1. Introduction

In the past few decades, high-technology industries have experienced evolution, shorter product life cycles, a higher production rate of new products, and radical changes over time for several reasons, such as technological developments, regulatory changes, or new consumer preferences [

1,

2]. Therefore, firms in these high-technology industries have inherently experienced great technological and market uncertainty and volatility in terms of rapid product innovation, obsolescence, and market saturation [

3]. Correspondingly, to be competitive in this industrial environment, firms have pursued technology or product convergence, which eventually leads to industry convergence, defined as the process of blurring boundaries between previously distinct industries [

1,

4,

5,

6,

7,

8,

9,

10,

11,

12]. This is because technology or product convergence became a way for firms to develop and sustain their competitive advantage in the face of rapidly changing industrial paradigms [

3].

Examples of convergence among high-technology industries are numerous: the smartphone industry, which integrated cell phones, portable computers, and software [

1]; the nutraceutical and functional food industry, which was created through convergence between the pharmaceutical and food industries [

1,

7,

13,

14,

15]; and the smart car industry, which accelerates the integration of automobiles, electronics, and software [

16,

17,

18]. These convergent industries have grown rapidly, and some firms in them—such as Apple, Walgreens, and Google—have led their industries and changed their inherent structure.

Because industry convergence has had such a significant impact on the structure of these inherent industries, some governments have established national programs to promote and support activities involved in convergence. In 2003, for example, the National Science Foundation in the United States published a report titled “Converging Technologies for Improving Human Performance” [

19]; in 2004, the European Commission of the European Union published the report “Converging Technologies: Shaping the Future of European Societies” [

20]; and in 2011 and 2012, respectively, South Korea passed the Industry Convergence Promotion Act and established the Korea National Industrial Convergence Center. In particular, it is important for policy makers to understand the diffusion patterns of convergent industries and to create and sustain policies that promote and support convergence because it occurs across industries, and its patterns of emergence and diffusion are heterogeneous across convergent-industry pairs [

10,

21]. However, to the best of our knowledge, no research to date has investigated the emergence and diffusion patterns of industry convergence. Although a recent study [

10] shows the trends in industry convergence, it is limited to the diffusion characteristics of convergence, such as the potential degree to which industry convergence will develop and the speed of development.

Therefore, this research aims to investigate the emergence and diffusion patterns of convergence among high-technology industries in order to provide important empirical grounds for public policy as well as an innovative study on industry convergence. In doing so, we use the co-occurrence-based analysis conducted by Kim et al. [

10] to identify industry convergence from an extensive and comprehensive set of newspaper articles. The original newspaper article dataset we use covers about two million articles published by a major newspaper company in the United States over 26 years, from 1987 to 2012. From this original dataset, we extract 45 high-technology-industry pairs that show a continuously rising trend in industry convergence. Then, we calculate the degree of industry convergence for every convergent-industry pair and estimate diffusion parameters, such as the potential degree of industry convergence and the growth rate of industry convergence for each convergent-industry pair.

The estimation results show a wide dispersion of industries in terms of the potential degree and the growth rate of industry convergence. In addition, we find that these two factors are negatively associated, which indicates that, if the potential degree of convergence among industries is high, the growth rate of convergence among them is low. Furthermore, the diffusion curves of the convergent-industry pairs indicate heterogeneous patterns. These findings suggest important empirical patterns in industry convergence from a market-based perspective, which has not been explored before. In addition, the heterogeneous patterns we found suggest important insights for firm strategies related to the accelerated changes due to industry convergence.

The remainder of this paper is structured as follows. First, literature on industry convergence is briefly reviewed. Second, our method for measuring industry convergence is introduced. Third, using this measurement, our empirical methodology for estimating the diffusion model is described. Fourth, results of our analysis are reported, followed by a discussion. Finally, implications of this study are explored in our concluding remarks.

