Effect of R&D Collaboration with Research Organizations on Innovation: The Mediation Effect of Environmental Performance

Abstract

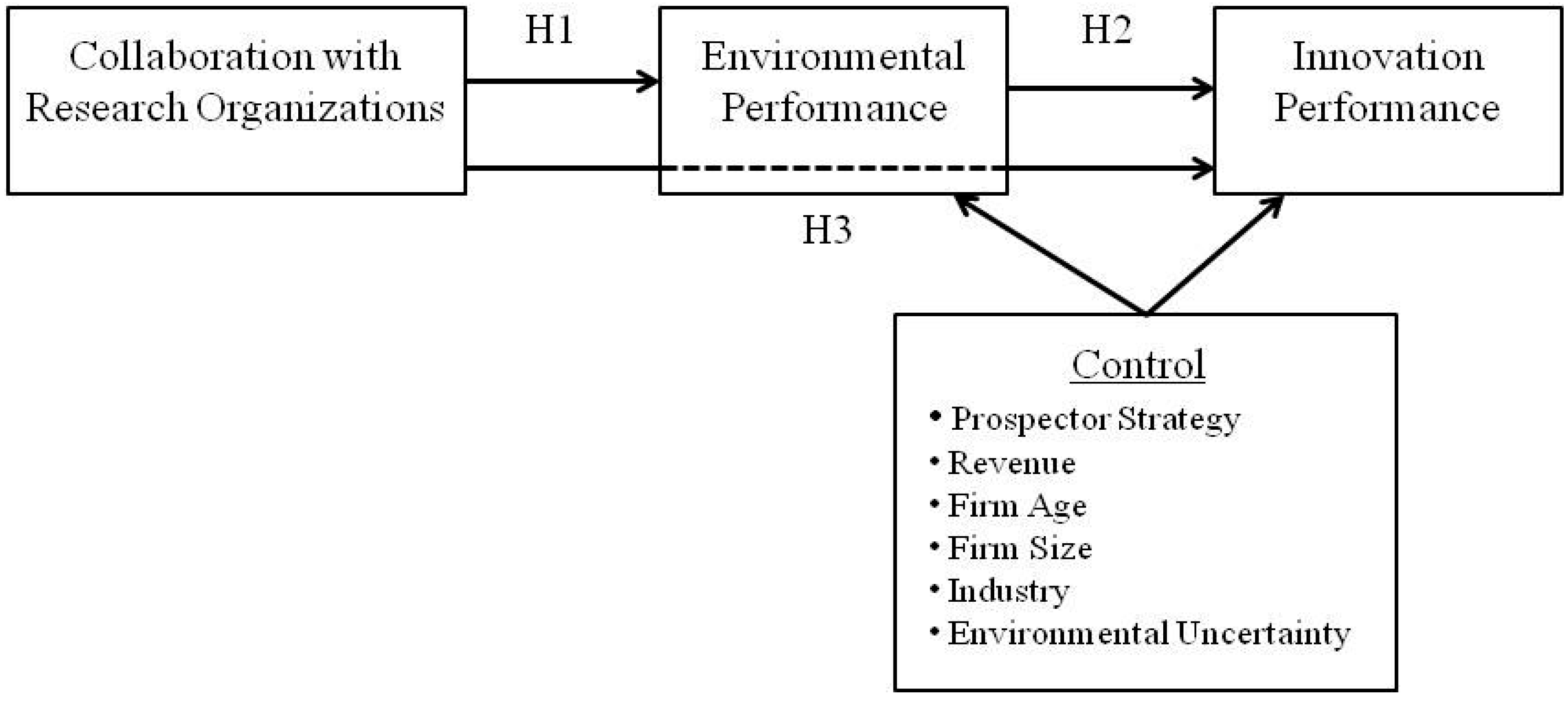

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. The Drivers of Environmental Performance

