The Sustainability of Global Chain Governance: Network Structures and Local Supplier Upgrading in Thailand

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. Study Context

3.2. Data

3.3. Variables

3.4. Statistical Methods

4. Empirical Results

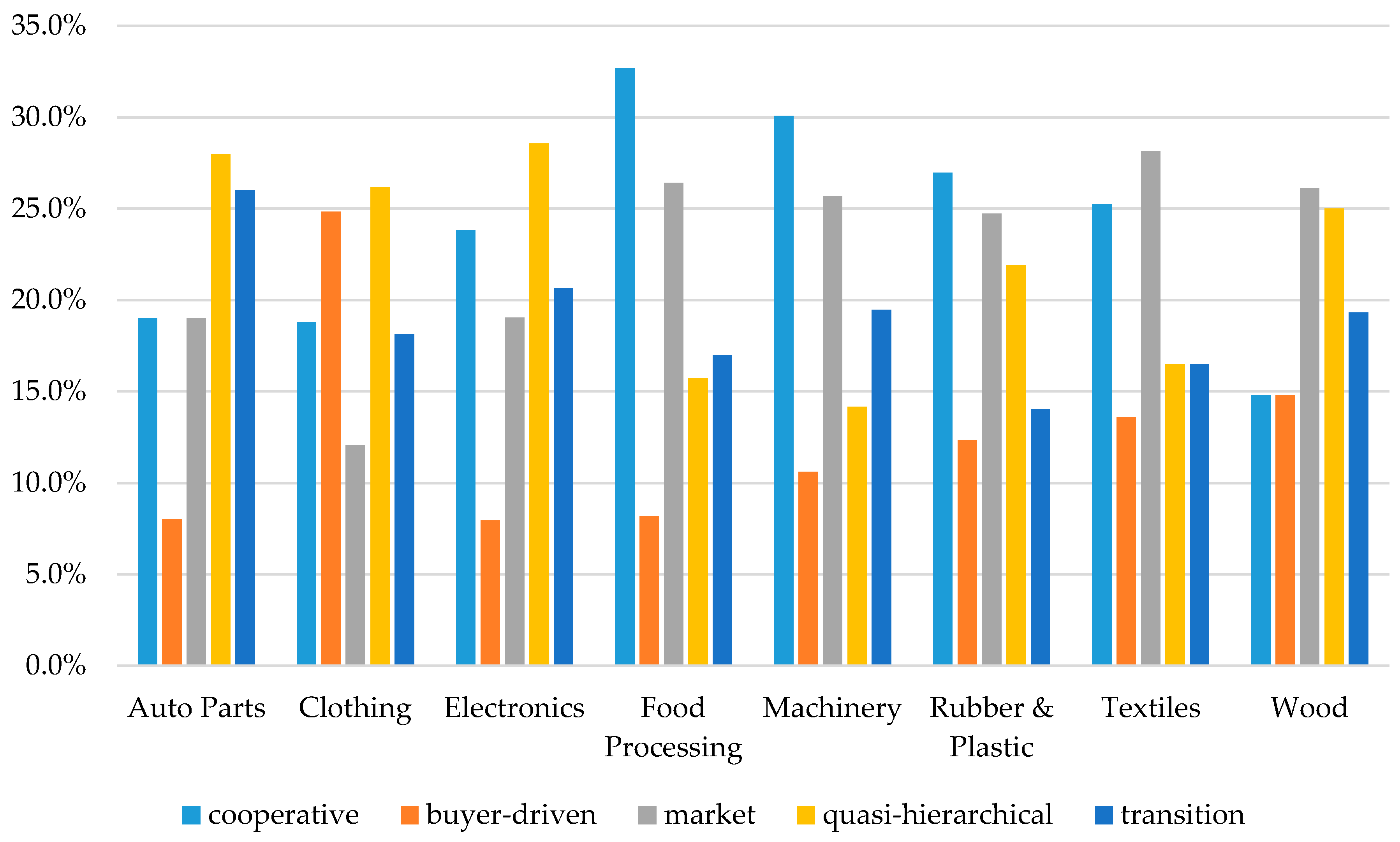

4.1. Results of Latent Class Analysis

4.2. Results of Logistic Regressions

5. Discussion and Conclusions

Author Contributions

Conflicts of Interest

References

- UNIDO. Industrial Development Report 2002/2003. Competing Through Innovation and Learning; United Nations: Vienna, Austria, 2002. [Google Scholar]