2. Literature Review

As a prevailing paradigm in the current high-technology industries, industry convergence increases connectivity and compatibility between converging industries [

10]. Ultimately, industry convergence introduces substitute or complementary offerings that cause creative destruction in related markets [

8,

22,

23]. It eventually triggers a transformation from a traditional industry to a newly restructured industry, altering the nature of competitive, cooperative, and regulatory interactions [

8,

10,

24,

25]. Firms that cannot effectively adapt to the restructured industrial environment fail in market competition and, eventually, lose their market position. The recent transformation of the mobile phone industry is a representative example. The integration of diverse functionalities in different product categories in various industries—such as high-speed data communication, high-resolution cameras, high-quality games, GPS-based navigation, and numerous applications—has restructured the traditional feature phone (i.e., cell phones that are not smartphones) industry, ceding dominance to the smartphone industry. Amid this turbulence, Nokia did not adjust to the smartphone industry well and was acquired by Microsoft in September 2013 [

16]. In other words, industry convergence becomes an important antecedent condition for firms to consider before they design a competitive strategy.

In this regard, existing studies examine the sources of industry convergence and suggest two major precursors of industry convergence: first, technology convergence [

1,

9,

14,

26,

27] and, second, applicational convergence [

5,

10,

23,

28,

29,

30,

31,

32] (other researchers call this type of convergence “market convergence” [

1,

7,

15]). Technology convergence generated by the combination of extant technologies replaces established technological paradigms, resulting in industry convergence that will disrupt the value chain of the existing industry [

10]. Applicational convergence occurs when market competition promotes firms’ technological innovation [

33], which eventually overshoots the market at some point [

34]. To overcome this market saturation, firms pursue convergence in the form of new applications, products, or services that provide the customer with value and differentiation vis-à-vis competitors—that is, applicational convergence [

9,

35]. To achieve successful applicational convergence, these firms need knowledge and capabilities vis-à-vis the new features of converged industries in which they were previously uninterested [

13,

36] and engage in interfirm relationships across industries as well as carry out open innovation activities, such as divestment, strategic alliances, joint ventures, mergers and acquisitions (M&As), and patent licensing, or demand articulation from the market [

1,

37,

38,

39,

40]. As firms gradually engage in these interorganizational activities, applicational convergence leads to collisions between existing business models [

30] and removes boundaries between the relevant industrial sectors—that is, industry convergence [

41].

Industry convergence is not a one-time event but, rather, a dynamic series of events that unfolds over time. Therefore, it demonstrates various diffusion trends, for example, some industries are continuously converging (i.e., evolutionary convergence) or are sometimes stagnant in its development (i.e., stationary convergence) [

10]. Other industries that previously converged can diverge later (i.e., divergence) [

10]. In particular, evolutionary convergence needs to be examined more closely with respect to which trends they demonstrate over time because it is the main type of convergence. In evolutionary convergence, as the size of the overlap between those industries expands, the degree of convergence increases according to an evolutionary pattern [

10]. This pattern indicates that over time this convergence permeates an industrial and economic system. Moreover, as the term ”evolutionary” is used with respect to innovation and change, in theory outside biology, coined by innovation studies (e.g., [

42]), it refers to gradual or radical change that implies the mechanism of variation, selection, and retention [

43]. In this mechanism, the characteristics of individual industries are uneven, and so are those of the converging industries. In particular, their diffusion characteristics may thus show heterogeneous patterns that can be determined by the potential degree and the growth rate of industry convergence. These diffusion characteristics may lead to unique policy perspectives on sustainable innovation that stimulates the emergence of radical technologies and changes in innovation system [

43] because those two factors determine the diffusion pattern that can be utilized as criteria for policy decision on the size and priority of R&D subsidization or promotion. However, to the best of our knowledge, little research has been conducted to date on these diffusion characteristics of evolutionary industry convergence.

To explore the characteristics of the diffusion of industry convergence, first, we need a way to measure industry convergence. As shown in

Table 1, previous studies have suggested how to measure industry convergence, most of them by carrying out co-classification analysis, citation analysis, or industry-technology concordance analysis of patent information [

1,

6,

7,

14,

23,

27,

44]. For example, Curran and Leker [

1] suggest an international patent classification (IPC) co-classification analysis to investigate industry convergence in nutraceuticals and functional foods, while Karvonen and Kässi [

44] provide a patent citation analysis to identify overlapping technologies in the computer, audiovisual, semiconductor, and optics industries.

