Evaluating Consistency in Environmental Policy Mixes through Policy, Stakeholder, and Contextual Interactions

Abstract

:1. Introduction

2. Understanding the Policy Making Process, Consistency, and Stakeholders in a Context

3. Review of Literature on Policy Interactions and Policy Context Analysis

4. Introducing a Multi-Level Methodology for Evaluating Consistency in Policy Mixes

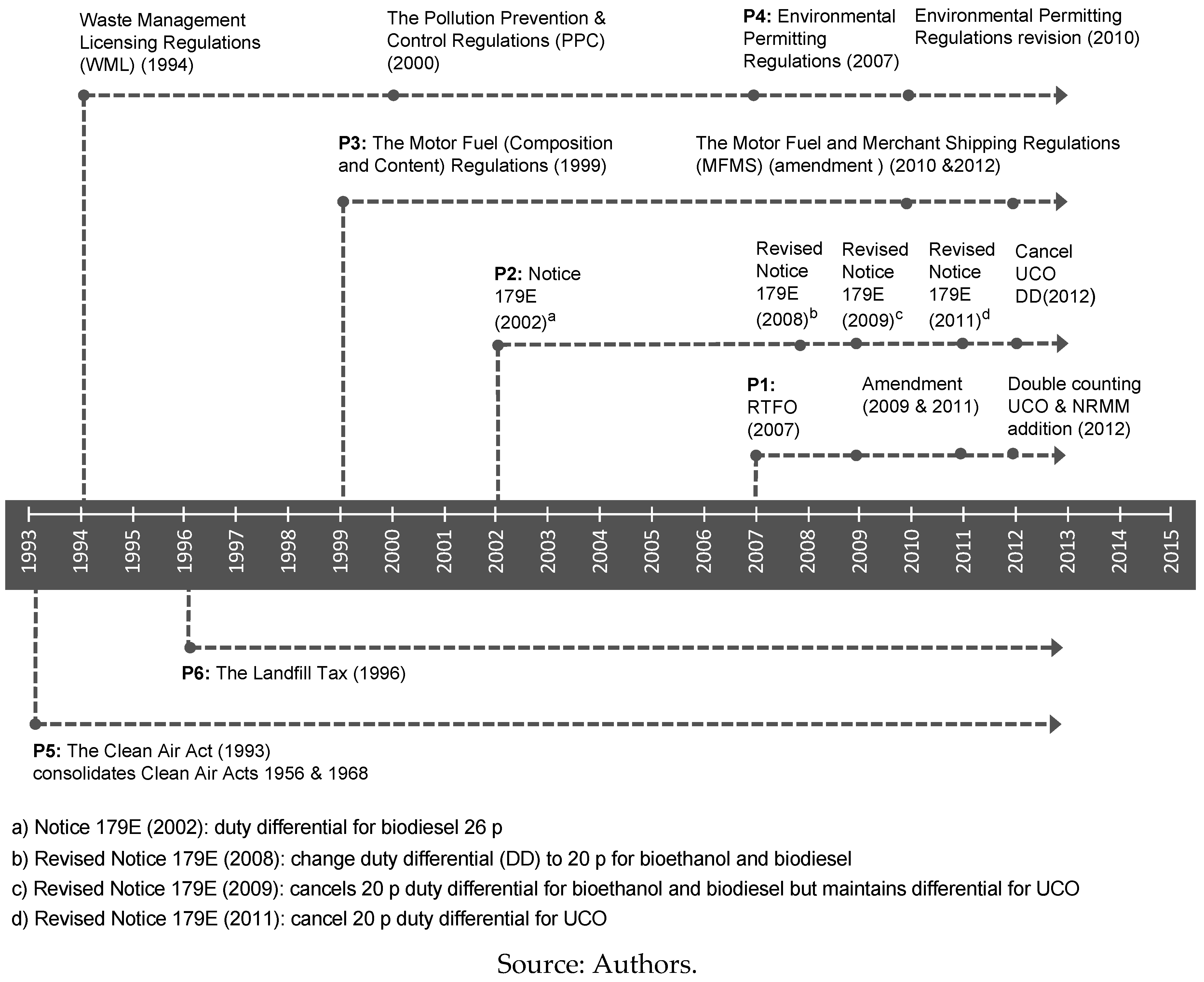

4.1. Level 1: Policy Interactions: Focus on Policy Design Interactions OVER Time

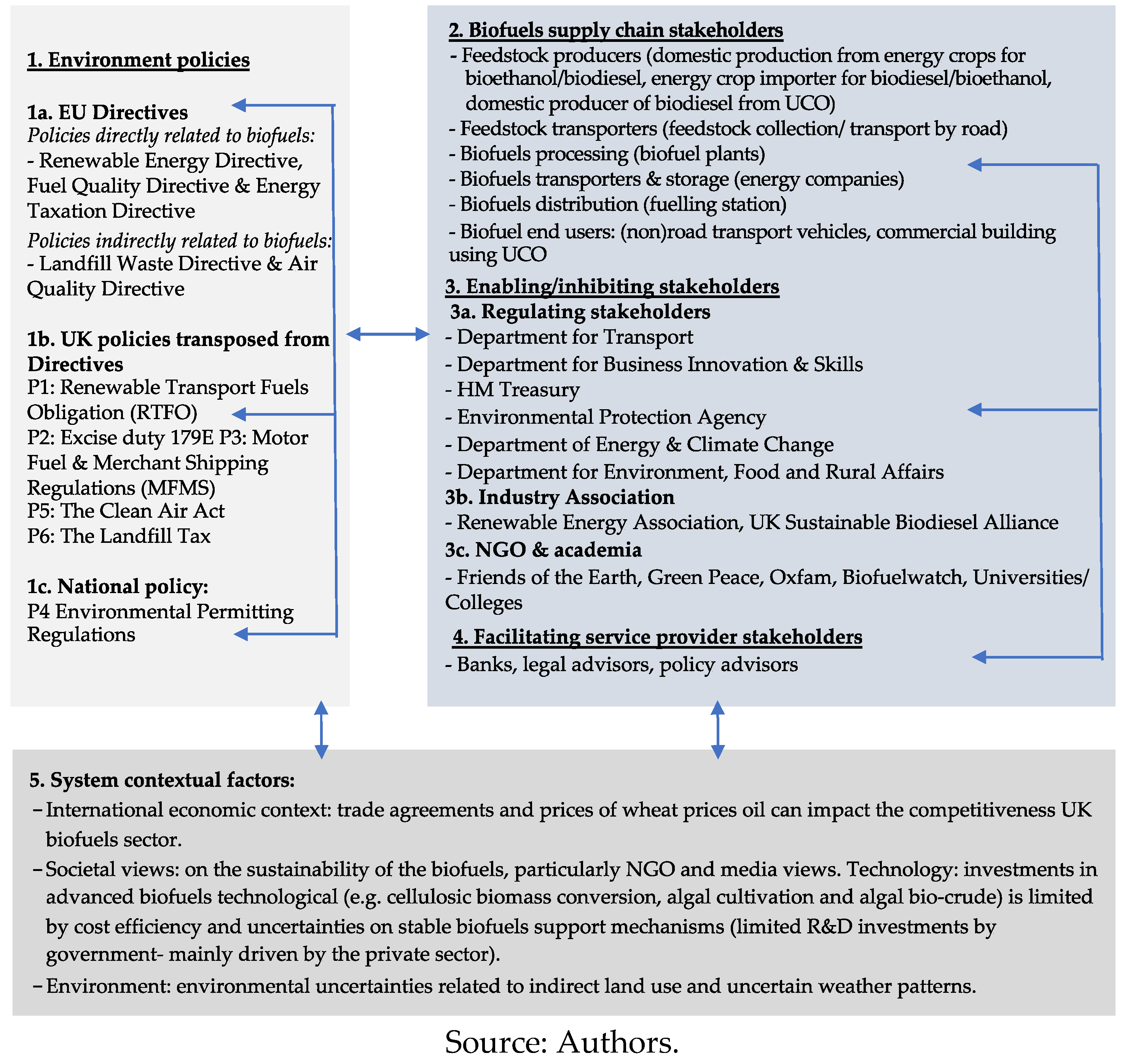

4.2. Level 2: Interactions at the Level of Targeted Stakeholders in a Context

4.2.1. Stakeholder Interactions with Other Stakeholder Groups

4.2.2. Stakeholder Interactions with the Policy Mix in a Context

5. Drawing the Policy Mix Boundaries

5.1. Drawing Boundaries for Policy Mixes

5.2. European Union Policy Context

5.3. Overview of UK Policy Instruments within the UK Biofuels Policy Mix

6. Applying the Multi-Level Method to Evaluate Consistency in Policy Mixes

6.1. Level 1 Analysing Policy Consistency: Policy Interactions in the UK’s Biofuels Policy Mix

6.2. Level 2 Analysis: Interactions between Policies and Stakeholders in the Context of the UK Biofuels Policy Mix

6.3. Other Contextual Factors That Have Impacted the Consistency of UK Biofuels Policy Mixes

7. Summary, UK Biofuels Sectoral Updates and Reflections on Policy Implications

7.1. Summary of Findings on the Consistency UK’s Biofuels Policy Mix

7.2. Policy Updates from the UK Biofuels Policy Mix

7.3. Reflections

