Analysis of the Threshold Effect of Financial Development on China’s Carbon Intensity

Abstract

:1. Introduction

2. Model Specification, Variables Selection and Data Sources

2.1. Model Specification

2.2. Variables and Data

2.2.1. Explained Variable

2.2.2. Core Explanatory Variables

2.2.3. Threshold Variable

2.2.4. Control Variables

2.3. Data Sources

3. Empirical Results and Analysis

3.1. Regional Carbon Intensity Measurement

3.2. Multi-Collinearity Test and Stationary Test

3.2.1. Multi-Collinearity Test

3.2.2. Stationary Test

3.3. Panel Threshold Effect Test

3.3.1. Panel Threshold Effect Test

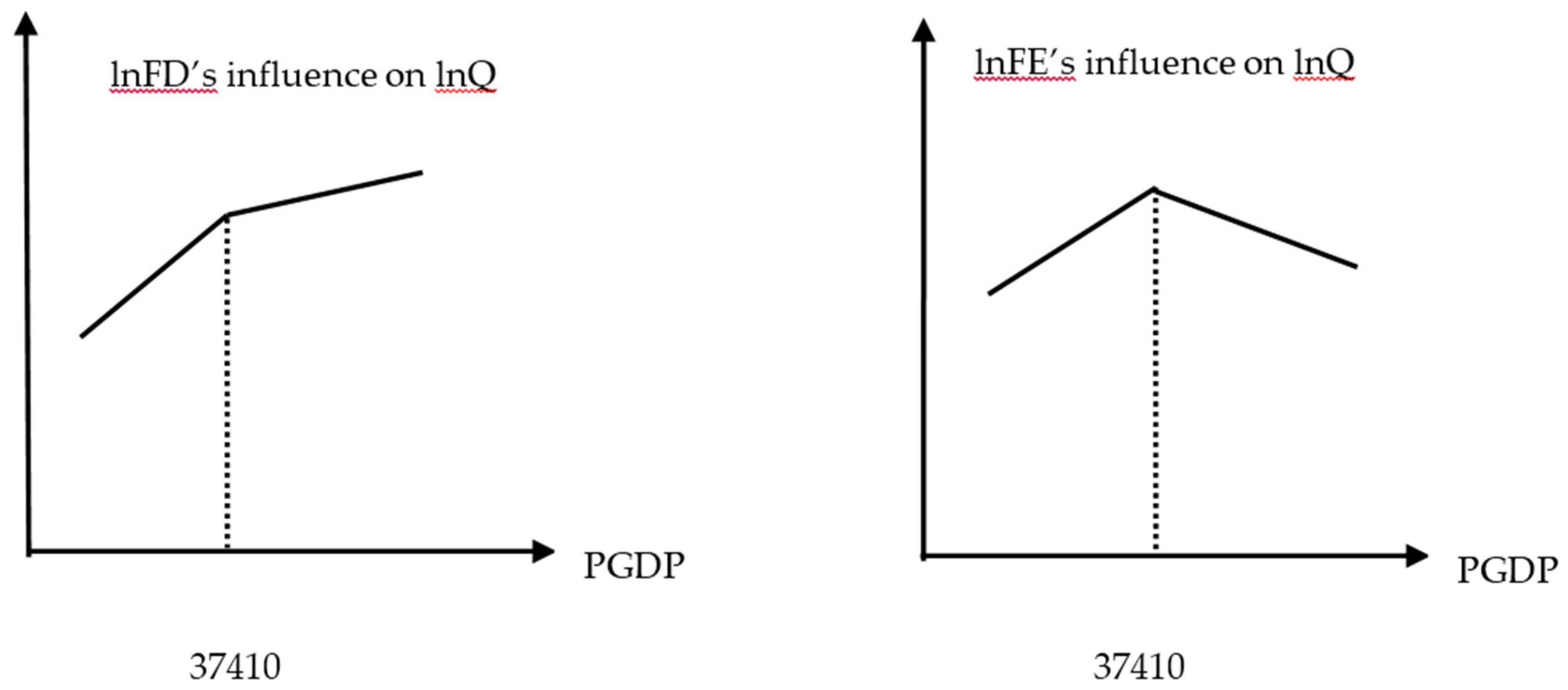

3.3.2. Analysis of the Core Explanatory Variables

3.3.3. Analysis of the Threshold Variable

3.3.4. Analysis of the Control Variables

3.4. Discussion

4. Conclusions and Policy Suggestions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Miomir, J.; Ljiljana, K.; Aleksandra, D.; Vladimir, K. The Impact of Agro-Economic Factors on GHG Emissions: Evidence from European Developing and Advanced Economies. Sustainability 2015, 7, 16290–16310. [Google Scholar]