However, despite the advantages of availability and inclusion of codified knowledge, patent data have limitations when it comes to measuring the degree of industry convergence [

10]. First, patent data imply a lack of contemporaneity. In general, patents explain possible outcomes derived from science and technology in the future, rather than indicating ongoing developments in industry convergence. This is because it takes a long time for patents to be commercialized by being transformed into products or services, which imply convergent characteristics. Second, patent data lack actuality. Because the IPC code of each patent is determined by individual patent examiners, a co-classification analysis using patents may not be capable of representing the actual phenomenon of industry convergence [

10].

From this perspective, to satisfy the need for contemporaneity and actuality in the measurement of the degree of industry convergence, recent studies choose alternative approaches, such as an interindustry product-market entry analysis using product-market entry data [

45] and a co-occurrence-based analysis using newspaper articles [

10]. First, the product-market entry measure can be used as a proxy of industry convergence. This measure is constructed based on the logic that the extent of convergence between two industries is determined by the relatedness between product markets in these two industries [

45]. In addition, it satisfies the need for contemporaneity and actuality by containing information on firms that actually introduce their products to the market. Second, the newspaper article data can be another information source to measure the degree of industry convergence. This is because newspaper articles include publicly announced interorganizational information, such as competitive actions against rivals, the formation of M&As, strategic alliances or joint ventures, engagement in joint research and development (R&D), and patent licensing with other companies that even belong to different industries. However, it is challenging to obtain this information from other public sources [

9]. In this research, we thus use a newspaper article dataset to measure the degree of industry convergence and investigate its emergence and diffusion pattern and characteristics.

4. Results

Based on the

DIC obtained from the previous section, this research estimates the diffusion parameters of

DIC for the convergent-industry pairs shown in

Table 3, while number 46 (Total) represents the mean

DIC of the entire convergent-industry pair. First, a coefficient of the initial degree of industry convergence (

b0)—that is,

DIC at the starting year, 1987—is significantly larger in pairs 285 (Paints, varnishes, lacquers, enamels, and allied–Paints, varnishes, lacquers, enamels, and allied) and 285 as well as 873 (Research, development, and testing services) and 281 (Industrial inorganic chemicals) than others. The former pair consists of a single SIC code (i.e., 285), which means the industry convergence occurs within this industry group. By contrast, this coefficient is significantly smaller in pairs 386 (Photographic equipment and supplies) and 284 (Soap, detergents, and cleaning preparations; perfumes, cosmetics, and other toilet preparations) as well as 356 (General industrial machinery and equipment) and 284 (Soap, detergents, and cleaning preparations; perfumes, cosmetics, and other toilet preparations) than others.

Second, the results for the potential degree of industry convergence (b1) suggest the extent to which industry convergence develops. The pairs 285 (Paints, varnishes, lacquers, enamels, and allied) and 284 (Soap, detergents, and cleaning preparations; perfumes, cosmetics, and other toilet preparations), 356 (General industrial machinery and equipment) and 281 (Industrial inorganic chemicals), and 356 and 284 show larger and significant coefficients, suggesting high convergence potential. In contrast, the pairs 873 (Research, development, and testing services) and 372 (Aircraft and parts) as well as 286 (Industrial organic chemicals) and 283 (Drugs) demonstrate significantly smaller coefficients than others with low convergence potential.

Third, the estimation result of the growth rate of the degree of industry convergence (b2) shows that the pairs 382 (Laboratory apparatus and analytical, optical, measuring, and controlling instruments) and 287 (Agricultural chemicals) as well as 386 (Photographic equipment and supplies) and 287 (Agricultural chemicals) are growing more rapidly than others. However, the pairs 285–284 and 873–281 show a significantly lower growth rate than others during 1987–2012.

