How Sustainable Is Transnational Farmland Acquisition in Ethiopia? Lessons Learned from the Benishangul-Gumuz Region

Abstract

:1. Introduction

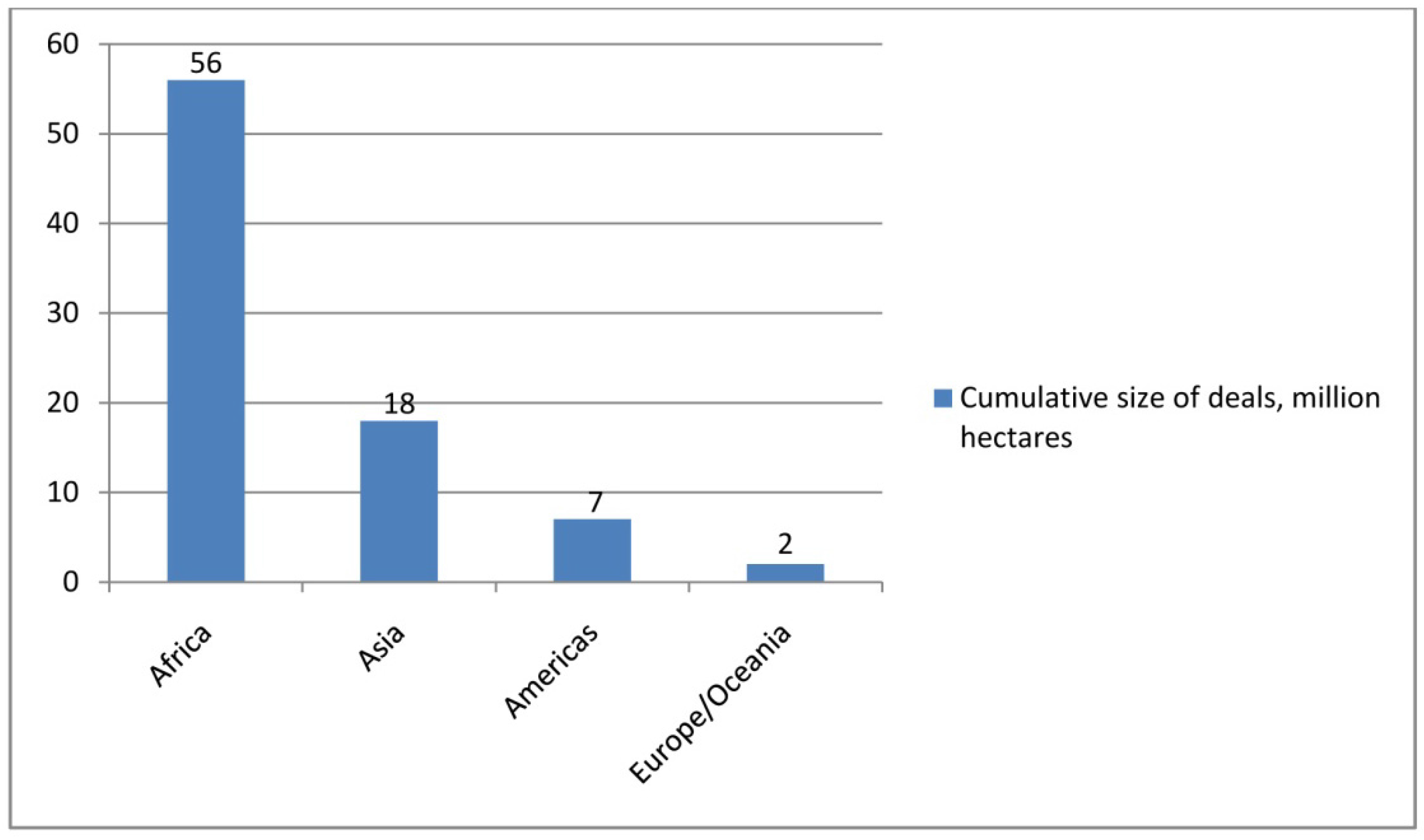

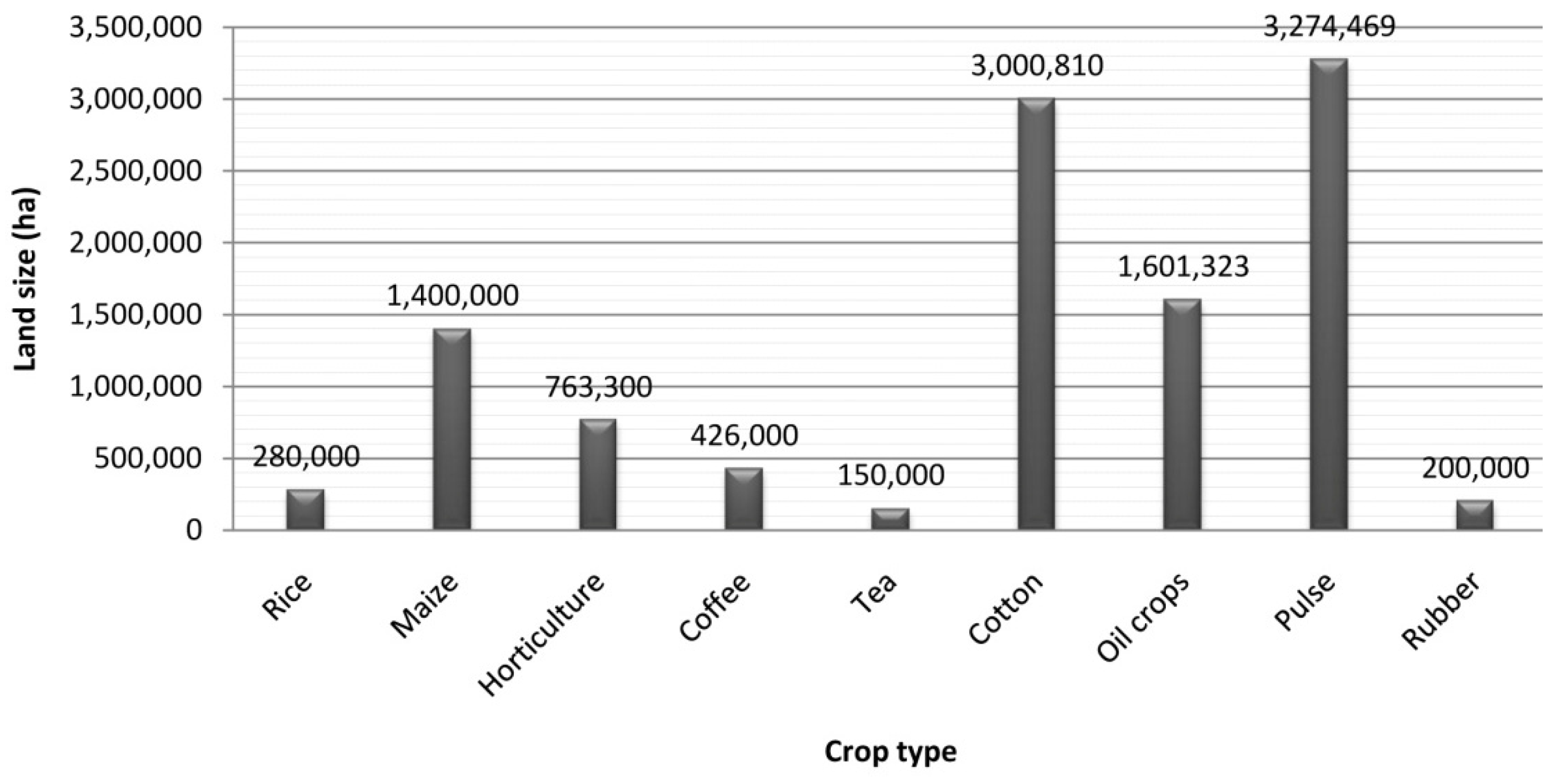

1.1. Transnational Land Acquisition

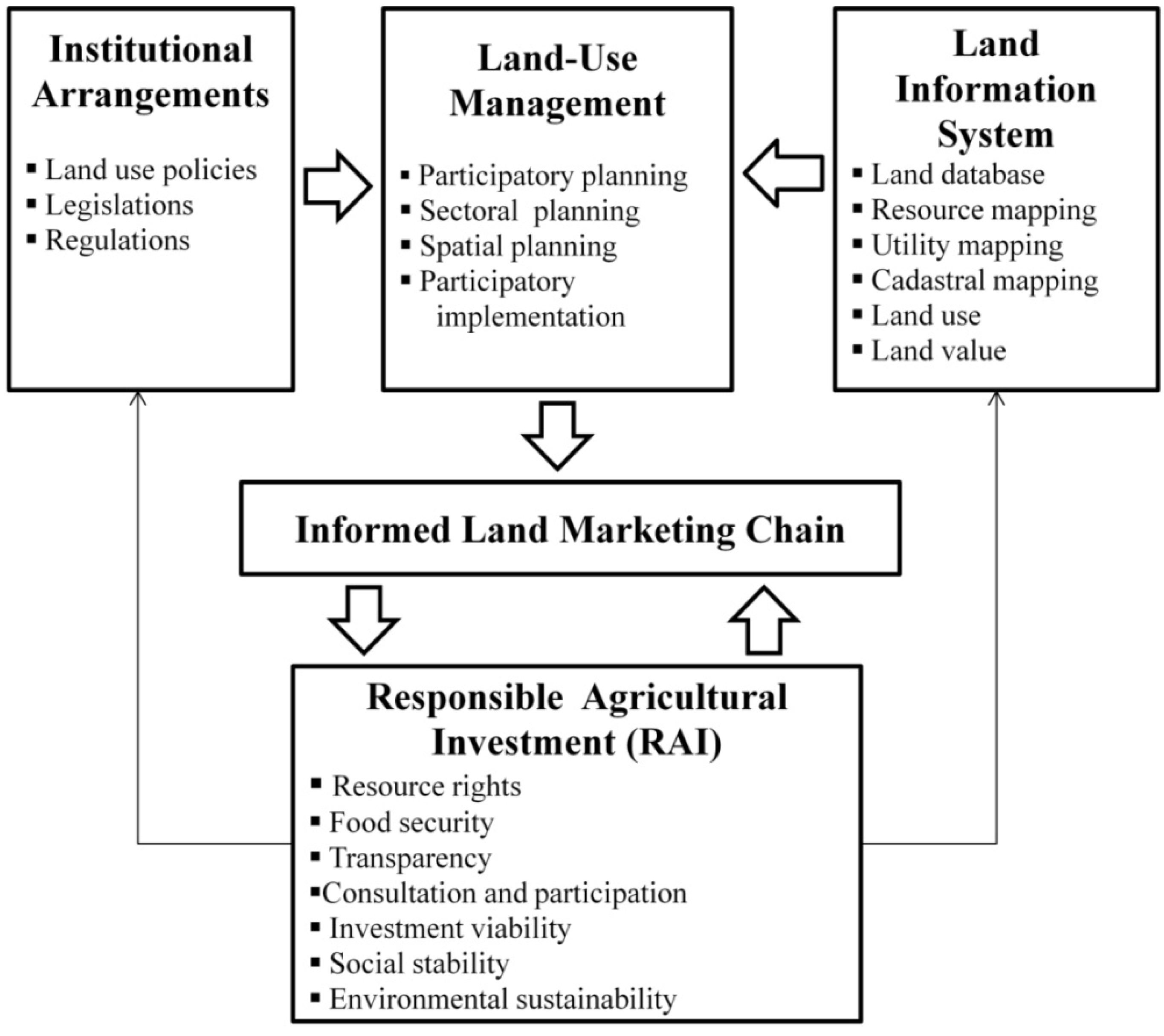

1.2. Conceptual Framework

1.3. Objectives

2. Methodology and Materials

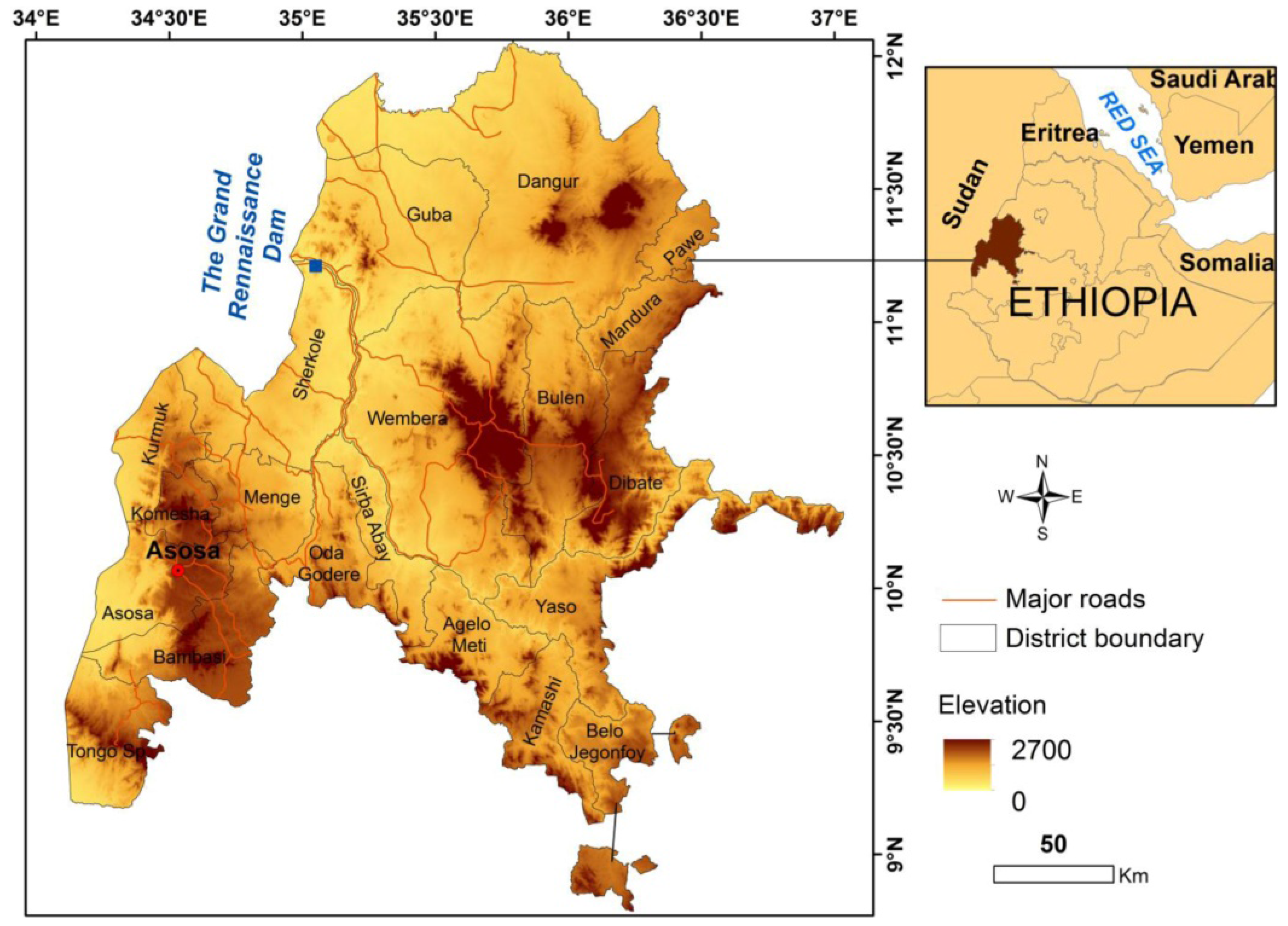

2.1. Description of Study Area

2.2. Data Collection and Analysis

3. Results and Discussion

3.1. Governance

3.1.1. Land in Ethiopia: The Institutional and Governance Framework

3.1.2. Evolution of Land Use–Land Governance Institutional Frameworks in Ethiopia

3.1.3. Investment Land Supply and the Land Lease Contracts

Investment Land Supply

Land Lease Contracts