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Sorrell, S.; Smith, A.; Betz, R.; Walz, R.; Boemare, C.; Quirion, R.; Sijm, J.; Konidari, M.P.D.; Spyros, V.; Haralampopoulos, D.; et al. The Research Directorate General of the European Commission under the Fifth Framework Program (EVK2-CT-2000-0067); Interaction in EU Climate Policy. The INTERACT Project; University of Sussex: Brighton, UK, 2003. [Google Scholar]

- Tuerk, A.; Fruhman, C.; Frieden, D. Understanding the Efficacy of Environmental Policy Instruments: The APRAISE 3E Method. In Proceedings of the International Energy Policies & Programmes Evaluation Conference (IEPPEC), Berlin, Germany, 9–11 September 2014. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). Instrument Mixes for Environmental Policy; Report; OECD Publishing: Paris, France, 2007. [Google Scholar]

- Majone, G. Evidence, Argument and Persuasion in the Policy Process; Yale University Press: New Haven, CT, USA; London, UK, 1989; p. 160. [Google Scholar]

- Ossenbrink, J.; Finnsson, S.; Bening, R.; Hoffmann, H.V. Delineating policy mixes—Contrasting the top down and bottom up approach along the case of energy storage in California. Res. Policy 2018. [Google Scholar] [CrossRef]

- Capano, G.; Lippi, A. Enlightening policy mix complexity: A typology of actors’ choices. In Proceedings of the 1st ICPP Conference, Grenoble, France, 28 June 2013. [Google Scholar]

- Howlett, M. What is a Policy Instrument? Policy Tools, Policy Mixes and Policy-Implementation Styles. In Designing Government: From Instruments to Governance; Pearl, E., Hill, M.M., Howlett, M., Eds.; McGill-Queen’s University Press: Montreal, QC, Canada; Kingston, ON, Canada, 2005; pp. 311–350. [Google Scholar]

- Bahn-Walkowiak, B.; Wilts, H. The institutional dimension of resource efficiency in a multi-level governance system—Implications for policy mix design. Energy Res. Soc. Sci. 2017, 33 (Suppl. C), 163–172. [Google Scholar] [CrossRef]