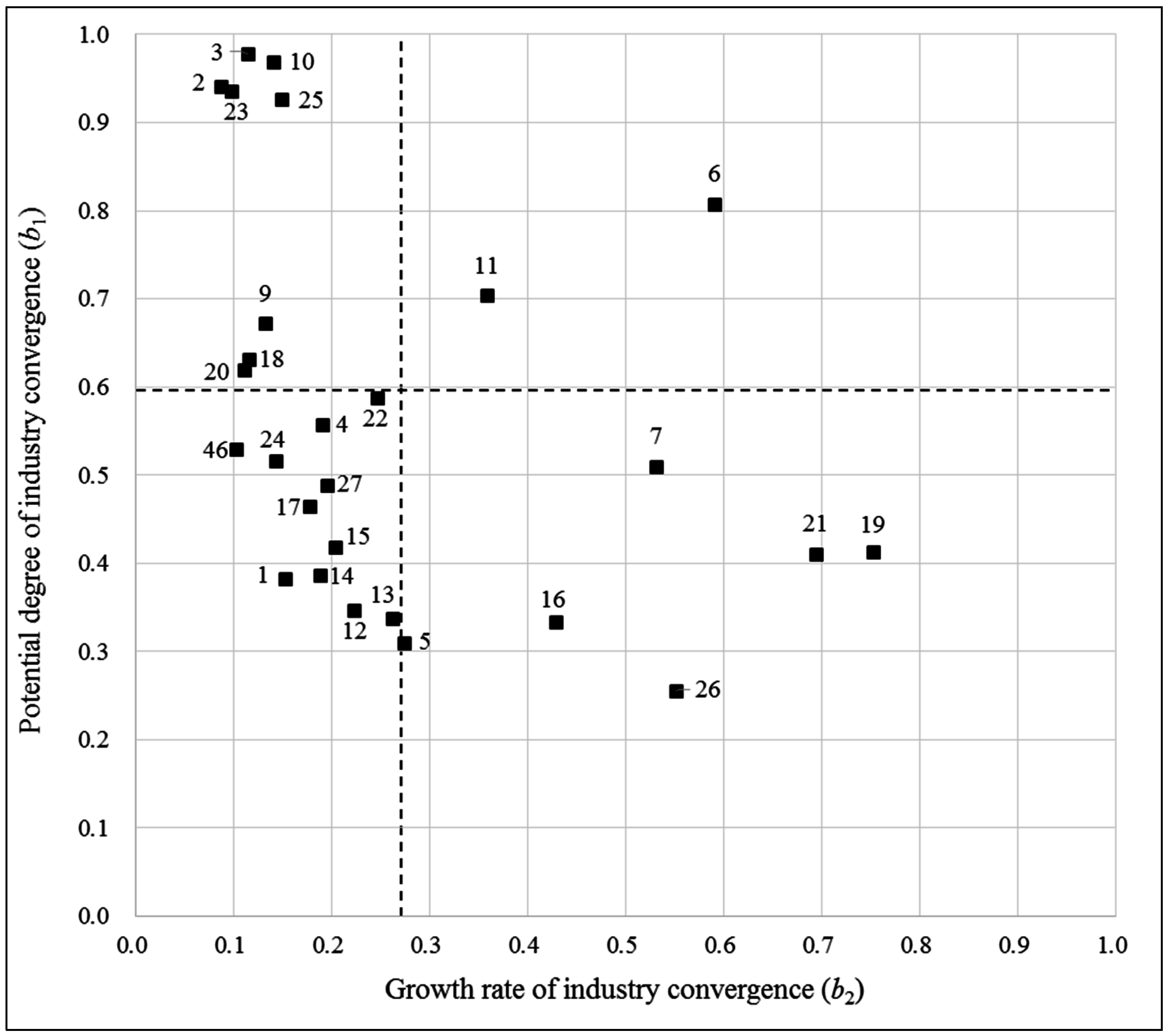

Among these three diffusion parameters, this research uses the potential degree (

b1) and the growth rate (

b2) of industry convergence to explore the dispersion of convergent-industry pairs (1 to 27) whose coefficients are both statistically significant. Using these two coefficients as separate axes, we draw a chart of the dispersion of convergent-industry pairs, shown in

Figure 1. Furthermore, we divide the dispersion area into quadrants by the average values of those two coefficients of the convergent-industry pairs (i.e., 0.590 and 0.262 for

b1 and

b2, respectively).

