A Framework of Production Planning and Control with Carbon Tax under Industry 4.0

Abstract

:1. Introduction

2. Research Background

2.1. Brief of Industry 4.0

2.2. Green Production and Environmental Protection in the Tire Industry

2.3. The Current Application of Industry 4.0 in Tire Industry

2.4. Sustainability and Industry 4.0

3. Production Planning Model with ABC and TOC

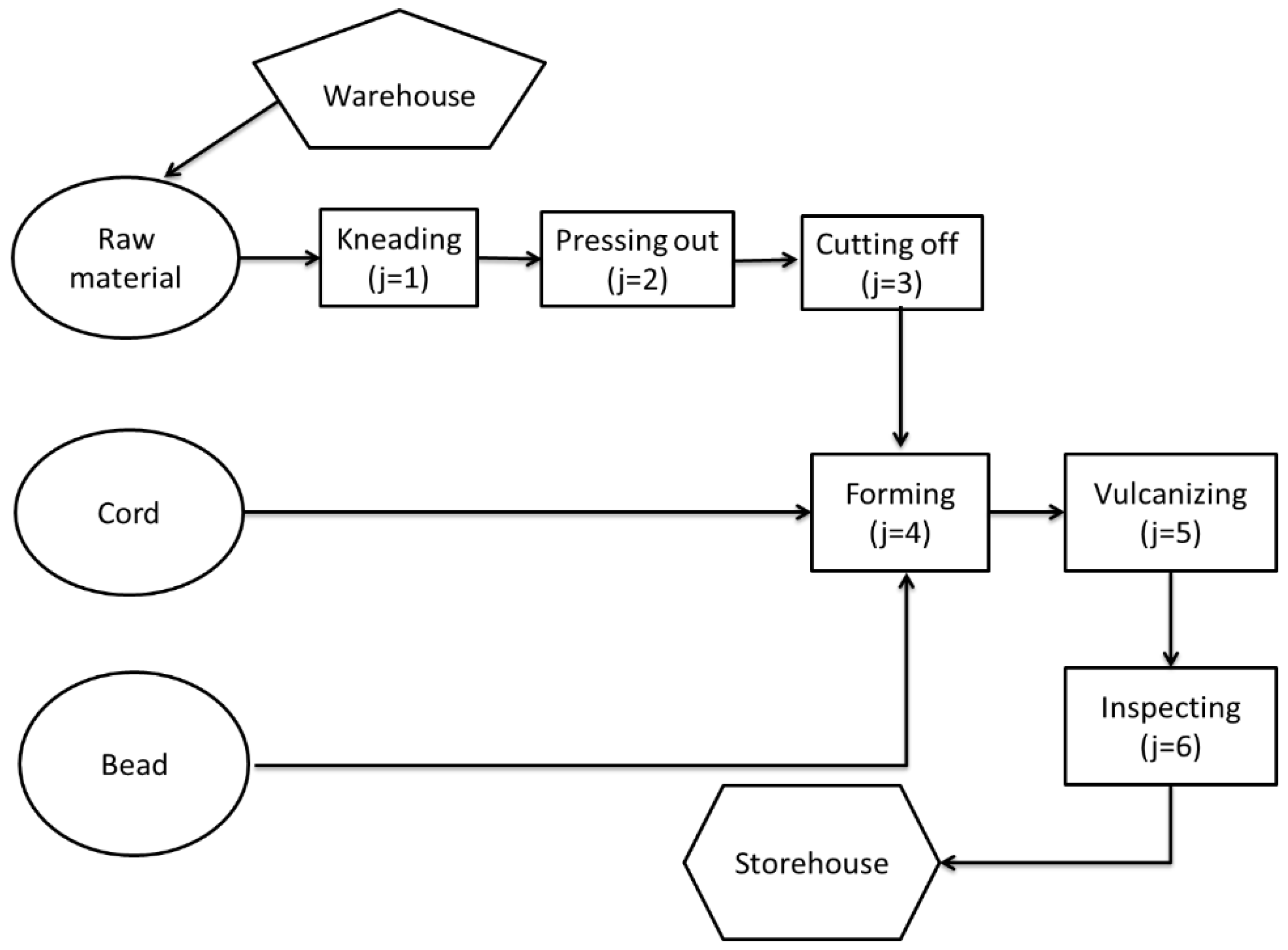

3.1. A Production Process for a Typical Tire Company

3.2. Assumptions

- The unit price of products remains unchanged within the relevant range of planning.

- The unit direct material costs are constant within the relevant range of planning.

- By working overtime with higher wage rates, direct labor resources can be expanded.

- The activities required for the tire production process and their activity drivers and the resources required for each activity and their resource drivers has been determined through ABC analyses.

- There are hundreds of materials for producing tires. This paper assumes that the five materials (natural rubber, soot, synthetic rubber, cord and bead) with the highest proportion in the manufacturing process are used as the direct material inputs. Other materials are not included in the research of this mathematical programming model.

- Carbon tax cost is considered as a variable cost, which is dependent on the quantity of carbon emissions and different carbon tax rates are used for different carbon tax ranges. Assume that all kinds of emissions have been calculated to the carbon equivalent.

- The data assumed in this study are in metric tons for carbon emission and U.S. dollars for amounts, as shown in Table 1.

3.3. Green Production Planning Model

3.3.1. Notations

| the production quantity of product i for Company T; | |

| , | a set of 0–1 variables of SOS1 (special ordered set of type 1), where only one variable will be non-zero [76,77]; |

| , , | a set of 0–1 variables of SOS1 (special ordered set of type 1), where only one variable will be non-zero [76,77]; |

| , , , | a set of non-negative variables of SOS2 (special ordered set of type 2), where at most two adjacent variables may be non-zero in the order of a given set [76,77]; |

| , , | a set of non-negative variables of SOS2 (special ordered set of type 2), where at most two adjacent variables may be non-zero in the order of a given set [76,77]; |

| the number of batches for material handling of product i; |

| the unit sales price of product i; | |

| the unit cost of the material k; | |

| the requirements of material k for producing a unit of product i; | |

| the quantity of material k available for use; | |

| the normal direct labor hours available; | |

| the maximal working hours at the first overtime rate plus the normal direct labor hours available; | |

| the maximal working hours at the first and second overtime rate plus the normal direct labor hours available; | |

| total direct labor costs at the normal direct labor hours available (); | |

| total direct labor costs at the maximal working hours at the first overtime rate plus the normal direct labor hours available (); | |

| total direct labor costs at the maximal working hours at the first and second overtime rate plus the normal direct labor hours available (); | |

| the actual operating activity costs for each activity driver in activity j; | |

| the number of machine hours required to produce one unit of product i in activity j = 1~6; | |

| the number of machine hours required to transport one batch of product i in activity j = 7; | |

| the quantity of product i for a batch in activity j; | |

| the requirement of direct labor hours for one unit of product i; | |

| TDL | total direct labor hours used from Equation (3); |

| the number of machine hours available for activity j; | |

| CEC1 | the total carbon tax cost at the upper limit of total carbon emission quantity of the first carbon tax range (CE1); |

