1. Introduction

A long-term investment plan is essential for stable power supply because the construction process takes a long time from the investment decision to completion of the facilities. Investment decision-making in the event of a power shortage cannot resolve the imbalance of the supply and demand of electricity. In the case of South Korea, construction times are 6–7 years for a nuclear power plant, 4–5 years for a bituminous coal-fired power plant, and 2–3 years for a gasification combined cycle power plant [

1] (NB. In this paper, Korea refers to the Republic of Korea (ROK)). Especially in Korea, it is impossible to import electricity in an emergency due to the isolated power grid. Therefore, optimum investment beforehand is crucial to maintaining a stable power supply.

In Korea, the supply reserve ratio had decreased consistently by 2013 (see

Figure 1), and people experienced rolling blackouts in 2011 due to the imbalance of electricity supply and demand. Although the supply reserve ratio has increased since 2014 because of repaired or newly-constructed plants, a long-term electricity-generation mix is another challenge associated with the 2015 Paris Climate Change Conference (COP21), because coal-fired power ranks number one in total power generation by 38.7% [

2]. The COP21 reached an agreement on reducing greenhouse gas emissions, and the Korean government proposed a decrease in the proportion of coal-fired power and an increase in nuclear and renewable energy [

3].

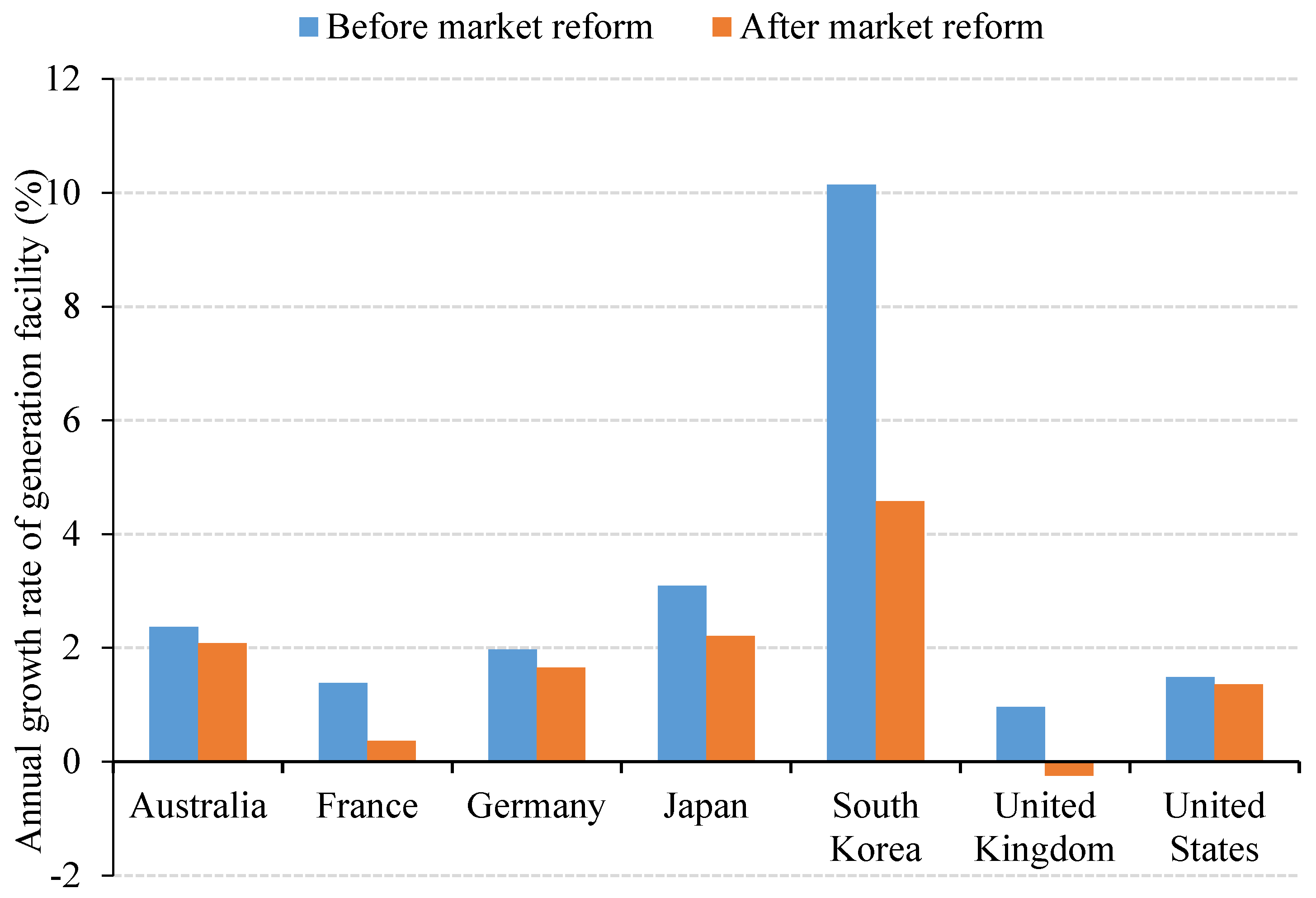

The scale or sector of investments in new power sources and facilities depends on fuel prices and government policies, such as licensing, carbon tax, renewable portfolio standards (RPSs), and market reform. Among the government policies in the energy sector, market reform is a key determinant of the scale of investment because it fundamentally affects the competition and incentive structure of the electric power industry. For example,

Figure 2 shows the Organisation for Economic and Co-operation Development (OECD) member countries’ annual average growth rates of generation facilities before and after 10 years of market reform. After the time of market reform, the growth rate decreased in these countries. Furthermore,