3.1.4. Bilateral Land Lease Contracts: Lessee-Lessor Rights and Obligations

Lessee

Lessor

3.2. Economic Payoff

3.2.1. Farm Land Lease Price

3.2.2. The Status of Large-Scale Land Deals

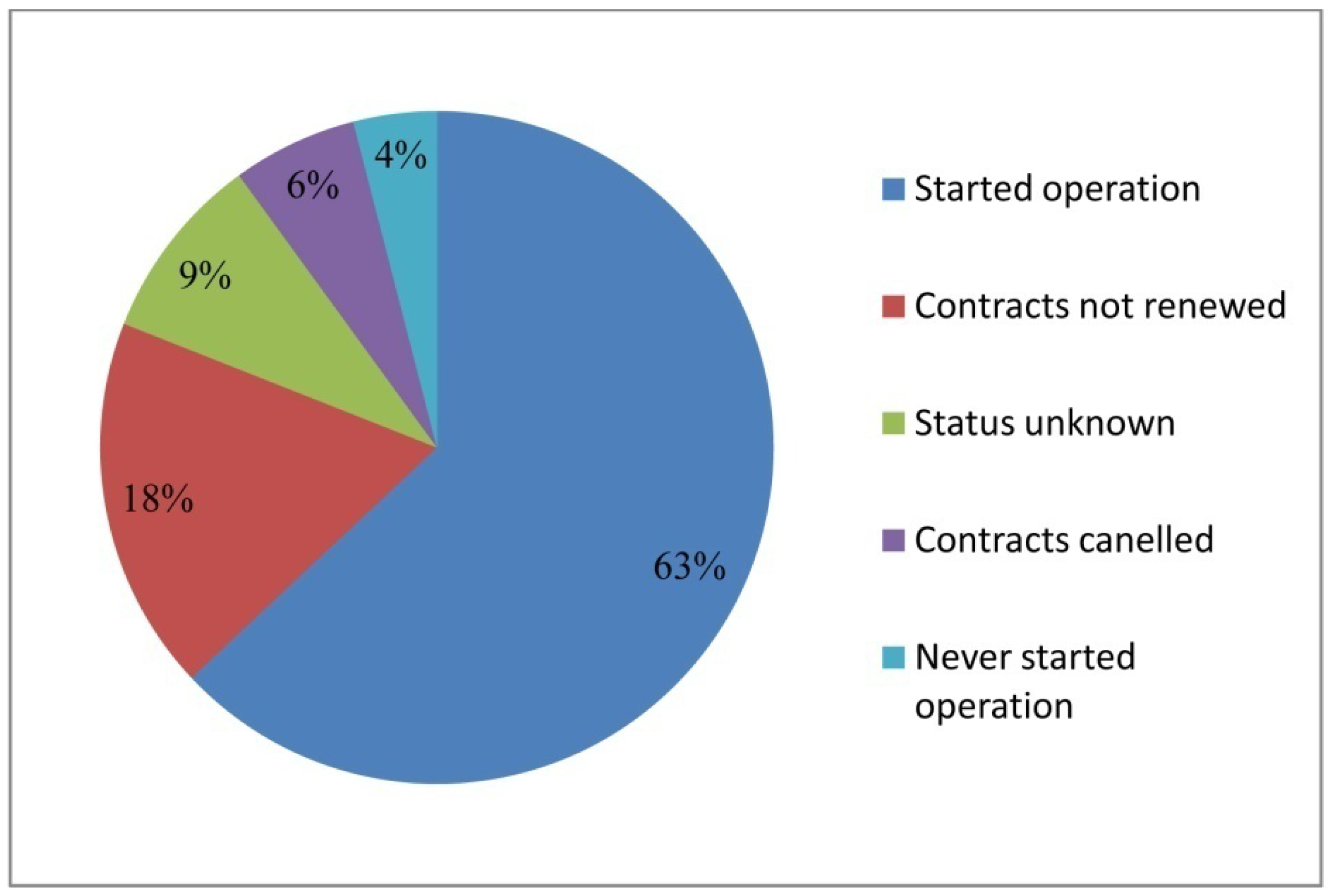

3.2.3. The Destination of Products

3.3. Social Aspect

3.4. Environmental Aspect

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix

| Proclamation(Regulation) | Basic Content Related to Land |

|---|---|

| 1955: Revised Constitution of Ethiopia (article 130) | All natural resources of the country (water, forest, land, etc.) became state domain. Land was part of the sacred trust and meant for the “benefit of both the present and succeeding generations of people” in Ethiopia [47]. However the imperial system was characterized with feudal lords who possessed land and the majority of citizens were tenants. Until the end of the imperial government in 1974, the land tenure system of the country was complex and intricate, it varied from region to region following the occurrence of different socio-political events in the country. Generally, the tenure system could be classified as private tenures and usufructuary tenures. Usufructuary tenure system is mainly based on the type of institutions which hold the eventual reversionary right over the land and could be classified as rist, semon, and maderia, or yemengist. Later in 1974, ownership for land became one of the major causes for the socialist-driven revolution in the country which overthrew the imperial/feudal system in the country. “Land to the tiller” was one of the mottos of the revolution. |