| CEC2 | the total carbon tax cost at the upper limit of total carbon emission quantity of the first carbon tax range (CE2); |

| CEC3 | the total carbon tax cost at the upper limit of total carbon emission quantity of the third carbon tax range (CE3); |

| the total quantity of carbon emission from Equation (15); | |

| CE1 | the upper limit of total carbon emission quantity of the first carbon tax range; |

| CE2 | the upper limit of total carbon emission quantity of the second carbon tax range; |

| CE3 | the upper limit of total carbon emission quantity of the third carbon tax range; |

| the cost of material handling for one batch of product i; | |

| the quantity of carbon emission for producing one unit of product i. |

3.3.2. The Objective Function

3.3.3. Direct Material Quantity Constraints

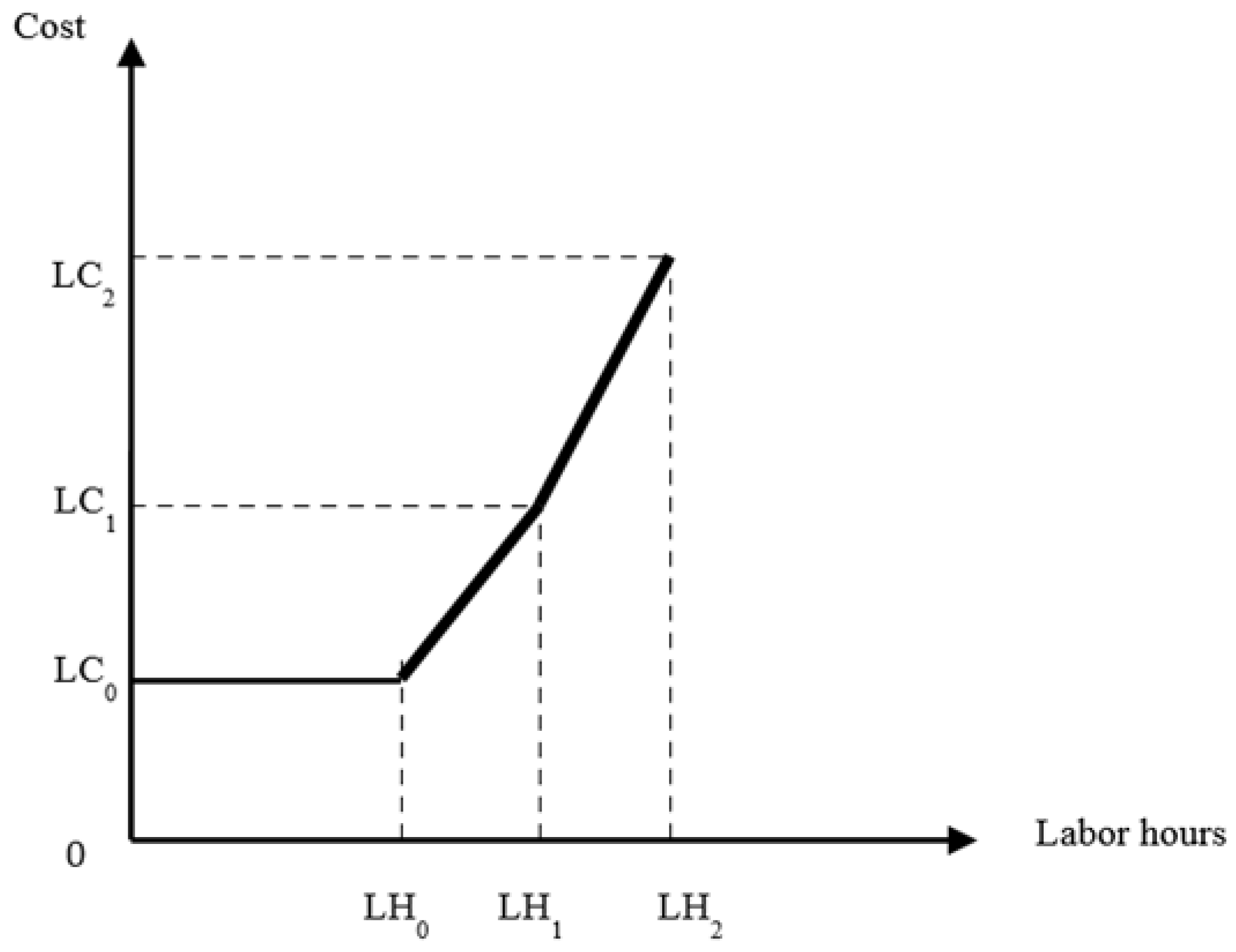

3.3.4. Direct Labor Cost Function

3.3.5. Machine Hour Constraints

3.3.6. Batch-Level Activity Cost Function for Material Handling

3.3.7. Carbon Tax Function

4. Illustration

4.1. Example Data and Optimal Decision Analysis

- 1 + 1.5 + 0.5 − 1760 − 2200 − 2640 = 0

- 5 + 10 + 1 ≤ 13,200,000

- 2 + 4 + 1 22,000,000

- 2 + 3 + 1 22,000,000

- 3 + 5 + 1 26,400,000

- 2 + 3 + 1 13,200,000

- 3 + 6 + 1 6,600,000

