Assessing the Challenges in Successful Implementation and Adoption of Crop Insurance in Thailand

Abstract

:1. Introduction

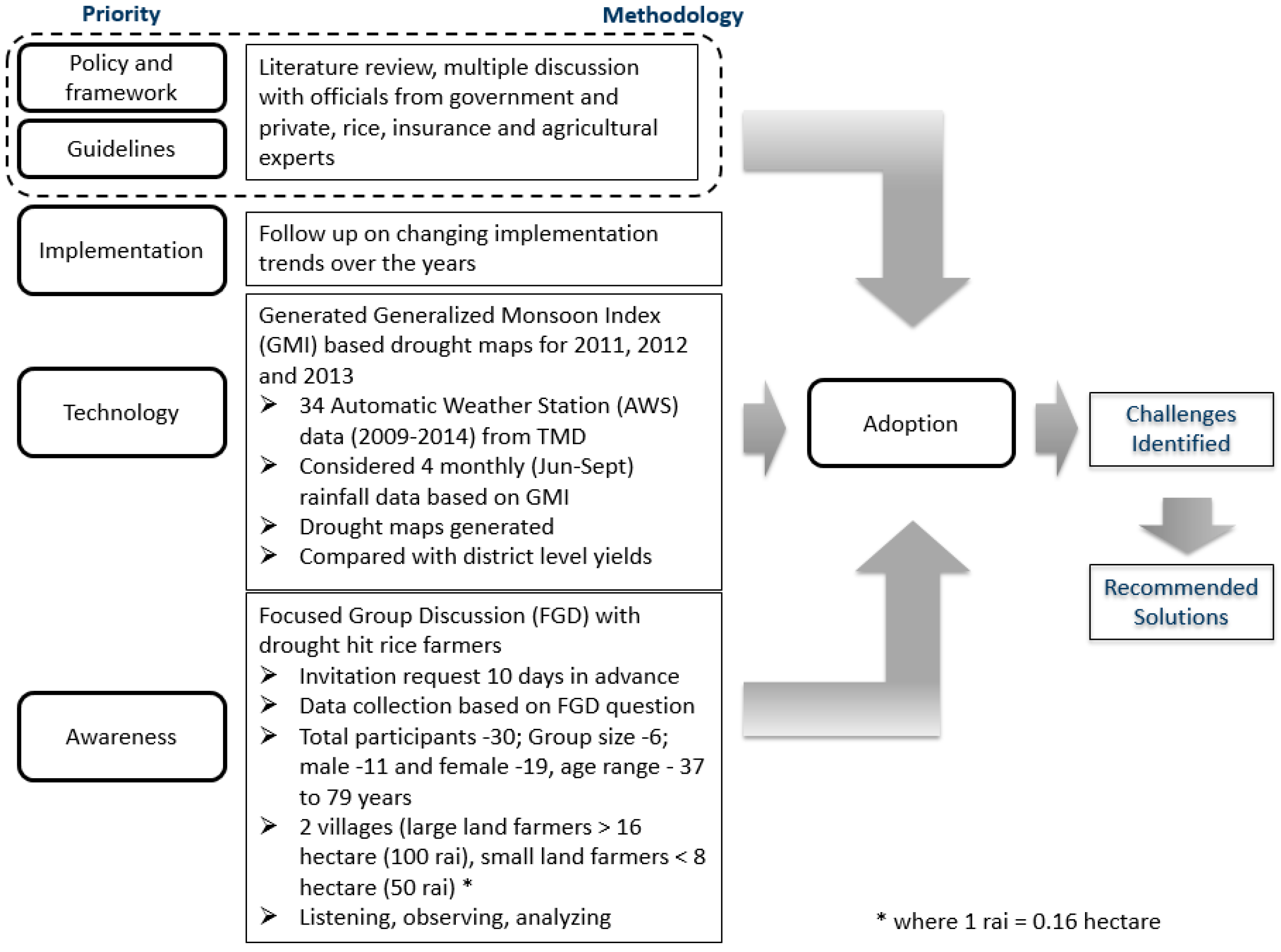

2. Methodology: Analyzing Gaps and Improving Weather Index Insurance (WII) Framework

3. Policy and Frameworks of Crop Insurance

- ➢

- The national agriculture insurance scheme generally has a monopoly agriculture insurance body where the entity is responsible for loss adjustment and has high level of government premium subsidy and reinsurance support; e.g., China.

- ➢

- In commercial competition with a high level of control, the policy design and premium rating criteria are controlled by the government and the insurer is obligated to offer crop insurance to all farmers and regions in order to qualify for the premium subsidies; e.g., Thailand.

- ➢

- In commercially-competitive situations with low levels of control, the private insurer is free to choose the crop/region/peril/premium rate they charge and the government role is to subsidize premiums only; e.g., India.

