Distributional Challenges of Sustainability Policies—The Case of the German Energy Transition

Abstract

:1. Sustainability Policy and Social Acceptability

2. The Social Acceptability of Energy-Related Sustainability Policies: Is Germany’s Renewable Energies Support Policy Socially Unjust?

2.1. The RES Support Scheme as a Driver of Energy Prices—Problematic on Social Grounds?

2.1.1. Overview

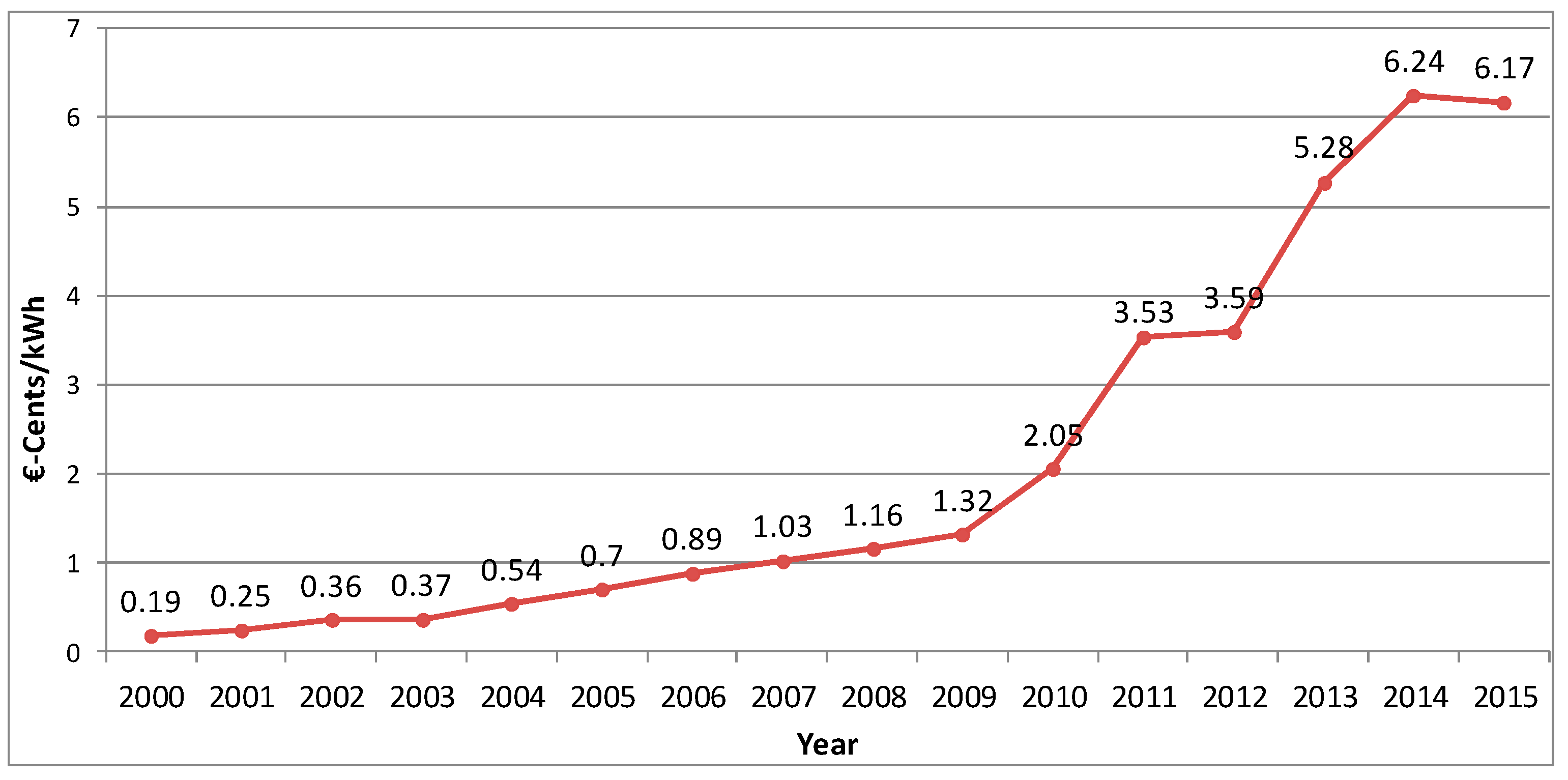

2.1.2. The Impact of the Promotion of Renewable Energy Sources on the Price of Electricity

2.1.3. Personal Distribution Impacts of Electricity Price Increases

2.1.4. What Do Prices Say about Justice?

2.2. Do Only “the Rich” Benefit from RES Support?

3. Remaining Distributional Challenges of the RES-Promotion Scheme—Socio-Political Desiderata

| Electricity Tax Reduction Proposal (2012/2013) | Annual Gains for a Private Household (Average) | Annual Tax Revenue Losses for the Federal Budget in EUR | Revenue Losses As a Percentage of Electricity Tax Revenues in 2013 |

|---|---|---|---|

| Reduction by 25% | 18 EUR | 716 million | 11% |

| Reduction to 0.5 ct/kWh | 54 EUR | 2.2 billion | 34% |

| Reduction to 0.1 ct/kWh for the first 500 kWh consumed | 10 EUR | 394 million | 6% |

| Reduction to 0.1 ct/kWh for the first 1,000 kWh consumed | 20 EUR | 789 million | 12% |

4. Discussion

5. Final Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/content/documents/7891Transforming%20Our%20World.pdf (accessed on 28 September 2015).

- Gawel, E. Zur Gerechtigkeit von Umweltabgaben. Steuergleichheit und Leistungsfähigkeitsorientierung als Probleme von Ökosteuern. Z. Wirtsch. 2000, 2, 182–211. [Google Scholar]