- 5 ≤ 0

- 10 ≤ 0

- 1 ≤ 0

- 2 + 3 + 1 1,760,000

- 0.2 + 0.1 + 0.1 − 700 − 850 − 950 = 0

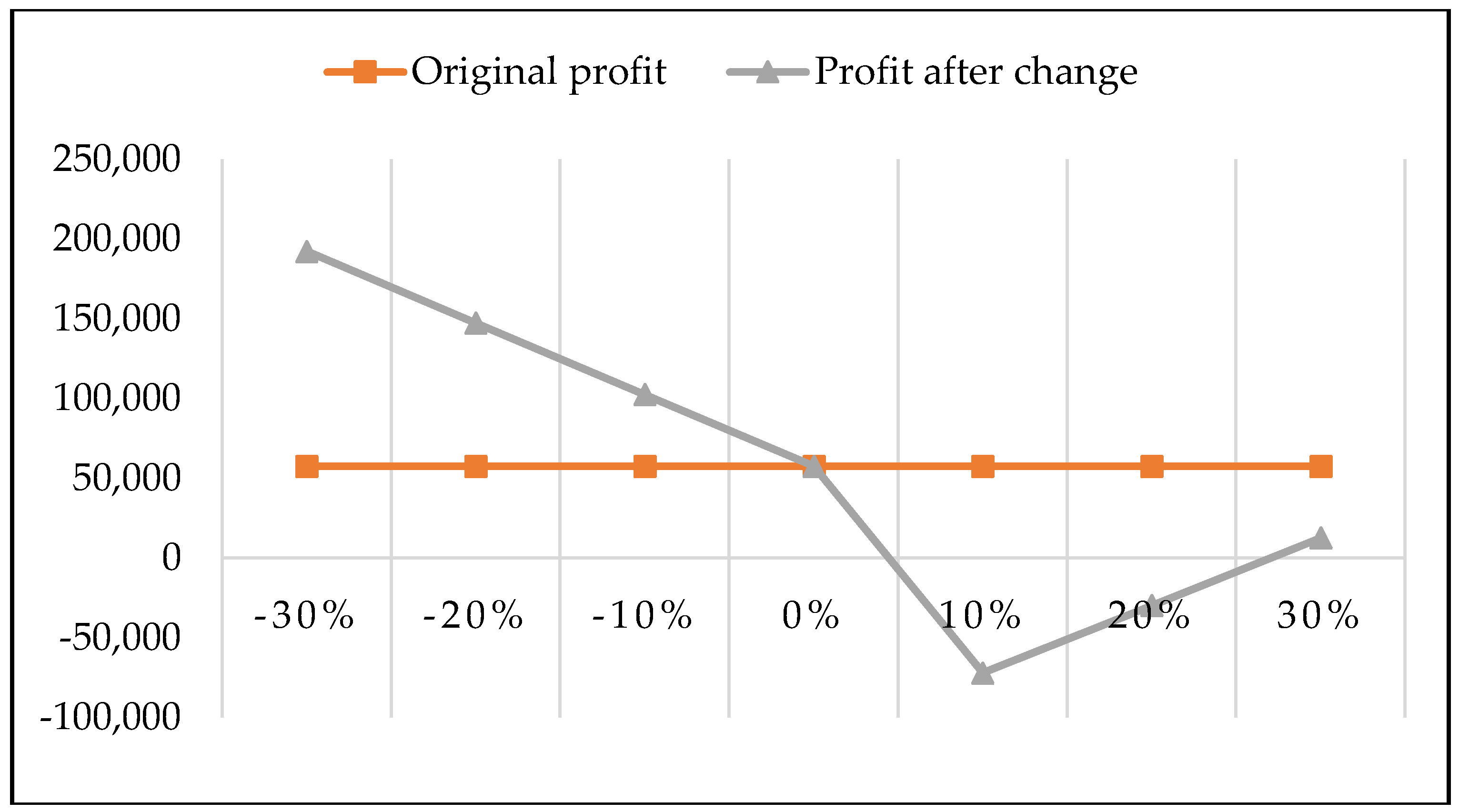

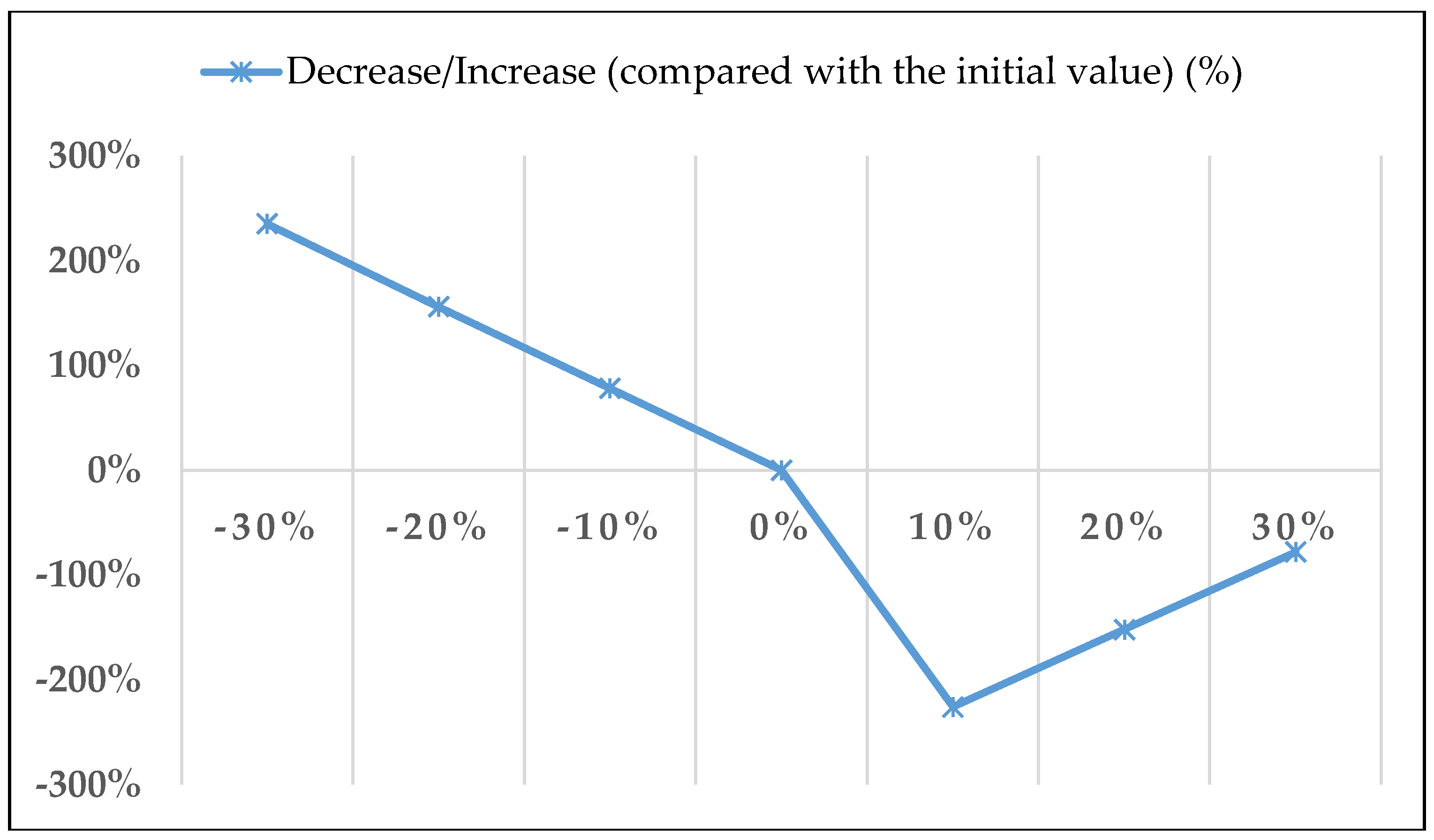

4.2 Sensitivity Analysis

5. Shop Floor Control under Industry 4.0 in the Tire Industry

- (1)

- Status Monitoring: Analysis of huge data sets (Big Data) could allow quick and accurate decision-making. For example, productivity improvements can be achieved by analyzing device performance and degradation for real-time feedback on configuration and optimization. Herman et al. [2] proposed a cloud-based IoT application architecture that will improve the deployment of intelligent industrial systems for remote monitoring and scrolling. Additionally, this can generate huge amounts of data during operation time due to the potential presence of hundreds or even thousands of sensors, considered as Big Data [83]. While cloud computing employed in industrial environments can bring benefits, it also poses challenges for the storage of Big Data, which describes cloud computing as a cloud-manufacturing counterpart to industrial environments [84], with the focus on increasing agility in the industrial environment and enabling the supply chain to capture the largest data sets [16,85,86].

