Studies related to renewable energy subsidy can be grouped into two types: the selection and effects of subsidy modes and the influence of subsidies on corporate financial performance.

2.1. Selection and Effects of Subsidy Modes

Studies on the selection and effect of subsidy modes focus on three aspects.

- (a)

Selection of renewable energy subsidy modes in China with a review of international experience

Du

et al. classified subsidies into four types: tax preference, fiscal subsidy, factor support, and preemption. Looking at the introduction of the US subsidy policies for the new energy industries and the analysis of existing flaws in Chinese policies, they proposed that China should encourage enterprises or individuals to build infrastructures for the new energy industry through either tax preference or tax reduction or exemption. In addition, China should both subsidize the individual purchases of new energy productsand incorporate a certain percentage of new energy products into governmental procurement. Finally, they maintained new energy companies could be subsidized through the addition of taxes on other traditional energy enterprises [

1]. Focusing on Germany, Denmark, and some other European countries that are considered renewable energy powerhouses, Xie

et al. analyzed their policy mechanisms and then proposed the direction Chinese reform could take regarding the types of subsidies, withaspectssuch as feed-in tariff, development foundation for renewable energy, and other financial support [

2].

- (b)

Effect of trade disputes on the choice of subsidy mode

Disputes on international trade may affect the selection of subsidy modes, and such disputes have already aroused the attention of some scholars. For example, in their study,Xiong and Zhou pointed out that both ordinary competitive subsidy and R&D subsidy were more compliant with the WTO regulations than prohibited subsidiessuch as export subsidy or import substitution subsidy [

3]; furthermore, these subsidies can avoid the trade disputes of “anti-subsidy” to a certain extent. Sun and Tang argued that a system plight exists in the subsidy of renewable energy under the WTO framework, and that China needs to reform subsidy policy to fix the problem [

4]. Such reforms should include using green governmental procurement to support the industry of renewable energy, using R&D subsidy as much as possible, and changing direct subsidy into indirect subsidy. In contrast with China, as shown in the studies of Steve and Carolyn on Canadian Ontario, the feed-in tariff of Ontario was regarded as a challenge of prohibitive import substitution subsidy during the first round of debates over renewable energy at the WTO [

5]. Therefore, the subsidy mode should also be improved.

- (c)

Effectiveness of the subsidy mode choices

Different subsidy modes indicate the varied influences of policy tools on the macro-economy, industrial or corporate production cost, technical innovation, and consumers. The results of the Grey prediction modelshow thatthe price subsidies of renewable energy in China can exert a noticeable positive influence on the macro-economy [

6]. This viewpoint has also been supported by Ouyang and Lin, who pointed out that the diversion of subsidy from fossil energy to renewable energy may narrow the income gap [

7].

Some scholars focused on the effect of subsidy modes on the downstream of the industry chain. For example, Lesserrevealed that the USwasbeing unreasonablypractical indirectlysubsidizing wind power generation because this subsidy mode aggravates market distortion [

8]. Marco and Sánchez-Braza studied the influence of subsidy modes on solar energy [

9,

10]. The difference between the two lies in the fact thatthe former focused on capital subsidies whereas the latter emphasized property tax incentives.

With regards to the innovation subsidies, some findings indicate that modessuch as tax reduction or exemption [

11], market and R&D support [

12], and the transfer payment of investment and development [

13] may exert influence on the technology of renewable energy and therefore have an indirect influence on corporate financial performance. However, as pointed out by Shen and Luo, some modes, such as the transfer payment of investment and development, may instead result in low-level technology [

13]. Analysis on the effect of subsidy modes from the perspectives of production and operation cost and the supply of finished products is a key topic of current studies found in the literature.