The first quadrant is where both coefficients are higher than average, which suggests that industry pairs in this region have high convergence potential as well as a high growth rate. For example, the industry pairs in this quadrant, that is, 287–281 (6) and 356–287 (11), have potentially higher degrees of industry convergence, and the growth rates of the degree of industry convergence are also higher than average. The second quadrant includes industry pairs whose convergence potential is higher, and the growth rates of DIC are lower than average. This quadrant includes eight industry pairs: 285–284 (2), 285–285 (3), 356–282 (9), 356–284 (10), 382–285 (18), 386–281 (20), 873–281 (23), and 873–356 (25). Interestingly, one industry group, 356 (General industrial machinery and equipment), is included in the first and second quadrants. This means that this industry group has converged with other industry groups, reaching a high potential degree of industry convergence, regardless of the growth rate of convergence.

The third quadrant is an area in which both coefficients are lower than average, including industry pairs such as 284–282 (1), 286–282 (4), and 357–285 (12). Furthermore, in general, the diffusion parameters of mean DIC of the entire industry pairs (46) also have values below average. Finally, the fourth quadrant has industry pairs with lower convergence potential and a higher growth rate of DIC than others, including 286–283 (5), 287–284 (7), 372–356 (16), 382–287 (19), 386–287 (21), and 873–372 (26). The convergence of industry pairs in this area seems to become saturated quickly, considering the potential and rate of convergence.

Interestingly, we find that the potential for industry convergence and the growth of industry convergence are negatively related. An ordinary least squares (OLS) regression result confirms this negative relationship in

Table 4. This indicates that convergence between high-technology industries, in general, takes a longer time to emerge, diffuse, and reach a high degree, if convergence potential is high.

After estimating the diffusion parameters, such as the initial

DIC (

b0), potential

DIC (

b1), and the growth rate of

DIC (

b2), and exploring the dispersion of convergent-industry pairs using these parameters, this research also shows the diffusion patterns of convergent-industry pairs (1 to 27) in