- (2)

- Work-in-process tracking: With the development of ERP, more and more manufacturing enterprises are interested in the integration of ERP and MES systems [87,88]. The MES system architecture is designed for short-term production support. Simulation testing can be used to support the decision-making process; the real-time dynamics of MES and WIP can be performed more accurately [89]; RFID and wireless information networks can capture real-time field data from manufacturing plants to monitor and reduce WIP inventory [90,91]. The correct use of materials according to the actual needs can reduce the investment in production material and the integration of ERP and MES can achieve the purpose of sharing resource and integrating the related information in management decision-making. MES uses RFID technology to improve the efficiency of data collection [92,93]. Another data collection approaches under Industry 4.0 were proposed such as the multi-mode data acquisition method [94] and the Sophos-MS’s practical solution design and development [95].

- (3)

- Throughput tracking: We can track the tire manufacturing process-related information; however, in order to understand whether the production quantity of tire manufacturing can be completed as scheduled, we can integrate ERP with the MES to truly track the progress of tire production; we can also immediately review the reasons for handling backward production and then find the possible solutions [96,97].

- (4)

- Capacity feedback: In the Industry 4.0 environment, the right application of big data management is one of the most important factors. The “Product Planning Software” concept and structure is a new process planning, operation sequencing and scheduling method, as presented by [97]. In order to track the utilization of capacity, sensors are added to each machine to track its utilization. By knowing the utilization of capacity, the tire manufacturing process can be controlled without increasing idle costs or inventory costs. In addition, bottleneck detection with the sensors systems and IoT in production can improve production efficiency and stability in order to increase capacity utilization [98,99]. This capacity utilization tracking can assist in the application of Theory of Constraints in the production planning stage.

- (5)

- Quality control: The MES and ERP systems collect information for production process control through automated equipment and the management software system mode of operation, tire quality is detected [100]. The production control system of smart manufacturing under Industry 4.0 should be able to real-timely respond to various production problems and to effectively coordinate different resources of different departments to solve the problems encountered [96]. Beyond this, Industry 4.0 can focus on predictive maintenance for machines before the production problems occur through the big data analyses of troubling sounds or images [101,102,103]. Besides, Rødseth et al. [104] developed an integrated planning (IPL) approach which simultaneously executed production and maintenance planning in production scheduling.

- (6)

- Real-time interconnection: Delima and Balaunzarán [105] claim that smart manufacturing under Industry 4.0 has four characteristics: (1) self-awareness of current state of the production process, (2) real-time predictive capabilities for possible production problems arise such as products’ bad quality and machine breakdown, (3) a high level of real-time automation of activities across the production process, (4) real-time interconnection. The characteristic of real-time interconnection is to connect all the system components of machines, equipment, persons, materials and products at the factory level through Cyber-Physical Systems (CPS) [106,107] and Industrial Internet of Things (IIoT) [108,109,110,111,112]. It also can connect with suppliers and customers at the external supply chain level [105,106]. Under these circumstances, companies can do the works from product development to after-sale services with more efficiency, lower cost, lower carbon emission and higher quality [113].

6. Discussion

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lasi, H.; Fettke, P.; Kemper, H.G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design principles for Industrie 4.0 scenarios: A literature review. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences, Koloa, HI, USA, 5–8 January 2016; pp. 3928–3939. [Google Scholar]

- Schaltegger, S.; Synnestvedt, T. The link between ‘green’ and economic success: Environmental management as the crucial trigger between environmental and economic performance. J. Environ. Manag. 2002, 65, 339–346. [Google Scholar]

- Menoni, M.; Morgavi, H. Is eco-efficiency enough for sustainability? Int. J. Perform. Eng. 2014, 10, 337–346. [Google Scholar]

- Yahya-Zadeh, M. Product-mix decisions under activity-based costing with resource constraints and non-proportional activity costs. J. Appl. Bus. Res. 1998, 14, 39–46. [Google Scholar] [CrossRef]

- Lockhart, J.; Taylor, A. Environmental Considerations in Product Mix Decisions Using ABC and TOC. Manag. Account. Q. 2007, 9, 13–31. [Google Scholar]

- Onwubolu, G.C.; Mutingi, M. Optimizing the multiple constrained resources product mix problem using genetic algorithms. Int. J. Prod. Res. 2001, 39, 1897–1910. [Google Scholar] [CrossRef]

- Kletti, J. Manufacturing Execution System—MES; Springer: Berlin, Germany, 2007. [Google Scholar]

- De Ugarte, B.S.; Artiba, A.; Pellerin, R. Manufacturing execution system—A literature review. Prod. Plan. Control 2009, 20, 525–539. [Google Scholar] [CrossRef]

- Almada-Lobo, F. The Industry 4.0 revolution and the future of manufacturing execution systems (MES). J. Innov. Manag. 2016, 3, 16–21. [Google Scholar]

- Timo, I.F.; Mónica, R.L.; Christian, B.; Friedrich, M.; Bernd, K.; Urlich, B.; Waldemar, S. Agent-based communication to map and exchange shop floor data between MES and material flow simulation based on the open standard CMSD. IFAC-PapersOnLine 2016, 49, 1526–1531. [Google Scholar] [CrossRef]

- Liu, W.; Chua, T.J.; Larn, J.; Wang, F.-Y.; Yin, X. APS, ERP and MES systems integration for semiconductor backend assembly. In Proceedings of the 7th International Conference on Control, Automation, Robotics and Vision, Singapore, 2–5 December 2002; pp. 1403–1408. [Google Scholar]

- Lee, J.; Kao, H.-A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Zhang, D.; Li, D.; Zhang, C. Towards smart factory for industry 4.0: A self-organized multi-agent system with big data based feedback and coordination. Comput. Netw. 2016, 101, 158–168. [Google Scholar] [CrossRef]

- Krzysztof, W. Internet of Things, Big Data, Industry 4.0—Innovative Solutions in Logistics and Supply Chains Management. Procedia Eng. 2017, 182, 763–769. [Google Scholar]

- Xu, X. From cloud computing to cloud manufacturing. Robot. Comput.-Integr. Manuf. 2012, 28, 75–86. [Google Scholar] [CrossRef]

- Bechtsis, D.; Tsolakis, N.; Vouzas, M.; Vlachos, D. Industry 4.0: Sustainable material handling processes in industrial environments. Comput. Aided Chem. Eng. 2017, 40, 2281–2286. [Google Scholar]

- Wan, J.; Tang, S.; Hua, Q.; Li, D.; Liu, C.; Lloret, J. Context-aware cloud robotics for material handling in cognitive industrial internet of things. IEEE Internet Things J. 2018, 5, 2272–2281. [Google Scholar] [CrossRef]

- .Jazdi, N. Cyber physical systems in the context of Industry 4.0. In Proceedings of the 2014 IEEE International Conference on Automation, Quality and Testing, Robotics, Cluj-Napoca, Romania, 22–24 May 2014; pp. 1–4. [Google Scholar]