- Duval, R. A Taxonomy of Instruments to Reduce Greenhouse Gas Emissions and their Interactions; OECD Economics Department Working Papers, No. 636; OECD Publishing: Paris, France, 2008. [Google Scholar]

- Jensen, S.G.; Skytte, K. Interactions between the power and green certificate markets. Energy Policy 2002, 30, 425–435. [Google Scholar] [CrossRef]

- Jensen, S.G.; Skytte, K. Simultaneous attainment of energy goals by means of green certificates and emission permits. Energy Policy 2003, 31, 63–71. [Google Scholar] [CrossRef]

- Sorrell, S.; Harrison, D.; Radov, D.; Klevnas, P.; Foss, A. White certificate schemes: Economic analysis and interactions with the EU ETS. Energy Policy 2008, 37, 29–42. [Google Scholar] [CrossRef]

- Burke, M.J.; Stephens, J.C. Energy democracy: Goals and policy instruments for sociotechnical transitions. Energy Res. Soc. Sci. 2017, 33 (Suppl. C), 35–48. [Google Scholar] [CrossRef]

- Jann, W.; Wegrich, K. Theories of the policy cycle. In Handbook of Public Policy Analysis: Theory, Politics, and Methods; Fischer, F., Miller, G.J., Sidney, M.S., Eds.; CRC Press, Taylor & Francis: Boca Raton, FL, USA, 2007; pp. 43–62. [Google Scholar]

- Kern, F.; Howlett, M. Implementing transition management as policy reforms: A case study of the Dutch energy sector. Policy Sci. 2009, 42, 391–408. [Google Scholar] [CrossRef]

- Gautier, P. Horizontal Coherence and the External Competences of the European Union. Eur. Law J. 2004, 10, 23–41. [Google Scholar] [CrossRef]

- Rogge, K.S.; Reichardt, K. Towards a More Comprehensive Policy Mix Conceptualization for Environmental Technological Change: A Literature Synthesis; Working Paper Sustainability and Innovation S3/2013; Fraunhofer ISI: Karlsruhe, Germany, 2013. [Google Scholar]