| 1975–1982: Public Ownership of Rural Lands proclamation, proclamation no. 31/1975; Peasant Association Organization and Consolidation Proclamation no. 71/1975; amended by Peasant Associations Consolidation Proclamation no. 223/1982 | Abolished (without compensation) all forms of private ownership, and all land used for agriculture or grazing purposes throughout the country was declared to become the collective property of the Ethiopian people. The law stipulated that no compensation would be paid for rural land or tree crops or any forest on such land [48]. In the same year, the proclamation was strengthened by the establishment of peasant associations to ensure equitable distribution of land and to expand the base of socialist relations that would work for the build-up of democracy in the country [48]. Later in 1982, local peasant associations (i.e, kebelle peasant associations) were given the powers and duties to distribute land within their territorial delimitations [48]. |

| 1995: The constitution of Ethiopia, proclamation no. 1/1995, article 40.2; article 50.2 | The 1995 constitution of Ethiopia is the existing supreme law of the country, its land, and all other natural resources. Land is commonly owned by the Nations, Nationalities, and Peoples of Ethiopia and it is not subject to sale or to other means of exchange. Regional states are given the power and mandate to administer land and other natural resources in accordance with federal laws. Peasants and pastoralists have usufruct right over land without any charge and without time limit, including the safeguard against expulsion from “their” land except if it is intended for public purposes, which is subject to compensation commensurate with the value of the property on the land [37]. |

| 1997: Rural Land Administration Proclamation no. 89/1997, Later repealed by proclamation no. 456/2005. | Stated general guidelines and set broader principles about the contents of land administration law to be enacted by each regional council, such as ensuring free assignment of landholding rights to peasants and nomads without any discrimination of sexes but with transparency, fairness, and participation [37,49]. |

| 2002: Investment proclamation. 280/2002. Later repealed by investment proclamation no. 769/2012 | So as to widen the participation of foreign investors in addition to the domestic ones. Stated four forms of investment and set minimum capital requirements for foreign investors (100,000 USD for single investment; 60,000 USD jointly with domestic investors), allocation of land, and further rights and privileges for different forms and types of investors [69]. |

| 2004: Reorganization of government organs of Ethiopia, proclamation no. 380/2004 | Restructured the powers and duties of the Ministry of Agriculture and Rural Development mandated with the power to draft land use policy, land administration guidelines, conservation and use of forest and related resources such as wildlife [48]. |

| 2005: Expropriation of landholdings for public purposes and payment of compensation Proclamation no. 455/2005 | Defined the key principles that should be considered to determine compensation for a person whose landholding has been expropriated for various development purposes. It also stated the state bodies that have the mandate to determine the responsibility to pay the compensation for land. Generally, it is part of the constitutional requirements of the constitution of the country, article 51/(5) and article 40/(8) to enact laws concerning the utilization of land. A district (woreda) or urban administrations are given mandate to expropriate rural or urban landholdings for public objectives [40]. |

| 2005: Federal Rural Land Administration and Land Use Proclamation no. 456/2005 (which repealed the Federal Land Administration Proclamation, 89/1997) | Targeted to increase the land tenure security, enhance farm land productivity, and circumvent expectation of land redistribution among citizens. Farmers hold a perpetual use right on their farm holdings, and this use right should be strengthened through the issuance of land holding-land use certificates and registration, followed by cadastre. A federal framework for rural land administration and land use proclamation, each regional state is mandated to arrange its own legal framework to register land in a region [40]. Security of land tenure versus agricultural investment has been a point argument which requires further investigation. Although the relationship between tenure security of land and agricultural investment varies, tenure security has a significant effect upon farmers’ investment in certain counties in Ethiopia [89]. |

| 2007: Payment for compensation for property situated on landholding expropriated for public purposes, Council of Ministers regulation no. 135/2007 | The amount of compensation for a property situated on a land to be expropriated should be determined on the basis of current market prices. Provisions are set concerning compensation for a building, fences, non-crops, perennial crops, trees, protected grass, permanent improvement on rural land, relocated property, a mining license, and burial ground. Furthermore, formulas for calculating the amount of compensation for the stated properties are set [49]. |

| 2009: Benishangul-Gumuz Region Rural Investment Land Use Regulation, Regional Council’s Regulation no. 29/2009 | Explains investment land supply procedures, investment landholding, lease system and duration of land use, forest protection, land evaluation, land use contract, land lease price in the different districts (woredas) of the region, rights and obligations of investors, etc. [57]. |

| 2010: Definition of power and duties of executive organs, proclamation no. 691/2010 | The proclamation established twenty ministries one of which was Ministry of Agriculture. The Ministry of Agriculture and Rural Development (MoARD) is dissolved and replaced with Ministry of Agriculture (MoA). Powers and duties which had formerly given to the MARD were transferred to the MoA. The MoA is mandated to ensure conservation of biodiversity, and “the administration of agricultural investment lands entrusted to the federal government on the basis of powers of delegation obtained from regional states” [90]. |

| 2010: Agricultural Transformation Council and Agency Establishment, Council of Ministers regulation no. 198/2010 | Lead the identification, design, and effective implementation of solutions to the challenges of agricultural development, for instance, identification of soil fertility problems and solutions for the same [71]. |

| 2012: Investment proclamation no. 769/2012, it repealed investment proclamation no. 280/2002 | Stated provisions which could enhance investment not only in the agriculture but also in the manufacturing sector and improve some laws stated in the previous investment proclamation. Areas of investment for domestic investors, foreign investors, and investments to undertaken jointly are delineated. Amendment on minimum capital requirements for foreign investors are set [64]. |

| 2012: Investment Incentives and Investment Areas Reserved for Domestic Investors, Council of Ministers regulation, regulation no. 270/2012 | Specified various types of incentives for investors depending on different criteria such as type of investment, location of investment, performance of investment or progress. Exceptions for income tax and exemptions from custom duty for two–nine years. Specifically, investors who invest in Afar, Benishangul-Gumuz, Gambela, and Somale Regions are entitled to 30% income tax reduction. Similar income tax reduction will be made if companies invest in theGuji and Borena zones of Oromia Region and in many of the areas in South-Omo, Segen, Bench-Maji, Sheka, Dawro, Kefa Zones, and some Woredas of the State of Southern Nations and Nationalities People [64]. |

References

- Cotula, L.; Vermeulen, S.; Leonard, R.; Keeley, J. Land Grab or Development Opportunity? International Land Deals in Africa Land Grab or Development Opportunity? 1st ed.; Food and Agriculture Organization of the United Nations (FAO): Rome, Italy; International Institute for Environment and Development (IIED): London, UK; The International Fund for Agricultural Development (IFAD): Rome, Italy, 2009; p. 120. [Google Scholar]

- White, B.; Borras, J.S.M.; Hall, R.; Scoones, I.; Wolford, W. The new enclosures: Critical perspectives on corporate land deals. J. Peasant Stud. 2012, 39, 619–647. [Google Scholar] [CrossRef]

- Mehta, L.; Veldwisch, G.J.; Franco, J. Introduction to the Special Issue: Water Grabbing? Focus on the (Re) appropriation of Finite Water Resources. Water Altern. 2012, 5, 193–207. [Google Scholar]

- Margulis, M.E.; Porter, T. Governing the Global Land Grab: Multipolarity, Ideas, and Complexity in Transnational Governance. Globalizations 2013, 10, 65–86. [Google Scholar] [CrossRef]

- Marx, K. Capital: A Critique of Political Economy, Volume One, Book One: The Process of Production of Capital; the Union of Soviet Socialist Republics (USSR): Moscow, Russia, 1887; p. 505.