- Vallati, A.; Grignaffini, S.; Romagna, M. A New Method to Energy Saving in a Micro Grid. Sustainability 2015, 7, 13904–13919. [Google Scholar] [CrossRef]

- Knight, K.W.; Schor, J.B. Economic Growth and Climate Change: A Cross-National Analysis of Territorial and Consumption-Based Carbon Emissions in High-Income Countries. Sustainability 2014, 6, 3722–3731. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, C. Dose Higher Economic and Financial Development Lead to Enviromental Degradation: Evidence from the BRIC Countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B.B. A Model of Growth and Finance: FIML Estimates for India. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef] [Green Version]

- Sadorsky, P. Financial Development and Energy Consumption in Central and Eastern European Frontier Economies. Energ. Pol. 2011, 39, 999–1006. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K. Economic Growth, Energy Consumption, Financial Development, International Trade and CO2 Emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef] [Green Version]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does Financial Development Reduce CO2 Emissions in Malaysian Economy? A Time Series Analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef] [Green Version]

- Omri, A. CO2 Emissions, Energy Consumption and Economic Growth Nexus in MENA Countries: Evidence from Simultaneous Equations Models. Energy Econ. 2013, 40, 657–664. [Google Scholar] [CrossRef]

- Boutabba, M.A. The Impact of Financial Development, Income, Energy and Trade on Carbon Emissions: Evidence from the Indian Economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef]

- Ziaei, S.M. Effects of Financial Development Indicators on Energy Consumption and CO2 Emission of European, East Asian and Oceania countries. Renew. Sustain. Energy Rev. 2015, 42, 752–759. [Google Scholar] [CrossRef]

- Al-mulali, U.; Che Sab, C.N.B. The Impact of Energy Consumption and CO2 Emissions on the Economic Growth and Financial Development in the Sub Saharan African Contries. Energy 2012, 39, 180–186. [Google Scholar] [CrossRef]

- Zhang, Y. The Impact of Financial Development on Carbon Emissions : An Empirical Analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the Long-run Relationship between Economic Growth, Electricity Consumption, Carbon Dioxide Emissions and Financial Development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 Emissions and Financial Development in an Emerging Economy: An Augmented VAR Approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econ. 1993, 93, 345–368. [Google Scholar] [CrossRef]

- Zhang, N.; Wei, X. Dynamic Total Factor Carbon Emissions Performance Changes in the Chinese Transportation Industry. Appl. Energy 2015, 146, 409–420. [Google Scholar] [CrossRef]

- Zhang, N.; Zhou, P.; Kung, C. Total-factor Carbon Emission Performance of the Chinese Transportation Industry: A Bootstrapped Non-radial Malmquist Index Analysis. Renew. Sustain. Energy Rev. 2015, 41, 584–593. [Google Scholar] [CrossRef]

- Li, J.; Wei, P. Financial Development and Total Factor Productivity Growth: Empirical Research Based on China’s Provincial Panel Data. Econ. Theory Bus. Manag. 2015, 35, 47–64. [Google Scholar]

- Zhao, Y.; Lei, D. Financial Development and Economic Growth: Productivity Promotion versus Capital Formation. J. World Econ. 2010, 33, 37–50. [Google Scholar]

- Pan, X.; Yang, Y. Research on Interactive Relationship between Foreign Trade and Carbon Emission: Based on Simultaneous Equation Model. Oper. Res. Manag. Sci. 2013, 01, 132–137. [Google Scholar]

- Zhang, N.; Choi, Y. Environmental Energy Efficiency of China’s Regional Economies: A Non-oriented Slacks-based Measure Approach. Soc. Sci. J. 2013, 50, 225–234. [Google Scholar] [CrossRef]

- Liu, L.; Liang, Q.; Wang, Q. Accounting for China’s Regional Carbon Emissions in 2002 and 2007: Production-based versus Consumption-based Principles. J. Clean Prod. 2015, 103, 384–392. [Google Scholar] [CrossRef]

- Huang, G.; Ouyang, X.; Yao, X. Dynamics of China’s regional carbon emissions under gradient economic development mode. Ecol. Indic. 2015, 51, 197–204. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics, No. 0435; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Pesaran, M.H. A Simple Panel Unit Root Test in the Presence of Cross-section Dependence. J. Appl. Econ. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Yang, Y. Impact of Non-state Economic Sector on China’s Industrial Enterprises Technical Efficiency. Econ. Res. J. 1998, 12, 29–35. [Google Scholar]

