Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective

Abstract

:1. Introduction

2. Literature Review

2.1. PPP Projects from the Sustainability Perspective

2.2. Selection of Capital Structure of PPP Projects

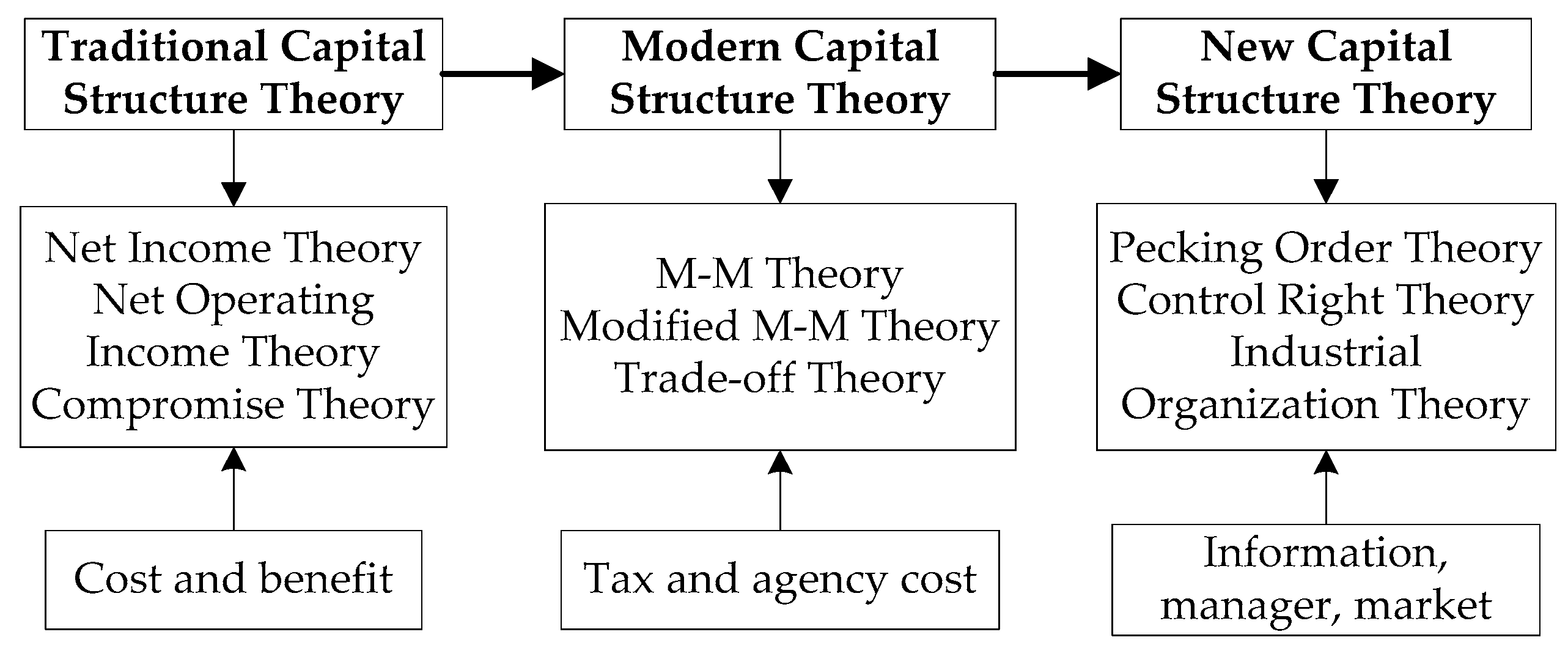

2.2.1. Capital Structure Theory

2.2.2. Selection Model of the Capital Structure of PPP Projects

3. Methodology

3.1. Selection of Methods

3.1.1. Multi-Objective Programming Model

3.1.2. Discounted Cash-Flow Model

3.1.3. Case Study

3.2. Procedure of Building Selection Model and Process

4. Selection Model of the Capital Structure of PPP Projects from the Sustainability Perspective

4.1. Assumptions

- The model does not consider other equity investors, and the equity investors of PPP projects are the public and private sectors.

- The participants of PPP projects are rational decision makers who pursue the maximization of their own interests.

- The equity funds of PPP projects are all invested at time t=0, while the debt funds are invested at stages according to reality.

- All the cash-flow is discounted to t=0, in accordance with the present value.