- Albu, M.; Griffith, A. Mapping the Market: participatory market-chain development in practice. Small Enterp. Dev. 2006, 17, 12–22. [Google Scholar] [CrossRef]

- Nikas, A.; Doukas, H.; Lieu, J.; Alvarez-Tinoco, R.; Charisopoulos, V.; van der Gaast, W. Managing stakeholder knowledge for the evaluation of innovation systems in the face of climate change. J. Knowl. Manag. 2017, 21, 1013–1034. [Google Scholar] [CrossRef] [Green Version]

- Spyridaki, N.A.; Banaka, S.; Flamos, A. Evaluating public policy instruments in the Greek building sector. Energy Policy 2016, 88, 528–543. [Google Scholar] [CrossRef]

- Bolton, R.; Foxon, T.J. A socio-technical perspective on low carbon investment challenges—Insights for UK energy policy. Environ. Innov. Soc. Transit. 2015, 14, 165–181. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Adapting Renewable Energy Policies to Dynamic Market Conditions; Report; IRENA: Abu Dhabi, UAE, 2014. [Google Scholar]

- Laswell, H.D. The Policy Orientation. In The Policy Sciences: Recent Development in Scope and Method; Lerner, D., Lasswell, H.D., Eds.; Stanford University Press: Palo Alto, CA, USA, 1951; pp. 3–15. [Google Scholar]

- Tinbergen, J. On the Theory of Economic Policy. Books (Jan Tinbergen); North-Holland Publishing Company: Amsterdam, The Netherlands, 1952. [Google Scholar]

- Mundell, R. A Theory of Optimum Currency Areas. Am. Econ. Rev. 1961, 51, 657–665. [Google Scholar]

- Branson, W.H. Macroeconomic Theory and Policy, 3rd ed.; Harper and Row: New York, NY, USA, 1989. [Google Scholar]

- Wildavsky, A. The Art and Craft of Policy Analysis; MacMillan Press: London, UK; Basingstoke, UK, 1979. [Google Scholar]

- Del Río González, P. The interaction between emissions trading and renewable electricity support schemes: An overview of the literature. Mitig. Adapt. Strateg. Glob. Chang. 2007, 12, 1363–1390. [Google Scholar] [CrossRef]

- Cory, K.; Couture, T.; Kreycik, C. Feed-in Tariff Policy: Design, Implementation, and RPS Policy Interactions; Technical Report (NREL/TP-6A2-45549); National Renewable Energy Laboratory: Golden, CO, USA, 2009.

- Tsao, C.; Campbell, J.E.; Chen, Y. When renewable portfolio standards meet cap-and-trade regulations in the electricity sector: Market interactions, profits implications, and policy redundancy. Energy Policy 2011, 39, 3966–3974. [Google Scholar] [CrossRef]

- Taeihagh, A.; Givoni, M.; Bañares-Alcántara, R. Which policy first? A network-centric approach for the analysis and ranking of policy measures. Environ. Plan. B Plan. Des. 2013, 40, 595–616. [Google Scholar] [CrossRef]

- Boots, M.G.; Schaeffer, G.J.; de Zoeten, C.; Mitchell, C.; Anderson, T.; Morthorst, P.E.; Nielsen, L.; Kühn, I.; Bräuer, W.; Stronzik, M.; et al. The Interaction of Tradable Instruments in Renewable Energy and Climate Changes Markets; The InTraCert Project; The Research Directorate General of the European Commission under the Fifth Framework Program (NNE5/1999/428); ECN: Amsterdam, The Netherlands, 2001. [Google Scholar]

- Böhringer, C.; Rosendahl, E.K. Green promotes the dirtiest: On the interaction between black and green quotas in energy markets. J. Regul. Econ. 2010, 37, 316–325. [Google Scholar] [CrossRef]

- Howlett, M.; Kim, J.; Weaver, P. Assessing Instrument Mixes through Program- and Agency-Level Data: Methodological Issues in Contemporary Implementation Research. Rev. Policy Res 2006, 23, 129–151. [Google Scholar] [CrossRef]

- Howlett, M.; Rayner, J. Patching vs. Packaging: Complementary Effects, Goodness of Fit, Degrees of Freedom and Intentionality in Policy Portfolio Design; Policy Design Working Paper Series. 20; Lee Kuan Yew School of Public Policy: Singapore, 2013. [Google Scholar]

- Assessment of Policy Interrelationships and Impacts on Sustainability in Europe (APRAISE). 2011–2013 and Carried Out under the 7th Framework Programme (FP7) of the European Commission; University of Sussex: Brighton, UK, 2013. [Google Scholar]

