Development of a Resource Allocation Model Using Competitive Advantage

Abstract

:1. Introduction

2. Preliminaries

3. Model

3.1. Development of a Resource Allocation Model

3.2. Resource Allocation

4. Examples

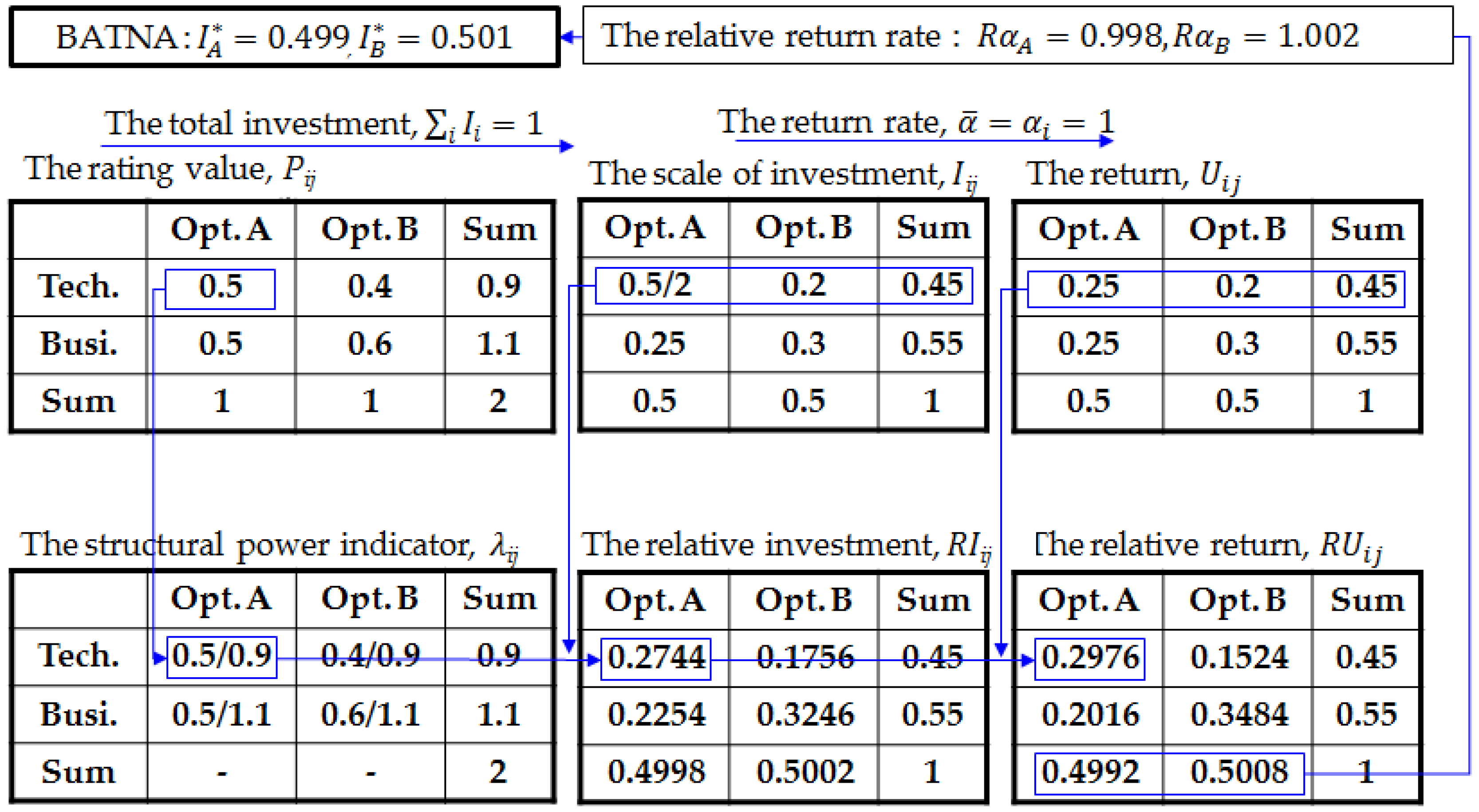

4.1. The Derivation Process of the Best Option

4.2. The Sensitivity of the Rating Value Variations

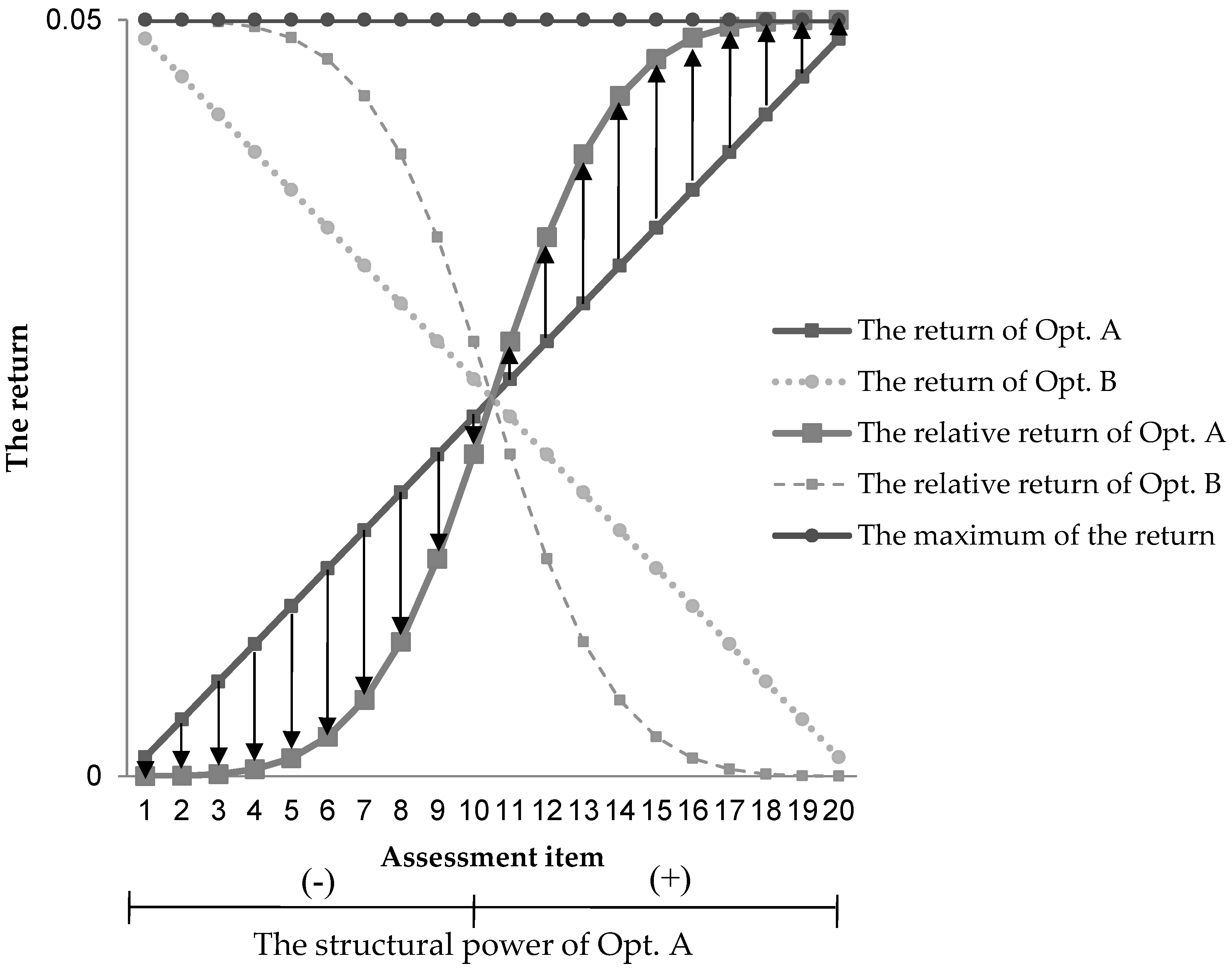

4.2.1. The Case of Crossing Values

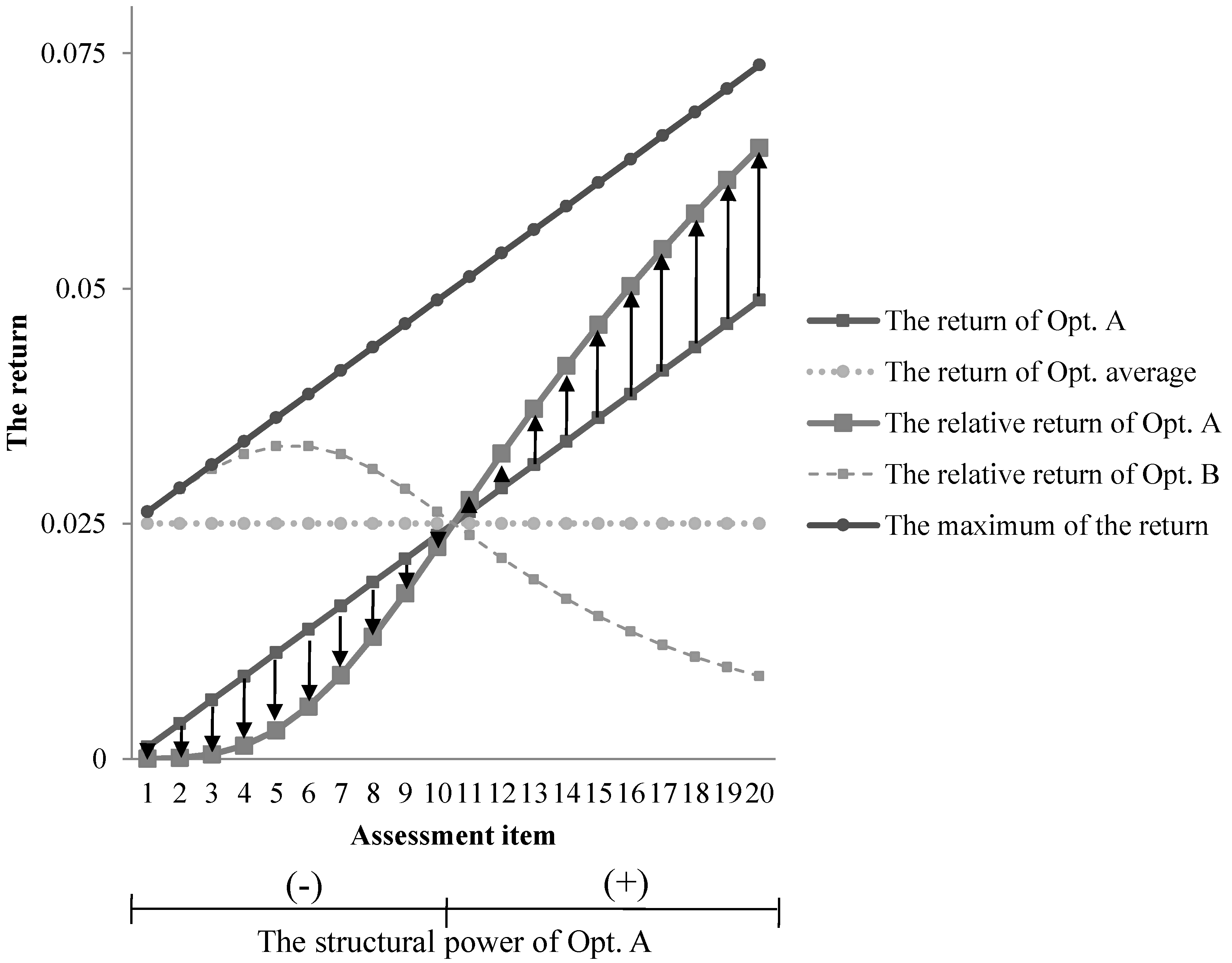

4.2.2. The Case of Increasing Values

4.3. Comparison of Proposed Method and Other Models

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Khorramshahgol, R.; Moustakis, V.S. Delphic hierarchy process (DHP): A methodology for priority setting derived from the delphi method and analytical hierarchy process. Eur. J. Opera. Res. 1988, 37, 347–354. [Google Scholar] [CrossRef]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Sun, Y.H.; Ma, J.; Fan, Z.P.; Wang, J. A group decision support approach to evaluate experts for R&D project selection. IEEE Trans. Eng. Manage. 