- Luo, X. The Effects of Privatization on Industrial Performance in Chinese Economic Transition—Analysis of the 2001 National Industrial Census data. Econ. Res. J. 2004, 8, 16–26. [Google Scholar]

- Zhang, N.; Choi, Y. Total-factor Carbon Emission Performance of Fossil Fuel Power Plants in China: A Metafrontier Non-radial Malmquist Index Analysis. Energy Econ. 2013, 40, 549–559. [Google Scholar]

- Zhang, N.; Kong, F.; Choi, Y.; Zhou, P. The Effect of Size-control Policy on Unified Energy and Carbon Efficiency for Chinese Fossil Fuel Power Plants. Energy Policy 2014, 70, 193–200. [Google Scholar] [CrossRef]

- Guo, W.; Sun, T.; Dai, H. Effect of Polution Structure Change on Cabon Emission in China. Sustainability 2016, 8, 225–244. [Google Scholar] [CrossRef]

- Liu, Y.; Xiao, H.; Zhang, N. Industrial Carbon Emissions of China’s Region: A Spatial Econometric Analysis. Sustainbility 2016, 8, 210–223. [Google Scholar] [CrossRef]

- Zhang, X.; Karplus, V.; Qi, T.; Zhang, D.; He, J. Carbon Emissions in China: How Far Can New Efforts Bend the Curve? Energy Econ. 2016, 54, 388–395. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X. Energy Policies for Managing China’s Carbon Emission. Renew. Sustain. Energy Rev. 2015, 50, 470–479. [Google Scholar] [CrossRef]

- Fang, J. Ownership, Institutional Environment and Capital Allocation. Econ. Res. J. 2007, 12, 82–92. [Google Scholar]

| Energy | Carbon Emission Coefficient | Energy | Carbon Emission Coefficient |

|---|---|---|---|

| Raw Coals | 0.7559 | Kerosene | 0.5714 |

| Cokes | 0.8550 | Diesel oils | 0.5921 |

| Crude oils | 0.5857 | Fuel oils | 0.6185 |

| Gasoline | 0.5538 | Natural gas | 0.4483 |

| Variable | Definitions and Measures | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| FD | total deposits and loans/GDP | 2.51 | 1.04 | 1.02 | 7.30 |

| FE | non-state enterprises’ loans/GDP | 0.58 | 0.34 | 0.05 | 2.05 |

| PGDP | GDP/population | 28,895.05 | 18,242.11 | 5052 | 93,173 |

| OPEN | total value of imports and exports/GDP | 4.61 | 5.29 | 0.61 | 22.91 |

| IND | added value of the tertiary industry/GDP | 40.28 | 7.79 | 22.49 | 75.9 |

| Province | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|---|

| Anhui | 1.90144 | 1.36451 | 1.18958 | 1.10726 | 1.09397 | 0.93355 | 0.82782 | 0.82952 |

| Beijing | 1.45569 | 0.55252 | 0.40509 | 0.30330 | 0.24163 | 0.20096 | 0.15946 | 0.13981 |

| Chongqing | 0.92751 | 0.94415 | 0.88350 | 0.91987 | 0.81199 | 0.68926 | 0.59926 | 0.50667 |

| Fujian | 1.35363 | 0.75283 | 0.64638 | 0.55118 | 0.53103 | 0.44041 | 0.44747 | 0.38235 |

| Gansu | 6.94534 | 2.38405 | 1.89134 | 1.45327 | 1.21831 | 1.15519 | 1.07602 | 0.99637 |

| Guangdong | 1.55875 | 0.62128 | 0.48035 | 0.39150 | 0.33149 | 0.30708 | 0.29690 | 0.26403 |

| Guangxi | 1.54945 | 0.87817 | 0.75054 | 0.59102 | 0.58898 | 0.55827 | 0.50909 | 0.47836 |

| Guizhou | 3.64512 | 3.66069 | 3.31357 | 2.63333 | 2.51270 | 2.25590 | 1.92486 | 1.72932 |

| Hainan | 5.88460 | 1.35323 | 0.87482 | 0.59004 | 0.47646 | 0.38644 | 0.35660 | 0.33750 |

| Hebei | 2.79879 | 1.88391 | 1.67803 | 1.45819 | 1.41319 | 1.33529 | 1.21284 | 1.16001 |

| Heilongjiang | 4.05115 | 1.88093 | 1.56659 | 1.37631 | 1.30290 | 1.20932 | 1.06992 | 1.02311 |

