1. Introduction

Over the past decade, there has been increasing evidence describing the credibility and sustainability of the international economic system, the active search for corporate sustainability, and determinants of sustainable innovation. This paper aims to analyze and discuss the integration of sustainability efficiency into investment resolutions and management systems, the relevance of incorporating the essential process standards into the culture within the corporation, and the forces leading to corporate embracing of sustainable business practices. The theory that we shall seek to elaborate here puts considerable emphasis on the connection between sustainability and economic functioning, the challenges of accomplishing long-run sustainable business performance, and the link between the firm and the community in which it performs. The purpose of this article is to gain a deeper understanding of the management of sustainability performance, the business value of sustainability, and managerial positions and abilities needed to foster creation and innovation. The mainstay of the paper is formed by an analysis of investments in environmental sustainability, environmental, social and governance (ES&G) management practices and performance, and the dynamic character of sustainability. This research makes conceptual and methodological contributions to the importance of sustainable development to private sector corporations, the link between environmental management and corporate performance, and the essential determinants of corporate dedication to sustainable innovation.

2. The Performance Implications of a Culture of Sustainability

Significant public sustainability (ES&G) reporting has grown relevantly. A robust management structure is directed by corporate undertaking and strategy and is overlain by substantial governance operations. Sustainable development indicates environmental standards, social integrity [

1], and economic well-being. Sustainability is effective as an organizing criterion for internal business betterment strategies. Organizations must lead considerably towards the improvement of society. Sustainability is a duty that concerns organizations and political entities. Corporate social responsibility (CSR) is a component of a corporate policy to undertake the sustainability imperative. CSR can include an organization’s attempts to react to the imperative to advance sustainable development. Sustainability investing entails evaluating an organization’s position and functioning concerning environment, health and security, social matters, and governance [

2]. Trade-offs and disputes between economic, environmental and social features in corporate management [

3] and functioning constitute the rule. An exclusive concern for win–win results conceals significant capability for positive corporate efforts to sustainable development. The win–win pattern restricts the opportunity of possible corporate reactions and advances to sustainable development [

4], and generates a restricted analytical view on corporate sustainability proposals and policies. The distinctive degree of trade-offs in corporate sustainability applies to separate decision-makers within firms. Organizational conduct concerning sustainable development relies on the insights, reasons, values and resolutions of individual participants. Trade-offs in corporate sustainability at the organizational degree apply to disputes between various sustainability features concerning the function and effect of corporations as individual organizations [

5].

The solution to business positive result is process development continued by constant betterment of the organization’s processes. Competitive markets request active reactions and elasticity. Business leaders should develop business undertakings, organization structures and performances. Corporate cultures and ensuing operational routines should satisfy dynamic market prerequisites. Adapting business processes is a leading method of supporting industry competitiveness. Process Improvement should enable organizational change. Enacting a relevant degree of process maturity assists in unlocking performance enhancement potential in organizations. The consequence of a well-designed process is expanded effectiveness and augmented efficiency. Leadership engagement and assistance are essential for effective Process Improvement efforts. Firms should supervise and evaluate organizational process maturity [

6]. Customer requests for environmentally friendly goods and improvements in green technologies stimulate companies to take part in sustainable product development. A combination of internal and external determinants directs corporate engagement to sustainable business practices. Global supervision is a determinant of sustainable innovation. Social activism drives firms to spend supplementary resources for environmental protection. Preserving the environment furthers profitability and growth. Alterations in consumer positions and request guide corporate financing of environmental R&D and technological innovation. Sustainable technology development provides a synergistic effect on the economy [

7].

The embracing of environmentally sustainable procedures can prove advantageous to the companies that adopt them. Many business organizations analyze environmental sustainability seriously. Enterprises compete with economic explanations for financing environmentally sustainable practices. Executives think that sustainable procedures are advantageous: these gains are “intangibles” that may not be economically quantifiable. Sustainability practices are associated with an augmented amount of business, and are related to lower expenditures. When individuals handle their options in terms of where to do business, environmental sustainability approaches may be decisive (when consumers have predilections, sustainability procedures are different in a positive sense) [

8]. Signs of sustainability stress how a set of assets is regulated over time. “Weak sustainability” claims that entire wealth should not diminish, and does not allow swift reduction of non-renewable resources. “Strong sustainability” holds that some types of natural assets have no equivalents and therefore cannot be substituted. Devastating welfare losses could occur if the strong sustainability scheme is not pursued. An investigation of the notions of full cost accounting may provide the guarantee for a better comprehension of corporate sustainability. Constantly negative genuine saving is unsustainable (prosperity will have to diminish sometime in the future) [

9].