2008, 55, 158–170. [Google Scholar]

- Epstein, L.G.; Zin, S.E. Substitution, risk aversion and the temporal behavior of consumption and asset returns, a theoretical framework. Econometrica 1989, 57, 937–969. [Google Scholar] [CrossRef]

- Emmer, S.; Kluppelberg, C.; Korn, R. Optimal portfolios with bounded capital-at-risk. Math. Financ. 2001, 11, 365–384. [Google Scholar] [CrossRef]

- Ortega, S.T.; Hanley, N.; Simal, P.D. A Proposed Methodology for Prioritizing Project Effects to Include in Cost-Benefit Analysis Using Resilience, Vulnerability and Risk Perception. Sustainability 2014, 6, 7945–7966. [Google Scholar] [CrossRef]

- Wolfe, R.J.; McGinn, K.L. Perceived relative power and its influence on negotiations. Group Decis. Negot. 2005, 14, 3–20. [Google Scholar] [CrossRef]

- Ezebilo, E.E.; Elsafi, M.; Garkava-Gustavsson, L. On-Farm Diversity of Date Palm (Phoenix dactylifera L) in Sudan: A Potential Genetic Resources Conservation Strategy. Sustainability 2013, 5, 338–356. [Google Scholar] [CrossRef]

- Corts, K.S. The interaction of task and asset allocation. Int. J. Ind. Org. 2006, 24, 887–906. [Google Scholar] [CrossRef]

- Liveratore, M.J. An extension of the analytic hierarchy process for industrial R&D project selection. IEEE Trans. Eng. Manage. 1987, EM-34, 12–18. [Google Scholar]

- Ramanathan, R.; Ganesh, L.S. Using AHP for resource allocation problems. Eur. J. Oper. Res. 1995, 80, 410–417. [Google Scholar] [CrossRef]

- Mario, E.; Tommaso, P. Project selection by constrained fuzzy AHP. Fuzzy Optim. Decis. Ma. 2004, 3, 39–62. [Google Scholar]

- Mohanty, R.P.; Agarwal, R.; Choudhury, A.K.; Tiwari, M.K. A fuzzy ANP-based approach to R&D project selection: A case study. Int. J. Prod. Res. 2005, 43, 5199–5216. [Google Scholar]

- Belmiro, P.M.D.; Reis, A. Developing a projects evaluation system based on multiple attribute value theory. Comput. Oper. Res. 2006, 33, 1488–1504. [Google Scholar]

- Dahl, R.A. The concept of power. Behav. Sci. 1957, 2, 201–218. [Google Scholar] [CrossRef]

- Sheu, J.B. Green Supply Chain Collaboration for Fashionable Consumer Electronics Products under Third-Party Power Intervention-A Resource Dependence Perspective. Sustainability 2014, 6, 2832–2875. [Google Scholar] [CrossRef]

- Emerson, R.M. Power-dependence relations. Am. Sociol. Rev. 1962, 1, 31–41. [Google Scholar] [CrossRef]

- Hall, J.C.; Hofer, W. Venture capitalists’ decision criteria in new venture evaluation. J. Bus. Venturing 1993, 8, 25–42. [Google Scholar] [CrossRef]

- Galbraith, C.S.; DeNoble, A.F.; Ehrlich, S.B. Predicting the commercialization progress of early stage technologies: An ex-ante analysis. IEEE Trans. Eng. Manage. 2012, 59, 213–225. [Google Scholar] [CrossRef]