3.1. Government Disaster Relief Programme

3.2. Rice Insurance with Premium Subsidies from the Government

3.3. Weather Index Insurance (WII) by Public Private Sector

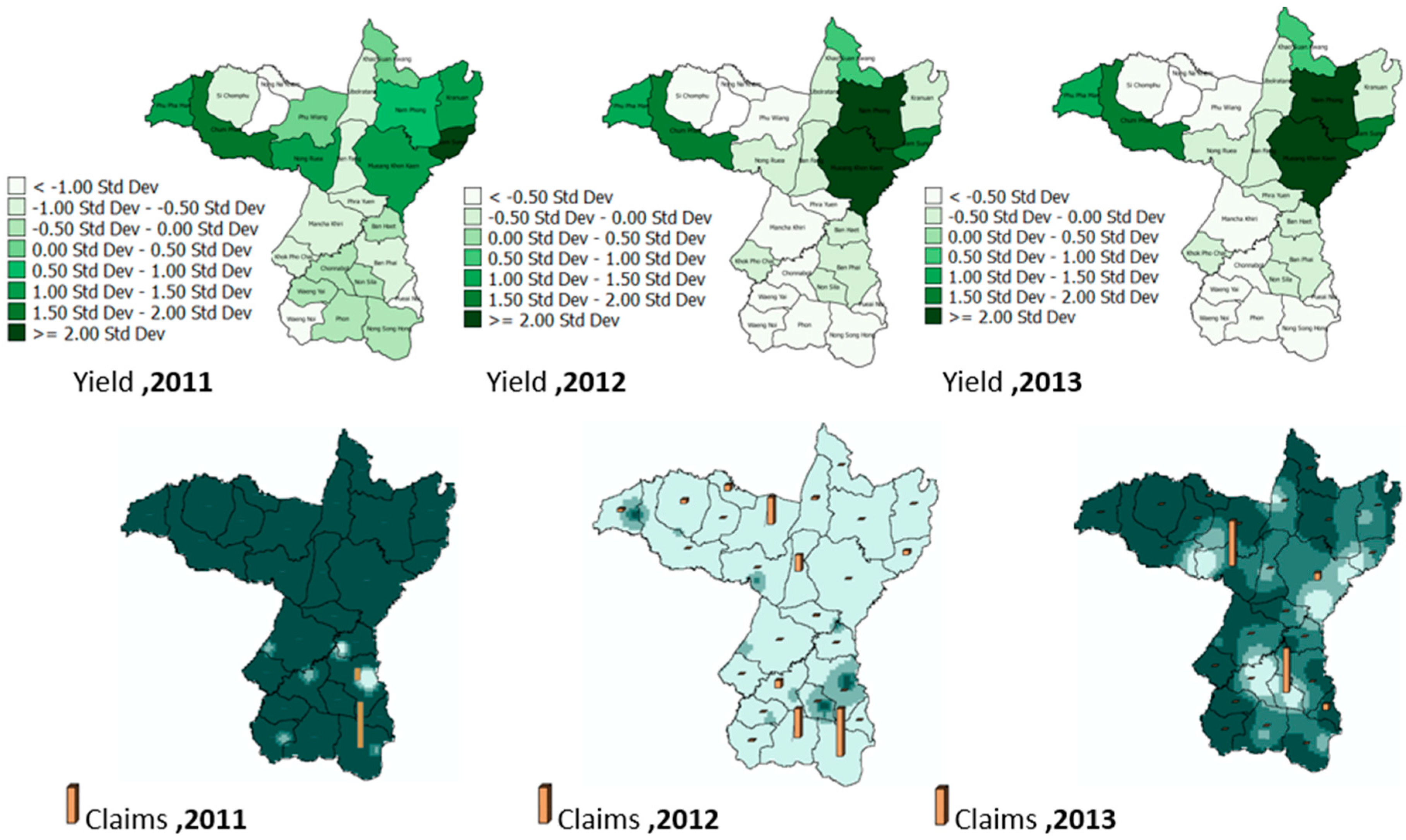

4. Technological Aspects of Weather Index Insurance (WII)

4.1. Data

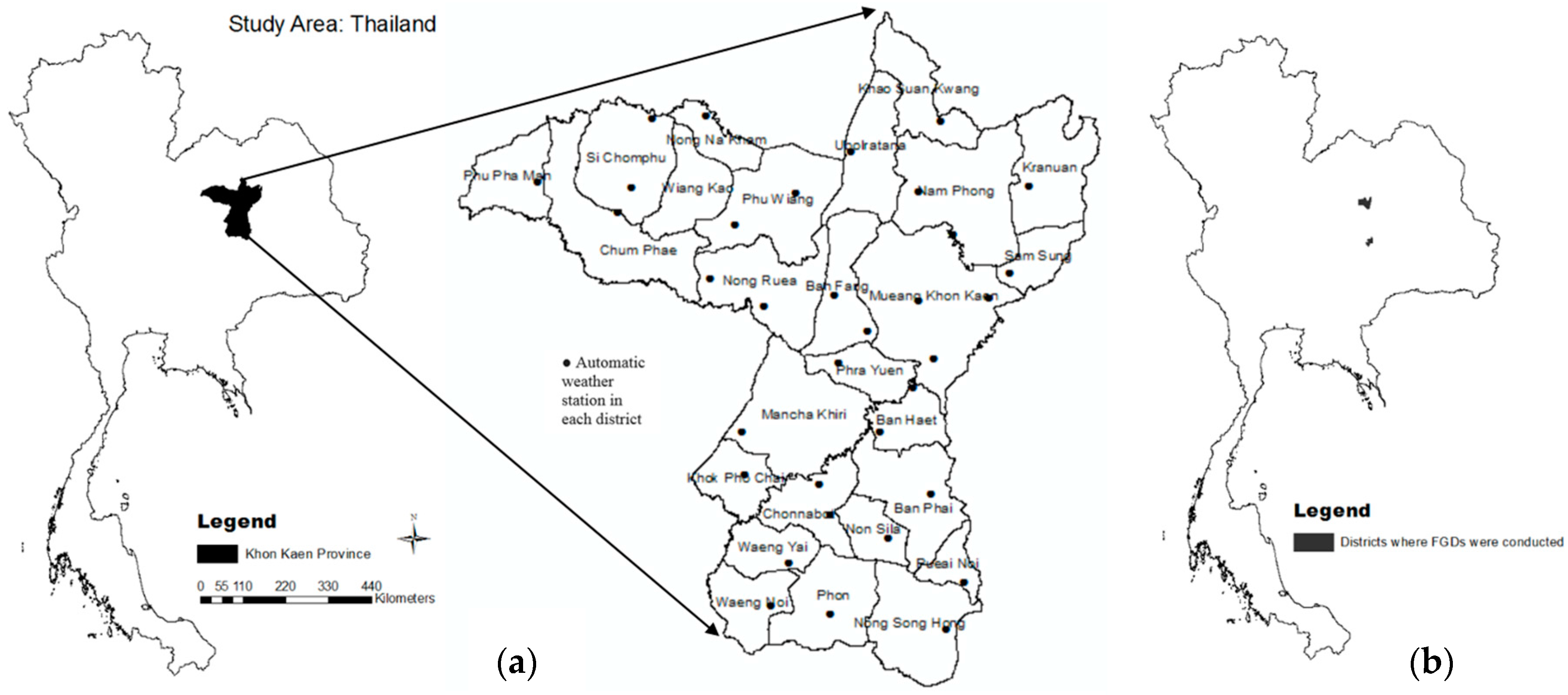

4.2. Weather Station Locations

4.3. Data Analysis, Integrated Planning, and Implementation Phase for Crop Insurance

4.4. Rainfall Index as Threshold Indicates High Basis Risk

4.5. Insurance Based on Classified Irrigated and Non-Irrigated Areas

4.6. Information about Rice Varieties Used

5. Farmers Awareness and Adoption for Crop Insurance

6. Key Findings and the Way Forward

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Shepherd, A.; Mitchell, T.; Lewis, K.; Lenhardt, A.J.; Lindsey, S.L.; Muir-Wood, R. The Geography of Poverty, Disasters and Climate Extremes in 2030. Available online: http://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/8633.pdf (accessed on 25 October 2016).

- Sinha, S.; Tripathi, N.K. Assessment of crop insurance international practices, policies and technologies as risk mitigation tools in India and Thailand. Int. J. Adv. Res. 2014, 2, 769–788. [Google Scholar]

- UNESCAP. Regional Forum on Space Technology Applications for Drought Monitoring and Early Warning I. Conclusions and Recommendations. Available online: http://www.unescap.org/sites/default/files/Final%20Report-DroughtRWG%201-2Jul2014SriLanka.pdf (accessed on 2 April 2015).

