1. Introduction

Noise coming from aviation and its supporting operations is a crucial issue at airports across the world. The aviation industry has come a long way in efficiency and sustainability thanks to improvements in operations and technology [

1]. It must be stated that huge improvements in technology have been made, so the level of noise coming from a single airplane is much lower than a few decades ago. Sustainable development in different aspects [

2], as well as of air transport through the reduction of aircraft noise pollution at airports is promoted by the EU Environmental Noise Directive [

3] and the associated Balanced Approach Regulation [

4].

In recent years, air transport has grown in significance. In the pre-accession of Poland to the European Union period, in the years 1989–2004, air transport was developing very slowly [

5]. After accession, post-socialist countries eliminated the barriers to entering their aviation markets [

6,

7]. Moreover, market liberalization resulted in new EU member countries being penetrated by low-cost carriers, which introduced new routes to destinations mainly in Western Europe [

8].

Apart from the undoubted benefits of the sustainable development of society, this form of transport also generates some broadly defined costs (social and economic). There is no doubt that an increase in the level of aircraft noise is and will be an increasingly serious problem for people living in the vicinity of airports (both large international airports and less important local ones). This is connected with the development of regional airports and the intensification of air traffic in their area, but, most importantly, with the growing number of international flights. Three factors influence noise burden: the number of flights, the level of noise emitted by each airplane, and the time of flight. Other factors that may have an impact include flight paths and procedures, the distribution of flights in flight paths, or the use of runways. The characteristic features of aircraft noise are the fact that it occurs instantly, quickly obtains its maximum level, and then rapidly decreases. Consequently, many inhabitants of the areas surrounding airports complain about the level of noise, although the results of aircraft noise measurements show that it does not contribute to permissible noise levels being exceeded significantly. Given the above, it seems necessary to examine the consequences of the vicinity of an airport.

An overview of the studies of the negative influence of aircraft noise allows us to distinguish its most important spheres [

9]:

Physical and mental health of people influenced by an airport (numerous studies show that exposure to aircraft noise destabilises one’s mental condition, causes anxiety, increases aggression and excitability, raises blood pressure, disturbs heart and breath rhythms, reduces brain efficiency, and is the cause of an increased number of heart attacks and coronary diseases, as well as contributing to hearing deficiency or loss and speech disorders [

10];

Sleep quality (which is directly affected by aircraft noise at night and indirectly influenced by noise during the day) [

11,

12];

Work efficiency (noise sensitivity increases the probability of disturbances in the execution of tasks and reduces work efficiency);

Learning at schools (recent research shows a relationship between noise and children’s ability to learn and absorb information) [

13];

Voice communication (both indoors and outdoors; this may involve interfering a conversation, watching television, or listening to the radio);

Using park and leisure areas (research shows that users find noise a very important factor influencing the quality of rest) [

14];

Air traffic noise has the most negative effect on housing prices. Meanwhile, road and train noises have similar but smaller effects [

15];

The market value of residential properties (almost all studies confirm the negative impact of noise on the market value of properties located near the airport).

In the paper, the influence of aircraft noise on the last of the above spheres will be discussed. Real properties are a specific good, which is a result of their physical, economic, institutional–legal and environmental features. The specificity of the real estate market is determined by the unique attributes of a property [

16]. Structural and locational attributes could have been considered by house buyers as a vital factor in property transactions [

17]. Having examined these features, it is justifiable to say that the market value of a property is influenced not only by its direct characteristics (such as the size and shape of a plot, the age of a building, construction type, technical condition [

18]), but also factors that involve its broadly defined surroundings [

19]. Studies of the determinants of housing prices in developed markets often take into account environmental components [

20,

21,

22,

23,

24]. These factors may be divided into two groups according to the kind of impact: positive influence (e.g., the vicinity of green areas, bodies of water) and negative influence (e.g., noise, air pollution) [

21]. The indoor environment of each building depends on some criteria, like temperature, humidity, noise, etc. [

25,

26].

The remainder of this paper is structured as follows. The next section presents a review of the literature on the relationship between aircraft noise and real estate prices in the areas surrounding an airport assessment. Section three presents study area, data collection and variables, and the methodological background of the hedonic models applied. Section four presents and analyzes the results obtained. The last section presents concluding remarks.

2. Literature Review

The externalities resulting from airport operation, particularly aircraft noise, represent social costs, which may be identified as a change in the value of properties located in the area affected by airport activities. The most frequently used methods of noise cost estimation included are based on revealed preferences. Revealed preferences are consumer choices, and they are analyzed with the use of historical data on property sales. Of all the models based on revealed preferences, the hedonic price model is the most frequently used method for analyzing the influence of airport operation on the property market.