- Zartman, I.W. The 50% Solution; Yale University Press: New Haven, CT, USA, 1983. [Google Scholar]

- Habbeb, W.M. Power and Tactics in International Negotiation; Johns Hopkins University Press: Baltimore, MD, USA, 1988. [Google Scholar]

- Prahalad, C.K.; Hamel, G. The core competence of the corporation. Harvard Bus. Rev. 1990, 68, 79–91. [Google Scholar]

- Dutta, S. Strategies for Implementing Knowledge-Based Systems. IEEE Trans. Eng. Manage. 1997, 44, 79–90. [Google Scholar] [CrossRef]

- Claude, C.; Jain, S.C. Global Business Negotiations: A Practical Guide; Thomson Learning: Boston, MA, USA, 2004. [Google Scholar]

- Fisher, R.; Ury, W. Getting to Yes; Houghton Mifflin: Boston, MA, USA, 1981. [Google Scholar]

- Park, C.; Ahn, S. Developing an investment negotiation model considering core competences. J. Kor. Soc. Supply Chain Manag. 2011, 11, 151–161. [Google Scholar]

- Eddie, W.L.C.; Heng, L. Analytic network applied to project selection. J. Constr. Eng. Ma. 2005, 131, 459–466. [Google Scholar]

| Evaluation Fields | Investment Options | Sum | ||

|---|---|---|---|---|

| A | B | |||

| Fields | Technology | 0.5 | 0.4 | 0.9 |

| Business | 0.5 | 0.6 | 1.1 | |

| Sum | 1 | 1 | 2 | |

| Assessment Item (j) | Rating Value () | Return () | Relative Return () | Sum of Return | ||||