Orvika provided evidence showing that subsidies that separate wind power incentives from markets signal dramatically increased costs [

14]; an inflexible power system should focus instead on investment subsidies rather than on production subsidies or fixed prices. In encouraging the development of renewable energy, the most common policy support includes the feed-in tariff of renewable energy (FIT) and the renewable portfolio standard (RPS), as reported by Keyuraphan

et al. [

15]. In Thailand, integrating these two ways has been a feasible approach in encouraging the power production of renewable energy. While studying the effect of subsidy on power generation of renewable energy, Zhang

et al. argued that determining a moderate subsidy limit is important in increasing the power generation capacity of wind energy [

16].

Cost-effectiveness is an important method in determining the choice ofwhich subsidy mode to use. Relevant studies generally compare either electricity price subsidy to capital subsidy [

17], electricity price subsidy to license market system or feed-in tariff to the three-policy mix of feed-in tariff, investment subsidy, and soft loan [

18]. In all these studies, the attention is focused on the downstream of the renewable energy industry chain.

2.2. Influence of Subsidy on Corporate Financial Performance

Theoretically, viewpoints on subsidy performance may seem contradicting, as in the case of promotion

vs. rent-seeking viewpoints. According to the former, subsidies promote R&D and the investment in enterprises which enhance corporate performance in the current period. This view, however, has gained the support of only a few scholars, such as Kong and Li [

19]. Instead, more scholars have pointed out that subsidy cannot necessarily be distributed effectively because of rent-seeking behavior. A subsidy may result in slow growth of profits or the reduction of return on asset. Beason, Bergstrom, Balsar and Ucdogruk, and Lu and Huang

et al. all validated this argument through their empirical analyses of investment subsidy, fiscal subsidy, or food and beverage manufacturing companies [

20,

21,

22,

23]. Moreover, the influence of subsidy on corporate financial performance may also be uncertain and subject to some conditions, such as the period of influence [

24], political relations, and others [

25,

26].