- Heindl, P.; Löschel, A. Addressing Social Implications of Green Growth. In Proceedings of the Green Growth and Sustainable Development Forum. Session 1: Energy Sector Reform and Its Impact on Households, Paris, France, 13–14 November 2014.

- Organisation for Economic Co-operation and Development (OECD). Managing Water for All: An OECD Perspective on Pricing and Financing; OECD: Paris, France, 2009. [Google Scholar]

- Bardt, H.; Niehus, J. Distribution Effects of the Renewable Energies Act. Z. Energiewirtsch. 2013, 37, 211–218. [Google Scholar] [CrossRef]

- BMWi; BMU. Energiekonzept für eine Umweltschonende, Zuverlässige und Bezahlbare Stromversorgung. Available online: http://www.bundesregierung.de/ContentArchiv/DE/Archiv17/_Anlagen/2012/02/energiekonzept-final.pdf?__blob=publicationFile&v=5 (accessed on 24 September 2015).

- Frondel, M.; Sommer, S. Energiekostenbelastung Privater Haushalte: Das EEG als Sozialpolitische Zeitbomb? RWI-Materialien: Essen, Germany, 2014. [Google Scholar]

- Initiative Neue Soziale Marktwirtschaft (INSM). Das EEG Belastet Vor Allem Geringverdiener. Available online: http://insm.de/insm/dms/insm/text/presse/pressemeldungen/2012/pressemeldung-EEG-studie/Pressemeldung%20EEG-Studie.pdf (accessed on 9 January 2015).

- Institut der Deutschen Wirtschaft Köln (IW). Geringverdiener Zahlen Die Zeche; IW: Köln, Germany, 2012; pp. 1–2. [Google Scholar]

- Vassiliadis, M. Energiewende mit Mehr Weitblick; Handelsblatt of 22 July 2013: Düsseldorf, Germany, 2013. [Google Scholar]

- Mayer, J.N.; Burger, B. Kurzstudie zur Historischen Entwicklung der EEG-Umlage; Fraunhofer ISE: Freiburg, Germany, 2014. [Google Scholar]

- BMWi. EEG-Umlage in Cent pro Kilowattstunde. Available online: http://www.bmwi.de/DE/Themen/Energie/Erneuerbare-Energien/eeg-2014,did=663076.html (accessed on 3 September 2015).