- Greatrex, H.; Hansen, J.; Garvin, S.; Diro, R.; Blakeley, S.; Le Guen, M.; Rao, K.; Osgood, D. Scaling up Index Insurance for Smallholder Farmers: Recent Evidence and Insights; CCAFS Report No. 14; CGIAR Research Program on Climate Change, Agriculture and Food security (CCAFS): Copenhagen, Denmark, 2015; Available online: https://cgspace.cgiar.org/bitstream/handle/10568/53101/CCAFS_Report14.pdf (accessed on 25 October 2016).

- The World Bank. Weather Index Insurance for Agriculture: Guidance for Development Practitioners; Agriculture and Rural Development Discussion Paper; The World Bank: Washington, DC, USA, 2011; Available online: http://documents.worldbank.org/curated/en/590721468155130451/Weather-index-insurance-for-agriculture-guidance-for-development-practitioners (accessed on 14 December 2015).

- Hellmuth, M.E.; Osgood, D.E.; Hess, U.; Moorhead, A.; Bhojwani, H. (Eds.) Index Insurance and Climate Risk: Prospects for Development and Disaster Management; Climate and Society No. 2; International Research Institute for Climate and Society (IRI): Columbia University, New York, NY, USA, 2009; Available online: http://iri.columbia.edu/docs/publications/Climate%20and%20Society%20Issue%20Number%202.pdf (accessed on 23 March 2015).

