The Impact of Population Migration on Urban Housing Prices: Evidence from China’s Major Cities

Abstract

:1. Introduction

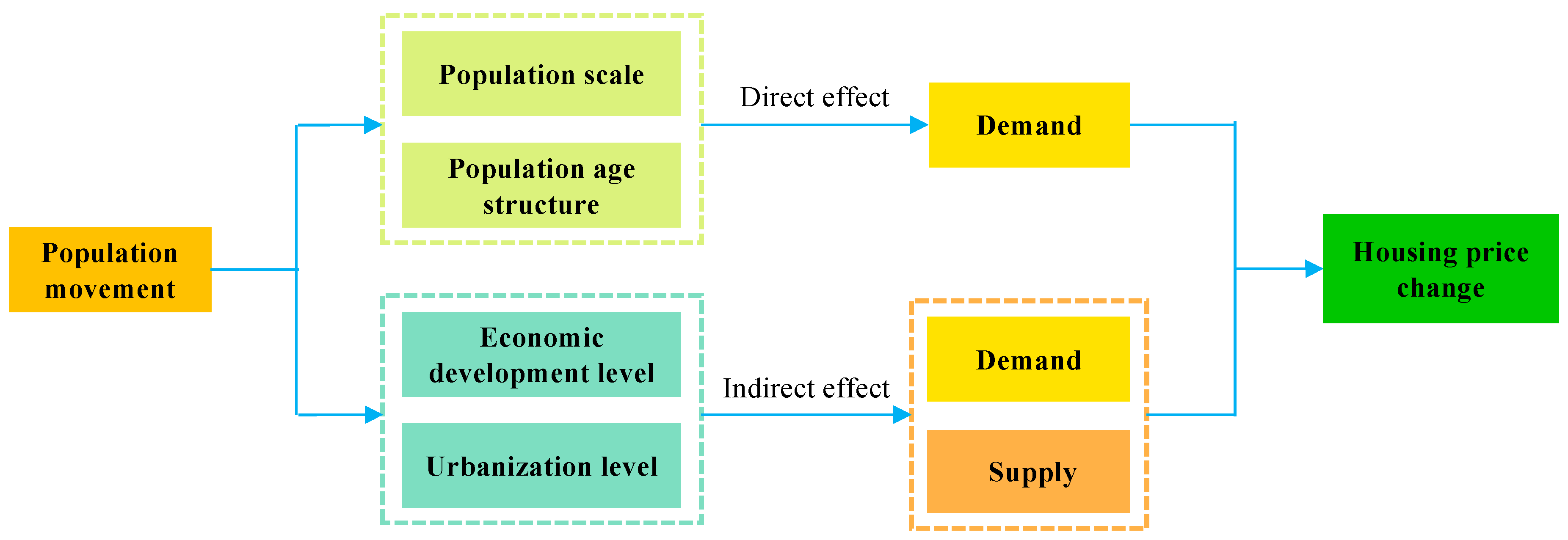

2. Theoretical Analysis of the Effect of Population Migration on Housing Prices

2.1. Direct Effect of Population Migration on Housing Prices

2.2. Indirect Effect of Population Migration on Housing Prices

3. Methodology and Data Sources

3.1. Panel Data Model

3.2. Variable Collection

3.3. Data Source and Processing

3.4. Model Specification

4. Results

5. Discussion

5.1. National Level: Population Migration Was Significantly Positively Correlated with Urban Housing Prices

5.2. Eastern Cities: Migrant Population Significantly Boosted Urban Housing Prices

5.3. Central and Western Cities: Population Migration Had No Significant Impact on House Prices

6. Conclusions and Policy Implications

- (1)

- The impact of population migration on urban housing prices, whether due to direct or indirect effects, ultimately leads to an imbalance in supply and demand in the real-estate market, further affecting housing price volatility. The imbalance between supply and demand in the real-estate market is reflected in both housing and construction land. In view of the imbalance between the supply and demand of housing, different levels of residential products should be provided according to the actual situation of the cities into which the population flows, combined with the family and individual characteristics of different groups. At the same time, the urban affordable housing system should be improved with a multi-channel guarantee and multi-subject supply to meet the increasing demand for housing in the migrant population; in view of the imbalance in the supply of construction land, a perfect system of linking land-use plans to population should be established. The annual land use plan of the country should be dynamically adjusted according to the population of each city. For the cities where the population gathers, the construction land index should be increased, and the cities from which the population flows out should reduce their land supply accordingly. Furthermore, under the premise of ensuring the red line of 1.2 million km2 of cultivated land, it is necessary to strengthen rural land remediation, scientifically addressing the problem of ‘occupying land on two sides’ for the agricultural population, and actively exploring the cross-provincial circulation of surplus land use indicators to increase construction land supply for the cities into which the population flows. From the supply side, to address the imbalance between supply and demand in the real-estate market, housing prices should be stabilized to ensure people have their own house to live in.