- Zoomers, A. Globalisation and the foreignisation of space: Seven processes driving the current global land grab. J. Peasant Stud. 2010, 37, 429–447. [Google Scholar] [CrossRef]

- De Schutter, O. How not to think of land-grabbing: Three critiques of large-scale investments in farmland. J. Peasant Stud. 2011, 38, 249–279. [Google Scholar] [CrossRef]

- Borras, S.; Kay, C.; Gomez, S.; Wilkinson, J. Land grabbing and global capitalist accumulation: Key features in Latin America. Can. J. Dev. Stud. 2012, 33, 402–416. [Google Scholar] [CrossRef]

- Gerlach, A.C.; Liu, P. Resource-seeking Foreign Direct Investment in African Agriculture A review of country case studies. Rome 2010, 31, 1–19. [Google Scholar]

- Hamelinck, C. Land Grabs for Biofuels Driven by EU Biofuels Policies; Ecofys: Utrecht, The Netherlnads, 2013; p. 106. [Google Scholar]

- Nhantumbo, I.; Salomão, A. Biofuels, Land Access and Rural Livelihoods in Mozambique; International Institute for Environment and Development (IIED): London, UK, 2010; p. 48. [Google Scholar]

- Schoneveld, G.C.; German, L.A.; Nutakor, E. Towards Sustainable Biofuel Development: Assessing the Local Impacts of Large-Scale Foreign land Acquisitions in Ghana. In Proceedings of the World Bank Land Governance Conference, Washington, DC, USA, 26–27April 2010.

- Stebek, E.N. Between “Land Grabs” and Agricultural Investment: Land Rent Contracts with Foreign Investors and Ethiopia’s Normattive Setting in Focus. Mizan Law Rev. 2011, 5, 175–214. [Google Scholar] [CrossRef]

- Hall, R. Land grabbing in Southern Africa: The many faces of the investor rush. Rev. Afr. Political Econ. 2011, 38, 193–214. [Google Scholar] [CrossRef]

- Lavers, T. “Land grab” as development strategy? The political economy of agricultural investment in Ethiopia. J. Peasant Stud. 2012, 39, 105–132. [Google Scholar] [CrossRef] [Green Version]

- EIA. Invest in Ethiopia: An Investment Guide to Ethiopia, Opportunities and Conditions; Ethiopian Investment Agency: Addis Ababa, Ethiopia, 2013. [Google Scholar]

- Demeke, A.; Dereje, T.; Dong-geun, H. Development of Foreign Direct Investment in a Rising Africa: A Case Study of Ethiopia. J. Econ. 2014, 114, 235–247. [Google Scholar]

- Reuters. Ethiopia Sets Aside Land for Foreign Investors. 2009. Available online: http://in.reuters.com/article/domesticNews/idINLT58431220090729 (accessed on 13 March 2015).

- Cotula, L. The Outlook on Farmland Acquisitions; International Land Coalition: Rome, Italy, 2011; p. 45. [Google Scholar]

- Lange, A.; Siebert, R.; Barkmann, T. Sustainability in Land Management: An Analysis of Stakeholder Perceptions in Rural Northern Germany. Sustainability 2015, 7, 683–704. [Google Scholar] [CrossRef]

- Popović, V.; Miljković, J.Z.; Subić, J.; Vasile, A.J.; Adrian, N.; Nicolăescu, E. Sustainable Land Management in Mining Areas in Serbia and Romania. Sustainability 2015, 7, 11857–11877. [Google Scholar] [CrossRef]

- Land Matrix. Available online: http://www.landmatrix.org/en/ (accessed on 30 January 2016).

- Schaffnit-Chatterjee, C. Foreign Investment in Farmland; Deutsche Bank: Frankfurt, Germany, 2012. [Google Scholar]

- Anseeuw, W.; Boche, M.; Breu, T.; Giger, M.; Lay, J.; Messerli, P.; Nolte, K. Transnational Land Deals for Agriculture in the Global South Analytical Report Based on the Land Matrix Database. Available online: https://www.oxfam.de/system/files/20120427_report_land_matrix.pdf (accessed on 4 March 2015).

- Rulli, M.C.; D’Odorico, P. Food appropriation through large scale land acquisitions. Environ. Res. Lett. 2014. [Google Scholar] [CrossRef]

- Ethiopian Investment Agency (EIA). Ethiopia Investment Guide 2012; Ethiopian Investment Agency: Addis Ababa, Ethiopia, 2012. [Google Scholar]

- Holden, S.; Otsuka, K.; Place, F.M. Understanding land markets: Questions and hypotheses. In The Emergence of Land Markets in Africa: Assessing the Impacts on Poverty, Equity, and Efficiency; Resources for the Future: Washington, DC, USA, 2008; pp. 18–54. [Google Scholar]

- Enemark, S. The Land Management Perspective—Building the Capacity. In Proceedings of ITC Lustrum Conference, Spatial Information for Civil Society Capacity Building for the International Geo-Information Society, Emschede, The Netherlands, 14–16 December 2005.

- Enemark, S.; Clifford, K.; Lemmen, C.; McLaren, R. Fit-for-Purpose Land Administration, Joint FIG/World Bank Publication, 1st ed.; International Federation of Surveyors: Copenhagen, Denmark, 2014; p. 44. [Google Scholar]

- Payraudeau, S.; van der Werf, H.M.G. Environmental impact assessment for a farming region: A review of methods. Agric. Ecosyst. Environ. 2005, 107, 1–19. [Google Scholar] [CrossRef]

- Ness, B.; Urbel-Piirsalu, E.; Anderberg, S.; Olsson, L. Categorising tools for sustainability assessment. Ecol. Econ. 2007, 60, 498–508. [Google Scholar] [CrossRef]

- Gasparatos, A.; Scolobig, A. Choosing the most appropriate sustainability assessment tool. Ecol. Econ. 2012, 80, 1–7. [Google Scholar] [CrossRef]

- Food and Agriculture Organization of the United Nations (FAO); The International Fund for Agricultural Development (IFAD); The United Nations Conference on Trade and Development (UNCTAD); World Bank. Principles for Responsible Agricultural Investment that Respects Rights, Livelihoods and Resources; FAO: Rome, Italy; IFAD: Rome, Italy; UNCTAD: Geneva, Switzerland; p. 22.