- Barrett, C.B.; Barnett, B.J.; Carter, M.R.; Chantarat, S.; Hansen, J.W.; Mude, A.G.; Osgood, D.; Skees, J.R.; Turvey, C.G.; Ward, M.N. Poverty Traps and Climate Risk: Limitations and Opportunities of Indexbased Risk Financing; IRI Technical Report No. 07-03; International Research Institute for Climate and Society: Palisades, NY, USA, 2007; Available online: http://barrett.dyson.cornell.edu/Papers/WP_Poverty_IRItr0702.pdf (accessed on 14 May 2015).

- Hazell, P.; Anderson, J.; Balzer, N.; Hastrup Clemmensen, A.; Hess, U.; Rispoli, F. The Potential for Scale and Sustainability in Weather Index Insurance for Agriculture and Rural Livelihoods; International Fund for Agricultural Development and World Food Programme: Rome, Italy, 2010; Available online: https://www.ifad.org/documents/10180/32647150-6e8a-41f3-8642-404768cfc99f (accessed on 17 August 2016).

- Cole, S.; Giné, X.; Vickery, J. How Does Risk Management Influence Production Decisions? Evidence from a Field Experiment; Harvard Business School Working Paper, No. 13-080; Harvard Business School: Boston, MA, USA, 2013. [Google Scholar]

- Food and Agriculture Organization of the United Nations (FAO). Country Fact Sheet—Thailand. Available online: http://www.fao.org/nr/water/aquastat/data/cf/readPdf.html?f=THA-CF_eng.pdf (accessed on 20 March 2016).

- Thaiturapaisan, T. Thailand’s Drought Crisis: Understanding It without the Panic. Available online: https://www.scbeic.com/en/detail/product/2127 (accessed on 23 October 2016).

- Mapraneat, V. Drought Conditions and Management Strategies in Thailand, Disaster Prevention and Mitigation, Thailand. Available online: http://www.ais.unwater.org/ais/pluginfile.php/597/mod_page/content/79/Thailand.pdf (accessed on 7 March 2016).

- Thaiturapaisan, T.; Drought, A. Worrying Situation for Thai Agriculture. Available online: https://www.scbeic.com/en/detail/product/1429 (accessed on 15 July 2015).

- The Telegraph. Farmers Fight over Water as Thailand Suffers Worst Drought in 10 years. Available online: http://www.telegraph.co.uk/news/worldnews/asia/thailand/11739503/Farmers-fight-over-water-as-Thailand-suffers-worst-drought-in-10-years.html (assessed on 15 December 2015).

- National News Bureau of Thailand—Public Relations. Available online: http://thainews.prd.go.th (accessed on 9 March 2016).

- UNESCAP. Disasters without Borders, Regional Resilience for Sustainable Development, Asia-Pacific Disaster Report 2015. Available online: http://www.unescap.org/resources/asia-pacific-disaster-report-2015 (accessed on 20 December 2015).

- Sirimanne, S.; Srivastava, S.; Kim, S.E.; Li, H.M.D.; Firer, A.; Sinha, S. Building Resilience to Droughts: Scaling up Weather Insurance in China, India, and Thailand. In Proceedings of the 7th World Water Forum, Daegu, Korea, 12–17 April 2015; Available online: http://lib.icimod.org/record/30291/files/CaseStudy_4WWF.pdf (accessed on 15 October 2015).

- Sakamoto, C.; Achutuni, R.; Steyaert, L. User’s Guide. Development of AgroClimatic/Crop Condition Index Assessment Models; NOAA, Atmospheric Science Department, University of Missouri: Columbia, MO, USA, 1984. [Google Scholar]

- Ueangsawat, K.; Jintrawet, A. An Assessment of Future Climate Change and Water Condition in Upper Ping River Basin under A2 and B2 Scenarios during 2015–2074. Environ. Nat. Resour. J. 2014, 12, 22–43. [Google Scholar]

- Pérez-Blanco, C.D. Insurance Schemes in the Agriculture Sector to Address Climate Change Impacts. International Center for Climate Governance; ICCG Reflection No. 46/March 2016. Available online: http://www.iccgov.org/wp-content/uploads/2016/03/46_Insurance-schemes-in-the-agriculture-sector-to-address-climate-change-impacts_C.-D.-P%C3%A9rez-Blanco.pdf (accessed on 26 October 2016).

- Food and Agriculture Organization of the United Nations (FAO). Agricultural Insurance in Asia and the Pacific Region. Available online: http://www.fao.org/3/contents/46ed3d30-a8e3-5f4b-ae3d-5de34231b111/i2344e00.pdf (accessed on 26 January 2015).

- Mahul, O.; Stutley, C. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries; The World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Mysiak, J.; Pérez-Blanco, C.D. Partnerships for affordable and equitable disaster insurance. Nat. Hazards Earth Syst. Sci. Discuss. 2015, 3, 4797–4832. [Google Scholar] [CrossRef]

- Bank for Agriculture and Agricultural Cooperatives (BAAC). Challenges and Experiences towards Sustainable Rural Finance. Unpublished work. 2016. [Google Scholar]

- Bangkok Post. 26m Rai of Farmland Insured, Says OIC. Available online: http://www.bangkokpost.com/business/news/1076372/26m-rai-of-farmland-insured-says-oic (accessed on 5 September 2016).