Corporate sustainability should be understood in consideration of a better estimation of the human welfare expenditure of pollution. Signs of sustainability are likely to stress either reserves of wealth or how a set of assets is handled over time. “Weak sustainability” claims that entire wealth should not diminish. The “overall” set is transmitted to the future that counts. Weak sustainability does not allow excessively swift reduction of non-renewable resources or entail that immoderate environmental deterioration is not important. “Strong sustainability” demonstrates a more substantial stress on the preservation of natural assets within the wider target of prudently handling a set of assets over time (

critical natural assets do not have equivalents and thus cannot be substituted). Devastating well-being losses could arise if a strong sustainability scheme is not pursued. An analysis of the notions of full cost accounting may assist in comprehending corporate sustainability. The idea of a “sustainable business” has significance beyond the supply of a consolidative standard for various matters regarding the corporate area and the environment. A business is less sustainable the more relevant the size of that damage, if things stay the way they are now [

9]. A

sustainable environment lasts if we exist within the planet’s regenerative and absorptive strength. The shortfall for preserving sustainability is on a route to develop further in the predictable future. Technology may generate goods and services sustainably. Firms, government agencies, nongovernmental organizations (NGOs), and persons must identify means to be sustainable and to fulfill them. Carrying out sustainability may not signify a resistance to profitability. By struggling for corporate sustainability, enterprises accomplish long-run profitability. By concentrating on their social responsibility, corporations can establish long-run employee, consumer, and individual trust as a foundation for sustainable business patterns. Through CSR, firms can be partly responsible considerably for the EU’s treaty goals of sustainable development. CSR provides a series of values on which to ground the shift to a sustainable economic system. Sustainable development should be analyzed rigorously in the board rooms of enterprises. Eco-efficiency is significant [

10] in determining a sounder and sustainable environment [

11].

International business citizenship is the route to sustainable capitalism. Individual managers and certain corporations should drive the processes of globalization toward sustainable capitalism. Every business has to internalize a more relevant sense of duty for bringing about and sustaining a sound world. Capitalism can sustainably fulfill its guarantee of wealth creation and fair allocation. Concentrating on sustainable business relevance is the ideal method to augment managers’ positive impact. Stakeholder requirements aim progressively at every company’s efforts to sustainable development and long-run value generation. Sustainability reporting insists on the aspects of economic, social, and environmental functioning, and furthers investment resolutions for socially and environmentally responsible investors [

12]. ES&G investing and investors exercise an important effect on the practice of corporate sustainability. Firms may exert leadership postures and sharply carry on new chances generated by developments in technology. Sustainability is a promising business management notion. Investors progressively look for data on corporate ES&G position and functioning, and make decisions about enterprises’ future expectations grounded on the information they have. Comprehending and generating significant outcomes in the sphere of corporate sustainability is considerably multifarious. Actively undertaking sustainability in a firm has many operational components. Any one individual’s knowledge and field expertise cannot direct all the required undertakings and actions implicated in operationalizing sustainability. Regulations have impacted and molded current ES&G management practices. Elaborate ES&G investors normally employ life cycle views. Leaders within nearly all well-run corporations actively back adequate regulations [

2].

Short-run analysis can subvert both long-run institution construction and sustained growth and gainfulness. Numerous large and medium-sized firms include sustainability in their business scheme. Sustainability focuses on constructing a community in which an appropriate equilibrium is brought about between economic, social and ecological targets. An enterprise that engages on the route of sustainability should cautiously inspect its task, perspective and values. By embracing sustainability standards, businesses can be more cost-effective and support their undertakings for a long period of time.

Firms can lead to the construction of a sustainable community by proactively innovating goods and services that are responsible for accomplishing a social requirement. Not all corporations actively utilize the notions of sustainable development. Instruments are demanded that evaluate the effect of sustainability on the short- and long-run functioning of businesses. A leader must convert a firm into a sustainable and socially responsible organization [

13].

High Sustainability enterprises tend to turn executive compensation into a task of environmental, interactional, and external perception standards, evaluating data associated with essential stakeholders and to boost the reliability of these measures by employing auditing procedures.

