1. Introduction

In recent years, China has experienced significant achievements in all industries and particularly e-commerce. Alibaba, the leader of the Chinese e-marketers, invented Kwangkunjie (Single’s Day), one-day online sale on November 11 that is similar to black Friday after Thanksgiving in the United States. On this double eleven day, Alibaba’s total turnover from all of its platforms has been 91.2 billion Yuan (US$13.68 billion), which involved 232 countries and 467 million logistics orders. These figures represent the world record for single-day online transaction volume [

1]. Alibaba’s significant success on Kwangkunjie may have resulted from the most successful intermediation of Alipay, the third-party online payment system that it launched in China in 2004. Alipay charges no transaction fees and provides an escrow service that enables consumers to verify their satisfaction with the goods they purchased before releasing money to the seller. This service is critical because it gives consumers guaranteed intermediation by an authorized third party, a necessity given China’s weak consumer protection laws and regulations. Its pro-activeness makes Alipay a unique payment-related service; for example, relative to U.S.-based Paypal’s simple third-party payment service, Alipay provides guarantees for transactions. Alipay also provides enhanced online payment functions through integrated diverse functions, such as for mobile games, movies and others. In contrast, Samsung Pay in Korea simply provides flexible payment services. Alipay is much more attractive to customers given its integrated one-stop multi-user-friendly services.

