The Dynamic Relationship between Growth and Profitability under Long-Term Recession: The Case of Korean Construction Companies

Abstract

:1. Introduction

2. Literature Review

2.1. Firm’s Growth

2.2. Relationship between Firm Growth and Profitability and Our Hypotheses

| Category | Sample | Variable | Effect of | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Country | Industry | Period | N | Growth | Profit | Estimation Methods | Profit on Growth | Growth on Profit | |

| Goddard et al. [42] | UK, France, Germany, Italy, Spain, | Bank | 1992–1998 | 583 | Log growth of total assets | Return on equity | OLS, GMM (VAR) | + | 0 |

| Coad [31] | France | Manufacturing | 1996–2004 | 8405 | Log growth of sales and employees | Operating surplus/Value added | OLS, Fixed Effect, SYSTEM-GMM | 0 | + |

| Coad et al. [30] | Italy | Manufacturing | 1989–1997 | 22,000 | Log growth of sales, employee | Gross Operating Surplus | OLS, LAD (VAR) | 0 | + |

| Nakano and Kim [44] | Japan | Manufacturing | 1987–2007 | 1633 | Log growth of assets | Return on assets | System-GMM | + | - |

| Jang and Park [45] | US | Restaurant | 1978–2007 | 100 | Growth rate of Sales | Return on Sales | SYSTEM-GMM (VAR) | + | - |

| Lee [46] | South Korea | Various | 1999–2008 | 606 | Growth rate of industry-adjusted sales growth and employee | Industry-adjusted ratio of net income to sales | Fixed Effect, GMM, LAD (GMM) | - | + |

- -

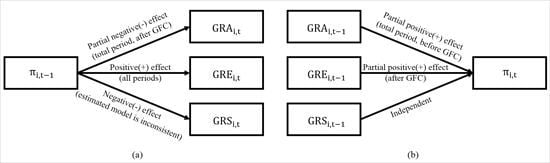

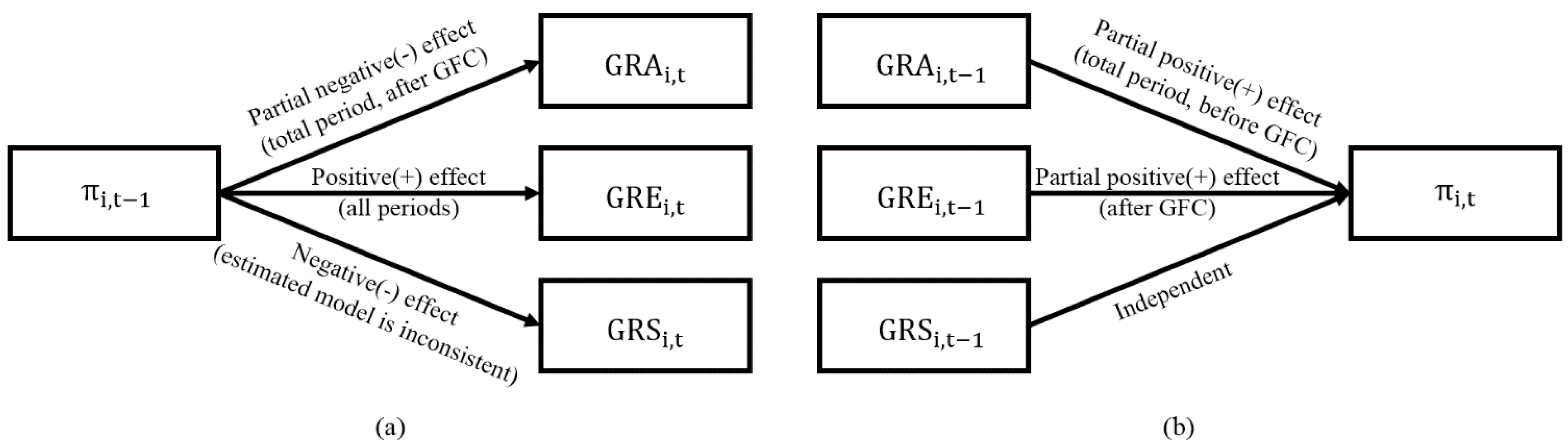

- Hypothesis 1: Past profitability of small- and medium-sized Korean construction companies will have a negative effect on current growth.