High Sustainability corporations evaluate and reveal more nonfinancial information, surpassing the control companies with regard to both stock market and accounting operation.

High Sustainability enterprises function better when examining accounting rates of return. This outperformance is more striking for companies that sell goods to individuals, rank due to brand and standing, and utilize a high quantity of natural resources.

High Sustainability companies tend to line up senior executive stimulants with environmental, interactional, and external perception functioning metrics [

14].

3. The Role of Companies for Achieving Sustainable Development

Many enterprises may not appropriately evaluate the risk that undeveloped processes pose to firm proposals or establish the sources of vulnerabilities in their operational settings. Elastic processes and maneuverable technologies allow companies to make the obligations necessary to satisfy customers’ demands. New processes may represent intricate business rules. Within every developing corporation, several undertakings should be carried out to back process performance and administration. The creation, betterment, and continuous supervising of a company and its processes are elaborate efforts. Process Improvement is an unceasing cycle of intricate enhancements and change management endeavors.

To stay competitive, enterprises must create first-rate products and services [

6]. A GDP assesses gross domestic product, not the sustainability of that growth. Successful cooperation is demanded to accomplish sustainable success. The global revision of supply chains has deactivated customers from the labor force. The advance of capitalism and sophisticated technology has stimulated the intensification of global consumerism. Firms should concentrate on producing prosperity, being considerably instrumental in economy and society (an enterprise that contributes to them is sustainable). Leadership has an essential function in sustainable performance. Corporations are arrangements of cyclical interlocution set up between persons and groups of persons. Organizational policy should focus on the aim to be attained, and should share proposals with the web of employees. Firm managements invariably tackle intricate systems. Management cannot ensure positive results through supervision and forecast [

15].

Clients are significant stakeholders an enterprise must consider when determining corporate schemes and prime concerns. If clients request responsible social and environmental operation, firms must act appropriately. Comprehending clients’ convictions on the relevance of different sustainable corporate performance features is key to successful management and marketing. Clients’ views about the sustainable corporate performance of firms they purchase from may be affected by their private values. Values may influence separate views and conduct of various kinds: values unswervingly affect personal positions, which shape individual’s behavior. Individuals’ values influence their views about how firms should act, which impact the conduct of the individual in connection with them. The link between persons’ values and their conduct is moderated by their views towards the associated particular behaviors. Individual stakeholders’ positions on how enterprises should act are connected with values. Positions on the relevance of corporate economic functioning are not notably associated with clients’ private values [

16]. Enforcing or developing environment, health, and safety (EHS) procedures enforces one or more prerequisites on an affected firm. Most enterprises have yet to set up elaborate advances to EHS management. Preserving conformity is the baseline degree of functioning that should be predicted of any enterprise. Both risk and chance occur for corporations in measuring the EHS and wider sustainability features of their goods and services. Clients have some degree of concern in purchasing more sustainably created products and services. Conformity to the client firm’s sustainability prerequisites is a necessary condition for a lasting business connection. EHS management and other sustainability plan expenditures must be handled dynamically by those having responsibility for supervising and setting up corporate sustainability programs. Individuals associated with sustainability endeavors in a corporate environment should take action to guarantee that the suitable views are entailed in the assessment and decision-making process [

2].

Proposals on the part of a firm backing sustainable innovation openly prove a corporation’s dedication to relevant corporate citizenship. The trade-off perspective of the association between growth and the environment claims that economic growth is not an adequate circumstance for enhancing the entire environment for the advantage of people and nature: firms do not tend to willingly react to emotional pleas for the social good [

17] or to widespread appeals to augment their environmental performance. The major determinants of sustainable innovation from the economic synergy view are client position and requests for sustainable goods and the progress of sustainable technologies [

7], Sustainability is key to satisfying human necessities and carrying out human aims [

18], and should fulfill the demands of present generation without affecting the capacity of future generations to satisfy them. The business world necessitates practical instruments and recommendations to incorporate sustainability into undertakings. Sustainability management should surpass the current practices. Incorporating sustainability management into the essential business of firms contributes to a more sustainable and unprejudiced planet. Corporations should enact determinants that lead to the positive result of a sustainable business pattern. Sustainability management represents the interplay of the environmental, the economic, and the social field. Businesses must take into account the concerns and views of stakeholders for the purpose of making outstanding steps in sustainability. It is vital to evaluate a firm’s stakeholder policy and involvement for the purpose of rightly evaluating and revealing its sustainability structure. A corporation must guarantee transparency in order to accurately involve stakeholders and advance its sustainability targets [

11].