In order to determine the annoyance costs related to noise, noise depreciation indices (NDIs) are used. NDIs are defined as the percent increase in the loss of property market values caused by a unit increase in noise exposure and are identified with the use of hedonic price methods. By now, there are approximately 50 HP studies for airports in Canada and the US, and probably an equal number of non-North American airports [

27]. The aircraft noise literature has been previously reviewed by Nelson [

27], Schipper et al. [

28], Bateman et al. [

29] and Wadud [

30]. A summary of these studies is presented in

Table 1.

These NDI estimates indicate that housing prices react differently across countries. This variation may be the result of different noise metrics (Noise Exposure Forecast (NEF), Noise Number Index (NNI), Australian Noise Exposure Forecast (ANEF), day–night sound Level (Leq, Ldn)), or different airport scales or different urban spatial structure. Otherwise different functional forms of models (linear, log-linear) used also account for a considerable part of the variation in these NDI estimates [

30]. Moreover, some researchers argue that NDI and wealth are positively correlated. Wadud [

30] carried out meta-regression analysis and concluded that the NDI tends to be higher in developed countries.

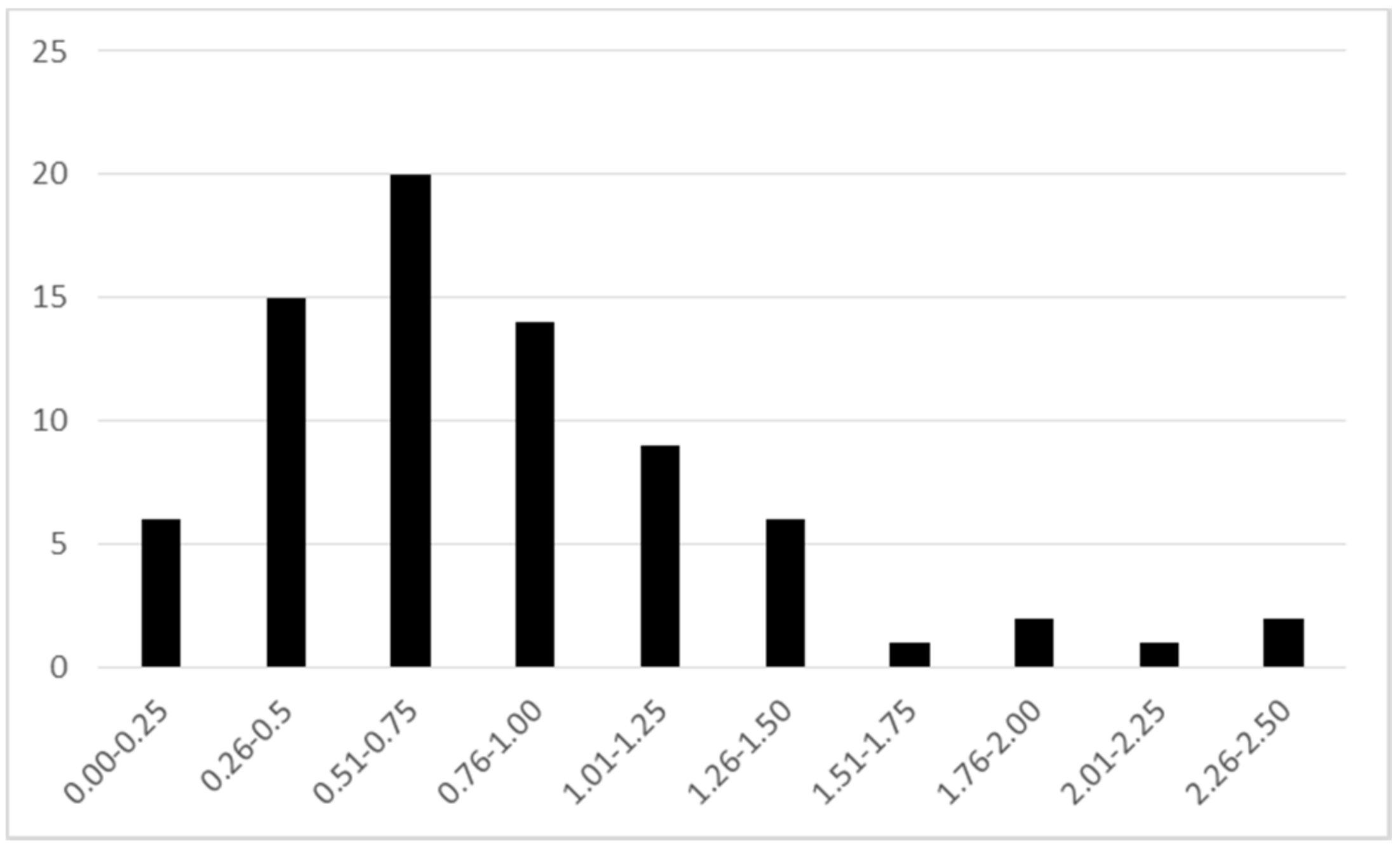

Figure 1 summarizes the NDI estimates through a frequency distribution based on 79 studies carried out form 1970 till 2016 all over the world.