- (2)

- From the empirical results, it can be seen that economically-developed urban agglomerations and large cities strongly appeal to the migrant population by virtue of their high-quality social public resources and good employment opportunities. Combined with the experience of developed countries, it is an inevitable trend for people to continue to gather in central cities and large cities in the future [73]. Therefore, to address the problem of the insufficient attractiveness of the central and western cities and the ‘urban disease’ problem which exists in megacities, we must follow this trend. As it is ‘better to divert rather than block’, we should build more national central cities, considering the current situation in the central and western region, and take the national central cities as the core for developing urban agglomerations. To build emerging national central cities in the central and western region, we ought to take the development experience of developed cities in the world as a reference, and steadily advance with the current situation. Above all, we should first advocate urban planning, and eliminate the hidden dangers of ‘urban diseases’ in big cities at the source; then, we can combine the economic situation to upgrade the industrial structure, promote economic development, and enhance urban attractiveness. At the same time, we must improve the talent introduction mechanism, give full support to the creativity of high-quality talents, better serve the development of urban construction, and encourage economic development and the continuous inflow of talent to develop a benign interaction.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- National Bureau of Statistics. National Economy and Society Developed Statistical Bulletin 2017. Available online: http://www.stats.gov.cn/tjsj/zxfb/201802/t20180228_1585631.html (accessed on 4 September 2018). (In Chinese)

- National Health and Family Center. Total Migrant Population in 2017. Available online: http://www.chinaldrk.org.cn/wjw/#/home (accessed on 3 September 2018). (In Chinese)

- Gonzalez, L.; Ortega, F. Immigration and Housing Booms: Evidence from Spain. J. Reg. Sci. 2013, 53, 37–59. [Google Scholar] [CrossRef]

- Mussa, A.; Nwaogu, U.G.; Pozo, S. Immigration and housing: A spatial econometric analysis. J. Hous. Econ. 2017, 35, 13–25. [Google Scholar] [CrossRef]

- Zhang, J.; Zhou, L. Incentive mechanism design of access management policy in affordable housing and analysis. CITIES 2011, 28, 186–192. [Google Scholar] [CrossRef]

- Xi, J. Secure a Decisive Victory in Building a Moderately Prosperous Society in All Respects and Strive for the Great Success of Socialism with Chinese Characteristics for a New Era. In Proceedings of the Opening address to the 19th National Congress of the Communist Party of China, Beijing, China, 18 October 2017; Available online: http://www.gov.cn/zhuanti/2017-10/27/content_5234876.htm (accessed on 4 September 2018). (In Chinese).

- Li, K. Report on the Work of the Government 2018. Available online: http://www.gov.cn/zhuanti/2018lh/2018zfgzbg/2018zfbgdzs.htm#book7/page1 (accessed on 4 September 2018).

- Li, J.; Xu, Y. Evaluating restrictive measures containing housing prices in China: A data envelopment analysis approach. Urban Stud. 2016, 53, 2654–2669. [Google Scholar] [CrossRef]

- Shen, Y.; Wang, N.; Zhang, Z. A Theoretical Analysis of Real Estate Investment and Urban Housing Price Dynamics in China; Zhang, S., Feng, Z., Zhao, H., Zhang, H., Eds.; Aussino Academic Publishing House: Marrickville, Australia, 2010; p. 225. [Google Scholar]

- Gholipour, H.F.; Al-mulali, U.; Mohammed, A.H. Foreign investments in real estate, economic growth and property prices: Evidence from OECD countries. J. Econ. Policy Reform 2014, 17, 33–45. [Google Scholar] [CrossRef]

- Wang, S.; Yang, Z.; Liu, H. Impact of urban economic openness on real estate prices: Evidence from thirty-five cities in China. China Econ. Rev. 2011, 22, 42–54. [Google Scholar] [CrossRef]