- Lieu, J. Assessment of Policy Impacts on Sustainability in Europe (EC FP7 APRAISE); Report on Case Study Biofuels for Transport in the United Kingdom; University of Sussex: Brighton, UK, 2012. [Google Scholar]

- Steiner, D.; Tuerk, A.; Hingsamer, M.; Frieden, D. Assessment of Policy Impacts on Sustainability in Europe (EC FP7 APRAISE)—D2.1 Report on New Qualitative ex-post and ex-ante Evaluation Methods. Graz. 2012. Available online: http://apraise.org/sites/default/files/apraise_d2.1_0_0.pdf#overlay-context=Deliverables (accessed on 5 December 2013).

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; The PRISMA Group. Preferred Reporting Items for Systematic Systematic Reviews and Meta-Analyses. 2009. Available online: http://prisma-statement.org/documents/PRISMA%202009%20flow%20diagram.pdf (accessed on 10 May 2018).

- European Union. Regulations, Directives and Other Acts. 2017. Available online: https://europa.eu/european-union/eu-law/legal-acts_en (accessed on 2 February 2018).

- European Commission. Roadmap to a Resource Efficient Europe; European Commission: Brussels, Belgium, 2011. [Google Scholar]

- European Commission. Environment Action Programme to 2020 ‘Living Well, within the Limits of our Planet’; 20 November 2013, Decision No 1386/2013/EU. 33; European Commission: Brussels, Belgium, 2013. [Google Scholar]

- The Renewable Transport Fuel Obligations Order 2007. The Renewable Transport Fuel Obligations Order 2007 Regulations 2007 No. 3072; UK Statutory Instruments; 2007. Available online: http://www.legislation.gov.uk/uksi/2007/3072/pdfs/uksi_20073072_en.pdf (accessed on 10 August 2013).

- HM Revenue & Customs (HMRC). HM Revenue and Customs. Retrieved March 8, 2013 from Biofuels and Other Fuel Substitutes: HMRC Reference: Notice 179E; 2011. Available online: http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=pageVAT_ShowContent&id=HMCE_CL_000205&propertyType=document (accessed on 10 August 2013).

- The Motor Fuel Regulations 2012. The Motor Fuel (Composition and Content) (Amendment) Regulations 2012; UK Statutory Instruments; 2012. Available online: http://www.legislation.gov.uk/uksi/2012/2567/made?view=plain (accessed on 10 August 2013).

- The Environmental Permitting Regulations 2010. The Environmental Permitting (England and Wales) (Amendment) (No. 2) Regulations 2010; UK Statutory Instruments; 2010. Available online: http://www.legislation.gov.uk/uksi/2010/2172/pdfs/uksi_20102172_en.pdf (accessed on 20 July 2013).

- Clean Air Act 1993. Clean Air Act 1993; Public General Acts; 1993. Available online: http://www.legislation.gov.uk/ukpga/1993/11/pdfs/ukpga_19930011_en.pdf (accessed on 20 July 2013).

- The Landfill Tax Regulations 1996. The Landfill Tax Regulations 1996; UK Statutory Instruments; 1996. Available online: http://www.legislation.gov.uk/uksi/1996/1527/contents/made (accessed on 20 July 2013).

- Charles, C.; Wooders, P. Biofuels—At What Cost? Mandating Ethanol and Biodiesel Consumption in the United Kingdom; Global Subsidies Initiative (GSI) of the International Institute for Sustainable Development (IISD): Geneva, Switzerland, 2012. [Google Scholar]

- Bailey, R. The Trouble with Biofuels: Costs and Consequences of Expanding Biofuel Use in the United Kingdom; Chatham House: London, UK, 2013. [Google Scholar]

- The Pollution Prevention and Control Regulations 2000. The Pollution Prevention and Control (England and Wales) Regulations 2000 No. 1973; UK Statutory Instruments; 2000. Available online: http://www.legislation.gov.uk/uksi/2000/1973/contents/made (accessed on 20 July 2013).

- HM Revenue & Customs and HM Treasury. Landfill Tax 2018. Available online: https://www.gov.uk/green-taxes-and-reliefs/landfill-tax (accessed on 6 April 2018).