- Crespo, J.; Suire, R.; Vicente, J. Lock-in or lock-out? How structural properties of knowledge networks affect regional resilience. J. Econ. Geogr. 2014, 14, 199–219. [Google Scholar]

- Grabher, G. The Embedded Firm; Routledge: London, UK, 1993. [Google Scholar]

- Dicken, P. Global Shift: Mapping the Changing Contours of the World Economy; Sage: London, UK, 2011. [Google Scholar]

- Yeung, H.W.C. Rethinking relational economic geography. Trans. Inst. Br. Geogr. 2005, 30, 37–51. [Google Scholar] [CrossRef]

- Hobday, M. The electronics industries of the Asia-Pacific: Exploiting international production networks for economic development. Asia Pac. Econ. Lit. 2001, 15, 13–29. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. How does insertion in global value chains affect upgrading in industrial clusters? Reg. Stud. 2002, 36, 1017–1027. [Google Scholar] [CrossRef]

- Kim, L.; Nelson, R.R. Technology, Learning, and Innovation: Experiences of Newly Industrializing Economies; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Lee, K.; Lim, C. Technological regimes, catching-up and leapfrogging: Findings from the Korean industries. Res. Policy 2001, 30, 459–483. [Google Scholar] [CrossRef]

- Amsden, A.H. Asia’s Next Giant: South Korea and Late Industrialization; Oxford University Press: New York, NY, USA, 1989. [Google Scholar]

- Lall, S. Learning to Industrialize: The Acquisition of Technological Capability by India; Macmillan Press: London, UK, 1987. [Google Scholar]

- Schmitz, H. Global competition and local co-operation: Success and failure in the Sinos Valley, Brazil. World Dev. 1999, 27, 627–650. [Google Scholar] [CrossRef]

- Fagerberg, J.; Srholec, M.; Verspagen, B. Innovation and economic development. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; North Holland: Amsterdam, The Netherlands, 2010; pp. 833–872. [Google Scholar]

- Hall, B. Innovation and diffusion. In The Oxford Handbook of Innovation; Fagerberg, J., Mowery, D.C., Nelson, R., Eds.; Oxford University Press: Oxford, UK, 2007; pp. 459–484. [Google Scholar]

- Kim, L. Imitation to Innovation: The Dynamics of Korea’s Technological Learning; Harvard Business School Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Amin, A.; Thrift, N.J. Globalization, Institutions, and Regional Development in Europe; Oxford University Press: New York, NY, USA, 1994. [Google Scholar]

- Hess, M.; Yeung, H.W. Whither global production networks in economic geography? Past, present, and future. Environ. Plan. A 2006, 38, 1193–1204. [Google Scholar]

- Zanfei, A. Transnational firms and the changing organisation of innovative activities. Camb. J. Econ. 2000, 24, 515–542. [Google Scholar] [CrossRef]

- Chong, Y.Q.; Wang, B.; Tan, G.L.Y.; Cheong, S.A. Diversified firms on dynamical supply chain cope with financial crisis better. Int. J. Prod. Econ. 2014, 150, 239–245. [Google Scholar] [CrossRef]

- Mizgier, K.J.; Wagner, S.M.; Holyst, J.A. Modeling defaults of companies in multi-stage supply chain networks. Int. J. Prod. Econ. 2012, 135, 14–23. [Google Scholar] [CrossRef]

- Lee, B.K.; Zhou, R.; de Souza, R.; Park, J. Data-driven risk measurement of firm-to-firm relationships in a supply chain. Int. J. Prod. Econ. 2016, 180, 148–157. [Google Scholar] [CrossRef]