|---|---|---|---|---|---|---|---|---|

| Opt. A | Opt. B | Sum | Opt. A | Opt. B | Opt. A | Opt. B | ||

| 1 | 0.0025 | 0.0975 | 0.1 | 0.0013 | 0.04875 | 8.429E-07 | 0.0500 | 0.05 |

| 2 | 0.0075 | 0.0925 | 0.1 | 0.0038 | 0.04625 | 2.664E-05 | 0.0500 | 0.05 |

| 3 | 0.0125 | 0.0875 | 0.1 | 0.0063 | 0.04375 | 0.0001453 | 0.0499 | 0.05 |

| 4 | 0.0175 | 0.0825 | 0.1 | 0.0088 | 0.04125 | 0.0004727 | 0.0495 | 0.05 |

| 5 | 0.0225 | 0.0775 | 0.1 | 0.0113 | 0.03875 | 0.0011943 | 0.0488 | 0.05 |

| 6 | 0.0275 | 0.0725 | 0.1 | 0.0138 | 0.03625 | 0.0025875 | 0.0474 | 0.05 |

| 7 | 0.0325 | 0.0675 | 0.1 | 0.0163 | 0.03375 | 0.0050206 | 0.0450 | 0.05 |

| 8 | 0.0375 | 0.0625 | 0.1 | 0.0188 | 0.03125 | 0.0088816 | 0.0411 | 0.05 |

| 9 | 0.0425 | 0.0575 | 0.1 | 0.0213 | 0.02875 | 0.0143823 | 0.0356 | 0.05 |

| 10 | 0.0475 | 0.0525 | 0.1 | 0.0238 | 0.02625 | 0.0212748 | 0.0287 | 0.05 |

| 11 | 0.0525 | 0.0475 | 0.1 | 0.0263 | 0.02375 | 0.0287252 | 0.0213 | 0.05 |

| 12 | 0.0575 | 0.0425 | 0.1 | 0.0288 | 0.02125 | 0.0356177 | 0.0144 | 0.05 |

| 13 | 0.0625 | 0.0375 | 0.1 | 0.0313 | 0.01875 | 0.0411184 | 0.0089 | 0.05 |

| 14 | 0.0675 | 0.0325 | 0.1 | 0.0338 | 0.01625 | 0.0449794 | 0.0050 | 0.05 |

| 15 | 0.0725 | 0.0275 | 0.1 | 0.0363 | 0.01375 | 0.0474125 | 0.0026 | 0.05 |

| 16 | 0.0775 | 0.0225 | 0.1 | 0.0388 | 0.01125 | 0.0488057 | 0.0012 | 0.05 |

| 17 | 0.0825 | 0.0175 | 0.1 | 0.0413 | 0.00875 | 0.0495273 | 0.0005 | 0.05 |

| 18 | 0.0875 | 0.0125 | 0.1 | 0.0438 | 0.00625 | 0.0498547 | 0.0001 | 0.05 |

| 19 | 0.0925 | 0.0075 | 0.1 | 0.0463 | 0.00375 | 0.0499734 | 3E-05 | 0.05 |

| 20 | 0.0975 | 0.0025 | 0.1 | 0.0488 | 0.00125 | 0.0499992 | 8E-07 | 0.05 |

| Sum | 1 | 1 | 2 | 0.5 | 0.5 | 0.5 | 0.5 | 1 |

| Assessment Item (j) | Rating Value () | Return () | Relative Return () | Sum of Return | ||||