- -

- Hypothesis 2: Past growth of small- and medium-sized Korean construction companies will have a positive effect on current profitability.

3. Data and Variables

3.1. Data

3.2. Variables

| Variable | Calculation | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| 0.098 | 0.258 | −0.728 | 0.888 | ||

| 0.009 | 0.258 | −0.934 | 0.886 | ||

| 0.066 | 0.545 | −1.770 | 1.780 | ||

| 3.973 | 9.867 | −57.971 | 25.682 | ||

| 24.106 | 1.118 | 21.677 | 27.716 | ||

| 3.860 | 0.834 | 1.609 | 7.286 | ||

| 24.073 | 1.197 | 20.102 | 27.646 | ||

| 22.426 | 11.991 | 1.000 | 70.000 | ||

| 0.448 | 16.921 | −48.050 | 61.302 | ||

| 44.341 | 23.675 | 6.415 | 133.833 | ||

| 20.212 | 0.833 | 17.671 | 22.453 | ||

| 80.618 | 12.260 | 39.839 | 119.538 |

4. Empirical Analysis

5. Estimation Results

| Category | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | |||||||||||

| 0.243 a | 1 | ||||||||||

| 0.332 a | 0.218 a | 1 | |||||||||

| 0.375 a | 0.186 a | 0.278 a | 1 | ||||||||

| −0.188 a | −0.058 a | −0.047 a | −0.253 a | 1 | |||||||

| −0.032 c | −0.102 a | −0.024 | −0.121 a | 0.738 a | 1 | ||||||

| −0.083 a | −0.021 | −0.171 a | −0.109 a | 0.836 a | 0.850 a | 1 | |||||

| −0.181 a | −0.084 a | −0.078 a | −0.226 a | 0.430 a | 0.420 a | 0.384 a | 1 | ||||

| −0.044 a | −0.007 | −0.131 a | 0.079 a | −0.058 a | −0.036 b | 0.021 | 0.024 | 1 | |||

| −0.226 a | −0.114 a | 0.014 | −0.265 a | 0.435 a | 0.117 a | 0.219 a | 0.024 | −0.085 a | 1 | ||

| 0.030 c | −0.122 a | 0.307 a | 0.090 a | 0.472 a | 0.153 a | 0.401 a | 0.083 a | 0.003 | 0.293 a | 1 | |

| −0.229 a | −0.100 a | −0.080 a | −0.409 a | 0.192 a | 0.214 a | 0.277 a | 0.284 a | −0.012 | 0.044 b | 0.233 a |

| Category | Model 1-1: → | Model 1-2: → | Model 1-3: → | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | Before | After | Total | Before | After | Total | Before | After | |

| 0.064 b | −0.039 | 0.094 b | |||||||

| (0.032) | (0.060) | (0.040) | |||||||

| −0.063 a | −0.086 a | −0.060 a | |||||||

| (0.009) | (0.015) | (0.010) | |||||||

| −0.060 a | −0.073 b | −0.066 b | |||||||

| (0.021) | (0.034) | (0.032) | |||||||

| −0.105 a | −0.116 a | −0.103 a | |||||||

| (0.013) | (0.016) | (0.014) | |||||||

| −0.047 a | −0.044c | −0.026 | |||||||

| (0.017) | (0.025) | (0.021) | |||||||

| −0.395 a | −0.407 a | −0.400 a | |||||||

| (0.023) | (0.024) | (0.024) | |||||||

| −0.004 a | −0.001 | −0.004 a | 0.003 a | 0.002 a | 0.003 a | −0.008 a | −0.011 a | −0.007 a | |

| (0.001) | (0.002) | (0.001) | (0.001) | (0.001) | (0.001) | (0.002) | (0.003) | (0.002) | |

| −0.002 a | −0.002 c | −0.002 a | 0.000 | 0.000 | 0.000 | 0.004 b | 0.005 a | 0.005 b | |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.002) | (0.002) | (0.002) | |