Taking into account some recent studies, most of them were carried out in Europe (

Table 2). There are a few new analyses regarding European case studies [

31,

32,

33,

34,

35,

36,

37,

38,

39,

40,

41,

42,

43,

44]. All of these European analyses of the relationship between aircraft noise and real estate prices in the areas surrounding an airport confirmed a negative influence of aircraft noise on the market value of properties. The NDI ranges from 0.5% to 1.7% per decibel. However, difficulties may arise when comparing the obtained results since different noise indicators, thresholds, types of property and sources of data were used in these studies.

3. Methods and Data

3.1. Study Area

Poznan is located in Central-Western Poland, in the central part of Wielkopolskie Province. It is the fifth largest city in Poland by population (541.6 thousand inhabitants) and the eight largest by size (262 sq km). There are two airports within the administrative borders of the city of Poznan: Poznan Lawica International Airport and Poznan Krzesiny military airport, part of NATO structures.

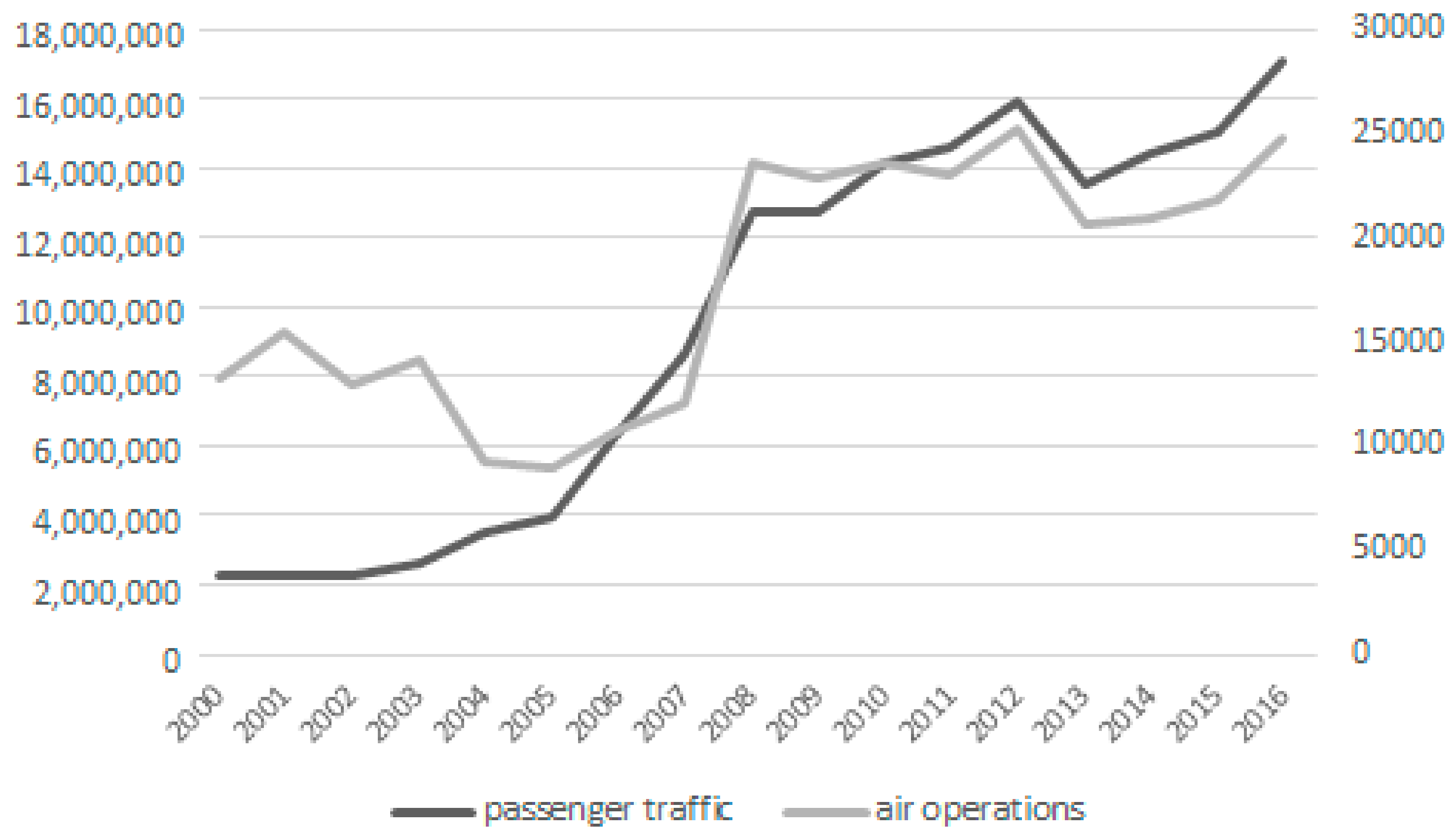

Henryk Wieniawski Poznan Lawica International Airport (code IATA: POZ, code ICAO: EPPO), an international airport and one of the oldest airports in Poland, is located seven kilometres west of the centre of Poznan. As of 2015, it was the seventh largest Polish airport regarding the number of passengers carried and the number of airport operations (see