- The income of a PPP project company should be used for debt repayment first, and then the remaining can be distributed.

4.2. Selection Model of the Capital Structure Based on Multi-Objective Programming

4.2.1. Objective Functions

- The maximization of benefits for investors: The maximization of the net present value (NPV)where CIt indicates cash inflow of the PPP project at time t, such as government payment or user payment; COt shows cash outflow at time t, including project costs, interests of debt, and taxes; N means the contract term of the PPP project; and iA is the discounted rate.

- The maximization of public interests: The minimization of social costs, including user payment (or user fee, feasibility gap subsidy, or government payment) and the opportunity cost of funds from the public sector.where is the debt funds of the PPP project; DSt shows debt–service payment of the project company at time t; indicates the financial expense of the PPP project; E2 is the equity investment of the public sector; and γ shows the opportunity cost coefficient of equity capital invested by the public sector. Thus, is the opportunity cost of funds from the public sector. E1 indicates the equity investment of the private sector; P1t shows the profit obtained by the private sector at time t; means the benefits of the private sector in the project. If the PPP project relies on user payment, the sum of the above two is the sum of the user payments of the PPP project (if the public sector pays for the PPP project, the sum of the above two is the sum of the government payment; if it is a project with a feasibility gap subsidy, the sum is the user payment plus the feasibility gap subsidy). The minimization of the above three parts shows the minimum social costs of the PPP project [48,71].

- The minimization of WACC: The weighted average cost of debt and equity.where Kd, Ke1, and Ke2 indicate the cost ratio of debt funds, the equity capital from the private sector, and the equity capital from the public sector, respectively.

4.2.2. Constraints

- The constraint of the solvency: The funds available for repayment of the principal and interest should be greater than or equal to the solvency requirements set by the creditors, aiming at ensuring that the PPP project company is able to repay debts to protect the interests of creditors.where DSCR(min) shows the minimum solvency ratio of the PPP project; iB is the rate of return for creditors, namely the interest rate of loans, bonds, etc.; n means the construction period of the PPP project; and indicates the present value of total debt service payment. Moreover, EBITDAt shows the funds available for repayment at time t, including profits before interest, tax, depreciation, and amortization; and Taxt is the income tax of the PPP project company at time t. Since the model is conducted before the financing plan, the adjusted income tax, whose calculation base does not cover interest, is used to increase this variable, which reduces the risk. Thus, means the present value of funds that can be used to repay the principal and interest.

- The constraint of the total investment: The sum of equity and debt funds raised by the project company should be equal to the total investment amount of the project, and they should be greater than or equal to the total cost required by the project to ensure ample funds during the whole life cycle of the PPP project.where I is total investment of the project—that is, the sum of equity and debt funds.

- The constraint of the attractiveness of the private sector: The profit obtained by the private sector (profit distribution minus equity investment) is greater than zero, which means that the rate of return of the private sector is not lower than the minimum value stipulated in the contract. This concept attracts the private sector to participate in the PPP project and ensures a reasonable profit for the private sector.where iP(min) shows the minimum rate of return for the private sector.

- The constraint of the public interest: The upper limit of rate of return of the private sector—that is, it should not be higher than the highest value agreed in the contract to avoid unjust profits of the private sector and damage to the public interest.where iP(max) indicates the maximum rate of return for the private sector.

- The constraint of the equity–debt ratio: The equity–debt ratio should meet the national regulations, considering different project types and industries.where α shows Chinese minimum equity ratio of a project in the industry to which the project belongs. This ratio is stated by the government.

- Non-zero constraint: Non-zero variables in the model, including cost, equity capital, debt capital, income, etc.where Ct is total costs of the PPP project at time t, including financing cost, construction cost, operation cost, management cost, etc. The total cost is . Dt shows debt funds of the PPP project at time t, while the total debt is . P2tindicates the profit obtained by the public sector at time t.

- Other constraints: Coefficient variables between 0 and 1 in the model, including return rate, opportunity cost ratio, and capital ratio.