- Tsai, I. Monetary policy and bubbles in the national and regional UK housing markets. Urban Stud. 2015, 52, 1471–1488. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhao, D.; Sanderford, A.; Du, J. Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities. Sustainability 2018, 10. [Google Scholar] [CrossRef]

- Yu, H.; Huang, Y. Regional heterogeneity and the trans-regional interaction of housing prices and inflation: Evidence from China’s 35 major cities. Urban Stud. 2016, 53, 3472–3492. [Google Scholar] [CrossRef]

- Gong, Y.; Boelhouwer, P.; de Haan, J. Interurban house price gradient: Effect of urban hierarchy distance on house prices. Urban Stud. 2016, 53, 3317–3335. [Google Scholar] [CrossRef]

- Reed, R. The relationship between house prices and demographic variables An Australian case study. Int. J. Hous. Mark. Anal. 2016, 9, 520–537. [Google Scholar] [CrossRef]

- Song, Y. The Impact of Demographic Structure on Housing Prices: Evidence from Macau. In Proceedings of the 2017 International Conference on Economics, Finance and Statistics (ICEFS 2017), Hong Kong, China, 14–15 January 2017; pp. 268–272. [Google Scholar]

- Youn, H. The Effects Regional Characteristics of Housing Environment in Seoul upon Housing Prices. J. Korea Real Estate Anal. Assoc. 2013, 19, 235–253. [Google Scholar]

- Wang, X.; Hui, E.C.; Sun, J. Population migration, urbanization and housing prices: Evidence from the cities in China. Habitat Int. 2017, 66, 49–56. [Google Scholar] [CrossRef]

- Liu, T.Y.; Su, C.W.; Chang, H.L.; Chu, C.C. Is urbanization improving real estate investment? A cross-regional study of China. Rev. Dev. Econ. 2018, 22, 862–878. [Google Scholar] [CrossRef]

- Meijers, E.; Hoekstra, J.; Spaans, M. Fixed link, fixed effects? Housing market outcomes of new infrastructure development in the Dutch Delta Area. Geogr. Tidsskr.-Dan. J. Geogr. 2013, 113, 11–24. [Google Scholar] [CrossRef]

- Irwin, E.G.; Jeanty, P.W.; Partridge, M.D. Amenity Values versus Land Constraints: The Spatial Effects of Natural Landscape Features on Housing Values. Land Econ. 2014, 90, 61–78. [Google Scholar] [CrossRef]

- Tian, G.; Wei, Y.D.; Li, H. Effects of accessibility and environmental health risk on housing prices: A case of Salt Lake County, Utah. Appl. Geogr. 2017, 89, 12–21. [Google Scholar] [CrossRef]

- Trojanek, R.; Tanas, J.; Raslanas, S.; Banaitis, A. The Impact of Aircraft Noise on Housing Prices in Poznan. Sustainability 2017, 9. [Google Scholar] [CrossRef]

- Li, R.Y.M.; Cheng, K.Y.; Shoaib, M. Walled Buildings, Sustainability, and Housing Prices: An Artificial Neural Network Approach. Sustainability 2018, 10. [Google Scholar] [CrossRef]

- Rashid, K.A.; Hasan, S.F. Understanding the Relationship between Construction Costs and Selling Prices with Specific Reference to Housing Projects in the Klang Valley; Soliman, K.S., Ed.; International Business Information Management ASSOC-IBIMA: Norristown, PA, USA, 2015; pp. 3248–3260. [Google Scholar]

- Jayantha, W.M.; Lau, S.S.Y. Causality Relationship between Housing Prices and Construction Costs. Int. J. Urban Sci. 2008, 12, 85–103. [Google Scholar] [CrossRef]

- Ik, K.J. The Comparison of Local Housing Price Determinants by Housing Type. Hous. Stud. 2017, 25, 175–195. [Google Scholar]

- Ma, M.; Cai, W. What drives the carbon mitigation in Chinese commercial building sector? Evidence from decomposing an extended Kaya identity. Sci. Total Environ. 2018, 634, 884–899. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, M.R. A dataset of housing market and self-attitudes towards housing location choices in Alexandria, Egypt. Data Brief 2017, 11, 543–545. [Google Scholar] [CrossRef] [PubMed]