The expected accessibility of data on the supply chain EHS characteristics of numerous consumer goods may assist customers comprehend which companies and products have more advantageous ES&G features. Managing an enterprise in a market economy is a fundamentally active operation. Businesses should identify and comprehend developing tendencies and state suitable reaction policies, and carry out action plans. Firms should cope more substantially with swift and relevant change, and to restore from the periodic setbacks that every corporation undergoes. Taking care of one’s clients is a crucial role of any firm. Executives in business enterprises that aim to enhance their ES&G position and functioning should inspect their own supply chains. ES&G matters determine a significant amount of business risks and restrictions that may involve nontrivial financial results. Business executives should be more well-informed of and adjusted to their firms’ ES&G vulnerabilities. Leaders in corporations with an outstanding fixed asset support should concentrate on developing prospects for enhanced ES&G functioning [

2]. A sustainable international society is appearing that is adapted toward maintaining restricted reserves and the natural ecology. First-rate audits should direct sustained performance enhancements. Environmental accounting regulates actions to advance sustainable environmental administration. Assessing complementary financing tools for environmental schemes is a crucial component in guaranteeing optimal asset employment within a sustainable development arrangement. Emergent “environmentally sensitive” market tendencies may have a deep effect on the sustainability of shareholder values. Eco-efficiency is a sound principal sign for sustainable earnings quality [

19].

Trade-offs at the industry level concern sustainability-related features that are relevant to a set of industry fellows and other notable participants at the industry level. Trade-offs at the societal level focus on disputes regarding the efforts of corporations to a more sustainable community (sustainable development essentially relates to the societal level). Trade-offs in the outcome aspect include disputes between various impact zones of corporate sustainability. The temporal aspect constitutes an essential sector of possible trade-offs in corporate sustainability, considering all trade-offs between present and future features in sustainability-related corporate conduct. The process dimension focuses on trade-offs in corporate policies, processes and changes for sustainable development, constituting the driving vehicles and paths towards sustainable development [

5]. The most crucial success component for sustainability is steady leadership within the corporation. Investors make demands on firms to involve in sustainability practices. Clients should make investment judgments grounded entirely or partially on ethical options and the sustainable performance of corporations. Undertaking sustainable performance involves long-run scenario setting up and risk management. The market may not recompense sustainability financings with premium margins. An enterprise should carry out activities with leadership and vision, remain elastic in response to change, and remain transparent in order to accomplish sustainable performance. Via CSR, businesses are instrumental in sustainable development. An essential sign of sustainability is the positive result of industry in producing wealth. In handling the economic effect of business on employment and taxation, firms should strategically associate economic performance and sustainability [

13].

Sustainable Value Added is the additional value produced when the entire degree of environmental and social effects is maintained steady, is founded on the model of strong sustainability, counterbalances possible causes of externalities for the shunning of externalities, and evaluates the surplus value adapted for alterations in eco- and social effectiveness. Corporate endeavors to sustainability can be estimated by reducing the expenditures from the benefits determined by a firm. A corporation is partly responsible for sustainability if the benefits surpass the total of internal and external expenditures. Relative procedures indicate corporate efforts to sustainability as advantages for unit of environmental or social effect. The relative corporate endeavor to sustainability can be evaluated in absolute monetary terms: relative Sustainable Value Added is the magnitude of the share of a company to more sustainability evaluated in monetary terms [

20]. Cautious administration of greenhouse gas releases and fossil fuel depletion is key for success. Corporate executives should set up the necessary circumstances for pursuing business favorable outcomes and long-run sustainability. Many external effects on the firm have a concern for ES&G position and functioning. An enterprise’s workforce and its skills are among its most important possessions. Undertaking sustainability in an efficient and systematic way starts with talk with the fellows of the enterprise. Investors and the analysts that assist them are concerned about corporate ES&G position and functioning. Investor conduct is a strong mechanism that is influencing corporate assessment and administration of ES&G matters. Stakeholders have various levels of implication with corporate decision making concerning ES&G matters, and fluctuating degrees of impact. The workforce is what determines a company’s function: firm employees should be the core of any significant endeavor to engage in corporate sustainability. The leadership of any firm should devote time and resources in strengthening the enterprise’s reliability, confidence, and brand soundness as a sustainable business [

2].