| 0.001 b | 0.000 | 0.001 b | −0.000 | 0.000 | −0.000 | −0.002 a | −0.001 | −0.002 a | |

| (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | |

| −0.004 a | −0.003 a | −0.005 a | −0.000 | 0.000 | −0.000 | −0.004 a | −0.004 a | −0.005 a | |

| (0.000) | (0.001) | (0.001) | (0.000) | (0.001) | (0.000) | (0.001) | (0.001) | (0.001) | |

| 0.087 a | 0.105 a | 0.078 a | −0.052 a | −0.067 a | −0.042 a | 0.657 a | 0.655 a | 0.673 a | |

| (0.011) | (0.017) | (0.013) | (0.011) | (0.016) | (0.013) | (0.032) | (0.040) | (0.032) | |

| −0.005 a | −0.005 a | −0.005 a | 0.001 | 0.002 b | 0.000 | 0.004 b | 0.009 a | 0.002 | |

| (0.001) | (0.002) | (0.001) | (0.001) | (0.001) | (0.001) | (0.002) | (0.003) | (0.002) | |

| Constant | 0.481 c | 0.625 | 0.587 c | 1.332 a | 1.671 a | 1.217 a | −3.678 a | −3.782 a | −3.931 a |

| (0.247) | (0.416) | (0.301) | (0.235) | (0.344) | (0.267) | (0.601) | (0.729) | (0.646) | |

| Year Dummy | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| n | 2992 | 1379 | 1613 | 2992 | 1379 | 1613 | 2992 | 1379 | 1613 |

| Wald | 502.212 a | 149.459 a | 319.973 a | 166.183 a | 108.381 a | 106.325 a | 897.959 a | 654.560 a | 738.474 a |

| (d.f.) | (18) | (11) | (13) | (19) | (12) | (13) | (18) | (11) | (13) |

| AR (1) | −7.734 a | −5.489 a | −7.739 a | −8.847 a | −7.425 a | −6.935 a | −6.804 a | −5.749 a | −5.917 a |

| AR (2) | −0.303 | −0.229 | −0.857 | 0.411 | 1.211 | −0.473 | −4.250 a | −2.057 b | −2.585 a |

| Hansen Test | 73.192 | 7.267 | 69.652 | 81.335 | 15.238 | 73.030 | 98.737 b | 10.601 | 84.503 c |

| (d.f.) | (76) | (13) | (67) | (89) | (19) | (75) | (76) | (13) | (67) |

| Category | Model (2-1): → | Model (2-2): → | Model (2-3): → | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | Before | After | Total | Before | After | Total | Before | After | |

| 0.053 | 0.079c | 0.052 | 0.082 b | 0.101 b | 0.072 | 0.086 b | 0.118 b | 0.085c | |

| (0.036) | (0.043) | (0.043) | (0.038) | (0.040) | (0.045) | (0.041) | (0.052) | (0.048) | |

| 1.561 b | 1.980 a | 1.226 | |||||||

| (0.662) | (0.697) | (0.997) | |||||||

| −2.868 a | −2.817 a | −2.974 a | |||||||

| (0.388) | (0.434) | (0.499) | |||||||

| 1.032 c | 0.121 | 1.975 b | |||||||

| (0.552) | (0.505) | (0.897) | |||||||

| 0.246 | 0.301 | 0.342 | |||||||

| (0.329) | (0.370) | (0.410) | |||||||

| 0.152 | 0.072 | 0.146 | |||||||

| (0.366) | (0.424) | (0.472) | |||||||

| −0.702 a | −0.956 a | −0.568 c | |||||||

| (0.260) | (0.369) | (0.328) | |||||||

| . | 0.028 | 0.042c | 0.028 | −0.037 | −0.062 a | −0.023 | −0.020 | −0.025 | −0.010 |

| (0.021) | (0.023) | (0.029) | (0.025) | (0.023) | (0.032) | (0.025) | (0.024) | (0.033) | |

| 0.008 | 0.007 | 0.013 | 0.006 | 0.003 | 0.007 | 0.009 | 0.002 | 0.011 | |

| (0.010) | (0.010) | (0.013) | (0.010) | (0.010) | (0.014) | (0.011) | (0.010) | (0.015) | |