| Henan | 2.08490 | 1.64873 | 1.49686 | 1.22878 | 1.24076 | 1.07015 | 1.03017 | 0.87761 |

| Hubei | 2.06157 | 1.21532 | 1.01270 | 0.78297 | 0.72211 | 0.67893 | 0.63750 | 0.56490 |

| Hunan | 1.76974 | 1.11964 | 0.98802 | 0.75378 | 0.67246 | 0.58974 | 0.53322 | 0.46501 |

| Jiangsu | 1.79411 | 0.90178 | 0.73042 | 0.59991 | 0.53069 | 0.48686 | 0.47395 | 0.42985 |

| Jiangxi | 1.59919 | 0.97760 | 0.85529 | 0.72204 | 0.60309 | 0.56739 | 0.50250 | 0.44278 |

| Jilin | 3.35502 | 1.79084 | 1.41156 | 1.17851 | 1.07422 | 1.00141 | 0.95807 | 0.85643 |

| Liaoning | 7.08184 | 2.33665 | 1.66361 | 1.21257 | 1.05876 | 0.89305 | 0.77241 | 0.69305 |

| InnerMongolia | 3.18939 | 2.95333 | 2.57666 | 2.47261 | 2.10918 | 1.44130 | 2.22740 | 2.09400 |

| Ningxia | 7.27537 | 5.16797 | 4.81474 | 4.15534 | 3.81109 | 3.63708 | 3.80199 | 3.18811 |

| Qinghai | 2.62426 | 1.51255 | 1.30848 | 1.29453 | 1.27534 | 0.99087 | 1.05624 | 1.10665 |

| Shaanxi | 4.69738 | 1.94276 | 1.49322 | 1.23163 | 1.09761 | 1.04334 | 0.93498 | 0.96286 |

| Shandong | 3.18005 | 1.56106 | 1.29938 | 1.04829 | 0.97823 | 0.88589 | 0.80216 | 0.74262 |

| Shanghai | 2.06268 | 0.74217 | 0.53883 | 0.43768 | 0.36669 | 0.33923 | 0.30380 | 0.27157 |

| Shanxi | 5.49681 | 5.47125 | 4.77691 | 3.90441 | 3.65558 | 3.18935 | 3.01833 | 3.11805 |

| Sichuan | 1.18163 | 0.93797 | 0.86237 | 0.79653 | 0.77306 | 0.62439 | 0.51413 | 0.47465 |

| Tianjin | 3.06597 | 1.14203 | 0.88543 | 0.65727 | 0.55751 | 0.48651 | 0.42497 | 0.38496 |

| Xinjiang | 7.09467 | 2.32796 | 1.75726 | 1.43981 | 1.62031 | 1.35691 | 1.32471 | 1.40170 |

| Yunnan | 1.75297 | 1.72786 | 1.50856 | 1.30605 | 1.28461 | 1.15867 | 0.98748 | 0.88904 |

| Zhejiang | 1.92510 | 0.85781 | 0.70277 | 0.57596 | 0.52612 | 0.44134 | 0.39420 | 0.35477 |

| East | 2.92375 | 1.15503 | 0.90046 | 0.71145 | 0.63744 | 0.56392 | 0.51316 | 0.46914 |

| Central | 2.78998 | 1.93360 | 1.66219 | 1.38176 | 1.29564 | 1.15498 | 1.07219 | 1.02218 |

| West | 3.71664 | 2.22159 | 1.92366 | 1.66309 | 1.55484 | 1.35556 | 1.35965 | 1.25707 |

| China | 3.17880 | 1.75372 | 1.47876 | 1.23913 | 1.14934 | 1.01180 | 0.97261 | 0.90552 |

