Modeling Global Trade in Phosphate Rock within a Partial Equilibrium Framework

Abstract

:1. Introduction

2. Materials and Methods

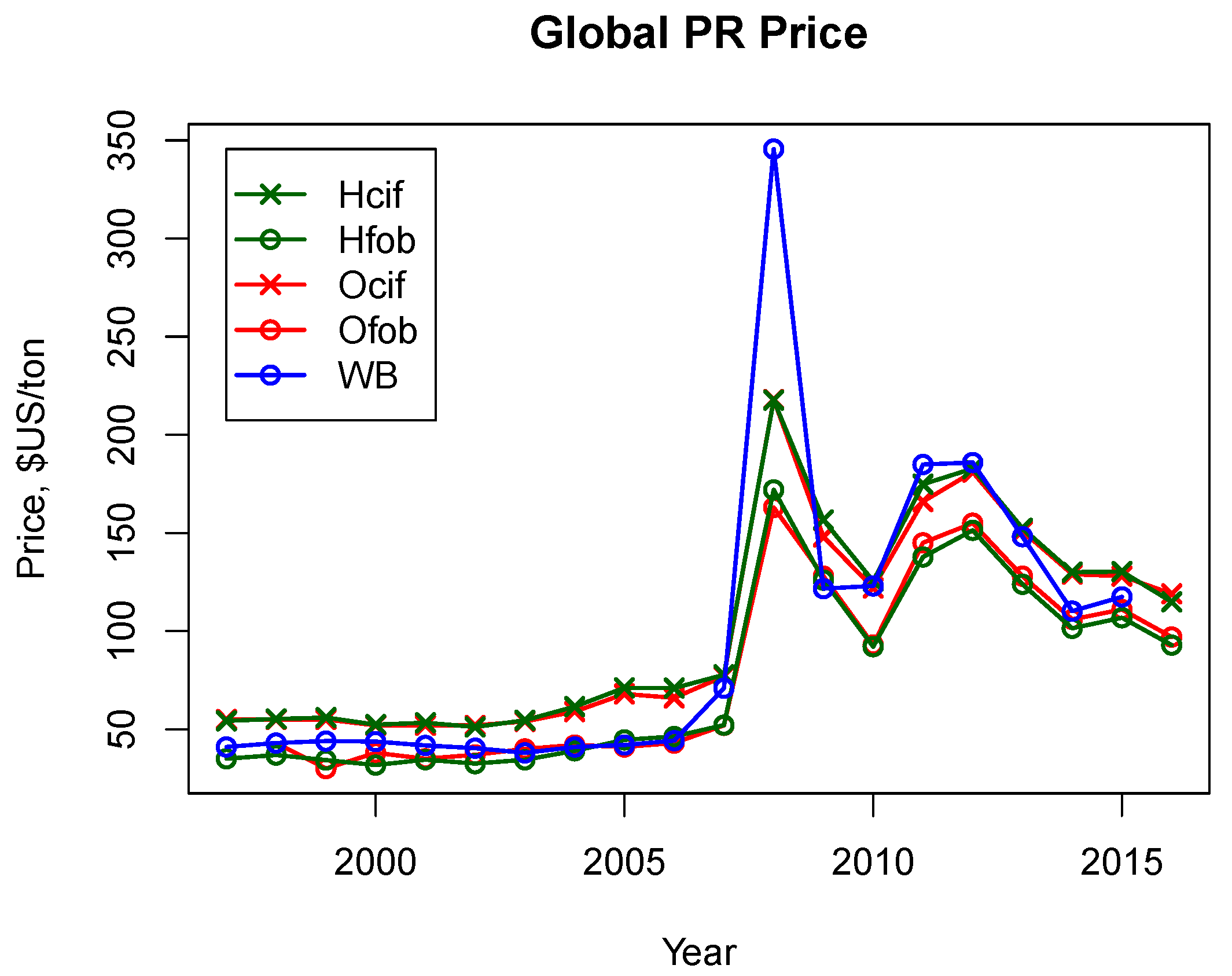

2.1. Data Preparation

- Initial import of a raw dataset into a database.

- Simplification by filtering out very small trades.

- Harmonization of bilateral traded quantities.

- Subsetting data on the basis of major exporters and importers.

- Fitting a regression of transportation costs on distance.

- Corrections of CIF and FoB prices.