- Reidsma, P.; König, H.; Feng, S.; Bezlepkina, I.; Nesheim, I.; Bonin, M.; Brouwer, F. Methods and tools for integrated assessment of land use policies on sustainable development in developing countries. Land Use Policy 2011, 28, 604–617. [Google Scholar] [CrossRef]

- Dereje, T.; Azadi, H.; Nyssen, J.; Mitiku, H.; Witlox, F. Transnational land deals: Towards an inclusive land governance framework. Land Use Policy 2015, 42, 781–789. [Google Scholar]

- The Federal Ministry of Agriculture (MoA). Agricultural Investment Land Handed to Investors, Excel File (Data Set); MoA: Addis Ababa, Ethiopia, 2013. [Google Scholar]

- Benishangul-Gumuz Regional State (GBGR). Regional Statistics: Benishangul-Gumuz, Benishangul-Gumuz Regional State Bureau of Finance and Economic Development Asosa; GBGR: Asosa, Ethiopia, 2012. [Google Scholar]

- Benishangul-Gumuz Regional State (GBGR). Regional Atlas of Benishangul-Gumuz Region, Asosa; Bureau of Finance and Economic Development: Asosa, Ethiopia, 2007. [Google Scholar]

- Government of Ethiopia (GOE). Federal Rural Land Administration Proclamation; Proclamation No. 89/1997; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 1997.

- Government of Ethiopia (GOE). Federal Democratic Republic of Ethiopia Rural Land Administration and Land Use Proclamation; Proclamation No. 456/2005; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 2005.

- Galor, O.; Moav, O.; Dietrich, V. Inequality in Landownership, the Emergence of Human-Capital Promoting Institutions, and the Great Divergence. Rev. Econ. Stud. 2009, 76, 143–179. [Google Scholar] [CrossRef] [PubMed]

- Cardenas, R. Green multiculturalism: Articulations of ethnic and environmental politics in a Colombian “black community”. J. Peasant Stud. 2012, 39, 309–333. [Google Scholar] [CrossRef]

- Pestana, C.; Francisco, A.; Ricardo, J. Brazilian Land Tenure and Conflicts: The Landless Peasants Movement. Cato J. 2013, 33, 47–75. [Google Scholar]

- Samuel, G. Land, Land Policy and Smallholder Agriculture in Ethiopia: Options and Scenarios. In Proceedings of the Future Agricultures Consortium Meeting at the Institute of Development Studies, Brighton, UK, 20–22 March 2006; p. 14.

- Crewett, W.; Ayalneh, B.; Korf, B. Land Tenure in Ethiopia Continuity and Change, Shifting Rulers, and the Quest for State Control; International Food Policy Research Institute: Washington, DC, USA, 2008; p. 35. [Google Scholar]

- Nyssen, J. Soil and water conservation under changing socio-economic conditions in the Tembien Highlands (Tigray, Ethiopia). Bull. de la Société géographique de Liège 1998, 35, 5–17. [Google Scholar]

- The Imperial Government of Ethiopia (IGE). 1995 Revised Constitution of Ethiopia; IGE: Addis Ababa, Ethiopia, 1955. [Google Scholar]

- The Government of Ethiopia (GOE). Public Ownership of Rural Lands Proclamation.(by the Provisional Military Administration Council); Negarit Gazeta: Addis Ababa, Ethiopia, 1975; pp. 93–101.

- The Government of Ethiopia (GOE). Constitution of the Federal Democratic Republic of Ethiopia; Proclamation No. 1/1995; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 1995.

- Tigistu, G.A. Experience and future direction in Ethiopian rural land administration. In Proceedings of the Annual World Bank Conference on Land and Property, Washington, DC, USA, 19–20 April 2011; p. 16.

- Deininger, K.; Byerlee, D.; Lindsay, J.; Norton, A.; Selod, H.; Sticker, M. Rising Global Interest in Farmland: Cant it Yield Sustainable and Equitable Benefits? World Bank: Washington, DC, USA, 2011; p. 206. [Google Scholar]

- Edelman, M.; Oya, C.; Borras, S.M., Jr. Global Land Grabs: Historical processes, theoretical and methodological implications and current trajectories. Third World Q. 2013, 34, 1517–1531. [Google Scholar] [CrossRef]

- Farmland Grab. Foreigners Can Buy as Much B.C. Farmland as They Want—And They Are. 2014. Available online: http://farmlandgrab.org/post/view/23452 (accessed on 11 March 2015).

- Oviedo, S. Avoiding the Land Grab: Responsible Farmland Investing in Developing Nations. Available online: http://www.sustainalytics.com/sites/default/files/avoiding-the-land-grab-responsible-farmland-investing-in-developingnations_final.pdf (accessed on 25 February 2015).

- Genetic Resources Action International (GRAIN). Land Grabbing and the Global Food Crisis Land Grabbing? Available online: http://www.grain.org/bulletin_board/entries/4429-new-data-sets-on-land-grabbing (accessed on 2 March 2015).

- The Federal Ministry of Agriculture (MoA). Agricultural Investment Land Lease Guideline; MoA: Addis Ababa, Ethiopia, 2009.

- Benishangul-Gumuz Regional State (GBGR). Benishangul-Gumuz Region Rural Investment Land Use Regulation; Regulation No. 29/2009; GBGR: Asosa, Ethiopia, 2009. [Google Scholar]

- The Federal Ministry of Agriculture (MoA). Land Rent Contractual Agreement Template Between Ministry of Agriculture and Investors; Ministry of Agriculture: Addis Ababa, Ethiopia, 2010.

- Ciriacy-wantrup, S.V. Agricultural & Applied Economics Association Capital Returns from Soil-Conservation Practices. J. Farm Econ. 1947, 29, 1181–1196. [Google Scholar]

- Diamond, P.A.; Hausman, J.A. Contingent Valuation: Is Some Number Better than No Number? J. Econ. Perspect. 1994, 8, 45–64. [Google Scholar] [CrossRef]

- Ready, R.C.; Berger, M.C.; Blomquist, G.C. Measuring Amenity Benefits from Farmland: Hedonic Pricing vs. Contingent Valuation. Growth Chang. 1997, 28, 438–458. [Google Scholar] [CrossRef]

- Venkatachalam, L. The contingent valuation method: A review. Environ. Impact Assess. Rev. 2004, 24, 89–124. [Google Scholar] [CrossRef]

- World Bank. Doing Business 2014, Economy Profile: Ethiopia. Comparing Business Regulations for Domestic Firms in 189 Economies, 11th ed.; World Bank: Washington, DC, USA, 2013; p. 108. [Google Scholar]

- The Government of Ethiopia (GOE). Investment Incentives and Investment Areas Reserved for Domestic Investors Council of Ministers Regulation; Regulation No. 270/2012; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 2012.