- Mizgier, K.J.; Wagner, S.M.; Jüttner, M.P. Disentangling diversification in supply chain networks. Int. J. Prod. Econ. 2015, 162, 115–124. [Google Scholar] [CrossRef]

- Dolan, C.; Humphrey, J. Changing governance patterns in the trade in fresh vegetables between Africa and the United Kingdom. Environ. Plan. A 2004, 36, 491–509. [Google Scholar] [CrossRef]

- Ivarsson, I.; Alvstam, C.G. Supplier Upgrading in the Home-furnishing Value Chain: An Empirical Study of IKEA’s Sourcing in China and South East Asia. World Dev. 2010, 38, 1575–1587. [Google Scholar] [CrossRef]

- Ernst, D.; Kim, L. Global production networks, knowledge diffusion, and local capability formation. Res. Policy 2002, 31, 1417–1429. [Google Scholar] [CrossRef]

- Vang, J.; Asheim, B. Regions, absorptive capacity and strategic coupling with high-tech TNCs: Lessons from India and China. Sci. Technol. Soc. 2006, 11, 39–66. [Google Scholar] [CrossRef]

- Coe, N.M.; Hess, M.; Yeung, H.W.; Dicken, P.; Henderson, J. ‘Globalizing’ regional development: A global production networks perspective. Trans. Inst. Br. Geogr. 2004, 29, 468–484. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2014. Investing in the SDGs: An Action Plan; United Nations: Geneva, Switzerland, 2014. [Google Scholar]

- UNCTAD. World Investment Report 2005. Transnational Corporations and the Internationalization of R&D; United Nations: New York, NY, USA, 2005. [Google Scholar]

- Lall, S.; Narula, R. FDI and Its Role in Economic Development: Do We Need a New Agenda? Research Memoranda No. 019; MERIT, Maastricht Economic Research Institute on Innovation and Technology: Maastricht, The Netherlands, 2004. [Google Scholar]

- Chaminade, C.; Vang, J. Innovation policy for small and medium size SMEs in Asia: An innovation systems perspective. In Handbook of Research on Asian Business; Yeung, H.W., Ed.; Edward Elgar: Cheltenham, UK, 2006; pp. 381–408. [Google Scholar]

- OECD. Oslo Manual: The Measurement of Scientific and Technological Activities: Proposed Guidelines for Collecting and Interpreting Technological Innovation Data; OECD, Organisation for Economic Co-Operation and Development: Paris, France, 1992. [Google Scholar]

- Hobday, M. East Asian latecomer firms. World Dev. 1995, 23, 1171–1193. [Google Scholar] [CrossRef]

- Hedge, D.; Shapira, P. Knowledge, technology trajectories, and innovation in a developing country context: Evidence from a survey of Malaysian firms. Int. J. Technol. Manag. 2007, 40, 349–370. [Google Scholar]

- Vermunt, J.K.; Magidson, J. Latent class cluster analysis. In Applied Latent Class Analysis; Hagenaars, J.A., McCutcheon, A.L., Eds.; Cambridge University Press: London, UK, 2002; pp. 89–106. [Google Scholar]

- Clogg, C.C. Latent class models for measuring. In Latent Trait and Latent Class Models; Langeheine, R., Rost, J., Eds.; Plenum Press: New York, NY, USA, 1988; pp. 173–205. [Google Scholar]

- Muthén, B.; Muthén, L. Integrating person-centered and variable-centered analyses: Growth mixture modeling with latent trajectory classes. Alcohol. Clin. Exp. Res. 2000, 24, 882–891. [Google Scholar] [CrossRef] [PubMed]

- Rogers, W. Regression standard errors in clustered samples. Stata Tech. Bull. 1993, 13, 19–23. [Google Scholar]

- Saliola, F.; Zanfei, A. Multinational firms, global value chains and the organization of knowledge transfer. Res. Policy 2009, 38, 369–381. [Google Scholar] [CrossRef]