- Van Dam, J.; Junginger, M.; Faaij, A.P.C. From the global efforts on certification of bioenergy towards an integrated approach based on sustainable land use planning. Renew. Sustain. Energy Rev. 2010, 14, 2445–2472. [Google Scholar] [CrossRef]

- Gamborg, C.H.T.; Anker, H.T.; Sandøe, P. Ethical and legal challenges in bioenergy governance: Coping with value disagreement and regulatory complexity. Energy Policy 2014, 69 (Suppl. C), 326–333. [Google Scholar] [CrossRef]

- Department for Transport. Year 3 Verified Report: 15 April 2010–14 April 2011; Department for Transport: London, UK, 2011. Available online: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/191478/rtfo-aug-2011.pdf (accessed on 20 August 2013).

- Department for Transport. Renewable Transport Fuel Obligation Statistics: Obligation Period 4, 2011/12; Report 5; Department for Transport: London, UK, 2012.

- Department for Transport. Renewable Transport Fuel Obligation Statistics: Obligation Period 5, 2012/13; Report 4; Department for Transport: London, UK, 2013.

- Department for Transport. Renewable Transport Fuel Obligation Statistics: Period 5, 2012–13; Report 4 XLS Tables; Department for Transport: London, UK, 2013.

- Department of Transport. Renewable Transport Fuel Obligation Statistics: Obligation Period 6, 2013/14; Report 6; Department for Transport: London, UK, 2015.

- Renewable Fuels Agency. Year One of the RTFO: Renewable Fuels Agency Report on the Renewable Transport Fuel Obligation 2008/09; Renewable Fuels Agency: London, UK, 2010.

- Renewable Fuels Agency. Year Two of the RTFO: Renewable Fuels Agency Report on the Renewable Transport Fuel Obligation 2009/10; Renewable Fuels Agency: London, UK, 2011.

- Non-Fossil Purchasing Agency Limited (NFPAS). e-TOC On-Line Auctions. 2013. Available online: http://www.nfpas-auctions.co.uk/etoc/trackrecord.html (accessed on 15 August 2013).

- Renewable Fuels Agency. The Gallagher Review of the Indirect Effects of Biofuels Production; Renewable Fuels Agency: London, UK, 2008.

- European Commission. MEMO: Indirect Land Use Change (ILUC). 2012. Available online: http://europa.eu/rapid/press-release_MEMO-12-787_en.htm (accessed on 10 August 2013).

- European Commission. New Commission Proposal to Minimise the Climate Impacts of Biofuel Production. EUROPA Press Release. 2012. Available online: http://europa.eu/rapid/press-release_IP-12-1112_en.htm (accessed on 2 February 2018).

- European Commission. Land Use Change. 2015. Available online: https://ec.europa.eu/energy/en/topics/renewable-energy/biofuels/land-use-change (accessed on 2 February 2018).

- Fritsche, U.R.; Wiegmann, K. Indirect Land Use Change and Biofuels; European Parliament’s Committee on Environment, Public Health and Food Safety, Policy Department Economic and Scientific Policy; European Parliament: Brussels, Belgium, 2011. [Google Scholar]

- Harrabin, R. Biofuels: MPs to Consider Subsidies for Power Stations. BBC News Science and Environment, 6 March 2013. Available online: http://www.bbc.co.uk/news/science-environment-21672840 (accessed on 15 August 2013).

- Pacini, H.; Assunção, L.; van Dam, J.; Toneto, R. The price for biofuels sustainability. Energy Policy 2013, 59 (Suppl. C), 898–903. [Google Scholar] [CrossRef] [Green Version]

- Van Vliet, O.P.R.; Faaij, A.P.C.; Turkenburg, W.C. Fischer–Tropsch diesel production in a well-to-wheel perspective: A carbon, energy flow and cost analysis. Energy Convers. Manag. 2009, 50, 855–876. [Google Scholar] [CrossRef]

- European Union. Directive (EU) 2015/1513 of the European Parliament and of the Council of 9 of September 2015 Amending Directive 98/70/EC Relating to the Quality of Petrol and Diesel Fuels and Amending Directive 2009/28/EC on the Promotion of the Use of Energy from Renewable Sources. 2015. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32015L1513 (accessed on 2 February 2018).