- Ostermeier, M.; Althoff, C.; Nolte, K. Large-scale Land Acquisitions—Employment Generator or Job-Killer? In Proceedings of the Paper Prepared for Presentation at the 2015 World Bank Conference on Land and Poverty, Washington, DC, USA, 23–27 March 2015.

- Dessalegn, R. Land to Investors: Large-Scale Land Transfers in Ethiopia; Forum for Social Studies: Addis Ababa, Ethiopia, 2011. [Google Scholar]

- Friis, C.; Reenberg, A. Land Grab in Africa: Emerging Land System; GLP Report No. 1; Global Land Project (GLP)-IPO: Copenhagen, Denmark, 2010. [Google Scholar]

- D’Odorico, P.; Rulli, M.C. The land and its people. Nat. Geosci. 2014, 4, 324–325. [Google Scholar] [CrossRef]

- The Government of Ethiopia (GOE). Ethiopia Environmental Impact Assessment Proclamation, 2002; Federal Negarit Gazeta: Addis Ababa, Ethiopia, 1975; pp. 1951–1958.

- Davis, K.F.; Yu, K.; Rulli, M.C.; Pichdara, L.; D’Odorico, P. Accelerated deforestation driven by large-scale land acquisitions in Cambodia. Nat. Geosci. 2015, 8, 772–775. [Google Scholar] [CrossRef]

- Cotula, L.; Vermeulen, S.; Leonard, R.; Keeley, J. Land grab or development opportunity? Available online: http://www.fao.org/docrep/011/ak241e/ak241e00.htm (accessed on 18 January 2014).

- Benjaminsen, T.A.; Bryceson, I.; Mangana, F.; Refseth, T. Conservation and Land Grabbing in Tanzania. In Proceedings of the International Conference on Global Land Grabbing, Brighton, UK, 6–8 April 2011.

- Bazuin, S.; Azadi, H.; Witlox, F. Application of GM crops in Sub-Saharan Africa: Lessons learned from Green Revolution. Biotechnol. Adv. 2011, 29, 908–912. [Google Scholar] [CrossRef] [PubMed]

- Oakland Institute. Understanding Land Investment Deals in Africa; Oakland Institute: Oakland, CA, USA, 2011. [Google Scholar]

- Rulli, M.C.; D’Odorico, P. The water footprint of land grabbing. Geophys. Res. Lett. 2013. [Google Scholar] [CrossRef]

- Rulli, M.C.; Saviori, A.; D’Odorico, P. Global land and water grabbing. Proc. Natl. Acad. Sci. USA 2013, 110, 892–897. [Google Scholar] [CrossRef] [PubMed]

- Brown, R.L. Expanding Deserts, Falling Water Tables, and Toxic Pollutants Driving People from Their Homes. 2011. Available online: http://www.earth-policy.org/book_bytes/2011/wotech6_ss2 (accessed on 24 January 2014).

- Global Greenhouse Warming (GGW). Sahara Desert, 2015. Available online: http://www.global-greenhouse-warming.com/Sahara-Desert.html (accessed on 7 January 2015).

- Salini Impregilo. Grand Ethiopian Renaissance Dam Project, 2011. Available online: http://www.salini-impregilo.com/en/projects/in-progress/dams-hydroelectric-plants-hydraulic-works/grand-ethiopian-renaissance-dam-project.html (accessed on 11 January 2015).

- ERTA. Ethiopia Launched Grand Millennium Dam Project, the Biggest in Africa, 2011. Available online: http://www.ethiopian-news.com/ethiopia-launched-grand-millennium-dam-project-the-biggest-in-africa/ (accessed on 10 March 2015).

- Haregeweyn, N.; Poesen, J.; Nyssen, J.; de Wit, J.; Mitiku, H.; Deckers, S. Reservoirs in Tigray (Northern Ethiopia): Characteristics and Sediment Deposition Problems. Land Degrad. Dev. 2006, 230, 211–230. [Google Scholar] [CrossRef]

- Tilman, D.; Cassman, K.G.; Matson, P.; Naylor, R.; Polasky, S. Agricultural sustainability and intensive production practices. Nature 2002, 418, 671–677. [Google Scholar] [CrossRef] [PubMed]

- Chazdon, R.L. Beyond deforestation: Restoring forests and ecosystem services on degraded lands. Science 2008, 320, 1458–1460. [Google Scholar] [CrossRef] [PubMed]

- Resosudarmo, I.A.P.; Atmadja, S.; Ekaputri, A.D.; Intarini, D.Y.; Indriatmoko, Y.; Astri, P. Does Tenure Security Lead to REDD+ Project Effectiveness? Reflections from Five Emerging Sites in Indonesia. World Dev. 2014, 55, 68–83. [Google Scholar] [CrossRef]

- Goitom, G. Ethiopia’s Grand Renaissance Dam: Ending Africa’s Oldest Geopolitical Rivalry? Wash. Q. 2014, 37, 25–37. [Google Scholar]

- Davis, K.F.; Rulli, M.C.; D’Odorico, P. The global land rush and climate change. Earth’s Future 2015, 3, 298–311. [Google Scholar] [CrossRef] [Green Version]

- Fairhead, J.; Leach, M.; Scoones, I. Green Grabbing: A new appropriation of nature? J. Peasant Stud. 2012, 39, 237–261. [Google Scholar] [CrossRef]

- Dereje, T.; Abebe, E. Land tenure and Farmers’ investment on agriculture: Evidences from three counties in Hawzen District, Tigray, Northern Ethiopia. Int. J. Res. Commer. Econ. Manag. 2011, 1, 5–12. [Google Scholar]

- The Government of Ethiopia (GOE). Agricultural Transformation Council and Agency Establishment Council of Ministers Regulation; Regulation No. 198/2010; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 2011.

- The Government of Ethiopia (GOE). Definition of Powers and Duties of the Executive Organs of the Federal Democratic; Regulation No. 691/2010; Federal Negarit Gazeta of the Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 2010.

| Level | Data Source 1 | Focus | Method Used |

|---|---|---|---|

| Federal | GOE, MOA, EIA (Addis Ababa) | Land laws, regulations, land/investment data | Document review, contract review, extraction of relevant data from accessed databases, and interviews |

| Regional | GBGR, investment bureau, BoARD (Asosa) | Regional land laws, regulations, and land lease system | Document review, key informant interviews, surveys |

| District | BoARD, and Natural Resource Protection Case Team (Dangure and Guba) | Practices of delivering land to investors, resettling communities | Key informant interviews, data extraction from regional databases |

| Village/farm | Community leaders, investors, and employees | Effects on local communities, environment, concerns from community, investors, and employees | Key informant interviews, data extraction from regional databases, participatory observation |

| Potential Investment Land | Total Land Delivered | Regions | ||||

|---|---|---|---|---|---|---|

| Benishangul-Gumuz | Oromiya | Gambella | Other 8 Regions (Total) | |||

| Land Size (ha) | 11,545,902 | 2,110,000 | 600,254 | 458,292 | 399,491 | 651,963 |

| Area of Investment | Threshold (Land in ha) | Area of Investment | Threshold (Land in ha) |