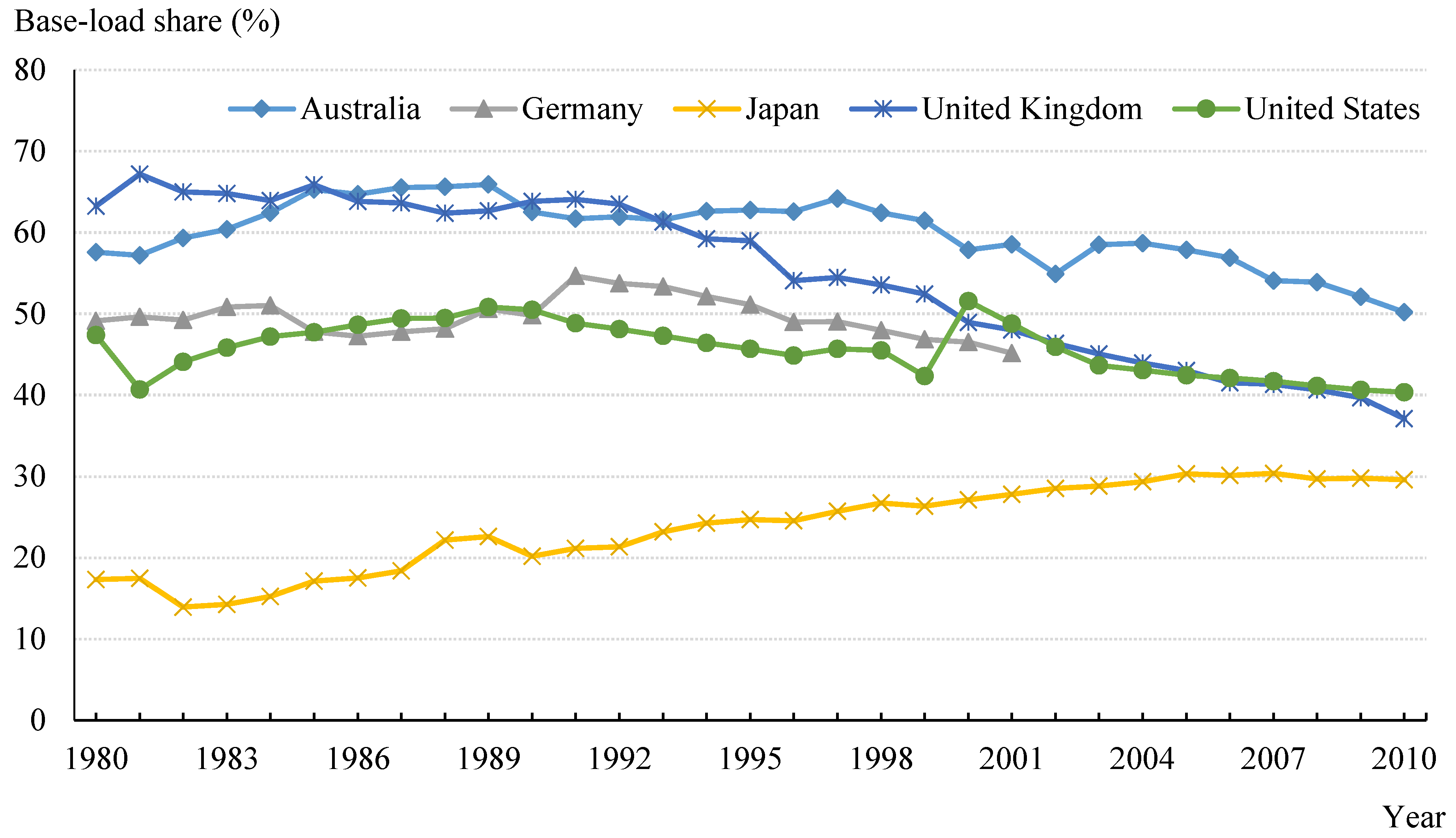

Figure 3 shows the base-load share, which tends to fall after market reform in the OECD member countries, except Japan.

The electric power industry had been operated in the form of monopolistic public or private companies under the regulations due to its technical and economic characteristics [

5,

6]. However, with the advent of new technologies such as combined gas turbines, the economies of scale were weakened in the power generation sector, and in some countries such as the United Kingdom, inefficiency in the monopoly system began to appear as a national problem [

7]. In addition, due to political orientation that emphasizes the role of the market, neoliberalism was diffused globally [

8]. Therefore, in the 1990s, under such backgrounds and purposes, many countries implemented market reform on the electric power industry, starting with the United Kingdom. At that time, the main purpose of the market reform was efficiency improvement through the introduction of competition, but privatization has been carried out to secure national fiscal revenues in some countries, regardless of the inefficiency [

9,

10].

At the beginning of the market reform, countries promoted liberalization by the forced unbundling of the vertical monopoly system of the United Kingdom, or by the sectoral opening of the monopoly franchise of the United States [

11]. Particularly, the reform plan of the United Kingdom, which focused on the introduction of competition such as vertical/horizontal unbundling, privatization, and spot-based power trading, became a reference for market reform in other countries [

12]. Thus, most of the existing studies on the electric power industry focused only on a socially-desirable industrial structures or the optimal scale of a desirable number of companies, and the core keywords were

economies of scale, management rationalization, and

deregulation [

13,