- Lee, J.; Bagheri, B.; Kao, H.-A. A cyber-physical systems architecture for industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Wan, J.; Tang, S.; Shu, Z.; Li, D.; Wang, S.; Imran, M.; Vasilakos, A.V. Software-Defined Industrial Internet of Things in the Context of Industry 4.0. IEEE Sens. J. 2016, 16, 7373–7380. [Google Scholar] [CrossRef]

- Dujin, A.; Blanchet, M.; Rinn, T.; Von Thaden, G.; De Thieullo, G. Industry 4.0—The New Industrial Revolution: How Europe Will Succeed; Roland Berger Strategy Consultants: Munich, Germany, 2014. [Google Scholar]

- Kiel, D.; Müller, J.M.; Arnold, C.; Voigt, K.I. Sustainable Industrial Value Creation: Benefits and Challenges of Industry 4.0. Int. J. Innov. Manag. 2017, 21. [Google Scholar] [CrossRef]

- Müller, J.M.; Kiel, D.; Voigt, K.I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Stock, T.; Seliger, G. Opportunities of sustainable manufacturing in industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef]

- Biljana, L.R.S.; Kire, V.T. A review of Internet of Things for smart home: Challenges and solutions. J. Clean. Prod. 2017, 140, 1454–1464. [Google Scholar]

- Berawi, M.A. Utilizing big data in industry 4.0: Managing competitive advantages and business ethics. Int. J. Technol. 2018, 9, 430–433. [Google Scholar] [CrossRef]

- Hendrik, U.; FrankBörner, E. Context Related Information Provision in Industry 4.0 Environments. Procedia Manuf. 2017, 11, 796–805. [Google Scholar]

- Kong, G.; White, R. Toward cleaner production of hot dip galvanizing industry in China. J. Clean. Prod. 2010, 18, 1092–1099. [Google Scholar] [CrossRef]

- Puurunen, K.; Vasara, P. Opportunities for utillising nanotechnology in reaching near-zero emissions in the paper industry. J. Clean. Prod. 2007, 15, 1287–1294. [Google Scholar] [CrossRef]

- Tsai, W.H.; Chen, H.C.; Liu, J.Y.; Chen, S.P.; Shen, Y.S. Using activity-based costing to evaluate capital investments for green manufacturing technologies. Int. J. Prod. Res. 2011, 49, 7275–7292. [Google Scholar] [CrossRef]

- European Environment Agency. Environmental Taxes, Implementation and Environmental Effectiveness; European Environment Agency: Copenhagen, Denmark, 1996. [Google Scholar]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emission. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Kunsch, P.; Springael, J. Simulation with system dynamics and fuzzy reasoning of a tax policy to reduce CO2 emission in the residential sector. Eur. J. Oper. Res. 2008, 185, 1285–1299. [Google Scholar] [CrossRef]

- Liao, Y.; Deschamps, F.; Loures, E.D.F.R.; Ramos, L.F.P. Past, present and future of Industry 4.0-a systematic literature review and research agenda proposal. Int. J. Prod. Res. 2017, 55, 3609–3629. [Google Scholar] [CrossRef]

- Conegrey, T.; Gerald, J.D.F.; Valeri, L.M.; Tol, R.S.J. The impact of a carbon tax on economic growth and carbon dioxide emission in Ireland. J. Environ. Plan. Manag. 2013, 56, 934–952. [Google Scholar] [CrossRef]

- Gianluca, D.; Joel, S.B.; Paolo, C. A Novel Methodology to Integrate Manufacturing Execution Systems with the Lean Manufacturing Approach. Procedia Manuf. 2017, 11, 2243–2251. [Google Scholar]

- Beier, G.; Niehoff, S.; Ziems, T.; Xue, B. Sustainability aspects of a digitalized industry—A comparative study from China and Germany. Int. J. Precis. Eng. Manuf.-Green Technol. 2017, 4, 227–234. [Google Scholar] [CrossRef]

- Giti Tire. The Tire Production Process is a Very Meticulous and Complex. Available online: http://www.corp.giti.com/images/newsdetailattach_20128194115667.pdf (accessed on 18 August 2018).

- Maribel, Y.S.; Jorge, O.E.S.; Carina, A.; Francisca, V.L.; Eduarda, C.; Carlos, C.; Bruno, M.; João, G. A Big Data system supporting Bosch Braga Industry 4.0 strategy. Int. J. Inf. Manag. 2017, 37, 750–760. [Google Scholar]

- Dekker, R.; Bloembof, J.; Mallidis, I. Operations research for greenlogistics—An overview of aspects, issues, contributions and challenges. Eur. J. Oper. Res. 2012, 219, 671–679. [Google Scholar] [CrossRef]

- Liu, C.; Jiang, P. A Cyber-physical System Architecture in Shop Floor for Intelligent Manufacturing. Procedia CIRP 2016, 56, 372–377. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Sustainable industry 4.0 framework: A systematic literature review identifying the current trends and future perspectives. Process Saf. Environ. Prot. 2018, 117, 408–425. [Google Scholar] [CrossRef]

- Basiago, A.D. Economic, social and environmental sustainability in development theory and urban planning practice. Environmentalist 1999, 19, 145–161. [Google Scholar] [CrossRef]

- Stock, T.; Obenaus, M.; Kunz, S.; Kohl, H. Industry 4.0 as enabler for a sustainable development: A qualitative assessment of its ecological and social potential. Process Saf. Environ. Prot. 2018, 118, 254–267. [Google Scholar] [CrossRef]

- Carvalho, N.; Chaim, O.; Cazarini, E.; Gerolamo, M. Manufacturing in the fourth industrial revolution: A positive prospect in sustainable manufacturing. Procedia Manuf. 2018, 21, 671–678. [Google Scholar] [CrossRef]

- Blunck, E.; Werthmann, H. Industry 4.0—An opportunity to realize sustainable manufacturing and its potential for a circular economy. In Proceedings of the DIEM: Dubrovnik International Economic Meeting, Dubrovnik, Croatia, 12–14 October 2017; Available online: https://hrcak.srce.hr/187419 (accessed on 23 August 2018).