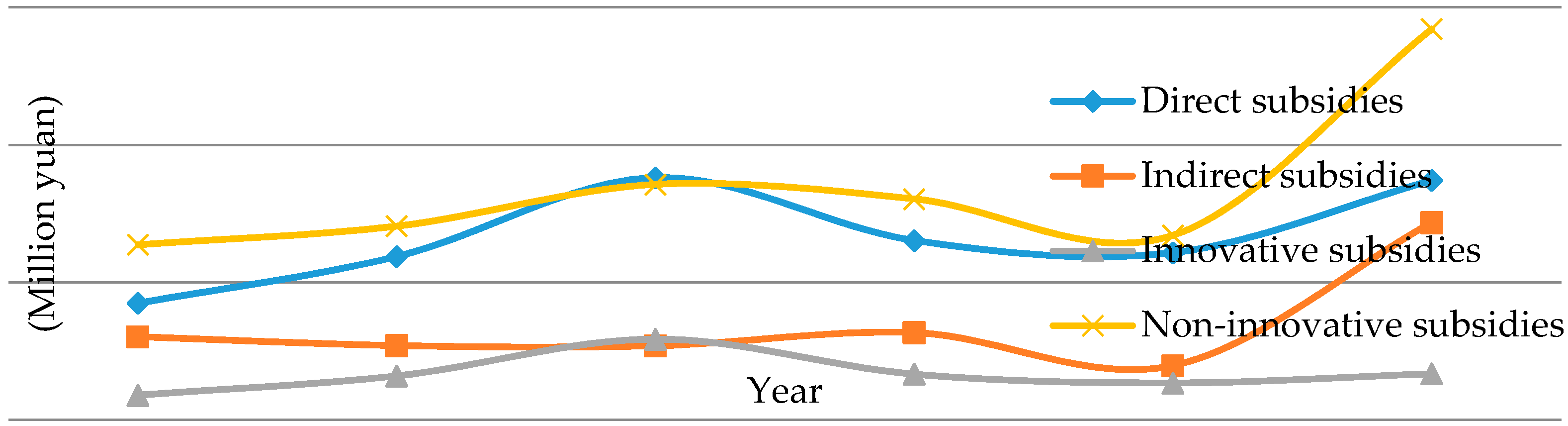

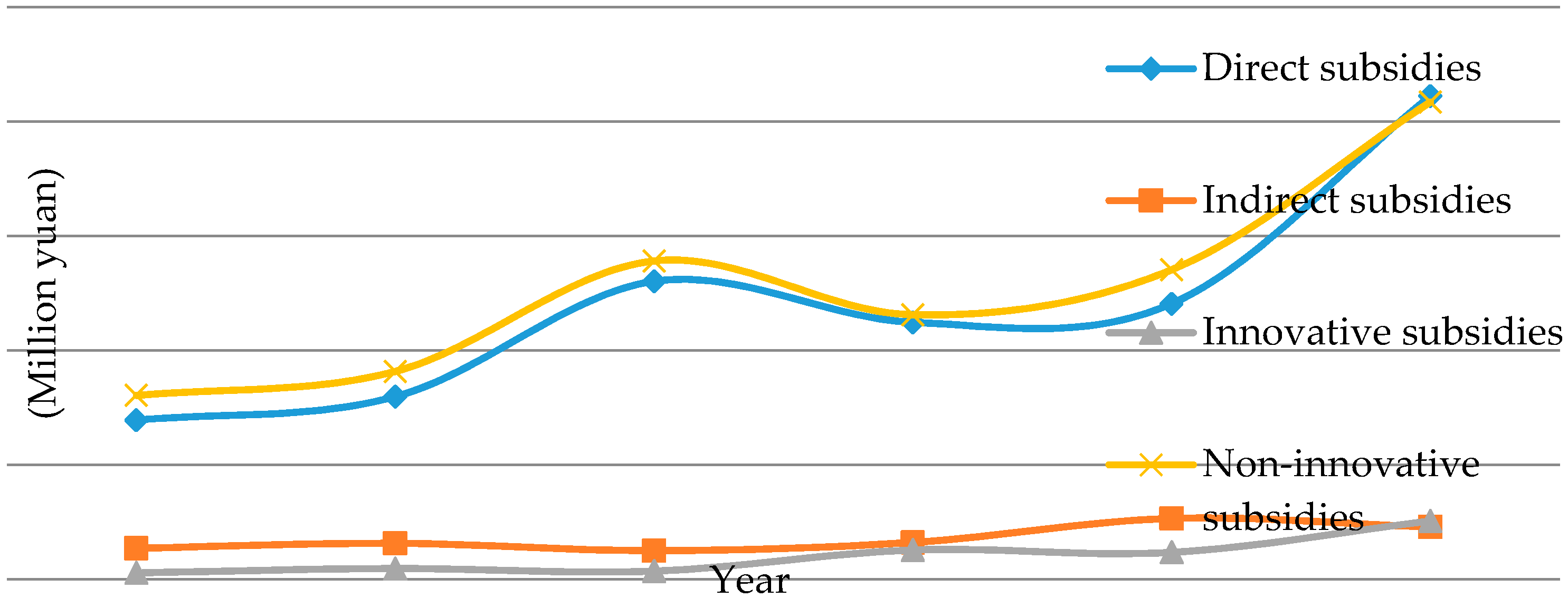

Although previous studies on the subsidy issue have been worthwhile and beneficial, several shortcomings are observed:(1) Studies on the relationship between subsidy and corporate financial performance mainlyexamine agriculture or ordinary manufacturing and pay little attention to the industry of renewable energy.Afew studies consider the influence of subsidy modes on corporate financial performance; (2) The classification of subsidy modes is not yet unified. At present, some scholars classify the subsidy modes into direct and indirect, whereas others classify the subsidy modes into tax preference, fiscal subsidy, factor support and preemption, and so on. The difference in classification results in an uncertain research conclusion. Using the abovementioned analysis and the subsidy types acquired by renewable energy firms in China, we classify subsidy modes according to the two standards (i.e., whether they are fiscal direct subsidies or innovative subsidies), in order to explore the relationship of subsidies to corporate financial performance.