|---|---|---|---|---|---|---|---|---|

| Opt. A | Opt. Aver. | Sum | Opt. A | Opt. Aver. | Opt. A | Opt. Aver. | ||

| 1 | 0.0025 | 0.05 | 0.0525 | 0.0013 | 0.025 | 3.281E-06 | 0.0262 | 0.02625 |

| 2 | 0.0075 | 0.05 | 0.0575 | 0.0038 | 0.025 | 9.67E-05 | 0.0287 | 0.02875 |

| 3 | 0.0125 | 0.05 | 0.0625 | 0.0063 | 0.025 | 0.0004808 | 0.0308 | 0.03125 |

| 4 | 0.0175 | 0.05 | 0.0675 | 0.0088 | 0.025 | 0.0013875 | 0.0324 | 0.03375 |

| 5 | 0.0225 | 0.05 | 0.0725 | 0.0113 | 0.025 | 0.0030274 | 0.0332 | 0.03625 |

| 6 | 0.0275 | 0.05 | 0.0775 | 0.0138 | 0.025 | 0.0055274 | 0.0332 | 0.03875 |

| 7 | 0.0325 | 0.05 | 0.0825 | 0.0163 | 0.025 | 0.0088875 | 0.0324 | 0.04125 |

| 8 | 0.0375 | 0.05 | 0.0875 | 0.0188 | 0.025 | 0.0129808 | 0.0308 | 0.04375 |

| 9 | 0.0425 | 0.05 | 0.0925 | 0.0213 | 0.025 | 0.0175967 | 0.0287 | 0.04625 |

| 10 | 0.0475 | 0.05 | 0.0975 | 0.0238 | 0.025 | 0.0225033 | 0.0262 | 0.04875 |

| 11 | 0.0525 | 0.05 | 0.1025 | 0.0263 | 0.025 | 0.0274970 | 0.0238 | 0.05125 |

| 12 | 0.0575 | 0.05 | 0.1075 | 0.0288 | 0.025 | 0.0324280 | 0.0213 | 0.05375 |

| 13 | 0.0625 | 0.05 | 0.1125 | 0.0313 | 0.025 | 0.0372024 | 0.0190 | 0.05625 |

| 14 | 0.0675 | 0.05 | 0.1175 | 0.0338 | 0.025 | 0.0417721 | 0.0170 | 0.05875 |

| 15 | 0.0725 | 0.05 | 0.1225 | 0.0363 | 0.025 | 0.0461214 | 0.0151 | 0.06125 |

| 16 | 0.0775 | 0.05 | 0.1275 | 0.0388 | 0.025 | 0.0502547 | 0.0135 | 0.06375 |

| 17 | 0.0825 | 0.05 | 0.1325 | 0.0413 | 0.025 | 0.0541873 | 0.0121 | 0.06625 |

| 18 | 0.0875 | 0.05 | 0.1375 | 0.0438 | 0.025 | 0.0579392 | 0.0108 | 0.06875 |

| 19 | 0.0925 | 0.05 | 0.1425 | 0.0463 | 0.025 | 0.0615318 | 0.0097 | 0.07125 |

| 20 | 0.0975 | 0.05 | 0.1475 | 0.0488 | 0.025 | 0.0649858 | 0.0088 | 0.07375 |

| Sum | 1 | 1 | 2 | 0.5 | 0.5 | 0.5464111 | 0.4536 | 1 |

| Assessment Item (j) | P1 | P2 | P3 | P4 | P5 | P6 | Sum | |

|---|---|---|---|---|---|---|---|---|

| 1 | 0.0058 | 0.0093 | 0.0070 | 0.0081 | 0.0070 | 0.0058 | 0.0430 | |

| 2 | 0.0085 | 0.0136 | 0.0085 | 0.0102 | 0.0085 | 0.0085 | 0.0577 | |

| 3 | 0.0069 | 0.0082 | 0.0096 | 0.0041 | 0.0055 | 0.0069 | 0.0411 | |

| 4 | 0.0093 | 0.0058 | 0.0081 | 0.0058 | 0.0058 | 0.0093 | 0.0442 | |

| 5 | 0.0070 | 0.0046 | 0.0070 | 0.0046 | 0.0058 | 0.0070 | 0.0360 | |

| 6 | 0.0126 | 0.0047 | 0.0111 | 0.0047 | 0.0126 | 0.0126 | 0.0584 | |

| 7 | 0.0126 | 0.0032 | 0.0111 | 0.0032 | 0.0063 | 0.0126 | 0.0490 | |

| 8 | 0.0082 | 0.0041 | 0.0055 | 0.0096 | 0.0055 | 0.0055 | 0.0384 | |

| 9 | 0.0191 | 0.0072 | 0.0167 | 0.0048 | 0.0119 | 0.0191 | 0.0787 | |

| 10 | 0.0121 | 0.0052 | 0.0121 | 0.0035 | 0.0086 | 0.0138 | 0.0553 | |

| 11 | 0.0150 | 0.0169 | 0.0113 | 0.0038 | 0.0113 | 0.0150 | 0.0732 | |

| 12 | 0.0056 | 0.0098 | 0.0084 | 0.0126 | 0.0084 | 0.0028 | 0.0476 | |

| 13 | 0.0136 | 0.0045 | 0.0113 | 0.0045 | 0.0113 | 0.0136 | 0.0589 | |

| 14 | 0.0117 | 0.0050 | 0.0100 | 0.0050 | 0.0100 | 0.0117 | 0.0534 | |

| 15 | 0.0107 | 0.0027 | 0.0094 | 0.0027 | 0.0094 | 0.0107 | 0.0456 | |

| 16 | 0.0105 | 0.0079 | 0.0092 | 0.0079 | 0.0105 | 0.0105 | 0.0564 | |

| 17 | 0.0102 | 0.0119 | 0.0068 | 0.0068 | 0.0102 | 0.0102 | 0.0560 | |

| 18 | 0.0105 | 0.0052 | 0.0105 | 0.0039 | 0.0105 | 0.0105 | 0.0511 | |

| 19 | 0.0102 | 0.0085 | 0.0102 | 0.0068 | 0.0102 | 0.0102 | 0.0560 | |

| ANP | Sum | 0.2000 | 0.1383 | 0.1836 | 0.1126 | 0.1693 | 0.1962 | 1 |

| Rank | 1 | 5 | 3 | 6 | 4 | 2 | ||

| The score method | Sum | 0.1972 | 0.1398 | 0.1832 | 0.1180 | 0.1692 | 0.1925 | 1 |