- Plevin, R.J.; Delucchi, M.A.; Creutzig, F. Using Attributional Life Cycle Assessment to Estimate Climate-Change Mitigation Benefits Misleads Policy Makers. J. Ind. Ecol. 2014, 18, 73–83. [Google Scholar] [CrossRef]

- Langeveld, J.W.A.; Dixon, J.; van Keulen, H.; Quist-Wessel, P.M.F. Analyzing the effect of biofuel expansion on land use in major producing countries: Evidence of increased multiple cropping. Biofuel Bioprod. Biorefin. 2014, 8, 49–58. [Google Scholar] [CrossRef]

- Popp, J.; Lakner, Z.; Harangi-Rakos, M.; Fari, M. The effect of bioenergy expansion: Food, energy, and environment. Renew. Sustain. Energy Rev. 2014, 32, 559–578. [Google Scholar] [CrossRef]

- HM Revenue & Customs (HMRC). A General Guide to Landfill Tax; HM Revenue & Customs: London, UK, 2013. [Google Scholar]

- Air Quality Expert Group. Road Transport Biofuels: Impact on UK Air Quality; Department for Environment, Food and Rural Affairs: London, UK; Scottish Government: Edinburgh, UK; Welsh Assembly Government: Cardiff, UK; Department of the Environment in Northern Ireland: Belfast, Ireland, 2011.

- Department for Transport. Renewable Transport Fuel Obligation Statistics: Period 10 2017/18; Report 1; Department for Transport: London, UK, 2017.

- Bounds, A.; Chris Tighe, C. Investors Lose Hundreds of Millions as UK Biofuels Industry Stalls. 2017. Available online: https://www.ft.com/content/31b0e84a-d9e1-11e7-a039-c64b1c09b482 (accessed on 13 May 2018).

- Department of Transport. The Renewable Transport Fuel Obligations Order: Government Response to the Consultation on Amendments; Department of Transport: London, UK, 2017.

- Department of Transport. Renewable Transport Fuel Obligation Annual Report 2015–16; Department of Transport: London, UK, 2017.

- TRANSrisk. Transitions Pathways and Risk Analysis for Climate Change Mitigation and Adaption Strategies. EU Horizon 2020 Programme, GA: 642260. 2018. Available online: http://transrisk-project.eu/ (accessed on 2 May 2018).

- Organisation for Economic Co-operation and Development (OECD). Aligning Policies for a Low-carbon Economy. In Proceedings of the Meeting of the OECD Council at Ministerial Level, Paris, France, 3–4 June 2015. [Google Scholar]

- Díaz Redondo, P.; van Vliet, O.; Patt, A.G. Do We Need Gas as a Bridging Fuel? A Case Study of the Electricity System of Switzerland. Energies 2017, 10, 861. [Google Scholar] [CrossRef]

- Lieu, J.; Virla, D.A.; Abel, R.; Fitzpatrick, C. Consensus Building in Engagement Processes’ for reducing risks in developing sustainable pathways: Indigenous interests as core elements of engagement. In Understanding Risks and Uncertainties in Energy and Climate Policy: Multidisciplinary Methods and Tools towards a Low Carbon Society; Doukas, H., Flamos, A., Lieu, J., Eds.; Springer: London, UK, 2017; in press. [Google Scholar]

| Consistency Level | Description |

|---|---|

| Inconsistent policy mix | A policy mix is considered to be inconsistent when policy instrument (PI) ‘contradictions’ within the mix outweigh the PI ‘synergies’ or ‘facilitations’. Contradictions can be traced at the level of PI design elements and during implementation. PI contradictions can lead to the under-performance of policy instruments, in terms of failing to meet policy objectives/strategies, despite the synergetic effects of other PIs in the mix. |

| Weak consistency of policy instrument mix | A PI mix can be characterized as having a weak consistency when there are no obvious contradictions or synergies between PIs. A lack of strong PI synergy may lead to the effects of the PI mix being equal or slightly lower to the (intended?) effects of the individual PI, or that the policy objectives are met at a higher cost. |

| Moderate to strong consistency of policy instrument mix | Synergies outweigh the contradictions in the PI mix. PIs complement each other and operate together, leading to higher effectiveness than the sum of effects of individual instruments in the mix, and/or higher cost-effectiveness. |

| EU Directive Reference | UK National Policies |

|---|---|

| Renewable Transport Fuels Obligation & sustainability criteria |

| Motor Fuel and Merchant Shipping Regulations |

| Biofuels and Other Fuel Substitutes Regulations |

| The Landfill Tax |

| Protection of Water Against Agricultural Nitrate Pollution |

| Single Payment Scheme for agricultural production |

| The Water Environment Regulations |

| The Urban Waste Water Treatment Regulations |

| The Landfill Tax; Waste and Emissions Trading Act |

| The Clean Air Act |

| The Landfill Tax |

| No national policy directly linked to biofuels identified |

| No national policy directly linked to biofuels identified |

| Environmental Permitting Regulations |

| Finance Act 2002, Chapter 23 |

| Infrastructure Grant Programme |

| Policy areas | UK National Policy Instruments | |||

|---|---|---|---|---|

| Energy | P1: Renewable Transport Fuels Obligation | P2: HMRC Excise duty Notice 179E Biofuels and other fuel substitutes | P3: Motor Fuel and Merchant Shipping Regulations | |