Figure 2). Two modern passenger terminals ensure the capacity of 1900 passengers arriving and 1100 passengers departing per hour. In the years 2011–2013, owing to European funds, Lawica Airport was extended, and now it has a complex of passenger terminals which can handle up to 3.5 m passengers yearly.

Henryk Wieniawski Poznan Lawica International Airport operates regular flight connections to more than 30 airports. In recent years, it has handled approximately 1.5 million passengers a year (in the years 2010–2016).

In the case of Krzesiny, the 31st Air Base, it is an air force base located in South-East Poznan. The 31st Air Base is an air force unit for military operations conducted as part of the national defence system and a NATO very high readiness joint task force. In 2001, it was modernised so that it could handle F–16 aircraft. The grounds of the base have a rectangular shape. In the years 2001–2002, it was thoroughly modernized. It was actually entirely re-built. Now, it can handle practically all aircraft that are operated.

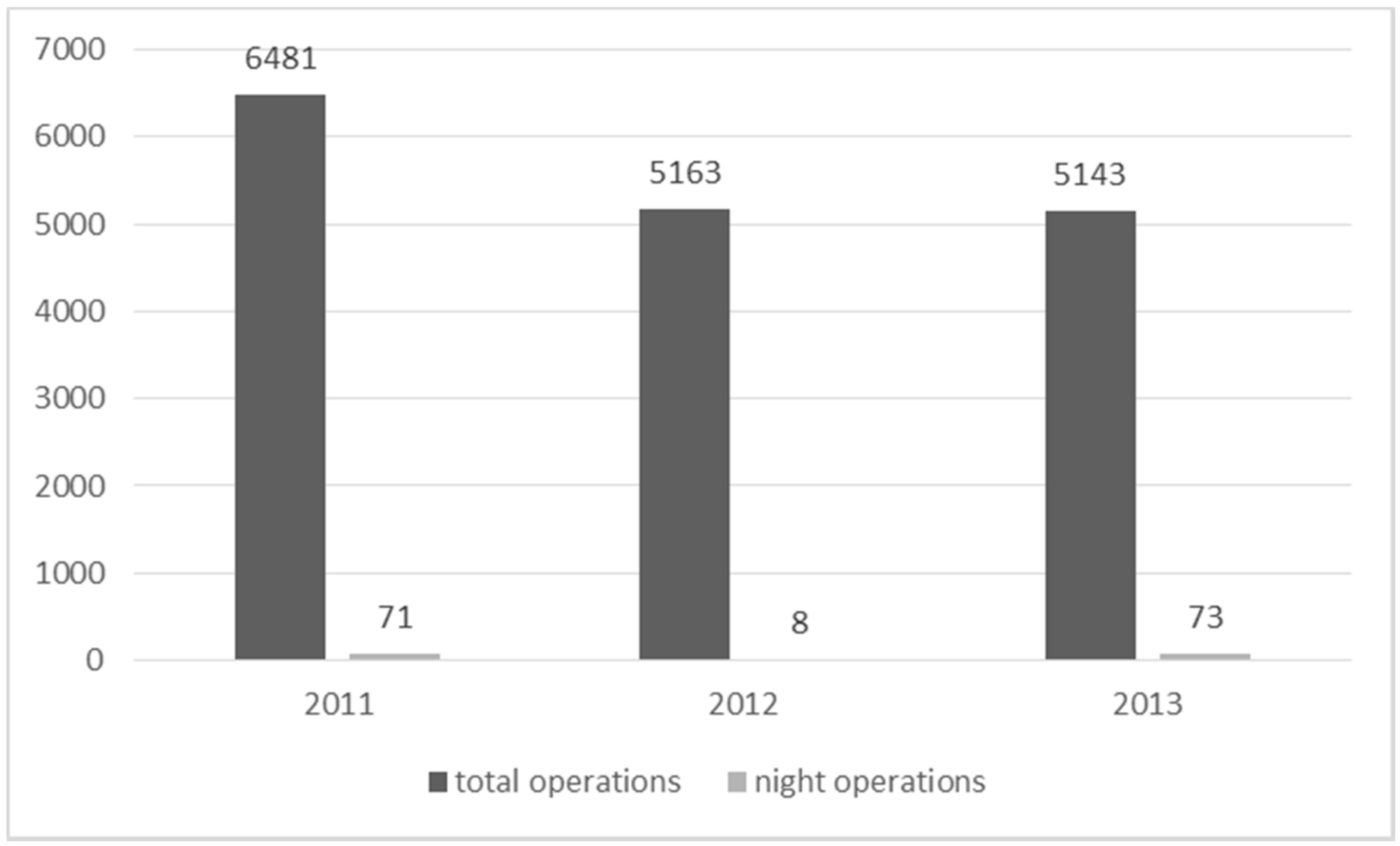

In comparison to 2011, in 2013 the total number of operations fell by 20.6% (from 6481 to 5143), with the number of night operations on almost the same level as in 2011 (see

Figure 3). Such a big drop in the number of air operations significantly contributes to the improvement of the acoustic climate in the vicinity of the Poznań-Krzesiny airport. At the military airport in Poznan, supersonic multirole fighter aircraft F-16 Block 52+ are presently used. The 31st Air Base has 32 such planes.