- Thanad, J. Recent Developments of Crop Insurance in Thailand. Available online: http://www.oecd.org/insurance/insurance/49657525.pdf (assessed on 9 September 2012).

- Sompo Japan Nipponkoa; Bangkok, Thailand. Personal communication, 2015.

- Norton, M.T.; Turvey, C.; Osgood, D. Quantifying spatial basis risk for weather index insurance. J. Risk Financ. 2012, 14, 20–34. [Google Scholar] [CrossRef]

- Black, E.; Tarnavsky, E.; Maidment, R.; Greatrex, H.; Mookerjee, A.; Quaife, T.; Brown, M. The Use of Remotely Sensed Rainfall for Managing Drought Risk: A Case Study of Weather Index Insurance in Zambia. Remote Sens. 2016, 8. [Google Scholar] [CrossRef]

- Sinha, S. Disaster Information Management in Asia and the Pacific: Issues, Challenges and Opportunities. Working Paper; Regional Expert Group Meeting on Capacity Development for Disaster Information Management. Available online: http://www.unescap.org/sites/default/files/APDIM%20Draft%20Working%20Paper%20for%20EGM%2021-%2022%20OCT%202014_BKK%20(website).pdf (accessed on 15 January 2015).

- Van Westen, C.J. Remote Sensing and GIS for Natural Hazards Assessment and Disaster Risk Management. Available online: ftp://ftp.itc.nl/pub/westen/Multi_hazard_risk_course/Powerpoints/Background%20paper%20Spatial%20data%20for%20hazard%20and%20risk%20assessment.pdf (accessed on 10 December 2014).

- He, Y.; Cai, W.; Chen, J.; Zhou, Z.; Gao, M.; Liu, Y.; Zhang, L. How climatic factors changes statistically relate to rice yield at agro-subzone and nationwide level during the period 1961–2040. In Proceedings of the 5th International Conference on Agro-Geoinformatics, Tianjin, China, 18–20 July 2016.

- Rice Department of Thailand. Using Water in Rice Cultivation. Unpublished work. 2016. [Google Scholar]

- Dobermann, A. Transformative Technologies. Available online: http://irri.org/blogs/achim-dobermann-s-blog/transformative-technologies (accessed on 15 December 2013).

- Anantha, M.S.; Patel, D.; Quintana, M.; Swain, P.; Dwivedi, J.L.; Torres, R.O.; Verulkar, S.B.; Variar, M.; Mandal, N.P.; Kumar, A.; et al. Trait Combinations That Improve Rice Yield under Drought: Sahbhagi Dhan and New Drought-Tolerant Varieties in South Asia. Crop Sci. 2016, 56, 408–421. [Google Scholar] [CrossRef]

- Organization of Agricultural Economics (OAE); Bangkok, Thailand. Personal communication, 2016.

- Orachos, N.; Carl, P. Adoption of drought-tolerant rice in Thailand: Participatory varietal selection and implications for breeding programs. J. Dev. Agric. Econ. 2014, 6, 394–404. [Google Scholar] [CrossRef]

- Rice Knowledge Bank; Bangkok, Thailand. Personal communication, 2016.

- Ward, P.S.; Spielman, D.J.; Ortega, D.L.; Kumar, N.; Minocha, S. Demand for Complementary Financial and Technological Tools for Managing Drought Risk: Evidence from Rice Farmers in Bangladesh. Available online: http://reliefweb.int/sites/reliefweb.int/files/resources/ifpridp01430.pdf (accessed on 25 May 2016).

- McLaurin, M.K.; Turvey, C.G. Applicability of the Normalized Difference Vegetation Index in Index-Based Crop Insurance Design. Available online: http://journals.ametsoc.org/doi/pdf/10.1175/WCAS-D-11-00059.1 (accessed on 22 March 2015).

- The World Bank. Agricultural Data and Insurance—Innovations in Agricultural Data Development for Insurance. Available online: https://blogs.worldbank.org/psd/files/agricultural-insurance-data-15sept2015.pdf (accessed on 22 March 2016).

- Prabhakar, S.V.R.K.; Bakar, A.A.; Claudio, C.P.B.; Hung, H.V.; Solomon, D.S. What Ails the Effectiveness of Crop Insurance? Emerging Bottom-up Issues and Solutions; Asia-Pacific Adaptation Network: Bangkok, Thailand, 2015. [Google Scholar]

| Year | Drought Area (Provinces) | Vulnerability | ||

|---|---|---|---|---|

| People | Agricultural Area (Hectare) | Losses (US $) | ||

| 2007 | 66 | 16,754,980 | 218,549.3 | 6,109,203.1 |

| 2008 | 61 | 13,298,895 | 84,983.8 | 3,200,888.5 |

| 2009 | 62 | 17,353,358 | 96,223.5 | 3,337,853.2 |

| 2010 | 64 | 15,740,824 | 277,914.3 | 43,598,997.7 |

| 2011 | 55 | 16,560,561 | 131,390.0 | 4,062,376.2 |

| 2012 | 52 | 15,234,597 | 240,628.0 | 12,297,552.2 |

| 2013 | 58 | 9,066,185 | 691,574.9 | 89,802,429.3 |

| Regions | Chaophraya-Thajeen | Maklong | North-Eastern | East |

|---|---|---|---|---|

| % Reduction in Reservoirs water level from 2014 to 2015 | −2% | −6% | −11% | −21% |