| −0.052 a | −0.034 b | −0.047 a | −0.083 a | −0.071 a | −0.080 a | −0.083 a | −0.068 a | −0.078 a | |

| (0.016) | (0.020) | (0.018) | (0.013) | (0.016) | (0.016) | (0.015) | (0.020) | (0.017) | |

| 5.344 a | 4.957 a | 5.515 a | 4.186 a | 3.580 a | 4.459 a | 4.532 a | 4.053 a | 4.622 a | |

| (0.431) | (0.496) | (0.533) | (0.371) | (0.367) | (0.482) | (0.403) | (0.421) | (0.542) | |

| −0.402 a | −0.380 a | −0.380 a | −0.375 a | −0.319 a | −0.396 a | −0.372 a | −0.319 a | −0.369 a | |

| (0.042) | (0.064) | (0.037) | (0.042) | (0.052) | (0.039) | (0.046) | (0.063) | (0.047) | |

| Constant | −1.724 | 2.086 | −4.080 | −47.334 a | −40.263 a | −51.971 a | −36.074 a | −25.325 b | −42.840 a |

| (8.795) | (10.217) | (11.553) | (7.291) | (7.534) | (8.594) | (8.516) | (9.937) | (10.746) | |

| Year Dummy | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| n | 2992 | 1379 | 1613 | 2992 | 1379 | 1613 | 2992 | 1379 | 1613 |

| Wald | 490.062 a | 231.213 a | 327.011 a | 436.333 a | 298.772 a | 279.197 a | 427.555 a | 251.053 a | 281.078 a |

| (d.f.) | (18) | (11) | (13) | (19) | (12) | (13) | (18) | (11) | (13) |

| AR (1) | −5.397 a | −2.588 a | −4.935 a | −5.636 a | −3.318 a | −4.989 a | −5.363 a | −2.568 a | −4.889 a |

| AR (2) | 0.888 | −1.433 | 1.613 | 0.630 | −1.570 | 1.742 c | 1.033 | −1.354 | 1.770c |

| Hansen Test | 80.223 | 21.425 | 70.576 | 87.221 | 22.005 | 74.793 | 86.590 | 21.494 | 76.108 |

| (d.f.) | (88) | (18) | (75) | (89) | (19) | (75) | (88) | (18) | (75) |

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Mass, N.J. The relative value of growth. Harv. Bus. Rev. 2005, 83, 102–112. [Google Scholar] [PubMed]

- Viguerie, P.; Smit, S.; Baghai, M. The Granularity of Growth: How to Identify the Sources of Growth and Drive Enduring Company Performance; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Ng, S.T.; Fan, R.Y.C.; Wong, J.M.W.; Chan, A.P.C.; Chiang, Y.H.; Lam, P.T.I.; Kumaraswamy, M. Coping with structural change in construction: Experiences gained from advanced economies. Construct. Manag. Econ. 2009, 27, 165–180. [Google Scholar] [CrossRef]

- Berkmen, P.; Gelos, G.; Rennhack, R.K.; Walsh, J.P. The global financial crisis: Explaining cross-country differences in the output impact. J. Int. Money Financ. 2012, 31, 42–59. [Google Scholar] [CrossRef]

- Choi, J.K.; Yoo, S.K.; Kim, J.H.; Kim, J.J. Capital structure determinants among construction companies in south korea: A quantile regression approach. J. Asian Archit. Build. Eng. 2014, 13, 93–100. [Google Scholar] [CrossRef]

- Jang, S.W.; Lee, S.H.; Kim, J.H.; Kim, J.J. Relationship between demand-supply in the housing market and unsold new housing stocks. J. Asian Archit. Build. Eng. 2010, 9, 387–394. [Google Scholar] [CrossRef]

- Kangari, R. Business failure in construction industry. J. Construct. Eng. Manag. 1988, 114, 172–190. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Beaver, W.H. Financial ratios as predictors of failure. J. Account. Res. 1966, 4, 71–111. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Viner, J. Cost Curves and Supply Curves. In Cost Curves and Supply Curves; Springer: Berlin, Germany, 1932; pp. 23–46. [Google Scholar]