| Rank | 1 | 5 | 3 | 6 | 4 | 2 | ||

| Assessment Item (j) | P1 | P2 | P3 | P4 | P5 | P6 | Sum | |

|---|---|---|---|---|---|---|---|---|

| 1 | 0.0046 | 0.0117 | 0.0066 | 0.0090 | 0.0066 | 0.0046 | 0.0430 | |

| 2 | 0.0072 | 0.0185 | 0.0072 | 0.0104 | 0.0072 | 0.0072 | 0.0577 | |

| 3 | 0.0064 | 0.0093 | 0.0126 | 0.0023 | 0.0041 | 0.0064 | 0.0411 | |

| 4 | 0.0112 | 0.0044 | 0.0086 | 0.0044 | 0.0044 | 0.0112 | 0.0442 | |

| 5 | 0.0079 | 0.0035 | 0.0079 | 0.0035 | 0.0055 | 0.0079 | 0.0360 | |

| 6 | 0.0144 | 0.0020 | 0.0111 | 0.0020 | 0.0144 | 0.0144 | 0.0584 | |

| 7 | 0.0156 | 0.0010 | 0.0119 | 0.0010 | 0.0039 | 0.0156 | 0.0490 | |

| 8 | 0.0097 | 0.0024 | 0.0043 | 0.0132 | 0.0043 | 0.0043 | 0.0384 | |

| 9 | 0.0234 | 0.0033 | 0.0179 | 0.0015 | 0.0091 | 0.0234 | 0.0787 | |

| 10 | 0.0135 | 0.0025 | 0.0135 | 0.0011 | 0.0069 | 0.0177 | 0.0553 | |

| 11 | 0.0164 | 0.0208 | 0.0092 | 0.0010 | 0.0092 | 0.0164 | 0.0732 | |

| 12 | 0.0034 | 0.0105 | 0.0077 | 0.0174 | 0.0077 | 0.0009 | 0.0476 | |

| 13 | 0.0163 | 0.0018 | 0.0113 | 0.0018 | 0.0113 | 0.0163 | 0.0589 | |

| 14 | 0.0139 | 0.0026 | 0.0102 | 0.0026 | 0.0102 | 0.0139 | 0.0534 | |

| 15 | 0.0125 | 0.0008 | 0.0095 | 0.0008 | 0.0095 | 0.0125 | 0.0456 | |

| 16 | 0.0115 | 0.0065 | 0.0088 | 0.0065 | 0.0115 | 0.0115 | 0.0564 | |

| 17 | 0.0107 | 0.0145 | 0.0047 | 0.0047 | 0.0107 | 0.0107 | 0.0560 | |

| 18 | 0.0116 | 0.0029 | 0.0116 | 0.0016 | 0.0116 | 0.0116 | 0.0511 | |

| 19 | 0.0109 | 0.0076 | 0.0109 | 0.0048 | 0.0109 | 0.0109 | 0.0560 | |

| Sum | 0.2213 | 0.1265 | 0.1858 | 0.0896 | 0.1593 | 0.2175 | 1 | |

| Rank | 1 | 5 | 3 | 6 | 4 | 2 | ||

| ANP | Sum | 0.2000 | 0.1383 | 0.1836 | 0.1126 | 0.1693 | 0.1962 | 1 |

| Rank | 1 | 5 | 3 | 6 | 4 | 2 | ||

| The score method | Sum | 0.1972 | 0.1398 | 0.1832 | 0.1180 | 0.1692 | 0.1925 | 1 |

| Rank | 1 | 5 | 3 | 6 | 4 | 2 | ||

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.; Ahn, S.; Park, C.; Park, Y.-J. Development of a Resource Allocation Model Using Competitive Advantage. Sustainability 2016, 8, 217. https://doi.org/10.3390/su8030217

Lee S, Ahn S, Park C, Park Y-J. Development of a Resource Allocation Model Using Competitive Advantage. Sustainability. 2016; 8(3):217. https://doi.org/10.3390/su8030217

Chicago/Turabian StyleLee, Sangwon, Suneung Ahn, Changsoon Park, and You-Jin Park. 2016. "Development of a Resource Allocation Model Using Competitive Advantage" Sustainability 8, no. 3: 217. https://doi.org/10.3390/su8030217