- Zhang, M.; Chen, J. Unequal school enrollment rights, rent yields gap, and increased inequality: The case of Shanghai. China Econ. Rev. 2018, 49, 229–240. [Google Scholar] [CrossRef]

- Nazir, N.N.M.; Othman, N.; Nawawi, A.H. Role of Green Infrastructure in Determining House Value in Labuan Using Hedonic Pricing Model. Procedia Soc. Behav. Sci. 2015, 484–493. [Google Scholar] [CrossRef]

- Hou, Y. Traffic congestion, accessibility to employment, and housing prices: A study of single-family housing market in Los Angeles County. Urban Stud. 2017, 54, 3423–3445. [Google Scholar] [CrossRef]

- Zhang, X.; Liu, X.; Hang, J.; Yao, D.; Shi, G. Do Urban Rail Transit Facilities Affect Housing Prices? Evidence from China. Sustainability 2016, 8. [Google Scholar] [CrossRef]

- Wu, Z.; Li, Y.; Wang, Y. The Analysis of the Microscopic Factors Affecting Urban Commercial Dwelling Prices: Take Guilin City for Example; Wang, Y., Pang, Y., Shen, G., Eds.; China Architecture & Building Press: Beijing, China, 2011; pp. 594–597. [Google Scholar]

- Pijnenburg, K. The spatial dimension of US house prices. Urban Stud. 2017, 54, 466–481. [Google Scholar] [CrossRef]

- Song, S.F. Home buyers’ characteristics and selling prices. Appl. Econ. Lett. 1998, 5, 11–14. [Google Scholar] [CrossRef]

- Ma, M.; Yan, R.; Du, Y.; Ma, X.; Cai, W.; Xu, P. A methodology to assess China’s building energy savings at the national level: An IPAT-LMDI model approach. J. Clean. Prod. 2017, 143, 784–793. [Google Scholar] [CrossRef]

- Rouwendal, J.; Longhi, S. The effect of consumers’ expectations in a booming housing market: Space-time patterns in the Netherlands, 1999–2000. Hous. Stud. 2008, 23, 291–317. [Google Scholar] [CrossRef]

- Shen, A. The Impact of Consumer Expectations on House Prices; Wang, Y.W., Xia, K.W., Shen, Q.P., Eds.; China Architecture & Building Press: Beijing, China, 2008; pp. 1322–1325. [Google Scholar]

- Levin, E.; Montagnoli, A.; Wright, R.E. Demographic Change and the Housing Market: Evidence from a Comparison of Scotland and England. Urban Stud. 2009, 46, 27–43. [Google Scholar] [CrossRef]

- Takats, E. Aging and house prices. J. Hous. Econ. 2012, 21, 131–141. [Google Scholar] [CrossRef]

- Green, R.K.; Lee, H. Age, demographics, and the demand for housing, revisited. Reg. Sci. Urban Econ. 2016, 61, 86–98. [Google Scholar] [CrossRef]

- Day, C. Population and house prices inthe United Kingdom. Scott. J. Political Econ. 2018, 65, 127–141. [Google Scholar] [CrossRef]

- Choi, C.; Jung, H. Does an economically active population matter in housing prices? Appl. Econ. Lett. 2017, 24, 1061–1064. [Google Scholar] [CrossRef]

- Han, Z. Demographic Structure and Housing Prices: Comparative Study on East Asia and Europe. Korea Real Estate Acad. Rev. 2016, 64, 184–198. [Google Scholar]

- Saita, Y.; Shimizu, C.; Watanabe, T. Aging and real estate prices: Evidence from Japanese and US regional data. Int. J. Hous. Mark. Anal. 2016, 9, 66–87. [Google Scholar] [CrossRef]

- Miles, D. Population Density, House Prices and Mortgage Design. Scott. J. Political Econ. 2012, 59, 444–466. [Google Scholar] [CrossRef]

- Chen, J.; Guo, F.; Wu, Y. One decade of urban housing reform in China: Urban housing price dynamics and the role of migration and urbanization, 1995–2005. Habitat Int. 2011, 35, 1–8. [Google Scholar] [CrossRef]

- Akbari, A.H.; Aydede, Y. Effects of immigration on house prices in Canada. Appl. Econ. 2012, 44, 1645–1658. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, S.; Li, G.; Zhang, H.; Jin, L.; Su, Y.; Wu, K. Identifying the determinants of housing prices in China using spatial regression and the geographical detector technique. Appl. Geogr. 2017, 79, 26–36. [Google Scholar] [CrossRef]