- Küchler, S. Kostenverteilung in der Energiewende und Strompreisprivilegien der Industrie. In Proceedings of the Workshop Sozial Gerechte Energiewende, Berlin, Germany, 26 November 2012.

- Rosenkranz, G.; Quentin, J.; Litz, P. Energiewende oder Energiewendeende: Warum der Ausgang der Bundestagswahl über den Erfolg der Energiewende Entscheidet; Deutsche Umwelthilfe: Berlin, Germany, 2013. [Google Scholar]

- BMWi. Zahlen und Fakten Energiedaten: Nationale und internationale Entwicklung. Available online: http://bmwi.de/BMWi/Redaktion/Binaer/energie-daten-gesamt,property=blob,bereich=bmwi2012,sprache=de,rwb=true.xls (accessed on 8 September 2015).

- Agentur für Erneuerbare Energien. Entwicklung der Monatlichen Energiekosten eines Drei-Personen-Musterhaushalts. Available online: http://www.unendlich-viel-energie.de/media/image/4087.AEE_Entwicklung_Energiekosten_Musterhaushalt_nov13_72dpi.jpg (accessed on 19 November 2015).

- Bundesverband Erneuerbare Energien (BEE). Hintergrundpapier zur EEG-Umlage 2014; BEE: Berlin, Germany, 2013. [Google Scholar]

- Sensfuß, F. Analysen zum Merit-Order Effekt Erneuerbarer Energien. Update für das Jahr 2010; Fraunhofer ISI: Karlsruhe, Germany, 2011. [Google Scholar]

- Erdmann, G. Kosten des Ausbaus der Erneuerbaren Energien; Studie der Technischen Universität Berlin; Im Auftrag der Vereinigung der Bayrischen Wirtschaft (VBW): Berlin, Germany, 2011. [Google Scholar]

- Fürsch, M.; Malischek, R.; Lindenberger, D. Der Merit-Order-Effekt der Erneuerbaren Energien—Analyse der Kurzen und Langen Frist; EWI Working Paper; EWI: Köln, Germany, 2012. [Google Scholar]

- BMWi. EEG in Zahlen: Vergütungen, Differenzkosten und EEG-Umlage 2000 bis 2015. Available online: http://www.erneuerbare-energien.de/EE/Redaktion/DE/Downloads/eeg-in-zahlen-pdf.pdf?__blob=publicationFile&v=4 (accessed on 8 September 2015).

- Reuster, L.; Küchler, S. Industriebegünstigungen bei der EEG-Umlage und deren Auswirkung auf die Restlichen Stromverbraucher; FOES: Berlin, Germany, 2012. [Google Scholar]

- Musgrave, R.A.; Musgrave, P.B. Public Finance in Theory and Practice, 5th ed.; McGraw-Hill: New York, NY, USA, 1989. [Google Scholar]

- Neuhoff, K.; Bach, S.; Diekmann, J.; Beznoska, M.; El-Laboudy, T. Distributional Effects of Energy Transition: Impacts of Renewable Electricity Support in Germany. Econ. Energy Environ. Policy 2013, 1, 41–54. [Google Scholar] [CrossRef]

- Grösche, P.; Schröder, C. On the redistributive effects of Germany’s feed-in tariff. Empir. Econ. 2014, 4, 1339–1383. [Google Scholar] [CrossRef]

- Heindl, P.; Schüßler, R.; Löschel, A. The German Energy Transition from the Perspective of Social Justice. Wirtschaftsdienst 2014, 7, 508–514. [Google Scholar] [CrossRef] [Green Version]

- Gawel, E.; Geißler, H.; Lehmann, P. Beeinträchtigt die Förderung erneuerbarer Energien die Erschwinglichkeit der Stromversorgung? Eine empirische Untersuchung für Deutschland. In Energie und Soziale Ungleichheit: Zur Gesellschaftlichen Dimension der Energiewende in Deutschland und Europa; Großmann, K., Schaffrin, A., Eds.; Springer: Berlin, Germany, 2015. [Google Scholar]

- Heindl, P. Ökonomische Aspekte der Lastenverteilung in der Umweltpolitik am Beispiel Energiewende. Ein Beitrag zum Interdisziplinären Dialog; ZEW Discussion Paper; ZEW: Mannheim, Germany, 2014. [Google Scholar]