4.3. Solution of Model and Analysis of Key Parameters

4.3.1. Solution of the Multi-Objective Programming Model

4.3.2. Analysis of Key Parameters in the Model

5. Selection Process of the Capital Structure of PPP Projects from the Sustainability Perspective

6. Case Study

6.1. Project Background

6.2. Application of the Selection Model and Process

6.2.1. Application of Multi-objective Programming Model

6.2.2. Qualitative Analysis of the Capital Structure

6.3. Discussion

6.3.1. Analysis of the Quantitative Calculation Results

6.3.2. Analysis of the Application Results of Selection Process

6.3.3. Comprehensive Analysis of the Selection Model and Process from the Sustainability Perspective

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- United Nations Brundtland Commission. World Commission on Environment and Development (WCED): Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Kuhlman, T.; Farrington, J. What is Sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef] [Green Version]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2014. [Google Scholar]

- United Nations Economic Commission for Europe. List of PPP Standards in Support of the United Nations Sustainable Development Goals; United Nations Economic Commission for Europe: Geneva, Switzerland, 2015. [Google Scholar]

- Yildirim, R.; Masih, M.; Bacha, O.I. Determinants of capital structure: Evidence from Shari’ah compliant and non-compliant firms. Pac.-Basin Financ. J. 2018, 51, 198–219. [Google Scholar] [CrossRef]

- HM Treasury. Budget 2018; HM Treasury: London, UK, 2018. [Google Scholar]

- Yang, S.; Yang, Q.; Yuan, S. Survey Report of Major Changes of PFI/PF2 in UK. Available online: http://www.zgppp.cn/hyzx/zxdt/7592.html (accessed on 18 December 2018). (In Chinese).

- Chang, L.-M.; Chen, P.-H. BOT Financial Model: Taiwan High Speed Rail Case. J. Constr. Eng. Manag. 2001, 127, 214–222. [Google Scholar] [CrossRef]

- European Commission. Resource Book on PPP Case Studies; European Commission: Brussels, Belgium, 2004. [Google Scholar]

- Wang, Y. Analysis of privatization mode of public utilities-an empirical study based on Hangzhou Bay Sea-crossing Bridge. J. Sichuan Adm. Coll. 2010, 98–101. (In Chinese) [Google Scholar] [CrossRef]

- Du, J.; Wu, H.; Zhao, X. Critical Factors on the Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective. Sustainability 2018, 10, 2066. [Google Scholar] [CrossRef]

- Kavishe, N.; Jefferson, I.; Chileshe, N. Evaluating issues and outcomes associated with public–private partnership housing project delivery: Tanzanian practitioners’ preliminary observations. Int. J. Constr. Manag. 2018, 19, 354–369. [Google Scholar] [CrossRef]

- Yuan, J.; Li, W.; Guo, J.; Zhao, X.; Skibniewski, M.J. Social Risk Factors of Transportation PPP Projects in China: A Sustainable Development Perspective. Int. J. Environ. Res. Public Health 2018, 15. [Google Scholar] [CrossRef] [PubMed]

- Koppenjan, J.F.M.; Enserink, B. Public-Private Partnerships in Urban Infrastructures: Reconciling Private Sector Participation and Sustainability. Public Adm. Rev. 2009, 69, 284–296. [Google Scholar] [CrossRef]

- Kyvelou, S.; Marava, N.; Kokkoni, G. Perspectives of local public-private partnerships towards urban sustainability in Greece. Int. J. Sustain. Dev. 2011, 14, 95–111. [Google Scholar] [CrossRef]

- Ferroni, M.; Castle, P. Public-Private Partnerships and Sustainable Agricultural Development. Sustainability 2011, 3, 1064–1073. [Google Scholar] [CrossRef] [Green Version]

- Hueskes, M.; Verhoest, K.; Block, T. Governing public–private partnerships for sustainability—An analysis of procurement and governance practices of PPP infrastructure projects. Int. J. Proj. Manag. 2017, 35, 1184–1195. [Google Scholar] [CrossRef]

- Bennett, A. Sustainable public/private partnerships for public service delivery. Nuturd Rerourm Forum 1998, 22, 193–199. [Google Scholar] [CrossRef]

- Biygautane, M.; Neesham, C.; Al-Yahya, K.O. Institutional entrepreneurship and infrastructure public-private partnership (PPP): Unpacking the role of social actors in implementing PPP projects. Int. J. Proj. Manag. 2019, 37, 192–219. [Google Scholar] [CrossRef]

- Shen, L.; Tam, V.; Gan, L.; Ye, K.; Zhao, Z. Improving Sustainability Performance for Public-Private-Partnership (PPP) Projects. Sustainability 2016, 8, 289. [Google Scholar] [CrossRef]