2.2. Model Description

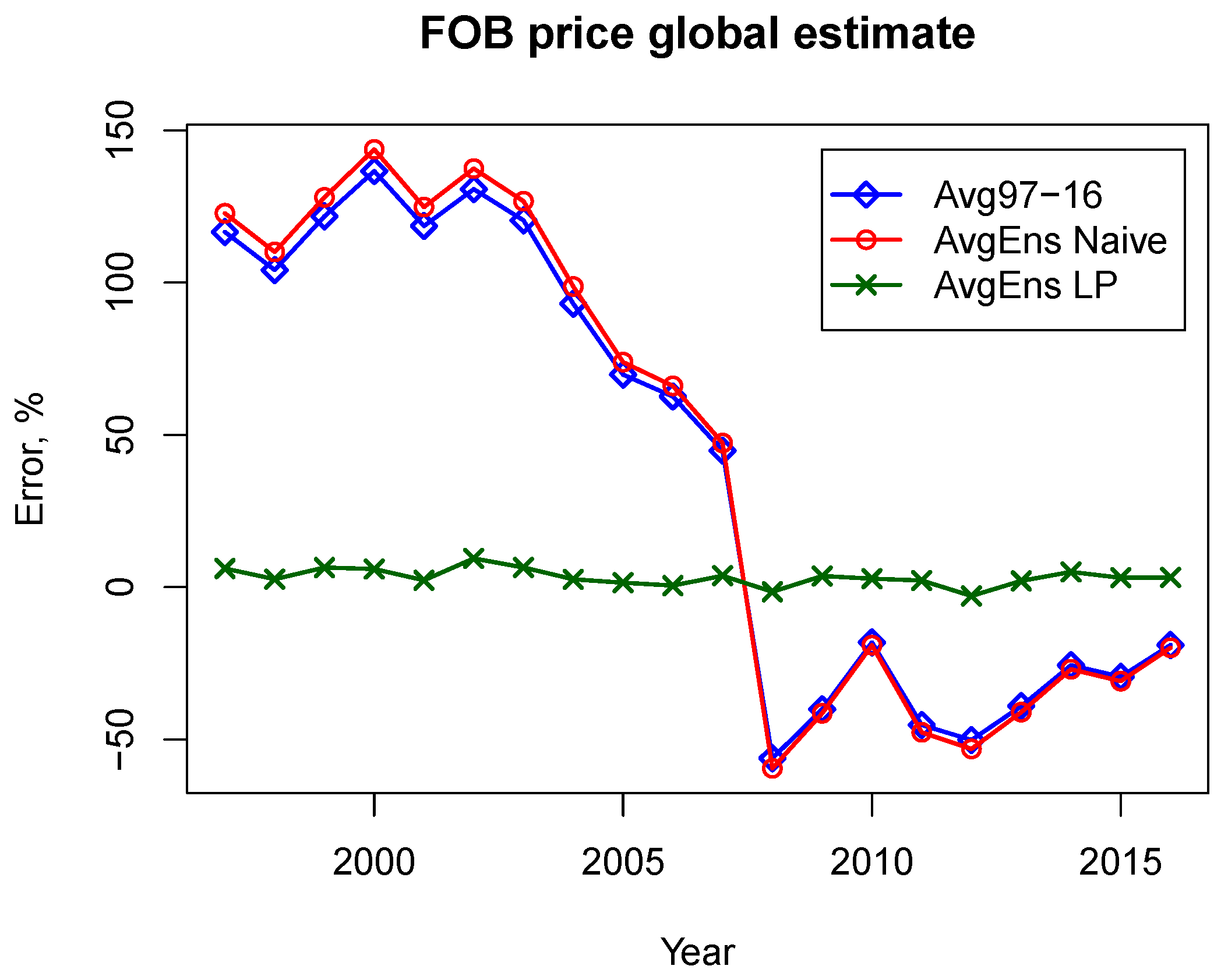

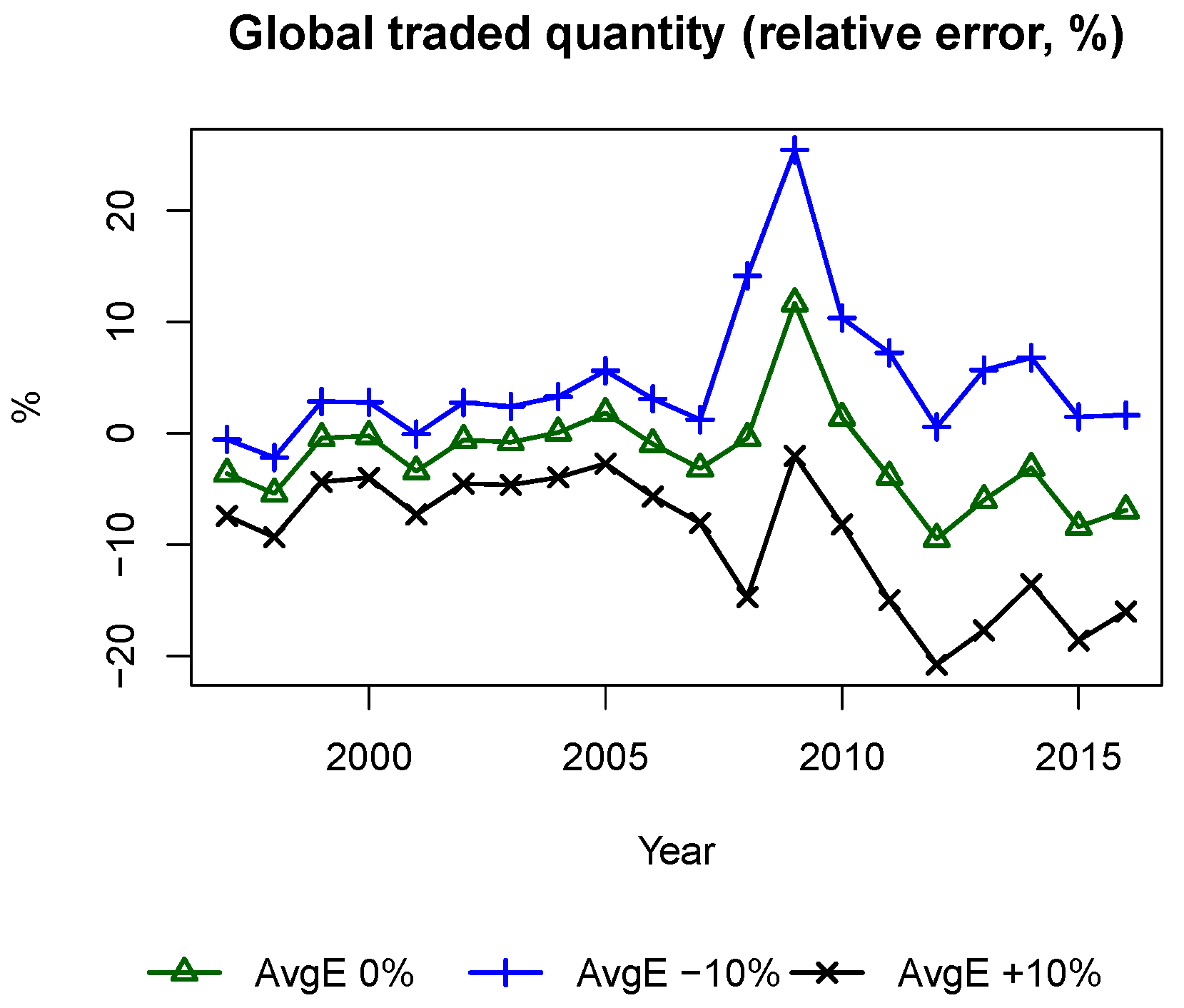

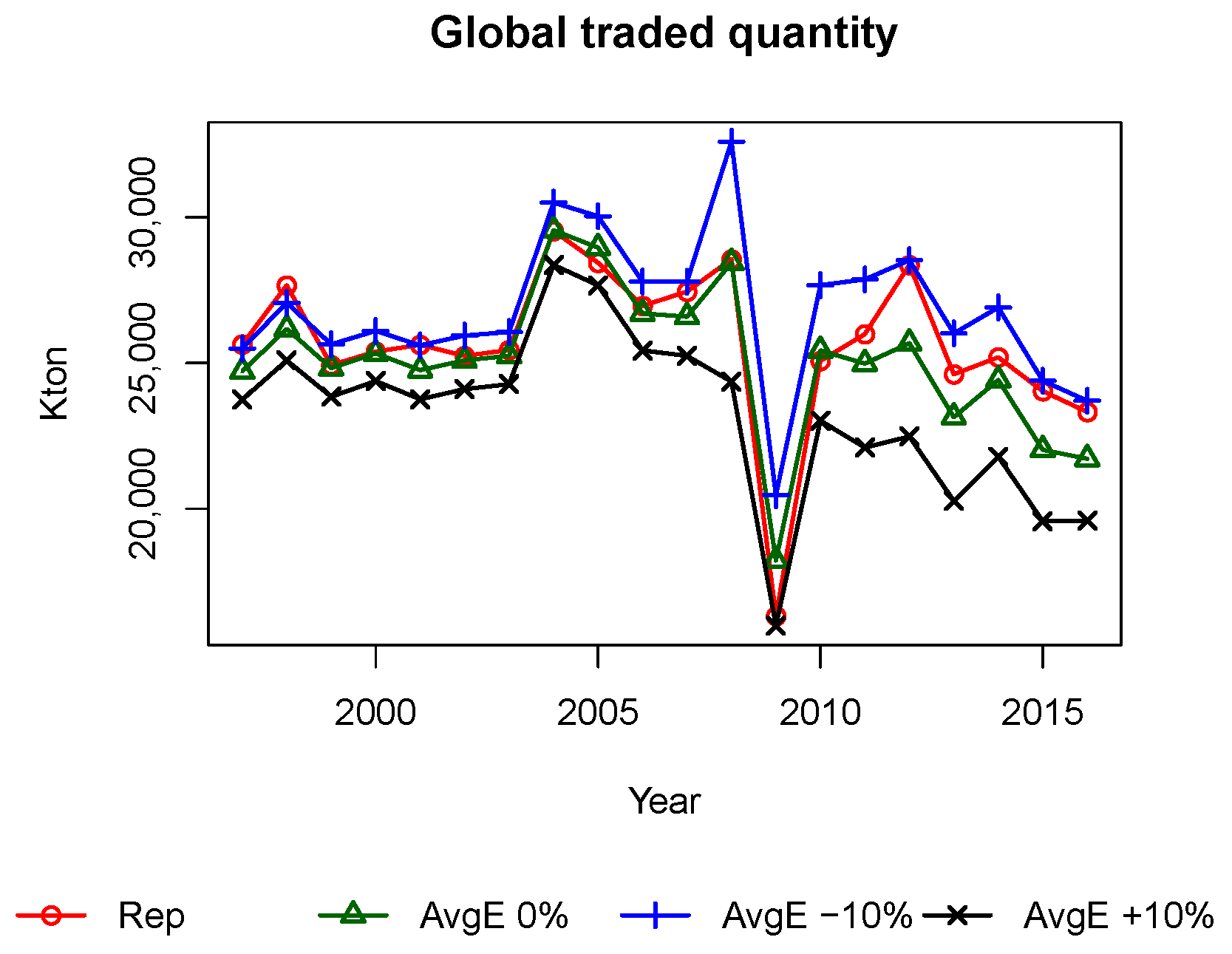

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CIF | Cost, insurance, and freight |

| ESM | Ecosystems Services and Management Program of IIASA |

| FoB | Free on board |

| IIASA | International Institute for Applied Systems Analysis |

| Kton | thousand ton |

| LP | Linear programming |

| PR | Phosphate rock |

| UN | United Nations |

References

- United Nations Development Programme. Sustainable Development Goals. 2016. Available online: http://www.undp.org/content/undp/en/home/sustainable-development-goals.html (accessed on 4 May 2018).

- United Nations Development Programme. Goal 12: Responsible Consumption and Production. 2016. Available online: http://www.undp.org/content/undp/en/home/sustainable-development-goals/goal-12-responsible-consumption-and-production.html (accessed on 4 May 2018).