2.2. The Outcomes of Environmental Performance

2.3. The Effect of Collaboration with Research Organizations on Environmental Performance

2.4. The Effect of Environmental Performance on Innovation Performance

2.5. The Mediating Effect of Environmental Performance

3. Methodology and Measurement

3.1. Data Collection

3.2. Measures

3.3. Estimation

4. Results

| Variables | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Innovation performance | 0.89 | 1.16 | ||||||||

| 2 | Environmental performance | 4.20 | 1.14 | 0.25 * | |||||||

| 3 | Collaboration with research organizations | 0.01 | 0.93 | 0.3 * | 0.38 * | ||||||

| 4 | Revenue | 3.86 | 0.98 | −0.03 | −0.07 | −0.06 | |||||

| 5 | R&D expenditure | 1.01 | 0.98 | 0.06 | 0.03 | −0.02 | −0.05 | ||||

| 6 | Firm age | 18.59 | 11.18 | 0.2 * | 0.10 | 0.08 | −0.05 | 0.11 | |||

| 7 | Firm size | 4.65 | 0.88 | 0.29 * | 0.12 | 0.12 | −0.07 | 0.05 | 0.34 * | ||

| 8 | Prospector strategy | 3.31 | 1.80 | 0.20 * | 0.27 * | 0.31 * | −0.06 | 0.01 | 0.05 | 0.04 | |

| 9 | Environmental uncertainty | 4.57 | 0.68 | 0.09 | 0.25 * | 0.11 | −0.08 | 0.04 | 0.01 | 0.09 | 0.21 * |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Variables | Innovation performance | Environmental performance | Innovation performance | ||

| Revenue | 0.025 | 0.028 | −0.024 | 0.031 | 0.031 |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | |

| R&D expenditure | 0.275 *** | 0.233 *** | −0.005 | 0.264 *** | 0.234 *** |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | |

| Firm age | 0.007 † | 0.007 † | 0.003 | 0.007 | 0.007 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Firm size | 0.334 *** | 0.304 *** | 0.046 | 0.317 *** | 0.297 *** |

| (0.06) | (0.05) | (0.05) | (0.05) | (0.05) | |

| Prospector strategy | 0.1 *** | 0.062 * | 0.088 ** | 0.072 ** | 0.049 † |

| (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | |

| Environmental uncertainty | 0.04 | 0.023 | 0.310 *** | −0.024 | −0.024 |

| (0.07) | (0.07) | (0.07) | (0.07) | (0.07) | |

| Collaboration with research organizations | 0.255 *** | 0.357 *** | 0.201 *** | ||

| (0.05) | (0.05) | (0.05) | |||

| Environmental performance | 0.197 *** | 0.151 *** | |||

| (0.04) | (0.04) | ||||

| constant | −1.724 *** | −1.332 ** | 2.479 *** | −2.105 *** | −1.707 *** |

| (0.45) | (0.45) | (0.45) | (0.45) | (0.46) | |

| F-value | 17.91 | 19.359 | 17.134 | 19.101 | 18.953 |

| R2 | 0.19 | 0.225 | 0.205 | 0.223 | 0.243 |

| Δ R2 | 0.03 *** | 0.07 *** | 0.033 *** | 0.053 *** | |

| Mediator | c | a | σa | b | σb | Z | Effect Ratio |

|---|---|---|---|---|---|---|---|

| Environmental performance | 0.37 | 0.47 | 0.05 | 0.16 | 0.04 | 3.58 *** | 0.2 |

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Aragon-Correa, J.A.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar]

- Sharfman, M.P.; Shaft, T.M.; Tihanyi, L. A model of the global and institutional antecedents of high-level corporate environmental performance. Bus. Soc. 2004, 43, 6–36. [Google Scholar] [CrossRef]

- Wisner, P.S.; Epstein, M.J.; Bagozzi, R.P. Organizational antecedents and consequences of environmental performance. Adv. Environ. Account. Manag. 2006, 3, 143–167. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Dowell, G.; Hart, S.; Yeung, B. Do corporate global environmental standards create or destroy market value? Manag. Sci. 2000, 46, 1059–1074. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strat. Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strat. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Vachon, S.; Klassen, R.D. Environmental management and manufacturing performance: The role of collaboration in the supply chain. Int. J. Prod. Econ. 2008, 111, 299–315. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Grant, R.M. The resource-based theory of competitive advantage. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. Acad. Manag. J. 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Kassinis, G.; Vafeas, N. Stakeholder pressures and environmental performance. Acad. Manag. J. 2006, 49, 145–159. [Google Scholar] [CrossRef]

- Bansal, P.; Clelland, I. Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar] [CrossRef]