High Sustainability companies are distinguished by a separate corporate governance pattern [

21] that concentrates on a broader series of stakeholders as portion of their corporate policy and business pattern. Companies that are not distinguished by a culture of sustainability tend to shrink on the ground of restraining opportunistic conduct. Corporations with a culture of sustainability are more proactive, more open, and more responsible in the manner they involve with their stakeholders.

High Sustainability firms are more concentrated on comprehending the demands of their stakeholders, investing in handling these connections, and announcing internally and externally on the relevance of their stakeholder links [

14].

4. The Potential Value That Sustainable Practices Can Have in the Creation of Business Value

Carrying out quality evaluations on organizational processes [

22] should guarantee substantial and high-quality outcomes. Organizations necessitate a determined set of processes for handling aims [

23] and ensuring mechanisms. Resources and capital investments should be addressed toward the most crucial proposals and performance-enhancing undertakings (a governance structure to direct their activities is necessary). Successful governance predicts the demands and targets of an entity’s teams and business departments. Every firm should establish the best manner to enact its own governance structure. Organizations should accurately recognize the expertise, competencies, and techniques needed by their employees with the purpose of securing broad cultural practice. An organization’s positive result relies on an involved workforce that has a secure, confiding, and supportive work setting [

6]. A consistent ES&G or sustainability plan should assist in creating bridges between the different operational sectors that exist in nearly all firms. Corporations have both irregular and constant responsibilities to carry out specific ES&G undertakings and/or accomplish certain degrees of performance. A systematic and complete policy should direct any internal sustainability plan. The sustainability policy must be an organic branch of the organizational business plan. All employees should contribute to enhancing the corporation’s ES&G functioning. All sustainability schemes should take up certain ES&G endpoints: all business entities have an ES&G mark, and at least some capacity to diminish its size. The most successful manner in which to handle the many undertakings influencing organizational sustainability is to set up or revise plans to concentrate on their accomplishment. Stimulants have a strong impact on people’s disposition to alter present conducts [

2].

Firms are agent webs that indicate developing behavior which occurs repeatedly within the network. The relevance of agent interplay in an enterprise sets up the quality of the corporation. Forecast and supervision are not attainable in active systems where they cannot be precisely estimated. Management by relevance is the concentration in handling for sustainable performance. Efficient companies comprehend the necessity for the human facet in management. Leadership is associated with communication [

24], and leaders are required to alter and transform. Leadership is the essential aspect of the manager in administration for sustainable performance (leadership and sustainability are thoroughly interwoven). Responsible business routines can establish confidence and social capital, and lead to broad-based improvement and sustainable markets. Effectiveness and efficiency are significant instruments for developing into a sustainable firm. As a business notion, innovation is meant to produce value. Sustainable performance aims at satisfaction of all the stakeholder concerns [

15]. Industrial sustainability endeavors presume that business can carry on mostly under prevalent expectations of growth and additive enhancement. Business undertakings and consumption models should be better lined up with environmental and social requirements. Firms should advance their business patterns to accomplish increased industrial sustainability. Sustainable business configurations search for to outweigh conveying economic relevance, and should be economically sustainable. At the center of business pattern innovation is re-considering of the goods/services the company provides to its stakeholders. To set up a sustainable business, a holistic perspective of the value proposition is needed. Business pattern innovation for sustainability aims to enlarge the distribution of positive relevance to all stakeholders: it is an indicator to carrying out future sustainability [

25].

Enterprises are progressively practicing CSR grounded on the stakeholder pattern: commercial entities are in charge of components influenced by the firm’s schemes, performance and business undertakings. Corporate sustainability proposals indicate top management’s engagement to sustainable innovation plans through strategic resource distribution (corporate sustainability proposals supported with corporate resources supply a powerful stimulant for fostering sustainable innovation). The perspective held by a firm forms or address strategic business judgments in connection with sustainable innovation [

7]. Furnishing suitable stimulants for the required conduct to accomplish targets is a vital driver of success. Many companies and trade organizations openly back exposure of their ES&G plans and functioning. To have a concrete and long-term effect, sustainability must become an indispensable element of the enterprise’s culture. Being transformed into a sustainable entity necessitates new plans, methods, and advances of doing business. Capital markets are reconfiguring how firms are tackling sustainability. Financial market participants are giving augmenting consideration to corporate sustainability matters. ES&G elements have a quantifiable effect on corporate financial functioning [

2].