- De Man, J.C.; Strandhagen, J.O. An Industry 4.0 research agenda for sustainable business models. Procedia CIRP 2017, 63, 721–726. [Google Scholar] [CrossRef]

- De Sousa Jabbour, A.B.L.; Jabbour, C.J.C.; Foropon, C.; Filho, M.G. When titans meet—Can industry 4.0 revolutionise the environmentally-sustainable manufacturing wave? the role of critical success factors. Technol. Forecast. Soc. Chang. 2018, 132, 18–25. [Google Scholar] [CrossRef]

- Waibel, M.W.; Steenkamp, L.P.; Moloko, N.; Oosthuizen, G.A. Investigating the effects of Smart Production Systems on sustainability elements. Procedia Manuf. 2017, 8, 731–737. [Google Scholar] [CrossRef]

- Ding, B. Pharma industry 4.0: Literature review and research opportunities in sustainable pharmaceutical supply chains. Process Saf. Environ. Prot. 2018, 119, 115–130. [Google Scholar] [CrossRef]

- Luthra, S.; Mangla, S.K. Evaluating challenges to industry 4.0 initiatives for supply chain sustainability in emerging economies. Process Saf. Environ. Prot. 2018, 117, 168–179. [Google Scholar] [CrossRef]

- Plenert, G. Optimizing theory of constraints when multiple constrained resources exist. Eur. J. Oper. Res. 1993, 70, 126–133. [Google Scholar] [CrossRef]

- Tsai, W.H.; Kuo, L. Operating Costs and Capacity in the Airline Industry. J. Air Transp. Manag. 2004, 10, 269–275. [Google Scholar] [CrossRef]

- Tsai, W.H. Quality cost measurement under activity-based costing. Int. J. Q. Reliab. Manag. 1998, 15, 719–752. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lai, C.W.; Tseng, L.J.; Chou, W.C. Embedding Management Discretionary Power into An ABC Model for A Joint Products Mix Decision. Int. J. Prod. Econ. 2008, 115, 210–220. [Google Scholar] [CrossRef]

- Tsai, W.H.; Kuo, L.; Lin, T.W.; Kuo, Y.C.; Shen, Y.S. Price elasticity of demand and capacity expansion features in an enhanced ABC product-mix Decision Model. Int. J. Prod. Res. 2010, 48, 6387–6416. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, W.R.; Fan, Y.W.; Lee, P.L.; Lin, S.J.; Hsu, J.L. Applying A Mathematical Programming Approach for A Green Product Mix Decision. Int. J. Prod. Res. 2012, 50, 1171–1184. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Liu, J.Y.; Lin, W.R.; Lee, K.C. Incorporating life cycle assessments into building project decision-making: An energy consumption and CO2 emission perspective. Energy 2011, 36, 3022–3029. [Google Scholar] [CrossRef]

- Tsai, W.H.; Shen, Y.S.; Lee, P.L.; Chen, H.C.; Kuo, L.; Huang, C.C. Integrating information about the cost of carbon through activity-based costing. J. Clean. Prod. 2012, 36, 102–111. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Lee, Y.F.; Chang, Y.C.; Hsu, J.L. Construction method selection for green building projects to improve environmental sustainability by using an MCDM approach. J. Environ. Plan. Manag. 2013, 56, 1487–1510. [Google Scholar] [CrossRef]

- Tsai, W.H.; Yang, C.H.; Huang, C.T.; Wu, Y.Y. The Impact of the Carbon Tax Policy on Green Building Strategy. J. Environ. Plan. Manag. 2017, 60, 1412–1438. [Google Scholar] [CrossRef]

- Tsai, W.H.; Hung, S.J. A fuzzy goal programming approach for green supply chain optimisation under activity-based costing and performance evaluation with a value-chain structure. Int. J. Prod. Res. 2009, 47, 4991–5017. [Google Scholar] [CrossRef]

- Tsai, W.H.; Hung, S.J. Treatment and recycling system optimisation with activity based costing in WEEE reverse logistics management: An environmental supply chain perspective. Int. J. Prod. Res. 2009, 47, 5391–5420. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lai, C.W. Outsourcing or capacity expansions: Application of activity based costing model on joint product decisions. Comput. Oper. Res. 2007, 34, 3666–3681. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lee, K.C.; Lin, H.L.; Liu, J.Y.; Chou, Y.W.; Lin, S.J. A mixed activity based costing decision model for green airline fleet planning under the constraints of the European Union Emissions Trading Scheme. Energy 2012, 39, 218–226. [Google Scholar] [CrossRef]

- Kaplan, R.S. Management accounting for advanced technological environments. Science 1989, 245, 819–823. [Google Scholar] [CrossRef] [PubMed]

- Patterson, M.C. The product-mix decision: A comparison of theory of constraints and labor-based management accounting. Prod. Invent. Manag. J. 1992, 33, 80–85. [Google Scholar]

- Kaplan, R.S.; Cooper, R. Cost & Effect: Using Integrated Cost Systems to Drive Profitability and Performance; Harvard Business School Press: Boston, MA, USA, 1998. [Google Scholar]

- Srinivassan, A.; Carey, M.; Morton, T. Resource Pricing and Aggregate Scheduling in Manufacturing Systems; Graduate School of Industrial Administration, Carnegie-Mellon University: Pittsburgh, PA, USA, 1988. [Google Scholar]

- Karmarkar, U. Capacity loading and release planning with work-in-process and lead times. J. Manuf. Oper. Manag. 1989, 2, 105–123. [Google Scholar]

- Chu, S.C.K. Optimal master production scheduling in a flexible manufacturing system: The case of total aggregation. In Proceedings of the First Conference on the Operational Research Society of Hong Kong, Hong Kong, China, 21–22 June 1991; pp. 103–108. [Google Scholar]

- Asmundsson, J.; Rardin, R.; Turkseven, C.; Uzsoy, R. Production Planning with Resources Subject to Congestion. Nav. Res. Logist. 2009, 56, 142–157. [Google Scholar] [CrossRef]

- Kefeli, A.; Uzsoy, R.; Fathi, Y.; Kay, M. Using a mathematical programming model to examine the marginal price of capacity resources. Int. J. Prod. Econ. 2011, 131, 383–391. [Google Scholar] [CrossRef]

- Kacar, N.B.; Uzsoy, R. Estimating clearing functions for production resources using simulation optimization. IEEE Trans. Autom. Sci. Eng. 2015, 12, 539–552. [Google Scholar] [CrossRef]

- Beale, E.M.L.; Tomlin, J.A. Special facilities in a general mathematical programming system for non-convex problems using ordered sets of variables. Oper. Res. 1969, 69, 447–454. [Google Scholar]

- Williams, H.P. Model Building in Mathematical Programming, 2nd ed.; Wiley: New York, NY, USA, 1985; pp. 173–177. [Google Scholar]

- Wang, B.; Liu, B.; Niu, H.; Liu, J.; Yao, S. Impact of energy taxation on economy, environmental and public health quality. J. Environ. Manag. 2017, 206, 85–92. [Google Scholar] [CrossRef] [PubMed]

- Igor, L.W.; George, V.B.; Jose, L.D.M.; Ofelia, D.Q.F.A. Carbon dioxide utilization in a microalga-based biorefinery: Efficiency of carbon removal and economic performance under carbon taxation. J. Environ. Manag. 2017, 203, 988–998. [Google Scholar]

- Ward, S.C.; Chapman, C.B. Risk-management perspective on the project lifecycle. Int. J. Proj. Manag. 1995, 13, 145–149. [Google Scholar] [CrossRef]

- Zhong, R.Y. Analysis of RFID datasets for smart manufacturing shop floors. In Proceedings of the 15th IEEE International Conference on Networking, Sensing and Control, ICNSC 2018, Zhuhai, China, 27–29 March 2018. [Google Scholar]

- Gontarz, A.; Hampl, D.; Weiss, L.; Wegener, K. Resource Consumption Monitoring in Manufacturing Environments. CIRP Ann.-Manuf. Technol. 2015, 26, 264–269. [Google Scholar] [CrossRef]

- Manyika, J.; Chui, M.; Brown, B.; Bughin, J.; Dobbs, R.; Roxburgh, C.; Byers, A.H. Big Data: The Next Frontier for Innovation, Competition and Productivity. McKinsey Global Institute Report. 2011. Available online: https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/big-data-the-next-frontier-for-innovation (accessed on 18 August 2018).