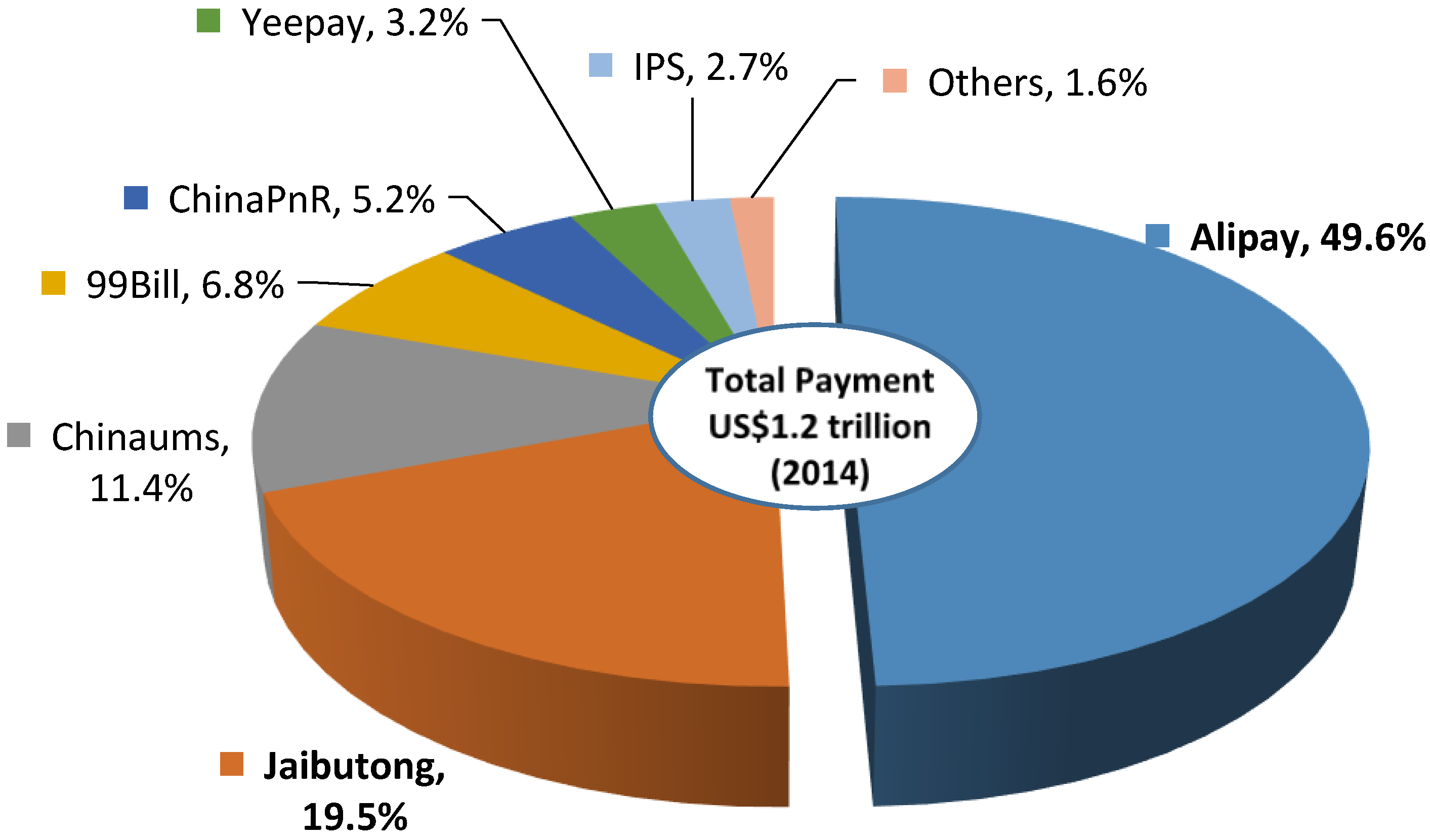

China’s third-party online payment volume increased to approximately eight trillion Yuan (US$1.2 trillion) in 2014, with growth of 50.3% compared to 2013. Alipay has led this rapidly increasing growth in third-party online payments, with a 49.6% market share or 3.87 trillion Yuan, as shown in

Figure 1 [

2]. More than 300 million people in the world use Alipay for payment services at Taobao and Tmall, as well as at many offline stores. Alipay’s strong escrow support enabled Alibaba to rapidly increase its online market share in China, and other followers effectively enabled consumers in this large country to integrate online shopping with online payments and logistics through one-source, multi-channel transactions. In 2013, Alipay launched a financial product platform called Yu’ebao that enables Alipay users to deposit any remaining money in an account and earn interest. This interest-yielding new invention by the third-party payer made Alipay the leader in this e-business new frontier.

Currently, Alipay provides both third-party escrow guarantees on online transactions and interest on the unused portion of an Alipay account. In addition to these direct support services for online shopping, many more applications exist for Alipay users who frequently visit diverse game and other entertainment sites and for users engaged in informative community activities. Alipay began as an online shopping supporter by being an escrow provider and became a multi-channel third-party online banking portal site. The continuing success of Alipay certainly arises from the proactive organizational culture of Alibaba (China) Co., Ltd., which is akin to reading users’ minds and pulling their demand instead of engaging in pushing-oriented forceful promotional marketing. Alipay’s long-term performance could be sustainable given its user-friendly, performance-oriented marketing efforts, because the value creation based on network management with diverse participants of a certain product is key to sustainable e-business management [

3].

Figure 1.

Third-party online payment market in China (2014). Source: China’s third-party online payment market in 2014 [

4].

Figure 1.

Third-party online payment market in China (2014). Source: China’s third-party online payment market in 2014 [

4].

However, as an online payment service, Alipay may require more sustainable operations for successful performance, because it is in the initial stages of the market, and the rapidly changing environment in China cannot guarantee that initial luck will carry forward to the long term. In particular, web marketing for an online payment service is also based on sustainable relationships with users. According to Bhattacherjee (2001), the sustainable performance of web services should not be based on simple, instantaneous intentions in the short term, but on reuse intentions for the long term [

5]. Chinese customers are quickly adopting “multichannel” shopping behavior that is creating both opportunities and challenges for social e-commerce brands/companies, retailers and companies. Taobao and its payment system Alipay certainly provide the most appropriate marketing platform in China [

6]. As previously mentioned, the U.S.-based PayPal does not provide escrow services, and Samsung Pay in Korea provides very flexible access points for payments, but no other services. Compared to these third-party online payment services, Alipay provides diverse, yet integrated services for multi-channel users. However, more is not always better, and a payment service’s core competence should maintain an appropriate “reach” to enable reuse by users [

7]. The purpose of this research is to determine Alipay’s sustainable factors as a third-party online payment service provider. To evaluate the sustainable feasibility of the online payment service, this paper empirically tests the relationship between the web marketing mix of Alipay and the reuse intention of users. However, a link is always missing between web marketing mix and its performance [

8]. Because of this missing link, previous studies conclude that initial trust in the web marketing mix is not effective enough [