14]. The electric power market in each country promoted liberalization with the introduction of competition as a top priority, and attempted the unbundling of the competition/noncompetition sectors, as well as the introduction of the independent system operator. Common features after market reform were the introduction of sales competition and bilateral contracts, serving both power generation and sales, a pursuit of supply stability, and the existence of independent regulatory organizations [

15].

In the 2000s, various types of industrial structures were developed regarding country-specific conditions—based on trial and error and evaluations—for market reform. Especially, rather than aiming at the competition itself, the policy objectives from the national economic perspective, such as resource adequacy and industrial competitiveness, were the main focus [

16]. Therefore, unlike the initial competition-oriented goals, market reform has transformed into a practical approach by simultaneously pursuing competition and integration, as well as combining various market transaction methods in accordance with needs.

The stability and management efficiency of the national energy mix are important factors that determine the types of market reform [

17]. For instance, countries with large inefficiency in management or the energy mix prefer rapid reform with unbundling and privatization. In the case of countries with sufficient supply-reserve ratios, they prefer methods of determining facility investments based on the market mechanism. In addition, countries where interchange of electricity is possible prefer reform based on a utility-interactive system. Thus, the market reform of major countries can be classified into three types: unbundling, integration, and utility-interactive. The characteristics of each type are shown in

Table 1. Therefore, rather than focusing on how well each type fits into the traditional reform model, efforts to find the most appropriate type of reform should be given priority, based on future industry competitiveness and contribution to the national economy.