- Zhong, R.Y.; Wang, L.; Xu, X. An IoT-enabled real-time machine status monitoring approach for cloud manufacturing. Procedia CIRP 2017, 63, 709–714. [Google Scholar] [CrossRef]

- Da Silva, P.R.S.; Amaral, F.G. An integrated methodology for environmental impacts and costs evaluation in industrial processes. J. Clean. Prod. 2009, 17, 1339–1350. [Google Scholar] [CrossRef]

- Jestratjew, A.; Kwiecień, A. Using Cloud Storage in Production Monitoring Systems. In Communications in Computer and Information Science; Kwiecień, A., Gaj, P., Stera, P., Eds.; CN 2010: Computer Networks; Springer: Berlin/Heidelberg, Germany, 2010; pp. 226–235. [Google Scholar]

- Ahmed, E.; Moutaz, H. The Future of ERP Systems: Look backward before moving forward. Procedia Technol. 2012, 5, 21–30. [Google Scholar]

- Telukdarie, A. MES to ERP integration: Rapid deployment toolset. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management, Bali, Indonesia, 4–7 December 2016; pp. 1030–1035. [Google Scholar]

- Rafal, C.; Adam, Z.; Lukasz, H.; Huseyin, E. Agent-based manufacturing execution systems for short-series production scheduling. Comput. Ind. 2016, 82, 245–258. [Google Scholar]

- Zhong, R.Y.; Dai, Q.Y.; Qu, T.; Hu, G.J.; Huang, G.Q. RFID-enabled real-time manufacturing execution system for mass-customization production. Robot. Comput.-Integr. Manuf. 2013, 29, 283–292. [Google Scholar] [CrossRef]

- Huang, G.Q.; Zhang, Y.F.; Jiang, P.Y. RFID-based wireless manufacturing for walking-worker assembly islands with fixed-position layouts. Robot. Comput.-Integr. Manuf. 2007, 23, 469–477. [Google Scholar] [CrossRef]

- Zhixin, Y.; Pengbo, Z.; Lei, C. RFID-enabled indoor positioning method for a real-time manufacturing execution system using OS-ELM. Neurocomputing 2016, 174, 121–133. [Google Scholar]

- Wang, C.; Jiang, P.; Lu, T. Production events graphical deduction model enabled real-time production control system for smart job shop. Proc. Inst. Mech. Eng. Part C 2018, 232, 2803–2820. [Google Scholar] [CrossRef]

- Uhlemann, T.H.J.; Lehmann, C.; Steinhilper, R. The Digital Twin: Realizing the Cyber-Physical Production System for Industry 4.0. Procedia CIRP 2017, 61, 335–340. [Google Scholar] [CrossRef]

- Longo, F.; Nicoletti, L.; Padovano, A. Smart operators in industry 4.0: A human-centered approach to enhance operators’ capabilities and competencies within the new smart factory context. Comput. Ind. Eng. 2017, 113, 144–159. [Google Scholar] [CrossRef]

- Bauza, M.B.; Tenboer, J.; Li, M.; Lisovich, A.; Zhou, J.; Pratt, D.; Ewards, J.; Zhang, H.; Turch, C.; Knebel, R. Realization of industry 4.0 with high speed CT in high volume production. CIRP J. Manuf. Sci. Technol. 2018, 22, 121–125. [Google Scholar] [CrossRef]

- Trstenjak, M.; Cosic, P. Process Planning in Industry 4.0 Environment. Procedia Manuf. 2017, 11, 1744–1750. [Google Scholar] [CrossRef]

- Roser, C.; Lorentzen, K.; Deuse, J. Reliable shop floor Bottleneck detection for flow lines through process and inventory observations. Procedia CIRP 2014, 19, 63–68. [Google Scholar] [CrossRef]

- Jia, Z.; Zhang, L.; Arinez, J.; Xiao, G. Performance analysis for serial production lines with Bernoulli Machines and Real-time WIP-based Machine switch-on/off control. Int. J. Prod. Res. 2016, 54, 6285–6301. [Google Scholar] [CrossRef]

- Teittinen, H.; Pellinen, J.; Järvenpää, M. ERP in action—Challenges and benefits for management control in SME context. Int. J. Account. Inf. Syst. 2013, 14, 278–296. [Google Scholar] [CrossRef]

- Peres, R.S.; Dionisio Rocha, A.; Leitao, P.; Barata, J. IDARTS—Towards intelligent data analysis and real-time supervision for industry 4.0. Comput. Ind. 2018, 101, 138–146. [Google Scholar] [CrossRef]

- Yan, J.; Meng, Y.; Lu, L.; Li, L. Industrial big data in an Industry 4.0 environment: Challenges, schemes and applications for predictive maintenance. IEEE Access 2017, 5, 23484–23491. [Google Scholar] [CrossRef]

- Kiangala, K.S.; Wang, Z. Initiating predictive maintenance for a conveyor motor in a bottling plant using industry 4.0 concepts. Int. J. Adv. Manuf. Technol. 2018, 97, 3251–3271. [Google Scholar] [CrossRef]

- Rødseth, H.; Schjølberg, P.; Wabner, M.; Frieß, U. Predictive Maintenance for Synchronizing Maintenance Planning with Production. Lect. Notes Electr. Eng. 2018, 451, 439–446. [Google Scholar]

- Delima, A.; Balaunzarán, M. Industry 4.0: The Fourth Industrial Revolution. 10 April 2018. Available online: http://insights.neoris.com/blogneoris/industry-4.0 (accessed on 20 August 2018).

- Sokolov, B.; Ivanov, D. Integrated scheduling of material flows and information services in industry 4.0 supply networks. IFAC-PapersOnLine 2015, 28, 1533–1538. [Google Scholar] [CrossRef]

- Bagheri, B.; Yang, S.; Kao, H.-A.; Lee, J. Cyber-physical systems architecture for self-aware machines in industry 4.0 environment. IFAC-PapersOnLine 2015, 28, 1622–1627. [Google Scholar] [CrossRef]

- Faul, A.; Jazdi, N.; Weyrich, M. Approach to interconnect existing industrial automation systems with the industrial internet. In Proceedings of the 2016 IEEE 21st International Conference on Emerging Technologies and Factory Automation (ETFA), Berlin, Germany, 6–9 September 2016. [Google Scholar]

- Jun, C.; Lee, J.Y.; Yoon, J.-S.; Kim, B.H. Applications’ integration and operation platform to support smart manufacturing by small and medium-sized enterprises. Procedia Manuf. 2017, 11, 1950–1957. [Google Scholar] [CrossRef]