| % Reduction in Useable water remaining from 2014 to 2015 | −13% | −28% | −24% | −26% |

| % of Reservoir Capacity | 4% | 9% | 13% | 19% |

| Remaining days of water supply | 32 | 128 | 185 | 190 |

| Public Sector | Private Sector | Public and Private Sector |

|---|---|---|

| Government has monopoly and intervenes to provide heavy subsidy and assumes the role of reinsurer. | Insurance companies compete for business and purchase the reinsurance from international commercial reinsurers. | Different forms varying on the level of government involvement. |

| High penetration as it is generally compulsory | Low to moderate penetration | High penetration |

| Well diversified portfolios | Low risk diversification | Well diversified portfolios |

| High fiscal cost | No fiscal cost | Reasonable fiscal cost |

| Adapting Country Examples | ||

| Bangladesh (Sadhurin Beema Corporation), Canada (10 provincial government crop insurance corporations), Cyprus (Agricultural Insurance Organization of the Ministry of Agriculture), Democratic People’s Republic of Korea (Korea National Insurance Corporation), Greece (Hellenic Agricultural Insurance Organization (ELGA), India (Agriculture Insurance Cooperation of India (AIC)), Iran (Government owned Agriculture Insurance Fund), Philippines (PCI), Sri Lanka (Agricultural and Agrarian Insurance Board) | Argentina, Australia, Germany, Hungary, India, Malaysia, New Zealand, Philippines, South Africa, Lanka, Sweden, Thailand, The Netherlands, United States, Vietnam | China, Indonesia, Japan, Mongolia, Pakistan, Republic of Korea, Thailand, United States, Vietnam |

| Crop Details | Regular | Special Announcement (Cabinet Resolution as of November 2010) | Special Announcement (Cabinet Resolution as of August 2011) | Ministry of Finance (Regulation 2013) |

|---|---|---|---|---|

| (US $/Hectare) | ||||

| Rice | 109.7 | 379.7 | 402.2 | 201.4 |

| Field Crop | 151.5 | 528.7 | 570.1 | 207.8 |

| Horticulture | 165.1 | 888.3 | 922.7 | 305.9 |

| Others | 51.9 | 444.2 | 461.4 | - |

| Details | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|

| Cabinet Resolution | 3 May | 26 June | 20 August | 24 June | 28 April |

| Insurers | Pool of 8 companies with Dhipaya Insurer as the key insurer | National Catastrophe Insurance Fund was established |

|

|

|

| Characteristics | Rice farmers who register with Department of Agricultural Extension | Insurance must be done within 45 days from planting date | - | ||

| Premium Rate | 129.47 THB/Rai ($23.4 USD/hectare) * | 129.47–510.39 THB/Rai ($23.4–$92.4 USD/hectare) * | |||

| Perils covered | Drought, flood, storm or typhoon, cold, hail and fire | Drought, flood, storm or typhoon, cold, hail, fire, pest and disease | |||

| Compensation Rates | First 60 days—606 THB/rai ($109.6 USD/hectare) and from 61st day to 1400 THB/rai ($253.4 USD/hectare) | Multi-Peril Compensation—1111 THB/rai ($201.1 USD/hectare) And Pest and disease Compensation—555 THB/rai ($100.5 USD/hectare) | |||

| Waiting Period | 7 Days (from the starting of insurance, no compensation is paid) | ||||

| Conditions | All district areas | Selective area based on level of risk | |||

| Area Insured (Hectare) | 169,460.96 | 139,590.48 | 19.2 | 132,907.8 | 241,931.56 |

| Premiums (US $) | 3,960,240 | 3,262,210 | 12,470 | 10,435,940 | 17,815,860 |

| Compensation (US $) | 21,938,151.2 | 7,425,313.6 | 902.13 | Not available | Not Available |

| Insurer | Sompo Japan Insurance (Thailand) Company Limited | |||||

|---|---|---|---|---|---|---|

| Details | 2009 (Pilot) | 2010 | 2011 | 2012 | 2013 | 2014 |

| Premium Rate | 4.64% of insured premium | |||||

| Indemnity Rate | 40% of insured amount in case of severe drought and 15% in case of drought | 5% for early drought (1–31 July) and 40% for drought and severe drought (1 August–30 September) | ||||

| Operation Areas | 5 districts of Khon Kaen province | All 25 district of Khon Kaen | Expanded to additional 4 provinces | Expanded to additional 4 provinces to a total of 9 | 9 Provinces | Expanded to additional 8 provinces to a total of 17 |

| Number of weather stations | 5 | 34 | 140 | 235 | 235 | 388 |

| Insured | 276 | 1158 | 6173 | 849 | 2863 | 4320 |

| Sum Insured (US $) | 287,158 | 466,320 | 2,074,950 | 291,450 | 955,550 | 1,640,820 |