|---|---|---|---|

| Bio-fuel | 50,000 | Food crop | 20,000 |

| Palm oil | 50,000 | Oil crop | 20,000 |

| Rubber tree | 10,000 | Vegetable production | 150 |

| Cotton | 20,000 | Fruit and enset production | 5000 |

| Forestry | 20,000 | Livestock farming | 30 |

| Sugar cane | 20,000 | Animal fattening | 5 |

| Coffee plantation | 5000 | Seed reproduction | 5000 |

| Tea plantation | 5000 | Wild animal production | 50 |

| Forage production | 5000 | Tobacco production | 5000 |

| Type of Investment Land | Lease Period/Duration (Years) | ||

|---|---|---|---|

| 201–500 ha | Above 500 ha | ||

| Cultivated land | Rain fed | 20–25 | 30–35 |

| Irrigation | 20–30 | 30–35 | |

| Non-cultivated land | Rain fed | 25–30 | 35–40 |

| Irrigation | 20–25 | 30–35 | |

| Dairy production | 20 | 25 | |

| Fast-growing perennial production | 20 | 35 | |

| Horticulture | 30 | 35 | |

| Livestock rearing and/or fattening | 20 | 25 | |

| Land Lease Price ha/Year | Districts |

|---|---|

| Birr 50 (Euro 3.14 *) | Sirba Abay |

| Kumruk | |

| Birr 60 (Euro 3.77) | Agalo |

| Komashi | |

| Menge | |

| Odabildglo | |

| Sherkole | |

| Wenbera | |

| Yaso | |

| Birr 70 (Euro 4.40) | Asosa |

| Homosha | |

| Bambasi | |

| Belewjiganfoy | |

| Bulen | |

| Dibate | |

| Dangure | |

| Guba | |

| Maokomo | |

| Mandura | |

| Pawe |

| In Ethiopia | In Benishangul-Gumuz | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Investment Land Size (ha) | Areas of Major Crops (ha) | Land Size Delivered for A Single Investor (ha) | Maximum of Land Lease Duration (Year) | Employment (2013/2014) | ||||||

| Potential Land | Land delivered | Pulse | Cotton | Oil crops | Max: Bio-fuel/Palm oil | Min: Animal fattening | Cultivated land | Non-cultivated land | Permanent | Temporary |

| 11,545,902 | 2,110,000 | 3274,469 | 3,000,810 | 1,601,323 | 50,000 | 5 | 30–35 | 35–40 | 848 | 3246 |

| Variable | Obs. | Mean | Std. Error | Std. Deviation |

|---|---|---|---|---|

| Size of land leased | 86 | 461.4535 | 83.5418 | 774.7348 |

| Size of cultivated land | 86 | 158.318 | 25.08216 | 232.6024 |

| Difference | 86 | 303.1355 | 63.54804 | 589.3203 |

| Mean (diff) = mean (Size of land leased − Size of cultivated land), t = 4.770 | ||||

| Ho: mean (diff) = 0 degrees of freedom = 85 | ||||

| Ha: mean (diff) < 0, Ha: mean (diff)! = 0, Ha: mean (diff) > 0 | ||||

| Pr (T < t) = 1.0000, Pr (|T| > |t|) = 0.0000, Pr (T > t) = 0.0000 | ||||

| Kebele * | Resettled Households | Households in Recipient Village (s) | Total (% Increase of Number of Households) |

|---|---|---|---|

| Abela Horus | 83 | 78 | 161 (106.4%) |

| Almehal | 87 | 306 | 393 (28.4%) |

| Bengo | 211 | 54 | 265 (390.7%) |

| Iyssid | 104 | 98 | 202 (106.12%) |

| Wedelbahit | 46 | 13 | 59 (3.54%) |

| Total | 531 | 549 | 1080 (96.72%) |

| Kebele * | Resettled Households | Households in Recipient Village(s) | Total (% Increase of Number of Households) |

|---|---|---|---|

| Azaltiktli | 97 | 73 | 170 (133%) |

| Aypapo | 158 | 38 | 196 (415.8%) |

| Burji | 173 | 190 | 363 (91.05%) |

| Gitsi | 115 | 110 | 225 (104.54%) |

| Dabuhkokel | 99 | 104 | 203 (95.19%) |

| Jimtiya | 144 | 149 | 293 (96.64%) |

| Gublak | 69 | 330 | 399 (20.9%) |

| Chidanguya | 74 | 23 | 97 (321.74%) |

| Dibatie | 48 | 106 | 154 (45.28%) |

| Bawla | 60 | 58 | 118 (103.45$) |

| Juraysis | 54 | 60 | 114 (90%) |

| DekMariam | 299 | 95 | 394 (314.73%) |

| Bengez | 11 | 57 | 68 (19.3%) |

| Kotay | 44 | 122 | 166 (36.07%) |

| Anjakuaya | 133 | 66 | 199 (201.52%) |

| Abaydar | 287 | 78 | 365 (368%) |

| Total (average % increase) | 1865 | 1659 | 3524 (112.42%) |

| Model Summary | |||||

|---|---|---|---|---|---|

| Model | R | R2 | Adjusted R2 | Std. Error | |

| 1 | 0.87 | 0.75 | 0.73 | 120 | |

| ANOVA | |||||

| Source | Sum of Squares | Df | Mean Square | F | Sig. |

| Regression | 3,437,915.40 | 5 | 687,583.08 | 47.38 | 0.0000 |

| Residual | 1,160,912.63 | 80 | 14,511.40 | ||

| Total | 4,598,828.03 | 85 | |||

| Coefficients | |||||

| Independent Variable | B | Std. Error | Beta | t | Sig. |

| Size of land leased | 0.25 | 0.02 | 0.841 | 14.81 | 0.000 |

| Permanent employees | 0.11 | 3.15 | 0.002 | 0.03 | 0.973 |

| Temporary employees | 0.18 | 0.69 | 0.016 | 0.25 | 0.801 |

| Distance from road | −2.13 | 0.88 | −0.138 | −2.41 | 0.018 |

| Level of education | 2.01 | 3.01 | 0.038 | 0.67 | 0.508 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teklemariam, D.; Azadi, H.; Nyssen, J.; Haile, M.; Witlox, F. How Sustainable Is Transnational Farmland Acquisition in Ethiopia? Lessons Learned from the Benishangul-Gumuz Region. Sustainability 2016, 8, 213. https://doi.org/10.3390/su8030213

Teklemariam D, Azadi H, Nyssen J, Haile M, Witlox F. How Sustainable Is Transnational Farmland Acquisition in Ethiopia? Lessons Learned from the Benishangul-Gumuz Region. Sustainability. 2016; 8(3):213. https://doi.org/10.3390/su8030213

Chicago/Turabian StyleTeklemariam, Dereje, Hossein Azadi, Jan Nyssen, Mitiku Haile, and Frank Witlox. 2016. "How Sustainable Is Transnational Farmland Acquisition in Ethiopia? Lessons Learned from the Benishangul-Gumuz Region" Sustainability 8, no. 3: 213. https://doi.org/10.3390/su8030213