- Gilley, K.M.; Worrell, D.L.; Davidson, W.N.; El-Jelly, A. Corporate environmental initiatives and anticipated firm performances: The differential effects of process-driven versus product-driven greening initiatives. J. Manag. 2000, 26, 1199–1216. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strat. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Kemp, R. An economic analysis of cleaner technology: Theory and evidence. In Environmental Strategies for Industry; Fischer, K., Schot, J., Eds.; Island Press: Washington, DC, USA, 1993; pp. 79–113. [Google Scholar]

- Dean, T.J.; Brown, R.L. Pollution regulation as a barrier to new firm entry: Initial evidence and implications for future-research. Acad. Manag. J. 1995, 38, 288–303. [Google Scholar] [CrossRef]

- Shrivastava, P. Environmental technologies and competitive advantage. Strat. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Sharma, S. Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar] [CrossRef]

- Groenewegen, P.; Vergragt, P. Environmental issues as threats and opportunities for technological innovation. Technol. Anal. Strateg. Manag. 1991, 3, 43–55. [Google Scholar] [CrossRef]

- Florida, R.; Davison, D. Gaining from green management: Environmental management systems inside and outside the factory. Calif. Manag. Rev. 2001, 43, 63–84. [Google Scholar] [CrossRef]

- Shrivastava, P. Ecocentric management for a risk society. Acad. Manag. Rev. 1995, 20, 118–137. [Google Scholar]

- Epstein, M.J.; Roy, M.J. Managing corporate environmental performance: A multinational perspective. Eur. Manag. J. 1998, 16, 284–296. [Google Scholar] [CrossRef]

- Winn, M.I.; Angell, L.C. Towards a process model of corporate greening. Org. Stud. 2000, 21, 1119–1147. [Google Scholar] [CrossRef]

- Keogh, P.D.; Polonsky, M.J. Environmental commitment: A basis for environmental entrepreneurship? J. Org. Change Manag. 1998, 11, 38–49. [Google Scholar] [CrossRef]

- Menon, A. Enviropreneurial marketing strategy: The emergence of corporate environmentalism as market strategy. J. Mark. 1997, 61, 51–67. [Google Scholar] [CrossRef]

- Hunt, C.B.; Auster, E.R. Proactive environmental management: Avoiding the toxic trap. Sloan Manag. Rev. 1990, 31, 7–18. [Google Scholar]

- Ambec, S.; Lanoie, P. Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Fiksel, J. Design for environment: The new quality imperative. Corp. Environ. Strat. 1993, 1, 49–55. [Google Scholar]

- Miles, R.E.; Snow, C.C. Organizational Strategy, Structure, and Process; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Konar, S.; Cohen, R.A. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Epstein, M.J. Measuring Corporate Environmental Performance; Irwin Professional Publishing: Chicago, IL, USA, 1996. [Google Scholar]

- Moore, M. Towards a confirmatory model of retail strategy types: An empirical test of miles and snow. J. Bus. Res. 2005, 58, 696–704. [Google Scholar] [CrossRef]

- Desarbo, W.S.; di Benedetto, C.A.; Song, M.; Sinha, I. Revisiting the miles and snow strategic framework: Uncovering interrelationships between strategic types, capabilities, environmental uncertainty, and firm performance. Strat. Manag. J. 2005, 26, 47–74. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration networks, structural holes, and innovation: A longitudinal study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Doz, Y.L.; Hamel, G. Alliance Advantage: The Art of Creating Value through Partnering; Harvard Business School Press: Boston, MA, USA, 1998. [Google Scholar]

- Eisenhardt, K.M.; Schoonhoven, C.B. Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organ. Sci. 1996, 7, 136–150. [Google Scholar] [CrossRef]

- Hagedoorn, J. Inter-firm R&D partnerships: An overview of major trends and patterns since 1960. Res. Policy 2002, 31, 477–492. [Google Scholar]

- Veugelers, R. Internal R&D expenditures and external technology sourcing. Res. Policy 1997, 26, 303–315. [Google Scholar]

- Baum, J.A.C.; Calabrese, T.; Silverman, B.S. Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strat. Manag. J. 2000, 21, 267–294. [Google Scholar] [CrossRef]

- Stuart, T.E. Interorganizational alliances and the performance of firms: A study of growth and innovation rates in a high-technology industry. Strat. Manag. J. 2000, 21, 791–811. [Google Scholar] [CrossRef]