- Foley, J.A.; DeFries, R.; Asner, G.P.; Barford, C.; Bonan, G.; Carpenter, S.R.; Chapin, F.S.; Coe, M.T.; Daily, G.C.; Gibbs, H.K.; et al. Global Consequences of Land Use. Science 2005, 309, 570–574. [Google Scholar] [CrossRef] [PubMed]

- Mueller, N.D.; Gerber, J.S.; Johnston, M.; Ray, D.K.; Ramankutty, N.; Foley, J.A. Closing yield gaps through nutrient and water management. Nature 2012, 490, 254–257. [Google Scholar] [CrossRef] [PubMed]

- The United States Geological Survey (USGS). Mineral Commodity Summaries; USGS: Reston, VA, USA, 2008.

- The United States Geological Survey (USGS). Mineral Commodity Summaries; USGS: Reston, VA, USA, 2015.

- UN Comtrade. International Trade Statistics Database. 2018. Available online: https://comtrade.un.org (accessed on 24 January 2018).

- Department of Fertilizers. Annual Report 2008–2009. 2009. Available online: http://fert.nic.in/sites/default/files/Annual-Report-2008-2009-english.pdf (accessed on 14 February 2018).

- Khabarov, N.; Obersteiner, M. Global Phosphorus Fertilizer Market and National Policies: A Case Study Revisiting the 2008 Price Peak. Front. Nutr. 2017, 4, 22. [Google Scholar] [CrossRef] [PubMed]

- International Chamber of Commerce. Incoterms 1953, International Rules for the Interpretation of Trade Terms. 1953. Available online: https://www.uncitral.org/pdf/english/texts_endorsed/INCOTERMS1953_e.pdf (accessed on 14 February 2018).

- Gaulier, G.; Mirza, D.; Turban, S.; Zignago, S. International Transportation Costs Around the World: A New CIF/FoB Rates Dataset. 2008. Available online: http://www.cepii.fr/baci_data/freight_rates/freight_rates_doc.pdf (accessed on 14 February 2018).

- Hummels, D.; Lugovskyy, V. Are Matched Partner Trade Statistics a Usable Measure of Transportation Costs? Rev. Int. Econ. 2006, 14, 69–86. [Google Scholar] [CrossRef]

- CEPII. BACI World Trade Database at A High Level of Product Disaggregation. 2018. Available online: http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=1 (accessed on 15 February 2018).

- SQLite Developers. SQLite—A Self-Contained, High-Reliability, Embedded, Full-Featured, Public-Domain, SQL Database Engine. 2018. Available online: https://sqlite.org (accessed on 15 February 2018).