| Area Insured (Hectare) | 917.28 | 1286.4 | 5724 | 840 | 2636 | 4526.4 |

| Premium (US $) | Pilot test, no payment | 21,637.25 | 96,277.68 | 13,523.28 | 44,337.52 | 76,134.05 |

| Indemnity (US $) | 3436.50 | 4089.00 | Early Drought $12,412 USD (359 farmers) | Early Drought $6003 USD (206 farmers) | Early Drought $49,445 USD (1322 farmers) | |

| Drought $7395 USD (168 farmers) | Drought $3958.5 USD (91 farmers) | Drought $12,963 USD (192 farmers) | ||||

| Severe Drought $26,100 USD (207 farmers) | Severe Drought $14,369.5 USD (125 farmers) | |||||

| Total Indemnity (US $) | $45,907 USD (734 farmers) | $9961.5 USD (297 farmers) | $76,777.5 USD (1369 farmers) | |||

| Loss Ratio | 15.88% | 4.24% | 339.47% | 22.47% | 100.85% | |

| Scale | Level | Mapping Scale (Million) | Spatial Resolution | Area Covered (km2) | Drought | Floods |

|---|---|---|---|---|---|---|

| Global | Global | <1:5 | 1–5 km | 148 million | ** | * |

| Very Small | Continental/large countries | 1–5 | 1 | 5–20 million | *** | ** |

| Small | National | 0.1–1 | 0.1–1 km | 30–600 million | *** | *** |

| Regional | Provincial | 0.05–0.1 | 100 m | 1000–10,000 | ** | *** |

| Medium | Municipal | 0.025–0.05 | 10 m | 100 | ** | *** |

| Large | Community | >0.025 | 1–5 m | 10 | * | *** |

| Province Level Rice Yield | Correlation Coefficient (R) | Coefficient of Determination (R2) |

|---|---|---|

| Total September Rainfall | 0.212 | 0.045 |

| Total August-September Rainfall | 0.139 | 0.019 |

| Total July-August-September Rainfall | 0.130 | 0.017 |

| Year | % of Rice Variety (Wet Season Only) | % of Rice Variety (Dry and Wet Seasons) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| RD6 | Kho Doc Mali 105 | RD15 | Photoperiod Sensitive | Photoperiod Insensitive | RD10 | Phitsanulok 1, 2 | Chai Nat 1 | Others | |

| 2009 | 72.01 | 22.26 | 1.14 | 0.89 | 0.87 | - | - | 0.57 | 2.26 |

| 2010 | 70.64 | 22.65 | 1.14 | 0.89 | 1.84 | - | - | 0.57 | 2.27 |

| 2011 | 70.08 | 23.88 | 0.77 | 0.78 | 1.81 | - | - | 0.38 | 2.30 |

| 2012 | 69.37 | 25.09 | 0.59 | 1.55 | 1.30 | - | - | 0.10 | 2.00 |

| 2013 | 69.97 | 24.73 | 0.56 | 1.02 | 1.53 | - | - | 0.11 | 2.08 |

| 2014 | - | - | - | - | 7.80 | 25.56 | 28.54 | 31.66 | 6.44 |

| Details | RD6 | Khao Dawk Mali (KDML-105) | RD15 |

|---|---|---|---|

| Started | 1977 | 1959 | 1978 |

| Location | North and Northeast | Northeast and Upper North | North East |

| Resistance | Drought Resistant | Drought Resistant | Drought Resistant |

| Characteristics | Fragrant, chewy, Glutinous | Fragrant, Soft, Non-Glutinous | Fragrant, Soft, Glutinous |

| Maturity | 21 November | 25 November | 10 November |

| Approximate Production | 666 kg/hectare | 363 kg/hectare | 560 kg/hectare |

| Quality | High | High | High |

| Demand | Domestic | Premium Export | Domestic |

| Focused Group Discussion with Rice Farmers; Number of Participants—30; Group Size—6; Average Age—60 Years; No. of Males—11; No. of Females—19; * Approx. Land Area in Rai, Where 1 Rai = 0.16 Hectare | ||||||

|---|---|---|---|---|---|---|

| Questions | Detailed Comments Based on | Total Farmers (30) | ||||

| Large land farmers (Approx. >16 Hectare) * | Small land farmers (Approx. < 8 Hectare) * | Frequency of Drought in 15 years | ||||

| 1. What is the frequency of drought occurrence in last 10 years? | Drought occurred 8–9 times, the general practice is to wait for rainfall | About 13 farmers claim it as “many times” | <5 | ≤10 | Many times | No comments |

| 9 | 8 | 13 | ||||

| 2. What is the general practice? | Some claim using water from channel, grow other plants like corn, along with some being unemployed with no source of income. Some also suggest presence of government support but insufficient. | Wait for Rain | Grow other crops | Use other sources of water | No comments | |

| 14 | 7 | 5 | 4 | |||

| 3. What do you think should be done to support farmers in case of droughts? | Need dam and channel | Need water supplement and resources. | ||||

| 4. Was your rice ever damaged because of less or delayed rainfall? | Yes, many times almost every year | Yes, heavy damage, no production in 2015 | ||||