| Climate | ||||

| Agriculture | Protection of Water Against Agricultural Nitrate Pollution | Single Payment Scheme for agricultural production | ||

| Air | P5: The Clean Air Act | |||

| Waste/resource use | P6: The Landfill Tax | Waste and Emissions Trading Act | The Urban Waste Water Treatment Regulations | P4: Environmental Permitting Regulations |

| Water | The Water Environment Regulations | |||

| Biodiversity | Conservation of Habitats and Species Regulations | |||

| Policy Mix 1 Nuclear Family (PI, P2 & P3) P1: RTFO; P2: Excise Duty 179E P3: MFMS | Policy Mix 2 Family (PI, P2 & P3) & (P4) P4: Environmental Permitting Regulations | Policy Mix 2 Family & Friends (PI, P2 & P3), (P4) & (P5 & P6) P5: The Clean Air Act P6: The Landfill Tax | |

|---|---|---|---|

| 1.Time-frame | (–) Time overlap: P1 over-laps with P2 creating contra-dictions. P1 supports biofuels & P2 increases costs. P2 overlaps with P3 from 2004. | (0) Time overlap: The time overlap between group P1–3 & P4 does not appear to have an impact on the overall performance of the PIs. | (0) Time overlap: The time overlap between group P1–3 & P5–6 does not appear to have an impact on the overall performance of the PIs. |

| 2. Policy objectives | (–) P1 and P3 promotes biofuels by setting targets while P2 sets a duty rate for biofuels equal to fossil fuels. | (–) P4 sets additional monitoring criteria on top of the sustainability criteria for biofuels producers from waste. | (+) P1–4 & P5–6: air quality standards encourage bio-fuels use in transport to decrease sulphur emissions & particulates. Higher landfill taxes divert waste from landfill & to reuse waste for biofuels. |

| 3. Type of instrument | (–) Mix of quota, trading schemes with regulations & taxes that can contradict meeting biofuels targets. | (–) Possibly over regulation in the permits covered by the sustainability criteria in P1. | (+) Stricter environmental regulations can complement meeting the biofuels target. |

| 4. Directly targeted stakeholders | (0) P1–P3: All domestic biofuels producers, importers of biofuels, & biofuels end-users. | (–) P4: Domestic biofuels producers from used cooking oil (UCO) subject to additional permitting. | (+) P5–P6: Domestic biofuels producers, importers of biofuels, & biofuels from waste producers (e.g., UCO). |

| RTFO Obligation Period | RTFO Obligation Year | Target (% by Volumne) of Biofuels Supplied | Actual (%) of Biofuels Supplied | Price Range (Pence per RTFC) | Target Achieved? |

|---|---|---|---|---|---|

| 2008–2009 | 1 | 2.5 | 2.7 | 0–8.0 | Yes |

| 2009–2010 | 2 | 3.25 | 3.33 | 6.0–8.0 | Yes |

| 2010–2011 | 3 | 3.5 | 3.27 | 12.75–19.9 | No |

| 2011–2012 | 4 | 4.0 | 3.6 | 5.00–23.5 | No |

| 2012–2013 | 5 | 4.5 | 3.0 | 8.84–17.97 | No |

| 2013–2014 | 6 | 4.7 | 3.46 | ~ 15.5 | No |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lieu, J.; Spyridaki, N.A.; Alvarez-Tinoco, R.; Van der Gaast, W.; Tuerk, A.; Van Vliet, O. Evaluating Consistency in Environmental Policy Mixes through Policy, Stakeholder, and Contextual Interactions. Sustainability 2018, 10, 1896. https://doi.org/10.3390/su10061896

Lieu J, Spyridaki NA, Alvarez-Tinoco R, Van der Gaast W, Tuerk A, Van Vliet O. Evaluating Consistency in Environmental Policy Mixes through Policy, Stakeholder, and Contextual Interactions. Sustainability. 2018; 10(6):1896. https://doi.org/10.3390/su10061896

Chicago/Turabian StyleLieu, Jenny, Niki Artemis Spyridaki, Rocio Alvarez-Tinoco, Wytze Van der Gaast, Andreas Tuerk, and Oscar Van Vliet. 2018. "Evaluating Consistency in Environmental Policy Mixes through Policy, Stakeholder, and Contextual Interactions" Sustainability 10, no. 6: 1896. https://doi.org/10.3390/su10061896