- Kościelniak, H.; Górka, A. Green Cities PPP as a Method of Financing Sustainable Urban Development. Transp. Res. Procedia 2016, 16, 227–235. [Google Scholar] [CrossRef] [Green Version]

- Villalba-Romero, F.; Liyanage, C.; Roumboutsos, A. Sustainable PPPs: A comparative approach for road infrastructure. Case Stud. Transp. Policy 2015, 3, 243–250. [Google Scholar] [CrossRef]

- Schachler, M.H.; Navare, J. Port risk management and Public Private Partnerships: Factors relating to risk allocation and risk sustainability. World Rev. Intermodal Transp. Res. 2010, 3, 150–166. [Google Scholar] [CrossRef]

- Myers, S.C. The Capital Structure Puzzle. J. Financ. 1983, 39, 575–592. [Google Scholar] [CrossRef]

- Durand, D. Costs of debt and equity funds for business: Trends and problems of measurement. In Conference on Research in Business Finance; NBER: Cambridge, MA, USA, 1952. [Google Scholar]

- Barth, J.R.; Miller, S.M. Benefits and costs of a higher bank “leverage ratio”. J. Financ. Stab. 2018, 38, 37–52. [Google Scholar] [CrossRef]

- Thippayana, P. Determinants of Capital Structure in Thailand. Procedia-Soc. Behav. Sci. 2014, 143, 1074–1077. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.J. Determinants of capital structure of Chinese-listed companies. J. Bus. Res. 2004, 57, 1341–1351. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Ardalan, K. Capital structure theory: Reconsidered. Res. Int. Bus. Financ. 2017, 39, 696–710. [Google Scholar] [CrossRef]

- Rose, J.R. The Cost of Capital, Corporation Finance, and the theroy of Investment. Am. Econ. Rev. 1959, 49, 638–639. [Google Scholar]

- Modigliani, F.; Miller, M.H. Corporate income taxes and the cost of capital: A correction. Am. Econ. Rev. 1963, 53, 433–443. [Google Scholar]

- Antill, S.; Grenadier, S.R. Optimal capital structure and bankruptcy choice: Dynamic bargaining versus liquidation. J. Financ. Econ. 2019, 133, 198–224. [Google Scholar] [CrossRef]

- Dierker, M.; Lee, I.; Seo, S.W. Risk changes and external financing activities: Tests of the dynamic trade-off theory of capital structure. J. Empir. Financ. 2019, 52, 178–200. [Google Scholar] [CrossRef]

- Kraus, A.; Litzenberger, R.H. A state-preference model of optimal financial leverage. J. Financ. 1973, 28, 911–922. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure—The incentive-signalling approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Harris, M.; Raviv, A. Corporate governance: Voting rights and majority rules. J. Financ. Econ. 1988, 20, 203–235. [Google Scholar] [CrossRef]

- Matemilola, B.T.; Bany-Ariffin, A.N.; Azman-Saini, W.N.W.; Nassir, A.M. Does top managers’ experience affect firms’ capital structure? Res. Int. Bus. Financ. 2018, 45, 488–498. [Google Scholar] [CrossRef]

- Stulz, R. Managerial control of voting rights: Financing policies and the market for corporate control. J. Financ. Econ. 1988, 20, 25–54. [Google Scholar] [CrossRef]

- Brander, J.A.; Lewis, T.R. Oligopoly and financial structure the limited liability effect. Am. Econ. Rev. 1986, 76, 956–970. [Google Scholar]

- Ning, Y. Research on the Selection of Optimal Capital Structure for Highway PPP Projects. Master’s Thesis, Beijing University of Civil Engineering and Architecture, Beijing, China, 2018. [Google Scholar]

- Liu, Y. Optimal Capital Structure for Public-Private Partnership Projects’ Refinance. Master’s Thesis, Tsinghua University, Beijing, China, 2011. [Google Scholar]

- Long, J. Analysis on the optimal capital structure of PPP project refinancing. Adm. Assets Financ. 2015, 42, 47. (In Chinese) [Google Scholar]

- Nie, Y.; Guo, Y.; Li, F. Research on fiscal control strategy of PPP mode. Local Financ. Res. 2016, 8, 78–83. (In Chinese) [Google Scholar]

- Zhang, M. The Optimal Capital Structure and Its Influencing Factors of PPP Projects in New Type Urbanization-Based on General Equilibrium Perspective to Win-win Cooperation. Ind. Technol. Econ. 2017, 89–97. (In Chinese) [Google Scholar] [CrossRef]