| 5. What else do you grow instead of rice in case of low rainfall predictions or drought situations? | Six large land farmers suggest growing only rice for years | 15 farmers suggested growing nothing because water is not enough, 1 farmer grew sugarcane, 1 grew cassava, and 3 indicated growing less water consuming plants provided by the government | Grow nothing | Sugarcane/Cassava | Other plants provided by Government | No comments |

| 15 | 2 | 3 | 4 | |||

| 6. Did you ever grow cassava or mung bean on the land you grew rice before? | Never | A farmer shared his experience of growing Cassava (5 rai~0.8 hectare) as it requires less water and its soil nutrients also support the growth of rice in the next season. | ||||

| 7. Have you ever planted drought resistant rice like RD6 and KDML-150? | Never grown RD6 | A combination of KDML-150 and RD6 is grown | ||||

| 8. What is the preferred rice for you to grow in this area? Do you keep changing the rice variety? | Have been using KDML-150 for years and do not prefer to change | Some farmers prefer to change rice variety whereas some do not, some preferred using KDML-150 while others would like to use RD6 and RD10 but need seeds (unavailable) | Variety Rice | KDML-150 | RD6/RD10 | Need Drought Resistant Rice |

| 3 | 8 | 8 | 1 | |||

| 9. What is the water requirement of drought resistant rice? | 50%–70% of the normal (approx.) | Need less water, RD10 grows in 3 months, and some farmers were unaware as they claim, have never grown drought resistant rice | ||||

| 10. How is the yield of drought resistant rice as compared to normal rice, what about price and demand? What do you prefer? Why? | Some farmers prefer normal rice as grown every year and have good price |

| Prefer normal rice | Prefer drought resistant rice | Why? | No comments |

| 8 | 3 | 8 | ||||

| 11. What do you understand by crop insurance? Do you want to have one? | Don’t want, need government subsidized premium | Need crop insurance as it gives good price, some do not understand, some find government compensation easy and are not interested in insurance, need government subsidized premium | Want | Don’t want | Why? | No comments |

| 8 | 8 | 14 | ||||

| 12. Do you understand the difference between weather index insurance and yield-based insurance? | 3 farmers indicated that weather is unreliable | Understand | Don’t Understand | Other comments | No comments | |

| 13 | 9 | 3 | 5 | |||

| 13. What is your preference in terms of buying drought resistant rice variety and buying crop insurance? | Prefer resistance rice and not buy crop insurance |

| Crop insurance | Drought resistant rice | Both | No comments |

| 10 | 12 | 2 | 6 | |||

| 14. What are the sources of irrigation in your farm land? | Rainfall is the only source | Apart from only rainfall some farmers had access to channel, ponds, wells | Only Rainfall | Dam/Channel | Ponds/Well | No comments |

| 21 | 7 | 2 | ||||

| 15. Is there any other hazard that impacts your crop growth other than drought? If yes, what are they? | Insect | Rice disease, insects, soil quality | Insects | Rice disease | Soil quality | Other comments |

| 16 | 8 | 1 | ||||

| 16. Any other comments? | Need to develop water resources and need good rice seed | |||||

| Priority | Challenges | Solutions |

|---|---|---|

| Policy, Framework and Guidelines | Existing but less attractive to farmers Need to integrate information available from various government sources into a national data infrastructure Standardization and improvement in data collection | Crop insurance should be mandatory and linked to credit (for example as in India) Making relevant information available to decision makers and insurance agencies would empower both government and private sector to develop better insurance products and markets |

| Technology | District level yield data unavailable More than 30 percent weather data unavailable in 2015 (non-working weather stations) High Basis Risk Only rainfall based index used Weather index insurance does not consider the relevance of distance between farm and weather station | Regular weather station maintenance Deploy more weather stations Develop GMI based drought maps Classify irrigated non-irrigated areas Classify drought resistant rice areas Identify areas with alternate wet and dry water management Post drought validation based on NDVI Integrating yield, weather and satellite data and reduce basis risk Bridge the gap between technology and farming practices |

| Awareness | Low awareness among farmers about potential benefits of crop insurance and drought resistant rice Low confidence in crop insurance Reluctant to choose non-rice crop Low irrigation in northeast part of Thailand | Proper marketing and awareness raising campaigns regarding insurance Need awareness regarding drought resistant rice and other crops that require less water for an improved decision making |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sinha, S.; Tripathi, N.K. Assessing the Challenges in Successful Implementation and Adoption of Crop Insurance in Thailand. Sustainability 2016, 8, 1306. https://doi.org/10.3390/su8121306

Sinha S, Tripathi NK. Assessing the Challenges in Successful Implementation and Adoption of Crop Insurance in Thailand. Sustainability. 2016; 8(12):1306. https://doi.org/10.3390/su8121306

Chicago/Turabian StyleSinha, Shweta, and Nitin K. Tripathi. 2016. "Assessing the Challenges in Successful Implementation and Adoption of Crop Insurance in Thailand" Sustainability 8, no. 12: 1306. https://doi.org/10.3390/su8121306