The main feature of our model is that we incorporate the sustainable design effort investment into the manufacturer’s decision problem. We assume that the manufacturer can invest some sustainable design effort to improve the functionality of the products, which is costly but can make the products be suitable for more needed people. Thus, more investment on the sustainable design effort will have positive effect on the demand. We also assume that the demand is sensitive in the selling price. Specifically, we let

be the realized demand quantity, where

p and

e are the selling price and the sustainable design effort, respectively. We consider the following demand function

where

is the market size,

is the price sensitive parameter, and

is the design-effort sensitive parameter. In our setting, the market size

a is fixed, the sensitive parameters

b and

β are given, and the selling price

p and the design effort

e are the decision variables. If the design effort is not considered, this kind of demand function is commonly adopted (see, e.g., Zhao et al. [

16], Dong et al. [

6]). On the other hand, the sustainable design effort investment is costly. We assume that if the sustainable design effort investment is

e, then the sustainable design cost is

, where

θ is the cost sensitive parameter. The design investment cost is a quadratic function and increasing in the sustainable design effort. This kind of cost associated with sustainability analysis is commonly used (see, e.g., Savaskan and Van Wassenhove [

20], Gurnani and Drkoc [

21], Dong et al. [

6]). To avoid a non-trial case, we assume that

. The other cost parameters include the unit production cost

c and the fixed production cost

F. We assume that the fixed production cost cannot be too large. Specifically, we assume

. It is easy to check that this is the upper bound on

F such that the manufacturer can at least achieve non-negative profit in the centralized case.

Regarding the product distribution channel for the manufacturer, we also consider two cases: the decentralized case, where the products is distributed through a separate retailer, and the centralized case, where the products is distributed through the manufacturer’s own retailing channel. We will find the optimal solutions in the different cases and also compare the results. In the following sections, we will first consider the decentralized case and then the centralized case.

3.1. The Decentralized Case

In the decentralized case, the manufacturer designs and wholesales the products to a separate retailer, and the retailer sells the products to the end market. We assume a Stackelberg game between the manufacturer and the retailer, where the former is the leader. Specifically, we assume that the manufacturer first determine the unit wholesale price w and the sustainable design effort investment e, and then the retailer determines the unit selling price p. We assume the retailer is always profit seeking, but the manufacturer aims at maximizing either the realized demand or the profit.

To formulate the problem, we denote

as the retailer’s profit given that the selling price is

p. Since the retailer is profit seeking, the retailer’s problem can be formulated as

We denote

as the retailer’s best response given the manufacturer’s decisions.

We denote

as the manufacturer’s profit given that the wholesale price is

w and the sustainable design effort investment is

e. We have

where

is the revenue from selling the products,

F is the fixed cost, and

is the sustainable design effort investment cost. We denote the manufacturer’s decision problem as

when the manufacturer is not for profit, and we denote the decision problem as

when the manufacturer is profit seeking. Then, problem

can be mathematically formulated as

and problem

can be formulated as

Since the retailer and the manufacturer perform in a Stackelberg game, we find the optimal solutions by backwards induction. We first solve the problem

and then the problem

(

). Consider the retailer’s decision problem

. From the demand function (1), the retailer’s profit function

can be written as

This is a quadratic function and the second order derivative of

versus

p is

, which implies that

is concave in

p, and thus the retailer’s best response can be determined by the first order condition. We have

Next, we submit the optimal price into the manufacturer’s problem. We will first solve the quantity maximization problem , and then the profit maximization problem .

Consider the quantity maximization problem

. From Equations (1)–(3), problem

can be reformulated in terms of

w and

e as follows:

Note that problem

is a constraint maximization problem. Thus, we can use a Lagrangian method to solve it. To apply a Lagrangian method, we first investigate the properties of the objective function and the constraint. First note that the objective function (4) is a linear function of

w and

e, which implies that the objective function is jointly concave over

w and

e. Regarding the constraint function

given by Equation (5), it is easy to check that its Hessian matrix is

where

,

, and the determinate

where the last inequality holds from our assumption that

. Thus, this Hessian matrix is negatively definite, which implies that the constraint (5) is also jointly convex in

w and

e. Therefore, the Karush–Kuhn–Tucker point of problem

is also its optimal solution. The Karush–Kuhn–Tucker point can be determined by using a Lagrangian parameter, and the results are summarized in the following proposition.

Proposition 1. In the decentralized case, if the manufacturer aims to maximize the realized demand quantity, then (i) the manufacturer’s optimal decisions arewhere , (ii) the retailer’s optimal price is(iii) the realized demand isand (iv) the constraint (5)

is binding. Proposition 1(iv) indicates that the manufacturer’s profit is zero. The retailer’s profit can be obtained as

Sensitivity analysis can be conducted regarding the above optimal solution, as summarized in the following proposition.