Sustainability is an outstanding variable in the strategic circumstances within which business functions. Many firms undergo a broad range of problems in taking action on sustainability accounting. Each judgment situation demands a correspondingly suitable approach of sustainability accounting. In the initial phases, a corporation’s sustainability accounting is supervised preponderantly by its specialist in synchronization with the operational sectors in which the information is primarily retained. The advance of sustainability accounting in firms may be extremely significant to the accountancy profession. Sustainability accounting includes accounting for both environmental and societal operations, and requires evaluating societal or environmental functioning, and its economic consequences. Sustainability managers are considerably implicated in determining the data to be brought about (some autonomy is demanded of sustainability managers in advancing new practices). The positive implication of a corporation’s accounting role [

26] can alter how it handles its sustainability accounting and includes relevance. The sustainability-related data significant for an enterprise can incorporate external and internal information. Which specific features of sustainability are most appropriate vary between firms [

27].

The views and conducts of decision makers in organizations [

28] influence and are impacted by ES&G topics and functioning. Making investments in ES&G enhancements unswervingly affects the company’s financial performance (ES&G issues can influence significantly the corporation’s financial success). The entity’s employees and suppliers are relevant assets and sources of competitive benefit. Firms must be economically aggressive to be sustainable in the long-run. External stakeholders demand information to make knowledgeable resolutions about where to invest funds. Constant performance betterment along appropriate ES&G aspects should be targeted by any consistent sustainability plan or proposal [

2]. The financial industry may shift companies towards corporate sustainability. Nearly all sustainability ratings endeavor to evaluate corporate environmental functioning. The same companies can operate both significantly and unsuccessfully on indicators employed in sustainable ratings. Sustainability rating approaches are in their early stages of development. Transparency will strengthen the reliability of sustainability ratings and further their normalization and possible distribution [

29].

To estimate corporate endeavors to sustainability during a period, alterations in eco-efficiency and in economic and eco-effectiveness should be examined. For the evaluation of corporate endeavor to sustainability, opportunity expenditure of the utilization of resources [

30] must be analyzed. Advances in eco-efficiency may not be enough for substantial corporate attempts to sustainability. Sustainable development puts forward that capital stocks must be maintained persistent for the purpose of guaranteeing intragenerational and intergenerational well-being. Strong sustainability may not be more restrictive or more expensive for business than weak sustainability. When formulated in economic terms, Sustainable Value Added indicates in absolute monetary terms the sustainable functioning of the firm with regard to a benchmark [

20].

High Sustainability companies are efficient communicators of their long-run method.

High Sustainability corporations place a greater stress on stakeholder participation than the

Low Sustainability ones. Another outstanding component of the corporate culture of sustainability is the degree to which a firm aims to be open in its external reporting concerning its environmental and social effect. Corporations with a culture of sustainability encounter tighter limitations in how they can act.

High Sustainability companies bring about considerably more relevant stock returns: setting up a corporate culture of sustainability may be a cause of aggressive superiority for a firm in the long-term.

High Sustainability companies surpass traditional ones when examining accounting rates of return [

14].

Case Study: Embedding Sustainability in Firm’s Corporate Strategy and Governance

Clarifying the sustainability challenge creates long-lasting competitive superiority. Sustainability may be a consolidative standard to direct the conception and conducts of all members of the corporation, and supplies the cover under which many entities are arranging their formerly distinct internal roles. Embracing a sustainability plan can assist to disturb the breaking of the arising organizational “silos” that are in several firms. In an entity aiming at sustainability, accomplishing better environmental functioning is an essential component of everyone’s task. Sustainability should be undertaken through a formal scheme conceptualization process. In some entities, the culture creates a prominent obstacle to more sustainable conduct. The persistent growth of ES&G investment and the requests of actors will generate faster and more considerable embracing of corporate sustainability conduct. ES&G investment is not an innovative undertaking, nor does its proficient employment cause substandard returns [

2]. A growing number of firms are presenting stand-alone sustainability evaluations that incorporate series of performance signs. Enterprises distribute data about their sustainability proposals through the diffusion of openly accessible reports. Performance signs are a crucial aspect of numerous corporate sustainability evaluations. Sustainability is not unswervingly quantifiable, whereas indicators constitute proxies for sustainability. Various enterprises have made praiseworthy endeavors to distribute data on their sustainability performance [

31].