| Variable | lnFD | lnFE | lnOPEN | lnIND |

|---|---|---|---|---|

| lnFD | 1 | |||

| lnFE | 0.3690 | 1 | ||

| lnOPEN | 0.4676 | 0.3495 | 1 | |

| lnIND | 0.5128 | 0.2277 | 0.3624 | 1 |

| VIF value | 1.63 | 1.21 | 1.38 | 1.39 |

| Variable | Lag Order | |||

|---|---|---|---|---|

| 0 | 1 | 2 | 3 | |

| lnFD | 36.167 *** | 34.943 *** | 15.787 *** | 6.501 *** |

| lnFE | 52.533 *** | 47.726 *** | 29.263 *** | 18.054 *** |

| lnQ | 21.037 *** | 9.707 *** | 0.115 * | 0.665 * |

| lnPGDP | 6.912 *** | 3.130 *** | 3.382 *** | 0.761 * |

| lnOPEN | 38.268 *** | 38.268 *** | 31.226 *** | 28.829 *** |

| lnIND | 25.109 *** | 13.263 *** | 13.263 *** | 16.422 *** |

| Variable | lnFD | lnFE | lnQ | lnPGDP | lnOPEN | lnIND |

|---|---|---|---|---|---|---|

| CIPS | −2.673 * | −3.059 *** | −3.067 *** | −2.256 *** | −3.352 *** | −4.391 *** |

| Hypothesis Test | LR (0%, 5%, 1% Critical Points) | F | p |

|---|---|---|---|

| H0:No threshold; H1:Single threshold | 7.3523 (4.4754, 5.9906, 8.9557) | 30.2544 | 0.0000 |

| H0: Single threshold; H1:Double-threshold | 9.1527 (5.1598, 6.6852, 9.3089) | 18.5894 | 0.0000 |

| H0: Double-threshold; H1:Triple-threshold | 11.1324 (5.2659, 7.1286, 10.7881) | 6.6683 | 0.0630 |

| Model | Estimated Value of Threshold | 95% Confidence Interval |

|---|---|---|

| Single-threshold Model | 10.5297 | (9.8660, 11.1324) |

| Double-threshold Model | 10.3118 | (10.2635, 10.8349) |

| Variable | Linear Model | Variable | Single-Threshold Model |

|---|---|---|---|

| lnFD | 0.9482 *** (4.4059) | lnFD (lnPGDP < 10.5297) | 1.6455 *** (6.0460) |

| lnFD (lnPGDP ≥ 10.5297) | 0.5573 * (1.6813) | ||

| lnFE | −0.8283 *** (−4.0871) | lnFE (lnPGDP < 10.5297) | 0.8645 *** (4.1699) |

| lnFE (lnPGDP ≥ 10.5297) | −0.8446 *** (−4.3830) | ||

| lnOPEN | −0.2022 *** (−4.4795) | lnOPEN | −0.2184 *** (−4.8296) |

| lnIND | −1.3732 *** (−4.6436) | lnIND | −1.3114 *** (−4.6240) |

| Hausman Test | 23.78 *** | 23.78 *** | |

| Year | Low Zone(GDP per Capita < 37,410 yuan) | High Zone(GDP per Capita > 37,410 yuan) |

|---|---|---|

| 2005 | Guizhou, Gansu, Yunnan, Anhui, Guangxi, Sichuan, Jiangxi, Shaanxi, Qinghai, Ningxia, Hunan, Hainan, Chongqing, Henan, Hubei, Shanxi, Jilin, Heilongjiang, Hebei, Inner Mongolia, Fujian, Liaoning, Shandong, Guangodng, Jiangsu, Zhejiang, Tianjin | Beijing, Shanghai |

| 2009 | Guizhou, Gansu, Yunnan, Anhui, Guangxi, Sichuan, Jiangxi, Hainan, Qinghai, Xinjiang, Hunan, Henan, Hebei, Shanxi, Ningxia, Heilongjiang, Chongqing, Jilin, Fujian, Liaoning, Shandong, Shaanxi | Inner Mongolia, Guangdong, Zhejiang, Jiangsu, Tianjin, Beijing, Shanghai |

| 2012 | Guizhou, Gansu, Yunnan, Anhui, Guangxi, Sichuan, Jiangxi, Hainan, Qinghai, Xinjiang, Hunan, Henan, Hebei, Shanxi, Ningxia, Heilongjiang | Shanghai, Beijing, Tianjin, Jiangsu, Zhejiang, Guangdong, Inner Mongolia, Shandong, Liaoning, Fujian, Jilin, Chongqing, Hubei, Shaanxi |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, X.; Yan, Y.; Peng, X.; Liu, Q. Analysis of the Threshold Effect of Financial Development on China’s Carbon Intensity. Sustainability 2016, 8, 271. https://doi.org/10.3390/su8030271

Pan X, Yan Y, Peng X, Liu Q. Analysis of the Threshold Effect of Financial Development on China’s Carbon Intensity. Sustainability. 2016; 8(3):271. https://doi.org/10.3390/su8030271

Chicago/Turabian StylePan, Xiongfeng, Yaobo Yan, Xiaoxue Peng, and Qing Liu. 2016. "Analysis of the Threshold Effect of Financial Development on China’s Carbon Intensity" Sustainability 8, no. 3: 271. https://doi.org/10.3390/su8030271