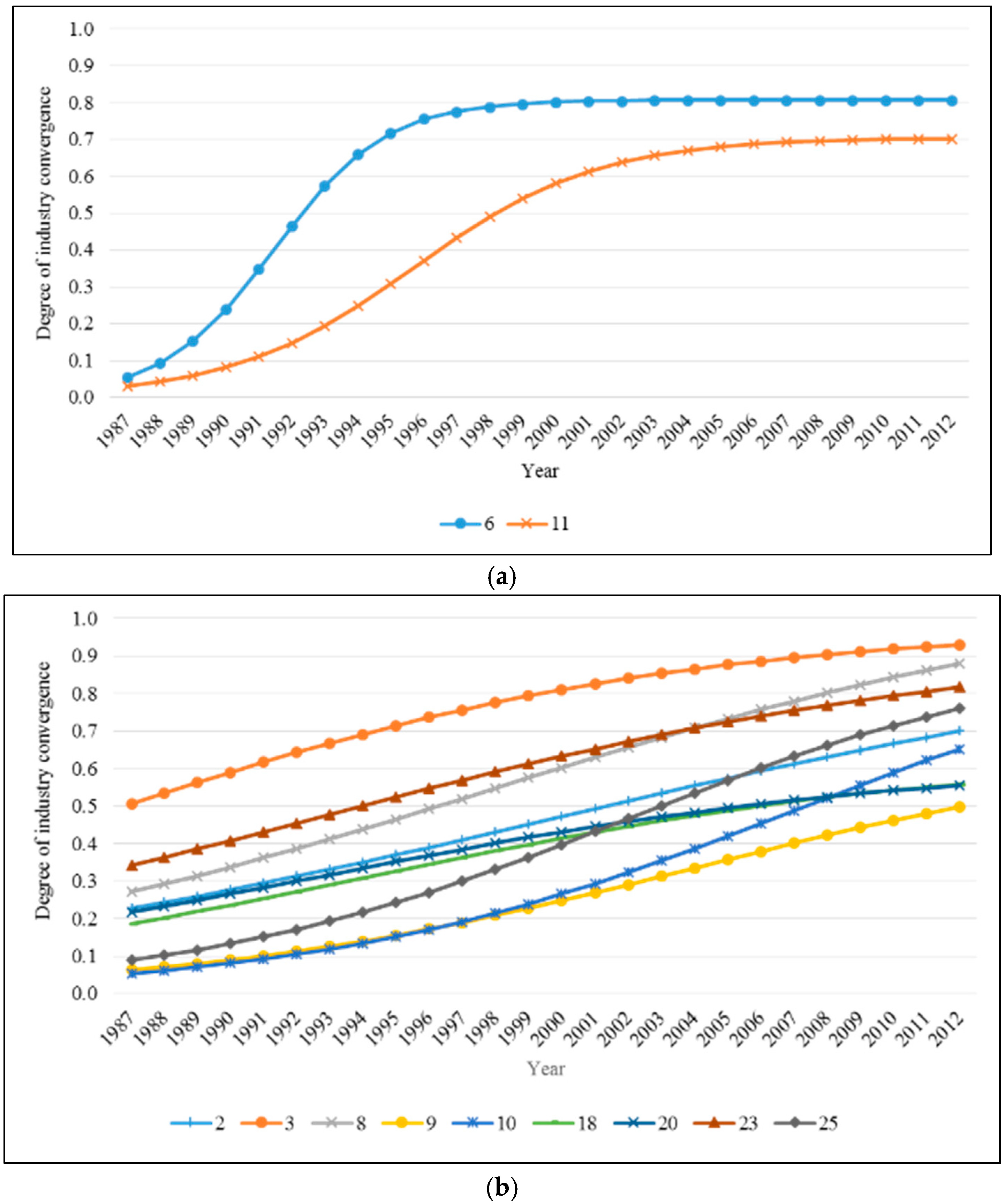

Figure 2. We find that the diffusion patterns of industry convergence are heterogeneous across the quadratic regions. In

Figure 2a, the diffusion curves of the convergent-industry pairs 287–281 (6) and 356–287 (11) in the first quadrant are depicted. Interestingly, although both the potential degree and the growth rate of industry convergence of these pairs are higher than average, their convergence potential is stagnant for several years. This means that the convergence between these industries occurred rapidly and has already achieved a very high degree.

The diffusion curves of the convergent-industry pairs in the second quadrant are shown in

Figure 2b. Because they have growth rates lower than average but a degree of potential that is higher, the diffusion curves show gradual growth up to the maximum degree of convergence between industries. Interestingly, two pairs—873 (Research, development, and testing services) and 356 (General industrial machinery and equipment) (25) as well as 356 and 284 (Soap, detergents, and cleaning preparations; perfumes, cosmetics, and other toilet preparations) (10)—show higher growth rates than other pairs in this quadrant (i.e., 0.150 and 0.142, respectively).

Figure 2c shows the diffusion curves of convergent-industry pairs in the third quadrant, where the convergence potential and growth rates of industry convergence are both lower than average. Among the pairs in this quadrant, the pair 386 (Photographic equipment and supplies) and 356 (22) has a potential degree of industry convergence close to average, while the pair 357 (Computer and office equipment) and 286 (Industrial organic chemicals) (13) shows a growth rate of industry convergence similar to the average. Finally,

Figure 2d shows the diffusion patterns of convergent-industry pairs in the fourth quadrant. The industry convergence of these pairs has grown rapidly but has a lower potential degree of convergence than others.

Overall, we find that convergent-industry pairs across different quadrants have heterogeneous and unique diffusion patterns. In other words, industry convergence is currently developing at a different rate and degree of potential depending on the industry pair. Some industries in particular—such as 873 (Research, development, and testing services), 356 (General industrial machinery and equipment), 284 (Soap, detergents, and cleaning preparations; perfumes, cosmetics, and other toilet preparations), 357 (Computer and office equipment), and 286 (Industrial organic chemicals)—show both a significant convergence rate and degree of potential and seem to be leaders of the industry convergence phenomenon.

5. Conclusions

As the high-technology market environment has changed rapidly and become more uncertain, firms have confronted intense competition, which accelerates firms’ technological innovation and product differentiation combining new product functionalities of other industrial sectors with their existing products. This combination of product functionalities drives applicational convergence, which promotes industry convergence and creates a new value chain in an industry as well as new market demand.