3.2. Data Collection and Variables

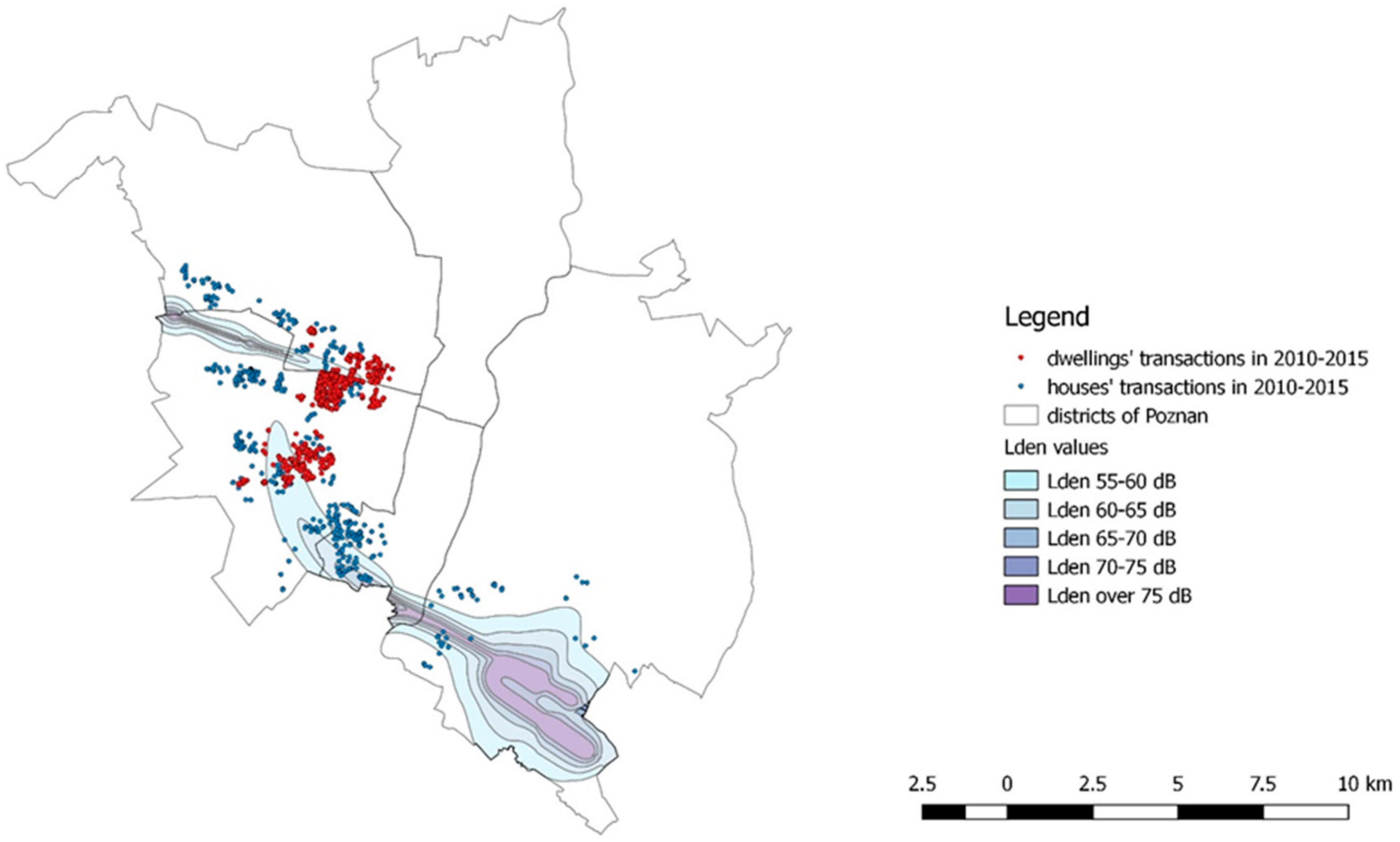

The research is based on transaction data (

Figure 4 shows the map of Poznan, noise counters produced by two airports and property sales). The data on apartment transactions conducted from the first quarter of 2010 to the fourth quarter of 2015 was obtained from the Board of Geodesy and Municipal Cadastre in Poznan. The obtained data referred to the transactions concerning all kinds of properties, both residential and non-residential (e.g., commercial properties or garages). In the process of data cleansing, purchases of more than one residential unit and non-free market transactions (e.g., debt collector sales) were removed. The data included in notarial contracts concerning apartments contain the following information: the transaction date, the price, the area of an apartment, the floor on which an apartment is located, and the area of any auxiliary premises (e.g., a garage/parking spot in an indoor parking lot or a cellar/residents’ cupboard). Such a set of factors may bias the results of the research, as notarial contracts do not include information on strong pricing components such as, for example, the construction technology. Then, thanks to the cadastre data, a great deal of information on the height of buildings and the year of construction was added. Using the street view application on maps.google.com, the missing data concerning the height, year of construction, and, first of all, technology was provided. Then, with the use of Googlemaps API (application program interface), the addresses were geocoded (addresses of transactions).

The data included in notarial contracts concerning single-family houses contain the following information: the transaction date, the price, the area of plot, gross covered area. Then, thanks to the cadastre data, a great deal of information on the number of floors and the year of construction was added. Using the street view application on maps.google.com, the missing data concerning the number of overground and underground floors and the year of construction was provided. Moreover, we specified the type of roof (flat, sloping), the type of building (detached, semi-detached, terraced), the type of garage (whether an integral part of a house or detached), and, first of all, the technical condition of a building on the basis of external elements (based on historical photos). There is no doubt that floor space is an important factor regarding. Unfortunately, it is included in less than 10% of the observations in notarial deeds. That is why we decided to establish the area of a building taking into account the built-up area, number of aboveground floors, correction factor, the existence of a garage and the type of roof.