- Faems, D.; van Looy, B.; Debackere, K. Interorganizational collaboration and innovation: Toward a portfolio approach. J. Prod. Innovat. Manag. 2005, 22, 238–250. [Google Scholar] [CrossRef]

- Schoenmakers, W.; Duysters, G. Learning in strategic technology alliances. Technol. Anal. Strat. Manag. 2006, 18, 245–264. [Google Scholar] [CrossRef]

- Belderbos, R.; Carree, M.; Lokshin, B. Cooperative R&D and firm performance. Res. Policy 2004, 33, 1477–1492. [Google Scholar]

- Nieto, M.J.; Santamaria, L. The importance of diverse collaborative networks for the novelty of product innovation. Technovation 2007, 27, 367–377. [Google Scholar] [CrossRef]

- Mansfield, E. Academic research and industrial innovation. Res. Policy 1991, 20, 1–12. [Google Scholar] [CrossRef]

- Jaffe, A.B. Characterizing the technological position of firms with application to quantifying technological opportunity and research spillovers. Res. Policy 1989, 18, 87–97. [Google Scholar] [CrossRef]

- Klevorick, A.K.; Levin, R.C.; Nelson, R.R.; Winter, S.G. On the sources and significance of interindustry differences in technological opportunities. Res. Policy 1995, 24, 185–205. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A. Strategic proactivity and firm approach to the natural environment. Acad. Manag. J. 1998, 41, 556–567. [Google Scholar] [CrossRef]

- Brock, W.A.; Evans, D.S. Small business economics. Small Bus. Econ. 1989, 1, 7–20. [Google Scholar] [CrossRef]

- Pashigian, B.P. The effect of environmental regulation on optimal plant size and factor shares. J. Law Econ. 1984, 27, 1–28. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competition; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Scherer, F.M.; Ross, D. Industrial Market Structure and Economic Performance, 3rd ed.; Houghton Mifflin: Boston, MA, USA, 1990. [Google Scholar]

- De Bondt, R.; Slaets, P.; Cassiman, B. The degree of spillovers and the number of rivals for maximum effective R&D. Int. J. Ind. Organ. 1992, 10, 35–54. [Google Scholar]

- Röller, L.; Siebert, R.; Tombak, M. Why Firms form Research Joint Ventures: Theory and Evidence; WZB Discussion Paper 97-06; Centre for Economic Policy Research: London, UK, 1997. [Google Scholar]

- Amir, R.; Evstigneev, I.; Wooders, J. Noncooperative versus cooperative R&D with endogenous spillover rates. Games Econ. Behav. 2003, 42, 183–207. [Google Scholar]

- Martin, S. Spillovers, appropriability, and R&D. J. Econ. 2002, 75, 1–32. [Google Scholar]

- Cassiman, B.; Veugelers, R. R&D cooperation and spillovers: Some empirical evidence from Belgium. Am. Econ. Rev. 2002, 92, 1169–1184. [Google Scholar]

- Davenport, T.H.; Prusak, L. Working Knowledge: How Organizations Manage What They Know; Harvard Business Press: Boston, MA, USA, 1998. [Google Scholar]

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital, and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar]

- Klassen, R.D.; Whybark, D.C. The impact of environmental technologies on manufacturing performance. Acad. Manag. J. 1999, 42, 599–615. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The influence of intellectual capital on the types of innovative capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Bresman, H.; Birkinshaw, J.; Nobel, R. Knowledge transfer in international acquisitions. J. Int. Bus. Stud. 1999, 30, 439–462. [Google Scholar] [CrossRef]

- Freeman, C. The Economics of Industrial Innovation, 2nd ed.; MIT Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Griliches, Z. Introduction to R&D and Productivity: The Econometric Evidence; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Patel, P.; Pavitt, K. The localized creation of global technological advantage. In Technological Innovation, Multinational Corporations and New International Competitiveness: The Case of Intermediate Countries; Molero, J., Ed.; Harwood Academic Publishers: New York, NY, USA, 1995. [Google Scholar]

- Pavitt, K. Uses and abuses of patent statistics. In Handbook of Quantitative Studies of Science Policy; van Raan, A., Ed.; Elsevier: Amsterdam, The Netherland, 1988. [Google Scholar]