- Mew, M. Phosphate rock costs, prices and resources interaction. Sci. Total Environ. 2016, 542, 1008–1012. [Google Scholar] [CrossRef] [PubMed]

- IndexMundi. Rock Phosphate Monthly Price—US Dollars per Metric Ton. 2018. Available online: https://www.indexmundi.com/commodities/?commodity=rock-phosphate&months=360 (accessed on 21 February 2018).

- Bourne, I. (Ed.) Argus Fertilizer Freight: Weekly International Market Prices and Commentary. 2012. Issue 12-20. Available online: http://www.argusmedia.com/~/media/files/pdfs/fertilizers/argus-fertilizer-freight.pdf/?la=en (accessed on 25 January 2018).

- Bourne, I. (Ed.) Argus Fertilizer Freight: Weekly International Market Prices and Commentary. 2012. Issue 12-25. Available online: http://www.argusmedia.com/fertilizer/~/media/files/pdfs/samples/argus-fertilizer-freight.ashx (accessed on 25 January 2018).

- World Freight Rates. Freight Calculator: Rate Estimates for Port-to-Port Ocean Shipments. 2018. Available online: http://worldfreightrates.com/en/freight (accessed on 25 January 2018).

- Mayer, T.; Zignago, S. Notes on CEPII’s Distances Measures: The GeoDist Database. 2011. Available online: http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=6 (accessed on 22 January 2018).[Green Version]

- Bank, T.W. DataBank Commodity Prices—History and Projections—Phosphate Rock, Nominal, $/mt. 2018. Available online: http://databank.worldbank.org/data/reports.aspx?source=3692&series=FPHOSROCK# (accessed on 22 February 2018).

- Baldos, U.L.C.; Hertel, T.W. Looking back to move forward on model validation: Insights from a global model of agricultural land use. Environ. Res. Lett. 2013, 8, 034024. [Google Scholar] [CrossRef]

- Mapila, M.A.; Kirsten, J.F.; Meyer, F.; Kankwamba, H. A Partial Equilibrium Model of the Malawi Maize Commodity Market; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2013; Volume 1254. [Google Scholar]

- McCarl, B.A.; Apland, J. Validation of linear programming models. South. J. Agric. Econ. 1986, 18, 155–164. [Google Scholar] [CrossRef]

- Makhorin, A. GNU Linear Programming Kit–Reference Manual for GLPK Version 4.64. 2017. Available online: https://www.gnu.org/software/glpk/ (accessed on 6 January 2018).

- Hastie, T.; Tibshirani, R.; Friedman, J. The Elements of Statistical Learning: Data Mining, Inference, and Prediction, 2nd ed.; Series in Statistics; Springer: Berlin, Germany, 2017. [Google Scholar]