- Hiller, N.; Lerbs, O.W. Aging and urban house prices. Reg. Sci. Urban Econ. 2016, 60, 276–291. [Google Scholar] [CrossRef] [Green Version]

- Saiz, A. Immigration and housing rents in American cities. J. Urban Econ. 2007, 61, 345–371. [Google Scholar] [CrossRef] [Green Version]

- Forte, F.; Antoniucci, V.; de Paola, P. Immigration and the Housing Market: The Case of Castel Volturno, in Campania Region, Italy. Sustainability 2018, 10. [Google Scholar] [CrossRef]

- Wang, J.; Xu, Q. The Influence of Floating Population on Real Estate Prices: An Empirical Study of Beijing, in DEStech Transactions on Social Science Education and Human Science; Pavlova, M., Liu, J., Zeng, X.Y., Pavlova, M., Eds.; DEStech Publishing Inc.: Lancaster, PA, USA, 2017; pp. 112–118. [Google Scholar]

- Wang, L.; Chen, W. A PVAR Study on the Relationship between Housing Price and Population Mobility. Mod. Urban Res. 2018, 9–15. (In Chinese) [Google Scholar] [CrossRef]

- Hou, Y.; Chen, Z. ‘Population migration-economic growth convergence puzzle’ in China: Based on analysis and testing of neoclassical endogenous economic growth model. China Popul. Resour. Environ. 2016, 11–19. (In Chinese) [Google Scholar] [CrossRef]

- Ma, M.; Cai, W. Do commercial building sector-derived carbon emissions decouple from the economic growth in Tertiary Industry? A case study of four municipalities in China. Sci. Total Environ. 2018. [Google Scholar] [CrossRef]

- Song, Y.; Knaap, G.J. New urbanism and housing values: A disaggregate assessment. J. Urban Econ. 2003, 54, 218–238. [Google Scholar] [CrossRef]

- Xie, D.; Lin, X. The Effect of Urban Scale, Economic Growth to Urban Housing Price. Econ. Geogr. 2014, 70–77. (In Chinese) [Google Scholar] [CrossRef]

- Rubin, Z.; Felsenstein, D. Supply side constraints in the Israeli housing market The impact of state owned land. Land Use Policy 2017, 65, 266–276. [Google Scholar] [CrossRef]

- Sun, J.; Gao, Y. Labor mobility, Growth Pole Cultivation and Regional Coordinated Development: Taking Jiangsu Province as an Example. Reform Econ. Syst. 2014, 40–44. (In Chinese) [Google Scholar]

- Lin, Y.; Li, Y.; Ma, Z. Exploring the Interactive Development between Population Urbanization and Land Urbanization: Evidence from Chongqing, China (1998–2016). Sustainability 2018, 10. [Google Scholar] [CrossRef]

- Yan, S.; Ge, X.J.; Wu, Q. Government intervention in land market and its impacts on land supply and new housing supply: Evidence from major Chinese markets. Habitat Int. 2014, 44, 517–527. [Google Scholar] [CrossRef]

- Hsiao, C. Why Panel Data? Singap. Econ. Rev. 2005, 50, 143–154. [Google Scholar] [CrossRef]

- Klevmarken, N.A. Panel Studies: What Can We Learn From Them? Eur. Econ. Rev. 1989, 33, 523–529. [Google Scholar] [CrossRef]

- Lan, F.; Wu, D. Population Mobility and Housing Prices Fluctuation—An Empirical Study Based on 35 Large and Medium-sized Cities in China. East China Econ. Manag. 2018, 32, 97–106. (In Chinese) [Google Scholar]

- Bettinger, E.P. Instrumental Variables. Int. Encycl. Educ. 2010, 17, 223–228. [Google Scholar] [CrossRef]

- Xu, T.; Yao, Y. Urban Population Migration and Housing Price Fluctuation: An Empirical Research Based on the Census Data and Baidu Migration Data. J. Jiangxi Univ. Financ. Econ. 2018, 11–19. (In Chinese) [Google Scholar]