- Wagner, M.; Schaltegger, S. The effect of corporate environmental strategy choice and environmental performance on competitiveness and economic performance: An empirical study of EU manufacturing. Eur. Manag. J. 2004, 22, 557–572. [Google Scholar] [CrossRef]

- Abernethy, M.A.; Guthrie, C.H. An empirical assessment of the “fit” between strategy and management information system design. Account. Finance 1994, 34, 49–66. [Google Scholar] [CrossRef]

- Chong, V.K.; Chong, K.M. Strategic choices, environmental uncertainty and SBU performance: A note on the intervening role of management accounting systems. Account. Bus. Res. 1997, 27, 268–276. [Google Scholar] [CrossRef]

- Ittner, C.D.; Larcker, D.F.; Rajan, M.V. The choice of performance measures in annual bonus contract. Account. Rev. 1997, 2, 231–256. [Google Scholar]

- Cooper, R. When Lean Enterprises Collide; Harvard Business School Press: Boston, MA, USA, 1995. [Google Scholar]

- D’Aveni, R.A.; Gunther, R.E. Hypercompetitive Rivalries; The Free Press: New York, NY, USA, 1995. [Google Scholar]

- Goldman, S.L.; Nagel, R.N.; Preiss, K. Agile Competitors and Virtual Organizations; Van Nostrand Reinhold: New York, NY, USA, 1995. [Google Scholar]

- Hamel, G.; Prahalad, C.K. Competing for the Future; Harvard Business School Press: Boston, MA, USA, 1994. [Google Scholar]

- Hoque, Z.; Hopper, T. Political and industrial relations turbulence, competition and budgeting in the nationalized jute mills of Bangladesh. Account. Bus. Res. 1997, 27, 125–143. [Google Scholar] [CrossRef]

- Hausman, J.; Hall, B.; Griliches, Z. Econometric models for count data with an application to the patents-R&D relationship. Econometrica 1984, 52, 909–938. [Google Scholar]

- Henderson, R.; Cockbum, I. Scale, scope, and spillovers: The determinants of research productivity in drug discovery. RAND J. Econ. 1996, 27, 32–59. [Google Scholar] [CrossRef] [PubMed]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Sobel, M.E. Some new results on indirect effects and their standard errors in covariance structure models. In Sociological Methodology; Tuma, N., Ed.; American Sociological Association: Washington, DC, USA, 1986. [Google Scholar]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef] [PubMed]

- Jose, P. Workshop on statistical mediation and moderation: Statistical mediation. In Proceedings of the SASP Conference, Wellington, New Zealand, 8–9 June 2008.

- Adler, P.S.; Kwon, S.W. Social capital: Prospects for a new concept. Acad. Manag. Rev. 2002, 17, 17–40. [Google Scholar]

- De Villiers, C.; Naiker, V.; van Staden, C.J. The effect of board characteristics on firm environmental performance. J. Manag. 2011, 37, 1636–1663. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strat. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Quintana-Garcia, C.; Benavides-Velasco, C.A. Innovative competence, exploration and exploitation: The influence of technological diversification. Res. Policy 2008, 37, 492–507. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar] [CrossRef]

- Gittelman, M. A note on the value of patents as indicators of innovation: Implications for management research. Acad. Manag. Perspect. 2008, 22, 21–27. [Google Scholar] [CrossRef]

- Kochhar, R.; David, P. Institutional investors and firm innovation: A test of competing hypotheses. Strat. Manag. J. 1996, 17, 73–84. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, G.J.; Rhee, S.-Y. Effect of R&D Collaboration with Research Organizations on Innovation: The Mediation Effect of Environmental Performance. Sustainability 2015, 7, 11998-12016. https://doi.org/10.3390/su70911998

Yu GJ, Rhee S-Y. Effect of R&D Collaboration with Research Organizations on Innovation: The Mediation Effect of Environmental Performance. Sustainability. 2015; 7(9):11998-12016. https://doi.org/10.3390/su70911998

Chicago/Turabian StyleYu, Gun Jea, and Seung-Yoon Rhee. 2015. "Effect of R&D Collaboration with Research Organizations on Innovation: The Mediation Effect of Environmental Performance" Sustainability 7, no. 9: 11998-12016. https://doi.org/10.3390/su70911998