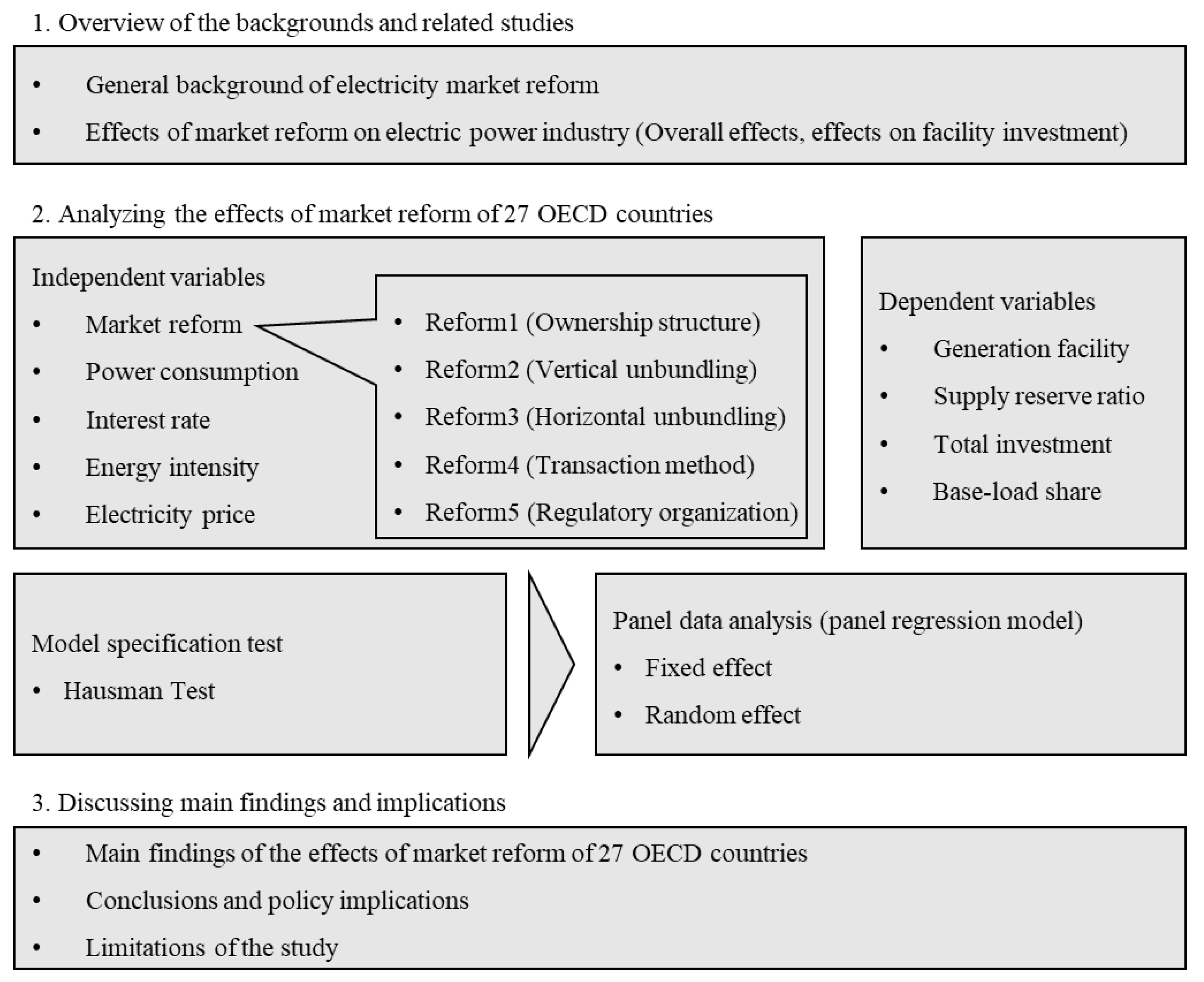

In this study, we used a panel regression model to analyze the effects of the market reform on facility investment in 27 OECD countries. Through empirical analysis, we discuss the impacts of ownership structure, unbundling, change of transaction, and government regulation on investment, and thereby derive policy implications. The schematic overview of this study is provided in

Figure 4.

The rest of this study is organized as follows.

Section 2 provides an overview of the related previous studies.

Section 3 explains the materials and methods used in the analysis. We analyze the effect of the market reform on facility investment through empirical analysis in

Section 4. Finally, we discuss the main findings and implications, as well as the limitations of this study in

Section 5.

3. Materials and Methods

We analyzed the statistical relationships between the dependent variables, with regard to investments in the electricity industry, and independent variables, with regard to market reform. The effect of market reform on the base-load share has only been analyzed qualitatively in the extant literature. In addition, the effect of the electricity price on investment is only analyzed empirically by [

34]. As such, in this section, we check the effects of market reform quantitatively through various models. We use data of 27 countries that performed electricity market reform from 1980 to 2010, which are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Japan, Korea (ROK), Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States. We use data from 1980 to 2010, but due to the lack of data on the supply reserve ratio in some countries, we use the data of the available period.