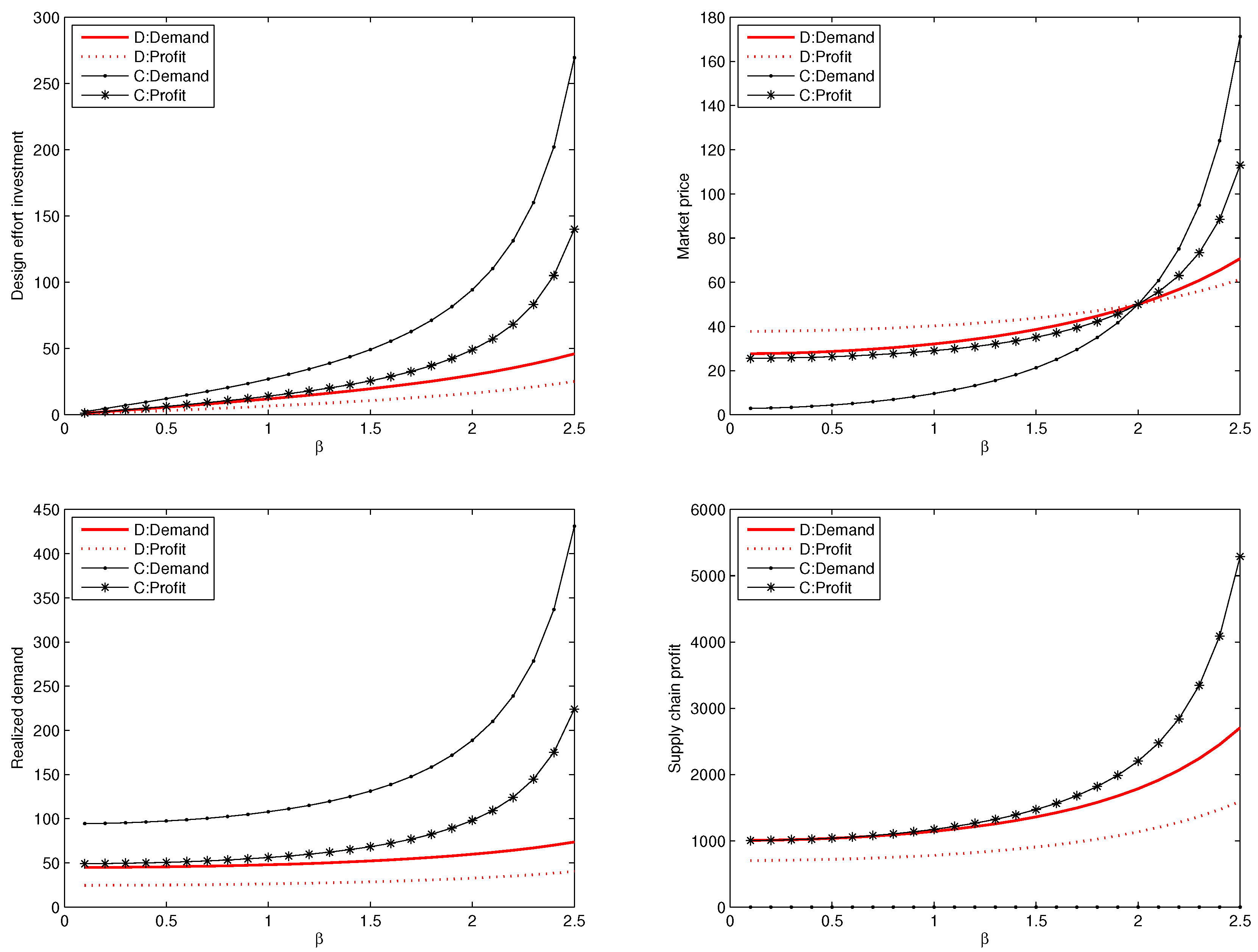

Proposition 2. Regarding the optimal decision variables to the decentralized problem, we have the following sensitivity analysis results: (i) the optimal price decreases in b and θ but increases in β; (ii) the optimal wholesale price decreases in b and θ but increases in β; (iii) the optimal sustainable design effort investment decreases in b and θ but increases in β; (iv) the optimal demand decreases in θ but increases in β, and (v) the retailer’s profit also increases in β but decreases in θ.

Next, we solve the profit maximization problem

. Recall that the manufacturer’s profit is

When solving problem

, we have checked that the Hessian matrix of the profit function

is jointly convex in

w and

e. Therefore, the optimal solution to problem

can be determined by considering the first order derivatives of

over

w and

e. The results are summarized in the following proposition.

Proposition 3. In the decentralized case, if the manufacturer aims to maximize the profit, then (i) the manufacturer’s optimal decisions are(ii) the retailer’s optimal price isand (iii) the realized demand is From Proposition 3, if the manufacturer aims at profit maximization, then the retailer’s profit is

and the manufacturer’s profit is

Recall that

is a demand quantity maximization problem, and that

is a profit maximization problem. Thus, it follows straightforwardly that

which can also be easily double checked from the optimal solutions in Propositions 1 and 3. Furthermore, from Propositions 1 and 3, we can obtain the following results by some simple algebra by using the assumption that

and the fact that

, the proof is thus omitted.