Spatial analyses were performed using the QGIS software. Those transactions, which took place within the area affected by aircraft noise (treatment group) and within 1.0 km from this zone (control group), were analyzed. In this research, apartments built before 1950 were excluded because such apartments are located mainly in the city center. Moreover, in the case of such apartments, the technical condition of a building is a significant determinant of their value (our dataset does not include this factor), which might affect the results obtained.

Table 3 and

Table 4 summarize the descriptive statistics (mean and standard deviation) of the variables used in the study. Based on a distance of 1.0 km from the aircraft noise, we sorted the housing transactions into a treatment group consisting of properties located in the noise zone (single-family houses, 107 observations, and apartments, 158 observations) and a control group with properties located outside (1 km buffer, e.g., [

45,

46]) the aircraft noise zone (single-family houses, 331 observations, and apartments, 1170 observations). We used the transaction prices in the logarithm term as the response variable in our models.

The information on aircraft noise zones was taken from an acoustic map from 2012. Directive 2002/49/EC of the European Parliament requires the carrying out of a long-term policy of environmental protection against noise in the European Union countries. Its realization is based on the estimation of the long-term noise indicators Lden and Ln in the areas under protection. The threshold value used in this study was 55 dB. In order to establish both airports’ noise influence on the acoustic map of Poznań, the following data was used: the acoustic characteristics of the aircraft used, arrival and departure routes, glide paths, take-off and landing profiles, and the distribution of the intensity of flights during daytime, in the evenings and at night.

Within the reach of aircraft noise Lden (Lawica and Krzesiny airports combined), there were 2137 inhabitants in the range from 65 to 75 dB. The number of inhabitants exposed to Lden noise at a level of 55–65 dB is about 26,000.

3.3. Hedonic Price Models

Mathematical statistics methods are broadly applied to analyze the pricing of real estate [

47,

48,

49,

50,

51,

52,

53,

54]. The most commonly applied methods of housing evaluation are divided into two groups: traditional and advanced methods. The advanced methods include techniques such as hedonic price modelling (HPM), artificial neural networks (ANN), case-based reasoning, and spatial analysis methods. The HPM is an ideal analytical tool to analyze a non-homogeneous commodity regarding its attributes.

The first documented use of hedonic regression dates back to 1922, when G. A. Hass developed the farmland price model [

55]. The first researcher to use the hedonic method to analyze the real estate market was probably Ridker, who aimed to identify the influence of pollution reduction on house prices [

56]. The theoretical framework of the hedonic method was developed by Lancaster [

57] and Rosen [

58].