- Gibrat, R. Les Inégalités Économiques; Librairie du Recueil Sirey: Paris, France, 1931. [Google Scholar]

- Hart, P.E.; Prais, S.J. The analysis of business concentration: A statistical approach. J. R. Stat. Soc. Ser. A 1956, 119, 150–191. [Google Scholar] [CrossRef]

- Simon, H.A.; Bonini, C.P. The size distribution of business firms. Am. Econ. Rev. 1958, 48, 607–617. [Google Scholar]

- Mansfield, E. Entry, gibrat’s law, innovation, and the growth of firms. Am. Econ. Rev. 1962, 52, 1023–1051. [Google Scholar]

- Jovanovic, B. Selection and the evolution of industry. Econometrica 1982, 50, 649–670. [Google Scholar] [CrossRef]

- Evans, D.S. The relationship between firm growth, size, and age: Estimates for 100 manufacturing industries. J. Ind. Econ. 1987, 35, 567–581. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Fazzari, S.M.; Hubbard, R.G.; Petersen, B.C.; Blinder, A.S.; Poterba, J.M. Financing constraints and corporate investment. Brook. Pap. Econ. Act. 1988, 1988, 141–206. [Google Scholar] [CrossRef]

- Lang, L.; Ofek, E.; Stulz, R. Leverage, investment, and firm growth. J. Financ. Econ. 1996, 40, 3–29. [Google Scholar] [CrossRef]

- Oliveira, B.; Fortunato, A. Firm growth and liquidity constraints: A dynamic analysis. Small Bus. Econ. 2006, 27, 139–156. [Google Scholar] [CrossRef]

- Khurana, I.K.; Martin, X.; Pereira, R. Financial development and the cash flow sensitivity of cash. J. Financ. Quant. Anal. 2006, 41, 787–807. [Google Scholar] [CrossRef]

- Coad, A.; Rao, R. Innovation and firm growth in high-tech sectors: A quantile regression approach. Res. Policy 2008, 37, 633–648. [Google Scholar] [CrossRef]

- Roper, S. Product innovation and small business growth: A comparison of the strategies of German, UK, and irish companies. Small Bus. Econ. 1997, 9, 523–537. [Google Scholar] [CrossRef]

- Freel, M. Do small innovating firms outperform non-innovators? Small Bus. Econ. 2000, 14, 195–210. [Google Scholar] [CrossRef]

- Bottazzi, G.; Dosi, G.; Lippi, M.; Pammolli, F.; Riccaboni, M. Innovation and corporate growth in the evolution of the drug industry. Int. J. Ind. Organ. 2001, 19, 1161–1187. [Google Scholar] [CrossRef]

- Geroski, P.A.; Machin, S.J.; Walters, C.F. Corporate growth and profitability. J. Ind. Econ. 1997, 45, 171–189. [Google Scholar] [CrossRef]

- Robson, P.A.; Bennett, R. Sme growth: The relationship with business advice and external collaboration. Small Bus. Econ. 2000, 15, 193–208. [Google Scholar] [CrossRef]

- Baily, M.; Bartelsman, E.; Haltiwanger, J. Downsizing and productivity growth: Myth or reality? Small Bus. Econ. 1996, 8, 259–278. [Google Scholar] [CrossRef]

- Coad, A.; Rao, R.; Tamagni, F. Growth processes of italian manufacturing firms. Struct. Change Econ. Dyn. 2011, 22, 54–70. [Google Scholar] [CrossRef]

- Coad, A. Testing the principle of “growth of the fitter”: The relationship between profits and firm growth. Struct. Change Econ. Dyn. 2007, 18, 370–386. [Google Scholar] [CrossRef]

- Alchian, A.A. Uncertainty, evolution, and economic theory. J. Polit. Econ. 1950, 58, 211–221. [Google Scholar] [CrossRef]