- Gereffi, G. International trade and industrial upgrading in the apparel commodity chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Cantwell, J.; Zhang, Y. Why is R&D internationalization in Japanese firms so low? A path-dependent explanation. Asian Bus. Manag. 2006, 5, 249–269. [Google Scholar]

- Lam, A. Organizational learning in multinationals: R&D networks of Japanese and US MNEs in the UK. J. Manag. Stud. 2003, 40, 673–703. [Google Scholar]

- Frank, A.G.; Cortimiglia, M.N.; Ribero, J.L.D.; de Oliveira, L.S. The effect of innovation activities on innovation outputs in the Brazilian industry: Market-orientation vs. technology-acquisition strategies. Res. Policy 2016, 45, 577–592. [Google Scholar] [CrossRef]

| Criteria | Number of Latent Clusters | |||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| AIC | 13,040 | 12,474 | 12,366 | 12,163 | 12,077 | 12,083 |

| BIC | 13,064 | 12,523 | 12,439 | 12,261 | 12,198 | 12,229 |

| Variables | Non-Supplier | Network Modes | ||||

|---|---|---|---|---|---|---|

| Cooperative | Buyer-Driven | Market | Quasi-Hierarchical | Transition | ||

| MNC R&D | 0.00 | 1.00 | 0.00 | 0.00 | 0.94 | 0.47 |

| Send | 0.00 | 0.54 | 0.81 | 0.14 | 0.59 | 0.32 |

| Standards | 0.00 | 0.91 | 0.81 | 0.72 | 0.97 | 0.90 |

| Specification | 0.00 | 0.09 | 0.94 | 0.07 | 0.94 | 0.44 |

| Process | 0.35 | 0.70 | 0.51 | 0.59 | 0.58 | 0.55 |

| Minor Product | 0.62 | 0.91 | 0.81 | 0.81 | 0.85 | 0.84 |

| Major Product | 0.37 | 0.67 | 0.47 | 0.55 | 0.53 | 0.59 |

| Brand | 0.43 | 0.63 | 0.42 | 0.63 | 0.39 | 0.57 |

| Internal R&D (%) | 0.04 | 0.06 | 0.05 | 0.05 | 0.08 | 0.06 |

| OJT | 0.47 | 0.77 | 0.69 | 0.71 | 0.80 | 0.74 |

| External R&D | 0.04 | 0.15 | 0.06 | 0.12 | 0.12 | 0.07 |

| Export | 0.30 | 0.77 | 0.84 | 0.75 | 0.69 | 0.77 |

| Associational | 0.40 | 0.66 | 0.65 | 0.65 | 0.63 | 0.67 |

| % College | 17.78 | 23.68 | 19.62 | 23.26 | 21.95 | 22.51 |

| % Reinvestment | 25.85 | 24.56 | 33.50 | 30.68 | 34.06 | 27.22 |

| ISO | 0.17 | 0.48 | 0.40 | 0.44 | 0.48 | 0.51 |

| Year | 0.47 | 0.51 | 0.26 | 0.29 | 0.48 | 0.39 |

| Age | 15.07 | 16.37 | 15.88 | 16.71 | 15.84 | 17.71 |

| Size | 101.16 | 279.52 | 129.31 | 141.11 | 182.69 | 181.37 |

| Variables | Model 1 | Model 2 | ||||||

|---|---|---|---|---|---|---|---|---|

| Process | Minor Product | Major Product | Brand | Process | Minor Product | Major Product | Brand | |