Proposition 4. (i) , , ; (ii) if , and otherwise.

Proposition 4(i) shows that when the manufacturer aims at maximizing the demand quantity rather than maximizing the profit, then he shall invest more on the sustainable design effort and set a lower wholesale price. Proposition 4(i) also shows that when the manufacturer aims at the demand quantity maximization, the retailer can achieve a better profit. Recall that the realized demand in this case is also greater than that in the profit-maximization case. Thus, when the manufacturer is not for profit, we can regard that the manufacturer split his own benefit into two parts. One part becomes the retailer’s profit, and the other part goes to benefit more customers.

Regarding the two optimal prices, the relation has different cases depending on the value of . This implies that the selling price in the profit maximization case may not necessarily be greater than that in the demand quantity maximization model.

3.2. The Centralized Case

In this subsection, we consider the centralized case, where the manufacturer distribute the products through its own channel, and the manufacturer determines both the sustainable design effort e as well as the selling price p. Similarly, we will also consider the optimal solutions in two different settings: the demand quantity maximization problem and the profit maximization problem. Note that the manufacturer makes all the decisions, we can regard this centralized case as a decision problem for the supply chain (consisting of the manufacturer and the retailer). Thus, we will use a subscript “SC" to denote the manufacturer’s problems and the profit.

Let

be the manufacturer’s profit. We have

If the manufacturer is not for profit and aims to maximize the demand quantity, then the problem is formulated as

and if the manufacturer is for profit and aims to maximize the profit, then the problem is formulated as

We first solve problem and then the problem .

Problem

is a constraint maximization problem, and thus we can also use a Lagrangian method to solve it. We first investigate the properties of the objective and the constraint of problem

. First note that the objective

is a linear function in both

p and

e, which implies that

must be jointly convex in

p and

e. Regarding the constraint

, from Equations (1) and (6), we have

the Hessian matrix of which is

Note that

,

, and the determinate

, where the last inequality holds from our assumption. Thus, this Hessian matrix is negatively definite, which implies that the constraint is also jointly convex in

p and

e. Therefore, the Karush–Kuhn–Tucker point determined by the Lagrangian method is also the optimal solution to problem

. The results are summarized in the following proposition. Note that to differentiate from the optimal solutions in the decentralized setting, we use a “hat" for all the optimal solutions in the centralized setting.

Proposition 5. In the centralized model, if the manufacturer aims to maximize the demand quantity, then (i) the optimal solution iswhere , (ii) the optimal demand quantity isand (iii) the constraint is blinded at the optimal solution. Note that, in this case, the profit for the supply chain is zero, i.e., , as indicated by Proposition 5(iii).

The following sensitivity results can be determined similarly to those in Proposition 2, and thus the proof is omitted.

Proposition 6. Regarding the optimal decision variables to the centralized problem, we have the following sensitivity analysis results: (i) the optimal price decreases in b and θ but increases in β; (ii) the optimal wholesale price decreases in b and θ but increases in β; (iii) the optimal sustainable design effort investment decreases in b and θ but increases in β; and (iv) the optimal demand decreases in θ but increases in β.

Next, we solve the profit maximization problem

. Recall that when investigating the properties of the constraint in problem

, we have shown that the Hessian matrix of the profit function

is jointly convex in

p and

e. Thus, the optimal solution can be obtained by considering the first-order derivatives. The results are summarized in the following proposition.

Proposition 7. In the centralized model, if the manufacturer aims to maximize the profit, then (i) the optimal solutions areand (ii) the optimal demand quantity is From Proposition 7, in the centralized case, the manufacturer’s (i.e., supply chain’s) optimal profit is given by

Recall that

is a demand quantity maximization problem, and that

is a profit maximization problem. Thus, it follows straightforwardly that

which can also be easily double checked from the optimal solutions in Propositions 5 and 7. Furthermore, from Propositions 5 and 7, we can obtain the following results by conducting some simple algebra and using the assumption that

and the fact that

, the proof is thus omitted.

Proposition 8. (i) ; (ii) if , and otherwise.

Proposition 8 shows that, in the centralized case, if the manufacturer is not for profit, then he will invest more on the sustainable design effort. However, the relation of the optimal prices of the two cases depends on the sign of , just like the case in the decentralized model.

Comparing Propositions 4 with 8, we can see that the relations of the optimal solutions look similar in the two cases. Either the supply chain is decentralized or centralized, the manufacturer will devote greater sustainable design effort if he is not for profit, and the relation of the optimal product selling prices, when the manufacturer’s objective differs, depends on the system parameters.