- Coad, A. The Growth of Firms: A Survey of Theories and Empirical Evidence; Edward Elgar Publishing Limited: Northhampton, MA, USA, 2009. [Google Scholar]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Kor, Y.Y.; Mahoney, J.T. Edith penrose’s (1959) contributions to the resource-based view of strategic management. J. Manag. Stud. 2004, 41, 183–191. [Google Scholar] [CrossRef]

- Marris, R. The Economic Theory of Managerial Capitalism; Macmillan: London, UK, 1964; Volume 258. [Google Scholar]

- Mueller, D.C. The persistence of profits above the norm. Economica 1977, 44, 369–380. [Google Scholar] [CrossRef]

- Porter, M.E. How competitive forces shape strategy. Harv. Bus. Rev. 1979, 21, 137–145. [Google Scholar]

- Barney, J.B.; Hesterly, W.S. Strategic Management and Competitive Advantage: Concepts and Cases; Pearson Education International: Upper Saddle River, NJ, USA, 2008. [Google Scholar]

- Lippman, S.A.; Rumelt, R.P. Uncertain imitability: An analysis of interfirm differences in efficiency under competition. Bell J. Econ. 1982, 13, 418–438. [Google Scholar] [CrossRef]

- Johnes, G.; Johnes, J. The persistence of efficiency. Expert Syst. Appl. 2013, 40, 5661–5672. [Google Scholar] [CrossRef]

- Goddard, J.; Molyneux, P.; Wilson, J.O.S. Dynamics of growth and profitability in banking. J. Money Credit Bank. 2004, 36, 1069–1090. [Google Scholar] [CrossRef]

- Arthur, W.B. Increasing returns and the new world of business. Harv. Bus. Rev. 1996, 74, 100–109. [Google Scholar] [PubMed]

- Nakano, A.; Kim, D. Dynamics of growth and profitability: The case of japanese manufacturing firms. Glob. Econ. Rev. 2011, 40, 67–81. [Google Scholar] [CrossRef]

- Jang, S.; Park, K. Inter-relationship between firm growth and profitability. Int. J. Hosp. Manag. 2011, 30, 1027–1035. [Google Scholar] [CrossRef]

- Lee, S. The relationship between growth and profit: Evidence from firm-level panel data. Struct. Chang. Econ. Dyn. 2014, 28, 1–11. [Google Scholar] [CrossRef]

- Sutton, J. Gibrat’s legacy. J. Econ. Lit. 1997, 35, 40–59. [Google Scholar]

- Cowling, M. The growth—Profit nexus. Small Bus. Econ. 2004, 22, 1–9. [Google Scholar] [CrossRef]

- Goddard, J.; Wilson, J.; Blandon, P. Panel tests of gibrat’s law for japanese manufacturing. Int. J. Ind. Organ. 2002, 20, 415–433. [Google Scholar] [CrossRef]

- Edum-Fotwe, F.; Price, A.; Thorpe, A. A review of financial ratio tools for predicting contractor insolvency. Construct. Manag. Econ. 1996, 14, 189–198. [Google Scholar] [CrossRef]

- Kale, S.; Arditi, D. Age-dependent business failures in the us construction industry. Construct. Manag. Econ. 1999, 17, 493–503. [Google Scholar] [CrossRef]

- Mason, R.J.; Harris, F.C. Predicting company failure in the construction industry. ICE Proc. 1979, 66, 301–307. [Google Scholar]

- Blundell, R.; Bond, S. Gmm estimation with persistent panel data: An application to production functions. Econom. Rev. 2000, 19, 321–340. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yoo, S.; Kim, J. The Dynamic Relationship between Growth and Profitability under Long-Term Recession: The Case of Korean Construction Companies. Sustainability 2015, 7, 15982-15998. https://doi.org/10.3390/su71215796

Yoo S, Kim J. The Dynamic Relationship between Growth and Profitability under Long-Term Recession: The Case of Korean Construction Companies. Sustainability. 2015; 7(12):15982-15998. https://doi.org/10.3390/su71215796

Chicago/Turabian StyleYoo, Seungkyu, and Jaejun Kim. 2015. "The Dynamic Relationship between Growth and Profitability under Long-Term Recession: The Case of Korean Construction Companies" Sustainability 7, no. 12: 15982-15998. https://doi.org/10.3390/su71215796