| Correction Based on | Records | Volume |

|---|---|---|

| CIF & FoB | 39.1% | 54.3% |

| CIF only | 45.0% | 23.4% |

| FoB only | 14.9% | 16.8% |

| Removed | 0.9% | 5.5% |

| Min | Avg | Max | |

|---|---|---|---|

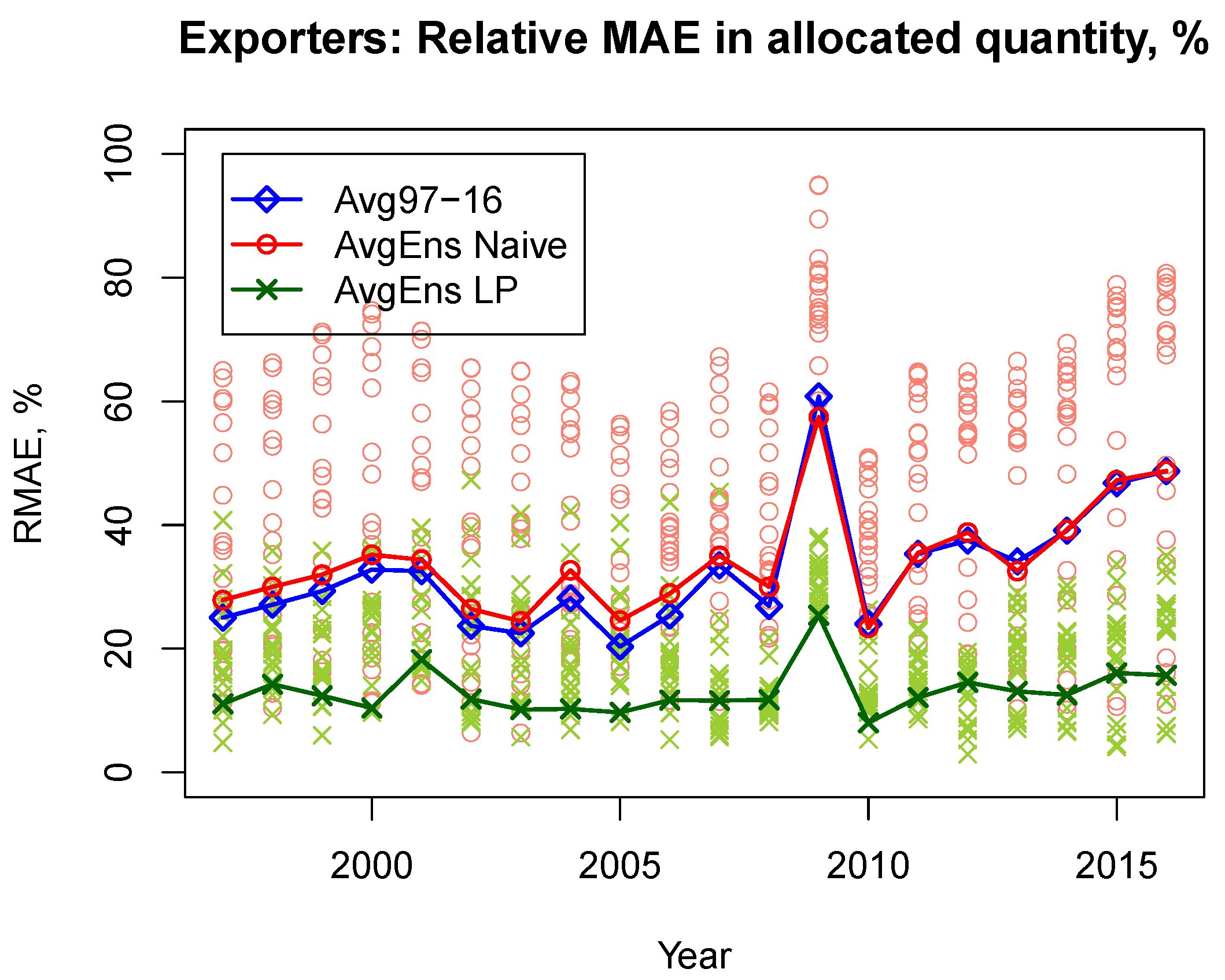

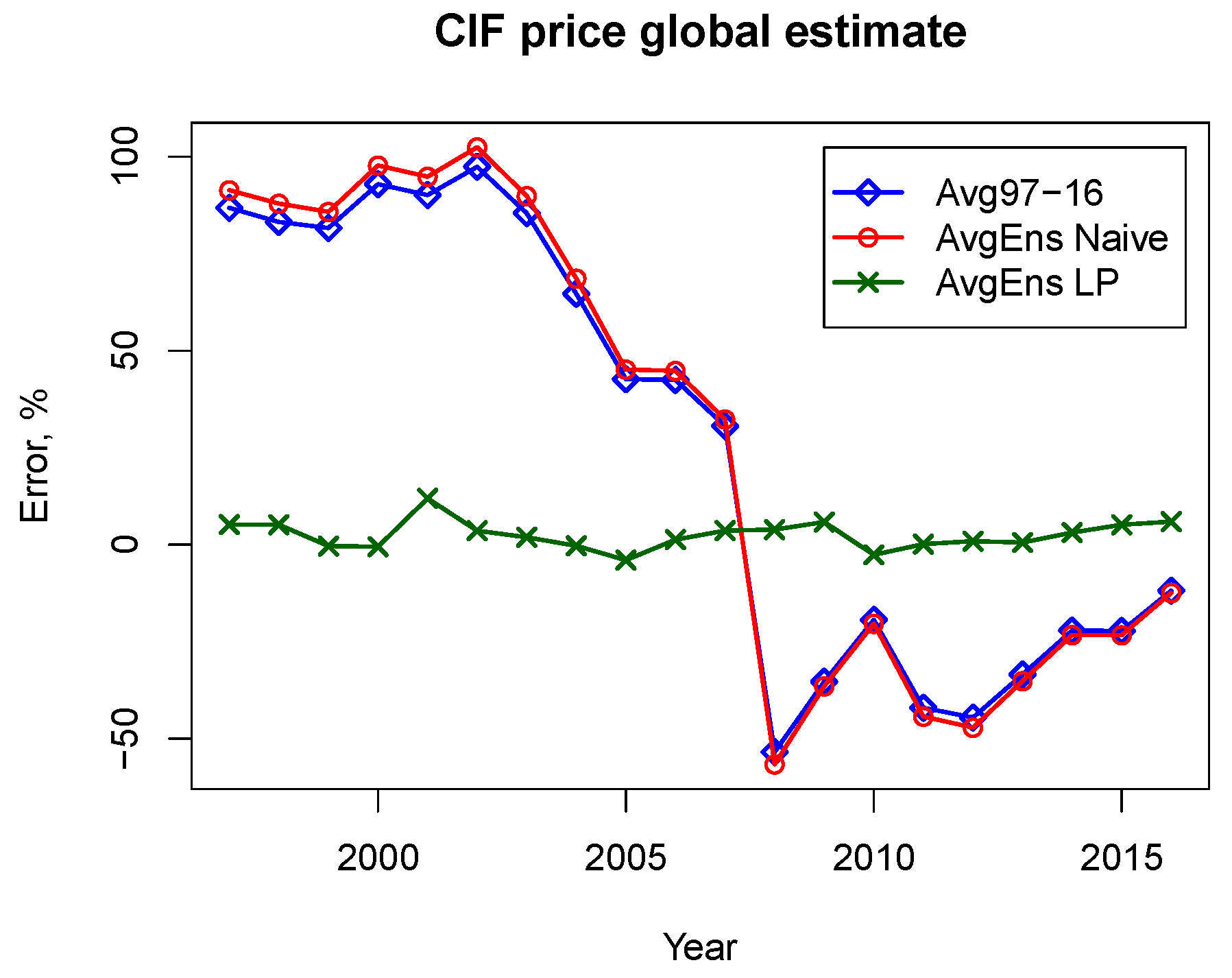

| 20 | 33 | 61 | Avg97-16 |

| 23 | 34 | 57 | AvgEns Naive |

| 8 | 13 | 25 | AvgEns LP |

| Min | Avg | Max | |