6], whereas others insist that the web marketing mix is significant [

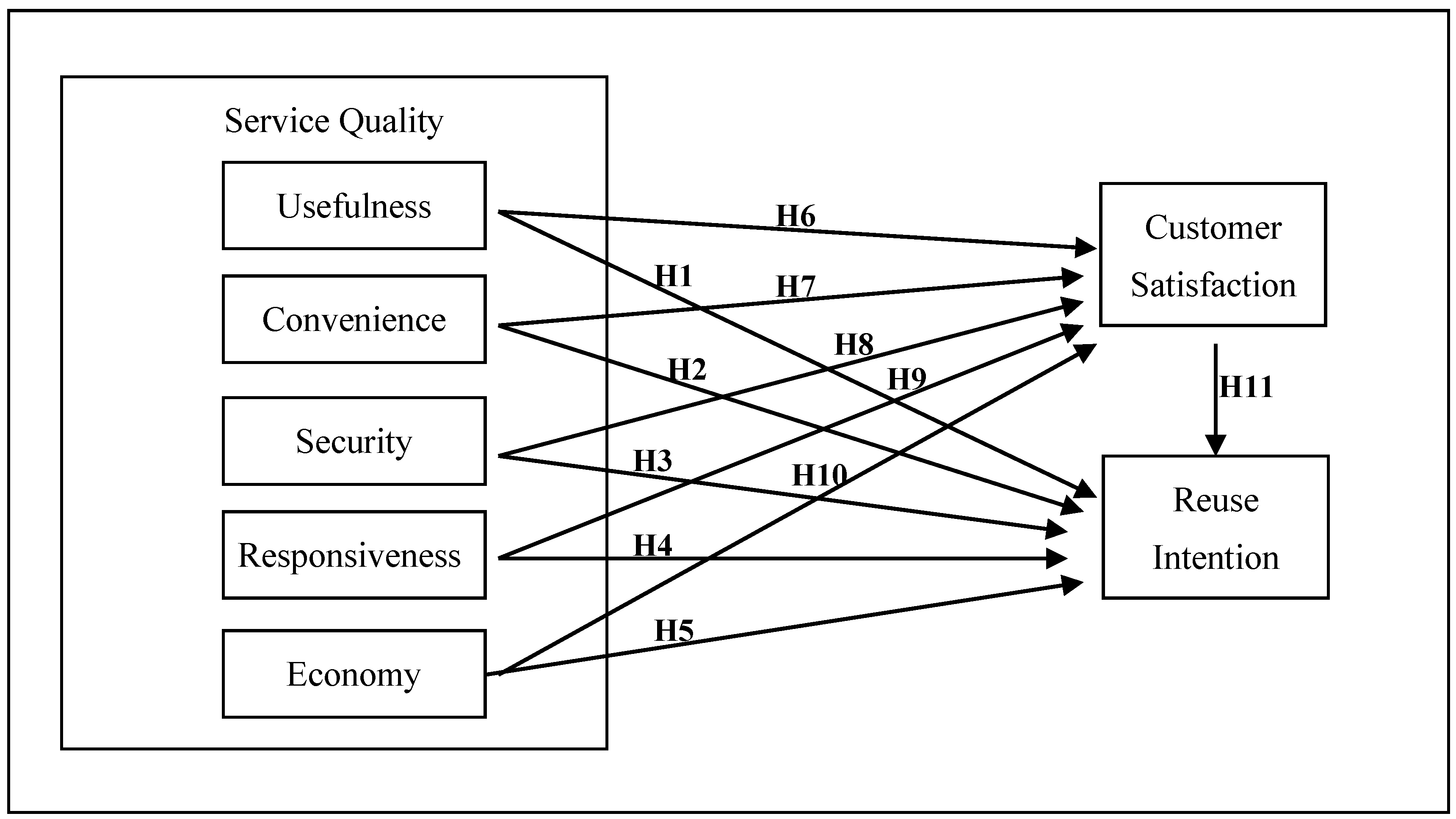

8]. Therefore, this research empirically tests the role of consumer satisfaction as a mediator between the web marketing mix and the reuse intention of consumers on third-party online payment systems, with an emphasis on the unique connectional characteristics of Alipay.

5. Discussion and Conclusions

This study examined the influence of dynamic trust on social e-commerce based on the web marketing mix theory. In China, the local competitors with cultural-friendly web companies based on social e-platforms gain much more effective initial and ongoing trust, compared to the global leaders, such as eBay and Facebook. The empirical results show that the issue of website dynamic trust is one of the most critical obstacles related to online transactions in social e-commerce. Over the past 10 years, many researchers have reported that trust is crucial for e-commerce; however, only a few of them noticed that trust is a kind of dynamic process. Customers’ trust constantly transforms during the different stages of a transaction. Therefore, we classified trust as initial trust and ongoing trust based on the perspectives of sustainability. In order to ensure successful performance, websites need to have a deeper understanding of how initial trust and ongoing trust are developed and how they affect purchases.