- Li, C. The Research for the Capital Structure of Quasi-Profit Infrastructure PPP Projects. Master’s Thesis, Tianjin University, Tianjin, China, 2013. [Google Scholar]

- Sheng, H. Study on the Capital Structure of PPP/BOT Projects. Ph.D. Thesis, Tsinghua University, Beijing, China, 2013. [Google Scholar]

- Sharma, D.; Cui, Q.; Chen, L.; Lindly, J. Balancing Private and Public Interests in Public-Private Partnership Contracts Through Optimization of Equity Capital Structure. Transp. Res. Rec. J. Transp. Res. Board 2010, 2151, 60–66. [Google Scholar] [CrossRef]

- Feng, K.; Wang, S.; Xue, Y. Optimization of PPP Project Equity Structures Based on the Satisfactions of the Main Stakeholder. J. Tsinghua Univ. (Sci. Technol.) 2017, 57, 376–381. (In Chinese) [Google Scholar] [CrossRef]

- Chen, W. Research on the Equity Structure of a Highway PPP Project Based on Risk Sharing. Master’s Thesis, Xian University of Architecture and Technology, Shanxi, China, 2017. [Google Scholar]

- Dias, A., Jr.; Ioannou, P.G. Debt Capacity and Optimal Capital Structure for Privately Financed Infrastructure Projects. J. Constr. Eng. Manag. 1995, 121, 404–414. [Google Scholar] [CrossRef]

- Kang, C.-C.; Feng, C.-M.; Khan, H.A. Risk assessment for build-operate-transfer projects: A dynamic multi-objective programming approach. Comput. Oper. Res. 2005, 32, 1633–1654. [Google Scholar] [CrossRef]

- Myerson, R.B. On the value of game theory in social science. Ration. Soc. 1992, 4, 62–73. [Google Scholar] [CrossRef]

- Keser, C.; Willinger, M. Theories of behavior in principal–agent relationships with hidden action. Eur. Econ. Rev. 2007, 51, 1514–1533. [Google Scholar] [CrossRef]

- Jang, W.; Yu, G.; Jung, W.; Kim, D.; Han, S.H. Financial Conflict Resolution for Public-Private Partnership Projects Using a Three-Phase Game Framework. J. Constr. Eng. Manag. 2018, 144, 05017022. [Google Scholar] [CrossRef]

- Zhu, L.; Zhao, X.; Chua, D.K.H. Agent-Based Debt Terms’ Bargaining Model to Improve Negotiation Inefficiency in PPP Projects. J. Comput. Civ. Eng. 2016, 30, 04016014. [Google Scholar] [CrossRef]

- Xiong, W.; Zhao, X.; Wang, H. Information Asymmetry in Renegotiation of Public–Private Partnership Projects. J. Comput. Civ. Eng. 2018, 32, 04018028. [Google Scholar] [CrossRef]

- Medda, F. A game theory approach for the allocation of risks in transport public private partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Xiong, W.; Zhao, X.; Yuan, J.F.; Luo, S. Ex post risk management in public private partnerships infrastructure projects. Proj. Manag. J. 2017, 48, 76–89. [Google Scholar] [CrossRef]

- Song, J.; Jin, L.; Zhao, Y.; Hu, W. Using bargaining-game model to negotiate compensation for the early termination of BOT highway projects. Transp. Res. Part A Policy Pract. 2017, 105, 197–209. [Google Scholar] [CrossRef]

- Liu, J.; Gao, R.; Cheah, C.Y.J.; Luo, J. Incentive mechanism for inhibiting investors’ opportunistic behavior in PPP projects. Int. J. Proj. Manag. 2016, 34, 1102–1111. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J. Evaluation of the excess revenue sharing ratio in PPP projects using principal-agent models. Int. J. Proj. Manag. 2015, 33, 1317–1324. [Google Scholar] [CrossRef]

- Cohon, J.L. Multiobjective Programming and Planning; Courier Corporation: North Chelmsford, MA, USA, 2013. [Google Scholar]

- Alireza, V.; Mohammadreza, Y.; Zin, R.M.; Yahaya, N.; Noor, N.M. An enhanced multi-objective optimization approach for risk allocation in public–private partnership projects: A case study of Malaysia. Can. J. Civ. Eng. 2014, 41, 164–177. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Lintner, J. The valuation of risk assets and the selection of risky investment in stock portfolios and capital budgets. Rev. Econ. Stat. 1965, 47, 13–37. [Google Scholar] [CrossRef]