Unconventional sustainability performance data can be estimated and employed to permeate decision-making. Social, environmental and economic effects [

32] are results that corporations are progressively striving to evaluate concerning sustainability and CSR. A significant aspect of sustainability performance is determining the stakeholders. Data resulting from sustainability performance evaluations can be employed in the decision-making process. Sustainability matters generally have long term perspectives, are especially hard to assess, and are inherently significant in uncertainty. Performance procedures must properly indicate causal connections that retain the possible consequences for sustainability performance. When performance is announced, additional investigation may allow decision-makers to partial out and more relevant clarify the origins of sustainability performance [

33]. Stakeholder involvement is a key aspect of sustainability reporting. Businesses that line up sustainability with their performances are concentrating on the whole variety of their stakeholders. Sustainability reports promote a competitive context where corporations are driven to correspond with the relevant benchmarks of others. Sustainability metrics are an association of economic, interactional, and environmental signs [

34] connected with performance and stakeholder observations. Annual evaluation is a strong instrument to acquire a profound comprehension of the corporate sustainability position. Sustainability may provide elucidations to further more relevant confidence in business by employing basic standards to essential business values and performances. Corporations that concentrate their view on sustainability and have a coherent policy facilitate the embracing of best practices, intensify performance and guarantee straightforward communications [

11]. Sustainable development is invariably in accord with first-rate business, and may influence operational asset employment negatively. Strategic management of environmentally connected sustainable development functioning is hard to determine and handle on an international basis. Sustainable development’s bases can be tracked to a steadily enlarging tendency for government participation [

35] in administering industrial and natural resource improvement. Corporate sustainability focuses on establishing long-run shareholder relevance [

36] by taking into account opportunities. Sustainability is the capacity of the enterprise to advance into the long-run [

37] through high quality in functioning and stewardship [

19].

Following Ernst & Young’s survey on corporate sustainability (2013) [

38], invitations were sent to 1600 managing directors of medium-sized companies (with 250–999 employees) who represented 15 sectors from the 28 EU countries via email indicating the aim of the investigation and to solicit their involvement in an online survey. A total of 1344 managing directors responded to the online survey, with an overall response rate of 84%. The self-administered survey instrument was fielded online from May 2014 to June 2014 (reminders were sent at 2- to 6-week intervals thenceforth to respondents who did not reply). Of the surveyed managing directors, 78.4% reported that they were male, 19.1% reported being female, and 2.5% of the sample did not disclose their gender. Almost all of the respondents (99.8%) had at least some college education. With respect to age, about three in four respondents were more than 40 years of age at the moment of the survey. The responding firms represent a wide variety of corporate sustainability experience.