Alibaba (China) Co., Ltd. provides a good benchmarking case for developing a third-party online payment service in China and worldwide. However, in its initial stage, sustainable issues for the successful performance between sellers and customers were the most significant obstacles for Alibaba. To overcome these barriers, Alibaba attempted to invent a diverse set of multi-channel services, including the most outstanding feature of the third-party online payment of a type of escrow guarantee system for online transactions. In 2002, Alibaba launched a strategy to address another trust-related risk management issue and created value from this trust risk by introducing “TrustPass.” Alibaba’s successful case educated the Chinese government and led to changes in the regulatory platform. Because this service provides another guarantee system for local vendors, many local governments provided public funding and cooperated with Alibaba to subsidize small local companies to allow them to obtain Alibaba’s TrustPass. Alipay is another guaranteed system that enables a third party to manage the win-win game rule of transparency in online transactions. All of these efforts by Alibaba (China) Co., Ltd. are based on the customized market- and performance-oriented paradigm of its business strategy, which seems to work well, at least presently.

However, all of these efforts should be evaluated more precisely and systematically for sustainable management. Thus, this research empirically tested the sustainable features of Alipay’s service quality. By comparing previous studies, we selected the core of the service quality in five determinants: usefulness, convenience, security, responsiveness and economy. All five determinants worked well for customer reuse intention, which explains Alipay’s current success in the market. Unfortunately, however, only two of the five—convenience and security—showed sustainable performance with the support of customer satisfaction as a mediator. Customer satisfaction is crucial to sustainable performance by increasing the reuse intention, which is key for customer relationship management. Because the e-business paradigm is the creation of values on the basis of network management among all stakeholders, sustainable trust in terms of customer satisfaction is critical for sustainable performance. The two factors of convenience and security may fit this criterion and could be considered the core competence or necessary condition for sustainable performance.

The other three determinants of usefulness, responsiveness and economy may be considered complementary or sufficient conditions for sustainable performance in Alipay. Even if they are not statistically significant, these factors should be considered “determinants”; thus, Alipay should make greater effort to enhance the functioning of these factors for the role of customer satisfaction as a mediator for reuse intention. As Choi and Jin [

5] conclude, this partial fulfillment of sustainable performance comes from the unique character of Chinese culture. Even if Chinese people emphasize “

Guanxi” (social relationship), it is based at its roots on mutual economic benefits, not just social friendliness. These mutual economic benefits are why the initial trust in Alibaba (China) Co., Ltd. is partially mediated by ongoing trust [

5], and the majority of the determinants in this paper did not indicate any mediation effect for customer satisfaction. Because a transparent and, thus, reliable market environment is crucial for an advanced economy, the Chinese government should also more strongly emphasize the promotion of the functioning of these factors through both diverse incentives and regulatory measures.

Although the growth rates of northeast Asian countries, such as China and Korea, still lead the global economy, their sustainable performance cannot be guaranteed to continue. Thus, priority should be given to sustainable strategies from the perspective of the overall performance of the e-business ecosystem. However, because of the complexity of a sustainable operation for a collaborative ecosystem, visualizing the performance of these sustainable strategies and practices is particularly difficult. Even so, the government’s failure to engage in a market-oriented implementation of its e-business policies may result in losing the public’s trust, and then, finally, an oversupply or a demand shortage may worsen market performance [

5]. This empirical test may have some limits in its implications due to the more precise approach with recent technologies, such as the bootstrapping procedure. It will be future tasks to enhance the implications and suggestions. Nonetheless, this paper strongly emphasizes that today’s success may not guarantee tomorrow’s success, at least in the Alipay case. In order to sustainably maintain its success on third party payment, Alipay should make more customized efforts for the reuse intention. Especially, Alipay needs to develop a complement role with the traditional off-line banks, because they have much stronger reuse intentions and motivations. Therefore, this study emphasizes the importance of creating a new paradigm of field- and performance-oriented strategies. Moreover, the intermediary role of customer satisfaction in addressing sustainable performance cannot be emphasized strongly enough, particularly in transient economies, such as China and Korea [

3].