Like the recent studies analyzing the relationships between market reform and investment, we use a panel regression model considering random effects and fixed effects for empirical analysis as follows:

We use four different variables as dependent variables (

), which are: the capacity of generation facilities, supply reserve ratio, total investment in the electricity industry, and base-load share. The capacity of generation facilities is the power-generation capacity of each country, and the supply reserve ratio is defined as follows:

The total investment is the amount of investment in the overall electricity industry including power generation, transmission, and distribution. To analyze the impact of market reform on the energy mix, we use the base-load share data as a dependent variable.

The explanatory variables include policy variables related to market reform (

) and control variables representing country characteristics (

).

is a dummy variable indicating whether country

i reforms the electricity market at time

t, so it has values of 0 and 1 indicating before and after the reform, respectively. The time when each country starts the reform is referenced from the study of [

54]. It also indicates the types of reform and their levels in the electricity market in country

i. In Models 5–8, we evaluate the level of market reform using a five-point scale in terms of ownership structure (level of privatization), vertical unbundling, horizontal unbundling, transaction method (level of liberalization), and regulatory organization. Here, the market reform level of each country is measured as the total sum of the above five variables, derived by evaluation opinions of Korean experts from industry and academia, such as KEPCO. For the control variables, electric power consumption is the net generation of electricity, and the interest rate is the lending interest rate of the private generation sector. Furthermore, energy intensity is primary energy consumption as a proportion of gross domestic product, and the electricity price is the retail price of the electricity.

and

are coefficients of the explanatory variables to be estimated.

The term

denotes a constant, and the

denotes a random error. In the model specification, researchers choose the random effect model or the fixed effect model regarding the assumption of the constant term

. The random effect model assumes that

is a time variant, whereas the fixed effect model assumes that

is a time invariant. First, the regression model is estimated using both the random effect and the fixed effect; then the correlations between the results of the two models are tested through Hausman test. The Hausman test is a model specification test which has been widely used for the panel data analysis to identify models between random effect and fixed effect models [

55,

56]. If the correlation is not significant, the estimation results of the random effect model is chosen; if it is significant, the fixed effect model is chosen. In this study, we estimate both the random effect model and the fixed effect model, and discuss the analysis results by focusing on the most valid model.

Data on the generation facilities, supply reserve ratios, base-load shares, and electricity prices are from [

4], and data on power consumption and energy intensity are from [

57]. The total investment data are from [

58], and interest rate data are from [

59].

Table 4 shows the correlations among market reform, interest rate, power consumption, and energy intensity. In addition, there are five types of market reform, so the correlations among the control variables, including the five types of reform, are shown in

Table 5.

4. Results and Discussion

4.1. Investment after Market Reform

We estimated four models using different dependent variables, using the dummy variable indicating market reform as an explanatory variable. As a result of the Hausman test, it was desirable to reject the null hypothesis that the correlation between

and explanatory variables of Model 1 is zero (χ

2 = 116.32). Thus, we chose the estimation results of the fixed effect model for Model 1 and the random effect model for Model 2, 3, and 4.

Table 6 shows the estimation results.

First, regarding market reform itself, it only has negative effects on generation facilities amongst the dependent variables. In general, a supply reserve ratio below a certain low value is a critical problem, but an excessively high reserve ratio also could be an important issue for effective investment. Thus, Model 2, which analyzes the absolute value of the reserve ratio shows very low explanatory power.

Generation facilities, total investment, and electricity price have positive correlations with each other. Considering the results of Models 1, 3, and 4, it is natural that generation facilities and total investment increase as electric power consumption increases. Thus, an increase in the power consumption or electricity price increases the generation facilities and total investment, but it does not have a statistically significant effect on the supply reserve ratio. The positive correlations of electricity price, generation facilities, and total investment mean that we should consider that lowering the cost through market reform can have a negative influence on facility investment. Furthermore, regarding the interest rate and energy intensity, Models 1, 2, and 3 show that they have no statistically significant effect on the generation facilities, supply reserve ratio, and total investment.

Moreover, the base-load share is positively related to power consumption, energy intensity, and electricity price, but negatively related to the interest rate because it is more cost-effective to increase the base-load share under an energy overconsumption system with high consumption or energy intensity. In general, the base-load share increases under good investment conditions with a low interest rate or high electricity price because the construction cost of base-load generation facilities is high in general.