The idea of the hedonic method lies in the assumption that the price of heterogeneous goods may be characterised by their attributes. In other words, this method allows us to estimate the value of the particular attributes of a given product. The price of a given good is the response variable, while its quantitative and qualitative attributes are the explanatory variables. The equation may be written as follows (1):

where

P is the price of a good,

β is the regression coefficient,

X is an attribute of a good (value driver),

u is a random error.

One of the key issues in hedonic methods is the choice of the form of the regression function. The log-linear (natural logarithm) form of the regression function is most frequently used for studying changes in the real estate market in empirical research. As housing is a heterogeneous good, it is difficult to indicate a full list of crucial attributes. The heterogeneity of real estate hinders the measurement of price impacts. Taking into account Malpezzi [

59] and Crompton’s [

60] suggestions, six major categories of characteristics of housing may be distinguished: (1) structural attributes, (2) neighborhood related services and features, (3) location and accessibility, (4) environmental attributes, (5) community attributes and (6) time-related features. In our study, we examine the implicit value of the aircraft noise. We hypothesize that transaction price is a function of structural features, locational attributes, time and aircraft noise. The basic hedonic function of price (y) can be stated as:

In this research, we used several variants of hedonic regression, namely standard ordinary least squares (OLS), robust weighted least squares (WLS) and spatial models. According to WLS, the estimation was made with the following steps: an OLS regression was run, then the logs of the squares of residuals become the dependent variable in an auxiliary regression, on the right-hand side of which are the original independent variables plus their squares. The fitted values from the auxiliary regression were then used to construct a weighted series, and the original model was re-estimated using weighted least squares [

61]. In recent years, a growing concern has risen regarding the spatial dependence found in most house price data. Spatial dependence intuition was presented by Tobler [

62], who concluded that there is a reason to believe that things that are near will be more related than distant ones. As one of the most important features of the housing market is the importance of location, the hypothesis of the spatial dependence of house prices seems plausible. The spatial-lag model is based on the assumption that the spatially weighted average of housing prices in a neighbourhood affects the price of each house (indirect effects) in addition to the features of housing and neighbourhood characteristics (direct effects) [

63]. The ordinary least squares (OLS) hedonic estimates are not biased, but estimation efficiency may be lowered by spatial dependence. The obtained results can be biased, especially regarding their statistical significance [

64,

65]. The model that deals with this interpretation of spatial dependence is called the spatial error model (SEM). In contrast, the spatial error model does not include indirect effects, but it assumes that there may be one or more omitted variable in the hedonic price equation and that the omitted variable(s) vary spatially [

63]. Due to this spatial pattern in the omitted variables, the error term of the hedonic price equation tends to be spatially autocorrelated. The econometric model dealing with this kind of spatial dependence is called the spatial lag model, or spatial autoregressive (SAR) model. In the spatial lag model, spatial dependence is assumed to be present in the additional explanatory variable.

4. Results

Among the apartment characteristics checked for in the research were the following: year of transaction, area of the apartment, age, construction technology, floor, the height of the building, basement, distance to city center and finally range of aircraft noise. In the case of single-family houses, we used: year of the transaction, the area of the house, age of the building, underground floor, quality of the building, basement, garage, type of plot ownership, distance to city center and range of aircraft noise. The choice of qualitative and quantitative data was limited by the availability of information in the database.

Table 5 presents the variables used in the study in case of single-family houses and

Table 6 regarding apartments.

To address the research questions, hedonic regression equations using ordinary least squares and spatial models were estimated. The dependent variable was the natural log of a sales price. Gretl and Geodaspace software were used to estimate the parameters of functions.

Houses are heterogeneous in nature. This heterogeneity may be the reason for heteroscedasticity in the residuals of the estimation of the function. Indeed, we found heteroscedasticity in the case of apartments (there was no problem in case of single-family homes, according to Breusch–Pagan and Koenker–Basset tests). That is why we used OLS with heteroscedasticity correction (WLS). Moreover, we tested for the presence of multicollinearity as it leads to unstable coefficients and inflated standard errors. The variance inflation factors (VIFs) was used to detect multicollinearity. The VIF values in the model do not exceed 4.7 in case of single-family houses and 2.8 in case of apartments, which is in line with the most conservative rules of thumb that the mean of the VIFs should not be considerably higher than 10. Tests for the normality of residuals are presented in

Table 7.

