004 | 0.001 | ** | 0.003 | 0.001 | ** | 0.004 | 0.001 | ** |

| Manager age | 0.020 | 0.007 | ** | 0.022 | 0.008 | ** | 0.020 | 0.008 | ** | 0.019 | 0.008 | ** | 0.022 | 0.008 | ** | 0.021 | 0.008 | ** | 0.025 | 0.008 | ** |

| Beta risk | 0.001 | 0.001 | † | 0.001 | 0.001 | † | 0.001 | 0.001 | ** | 0.001 | 0.001 | * | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 | |||

| Perf. hazard | −0.001 | 0.001 | † | −0.001 | 0.001 | † | −0.001 | 0.001 | † | −0.001 | 0.001 | −0.001 | 0.001 | † | −1.603 | 0.367 | *** | −0.001 | 0.001 | *** | |

| Epsilon risk | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.001 | |||||||

| Fam Firm | −0.179 | 0.150 | −0.438 | 0.229 | † | −0.318 | 0.232 | −0.192 | 0.153 | −0.439 | 0.229 | † | −0.111 | 0.245 | −0.580 | 0.239 | ** | ||||

| Fam.Employees (FE) | 0.122 | 0.080 | 0.093 | 0.079 | 0.142 | 0.194 | −0.026 | 0.089 | −0.030 | 0.106 | |||||||||||

| FE*Beta risk | 0.000 | 0.000 | |||||||||||||||||||

| FE*Perf.Hazard | 1.602 | 0.367 | *** | ||||||||||||||||||

| FE*Epsilon | 0.001 | 0.000 | * | ||||||||||||||||||

| Generations | −0.245 | 0.097 | * | ||||||||||||||||||

| Family manager | 0.068 | 0.162 | |||||||||||||||||||

| Log likelihood | −598.385 | −597.218 | −594.035 | −598.296 | −597.212 | −587.418 | −594.955 | ||||||||||||||

| Bayes Info Criterion | 1247.183 | 1252.051 | 1252.887 | 1254.208 | 1259.241 | 1239.653 | 1254.727 | ||||||||||||||

| Pseudo R-squared | 0.721 | 0.722 | 0.723 | 0.721 | 0.722 | 0.726 | 0.723 | ||||||||||||||

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Herrero, I. Family Involvement and Sustainable Family Business: Analysing Their Effects on Diversification Strategies. Sustainability 2017, 9, 2099. https://doi.org/10.3390/su9112099

Herrero I. Family Involvement and Sustainable Family Business: Analysing Their Effects on Diversification Strategies. Sustainability. 2017; 9(11):2099. https://doi.org/10.3390/su9112099

Chicago/Turabian StyleHerrero, Ines. 2017. "Family Involvement and Sustainable Family Business: Analysing Their Effects on Diversification Strategies" Sustainability 9, no. 11: 2099. https://doi.org/10.3390/su9112099