4.2. Investment by Level of Market Reform

To analyze the effect of the type and level of market reform on facility investment, we estimated four different models (Models 5–8) by including five types of market reform as the explanatory variables. Each variable of the five types of the market reform has a value of 1 to 5 based on its level. As a result of the Hausman test, the null hypothesis was rejected in Model 5, 6, and 8. Therefore, we chose the estimation results of the fixed effect model for Model 5, 6, and 8 and the random effect model for Model 7.

Table 7 shows the estimation results.

We can find that as the ratio of the power generation of private companies increases, there are negative effects on generation facility and base-load share. This result coincides with the previous literature, which concludes that the privatization of the electricity market has a negative influence on facility investment. Especially, in the case of base-load facilities, it is possible for the private company to reduce its investment because of the high uncertainty due to the large investment amount and long construction time.

Vertical unbundling has a positive relationship with the supply reserve ratio, which means that the strategy of European Union, i.e., pushing ahead with investment expansion through vertical unbundling, is meaningful. However, as the effects of vertical unbundling on investment vary depending on whether the method of vertical unbundling is ownership or legal unbundling, we need an additional analysis to distinguish these two bundling types. Furthermore, horizontal unbundling does not significantly affect the generation facility.

The level of liberalization of the transaction method has a positive effect on generation facility, supply reserve ratio, and base-load share. It seems that the operation of spot and future markets and activation of bilateral contracts decrease the risk of investment by lowering the uncertainty of future demand and price. However, the demand for the future market to reduce the volatility of the electricity price may not be high when the number of participants is very limited, and price volatility is low because of government intervention on the electricity price, like in Korea [

60].

The level of establishment of regulatory organizations has a negative influence on generation facility and base-load share. Moreover, the generation facility has a negative correlation with the interest rate, while the base-load share has a positive correlation with energy intensity and negative correlation with the electricity price. In addition, the electricity price has a positive correlation with the total investment, which is the same result as that of [

34]. As expected, power consumption increases the total investment and reduces the supply reserve ratio. The effects of other control variables are similar to the results of the previous studies [

34,

40,

41,

46].

In the case of Korea, the efficiency of combined cycle power decreases because it has four distinct seasons, and the price of natural gas is high due to the cross-subsidy. Thus, the peak-load share is not likely to increase [

53], but we should be aware of the tipping effect of peak-load generation due to changes in investment incentives, as the empirical analysis shows. Regulatory organization can be a burden to companies, so it can have a negative effect on facility investment. The regulation of the electricity price can also negatively affect investment and base-load share. With regard to the level of price regulation, whether the level can induce adequate facility investment as well as prices and consumer benefits needs to be considered. Vertical unbundling contributes to raising the reserve ratio, whereas horizontal unbundling does not have any significant effect on investment. The effect on investment is limited because the generation facilities and total investment were not statistically affected. Imposing spot and future markets, as well as bilateral contracts, have positive effects on investment by lowering the volatility risks of the price and demand, but in the case of the future market in the Korean electric power market, the benefits of the imposition may not be large.

5. Conclusions

This study analyzes the effects of market reform on generation facilities, supply reserve ratio, total investment in the electricity industry, and base-load share. For the empirical analysis, we performed four panel regression models using the data of 27 OECD countries. The panel data analysis showed that the electricity market reform has a negative effect on the generation facility, and has no statistically significant effect on supply reserve ratio, the amount of investment, and base-load share. When we considered five types of the market reform, we found that privatization of the electricity market has negative effects on the generation facility and base-load share. Vertical unbundling has a positive effect on the supply reserve ratio, but the horizontal unbundling has no statistically significant effect on the facility investment.

From the results, we also found that the generation facilities decreased after market reform under the assumption of ceteris paribus. This means that electricity market reform, which has been conducted to increase the efficiency of the electricity market in many countries, has a negative effect on facility investment, and it seems that there is the danger of hindering the supply stability. In addition, the electricity supply and price can be unstable and volatile from privatization and a low base-load share. In particular, when the construction compliance of the private power-generation companies is decreased and there is no compulsory institutional method to force it, as in Korea, market reform can be a negative factor in the supply stability of electricity.

The limitations of this study are as follows. First, our analysis does not cover the entire 1980–2010 period for some countries due to the lack of data. Second, despite the significant implications presented here, it is a challenge to generalize the results because the detail structures and policies of the electricity industry vary by country. Therefore, future studies need to consider supplementary data and additional explanatory variables to overcome these limitations.