- Energy Brainpool. Zusammenhang von Strombörsenpreisen und Endkundenpreisen; Study on Behalf of Agora Energiewende; Energy Brainpool: Berlin, Germany, 2013. [Google Scholar]

- Bürger, V. Quantifizierung und Systematisierung der technischen und verhaltensbedingten Stromeinsparpotenziale der deutschen Privathaushalte. Z. Energiewirtsch. 2010, 34, 47–59. [Google Scholar] [CrossRef]

- Tews, K. Stromeffizienztarife für Verbraucher in Deutschland? Vom Sinn, der Machbarkeit und den Alternativen einer Progressiven Tarifsteuerung; FFU-Report 05-2011; FFU: Berlin, Germany, 2011. [Google Scholar]

- Tews, K. Energiearmut definieren, identifizieren und bekämpfen—Eine Herausforderung der sozialverträglichen Gestaltung der Energiewende—Vorschlag für eine Problemdefinition und Diskussion des Maßnahmenportfolios; FFU-Report 04-2013; FFU: Berlin, Germany, 2013. [Google Scholar]

- Gawel, E.; Korte, K. Distributional Effects of the Renewable Energies Act: The criticism focuses on the wrong issues. Wirtschaftsdienst 2012, 8, 312–315. [Google Scholar]

- Gawel, E.; Korte, K. Verteilungswirkungen des EEG: Wird die Energiewende ungerecht organisiert? Z. Umweltr. (ZUR) 2012, 9, 457–458. [Google Scholar]

- Christian Democratic Union of Germany (CDU); Christian Social Union in Bavaria (CSU). Deutschlands Zukunft Gestalten. Coalition Agreement between CDU, CSU and SPD; CDU: Berlin, Germany, 2013. [Google Scholar]

- Küchler, S.; Meyer, B. Was Strom Wirklich Kostet. Vergleich der Staatlichen Förderungen und Gesamtgesellschaftlichen Kosten von Konventionellen und Erneuerbaren Energien; FOES: Berlin, Germany, 2012. [Google Scholar]

- Manssen, G. Die Zukunft der EEG-Umlage—Weiter auf verfassungswidrigen Wegen? Energiewirtschaftliche Tagesfr. 2012, 11, 49–51. [Google Scholar]

- Gesamtverband Textil + Mode. Eckpunkte für eine Fair Finanzierte Energiewende. Available online: http://www.markenverband.de/presse/pm/PM%20-Wirtschaftsbuendnis%20fordert%20faire%20Lastenverteilung/pmanlageeckpunktepapier (accessed on 24 September 2015).

- Verbraucherzentrale Bundesverband (VZBV). Energiewende: VZBV fordert Entlastung für Verbraucher. Available online: http://www.vzbv.de/pressemitteilung/energiewende-vzbv-fordert-entlastung-fuer-verbraucher (accessed on 24 September 2015).

- Gawel, E. EEG-Umlage: Auch weiterhin keine verfassungswidrige Finanzierungs-Sonderabgabe. Energiewirtschaftliche Tagesfr. 2013, 4, 25–30. [Google Scholar]

- Gawel, E. Die EEG-Umlage: Preisregelung oder Sonderabgabe. Deutsch. Verwalt. 2013, 7, 409–417. [Google Scholar]

- Gawel, E.; Korte, K. Regionale Verteilungswirkungen und Finanzierungsverantwortung: Bund und Länder bei der Strom-Energiewende. In Energiewende im Föderalismus; Müller, T., Kahl, H., Eds.; Nomos: Baden-Baden, Germany, 2015; pp. 143–184. [Google Scholar]

- BMWi. Zur Novelle des Erneuerbaren-Energien-Gesetzes. In Open Letter of the Scientific Advisory Board at the Federal Ministry for Economic Affairs and Technology to the Federal Minister for Economic Affairs (retd.); Rainer Brüderle: Berlin, Germany, 2011. [Google Scholar]

- Wetzel, D. Der große Schwindel mit der Solarenergie. Available online: http://www.welt.de/104445672 (accessed on 9 January 2015).