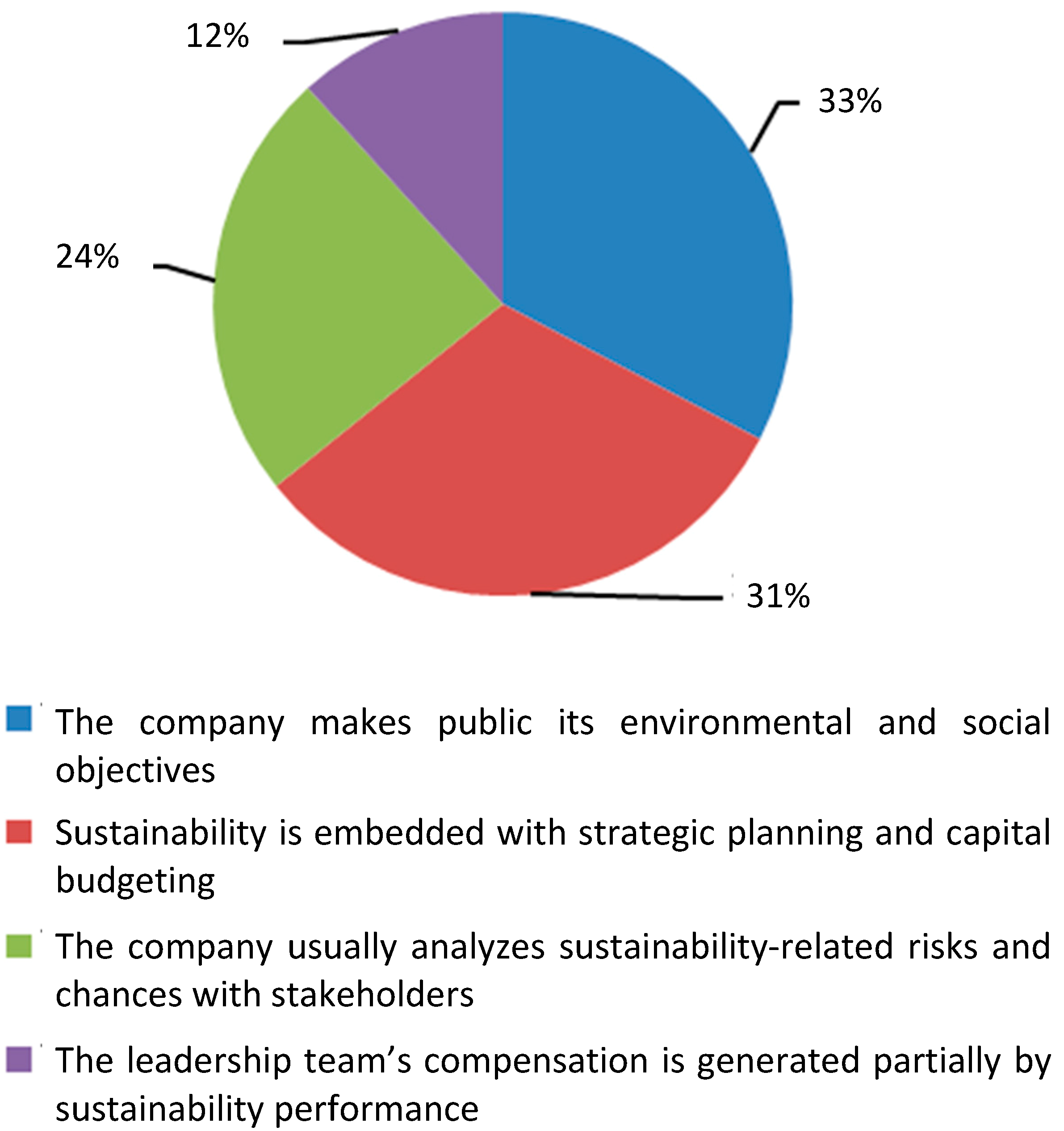

Firms are reacting to a broad variety of internal and external forces associated with environmental sustainability risks. The data from this study reveals that companies tend to make public their environmental and social objectives [

39], and usually analyze sustainability-related risks and chances taken with stakeholders (sustainability risks are mainly included into the enterprise risk management model), embedding considerably sustainability with strategic planning and capital budgeting. The leadership team’s compensation is generated only partially by sustainability performance. Corporate sustainability has become a component of the framework of most of the medium-sized companies.

Answerers displayed a powerful agreement that CEOs most drive their company’s advance to sustainability. In addition, business customers/supply chain plays an important role, pushing firms to incorporate sustainability matters ever deeper into corporation operations. Being proactive in sustainability matters would fortify shareholders’ concerns. Sustainability should be more firmly assimilated throughout the company.

Figure 1.

The degree to which sustainability is embedded in the corporate strategy and governance.

Figure 1.

The degree to which sustainability is embedded in the corporate strategy and governance.

Figure 2.

The most important drivers to companies’ approaches to sustainability.

Figure 2.

The most important drivers to companies’ approaches to sustainability.

5. Conclusions

The current study has extended past research by clarifying the economic relevance of firm, challenges in advancing an efficient corporate sustainability strategy, and the significance of the shareholders for managerial positive result. The implications of the developments outlined in the preceding sections of this paper suggest a growing need for a research agenda on the functioning involvements of a culture of sustainability, the function of corporations for accomplishing sustainable development, the possible relevance that sustainable actions can have in the production of business value, and the challenge of effecting sustainable development practices. The paper generates insights about the advance of sustainability metrics, the determinants, risks, and chances entailed in making the switch to sustainability, and stakeholders concerned in corporate ES&G management conduct and functioning. The results of the current study converge with prior research on the connection between sustainability and corporate financial operation [

40], social and environmental features of sustainability, and the concept of sustainable performance. These findings highlight the importance of examining the effect of environmentally sustainable operations on firm performance, the rise of ES&G matters as significant determinants of business conduct, and the individual as a crucial power in organizational change. Our analysis complements the growing literature on the multifarious character of sustainable development, the environmental functioning of organizations, and duty as an essential element and determinant of managerial performance.