- Liu, T.; Liu, H.; Qi, Y. Construction land expansion and cultivated land protection in urbanizing China: Insights from national land surveys, 1996–2006. Habitat Int. 2015, 46, 13–22. [Google Scholar] [CrossRef]

- Tan, M. Strict Control and Incentive: Evolution of the Policy of Linking Decrease of Arable Land with Increase of Construction Land and Its Local Implementation. Soc. Sci. China 2014, 7, 125–142. (In Chinese) [Google Scholar]

- Lin, X.; Wang, Y.; Wang, S.; Wang, D. Spatial differences and driving forces of land urbanization in China. J. Geogr. Sci. 2015, 25, 545–558. [Google Scholar] [CrossRef] [Green Version]

- Otterstrom, S.M. Population concentration in United States city-systems from 1790 to 2000: Historical trends and current phases. Tijdschr. Voor Econ. Soc. Geogr. 2003, 94, 477–495. [Google Scholar] [CrossRef]

| Variable Symbol | Variable Name | Variable Definition | Unit |

|---|---|---|---|

| HOUPR | Urban housing prices | Expressed by the average sales price of residential housing. | yuan/m2 |

| MIPOP | Population migration | The population inflow rate is expressed as the ratio of the migrant population to the permanent population. | % |

| REINV | Real-estate investment | Expressed by the ratio of residential housing investment to fixed asset investment. | % |

| ECODE | Economic development level | Expressed by the ratio of the added value of the tertiary industry to GDP. | % |

| AVINC | Income level | Expressed by the per capita disposable income of urban residents | yuan |

| Regions | Eastern Region | Central Region | Western Region |

|---|---|---|---|

| Cities | Beijing, Tianjin, Shijiazhuang, Shenyang, Shanghai, Nanjing, Hangzhou, Ningbo, Fuzhou, Xiamen, Jinan, Qingdao, Guangzhou, Shenzhen, Haikou | Taiyuan, Hefei, Nanchang, Zhengzhou, Wuhan, Changsha | Chongqing, Hohhot, Nanning, Chengdu, Guiyang, Kunming, Xi’an, Lanzhou, Xining, Yinchuan, Urumchi |

| Variable | Model I | Model II | Model III | Model IV |

|---|---|---|---|---|

| Research scope | National level | Eastern region | Central region | Western region |

| F-statistic | 153.2970 *** | 443.9256 *** | 15.2139 *** | 28.5913 *** |

| 0.0166 | 0.0103 | −0.0405 | 0.0220 *** |

| Variable | Model I | Model II | Model III | Model IV |

|---|---|---|---|---|

| C | 1.0131 *** | −0.2926 | 0.5523 | 1.1213 *** |

| MIPOP | 0.0031 *** | 0.0134 *** | 0.0029 | −0.0046 |

| REINV | 0.0056 *** | 0.0114 *** | 0.0054 * | 0.0052 ** |

| ECODE | −0.0026 | 0.0025 * | −0.0030 | −0.0058 * |

| AVINC | 0.7610 *** | 0.8426 *** | 0.8010 *** | 0.7521 *** |

| 0.9670 | 0.8846 | 0.8832 | 0.7465 | |

| F-statistic | 237.7284 *** | 277.8541 *** | 42.0115 *** | 94.2941 *** |

| Hausman test | 21.2601 *** | 21.3962 *** | 17.0175 *** | 4.0877 |

| Cointegration test | −6.7148 *** | −4.5508 *** | −4.2372 *** | −5.7987 *** |

| Sample capacity | 320 | 150 | 60 | 110 |

| Estimation method | OLS | OLS | OLS | TSLS |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, Y.; Ma, Z.; Zhao, K.; Hu, W.; Wei, J. The Impact of Population Migration on Urban Housing Prices: Evidence from China’s Major Cities. Sustainability 2018, 10, 3169. https://doi.org/10.3390/su10093169

Lin Y, Ma Z, Zhao K, Hu W, Wei J. The Impact of Population Migration on Urban Housing Prices: Evidence from China’s Major Cities. Sustainability. 2018; 10(9):3169. https://doi.org/10.3390/su10093169

Chicago/Turabian StyleLin, Yingchao, Zhili Ma, Ke Zhao, Weiyan Hu, and Jing Wei. 2018. "The Impact of Population Migration on Urban Housing Prices: Evidence from China’s Major Cities" Sustainability 10, no. 9: 3169. https://doi.org/10.3390/su10093169