In spite of the appearance of industry convergence arising from not only technological development but also application/market development, previous research has studied industry convergence primarily from the perspective of technology. Although one recent study focuses on the market perspective [

10], it does not explore which industries have converged more rapidly and how their diffusion characteristics vary. Therefore, this paper investigates the diffusion patterns in industry convergence in U.S. high-technology industries by applying a text-mining-based co-occurrence analysis using a large set of newspaper article data. It is appropriate to examine industry convergence using newspaper article data because they provide various detailed information regarding firms and their changes. However, the data have not been used in innovation research, due to data related capability. Recent advancements in computer science enable us to obtain appropriate information regarding firms from newspaper articles [

10].

As a result, we estimate the potential degree and the growth rate of industry convergence of convergent-industry pairs that show an evolutionary convergence pattern. Furthermore, we explore the dispersion of convergent-industry pairs, dividing the dispersion area into four quadrants by the potential degree and growth rate of industry convergence. We find that the potential degree of industry convergence has a significantly negative association with the growth rate of industry convergence, which indicates that it takes a long time for high-technology industries with high convergence potential to achieve a high degree of industry convergence. This result is consistent with that of Choi et al. [

55] in terms of the negative relationship between these two factors of convergence, although they analyze the diffusion patterns of technology convergence, not industry convergence. Furthermore, the diffusion curves obtained from the diffusion parameters indicate the heterogeneous diffusion patterns of convergent-industry pairs. With these results, one can infer not only which high-technology industries have converged but also how intense and how rapid their convergence has been.

This research contributes to the literature on industry convergence in three ways. First, this study provides a new approach that has rarely been explored previously to investigate industry convergence (i.e., interorganizational dynamics and market-based industry convergence). By analyzing text-mining-based co-occurrence using newspaper articles, our study provides unique results on industry convergence from the market perspective. Second, this paper also suggests a specific industry-pair-level of analysis of industry convergence while previous studies have engaged in a general-industry-level or technology-sector-level analysis. While a general-industry-level analysis shows overall trends of industry convergence, the analysis in this paper shows which industries are converging at a specific level. This allows policy makers to understand the phenomenon of industry convergence from a different perspective than previous studies, by providing implications about which industries are converging and which form of convergent industry will be created. Third, this research estimates the diffusion parameters of convergent-industry pairs, which also has implications for the extent and the speed of industry convergence. This evolutionary perspective becomes even more important for policy analysis as radical technologies and system changes are regarded as ways of achieving sustainable innovation and development [

43]. Since the industry convergence is a problematic innovation because of the high level of uncertainty, it needs to take an evolutionary approach that be modified depending on the situation.

Moreover, our findings have important managerial implications for industry convergence. As interorganizational activities are drivers of industry convergence, firms should recognize that their strategic decisions may not be limited to their business area but can expand or change over the course of evolutionary convergence. It is very important for managers to recognize how their business area (i.e., industry) changes and converges because industry convergence introduces new competitors who were previously in different arenas. In this context, managers can use an adaptation or niche differentiation strategy to address evolutionary convergence, especially when it is not complete [

45,

58].

Despite the contributions described above, this research has several limitations that should be addressed in future studies. First, although we eliminated noisy information in the newspaper articles, other noise may exist. Future studies can apply an advanced NLP method to extract more precise and clearer co-occurrence information from the newspaper articles. Second, the analytical basis used in this research—that is, the industry-pair level—cannot fully describe the formation of convergent industries that consist of more than two industries. For example, the smartphone industry integrated cell phones, portable computers, and software [

1], which we cannot define at the pair level. This might be due to the method of measuring industry convergence (i.e., co-occurrence analysis). The degree of industry convergence based on the co-occurrence of SIC codes only shows the diffusion patterns of convergence between those two industries. A network perspective may be helpful for identifying the convergent industry cluster. Third, this paper focuses only on convergence among high-technology industries, not on entire industries. Industry convergence seems to occur among entire industrial sectors [

9]. In addition to convergence between high-technology industries, future studies can usefully investigate the diffusion patterns of convergence between high-technology and other industries. This will enable us to draw a fuller picture of the diffusion patterns of entire convergent industries.