| MNC supplier | 0.171 ** | 0.200 ** | 0.120 ** | 0.010 | ||||

| (0.023) | (0.025) | (0.027) | (0.032) | |||||

| GOV1—collaborative | 0.267 ** | 0.239 ** | 0.211 ** | 0.100 ** | ||||

| (0.139) | (0.028) | (0.037) | (0.032) | |||||

| GOV2—buyer-driven | 0.112 * | 0.199 ** | 0.042 | −0.107 * | ||||

| (0.054) | (0.036) | (0.066) | (0.043) | |||||

| GOV3—market | 0.171 ** | 0.182 ** | 0.109 * | 0.091 ** | ||||

| (0.022) | (0.025) | (0.044) | (0.032) | |||||

| GOV4—quasi-hierarchical | 0.145 ** | 0.187 ** | 0.066 | −0.128 * | ||||

| (0.044) | (0.034) | (0.038) | (0.050) | |||||

| GOV5—transition | 0.117 * | 0.190 ** | 0.140 ** | 0.047 | ||||

| (0.050) | (0.022) | (0.041) | (0.034) | |||||

| Internal R&D (%) | 4.944 ** | 2.542 | 6.640 ** | 3.200 | 4.990 ** | 2.570 | 6.763 ** | 3.533 |

| (1.354) | (2.143) | (2.320) | (2.014) | (1.548) | (2.122) | (2.267) | (1.944) | |

| OJT | 0.105 ** | 0.080 ** | 0.092 ** | 0.019 | 0.104 ** | 0.080 ** | 0.093 ** | 0.024 |

| (0.014) | (0.009) | (0.019) | (0.036) | (0.015) | (0.001) | (0.020) | (0.037) | |

| External R&D | 0.103 | 0.112 ** | 0.158 ** | 0.132 ** | 0.092 | 0.109 ** | 0.151 ** | 0.125 ** |

| (0.065) | (0.010) | (0.025) | (0.024) | (0.063) | (0.014) | (0.019) | (0.022) | |

| Export | −0.041 | −0.058 * | 0.002 | 0.110 | −0.041 | −0.059 * | 0.001 | 0.108 |

| (0.028) | (0.024) | (0.010) | (0.067) | (0.028) | (0.024) | (0.010) | (0.061) | |

| Associational | 0.009 | 0.065 * | 0.052 ** | −0.004 | 0.009 | 0.065 ** | 0.052 ** | −0.006 |

| (0.033) | (0.019) | (0.003) | (0.023) | (0.033) | (0.019) | (0.002) | (0.023) | |

| %College | 0.001 | 0.000 | 0.001 | 0.003 ** | 0.001 | 0.001 | 0.001 | 0.003 ** |

| (0.001) | (0.000) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| %Reinvestment | 0.000 | 0.000 | 0.000 | −0.000 | 0.000 | 0.000 | 0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| ISO | 0.161 ** | 0.064 ** | 0.090 ** | 0.044 | 0.162 ** | 0.064 ** | 0.089 ** | 0.043 |

| (0.021) | (0.015) | (0.019) | (0.025) | (0.023) | (0.016) | (0.018) | (0.023) | |

| Year | −0.039 * | 0.133 ** | 0.023 | −0.063 | −0.044 * | 0.131 ** | 0.018 | −0.061 |

| (0.018) | (0.015) | (0.044) | (0.039) | (0.018) | (0.015) | (0.043) | (0.040) | |

| Age | −0.000 | −0.001 | −0.004 ** | 0.004 | −0.000 | −0.001 | −0.004 ** | 0.004 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Size | 0.000 ** | −0.000 | 0.000 | 0.000 | 0.000 ** | −0.000 | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cho, S.; Lim, U. The Sustainability of Global Chain Governance: Network Structures and Local Supplier Upgrading in Thailand. Sustainability 2016, 8, 915. https://doi.org/10.3390/su8090915

Cho S, Lim U. The Sustainability of Global Chain Governance: Network Structures and Local Supplier Upgrading in Thailand. Sustainability. 2016; 8(9):915. https://doi.org/10.3390/su8090915

Chicago/Turabian StyleCho, Sungchul, and Up Lim. 2016. "The Sustainability of Global Chain Governance: Network Structures and Local Supplier Upgrading in Thailand" Sustainability 8, no. 9: 915. https://doi.org/10.3390/su8090915