- Trend:research; Leuphana Universität Lüneburg. Definition und Marktanalyse von Bürgerenergie in Deutschland; Leuphana Universität Lüneburg: Lüneburg, Germany, 2013. [Google Scholar]

- Sorge, N.V. Warum es keinen neuen Strompreis-Schock geben wird. Available online: http://www.manager-magazin.de/unternehmen/energie/analyse-warum-strompreise-trotz-hoeherer-eeg-umlage-kaum-steigen-a-931919.html (accessed on 9 January 2015).

- Tews, K. Fuel Poverty in Germany: From a Buzzword to a Definition. GAIA 2014, 1, 14–18. [Google Scholar] [CrossRef]

- DIW; EEFA. Auswertungstabellen zur Energiebilanz Deutschland 1990 bis 2013. Available online: https://www.google.de/url?sa=t&rct=j&q=&esrc=s&source=web&cd=3&ved=0CC0QFjACahUKEwi8kNDT8ZHIAhWBghoKHZFvCtU&url=http%3A%2F%2Fwww.ag-energiebilanzen.de%2Findex.php%3Farticle_id%3D29%26fileName%3Dausw_10092014ov.pdf&usg=AFQjCNFjnSy1DZOa4cA0qK3xTtW5gROKpw&cad=rja (accessed on 25 September 2015).

- Gawel, E.; Korte, K. Sozialverträglichkeit als Herausforderung der Energiepolitik—Die ökonomische Sicht. In Proceedings of the Berliner Energietage 2013 (Berlin Energy Days 2013), Berlin, Germany, 15–17 May 2013.

- Liddell, C.; Morris, C.; McKenzie, P.; Rae, G. Defining Fuel Poverty in Northern Ireland. A Preliminary Review; Ulster: Northern Ireland, UK, 2011. [Google Scholar]

- Li, K.; Lloyd, B.; Liang, X.J.; Wie, Y.M. Energy poor or fuel poor: What are the differences? Energy Policy 2012, 68, 476–481. [Google Scholar] [CrossRef]

- Verde, S.F.; Pazienza, M.G. Cost Recovery of RES-E Support in Italy: A New Case for a Carbon Tax; EUI Working Papers RSCAS 2103/72; European University Institute: Florence, Italy, 2013. [Google Scholar]

- Nelson, T.; Simshauser, P.; Kelley, S. Australian Residential Solar Feed-in Tariffs: Industry Stimulus or Regressive form of Taxation? Econ. Anal. Policy 2011, 41, 113–129. [Google Scholar] [CrossRef]

- Rausch, S.; Mowers, M. Distributional and efficiency impacts of clean and renewable energy standards for electricity. Resour. Energy Econ. 2014, 36, 556–585. [Google Scholar] [CrossRef]

- Gough, I. The Challenge of Climate Change for Social Policy. Available online: http://eprints.lse.ac.uk/51146/1/__Libfile_repository_Content_Gough%2C%20I_Gough_challenge_climate_%20change_Gough_challenge_climate_%20change_2013.pdf (accessed on 12 November 2015).

- Bardt, H.; Niehues, J.; Techert, H. Das Erneuerbare-Energien-Gesetz—Erfahrungen und Ausblick; Initiative Neue Soziale Marktwirtschaft: Cologne, Germany, 2013. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gawel, E.; Korte, K.; Tews, K. Distributional Challenges of Sustainability Policies—The Case of the German Energy Transition. Sustainability 2015, 7, 16599-16615. https://doi.org/10.3390/su71215834

Gawel E, Korte K, Tews K. Distributional Challenges of Sustainability Policies—The Case of the German Energy Transition. Sustainability. 2015; 7(12):16599-16615. https://doi.org/10.3390/su71215834

Chicago/Turabian StyleGawel, Erik, Klaas Korte, and Kerstin Tews. 2015. "Distributional Challenges of Sustainability Policies—The Case of the German Energy Transition" Sustainability 7, no. 12: 16599-16615. https://doi.org/10.3390/su71215834