In order to test for the presence of spatial effects in the data, we calculated spatial weights between observations [

66]. Based on the geographical coordinates, we created (438 × 438 for sing-family houses and 1328 × 1328 for apartments) spatial weight matrixes based on the distance between them; a 200 m for apartments and 400 m for single-family houses threshold distance d was assumed. We tested different threshold distances and decided to use these as they had the highest value of I-Moran statistics. Following the arguments of Anselin [

67], tests for the presence of spatial effects were carried out (both spatial autocorrelation and spatial lag dependence). To conclude, we found strong evidence of spatial dependence in the form of spatial autocorrelation and spatial lag.

The estimation results for single-family houses are presented in

Table 8 and for apartments in

Table 9.

The estimated models were well-fitted in case of apartments, as they explained about 82% of the price variations. As far as for the single-family houses, the models explained from 65–66%, depending on the model. Almost all of the variables applied in the models turned out to be statistically relevant, and the expected coefficient signs were correct. The results of the spatial models (in the case of single-family houses and apartments) suggest that spatial effects were present in the data, in the form of unobserved variables and significant spatial processes (in the case of single-family houses).

We observed that within the period under study (2010–2015), time had a significant impact on transaction prices. It is worth mentioning that housing prices in the biggest cities in Poland increased by about 100% between 2006 and 2007 [

68,

69]. At the end of 2007, the subsequent decreasing phase in the property price cycle began, resulting from this abnormal price increase and the beginning of financial crisis [

70]. It is worth noticing that in the case of single-family houses, this downturn was higher than considering apartments in the analyzed locations.

Taking into account the perspective of this paper’s objectives, the statistical relevance of the air-noise variable is important. The application of the log-linear model enabled the percentage difference in the price of the single-family house/apartment with similar characteristics located within aircraft noise zones and the 1.0 km buffer zone to be identified. The value of the air-noise coefficient in the SEM model (the regression coefficients obtained in models were similar, however for the interpretation we used the SEM model as it is most robust) reached the value of −0.0447 (

Table 8), which indicates that a single-family house located in area affected by the aircraft noise was about 4.59% cheaper (in the area with aircraft noise level values of Lden 55–60 dB), 9.18% cheaper (in the area with aircraft noise level values of Lden 60–65 dB) and 13.77% cheaper (in the area with aircraft noise level values of Lden 65–70 dB) than a single-family house (with the same characteristics) located in the 1.0 km buffer zone (with aircraft noise under 55 dB) in the years 2010–2015. In case of apartments, this decrease was smaller- it was about 2.86% (Lden 55–60 dB).

5. Conclusions

To our best of our knowledge, this study is one of the first studies to address the effects of aircraft noise (measured with Lden) on real estate value in the post-socialist urban context. While the problem has been addressed in many articles, most of them focused on areas in the USA, Canada and Western European countries. Moreover, we managed to distinguish the influence of aircraft noise on different types of housing. In earlier studies, mainly one type of housing (for example apartments) was the basis of the analysis. It was difficult, actually impossible, to compare NDIs for different types of housing, taking into account differences in the location of airports, residential markets, various periods, measures of noise, model specifications.

This article aimed to identify the impact of aircraft noise created by airports on apartment and single-family house prices in Poznan. In this research, the hedonic method in OLS, WLS, SEM and SAR models were used. The application of the log-linear model allowed the identification of the percentage difference in the price of an apartment with similar features located within the noise zones and outside. In order to compare the obtained results with previous studies, we estimated the NDI values. The NDI value we found in our study was 0.87 in the case of single-family houses, which means there is a 0.87% value discount per decibel (Lden noise indicator). Regarding apartments, the NDI was a 0.57% decrease of value per 1 dB of aircraft noise. The reason for the difference in the level of impact of aircraft noise may be the fact that the buyers of such apartments may be less sensitive to aircraft noise than the owners of single-family houses, who, because of higher noise levels cannot fully take advantage of the benefits related to a single family home (e.g., limited enjoyment of their garden).

Our investigation showed that the sensitivity of buyers differs depending on housing type. Although the results are reasonable, our proposal is not without limitations, which are mainly related to the possible change of acoustic climates and the limitations of the dataset regarding the variables describing properties. Our study was made on based on the acoustic map from the year 2012, so some limitation may arise, as the acoustic climate of the city may have changed. However, we were not able to overcome this issue as the map is created every five years. On the other hand, taking into account the number of flights (a rather stable number), it may be assumed that aircraft noise did not change significantly. As far as the dataset is concerned, gathering the data for a housing market analysis is always a huge challenge. In the case of our research, we used different sources of information, however, we were not able to control directly for the quality of an apartment or a single-family house (inside). Moreover, the impact of aircraft noise in other cities in Poland may be different as the influence of wealth effects is regionally distributed.

In this regard, future research should be carried out in other cities in Poland so that it would be possible to compare NDI values from different airports. In order to increase the comparability of future research, they should be based on the same assumptions (variables describing the properties, time scope, methods used). It could provide a chance to examine the impact of regional wealth effects on NDI values.