- Åkerman, M.; Fast-Berglund, Å.; Halvordsson, E.; Stahre, J. Modularized assembly system: A digital innovation hub for the Swedish smart industry. Manuf. Lett. 2018, 15, 143–146. [Google Scholar] [CrossRef]

- Weber, K.M.; Gudowsky, N.; Aichholzer, G. Foresight and Technology Assessment for the Austrian Parliament—Finding New Ways of Debating the Future of Industry 4.0. Futures 2018. Available online: https://www.terkko.helsinki.fi/article/19090791_foresight-and-technology-assessment-for-the-austrian-parliament-finding-new-ways-of-debating-the-future-of-industry-40 (accessed on 20 August 2018). [CrossRef]

- Gravina, R.; Palau, C.E.; Manso, M.; Liotta, A.; Fortino, G. Integration, Interconnection and Interoperability of IoT Systems; Springer: Berlin, Germany, 2018. [Google Scholar]

- Mourtzis, D.; Fotia, S.; Boli, N.; Pittaro, P. Product-service system (PSS) complexity metrics within mass customization and Industry 4.0 environment. Int. J. Adv. Manuf. Technol. 2018, 97, 91–103. [Google Scholar] [CrossRef]

- Dalenogarea, L.S.; Beniteza, G.B.; Ayalab, N.F.; Frank, A.G. The expected contribution of Industry 4.0 technologies for industrial performance. Int. J. Prod. Econ. 2018, 204, 383–394. [Google Scholar] [CrossRef]

- Almada-Lobo, F. Six Benefits of Industrie 4.0 for Businesses. Control Engineering. 25 May 2017. Available online: https://www.controleng.com/single-article/six-benefits-of-industrie-40-for-businesses/5c57cc3925c0ff323553da64108d5c0c (accessed on 4 September 2018).

- Moktadir, M.A.; Ali, S.M.; Kusi-Sarpong, S.; Shaikh, M.A.A. Assessing challenges for implementing Industry 4.0: Implications for process safety and environmental protection. Process Saf. Environ. Prot. 2018, 117, 730–741. [Google Scholar] [CrossRef]

- Tsai, W.-H. Green production planning and control for the textile industry by using mathematical programming and Industry 4.0 techniques. Energies 2018, 11, 2072. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lai, S.-Y. Green Production Planning and Control Model with ABC under Industry 4.0 for the Paper Industry. Sustainability 2018, 10, 2932. [Google Scholar] [CrossRef]

| Product | PCR (i = 1) | TBR (i = 2) | MC (i = 3) | Available Capacity (thousand) | ||||

|---|---|---|---|---|---|---|---|---|

| Maximum demand: (thousand) | j | Qi | 1000 | 100 | 1500 | |||

| Selling price: (USD) | Si | 300 | 1000 | 150 | ||||

| Direct material: | k = 1 | 20 | 4 | 6 | 2 | W1 = 10,500 | ||

| (USD/ton) | k = 2 | 10 | 2 | 10 | 1 | W2 = 8000 | ||

| k = 3 k = 4 k = 5 | 5 37 21 | 5 2 2 | 15 6 15 | 2 1 1 | W3 = 8600 W4 = 7000 W5 = 7800 | |||

| Machine hour constraint: | ||||||||

| Kneading Pressing out Cutting off Forming Vulcanizing Inspecting | Machine hours Machine hoursMachine hours Machine hours Machine hours Machine hours | 1 2 3 4 5 6 | 5 2 2 3 2 3 | 10 4 3 5 3 6 | 1 1 1 1 1 1 | MH1 = 13,200 MH2 = 22,000 MH3 = 22,000 MH4 = 26,400 MH5 = 13,200 MH6 = 6600 | ||

| Material handling constraint: | ||||||||

| Machine hours (hr) Cost (USD) | q1 = 50; q2 = 150; q3 = 10 | 7 | 2 5 | 3 10 | 1 1 | MH7 = 1760 | ||

| Direct labor constraint: | ||||||||

| Cost: Labor hours (hr) | LC0 = 7040 LH0 = 1760 | LC1 = 11,000 LH1 = 2200 | LC2 = 15,840 LH2 = 2640 | 1 | 1.5 | 0.5 | ||

| Wage rate (USD/hr) | r0 = 4 | r1 = 9 | r2 = 11 | |||||

| Carbon emission constraint: | ||||||||

| Cost (USD) Emission quantities | CEC1 = 7000 CE1 = 700 | CEC2 = 10,000 CE2 = 850 | CEC3 = 13,000 CE3 = 950 | 0.2 | 0.1 | 0.1 | ||

| Tax rate (USD/ton) | T1 = 10 | T2 = 20 | T3 = 30 | |||||

| Total fixed cost: (USD) | 20,000 | |||||||

| =1,020,000 | =60,000 | =1,300,000 | |||

| =1 | =0 | =0 | |||

| =204,000 | =6000 | =1,300,000 | |||

| =0.49 | =0 | =0 | |||

| =0.51 | =1 | =0 | |||

| =1 | =0 | =0 | |||

| Machine hours | Direct material quantity | Direct labor hour = 1,760,000 | |||

| 1 | 7,000,000 | 1 | 7,040,000 | Carbon emission quantity = 340,000 | |

| 2 | 3,580,000 | 2 | 3,940,000 | Carbon tax = $3,400,000 (USD) | |

| 3 | 3,520,000 | 3 | 8,600,000 | Total profit π = $57,320,000 (USD) | |

| 4 | 4,660,000 | 4 | 3,700,000 | ||

| 5 | 3,520,000 | 5 | 4,240,000 | ||

| 6 | 4,720,000 | ||||

| 7 | 1,726,000 | ||||

| Direct Material and Carbon Cost Decrease/Increase Ratio (%) | Original Profit (A) | Profit after Change (B) | Decrease/Increase Profit (C) = (B − A) | Decrease/Increase (Compared with the Initial Value) (%) (D = C/A) |

|---|---|---|---|---|

| −30% | 57,320 | 192,062 | 134,742 | 235% |

| −20% | 57,320 | 147,148 | 89,828 | 156% |

| −10% | 57,320 | 102,234 | 44,914 | 78% |

| −0% | 57,320 | 57,320 | 0 | 0% |

| 30% | 57,320 | −72,268 | −129,588 | −226% |

| 20% | 57,320 | −29,952 | −87,272 | −152% |

| 10% | 57,320 | 12,406 | −44,914 | −78% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H.; Lu, Y.-H. A Framework of Production Planning and Control with Carbon Tax under Industry 4.0. Sustainability 2018, 10, 3221. https://doi.org/10.3390/su10093221

Tsai W-H, Lu Y-H. A Framework of Production Planning and Control with Carbon Tax under Industry 4.0. Sustainability. 2018; 10(9):3221. https://doi.org/10.3390/su10093221

Chicago/Turabian StyleTsai, Wen-Hsien, and Yin-Hwa Lu. 2018. "A Framework of Production Planning and Control with Carbon Tax under Industry 4.0" Sustainability 10, no. 9: 3221. https://doi.org/10.3390/su10093221