|---|---|---|---|

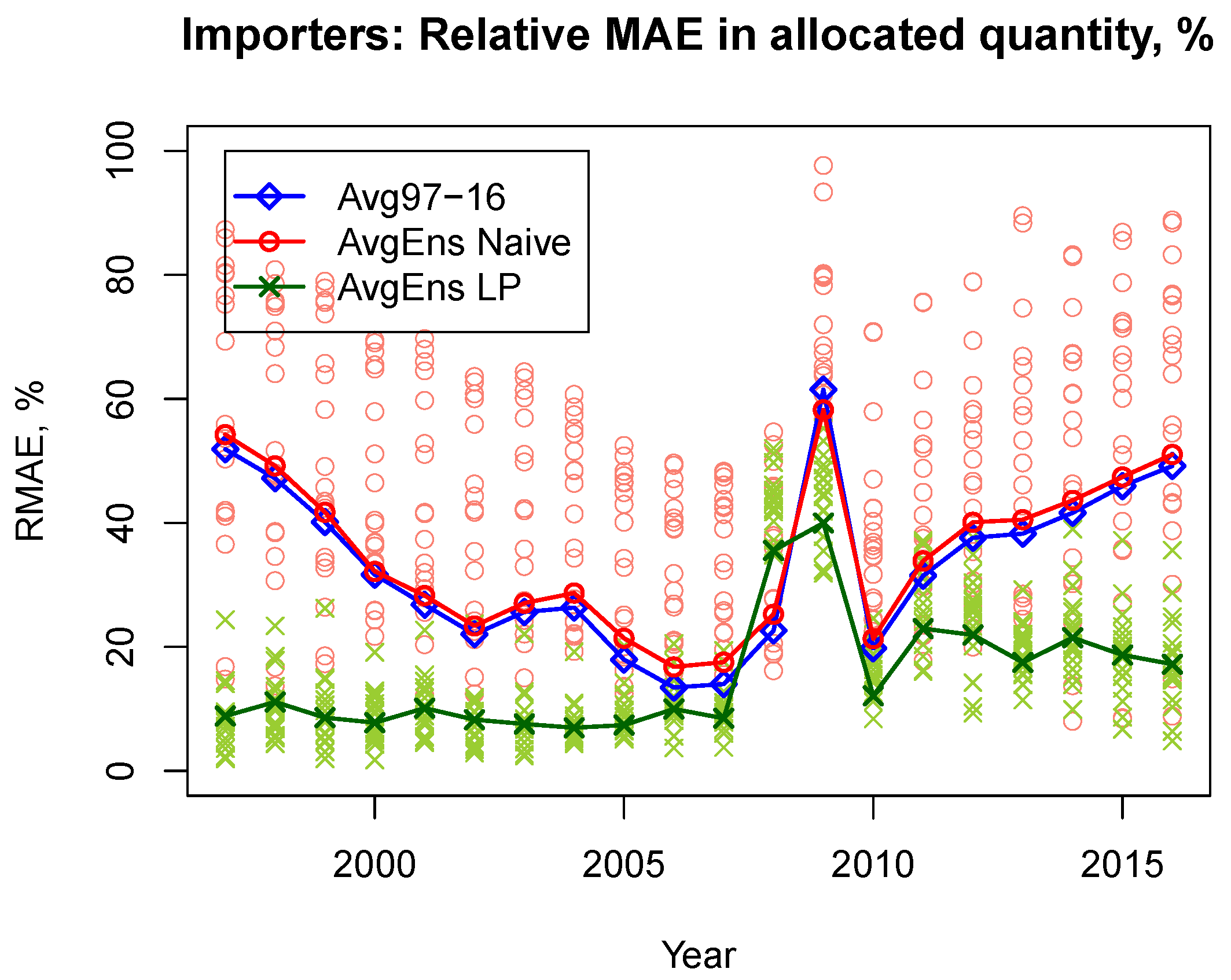

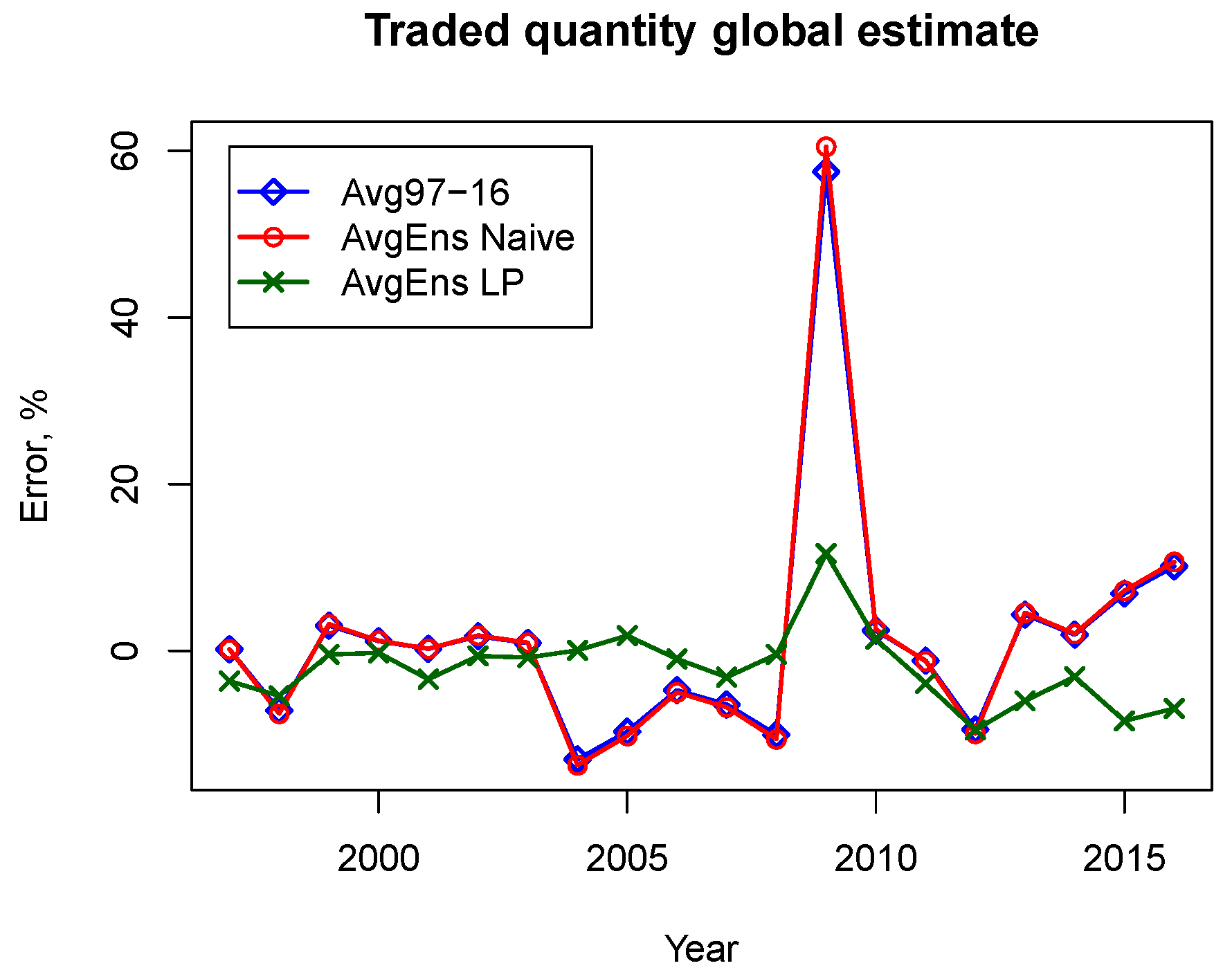

| 13 | 33 | 62 | Avg97-16 |

| 17 | 35 | 58 | AvgEns Naive |

| 7 | 15 | 40 | AvgEns LP |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khabarov, N.; Obersteiner, M. Modeling Global Trade in Phosphate Rock within a Partial Equilibrium Framework. Sustainability 2018, 10, 1550. https://doi.org/10.3390/su10051550

Khabarov N, Obersteiner M. Modeling Global Trade in Phosphate Rock within a Partial Equilibrium Framework. Sustainability. 2018; 10(5):1550. https://doi.org/10.3390/su10051550

Chicago/Turabian StyleKhabarov, Nikolay, and Michael Obersteiner. 2018. "Modeling Global Trade in Phosphate Rock within a Partial Equilibrium Framework" Sustainability 10, no. 5: 1550. https://doi.org/10.3390/su10051550