- Zhang, B. Application comparison of asset pricing model and arbitrage pricing model. J. Hubei Coll. Financ. Econ. 2005, 17, 47–50. (In Chinese) [Google Scholar]

- Parker, R.H. Discounted Cash Flow in Historical Perspective. J. Account. Res. 1968, 6, 58–71. [Google Scholar] [CrossRef]

- Yin, R. Case Study Research: Design and Methods, 4th ed.; SAGE: Thousand Oaks, CA, USA, 2007. [Google Scholar]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. J. 1989, 14, 532–550. [Google Scholar]

- Feng, K.; Xiong, W.; Wang, S.; Wu, C.; Xue, Y. Optimizing an Equity Capital Structure Model for Public-Private Partnership Projects Involved with Public Funds. J. Constr. Eng. Manag. 2017, 143, 04017067. [Google Scholar] [CrossRef]

- Jalalvand, A.R.; Roushani, M.; Goicoechea, H.C.; Rutledge, D.N.; Gu, H.W. MATLAB in electrochemistry: A review. Talanta 2019, 194, 205–225. [Google Scholar] [CrossRef]

- Arya, R.; Singh, P. Fuzzy efficient iterative method for multi-objective linear fractional programming problems. Math. Comput. Simul. 2019, 160, 39–54. [Google Scholar] [CrossRef]

- Jiang, Q.; Chen, R. Analysis of the value of discount rate in the financial evaluation of PPP projects. Spec. Zone Econ. 2018, 6, 91–93. (In Chinese) [Google Scholar]

- Koh, B.S.; Wang, S.; Tiong, R.L.K. Qualitative Development of Debt/Equity Model for BOT Infrastructure Projects. In Proceedings of the International Conference on Construction Process Re-engineering, Sydney, Australia, 12–13 July 1999. [Google Scholar]

- Chinese Ministry of Finance. Operational guidelines for Public-Private Partership Mode; Chinese Ministry of Finance: Beijing, China, 2014. (In Chinese)

- Online Database of Public Private Partnership Projects. Available online: http://www.cpppc.org:8086/pppcentral/map/toPPPMap.do (accessed on 29 January 2019).

- Chinese State Council. Notice of the State Council on the Adjustment and Improvement of the Capital System for Fixed Asset Investment Projects; Chinese State Council: Beijing, China, 2015. (In Chinese)

- Moszoro, M. Efficient Public-Private Capital Structures. Ann. Public Coop. Econ. 2014, 85, 103–126. [Google Scholar] [CrossRef]

| Variable | Symbol | Value |

|---|---|---|

| Total investment | I | 136874 (Excluding interest during construction period) |

| Contract term | N | 20 |

| Construction period | n | 2 |

| Opportunity cost coefficient of public funds | γ | 2% |

| Minimum equity ratio | α | 25% |

| Minimum rate of return for the private sector | iP(min) | 7% |

| Maximum rate of return for the private sector | iP(max) | 12% |

| Rate of return for creditors | iB | 4.9% |

| Solvency ratio of the PPP project | DSCR | 1.3 |

| Discount rate | iA | 6% |

| Cost ratio of capital of debt funds | Kd | 3.78% |

| Cost ratio of capital of equity from the private sector | Ke1 | |

| Cost ratio of capital of equity from the public sector | Ke2 | 0 |

| Factors | Benefit | Cost | Project Condition | Ability | Government Support | External Situation | Risk | |

|---|---|---|---|---|---|---|---|---|

| Capital Structure | ||||||||

| Equity–debt ratio | Not change | Not change | Not change | decrease | increase | increase | decrease | |

| Equity investment ratio of the private sector | Not change | Not change | Not change | decrease | decrease | increase | increase | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, J.; Wu, H.; Jin, R. Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective. Sustainability 2019, 11, 3505. https://doi.org/10.3390/su11133505

Du J, Wu H, Jin R. Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective. Sustainability. 2019; 11(13):3505. https://doi.org/10.3390/su11133505

Chicago/Turabian StyleDu, Jing, Hongyue Wu, and Ruoyu Jin. 2019. "Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective" Sustainability 11, no. 13: 3505. https://doi.org/10.3390/su11133505